13 minute read

BERIBLOCK

BERIBLOCK: PRIVATE BLOCKCHAIN TO ENSURE AND GUARANTEE THE INTEGRITY OF DIGITAL DOCUMENTS

Financial institutions and “fintechs” (technologybased companies that offer financial services) in Latin America are exploring applications to use Blockchain technology to improve their operational processes and internal fraud risk. Making an investment in this type of technology without being certain that it will be a success can be a risk that entities prefer not to take, either due to high development costs, lack of expertise, resources, or other reasons. The foregoing leads to these financial institutions losing all the benefits that Blockchain technology can provide today, specifically to guarantee the integrity of any electronic document, record any modification to them and certify who is their owner, all without depending on a third party such as custodians or securities deposits.

Advertisement

WHAT DOES BERIBLOCK OFFER?

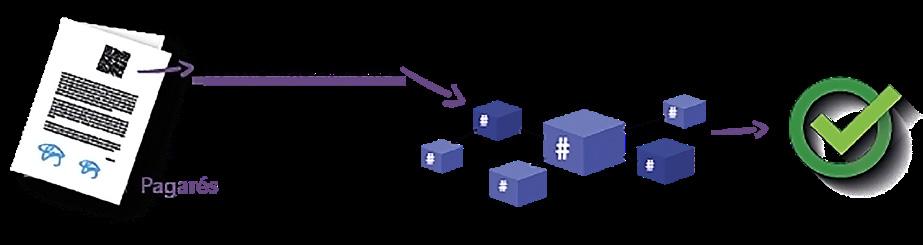

A private Blockchain made up of all the clients of the company, in which our clients can register any type of electronic document, such as electronic promissory notes, debt or capital securities, invoices, contracts, financial or merchandise certificates of deposit, diplomas and degree certificates, product integrity certificates, among many others.

The main benefit provided by using the Beriblock platform is to guarantee, through state-of-theart private Blockchain technology, the integrity, authenticity and non-repudiation of any registered electronic document, and at the same time preserve the traceability of any modification

to them, which includes keeping the record and certifying who are the owners of said documents at any moment of time. All of the above with the highest digital security and at the lowest market price. Other complementary services we offer are electronic signature of documents, origination of documents such as promissory notes and contracts, custom development of digital credit solutions such as affiliation, digital identity and financial scoring, and custom developments for the implementation of Blockchain technology in traceability of physical products, as well as development of “Smart Contracts” fo _asset tokenization projects, among others.

SCOPE OF BERIBLOCK TECHNOLOGY

Beriblock operates with Hyperledger Sawtooth technology, which is a modular platform that allows the creation of distributed databases that are maintained and implemented without the need of a centralizing entity of the information. This network is maintained and controlled by the Linux Foundation, which hosts the most important open source projects in the world such as companies the size of Google, AT&T, IBM, Intel, Microsoft, among others. Hyperledger is recognized as the largest and most important private or enterprise Blockchain network that exists today. Specifically, the Sawtooth network has unique advantages in terms of scalability, operability, storage and transaction speed of the digital assets registered on it. One of the most important characteristics of the Sawtooth network is that it allows parallel transactions and can support transactions with and without prior permission1. Likewise, its modular architecture allows it to be adaptable to multiple varied solutions, meaning it is highly flexible in its usability. Hyperledger Sawtooth internal governance is managed by the Linux Foundation and is focused on creating very strict and secure consensus and smart contract rules. Similarly, this platform is designed for business solutions since it comes with BFT features2, supports Smart contracts written in Java language and its storage system is the merkle radix data structure, which is common in other Blockchains such as Ethereum.

1 Concept 2006033594-001 of August 29, 2006. 2 Concept 2018120539-008 of November 14,2018. All this allows: Transfer digital assets quickly and safely. Maintain the traceability, inalterability, nonrepudiation and integrity of the transferred documents. Guarantee the security of the information of the documents according to the strictest standards of our clients.

REGULATORY FRAMEWORK

For the registration, transfer and execution of promissory notes with blockchain. With the advent and emergence of new technologies, which generate increasingly rapid changes in the way of doing business, today it is very common that given its nature, electronic promissory notes are issued in the process of creation, circulation and negotiation, the fintech sector is carried out exclusively by virtual means, without resorting to the services of a custodian or securities depository. It is increasingly common that companies that are part of the fintech sector, use this practice to develop their corporate purpose, even more so if it is taken into account that the reason for being of this sector is precisely to incorporate, in an agile and safe way, new technologies in the provision of financial services. In this sense, it is feasible to use innovative technologies with Blockchain (especially private blockchains), which guarantee the integrity, nonrepudiation, traceability and confidentiality of records of electronic promissory notes, as well as the possibility of registering any change of status (cancellation, seizure blocking, modifications, annulment / cancellation, among others), register electronic signatures on unregistered or previously registered documents, and register transfers of ownership thereof, covering figures such as property endorsement, guarantee endorsement, proxy endorsement, and any other type of endorsement. Due to the nature of the technology, it is virtually impossible to delete the records and modify them, thus ensuring the integrity of these records through this technology is met.

The practice in question fully complies with the Colombian regulations applicable in this regard, in

particular, the regulation on securities provided by the Commercial Code and Law 527 of 1999 that defines and regulates the access and use of data messages, such as the following is specified: Article 619 of the Commercial Code defines the securities, within which the promissory note is counted, as “necessary documents to legitimize the exercise of the literal and autonomous right that is incorporated in them”, which will be fully Valid if they meet the requirements established in article 621 of the same estate, that is, that the right that is incorporated in them is mentioned and that it is signed by the creator of the title. For its part, Law 527 of 1999 recognizes the legal validity of data messages, that is, electronic documents, including electronic promissory notes. In this sense, the Financial Superintendency of Colombia stated that “a data message may be classified as a security, to the extent that in addition to the requirements provided by Law 527 of 1999 to be considered as a data message, it complies with the characteristics of the securities and with the general requirements provided for in article 621 of the Commercial Code”3 .

Thus, for the creation and validity of an electronic promissory note, it is enough to comply with the definitions and conditions of Law 527 of 1999 and the Commercial Code. In this regard, the intervention of a custodian or a securities depository is not necessary, as their services are only necessary in the stock market, given the magnitude of the operations carried out there. It is important to note what was expressed by the Financial Superintendency in this regard: “in relation to the legal nature of electronic securities, it is important to mention that they are regulated under commercial law, particularly in the Commercial Code and in the case of electronic titles under Law 527 of 1999 (hereinafter “Law 527”) and its regulatory decrees. Second, as supported by the concepts mentioned in your question, there is the legal possibility of issuing electronic securities, which meet the legal requirements, which may be deposited in a Securities Depository, for the purposes of their dematerialization and annotation. Taking into account, among others. That said, we find that, in the issuance of electronic securities, the deposit and custody in a Securities Depository is optional and not mandatory4 .

3 Concept 2006033594-001 from August 29 of 2006. 4 Concept 2018120539-008 of November 14, 2018.

One of the ways in which the incorporation of technologies in the provision of financial services is achieved is through the creation, subscription, circulation, negotiation and execution of electronic promissory notes, whose authenticity, originality and traceability are guaranteed by new technologies, in the terms of Law 527 of 1999, being fully valid for the celebration of any business, and even for its judicial execution, if necessary, as explained below: Negotiability: In accordance with the Commercial Code, the Securities must be negotiated in accordance with their circulation law, namely:

i) registered ii) to order, and iii) bearer.

Said negotiation can be with or without responsibility. It is clear, then, that electronic promissory notes created and subscribed through new technologies can be negotiated under the terms of the Commercial Code, since nothing obliges individuals to resort to the services of a custodian and, much less, the law detracts from the validity of documents represented in data messages, as already mentioned. Regarding the vocation of circulation of electronic promissory notes, article 9 of Law 527 has provided for the possibility of negotiation through endorsement, a figure that in principle was instituted for the transfer of securities, as mentioned in the explanatory memorandum of said Law. Execution: For a promissory note, in general, to be recognized by a judicial authority, it must contain a clear, express and enforceable obligation in accordance with the requirements of article 422 of the General Process Code (CGP). Additionally, in regards to electronic promissory notes, article 244 of the CGP, presumes the authenticity of those documents in the form of data messages. For its part, Law 527 of 1999, in its 10th article, establishes that data messages will be admissible as means of proof and their probative force is that granted in the provisions of the General Code of Process.

The foregoing supports the possibility of providing an electronic promissory note in order to make the payment of an obligation effective within a judicial process. Likewise, it is important to note that, as the doctrine has indicated, there is evidentiary and technical freedom to accredit the reliability of and security and reliability of a computer system outside of the Specific Accreditation Criteria, it enjoys technical freedom, provided that under the procedural rules are accompanied by a proficient expert in the matter and its reliability and safety is demonstrated. (Mendieta, 2020). Finally, it is important to note that there are already orders for the payment of promissory notes that have been executed without the need to use a Securities Deposit or a certificate of patrimonial rights, such as that of the Seventh Court of Small Causes and Multiple Competence of Bogotá, filing 2018-0606 Legitimation and circulation: In the same way, the legitimation also fulfilled due to the fact that the person who has the data message is to exercise the right, allowing its communication or sending to whoever can exercise the right, fulfilling the requirement of the delivery of the title. This has been indicated by the Financial Superintendency of Colombia, through concept No. 2006033594-001 of August 29, 2006, where it stated that “regarding electronic securities it should be noted that the material delivery of the same is not common, so that will be transferred from the use of one or more data messages or electronic records “.

With regard to the law on the circulation of the electronic security, this must be complied with as provided for in the regulations on the circulation of physical securities. In this sense, as the doctrine has indicated, “the transfer of the electronic security or order, and in accordance with its circulation law, requires electronic endorsement and electronic delivery (remission and receipt of the data message or the Electronic record). The registered electronic security title requires electronic endorsement, electronic delivery and registration in the obligor’s book. The electronic bearer security will continue to circulate with the electronic delivery of the document to the new endorsee holder. But unlike the traditional security, each new holder is identified through the same electronic transfer record ”. Consequently, in electronic securities the physical delivery is replaced by the electronic record that guarantees integrity and authenticity, which are the requirements established in article 10 of the UNCITRAL Model Law on Electronic Transferable Documents, an article of mandatory compliance in attention to article 3 of Law 527 of 1999. On the other hand, it is important to note that the Financial Superintendence of Colombia, in the Basic Legal Circular, Part 1 Title II Chapter 1 numeral 1.3, empowered the supervised entities to optimize operational processes and improve the provision of services to financial consumers, specifically, the aforementioned circular stipulated that “Surveillance entities can adopt technologies such as augmented reality, internet of things, blockchain, intelligence artificial, machine learning, big data, robots, among others, when they consider it pertinent to improve providing services to financial consumers and optimizing their processes.

For this purpose, the entity must carry out adequate management of the risks associated with the technology adopted, regularly verify the effectiveness of the controls implemented and comply with the current regulations on data protection and habeas data. “ Finally, it is noteworthy that the will of the parties in commercial relations must prevail, especially if there is no express rule that prohibits making the agreements that the parties determine, by virtue of the principle of legality for private parties and

In our team

Juan Fernando Chaparro - Legal Director

María Alejandra Estupiñán - Commercial Manager

María Camila Peña - Commercial Leader

Valentina Palacio - Marketing Analist

the principle of freedom of enterprise enshrined in our Magna Carta. In this sense, if both the debtor and the creditor expressly agree that the signing and / or registration of endorsements and modifications of a promissory note will be carried out by means of a specific technology, such as blockchain technology, which adjusts to the regulatory parameters set forth above. It must be ensured that the will of the parties prevails and is fulfilled as in any other private agreement.

ABOUT OUR CLIENTS

Currently our clients, among which Homecenter and Compensar stand out, enjoy the advantages of Blockchain technology for the protection and registration of promissory notes, invoices and other valuable documents. Specifically, with Homecenter we provide the digital integrity service in the “Scan & Go” product, which allows buyers to pay digitally and not have to go through the checkouts in stores. On the other hand, Compensar originates its loan portfolio with our technology, and ensures the integrity of its promissory notes with blockchain technology, that is, without depending on an intermediary and acquiring a copy of these registers upon becoming a node on the network. We also work with other “Fintechs” such as Bancupo, Oncredit, Prestagente, Rapicash, and we are in a pilot with a Bank of great importance for the agricultural sector, as well as with many other companies in the financial and real sector that bet on innovation and see in Beriblock, a great ally to guarantee the integrity of your valuable documents such as electronic promissory notes, with the highest security in the market and at the lowest price.

ABOUT US

Beriblock was founded by the PrestaGente team, the first Fintech startup to use Blockchain for document authentication in Latin America (since 2017). This technology has been recognized by the Accenture Innovation Award, Digital Bank Award 2019, the BBVA Open Talent 2018 contest, Apps.co, Holt Fintech Accelerator in Canada and Rokk3r Labs in Miami, among others.

We offer various companies in Latin America, guarantees against the integrity of documents of all kinds, secure digital credit processes and electronic signature.

We offer to various Latin American companies, guarantees against integrity of documents of all kinds, digital credit processes, insurance and electronic signature.

We are the first ‘fintech’ for SMEs in Latin America offering 100% digital financing (factoring, confirming and working capital credit).