17 minute read

DAVIPLATA

DAVIPLATA, A FINANCIAL SOLUTION IN THE HANDS OF EVERY COLOMBIAN

Allowing all people to access the benefits of the products and services of the financial system is one of the great challenges that modern societies face. Recently, technological development and new ways of relationship between people and banking have put on the table the need to generate innovation processes and a deep understanding of the client to allow financial institutions to offer products that fit the customer needs and easen their daily life to improve their well being and quality of life.

Advertisement

2011: THE BEGINNING OF A NEW ERA IN DIGITAL BANKING

In 2011, only 40% of the Colombian population had access to a financial product according to the Global Findex of the World Bank. This low penetration of financial products in the country showed the importance of generating financial and social inclusion processes to Colombians in order to boost the acquisition and usage of financial services.

Also, access to financial products of rural and low income population was limited and it presented a significant gap compared to the urban population. This lack of access responded to different types of barriers, some related to the supply, like physical presence of bank branches or the costs associated with the products, but some other limitations were related to customers itself like the lack of knowledge of the products available or even the perception of no need for the products.

Taking into account these problems, the colombian financial industry, along with the regulatory and supervisory entities, undertook the task of promoting financial inclusion in Colombia by allowing the offering of products adapted to the customers’ needs and eliminating the existing barriers when interacting with the bank. Adjustments were made to financial regulation in 2011 to allow financial institutions to offer a new type of products with no paperwork and remotely to open it, and without leaving out the stability and security of the financial system as a whole. Before these changes were made, customers needed to go to a bank branch to fill out documents in order to get a savings account, making the process complex and expensive.

Thanks to these changes, several banks began to offer savings accounts with a simplified process through cell phones; In this path DaviPlata became the leader and pioneer in the implementation of this type of financial products with a simple and easy process of acquisition. These regulatory modifications boost financial inclusion in Colombia as more banks started to offer these products.

DAVIPLATA: A PRODUCT IN CONSTANT DEVELOPMENT

In 2012, Banco Davivienda launched DaviPlata, a financial product that seeks a closer relationship of clients with the bank of those who were unbanked. The development of DaviPlata was possible thanks to the multiple efforts of different areas of Banco Davivienda to design and implement a 100% digital product that is handled directly from a cell phone, with a simplified, practical, easy to use opening process, and without costs or commissions to the client.

DaviPlata was initially developed on the SIM Tool Kit - STK technology, which allowed any Colombian, with a cell phone and ID number, to have the product. This allowed DaviPlata to reach every colombian with a complete and wide range product indistinct of its location or income. DaviPlata’s adoption and adaptation

among colombian population was a success after launching to the market, making possible to accelerate financial inclusion in the country.

In 2016, DaviPlata evolved to offer its services through a mobile application, expanding the range of services offered. In this transition from STK technology to the mobile application, services offered were enhanced and personalized, allowing a better experience to the client and an easier way to use it.

DAVIPLATA’S ADD VALUE TO THE COLOMBIAN MARKET

DaviPlata is a 100% digital product, free to the client, with a transparent language and with a simplified opening process without the need to go to a bank branch and with no restrictions for its acquisition, democratizing financial products in Colombia. The close relationship with the client and easy understanding of the product is one of the added values of DaviPlata. The financial industry has traditionally been viewed by clients as distant and complex. Taking in consideration this reality, during the development of DaviPlata, it was necessary to create and design a product that was understandable to the client, with a self-explanatory language and terminology to create a friendly relationship with the customer. DaviPlata has become an ally for Colombians when it comes to carrying out their daily activities and financial transactions. DaviPlata offers to its clients the possibility of making transfers to any colombian, regardless of the other person’s bank, free and immediately. Also, users can pay their utility bills, buy airtime top up, save with a savings pocket within the product and many more, all of this, in the cell phone.

To withdraw money it is not necessary to have a card. DaviPlata was the first financial product in Colombia that allowed customers to withdraw money at an ATM with a code sent to the client through a text message. This innovation revolutionized the colombian financial market and from that moment several entities have adopted this form of withdrawal of money on their products. Additionally, customers have a savings pocket, which allows them to put part of the balance away from the available balance to foster a culture of savings among customers and making it easy for them to achieve their long term goals.

Nowadays, DaviPlata users have the possibility to make purchases in stores through a QR code, improving security by avoiding them carrying large sums of money to make their purchases, facilitating technology adoption, cash reduction and electronic payments.

FINANCIAL INCLUSION

FOR ALL: DAVIPLATA IS SUITABLE FOR PEOPLE WITH VISUAL DISABILITIES

In 2016, the DaviPlata team acknowledged that people with visual disabilities encountered great barriers to access financial products. Taking into account DaviPlatas motto, that financial inclusion is for all, it began one of the biggest challenges for the team. Working along with the Colombian National Institute for the Blind - INCI, it began the adaptation of DaviPlata application to allow the visually impaired population to use the product with the use of the Talk back functionality (On Android) and Voice Over (On iOS) thats provides voice guidance to the person in a simple and intuitive way. By doing this, DaviPlata opened the doors of the financial industry to those with visual impairments in Colombia.

“La Tecla de la Casita Roja” a solution for the young population “La Tecla de la Casita Roja” is an innovative and disruptive feature launched by DaviPlata in the colombian market that allows all customers to make their transactions from their cell phone keyboard while using any social network immediately and at no cost.

This feature was possible through an alliance with a startup in Israel called PayKey, which allows each customer to transfer money to another person, buy airtime top up, send a money order to another person or divide a restaurant check without opening the DaviPlata application and without leaving the social network.

Since its launching in 2017, more than 700.000 clients have used this solution to carry out their transactions. “The Tecla de la Casita Roja ” is in constant evolution to the new social and financial realities of our clients, offering a product according to their needs.

Buying microinsurance through a cell phone: a change in the market To enhance the services of DaviPlata, in alliance with Seguros Bolívar, one of the biggest insurance companies in Colombia, a microinsurance product was developed for the customers. This product is a 100% digital, with no exclusions, easy to acquire and at a low cost. In 2019, pet microinsurance was launched allowing customers to insure their dog or cat for a reasonable price.

Nowadays, alternative means of transportation are gaining popularity, and that’s why DaviPlata is offering a bicycle microinsurance that allows the customer to receive compensation for the theft of the bicycle or in case the person injures someone while driving it.

The world of e-commerce with the Ecard DaviPlata The rapid growth of ecommerce in recent years has encouraged people to migrate to online shopping leaving behind the present purchases. However, the preferred means of payment to make these purchases in Colombia continues to be cash.

The ecommerce usage is commonly used for new generations as they consider time as a very valuable asset and immediacy as an important attribute and ecommerce offers them a solution to their daily activities. However, this group of people faces a reality that prevents them from being part of the digital world and taking advantage of the benefits of commerce that it is the need of a credit card.

Because of this, DaviPlata started to design and create a solution accessible to their customers that would eliminate barriers, such as the lack of credit experience or stable income that face digital natives to get a credit card.

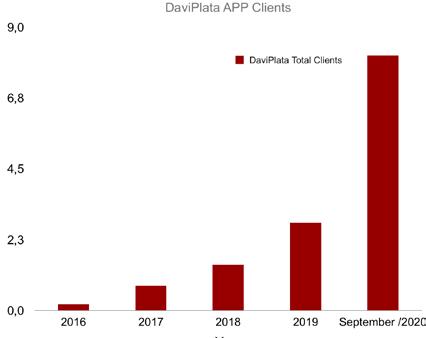

DaviPlata Clients

In March 2019, the Ecard DaviPlata was launched to the market. With it, users can make their purchases on digital platforms and ecommerce without interest rates or commissions just by recharging the card with the funds from their DaviPlata balance. In less than a year, the Ecard has opened the doors of ecommerce to 1 million customers in Colombia.

GREAT NUMBERS FOR DAVIPLATA TO DATE

As of September of 2020, around 11 million Colombians have DaviPlata in Colombia without distinction of gender or socioeconomic status. Those clients have performed more than 900 million transactions since its launch, consolidating it as a widely used product that has contributed significantly to the promotion of electronic transactions and financial inclusion in the country. Users belong to all age ranges, with a concentration among 22 and 45 years of age. Customers are located along the whole national territory, from La Guajira to the Amazon, down in the south of the country. DaviPlata use has been possible thanks to the wide network of bank correspondents of Banco Davivienda that account for more than 23.000 locations with presence in 979 municipalities.

Since 2011, DaviPlata has been the first financial product for 2.5 million Colombians. At the end of september 2020, nearly 8 million customers made their transactions from the mobile application. The app can be used without having mobile internet being the first financial application in the colombian market to offer this benefit.

During 2020, due to the Covid19 pandemic, the number of customers of DaviPlata as of September, doubled in a 5 month period. This extraordinary growth seen in 2020 was accompanied by a remarkable increase in the usage of the product along old and new customers. The amount of transactions done in DaviPlata during the month’s quarantine grew by 300% and the money traded in a month doubled compared to the amount of the first months of 2020.

DaviPlata APP Clients

DAVIPLATA HAS BEEN AN ALLY TO THE NATION GOVERNMENT TO SUBSIDIES DISBURSEMENT

DaviPlata has been one of the allies of the National Government in the disbursement of subsidies from different social programs in the country. Some of the programs that DaviPlata has helped on are Familias en Acción, Jóvenes en Acción, Ayuda humanitaria a Víctimas, transportation subsidies and Familias en su Tierra, Ingreso Solidario, Devolución del IVA, Bogotá Solidaria throughout the country, in urban and rural areas and even in some indigenous reservoirs in the south of the country.

The subsidies disbursement have benefited more than 2.6 million people that have received their money through DaviPlata and they have distributed a just over 7.2 billion COP in about 36 million transactions and people from more than 900 municipalities have been disbursed

During 2020, DaviPlata was an ally of the government to disburse all the humanitarian help to people that suffer the negative consequences of the Covid19 pandemic. In this path, DaviPlata participated in the disbursement of nationwide programs like Ingreso Solidario, Devolución de IVA, Familias en Acción, Jóvenes en Acción and regional or local programs like Bogotá Solidaria, making possible for many people around the country to get the government subsidy directly in their phones.

The disbursements made by DaviPlata not only facilitated the reception of the subsidy from the Government but also contributed to the digital adoption of the beneficiaries and opened the doors to the financial system to these people. During the process of activation of DaviPlata, encounters with the beneficiaries were held in order to show them how to use the product and all the benefits. Also, some lessons of financial education were made to the customers so they can learn about the benefits of savings and the proper use of money to achieve goals in the long term.

TRANSFORMING THE LIVES OF WORKERS

Another milestone that has been achieved DaviPlata is the financial inclusion of low income workers of multiple economic sectors of the colombian economy and even members of the armed forces. DaviPlata has consolidated as the payroll product for low- and middle-income workers in Colombia, being the product through which employees receive the money derived from their work. Likewise, DaviPlata is an ally of SMEs, given the easy process of opening, the zero costs to the client and the large portfolio of services it offers. As of September 2020, more than 15.000 companies have trusted DaviPlata as the payment channel to its employees.

One of the best examples of how DaviPlata has helped companies are the employees of flower crops in the savannah of Bogotá. Before receiving their salary through DaviPlata, these people were exposed to security problems by having to carry the money that was paid to them in cash. With DaviPlata this problem is a thing of the past, because now they can go to any Davivienda ATM at any time and withdraw their money for free as many times as necessary.

Another example is related to the wage payment of the members of the military. Many of the country’s soldiers work in remote rural areas and may take months to return home. Because of this, their relatives were affected since the money to pay all the bills was not available due to the absence of the account owner. Now the soldiers who are working in these areas can send money to their relatives from there, through their cell phone, eliminating their worries and improving the quality of life of their families.

DAVIVIENDA

ECOSYSTEMS: AN ALTERNATIVE APPROACH TO COMMUNITIES

In recent years, Colombia is working to promote electronic payments, given the enormous advantages that this type of payments offers to the society in terms of security, traceability, formality and reduction of transaction costs.

In 2015, Davivienda and DaviPlata had a dream to make a municipality in Colombia into the “first town” without cash for a day. This ambitious project for Banco Davivienda and the country, was possible through the articulation of different private sector actors, as well as of the public sector, that viewed this initiative as the first step to promote electronic payments in Colombia and the perfect setting to show the world that digitization of the economy is possible.

The chosen town for the project was Concepción, Antioquia, a municipality of 5,000 inhabitants in the eastern mountains of Antioquia. During the design process and implementation, interdisciplinary teams from Banco Davivienda visited Concepción for months, learned about its economic transactions and the needs of its inhabitants. Once the initial phase was executed, the stage of training activation of the habitants and shops took place in order to have everything ready for the big day. The shops of Concepción were activated and started their path to digitization receiving payments of their sales through DaviPlata. Shops of groceries, beauty salons, bars,restaurants,nightclubs, public transportation and even the church began to do all the money transactions with cash and only through electronics payments.

The big day took place on July 9 of 2015. During that day the residents of Concepción, tourists, government officials, National, local authorities and all the people, enjoyed the experience of a town being 100% cashless and digital. The transactions were carried out by DaviPlata immediately and without costs to the customer. With this first exercise, it was proven locally and globally that eliminating paper money is possible.

In 2017, a similar model as the one carried out in Concepción was implemented in 4 coffee corridors in the departments of Antioquia, Caldas and Huila, which cover about 45 municipalities. In this exercise, it was possible to involve the entire supply chain of the production cycle of coffee to eliminate cash between actors, from the collector to the marketer. An ecosystem was created around coffee production, that allowed the promotion of electronics payments and a substantial improvement in operational processes and costs reductions. Likewise, Banco Davivienda managed to modify some products to customize them to the needs of the actors involved in the coffee production cycle, facilitating their interaction with the financial system.

In 2019, another ecosystem to promote electronic payments was launched in Usiacurí, Atlántico, known as the second artisanal municipality of Colombia, with great cultural wealth and one of the bastions of the Caribbean culture in the country.

At Usiacurí, a project to promote electronics payments was implemented to eliminate the use of cash for the purchase of the iraca palm handicrafts made by the municipality’s traditional artisans. Actually, anyone can make the purchase of crafts with DaviPlata through a QR code, without having to have cash, safely, immediately and at no cost. Additionally, Banco

Davivienda will allow these artisans to sell their creations online through a platform that will make available the opportunity for some to start their way to export their products.

With these projects Banco Davivienda seeks to facilitate the life of the communities that inhabit these municipalities, encourage and promote electronic means of payments, contribute to their formalization and the integral development of sustainable and digital communities. Also, it was demonstrated that the elimination of cash in communities is possible and that the positive effects are greater than the costs resulting from the design, planning and implementation of these types of experiments.

Additionally, the implementation of these ecosystems allowed a process of financial education for the residents of the municipalities. Training sessions of financial education were given to the residents and through these, the knowledge of the financial system was strengthened and the importance of managing money in a proper way, the role of saving and financial planning, for the day basis.

DAVIPLATAS FUTURE:

CONTINUE THE PATH OF INNOVATION AND FINANCIAL INCLUSION TO REACH A DIGITAL SOCIETY The digital transformation of the colombian financial system and the new consumers will remain the focus and objective for the future. Along these years of work, great steps have been taken to make DaviPlata a leading innovation product in the colombian financial industry and that work should continue to consolidate its leadership and stand out as the main digital financial product in the country.

At DaviPlata we believe that financial inclusion should be to all socioeconomic levels, without distinction of age, gender or location. In the coming years, the empowerment of women will be one of the main goals to close the gender gaps that still exist in the access of financial products. DaviPlata will continue to innovate and enhance their services by offering credit products adapted to the needs and characteristics of the customers. In the future we will work together with local governments to support the construction of smart cities and the creation of innovative solutions for transport and social services among cities.

In the years to come, work will focus on to keep the product at the forefront of new trends and technologies, the generation of alliances with companies of different sectors, such as the one did with Rappi in 2019, for the launching of RappiPay Davivienda, in order to be a financial product that is useful for our clients, facilitating their daily life and improving their well being.

An alternative bank focused on designing Grupo empresarialfinancial solutions simple and flexible tailored to the needs of the fashion sector.