its members. Consequently, large companies move the index. The largest five companies in the index, Apple, Microsoft, Alphabet, Amazon, and Berkshire Hathaway, account for 22.8% of the combined equity value of the whole index. Expanding the list to the most significant ten index members takes up 30.4% of the index value.

The largest five have experienced an average yearto-date return of 26.2%. On average, the top ten index members have increased their stock value by 35.9%. Meanwhile, the average return of the rest of the index, approximately 490 stocks, is 0.3% since the beginning of the year. The point? Effective stock picking has earned remarkable rewards so far. However, beware of the Jabberwock. The prominent contributors to this year’s gains now trade at significant premia to their historical multiples.

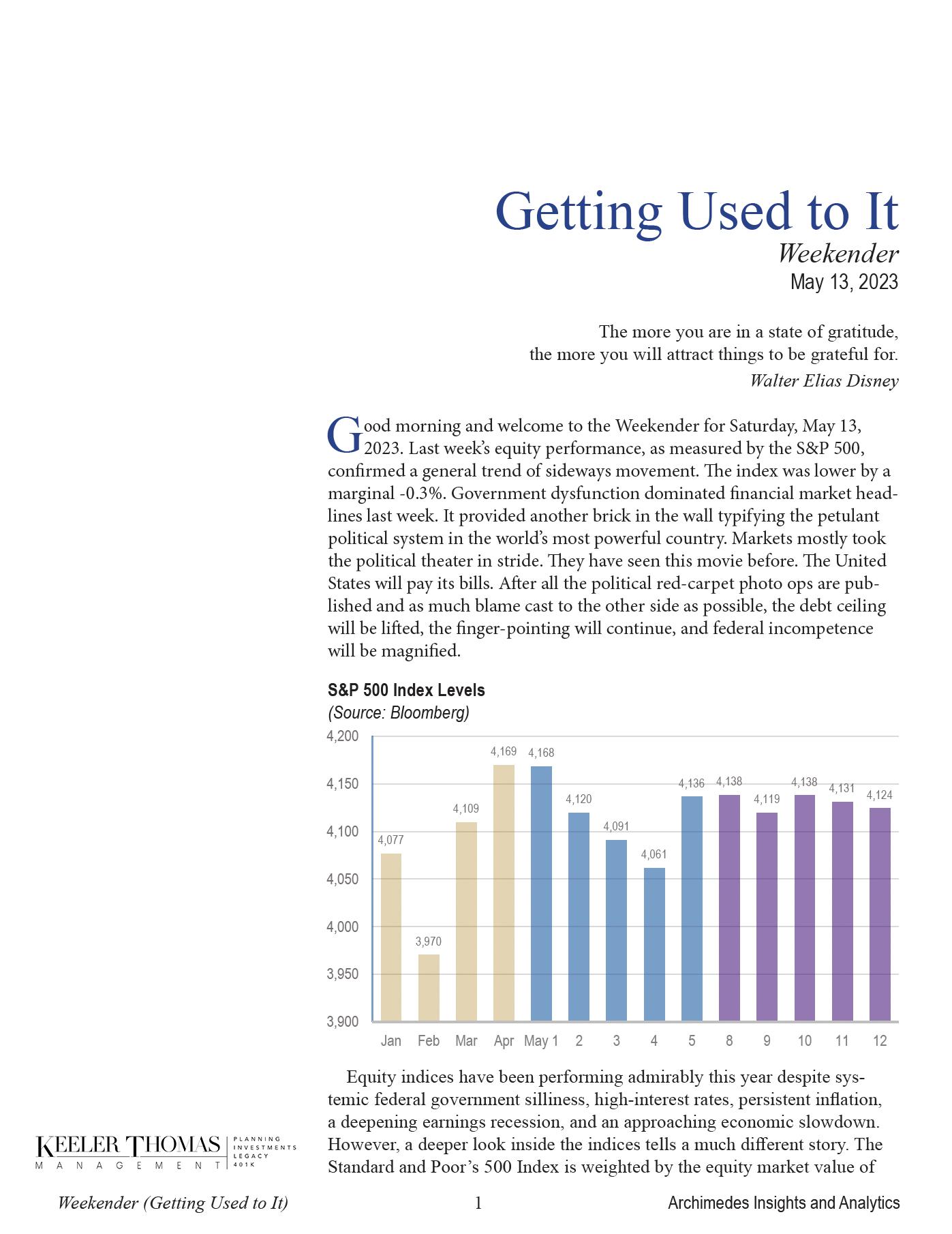

Year-to-Date Returns for S&P 500 Value Weight (Blue) and Equal Weight (Gold)

Year-to-Date Returns

January 2 - May 12, 2023

(Source: Bloomberg)

The Jabberwock driving markets comes from the artificial intelligence (AI) sugarplums dancing in the head of investors. This shows up in the disproportional stock price performance of large technology companies. So far, artificial intelligence has been referenced more than 1,000 times in first-quarter earnings calls. Some expect AI applications to increase cloud computing load by 25% over the next three years alone. AI’s immediate belt and suspender beneficiaries are Nvidia, AMD, Microsoft, Amazon, and Alphabet. They have all outperformed the S&P 500 since the beginning of the year.

The AI spoils will likely exceed previous technology revolutions by a wide margin. Many legacy firms are redirecting their firms to take advantage of AI opportunities. At the same time, AI is breathing fresh air into the venture and private equity community. Ultimately, similar to the evolution of the internet, we expect AI to become a fully integrated technology use case instead of a new industry. Social changes wrought by AI technology are also likely to be revolutionary. A revolution I, due mainly to age, senility, and infirmity, am only too grateful to miss—sorry, kids.

Another contravening factor working its magic on markets is the decline in stock buybacks. During the pandemic, when interest rates were meager, corporations binged on free credit using the proceeds to repurchase their shares. Higher interest rates, for a longer period of time, change the buyback math. US firms have announced plans to purchase $580 billion of their shares in 2023, approximately -8.2% lower than a year ago.

In January, buyback announcements were hitting records. We believe tighter profit margins and softer demand will continue to pressure corporate cash flows, which, combined with higher borrowing costs, make corporations more hesitant to keep buying their shares. Stocks of companies with aggressive buyback programs have been underperforming the broader market, and we expect this to continue until interest rate relief arrives.

Year-to-Date Returns for S&P 500 (Blue) and Buyback Index (Gold)

January 2 - May 12, 2023

(Source: Bloomberg)

economic recession, corporate earnings are already deep into one. Approximately 87.1% of publicly traded companies in the United States have released first-quarter earnings. Market pundits are aflutter with commentaries about how companies have beat expectations. Diminished expectations. Data show that sales growth is higher by 4.9% compared to last year. Sounds respectable, but it’s right in line with the inflation reading from the Consumer Price Index (CPI), which came in at 4.9%. So, there was no actual increase in revenue at all.

This Weekender will look at inflation and earnings and highlight factors driving countries, instruments, sectors, and themes. We will not have a One More Thing segment this week. But next week, we will include an analysis of Disney.

Economic Narrative

Inflation data released last week showed a sub-5% consumer price index at the headline level. Prices are moving in the right direction, but the early drops have come from fat pitches. Harder-won declines must come from upward sticky areas like housing and wages. Meanwhile, at approximately 5%, inflation is still twice the Fed’s target. The most challenging problem with inflation is that consumers, companies, and the economy are learning to deal with it. Companies with pricing power have been known to benefit from it.

The University of Michigan released consumer confidence data that was much worse than expected. Inflation stretches household budgets, pushing consumers to use credit cards for daily purchases. As part of the Michigan data, consumers’ expectations of where they think inflation will be over the next 5-10 years rose to 3.2%. This is important for two reasons. First, this data is surprisingly accurate over the long term. Second, it shows a degree of consumer resignation. Companies and consumers are learning to live with inflation. While the economy seems teetering on the edge of

Meanwhile, earnings growth so far has been an abysmal -4.3%. Adjusted for inflation, earnings are lower by -9.2% compared to last year. Earnings results are generally not adjusted for inflation. But that is because inflation has been so intense—until now. Looking more narrowly, for members of the S&P 500 Index, Revenues compared to last year are higher by 4.3%, and earnings are lower by -3.3%. If analysts’ estimates are to be believed, earnings for the second quarter are expected to fall by -7.3% compared to the second quarter of last year.

The current earnings recession is mainly a function of margin compression instead of weak demand. Bloated inventories, a partial response to pandemic-era stockouts, have forced companies to heavily discount products to make way for the 2023 holiday season build-up. Below is a graph of retail inventories divided by wholesale inventory. Retail channels remain stuffed.

Retail-to-Wholesale Inventory Ratio

January 2000 - April 2023

(Source: Bloomberg)

We expect that inflation will continue to fall in the coming months but at a much slower pace. The Fed has been explicit about its view that interest rates are not likely to come down at their hand until next year, at best. We find no reason to disagree with them. We expect bloated inventories to drive aggressive product discounts and tighter corporate margins and profits in the months ahead. Artificial intelligence hoopla aside, the large technology companies leading the market this year will struggle in the back half. Meanwhile, many high-quality names currently hiding in the shadows are very attractively valued.

Countries

Weekly Instrument Returns

May 8 - 12, 2023

(Source: Bloomberg)

India

and Japan were the best performers, while China-sensitive countries declined together. Countries with stars connected to the Middle Kingdom fell on a confluence of disappointing economic data suggesting China’s post-shutdown renewal may entail only a partial resurrection.

Weekly Country Returns

May 8 - 12, 2023

(Source: Bloomberg)

The yield curve continues to be severely inverted, although it lifted off all-time lows last week. Few indicators are more reliable predictors of inflation, and this one is still blinking red.

Yield

Bitcoin was the biggest loser by a wide margin. Crypto traders are generally cautious as economic indicators increasingly point to economic softness and the persistence of higher inflation and interest rates. The Dollar was the primary winner this week after months of softness.

Meanwhile, money continues to flow out of bank deposits and into money market instruments. A race for yield is intensifying. Banks continue to offer meaningless returns on deposits compared to short-term securities.

Money Market Balances (Billions)

March 30, 2022 - May 12, 2023

(Source: Bloomberg)

driven by the flow of artificial intelligence dollars into the space.

Weekly Sector Returns

May 8 - 12, 2023

(Source: Bloomberg)

As mentioned earlier, large growth companies performed exceptionally well this week, especially those wearing a dog tag with artificial intelligence. Value underperformed, and small companies were in the penalty box compared to their larger peers.

Weekly Equity Instrument Returns

May 8 - 12, 2023

(Source: Bloomberg)

As mentioned, approximately 87.1% of publicly traded US companies have reported profit results for the first quarter. In most sectors, earnings have fallen significantly. Industrials benefit from contracts locked in higher prices. Energy profits were buoyed by better capital discipline and higher crude prices. Strong consumer spending, credit cards, and a tight labor market highly benefited consumer discretionary earnings.

Sectors were broadly lower, except communications and consumer discretionary. Communications were

Themes

Among themes, cloud computing was lifted by its connection to artificial intelligence. Blockchain fell in sympathy with cryptocurrencies.

Weekly Theme Returns

May 8 - 12, 2023

(Source: Bloomberg)

Conclusion

That’s it for this Weekender. Have a wonderfulweek.

Disclosure Statement

Index performance does not reflect the deduction of any fees and expenses, and if deducted, performance would be reduced. Indexes are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. Investing involves risk, including loss of principal.

The statements provided herein are based solely on the opinions of the author(s) and are being provided for general information purposes only. The information provided or any opinion expressed do not constitute an offer or a solicitation to buy or sell any securities or other financial instruments. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The foregoing information has been obtained from sources considered to

be reliable, but we do not guarantee it is accurate or complete. Consult your financial professional before making any investment decision.

The stock indexes mentioned are unmanaged groups of securities considered to be representative of the stock markets in general. You cannot invest directly in these indices.