SWORD P.04 PROSERV AND P.24 INTELLIGENT PLANT ARNLEA P.26 VIPER INNOVATIONS P.29 CAN GROUP P.31 FEARNLEY GROUP P.39 INTERVENTION RENTALS P 49 RCP P.45 LEYTON P.46 READ ONLINE AT Digital transformation In this issue... SEPT 2023 - ISSUE 72 GLOBAL ENERGY NEWS WORLD PROJECTS MAP DIGITAL TRANSFORMATION INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE

STATS & ANALYTICS LEGAL & FINANCE EVENTS READ ON PAGE 4

DIGITAL TRANSFORMATION

DECOMMISSIONING

+44 (0) 1779 479 742 www.jbsgroupglobal.com Dales Industrial Estate Peterhead, Scotland, AB42 3GZ info@jbsgroupglobal.com Using the best available technology to deliver innovative engineering solutions globally Subsea Excavation Blast Containment Screw Conveyors Steel Fabrication Our services include: •Screw Conveyors •Steel Fabrication •Blast Containment •Subsea Excavation

A WORD FROM OUR EDITOR

Welcome to the September edition and the ‘SPE Offshore Europe’ edition of ‘OGV Energy Magazine’ where we will be exploring the theme of ‘Digital Transformation’ and its increasingly important role with the Energy sector.

A big thank you to our front cover partner Sword Group, and you can hear from their BU Director - Jared Owen and CTO - Mike Stewart on how they feel the ‘Digital Twin’ concept could evolve on pages 4 and 5.

We also have contributions on this theme from Proserv and Intelligent Plant, Arnlea Systems, Viper Innovations, CAN Group, Worley, Fearnley Group, Intervention Rentals, Rig Control Products and our very own OGV Studio.

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Middle East, the US and Australasia along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

Daniel Hyland, Sales and Operations Director

CONTENTS FOLLOW US VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine @OGVENERGY OGVENERGY @OGVENERGY OGV-ENERGY COVER FEATURE OGV COMMUNITY NEWS GLOBAL ENERGY NEWS WORLD PROJECTS MAP DIGITAL TRANSFORMATION INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS P.04 P.08 P.10 P.20 P.22 P.46 P.48 P.50 P.52 P.54 P.56 P.58 P.59

4 8 22 24 29 46 26 10

3

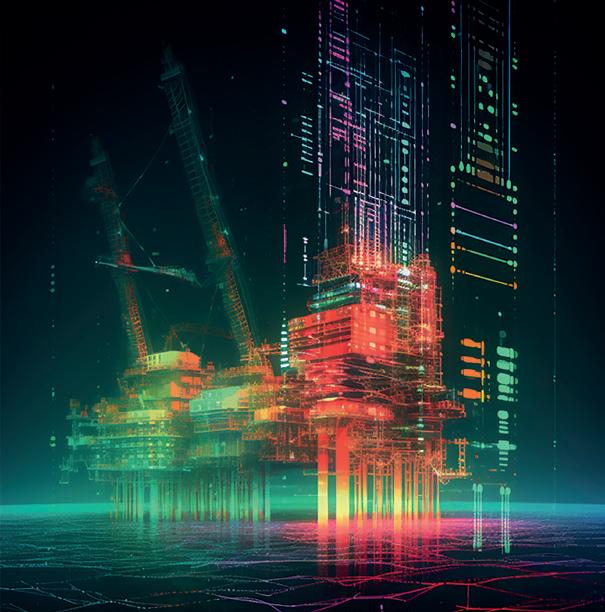

Is it time for the digital twin to grow up?

In recent years, digital twins have been seen to be the answer to many of the energy industries challenges. In this article, we delve into the roots of this concept with Mike Stewart and Jared Owen from Sword, as they uncover why it is now the opportune moment for digital twins to unleash their full potential and evolve, if done the right way.

The Energy industry’s digitalisation continues to drive innovation and collaboration across domains and disciplines. This plays a vital role, helping companies maximise the value of their data, improving technical decision making whilst decreasing commercial and safety uncertainty. As our customers digitalise processes and generate increasing amounts of digital data across their assets, the challenge becomes one of unification –providing flexible access to federated data wherever it sits, in a robust model that can pivot to meet a diverse range of industry use cases.

A contextualised, liberated and pivotable Master Data Model (MDM) is a great realworld example of that principle: supporting engineering workflows with a trusted foundation, providing a leverageable data set for modern analysis techniques, and aiding regulatory compliance.

The success of a digital twin relies on its adoption across a business, evolving how it's maintained, upgraded, and decommissioned. Investment in the foundational building blocks, in the underlying data governance, is crucial to the long-term viability aligned to proper ownership and maintenance.

Our industry is and has always been driven by innovative engineering, we operate our entire infrastructure around it. In today’s world engineering needs to evolve to the next level but retain the fundamental principles and value it has unlocked

for us. We have moved from original drawings and diagrams to computer aided design (CAD) and 3D modelling and now to a digital twin representation of a physical asset. But what do we gain with this evolution? We still strive to design, build, and deliver complex engineering solutions and make decisions that are underpinned by data. Does technology make this better?

Today’s digital engineering allows us to make decisions on decades of design and learning made accessible through modern technology accessing relevant and liberated data.

Digital engineering, wait, what happened to the Twin?

The ability to visualise and analyse datadriven content is increasingly directed by the environment around us becoming ‘smart.’ This brings near limitless options when it comes to deciding how best we apply digital engineering to improve processes.

Sword defines digital engineering as ‘the ability to digitally replicate and manage an engineering environment through the use of digital applications and a single source of truth.’ Starting from those original drawings through to the latest 3D visualisation, engineers are looking to use increasingly advanced technologies to capture data, analyse, manipulate and then design and/or manage solutions in a digital engineering environment.

COVER FEATURE 4

www.ogv.energy I September 2023

The ability to visualise and analyse data-driven content is increasingly directed by the environment around us becoming ‘smart.’

To achieve the ambition of a digital representation of a physical asset such as a ‘digital twin’, we need the right building blocks in place to reference and represent how the asset or infrastructure was initially constructed and maintained, from the initial equipment lists to past and ongoing modifications. This means you need to be confident you have the right information for your entire data stack prior to asset digitalisation.

The heart of digital engineering

Sword focuses on the discovery and integration of all relevant data sources to first build a Master Data Model (MDM) as the single source of truth that can be accessed and interrogated by multiple users with differing needs. Our approach to building an MDM aligns with industry best practice to ensure an entire asset is captured and structured in a way they can be represented digitally.

Maturing from the teenage years

A key benefit of the MDM build is the flexible approach we have taken to client data models. Instead of requiring data to be fully exported and only consumed within our application databases like other industry solutions, we use a connected interface allowing clients to retain ownership of the master database while still benefitting from visualising that same data in our applications. This reassures customers who are becoming increasingly aware

of data governance and don’t want to be locked-in to a single software provider. In addition to the MDM, Sword have designed and delivered modular digital engineering applications accessed via our Sword Digital Engineering Platform that work with the MDM to maximise the interface and interaction of the asset data to facilitate and aid data-driven decisions. This empowers engineers to model, capture and manage information in a single accessible form, so they can use it to deliver projects, manage operations and drive industrial transformation.

Our Sword Digital Engineering suite of applications are configurable to multiple user groups, ensuring that the right users access the right tools to maximise production and minimise cost of use which differs to alternative tools that contain advanced functionality and features not required. This provides an element of cost agility other competitors in the market are unable to offer.

Our industry’s drive for innovation and collaboration in a changing environment is exciting. The benefits to a digital representation of both offshore and onshore infrastructure can unlock vast potential to make better decisions, maximise safety, increase efficiency and extend the life of the basin. The holy grail of a Digital Twin lies at our feet. It could however be just another half-hearted digital gimmick unless we focus on trusted and accessible data first, and then make the solution flexible and fit for purpose.

Jared has

Mike has been involved with Energy data and Information management for more than 17 years and now helps customers leverage Sword's full data capability across sectors and disciplines.

COVER FEATURE

20 years’ of experience in the indsutry. He works with customers in the design, development and support of bespoke engineering-led solutions and digital engineering applications.

Jared Owen Business Unit DirectorApplications

5

Mike Stewart Chief Technology OfficerData

STATS GROUP

Managing Pressure, Minimising Risk

Mechanical Pipe Connector

Piping Repair, Tie-In or Capping

seal vertification port

DNV TYPE APPROVAL

Permanent pipe to flange connection where welding may be undesirable. The slipover design and external gripping assembly enables a quick and cost-effective solution, with no specialist installation or testing equipment required.

dual graphite seals

taper lock grips

dual graphite seals

taper lock grips

Header Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes. OUR PARTNERS TRAVEL MANAGEMENT PARTNER LOGISTICS PARTNER Leading provider of logistics services to this industry, offering its customers airfreight, road freight, sea freight, project forwarding, customs compliance, training and consultancy, packing, crating, lashing & securing services warehousing, distribution, freight management, rig relocation and mobilisation services and offshore logistics. Corporate Travel Management (CTM) is a global leader in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world. Editorial newsdesk@ogvenergy.co.uk +44 (0) 1224 084 114 Advertising office@ogvenergy.co.uk +44 (0) 1224 084 114 Design Jen McAdam Ben Mckay Journalist Tsvetana Paraskova www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations Maintenance Repair orders Technical support VIEW our media pack at www.ogv.energy/advertise-with-us or scan the QR code ADVERTISE WITH OGV CONTRIBUTORS

Brimmond launch UK’s first turnkey aquaculture net cleaning tech amid Government drive to double sector’s value

FIND ALL THE FULL COMMUNITY NEWS ARTICLES ON OGV ENERGY'S WEBSITE

North-east 3D scanning firm awarded UK first approval for Remote Inspection Techniques

Aberdeen-based 3D scanning specialists, Viewport3, have become the first business in the UK to be approved for Remote Inspection Techniques (RIT) using underwater photogrammetry by Lloyd’s Register (LR).

The certification was granted to Viewport3 following a successful offshore project along with an onshore validation trial, which involved using photogrammetry to verify mooring chain link critical dimensions to a sub-millimetric level – a level of accuracy and data density that far exceeds those attained by traditional approaches. As a result, the Viewport3 team have developed new reporting methods that better suit the high-resolution 3D replica of mooring links, that meet the requirements of both field operator and statutory inspection regulations.

North-east Scotland based engineering specialists, Brimmond, have launched their latest technology, NetJet™ which sees them become the first company in the UK to offer a full 360o manufacture, rental and support package for high-pressure net cleaning pumps for the offshore aquaculture sector.

Sureclean set for continued growth with four key new appointments

Brimmond, which specialises in the design, manufacture, rental and repair of lifting, mechanical and hydraulic equipment for industry, has invested c. £450K developing the high-end pump units, NetJet™ in house. The firm’s engineering team designed, specified and manufactured the pump units, following the identification of a gap in the flourishing aquaculture market for a rental option for net cleaning pumps.

Fish welfare is a priority for the aquaculture industry, and therefore nets are cleaned around every 5 days in the summer to preserve water quality and protect the fish. With over 200 offshore finfish sites in the UK, operating an estimated 2,200 nets, this is potentially an arduous and time-consuming task. While the technology exists to speed up the operation, the six-figure purchase price represents a considerable – and for many, unattainable - outlay.

New energy developments lead to record-breaking revenue for STRYDE

Newly relaunched industrial cleaning specialists, Sureclean, has announced a raft of key new appointments bringing in operation and project management along with health & safety expertise to the global energy industry.

Four new staff members have joined the company’s Operations division bolstering its service offering to play a central role in realising future growth ambitions. The recruitment drive comes just six months into the company’s relaunch following a management buy-out earlier this year.

Oldmeldrum-based Sureclean, previously NRC UK, was bought over from Americanbased US Ecology with new owners, Simon Gibb and Mark Kelly, rebranding the firm back to its original name, Sureclean.

STRYDE has delivered strong results across the first half of the year, seeing its strongestever revenues in both Q1 and Q2.

The business recorded a 100% increase in revenue compared with the same period in 2022, with new energy markets and new oil and gas exploration surveys stated as a key factor in its growth.

STRYDE, which has now been used in 42 countries around the globe, helps organisations to acquire an unparalleled understanding of the subsurface, faster, and more cost-effectively than ever before. As the creators of the world’s smallest seismic sensors, who also offer fast-track data processing services, STRYDE has enabled high-resolution seismic data to be accessible for any industry, including the fast-growing renewables sector.

www.ace-winches.com

www.thistletubulars.co.uk

www.ryscocorrosion.com

OGV COMMUNITY NEWS

www.revive-intra.com www.macartney.com reachsubsea.no www.ogv.energy/register LATEST OGV COMMUNITY SIGN-UPS JOIN THE OGV COMMUNITY FOR JUST £30 A MONTH 8

Connecting What’s Needed with What’s Next™ Copyright © 2023 Oceaneering International, Inc. All rights reserved. JOIN OUR TEAM SIGN-ON BONUS AVAILABLE* oceaneering.com/careers *available on specific roles only Cegal turns complex IT into digital success stories. that increases efficiency and control while reducing cost and emissions. with tech, energy, and business experts. of mission critical IT in hybrid cloud environments. Modern Industrial Software Super Skilled Agile IT Services Specialized Cloud Operations cegal.com Meet us at SPE Offshore Europe, 5-8 September 2023. OGV Energy Pavilion booth 2M60.

pledge

September 2023

UK NORTH SEA Oil & Gas Review

By Tsvetana Paraskova

By Tsvetana Paraskova

Hundreds of new oil and gas licences will be granted in the UK, Prime Minister Rishi Sunak confirmed on 31 July, as the UK Government continues to back the North Sea oil and gas industry as part of the drive to make Britain more energy independent.

The Government and the North Sea Transition Authority (NSTA) announced their joint commitment to undertake future licensing rounds, which will continue to be subject to a climate compatibility test. By adopting a more flexible application process, licences could also be offered in close proximity to currently licensed areas. This is expected to unlock oil and gas reserves which can be brought online faster due to existing infrastructure and previous relevant assessments.

With the commitment to award hundreds of new oil and gas licences, the UK Government is taking steps to slow the rapid decline in domestic production of oil and gas, which will secure Britain’s domestic energy supply and reduce reliance on hostile states.

The NSTA expects the first of the new licences in the 33rd offshore oil and gas licensing round to be awarded in the autumn, with the round expected to award over 100 licences in total.

“Future licences will be critical to providing energy security options, unlocking carbon capture usage and storage and hydrogen opportunities

– building truly integrated offshore energy hubs that make the best use of the established infrastructure,” the Government said.

“Even when we’ve reached net zero in 2050, a quarter of our energy needs will come from oil and gas. But there are those who would rather that it come from hostile states than from the supplies we have here at home,” Prime Minister Sunak said.

“We’re choosing to power up Britain from Britain and invest in crucial industries such as carbon capture and storage, rather than depend on more carbon intensive gas imports from overseas – which will support thousands of skilled jobs, unlock further opportunities for green technologies and grow the economy.”

Offshore Energies UK, the leading trade association for energy firms, welcomed the government’s commitment to the 33rd licencing round and its carbon capture announcements as important steps forward for long-term energy security and jobs.

“Domestic production is the best pathway to net zero and the UK Government’s commitment to licences is a welcome boost for energy security and jobs,” OEUK chief executive David Whitehouse said.

“Oil and gas fields decline naturally over time. The UK needs the churn of new licences to manage production decline in-line with the maturing basin,” Whitehouse added. Currently, the UK North Sea hosts 283 active oil and gas fields, but by 2030 around 180 of those will have ceased production due to natural decline, OEUK noted.

“If we do not replace maturing oil and gas fields with new ones, the rate of production will decline much faster than we can replace them with low carbon alternatives,” Whitehouse said.

Separately, OEUK launched on 8 August a major survey aimed at improving how companies conduct business to assess how the industry is treating its supply chain. The survey is open until 29 September.

“The Working as One survey will measure how companies are adhering to the Supply Chain Principles, a set of 10 commercial behaviours developed by the industry to promote continuous improvement. It seeks feedback on key areas including timely payment of suppliers and clarity regarding contractual terms and conditions,” Katy Heidenreich, OEUK’s Supply Chain and People Director said.

“The health of the supply chain is dependent on sustainable contracting practices and a cooperative mindset, but our research reveals many businesses face pressures

The government’s

to award new North Sea oil and gas licences, the cost of decommissioning, and updates on various projects and drilling contracts featured in the UK North Sea oil and gas industry over the past month.

UK NORTH SEA REVIEW SPONSORED BY

www.ogv.energy I September 2023 10

on several fronts including negative commercial behaviours,” Heidenreich added.

The North Sea oil and gas industry spent £1.6 billion decommissioning redundant wells and infrastructure in 2022, more than in any of the previous five years, the NSTA said in its annual UKCS Decommissioning Cost and Performance Report 2023.

The report found that the UK offers a significant opportunity ahead for the decommissioning sector, with £21 billion of spending on decommissioning expected for the next decade alone. The industry, however, needs to maintain its focus on performance, collaborate effectively, and urgently commit to decommissioning plans to achieve further cost-efficiencies amid challenging market conditions, NSTA noted.

The decommissioning sector has developed an impressive track record of decommissioning wells and infrastructure to a high standard while keeping costs competitive, marking it out as a world leader in decommissioning, according to the report.

Between 2017 and 2022, industry spent around £8 billion on decommissioning projects, helping it establish a solid foundation of decommissioning expertise. Continuous improvement has been embedded into the planning and execution of projects, contributing to a reduction in the overall cost estimate of UKCS decommissioning by £15 billion, or 25 percent, in the same period.

An encouraging sign is that UK suppliers are in line to secure around 70 percent of the work associated with UK North Sea decommissioning projects listed in Supply Chain Action Plans (SCAPs) lodged with the NSTA last year.

“Achieving further improvements will be challenging, however, in the face of factors including heightened demand for equipment, vessels and services from other regions and sectors, such as offshore wind – which have pushed up prices, taking the total cost estimate for decommissioning to £40 billion,” NSTA said.

Sam Long, Decom Mission Chief Executive, said: “Decommissioning is but one of many market opportunities that members face, with the continuing advancement of the energy transition and the international need for decommissioning services.”

Another NSTA analysis showed that North Sea gas is almost four times cleaner than LNG imports.

The UK gas carbon intensity is 21 kg CO2/boe and compares with LNG import average carbon intensity 79 kg CO2/boe. Norway has the lowest carbon intensity of all LNG imports at 33 kg CO2/boe, and Peru the highest at 90, with the average coming to 79, while UK gas has a carbon intensity of only 21 kg CO2/boe. The difference is due to both the way the gas is transferred and, in some cases, the methods of extraction, the NSTA analysis showed. The primary causes for the stark difference in emissions are the process of liquefaction – turning the gas into liquid for transport - then transportation via shipping, and finally regasification, turning the liquid back into gas so it can be used.

The NSTA report showed that around 63 percent of UK gas supply was imported into the country in 2022, 187 mmboe via pipeline and 156 mmboe from LNG. The UK produced 38 percent of its gas supply last year, yet that 38 percent was responsible for only 24 percent of total emissions associated with gas supply, whereas LNG from the United States was responsible for 35 percent of the emissions, despite accounting for only 14 percent of the supply.

In company news, bp and OMV announced the signing of a long-term sale and purchase agreement covering supply of up to 1 million tonnes of liquefied natural gas (LNG) per year for 10 years from 2026. bp will provide OMV with LNG from its global portfolio of LNG, which will be received and re-gasified through the Gate LNG terminal in Rotterdam, The Netherlands, where OMV holds regasification capacity, or other terminals in Europe.

“At bp, we see LNG as an essential part of the energy transition and essential for our own pivot to becoming an integrated energy company,” said Jonty Shepard, VP global LNG trading & origination, bp.

Shelf Drilling has secured a contract for the Shelf Drilling Fortress jack-up rig with CNOOC Petroleum Europe Limited for operations at the Golden Eagle platform in the UK Central North Sea. The firm term of the contract is two wells, approximating to between four and five months. The contract value for the firm period is around $17 million. The contract also includes options for additional wells with a total estimated duration of 13 months. The planned start-up of operations is September 2023.

United Oil & Gas and Quattro Energy Limited have agreed to extend the long stop date in their agreement for the sale of the UK Central North Sea Licence P2519 containing the Maria discovery to 30 September 2023. It was also agreed that a further extension may be required for all conditions precedent to be met to allow completion of the sale, namely regulatory approvals to enable the transfer of funds to United, and the Licence assignment to Quattro.

Hibiscus Petroleum announced that it had received a Development and Production Works Consent to a Field Development Plan (FDP) for the Teal West field from the North Sea Transition Authority on 1 August 2023. The FDP approval comes pursuant to the unconditional grant of consent for the Environmental Statement received on 7 July 2023. The next stage after the FDP approval is the internal Final Investment Decision (FID), which if proceeded with, would result in first oil from the Teal West field expected by late 2024/early 2025.

Repsol Sinopec Resources UK Limited awarded in mid-August a $165 million decommissioning contract to Archer to execute the plug and abandonment (P&A) of 30 wells in the Fulmar Field and two wells in the Halley Field. The contract is a fully integrated P&A project, covering the complete work scope, including a modular P&A rig, well services, and well engineering.

The Fulmar scope includes removal of the existing drilling facility and installation of one of our P&A rigs. In addition, Archer will deploy its P&A well services offering to reduce time and cost to plug each well. The contract will commence immediately, and Archer expects integrated offshore P&A operations to start in the second half of 2024 or early 2025.

Repair, Conversion & New Build of Marine and Offshore Living Quarters & Technical Buildings Aberdeen | Blyth | Las Palmas | Dubai | Abu Dhabi | Qatar | Bahrain | KSA | Baku Proud Sponsor of the UK North Sea Review modutec.com

Europe Energy Review

By Tsvetana Paraskova

Oil & Gas

Natural gas in the EU’s storage sites hit the 90-percent full target in the middle of August, well in advance of the EU deadline set for 1 November, thanks to milder 2022/2023 winter and increased LNG imports.

OKEA ASA and DNO ASA, the partners in the Brasse licence in the northern North Sea offshore Norway, have agreed on a fasttrack development concept for the oil and gas discovery, paving the way for detailed design studies to link up with the Brage field. A final investment decision is expected in early 2024. Brasse is an oil and gas discovery 13 kilometres south of the Brage field and 13 kilometres southeast of the Oseberg Field Center.

Equinor said in early August that the Norwegian government had approved the Snøhvit partners’ plans for the future operation of Snøhvit and Hammerfest LNG via electrification, subject to certain conditions. Compared to the Snøhvit partnership’s application, the authorities have postponed the start of electrification by two years, from 2028 to 2030. The plant will continue to run on gas turbines during this period.

The electrification of Hammerfest LNG will replace today’s gas turbines with electricity from the grid. This would cut CO2 emissions from the plant by around 850,000 tonnes

annually—the most substantial individual emission reduction decision that has been made aimed at decarbonising oil and gas production in Norway, Equinor says.

Low Carbon Energy

A research study led by the University of Aberdeen has identified areas of a North Sea gas 'super basin' with the greatest potential for storing industrial carbon emissions. Described as ‘world-class research’ by the UK Regulator, the North Sea Transition Authority (NSTA), scientists from the University’s Centre for Energy Transition used subsurface data and techniques usually employed in oil and gas exploration, to produce a detailed technical study of the Anglo-Polish Super Basin in the Southern North Sea to determine its suitability for carbon capture, utilisation and storage (CCUS).

The results of the study confirmed the huge potential of the area as a future CCUS hub where industrial emissions can be safely stored in former gas fields and other geological formations.

“By establishing a consistent regional geological framework, this work will assist the evaluation of storage sites within the Southern North Sea, allowing the optimisation of their exploitation and supporting assessments of risk and uncertainty,” said Dr Nick Richardson, Head of Exploration & New Ventures at

GLOBAL ENERGY REVIEW

www.ogv.energy I September 2023 12

European gas storage sites hit the target to be 90 percent full months in advance compared to the EU deadline of 1 November, oil and gas projects offshore Norway reached important regulatory milestones, while the UK and Europe advanced and assessed the potential of various renewable energy sources.

the UK’s regulator for Carbon Storage activities, the North Sea Transition Authority, commenting on the study.

“It will also aid regulatory and marine planning bodies in their ongoing efforts to identify synergies between offshore activities, and maximise opportunities for innovation and collaboration on the pathway to net zero.”

Europe is storing huge amounts of solar panels made in China as the rate of imports exceeds installations, Rystad Energy said in a report at the end of July.

Around 40 gigawatts-direct current (GWdc) of capacity of China-made panels are currently in storage across Europe– the same amount installed across the continent in 2022, the independent energy research and business intelligence company said.

These solar panels in storage are worth about €7 billion and could generate enough electricity to power 20 million homes per year. The build-up is only set to grow this year, with Rystad Energy forecasting 100 GWdc of solar capacity in storage by the end of 2023.

Currently, China-made panels often cost as little as two-thirds of European-manufactured panels.

“European countries are desperate to get their hands on affordable solar infrastructure to advance their renewable energy targets, decarbonize and avoid paying elevated prices for new capacity,” said Marius Mordal Bakke, senior supply chain analyst at Rystad Energy.

“Although efforts are underway to build a reliable solar supply chain in Europe, the need for panels now means leaders cannot wait until 2025 or later to buy European.”

A new £10 million government fund will support rural and local communities across England to develop local renewable energy projects, the UK government said in August. The funding, dubbed Community Energy Fund, is aimed at helping communities launch projects such as small-scale wind farms and rooftop solar partnerships, battery storage, rural heat networks, electric vehicle charging points, and fuel poverty alleviation schemes - all proposed, designed, and owned by local people.

Crown Estate Scotland is launching an indepth survey of developers working in the tidal and wave energy sectors to help inform Crown Estate Scotland’s plans to support future leasing. The study will be carried out by Offshore Renewable Energy (ORE) Catapult on behalf of Crown Estate Scotland.

Norway extended the deadline for applications in its offshore wind tender by two months to 1 November from 1 September in order to finalise the support the state would offer to the winning projects. The Norwegian Ministry of Petroleum and Energy targets the projects up for grabs in the Southern North Sea II and Utsira Nord areas to begin operations by 2030.

New areas for offshore wind are expected to be announced in 2025, Petroleum and Energy Minister Terje Aasland said.

In company news, bp – via bp ventures –led a $12.5-million Series A financing for Advanced Ionics, a developer of a new category of hydrogen electrolyzers useful for expanding green hydrogen production. Additional investors including Clean Energy Ventures, Mitsubishi Heavy Industries, and GVP Climate.

“Advanced Ionics’ technology has the potential to drive down cost and disrupt the hydrogen market,” Gareth Burns, vice president of bp ventures, said.

bp has also recently invested £4 million in UKbased fleet optimization software provider Dynamon and announced a commercial agreement.

bp ventures’ Burns commented:

“Faster adoption of lower carbon energy and mobility solutions will help drive bp towards meeting its ambition to become a net zero company by 2050 or sooner and helping the world get to net zero.”

Carbon Catalyst and Perenco UK announced in mid-August they were awarded a carbon storage licence by the NSTA to progress the Poseidon carbon storage project in the Southern North Sea sector of the UK Continental Shelf.

Poseidon envisions the permanent geological storage of around one billion tonnes of CO2 into the UK's largest depleted gas field, the Perenco UK-operated Leman gas field, and other adjacent storage reservoirs within the carbon storage licence. The project is scheduled to be operational by 2029, with initial CO2 injection rates of 1.5 million tonnes per annum (Mtpa), increasing to 40 Mtpa over a 40-year period.

Stanlow Terminals Ltd, the UK’s largest independent bulk liquid storage provider, has signed a Memorandum of Understanding (MoU) with Eni’s UK subsidiary to explore the development of CO2 collection, shipping, and storage at the Stanlow Terminal location and then delivering the received CO2 into Eni UK’s carbon transport and storage infrastructures currently being developed in the northwest of the UK.

Rovco has won a survey contract by Flotation Energy to carry out a geo-environmental survey at its planned Cenos floating offshore windfarm, 200 kilometres off the north-east coast of Scotland. Located in the Central North Sea, the 1.4 GW Cenos floating wind development will cover approximately 333 square kilometres. Rovco’s scope of work involves the acquisition of geophysical and benthic information to provide detailed data to inform environmental impact assessment (EIA) consents and the engineering processes from engineering to early front-end engineering and design (FEED) study.

The GB electricity regulator Ofgem has provisionally approved SSEN Transmission’s proposals to upgrade the electricity transmission network in Argyll and Kintyre. The upgrade project will secure future electricity supplies in the area and enable the connection of new renewable electricity generation in the region. It will support the connection of at least 970 MW of new renewable electricity generation, enough to power more than 500,000 homes.

UK-based renewable energy and battery storage developer Luminous Energy has achieved financial close on the 28.5 MWp Bracon Ash Solar Farm, near Norwich, Norfolk. The project is expected to achieve first power in the summer of 2024 and generate enough electricity to power more than 9,500 households annually.

German energy giant RWE has been granted by the German Federal Network Agency awards in the Nordseecluster B area in the latest German offshore wind tender in August. The award involves the N-3.6 and N-3.5 sites in the German North Sea, on which RWE intends to develop, build, and operate two wind farms with a total capacity of 900 MW. The company was also awarded a further offshore site with 630 MW, subject to exercise of third-party step-in rights by another company.

RWE also said in August it had invested €9 billion in the first six months of 2023, while its capacity increased by 5.1 GW through acquisitions and the commissioning of new plants.

“We are currently constructing more than 70 renewable energy projects in 12 countries with a total capacity of over 7 gigawatts – that’s more than ever before,” RWE chief executive Markus Krebber said.

EUROPE EUROPE NEWS SPONSORED BY

13

Energy Review

By Tsvetana Paraskova

US crude oil production is expected to rise more than previously expected in 2023 and 2024 as many companies raised their output guidance after reporting second-quarter results. Deals in the US upstream sector boomed in the second quarter as the top oil-producing basin, the Permian, returned to the centre of the mergers and acquisitions (M&A) activity. In addition, energy trade groups called on the Biden Administration to finalise a robust programme for federal offshore leasing.

US Oil Production Set To Rise More than Previously Thought

US crude oil production is set to increase this year more than previously estimated, the US Energy Information Administration (EIA) said in its Short-Term Energy Outlook (STEO) for August.

The EIA now expects U.S. crude oil production will average 12.8 million barrels per day (bpd) in 2023 and 13.1 million bpd in 2024, both annual records, as a result of higher expected well-level productivity and higher crude oil prices. These forecasts were raised by 200,000 bpd for 2023 and by 300,000 bpd for 2024 compared to the projections in the July report.

Announcing second-quarter results, some US companies reported record crude oil

production in the Permian basin and others raised their full-year 2023 guidance for oil output. Supermajors ExxonMobil and Chevron both reported record oil production from the Permian, while ConocoPhillips, Pioneer Natural Resources, and Occidental all raised their full-year production guidance, citing continued strong well productivity and highly efficient operations.

However, a new report by Enverus Intelligence Research (EIR) showed in the middle of August that oil decline profiles have steepened across US shale oil plays over the last decade. Despite the fact that recoveries from the average US shale oil well have doubled in the past decade, production profiles for the average well have steepened more than half of a percentage point annually since 2010, Enverus noted. Another key finding is that the

average oil production profile in the Permian’s Midland Basin has steepened by 0.5 of a percentage point each year since 2014. The Delaware Basin has steepened by even more since that time.

EIR sees Permian-type curve shapes to continue to steepen over time as the basin gets more densely developed. As a result of steeper declines, average breakeven prices for profitable drilling will rise.

“We’ve observed that declines curves, meaning the rate at which production falls over time, are getting steeper as well density increases. Summed up, the industry’s treadmill is speeding up and this will make production growth more difficult than it was in the past,” said Dane Gregoris, report author and managing director at EIR.

digitisingreality.com

GLOBAL ENERGY REVIEW

From flare tip to the jacket, Digitising Reality can create a digital twin of your offshore asset so you can efficiently manage your resources effectively.

Assets Digitised. Savings Realised.

SPONSORED BY www.ogv.energy I September 2023 14

Upstream M&A Activity Booms

Another report by Enverus Intelligence Research showed that the Permian led the mergers and acquisitions (M&A) activity in the US upstream sector in the second quarter. A total of $24 billion was transacted in 20 deals with the Permian returning to its usual position as the centre of M&A activity, EIR said.

“The second quarter saw a thunderous return to Permian M&A after a relatively quiet start to the year,” said Andrew Dittmar, director at Enverus.

“The need for public buyers to secure quality drilling inventory has been brewing, and the pressure to make a deal has been mounting as the remaining opportunities are narrowed with each successive transaction. That in turn is driving higher valuations on the remaining assets.”

There are a handful of private Permian assets still available for the rest of this year, and a number of these assets are likely to find buyers before the year ends, EIR reckons.

Energy Groups Urge Biden To Finalise Offshore Leasing Programme

The American Petroleum Institute (API), the main oil lobby in the US, joined in early August 17 other energy trade groups representing all sectors of the US natural gas and oil industry in calling on the Biden Administration to support US energy security by finalizing a robust program for federal offshore leasing. The energy trade groups sent a letter to US President Joe Biden, in which they urged the Administration to finalise a programme that includes the maximum number of lease sales and begin the pre-leasing work required to start holding sales in 2024.

The letter follows a recent Stipulated Stay agreement that imposed baseless restrictions on an estimated 11 million acres in the US Gulf of Mexico, leaving the offshore energy industry in an extended period of uncertainty, API said.

“U.S. offshore oil and natural gas production is fast approaching yet another period of extended uncertainty that could negatively impact American energy security. Though the administration has committed to issuing a new five-year offshore leasing program by the end of September, it already is a year and a half late because the previous program expired in June 2022,” the letter reads.

“Time is running out to avoid significant consequences that could result from a prolonged gap in federal offshore leasing and production in the years ahead.”

A recent comprehensive study on global oil production and emissions by ICF found that oil and gas production in the US Gulf of Mexico has a carbon intensity 46 percent lower than production in other parts of the world, the energy groups said in the letter.

Moreover, the US offshore industry plays a significant role in the regional, state, and local economies of the Gulf Coast and provides nearly 15 percent of domestic oil and natural gas production, they added.

API also joined grid operators, electric utilities, and regulatory authorities in expressing concerns about challenges to meeting the tight timeline for compliance in the US Environmental Protection Agency’s (EPA) proposed regulation of greenhouse gas emissions from US power plants.

Earlier this year, EPA proposed to establish emission guidelines for large, frequently used existing fossil fuel-fired stationary combustion turbines, generally natural gasfired, as well as to strengthen the current New Source Performance Standards (NSPS) for newly built fossil fuel-fired stationary combustion turbines.

“While carbon capture (CCS) and hydrogen are promising technologies to help reduce GHG emissions, operators will need time to develop and build significant amounts of new infrastructure to support the deployment of these technologies, a task that is increasingly difficult with our nation’s complex and outdated permitting process,” API said, commenting on its input on the proposed rules.

“We urge EPA to comprehensively analyze the potential reliability risks of its proposal, recognizing it coincides with rising U.S. electricity demand. Today natural gas is responsible for 40% of electricity generation in America, helping meet growing demand and balancing variable renewable resources,” API Senior Vice President of Policy, Economics and Regulatory Affairs, Dustin Meyer, said.

Texas Set New Oil & Gas Production Records in June

Texas set new production records in June, exceeding previous all-time highs, according to the August monthly energy economics analysis prepared by Texas Oil & Gas Association (TXOGA) Chief Economist Dean Foreman, Ph.D.

Texas’ oil production reached a record high 5.5 million bpd in June and July, while the state’s natural gas marketed production reached 31.4 billion cubic feet per day (bcf/d) in June before decreasing to 31.2 bcf/d in July, TXOGA estimates showed.

Year-to-date through July 2023, Texas’ shares rose to 43.3 percent of oil production in the US and 27.4 percent of natural gas marketed production. These numbers also represent the highest level of oil production for any month on record in Texas since 1981, and the highest level of natural gas liquids on record for any month since 1993, the analysis found. “Policies and politics in Texas and across our nation will determine if we can be the trusted ally the world turns to, or if nations will have to look elsewhere for leadership on energy security,” TXOGA President Todd Staples said, commenting on the analysis.

“To that end, we need bold policy at the state and federal levels to keep Texas the global energy leader.”

USA US NEWS SPONSORED BY

“The second quarter saw a thunderous return to Permian M&A after a relatively quiet start to the year,”

“Policies and politics in Texas and across our nation will determine if we can be the trusted ally the world turns to, or if nations will have to look elsewhere for leadership on energy security,”

Andrew Dittmar, director at Enverus.

TXOGA President Todd Staples

15

MIDDLE EAST Energy Review

By Tsvetana Paraskova

Oil production from the OPEC+ group and the Middle East slumped in July as Saudi Arabia began its unilateral output cut, while Saudi Aramco reported lower earnings as oil prices slid in the second quarter and the United Arab Emirates’ state oil and gas firm ADNOC signed several new deals to expand its gas business abroad and tap into geothermal energy and carbon management.

Crude oil production from all 13 OPEC members plummeted by 836,000 barrels per day (bpd) to 27.31 million bpd in July, led by a 968,000 bpd decline in Saudi Arabia’s output as the Kingdom nearly delivered its promised 1-million-bpd cut, OPEC’s Monthly Oil Market Report (MOMR) showed in August

Saudi Arabia, the biggest oil producer in OPEC and the Middle East, reduced its crude oil production by 968,000 bpd from June to an average of 9.021 million bpd in July, according to OPEC’s secondary sources in the monthly report. Crude oil production from Saudi Arabia has now fallen below the oil output of Russia, the key partner of OPEC in the OPEC+ alliance.

The other large output declines in OPEC in July came from Libya and Nigeria, two members that have been constantly plagued by field blockades and infrastructure leaks, respectively. Middle Eastern producers Iraq and Iran, as well as Angola and Venezuela, increased their respective output, according to the secondary sources in OPEC’s report. Iran, Libya, and Venezuela, however, are exempted from the OPEC+ production cuts, due to sanctions on Iran and Venezuela and port and field blockades in Libya.

Oil production from OPEC and the Middle East as a whole is set to be low in September, too, after Saudi Arabia said in early August it would extend its unilateral cut of 1 million bpd into September, adding that the reduction could be further extended or even extended

Smart Procurement

At Craig International, procurement isn’t just about processes, products and numbers. We promote a culture of ownership among our people, who are trusted to get on with the job on your behalf. We’re proud of how we serve clients.

www.craig-international.com

We’re always looking for new ways to add value and routinely introduce new technological solutions to make service delivery even simpler, smoother, faster.

and deepened. Saudi oil production for the month of September 2023 will be around 9 million bpd, as it was in July and August.

“This cut is in addition to the voluntary cut previously announced by the Kingdom in April 2023, which extends until the end of December 2024,” the Saudi Press Agency reported.

“This additional voluntary cut comes to reinforce the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil markets,” it added.

OPEC Leaves Oil Demand Growth Estimate Unchanged

In the same report, OPEC left its global oil demand outlook unchanged from the previous month, expecting demand to grow by 2.4 million bpd to average 102.0 million bpd in 2023. Most of the growth is expected to come from the developing economies, thanks to a steady increase in transportation and industrial fuel demand, supported by a recovery in activity in China and other nonOECD regions, OPEC said.

Next year, solid global economic growth amid continued improvements in China is expected to boost oil demand, which is set to rise by 2.2 million bpd compared to 2023, with world oil demand projected to average 104.3 million bpd. China and India will lead demand growth in 2024, OPEC noted.

GLOBAL ENERGY REVIEW

SPONSORED BY

16 www.ogv.energy I September 2023

Image courtesy of: www.adnoc.ae

“Other regions, particularly the Middle East and Other Asia, are also expected to see considerable gains, supported by a positive economic outlook. In terms of fuels, jet kerosene, gasoline and diesel are assumed to lead oil demand growth next year,” the cartel said.

Saudi Aramco Profit Tumbles, Dividends Grow

Saudi Aramco, the state oil giant and the largest oil firm in the world by both production and market capitalisation, reported in early August a net income of $30.1 billion for the second quarter of 2023, a decline of 38 percent compared to the $48.4 billion net profit for the same period of 2022. In the spring of last year, oil prices hit $100 per barrel after the Russian invasion of Ukraine, while Brent prices averaged below $80 per barrel, $78 a barrel to be precise, in the second quarter of this year.

Saudi Aramco’s average realised crude oil price was $78.80 per barrel in the second quarter of 2023, down from $113.20 a barrel for the same period last year.

But the company raised its dividend payout as it plans to distribute performancelinked dividends over six quarters beginning in the third quarter of 2023. Aramco plans to calculate the first performance-linked dividends based on the combined full-year results of 2022 and 2023. Aramco expects these performance-linked dividends to be calculated based on 70 percent of the Group’s combined full-year free cash flow for 2022 and 2023, net of the base dividend and other amounts including external investments.

“At Aramco, our mid to long-term view remains unchanged. With a recovery anticipated in the broader global economy, along with increased activity in the aviation sector, ongoing investments in energy projects will be necessary to safeguard energy security,” president and CEO Amin Nasser said.

“We are maintaining the largest capital spending program in our history, with the aim of increasing our oil and gas production capacity and expanding our Downstream business — with petrochemicals projects, such as our $11.0 billion expansion of the SATORP refinery with TotalEnergies, essential to meet future demand.”

UAE’s ADNOC Signs Deals, Brings Forward Net-Zero Target To 2045

ADNOC, the state energy firm producing most of the oil and gas in the United Arab Emirates, brought forward its net-zero target five years earlier than planned and signed several deals to expand in natural gas, carbon management, and hydrogen.

At the end of July, ADNOC said that Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Chairman of the Abu Dhabi Executive Council, approved the company’s accelerated decarbonisation

plan to bring forward its net zero ambition to 2045, from its previous target of 2050, and to achieve zero methane emissions by 2030. ADNOC is the first company in its peer group to accelerate its net zero target to 2045.

ADNOC also reported emissions intensity for 2022, saying that its upstream carbon intensity last year was around 7 kg of carbon dioxide equivalent (CO2e) per barrel of equivalent, one of the world’s lowest. ADNOC’s methane intensity was around 0.07 percent, the oil giant said.

ADNOC has also announced that it had started construction on the Middle East’s first high-speed hydrogen refuelling station. The station, which is being built in Masdar City by ADNOC, will create clean hydrogen from water, using an electrolyser powered by clean grid electricity.

“Hydrogen will be a critical fuel for the energy transition, helping to decarbonize economies at scale, and it is a natural extension of our core business,” said Sultan Ahmed Al Jaber, Minister of Industry and Advanced Technology and ADNOC Managing Director and Group CEO.

“Through this pilot program, we will gather important data on how hydrogen transportation technology performs as we continue to develop the UAE’s hydrogen infrastructure.”

ADNOC and US energy firm Occidental have signed a strategic collaboration agreement to evaluate potential investment opportunities in carbon dioxide (CO2) capture and storage (CCS) hubs in the United Arab Emirates (UAE) and United States with a view to develop a carbon management platform to accelerate the net-zero goals of both companies.

As part of the agreement, ADNOC and Occidental are evaluating the development of direct air capture (DAC) facilities in the UAE, including what could be the first megaton DAC project constructed outside of the US. The companies will also assess the joint development of one or more carbon management hubs in the UAE. The hubs would be able to offer carbon capture services and provide the necessary infrastructure to safely transport CO2 from the UAE’s carbonintensive and hard-to-abate sectors and

permanently store it in Abu Dhabi’s geological formations.

ADNOC and the National Central Cooling Company PJSC (Tabreed) announced in midAugust a breakthrough in the first project in the Gulf region to harness geothermal energy following the conclusion of testing on two geothermal wells at Masdar City in Abu Dhabi. The hot water generated by the heat from the wells will now pass through an absorption cooling system to produce chilled water, which will then be supplied to Tabreed’s district cooling network at Masdar City, accounting for 10 percent of its cooling needs.

ADNOC has also signed a deal to buy 30 percent in the Absheron gas field in the Caspian Sea in Azerbaijan by acquiring 15-percent stakes from each of the current partners, TotalEnergies and SOCAR.

“With global gas demand expected to steadily increase over the coming decades, ADNOC will continue to responsibly meet the world’s energy needs by developing and producing natural gas from world-class assets such as Absheron,” said Musabbeh Al Kaabi, Executive Director, Low Carbon Solutions and International Growth at ADNOC.

QatarEnergy’s projects are expected to provide around 40 percent of all new global LNG supplies by 2029, according to Saad Sherida Al-Kaabi, Qatar’s Minister of State for Energy Affairs and the President and CEO of QatarEnergy.

“By 2029, about 40% of all new global LNG supplies will be provided by QatarEnergy projects,” Al-Kaabi said at the 12th LNG Producer-Consumer Conference in Tokyo in July.

“These projects will achieve significant reductions in greenhouse gas emissions through carbon capture and sequestration as well as the use of solar energy. In all, we aim to reduce the overall carbon intensity by about 30% compared to previous generation designs,” Al-Kaabi added.

A huge contract for Qatar’s North Field South (NFS) LNG project led to a 60-percent jump in the overall disclosed contract value in the oil and gas industry in the second quarter of 2023, data and analytics company GlobalData said in a report in early August.

The overall contract value jumped from $35.4 billion in the first quarter of 2023 to $56.7 billion in the second quarter.

“The big boost on the value front is attributed to Technip Energies and Consolidated Contractors Company (CCC) joint venture’s landmark $10 billion engineering, procurement, construction and commissioning (EPCC) contract to build 16 million tonnes per year

North Field South (NFS) LNG project in Qatar,” said Pritam Kad, Oil and Gas Analyst at GlobalData.

MIDDLE EAST MIDDLE EAST NEWS SPONSORED BY

Sultan Ahmed Al Jaber, Minister of Industry and Advanced Technology and ADNOC Managing Director and Group CEO.

17

“Hydrogen will be a critical fuel for the energy transition, helping to decarbonize economies at scale, and it is a natural extension of our core business,”

Heila HLM20-3S: 1,700kg @ 10.5m

Effer 440M-5S: 2,150kg @ 14.5m

Effer 440M-8S: 955kg @ 21.5m

Effer 120000-3S: 6,850kg @ 15m

Heila HLRM170-4S 10,000kg @ 14m

Effer 175000-6S: 5,350kg @ 21.5m

Effer 175000-6SL: 2,250kg @ 27.3m

Modular Options Available

Come and see us at Offshore Europe on stand IR39

Qualified STAGE 2 Crane Operators

Support Technicians

Onshore Test Facility

T Kintore, Aberdeenshire, Scotland, AB51 0QP

+44 (0)1467 633805

ma r in e c r aneS

www.brimmond.com

info@brimmond.com rental

BRENT OIL PRICES OVER THE YEARS

THE DIGITAL MEDIA STRATEGIST

FROM EFORT TO IMPACT, TRANSFORMING YOUR DIGITAL MEDIA FOR COMMERCIAL GROWTH...

1 Year Ago - $93.45

At the beginning of September OPEC agreed to cut supply to prop up oil prices. This decision went against calls from Western governments who were battling to curb inflation in the face of a mounting global energy crisis. The decision would see 100,000 barrels a day cut - starting from October

By Eric Doyle

By Eric Doyle

There was a time when digital transformation meant using digital technology to enhance our internal processes. You might remember a time when your company said “we are implementing a new ERP system” or perhaps a digital accounting system or a CRM. All technology to allow us to save time and become more organised and efficient.

As the digital wind really started to blow, it encompassed more and more of what we do as professionals and it crept into our external facing, commercial worlds.

The answers to those 3 questions:

• It should be you and your team and you should be able to speak with confidence and hard evidence as to why.

5 Years Ago - $78.22

Experts warned that the global economy could be damaged if oil prices returned to the $100 mark by the end of 2018. Market watchers predicted that prices could reach somewhere between the $90 and $100 mark by year’s end after OPEC rejected Donald Trump’s demands to expand production.

Marketing, Sales and Business development all now picking up pace in the digital version of your commercial world - your commercial digital twin.

In this digital twin, the language and behaviour is different to our previous analogue commercial worlds. There are new rules, new methods and new skills required. When we meet a new client, we ask them to think about the answer to 3 questions…

• Who are the leading technical and commercial digital influencers in your sector..?

• Why should you care..?

• Why is it important..?

Have a think about these questions in relation to you, your team and your business…

10 Years Ago - $113.31

It was suggested back in September 2013 that the majors, such as Exxon Mobil, Shell and BP weren’t growing. They were discovering relatively little oil in recent years despite an increase in their investment. One factor at play was the fact the big companies were gradually becoming producers of natural gas rather than oil.

Some organisations are doing really well with this, some are dabbling and many are still to realise or confused…

Some have a digital commercial strategy and have rewired their commercial processes to become digital first, others are still thinking/ hoping that those occasional posts from the marketing team on the company page will be enough to win in the digital twin of their sector.

• As buying moves further to digital first, as prospecting and networking moves more to digital first, as our entire commercial worlds transform to digital…it’s likely you don’t want to be left behind, and its lilley you will see that you can lead in your sectors.

• As digital commercial worlds grow there is an opportunity to turn the volume down on your competition and ‘own the air’ around your specialist area - to be seen and understood as the clear and true answer to those problems your sector - to provide so much evidence of your expertise and personality that people in your space begin to trust you - people leaving schools, colleges and universities want to work with you, because they feel they know your business - harnessing the power of your complete team and experiencing the buzz that they all feel being part of something special.

Eric Doyle is the Managing Director of The OGV Studio, a Digital Media Strategy company whose mission is to Energise your Media for growth. Eric is a Fellow of the Institute of Sales Professionals.

10

AGO 5 YEARS AGO 1 YEAR AGO

“GOOD MEDIA MAKES PEOPLE VISIBLE, GREAT MEDIA MAKES THEM THE LEADERS IN THEIR SECTORS...”

YEARS

Brent Oil Column September 2023

At The OGV Studio, we believe in the transformative power of energising media. Scan the QR code to find out more. 19

SURINAME Block 58 Field Development Project TotalEnergies

$10 billion

APA Corporation has confirmed that the Krabdagu-3 appraisal well, drilled by the Development Driller III drillship, successfully tested three oil reservoirs 14km from the main discovery. Additionally, the company is studying an oil hub project that combines the Sapakara and Krabdagu discoveries that could see 800 million barrels of oil produced. A final investment decision on the future development is expected by the end of 2024.

BRAZIL Wahoo Field PRIO

$1 billion

PRIO expects that the drilling campaign and subsea installation/connection will start in October 2023. Topside adaptation works at the Valente FPSO are underway and manufacturing of equipment is progressing. First oil is expected in April 2024. In total, the field will require the deployment of 46 subsea structures, including six subsea trees (WCTs), two manifolds, one multiphase pump (MPP), eight inline structures (ILS), 18 umbilical termination assemblies (UTA), eight PLETs, one PLEM and two subsea control systems (SCS).

ROMANIA Neptun Block (Domino and Pelican South Fields)

OMV Petrom

$4.4 billion Saipem has been awarded a major EPCIC contract at the development. The work will comprise of construction of the gas processing platform, three subsea developments, a 30" gas pipeline approximately 160 kilometres in length, and an associated fibre optic cable from the shallow water platform to the Romanian coast.

Energy projects and business intelligence in the energy sector

www.eicdatastream.the-eic.com

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

USA

Mad Dog Southwest Field Development (Subsea Tie-Back)

BP

$750 million

BP is assessing the installation of a five-well subsea tieback from Mad Dog Southwest to the Argos platform. In May 2023, the developers drilled the SWX4 appraisal well in the southwest region of Mad Dog and concluded an additional connection to the Argos platform would help maximise its use, especially with prospects nearby.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

WORLD PROJECTS

3 9 6 10 1 1 7 3 2 4 5 12 2 8 11 4

SPONSORED BY www.ogv.energy I September 2023 20

ANGOLA Block 15/06: Ndungu Oil Field – FPSO Eni

$1 billion

TechnipFMC has been awarded a contract valued at between $75 million and $250 million to provide flexible pipe for the project, while Aker Solutions will deliver eight infield umbilicals and spares totalling over 25 kilometres. Aker Solutions' facilities in Fornebu and Moss, Norway, will be responsible for project execution, engineering, and fabrication. Work will commence immediately, and completion is scheduled for the 4Q 2024.

CYPRUS Aphrodite Gas Field Chevron

$3 billion

Chevron has submitted the development concept to the Cypriot authorities following the appraisal well's positive result. FEED work could commence by the end of 2023, pending approval. A final investment decision could be made in 2024, and gas production could begin in 2027.

QATAR North Field Expansion Project

Qatargas

$4 billion

Qatargas has awarded SLB a 5-year contract with an option to extend for another 5 years to provide unitised Cameron wellhead and tree systems installed in 50 offshore wells and 5 onshore wells in the North Field South project.

AUSTRALIA Laminaria-Corralina Fields Decommissioning

Northern Territory Government

$260 million

Xodus has secured a contract for the decommissioning of the Northern Endeavour FPSO. Under the contract, Xodus will be working for the Australian government in providing advice on project coordination, regulatory and environment, health and safety, technical, quality assurance, and contract management for Phase 1 of the decommissioning of the Northern Endeavour FPSO. Phase 2 of the project will involve the permanent plugging and well abandonment while Phase 3 requires the removal of subsea infrastructure and remediation of the Laminaria and Corallina fields.

LIBYA Bouri Gas Utilisation Project

Mellitah Oil & Gas

$1 billion

Saipem has been awarded a $1 billion EPCIC contract from Mellitah Oil & Gas. The scope of work includes the engineering, procurement, construction, installation, and commissioning of a 5,000 tonnes Gas Recovery Module (GRM) on the existing DP4 offshore facility, along with the laying of 28 km of pipelines connecting the DP3, DP4 and Sabratha platforms. The project will involve significant lifting operations by the Saipem 7000 semisubmersible crane vessel.

ISRAEL

Leviathan Gas Field –Phase 1B

Chevron $570 million

Chevron has awarded Corinth Pipeworks a contract to fabricate and supply approximately 118 kilometres of arc-welded steel pipes needed for the new pipeline. The pipes will be fabricated at Corinth's facilities in Thisvi, near Athens, with installation work set to begin in 2024.

INDONESIA Ande Ande Lumut Oil Field

$800 million

Prima Energi has completed the acquisition of the Ande Ande Lumut field and no plans to develop the field through an early production scheme with first oil production targeted to be achieved in 2026. The plan will involve the construction of a central processing platform (CPP) or wellhead platform. It will also include the drilling of up to eight production wells. The project also calls for conversion of a tanker into a floating production, storage and offloading vessel, or a floating storage and offloading facility.

NEW ZEALAND Tui Field Decommissioning

Tamarind Resources

$101 million

Sapura Energy, through Sapura Project Pty Ltd has secured a contract for the Tui Field Decommissioning Programme. The contract covers the recovery of four mid-water arches, its gravity bases, and tethering chains from the Tui field, and will be offloaded to a laydown area at Port Taranaki for processing and removal. The scopes are expected to be conducted from December 2023 until March 2024.

WORLD PROJECTS WORLD PROJECTS SPONSORED BY 12 9 5 6 10 11 8 7

21

DIGITAL TRANSFORMATION IN THE ENERGY INDUSTRY

By Tsvetana Paraskova

Digitalisation is helping both oil and gas producers and the clean energy industries to innovate, maximise efficiency of operations, and streamline costs.

Digital geophysical surveys and digital twins are already in use en masse among oil and gas exploration and production (E&P) companies, while various technology tools are deployed in the clean energy industries to accelerate the energy transition to greener sources.

Every company looks to use data analytics and various forms of artificial intelligence (AI) and machine learning to be an early adopter of technologies that can make the difference and place the firm ahead of competitors in an increasingly digital world.

Digitalisation in the Oil & Gas Industry

The oil and gas industry is accelerating the adoption of digitalisation as companies of all sizes and in all markets look to boost efficiency, cut costs, and maximise returns on investment and returns for shareholders.

Several recent examples of digitalisation include Petrobras awarding a five-year contract to SLB for an enterprise-wide deployment of its Delfi™ digital platform as Brazil’s state-held oil and gas giant looks to accelerate its digital transformation.

The contract scope covers Petrobras’ digital transformation from exploration, development, and production operations, including moving subsurface workflows to

the cloud to significantly accelerate decision making. The award represents one of Petrobras’ largest investments in cloudbased technologies and sets the foundation for it to achieve its decarbonisation and net zero targets.

“By leveraging AI, machine learning, and highperformance computing technology from SLB, Petrobras will drive aggressive efficiency and production increases across its E&P business,” Rakesh Jaggi, president, Digital & Integration, SLB, commented.

“Leveraging the Delfi platform to digitally transform Petrobras’ E&P workflows, will improve efficiency and demonstrates its commitment to sustainability and energy transition.”

SLB says that its platform, with AI and machine learning applications, reduced fault interpretation time in petrophysical modeling workflows by 60 percent.

SLB has also announced an alliance with Italian energy major Eni SpA to deploy e-vpms® (Eni Vibroacoustic Pipeline Monitoring System) technology, an innovative vibroacoustic wave detection system capable of providing real-time analysis, monitoring, and leak detection for pipelines around the world.

Enivibes, a subsidiary of Eni, will bring the new proprietary pipeline integrity technology to the global market through SLB’s industry-leading digital expertise and operations in more than

100 countries. The e-vpms technology can be retrofitted to any pipeline, regardless of age, providing immediate integrity data essential for maintaining a network’s continually reliable operation, SLB said at the end of July.

“Operators will be able to receive reliable and specific real-time information, allowing for focused and timely responses, especially in instances of an environmental nature,” said Ziad Jeha, business line director, Midstream Production Systems, SLB.

Several international majors have recently teamed up to develop and implement a digital inventory using 3D printing, more accurately known as Additive Manufacturing (AM) Equinor has teamed up with TotalEnergies, Shell, ConocoPhillips, Vår Energi, and Fieldnode to develop and implement this globally.

Digital Inventory, also called Digital supply Network, is set to transform the supply chain in the industry, Equinor says. This is a way of connecting all suppliers and end users in the energy industry, and to combine the digital recipe with on-demand manufacturing of spare parts.

“3D printing, more accurately known as Additive Manufacturing (AM) is quickly turning from a disruptive, fringe technology to a requirement in our industry, and we are already using it extensively to solve supply chain challenges and innovate faster, boosting productivity and

The energy industry is undergoing a major transformation as the energy transition progresses while energy customers are focused as much on decarbonisation as on security of supply.

22 www.ogv.energy I September 2023

Leveraging the Delfi platform to digitally transform Petrobras’ E&P workflows, will improve efficiency and demonstrates its commitment to sustainability and energy transition.

cutting costs from oilfield to refinery,” Equinor says.

According to McKinsey & Company, only 30 percent of oil and gas companies have successfully scaled digital manufacturing.

“Our work with oil and gas clients shows that only 30 percent of companies have successfully scaled digital technologies to deliver meaningful improvement. Usually, technology isn’t the problem. Most tech transformations stall due to fundamental cultural and organizational barriers,” Thomas Hansmann, a partner in McKinsey’s Jakarta office, said at the end of last year.

Yi Zhou, an associate partner in McKinsey’s Singapore office, added,

“Now, oil and gas companies want to embed tech-enabled operations into every part of their business. To do this right, oil and gas CEOs need to upgrade the capabilities of the people and revamp their information infrastructure, while remaining laserfocused on ensuring that the digital efforts generate real value.”

Digitalisation for Decarbonisation

Digital transformation is a key enabler not only for the oil and gas industry but also for the clean energy industry and for speeding up decarbonisation if countries want to have a chance to reach net zero by 2050. Digitalisation of the

power systems and grids needs to accelerate and investment needs to grow now because time is of the essence to avoid much higher costs later, the International Energy Agency (IEA) says

“Digital technologies and data hold tremendous potential to forecast and match electrical supply and demand, thereby cutting costs, improving efficiency and resilience, and reducing emissions,” according to the IEA. More efforts are needed in digitalisation, the Paris-based agency added.

Grid-related investment in digital technologies has grown by more than 50 percent since 2015, and is expected to reach 19 percent of total grid investment in 2023 globally. There is an increasing focus on the distribution segment, which now represents more than 75 percent of the total digital spend. There has also been a substantial increase in investment

in electric vehicle (EV) charging infrastructure, which doubled in 2022 compared to the previous year, according to the IEA.

Investment in digital-related grid efficiency continued to grow to a new high of US$63 billion in 2022. Expanded EV charging infrastructure was the main driver of growth, with global investment in public EV charging reaching US$16.8 billion last year, a more than tenfold increase from US$1.5 billion in 2018, reflecting the rapidly increasing number of EVs.

“However, further efforts by policy makers and industry will be necessary to realise the full potential of digitalisation to accelerate clean energy transitions. This includes the implementation of enabling standards, policies and regulations that prioritise innovation and interoperability while addressing risks to cybersecurity and data privacy,” the agency noted.

To get in step with the net-zero scenario, the global inventory of flexible assets needs to increase tenfold by 2030, which means that all sources of flexibility – including batteries and demand response supported by smarter and more digitalised electricity networks –need to be leveraged, the IEA said.

Enabling digital technologies such as smart meters and distributed monitoring and control devices is essential to fully exploit the flexibility potential of the growing number of connected devices, according to the agency.

“Power grids are among the unsung heroes of the energy transition, but they need massive investment,’’ IEA Executive Director Fatih Birol said in June, commenting on an IEA report on the digitalisation of power systems.

“While much attention goes to solar panels and electric vehicles, it is grids that connect everything together. By digitalising our grids, our power systems become more reliable and secure, and our utilities can better manage the balance of electricity supply and demand,” Birol added.

“The longer we wait to upgrade and digitalise our grids, the more expensive it will get.’’

DIGITAL TRANSFORMATION 23

On the same page

At a very quick glance, Proserv, a longstanding controls technology business with multiple sites across the globe and rubbing shoulders with some of the biggest OEMs and service providers around, and Intelligent Plant, a small but growing award-winning data analytics disrupter, might not appear to be the most obvious of fits. But you need to take a closer look.

In truth, Proserv does have history for forging innovative partnerships, whether with fellow supply chain leaders in the US to underpin its subsea oil and gas offering or with university spin-outs to further its push into offshore wind. But it was a shared philosophy around data access and how it can unlock advantage for clients that brought these two Aberdeen based companies together. As Steve Aitken reveals:

“I first met Stuart Harvey, Proserv’s VP, Digital Innovation when I was speaking at a conference and we got talking about some of the things we were doing. We realised that we were both facing similar challenges, but in different spaces. Us from a digital viewpoint and Proserv from a controls hardware perspective.

“We share many values and it was really great to find out that there was someone else out there who had the same regard and approach

to using data, the benefits of data analytics, and how this can empower operational strategy and performance.”

Positives from the pandemic

Davis Larssen adds that in the early days, as he and Steve began to connect personally, it was a question of building trust and a foundation. It was the advent of the first pandemic in a century that, quite conversely, enabled the two business leaders to forge greater understanding of their respective outlooks and to cement their relationship – just as social distancing was keeping many other people apart.

“With two companies of contrasting size and scale, it isn't necessarily easy for them to come together as a true partnership, and so Steve and I spent a lot of time establishing that solid ground.

“Ironically, while we talk about shared digital philosophies being at the heart of our alliance, Covid-19 actually played a positive role in moving it forward. Due to some of the restrictions in place, Steve and I would often simply meet up outside for a walk and a coffee. Sometimes this could be for up to a couple of

hours, and that allowed us to get to the core of a lot of issues and build a really fundamental basis for the two companies.”