Advantages

•

•

•

•

ITA Executive Committee

Marty Pike President ATI Specialty Materials

Sam Stiller Vice President Howmet Aerospace

Brett Paddock Secretary / Treasurer Titanium Industries Inc

Dr. Markus Holz Academic Member, Professor

ABOUT THE ITA:

ITA (https://titanium.org/) is a membership-based international trade association dedicated to the titanium metal industry. Established in 1984, the ITA’s main mission is to connect the public interested in using titanium with specialists from across the globe who may offer sales and technical assistance. Working through its extensive membership resources, the ITA seeks to expand the knowledge base for the metal, providing technical literature and sponsoring seminars and conferences.

Membership Drive for 2026 Starts October 1st - Contact ITA today to join & take advantage of priority selection of booth space in 2026.

ITA Directors

Steve Chavez CEO

All-Met Recycling

Jeffrey Easto Vice President Purchasing

TIMET, Titanium Metals Corporation

Olivier Maillard

Vice President Metallic Raw Material, Forgings & Castings and Fasteners

Procurement - PMM

Airbus SAS (France)

Michael Marucci

Division President

Advanced Solutions and Surface Technologies business units Kymera International

John Scherzer Vice President – Medical Markets

Carpenter Technology Corporation

Edward Sobota

Vice President, New Product Development STS Metals

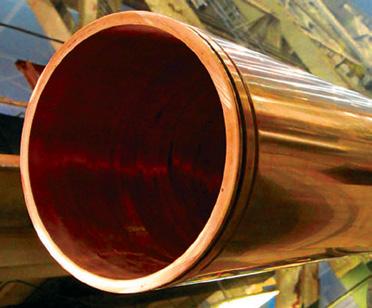

That’s why when it comes to the design and manufacture or the repair and reconditioning of crucibles, molds, and hearths for your ESR, VAR, EBM, or PAM installations, we draw on our more than 135 years of design, engineering and manufacturing excellence to ensure that your copper-based melting equipment is operating at peak efficiency.

Quality vessel repair services to keep you running at high production levels.

A reputation for quality work and on-time delivery. Our staff of expert millwrights, welders and machinists can tear down, assess, repair and test your valuable melting equipment.

Additionally, our manufacturing capabilities are fully supported by our staff of over 50+ engineers.

Our services include:

• Machining, welding, straightening, and sizing of stainless steel, copper, nickel, aluminum, bronze, and carbon steel

• Preventative maintenance, including cleaning, re-sizing, straightening and seal replacement

• Crucible diameter and size modifications

• New crucibles, molds, base assemblies, water jackets, etc.

To learn more about our rebuilding and manufacturing services,call (330) 337-0000, visit www.ButechBliss.com or email cu@butech.com.

Medical Technology

Dr. Colin McCracken

Product Manager, Biomedical, Titanium Oerlikon Metco (Canada) Inc

Colin McCracken gained his B Sc , M Phil and Ph D in Metallurgy from Brunel University of West London, UK in 1992 . Colin then joined AVX Ltd - Tantalum Division working on capacitor grade tantalum powders and left in 2005 as Head of R&D Colin then moved to the USA to join Reading Alloys Inc . as Development Manager - Powder Products and in 2011 Colin was appointed to Director of Product and Market Development at Ametek SMP - Reading Alloys In 2013 Colin relocated to Ontario Canada to work with H C Starck Canada Inc and then later joined Tekna Advanced Materials before finally joining Oerlikon Metco Canada Inc in 2017 as a Product Manager for Biomedical and Titanium products In 2016 Colin was awarded a Fellow from the UK Institute of Materials, Minerals and Mining

Global Industrial Markets POSITION OPEN –contact ITA for more details

Safety Education

Robert Lee (Co-Chair) President Accushape™ Inc

Robert G Lee is the President and Owner of Accushape™ Inc Mr Lee is Chair of the ITA Safety and Compliance Committee During the past 50 years, Robert Lee has been directly involved in the processing of titanium and other special metals in many forms including, machining, welding, forging casting, screening, pressing and sintering of titanium powder Accushape™ was started in 1987 by Robert Lee for the purpose of scaling up the production of knife handles for Buck Knives made by pressing and sintering (P/S) of titanium sponge granules (titanium powder) (TSG) to produce a net shape finished knife handle Accushape has produced over 500,000 titanium P/S parts including knife handles, golf club inserts, hex nuts and washers . Accushape™ has processed and screened 100’s of thousands of pounds of titanium sponge fines to customer’s special requirements More recently, Mr Lee has been issued 7 patents for a new titanium based material system TiCarbonite® and the ODAK™ tile system TiCarbonite® is a light weight, extremely hard and tough material finding applications for ballistics armor ODAK™ tiles create many types of systems with no increase in thickness and no through gap, making possible flexible material systems that can fit contours

Michael Marucci (Co-Chair) Division President Advanced Solutions and Surface Technologies business units Kymera International

Michael Marucci serves as Division President at Kymera International, a global leader in specialty materials Kymera produces silicon carbide, titanium powders, aluminum powders, copper powders, specialty alloys for titanium production, and surface technology solutions

Mike joined Kymera in March 2020, following the company’s acquisition of Reading Alloys, Inc from AMETEK In his current role, he oversees Kymera’s Surface Technologies and Advanced Solutions business units

The Surface Technologies unit specializes in high-quality thermal spray services, anticorrosion coatings for global navies, thermal spray materials, and advanced spray equipment and automation solutions The Advanced Solutions unit produces high-purity master alloys for titanium production, processes high-purity titanium scrap, and manufactures titanium powders, tantalum, ferro-titanium, copper, and bronze powders

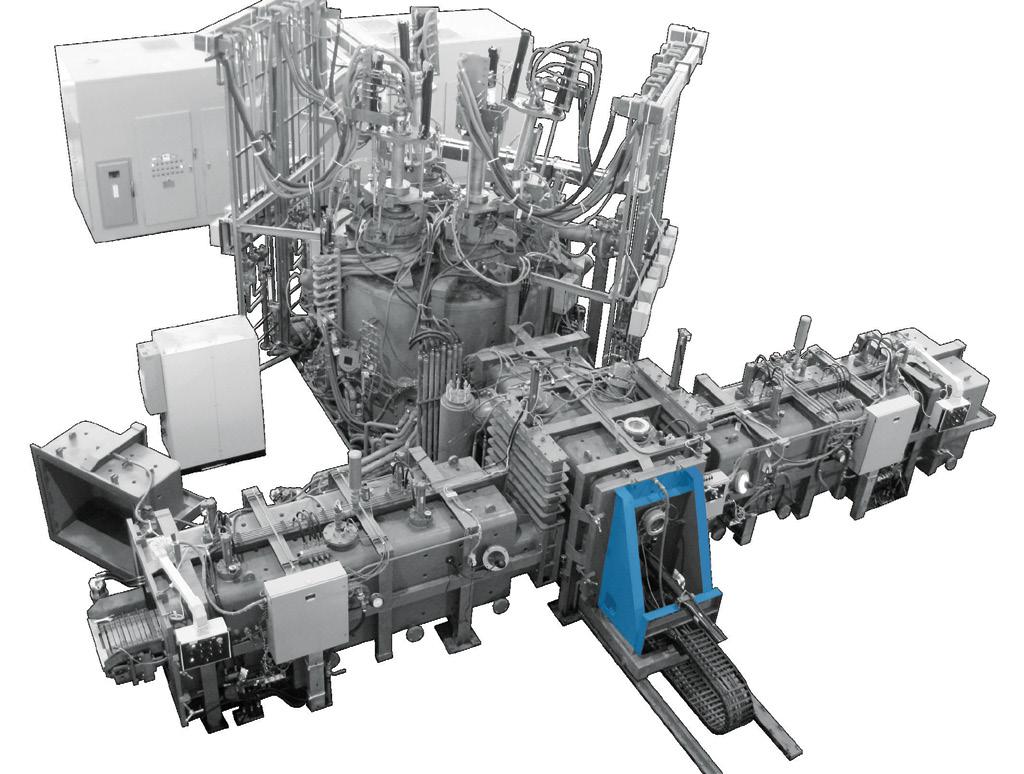

Are you aiming to increase the recycling rates in your titanium production shop?

INTECO´s new innovative vacuum arc cold hearth skull melting and casting furnace

› can achieve recycling rates of up to 100% by feeding virgin and scrap material (e.g. compacted chips) between melting & casting cycles

› can achieve an improved energy ef ciency compared to other cold hearth technologies

› allows static casting of ingots and slabs as well as dynamic casting of complex investment cast parts

› can achieve pouring weights from 250kg up to 3.000kg in one cast

Why team up with INTECO?

› More than 20 years of experience as a premium supplier in the titanium industry

› Supply of melting and casting equipment for titanium including auxiliaries

› Engineering studies, project- and technology consulting for entire titanium production lines

› Know-how transfer, from selections of raw material up to aerospace certi cation

› Customized process and production management systems (IMAS) for titanium production lines

ITA Contributor Michael Gabriele is an independent freelance writer on behalf of the International Titanium Association (ITA)

Executive VP of the Americas Neotiss Inc

Director of Commercial Metalwerks Inc

Titanium Mill Products:

Sheet, Plate, Bar,Pipe,Tube,Fittings, Fasteners, Expanded Sheet & Ti Clad Copper or Steel.

Titanium Forgings and Billet:

Staged intermediate ingot & billet to deliver swift supply of high quality forgings in all forms and sizes including: rounds, shafts, bars, sleeves, rings, discs, custom shapes, and rectangular blocks.

Titanium, Zirconium, Tantalum & High-Alloy Fabrication & Field Repair Services: Vessels, Columns, Heat Exchangers, Piping, Anodes, Custom Fabrications, Field & In-House Reactive-Metal Welding & Equipment Repair Services Available 24/7.

Plate Heat Exchangers:

Plate Heat Exchangers to ASME VIII Div 1 Design, Ports from 1” through 20” with Stainless Steel, Titanium and Special Metals, Plate Heat Exchanger Refurbishing Services & Spare Parts.

Two Service Centers & Fabrication Facilities in Ohio & Texas with Capabilities in: Waterjet, Welding, Machining, Sawing, Plasma Cutting & Forming.

Serving a Wide Variety of Industries: Chemical Processing, Mining, Pulp & Paper, Plating, Aerospace, Power and others.

Tricor Metals, Ohio Division 3225 W. Old Lincoln Way Wooster, Ohio 44691

Phone: 330-264-3299

Fax: 330-264-1181

Tricor Metals, Texas Division 3517 North Loop 336 West Conroe, Texas 77304

Phone: 936-273-2661

Fax: 936-273-2669

Tricor Metals, Michigan Division 44696 Helm St. Plymouth, MI 48170

Phone: 734-454-3485

Fax: 734-454-7110

Astrolite Alloys California Division 201 Bernoulli Circle, Units B & C Oxnard, CA 93030

Phone: 805-487-7131 Fax: 805-487-9694

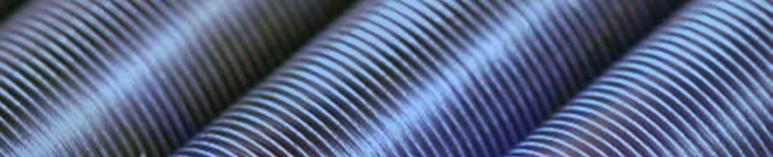

Titanium tubes are increasingly becoming a cornerstone in various industrial applications, driven by their unique properties and the evolving demands of modern industries. As we look towards the future, several key trends are shaping the global titanium tube market. By 2032, circular tubes are expected to dominate the market with a substantial share of 76.5 percent. This preference is largely due to their versatility and efficiency in numerous applications, ranging from aerospace to chemical processing. Square tubes will follow with a market share of 10.9 percent, offering robust solutions for structural and mechanical uses. Rectangular tubes, accounting for 7.8 percent, are favored for their strength and adaptability in specialized applications. Other shapes will hold a market share of 4.8 percent, catering to niche requirements and innovative designs.

The global titanium market is projected to exceed $57 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.5 percent. This impressive growth is primarily driven by the aerospace and defense sectors, where titanium’s high strength-toweight ratio and corrosion resistance are indispensable. Additionally, technological advancements and expanding industrial applications are significantly contributing to the market’s expansion.

influenced by several critical factors, including energy sector dynamics, global economic growth, technological advancements, and raw material availability. Understanding these elements is essential for navigating this vital industry and ensuring its continued success.

Titanium tubes are crucial in the energy industry as the world shifts towards cleaner energy solutions. High coal and oil prices drive investments in offshore drilling, while the nuclear power industry is increasingly adopting small modular reactors (SMRs) for cleaner energy

in sectors such as chemical, medical, energy, and aerospace. Conversely, economic downturns can reduce industrial investment and delay projects, resulting in lower demand for titanium tubes.

Technological progress in materials science and production techniques drives innovations that enhance titanium extraction, processing, and tube manufacturing. These advancements reduce costs and improve product quality. Developments in alloy creation and 3D printing make production more efficient and less wasteful, expanding the range of applications for titanium tubes.

The availability and cost of titanium ores significantly impact production costs and tube supply. Factors such as mining regulations, geopolitical stability, and environmental policies influence ore availability. Tight supplies can raise prices and reduce demand, while abundant supplies stabilize or lower prices, increasing demand.

Innovations in manufacturing technologies, such as additive manufacturing (3D printing), are set to impact the titanium tubes market significantly. These advancements allow for complex and customized titanium parts, enhancing design flexibility and performance. Improvements in precision welding and machining techniques will increase the efficiency and reliability of titanium tubes.

production. These trends highlight the growing importance of titanium tubes in supporting sustainable energy initiatives.

The titanium tube market is

The health of the global economy directly impacts the titanium tube market. During periods of economic growth, infrastructure development and industrial activity surge, leading to higher demand for titanium tubes

Titanium tubes are increasingly becoming the backbone of modern industry, thanks to their unique properties and the evolving demands of various applications. These tubes are shaping the future across multiple segments, driven by their versatility, strength, and lightweight characteristics. These tubes come in various shapes, each serving specific purposes. By 2032, circular

Established in France (Lyon), the stockist Acnis Group is one of the world leaders in the distribution of metal alloys especially in TITANIUM, in all forms : sheets, bars, tubes and powder for 3D printing.

ISO 13485 certified since 15 years , the family business has specialized in the medical field since its creation in 1991, to meet the demand of orthopedic manufacturers and dental implants, as well as surgical instruments.

ACNIS Group acts as a buffer between producers and users, thanks to its 600 to 700 tons rotating stock and 1,300 references of different origins. Our unique cut-to-size service center (15 machines: waterjet, high-definition waterjet, plate sawing, bar sawing, shearing, machining, chamfering) allows us to reduce your costs by optimizing scrap rates.

As a result, the company is able to deliver very quickly its customers, in barely a week , no matter the ordered quantity. Major implant manufacturers among the main American and European OEMs themselves call on ACNIS Group to source their metal alloys.

The last creation of ACNIS USA stock in 2023 in Chicago has changed the game. Acnis Group is now the only distributor that can stock and deliver any quantity in North America (ACNIS TITANIUM & ALLOYS USA-Chicago), South America (ACNIS DO BRAZIL-Sao Paulo), Europe (ACNIS FRANCE-Lyon), South Asia (ACNIS CHINAShanghai) for global worldwide contracts.

Acnis is your one-stop shop for all TITANIUM grades, stainless steel (316L, 420B, cobalt chrome, 17/4 PH, high nitrogen alloy, Custom 455, Custom 465…) and polymers

Our dental subsidiary BCS , a European leading distributor of CAD CAM products for additive manufacturing, is registered with the FDA for titanium powder & discs, and cobalt chromium powder.

ACNIS TITANIUM & ALLOYS

1940 E Devon Elk Grove Village 60007 - IL - USA

dfreitag@acnis-titanium.com

kragan@acnis-titanium.com

224-550-2422

tubes are expected to dominate the market with a 76.5-percent share. These tubes are highly valued in aerospace applications for their ability to enhance performance and reduce weight. They are essential for components like fuel lines, hydraulic systems, and structural supports due to their strength and lightweight properties.

Titanium tubes are also categorized by diameter, with segments up to 10 cm and more than 10 cm. By 2032, the small diameter segment is projected to hold a 76.9-percent market share. Smalldiameter titanium tubes are versatile and widely used in the medical and healthcare industry. Their biocompatibility makes them ideal for implants, surgical instruments, and medical devices, especially in minimally invasive procedures like stents, bone screws, and catheter systems. In aerospace, these tubes contribute to weight reduction and improved fuel efficiency, being used in hydraulic systems, fuel lines, and structural components.

Titanium tubes are used in various industries, each with unique applications and benefits:

• Aerospace: By 2032, aircraft hydraulic systems are expected to hold the largest market share at 34.2 percent. Titanium tubes are favored in this segment due to their high strength-to-weight ratio, which enhances aircraft performance and fuel efficiency. They are crucial for components like landing gear, which must endure high stress and fluctuating temperatures.

• Chemical Processing: Applications including desalination and chlor-alkali manufacturing are projected to account for 23.5 percent of the

market by 2032. Titanium tubes are essential in these processes due to their resistance to seawater corrosion and chloride-induced stress cracking, making them ideal for handling seawater and brine.

• Power Generation: Particularly in nuclear power, titanium tubes are expected to hold a 20.2-percent market share by 2032. They are vital in nuclear power plants for heat exchangers, condensers, feed water heaters, and moisture separator reheaters, where they must withstand radiation, high temperatures, and high pressures.

• Oil and Gas: Offshore drilling rig components are projected to account for 12.7 percent of the market by 2032. Titanium tubes are highly resistant to seawater corrosion, making them suitable for critical components like risers, flowlines, and piping systems. The increase in offshore drilling and subsea explorations drives demand in this segment.

• Healthcare: Artificial bones, including hip and knee replacements and spinal implants, are expected to hold a 5.5-percent market share by 2032. Titanium’s biocompatibility and ability to support bone formation make it ideal for medical implants.

• Other Applications: Accounting for 3.9 percent of the market, these include automotive

components, desalination plants, and telecommunications. In the automotive industry, titanium tubes are used in performance components, suspension parts, and exhaust systems due to their heat resistance. In desalination plants, they are used in evaporators and condensers to handle large volumes of seawater. In telecommunications, titanium tubes are used in antennas and mounts, where their lightweight properties simplify installation and maintenance.

The global titanium tube market is projected to be driven by several key regions by 2032:

• Asia Pacific: Expected to lead with a 47.6-percent market share, driven by the expansion of chemical, petrochemical, and power generation industries.

• North America: Projected to hold a 28.7-percent market share, driven by the aerospace and defense sectors, where titanium is widely used for aircraft manufacturing.

• Europe: Anticipated to account for 16.6 percent of the market, supported by the automotive industry and renewable energy projects, such as offshore wind farms.

• Latin America and Middle East & Africa: Combined, these regions are expected to hold a 7.1-percent

market share, driven by the oil and gas industry in Latin America and investments in desalination plants in the Middle East and Africa.

The glimpse of tomorrow’s industries is essentially driven by biocompatibility, resistance to harsh environments, driving efficiency, powering and shaping a greener future, meeting extreme demands, and new frontiers such as artificial intelligence.

expected between 2024 and 2044.

The healthcare sector is crucial in driving the titanium tube market. Titanium’s strength, corrosion resistance, and biocompatibility make it ideal for medical applications. Titanium tubes are used in orthopedic implants, dental prostheses, and surgical instruments. The aging global population and advancements in medical technology increase the demand for sophisticated medical equipment, making titanium

The airline industry’s expansion is a major driver for the titanium tube market. Titanium’s excellent strength-to-weight ratio enhances aircraft performance and fuel efficiency, making it indispensable in modern aircraft design. As passenger traffic increases and the demand for advanced, fuel-efficient aircraft grows, the need for titanium tubes rises. These tubes are used in various aircraft components, including fuel lines, hydraulic systems, and structural parts. The market is expected to continue growing as airlines invest in new technologies and aircraft to meet regulatory standards and consumer expectations. According to Airbus GMF report, 42,430 new single-aisles and wide-body aircraft deliveries are

tubes essential for their durability and ability to withstand harsh environments.

The growth of the oil and petrochemical industry significantly impacts the demand for titanium tubes. These tubes are vital for

drilling, production, and exploration equipment, especially in offshore applications where conditions are extreme. In the petrochemical industry, titanium tubes are used in heat exchangers, reactors, and condensers to handle highly corrosive substances. Increasing global energy demands and exploration of new reserves amplify the need for titanium tubes.

The titanium tube market is set for significant growth, driven by key opportunities in the automotive, renewable energy sectors, and data centers to ignite the artificial intelligent era.

The automotive industry’s focus on performance, fuel efficiency, and safety presents a strong growth opportunity especially for high-performance applications, particularly in luxury and highperformance cars where reducing weight enhances both performance and fuel economy. Additionally, the rise of electric vehicles (EVs) and innovations in this industry can further boost demand for as lightweight materials offset the weight of heavy batteries.

The shift towards renewable energy sources such as wind, solar, and geothermal power also presents

significant opportunities as the world adapts to changing climatic conditions. In the wind energy sector, titanium tubes are used in offshore wind turbines, where they can withstand high pressure and harsh environments. In concentrated solar power plants, titanium tubes are essential components of heat exchangers that operate at high temperatures. The geothermal energy sector also benefits from titanium’s properties, as geothermal systems often involve highly corrosive environments.

The rapid expansion of data centers and the increasing demand for power generation driven by the rise of artificial intelligence (AI) are creating a significant need for reliable cooling solutions. Data centers are the pillar of the digital age, housing the servers and infrastructure that power the internet, cloud computing, and AI applications. As the volume of data processed and stored continues to grow exponentially, the need for efficient and reliable cooling systems becomes paramount. Titanium tubes play a vital role in these cooling systems, ensuring that data centers operate at optimal temperatures and maintain high performance due to their exceptional durability and resistance to corrosion.

Other interesting future trends are the biocompatibility of titanium, which makes it a popular choice for medical implants and surgical instruments, where titanium tubes are used in manufacturing medical devices such as bone screws, plates, artificial joints, spinal implants and hip replacements due to their durability and compatibility with human tissue.

Innovations in manufacturing technologies, such as additive manufacturing (3D printing), are set

to impact the titanium tubes market significantly. These advancements allow for complex and customized titanium parts, enhancing design flexibility and performance. Improvements in precision welding and machining techniques will increase the efficiency and reliability of titanium tubes.

The development of new titanium alloys with enhanced properties, such as improved strength, corrosion resistance, and temperature tolerance, is a key trend. These advanced alloys meet the demanding requirements of aerospace, defense, and industrial applications, expanding the scope of titanium tubes in extreme environments.

There is a growing emphasis on sustainability and recycling within the titanium industry. Efforts to recycle titanium scrap and develop sustainable production methods are expected to positively influence the market, aligning with global green and sustainable practices.

Finally, emerging economies, particularly in Asia Pacific and Latin America, are expected to see significant growth in the titanium tubes market. Rapid industrialization, infrastructure development, and expanding aerospace and automotive industries in these regions will boost demand. n

[Editor’s note: Ricardo Silva is at the helm of driving pivotal trends in the titanium tube market. He served as a speaker at the TITANIUM USA Conference and Exhibition held last October in Austin, TX. Under his leadership, Neotiss has leveraged the unique properties of titanium, coupled with technological advancements and a steadfast focus on sustainability, to position titanium tubes as indispensable components in a myriad of high-performance

applications. Silva emphasizes that as industries continue to evolve, the demand for titanium tubes is poised to rise significantly. This surge reflects their critical role in modern industrial progress, where quality, efficiency, durability, and environmental responsibility are paramount. From aerospace to automotive, and from chemical processing to power generation, titanium tubes are becoming the backbone of innovation and sustainability.

According to Silva, Neotiss is “a beacon of innovation and sustainability” in the manufacturing of welded tubes, catering to a wide range of industries including nuclear, power generation, desalination, chemical processing, HVAC, automotive, aquaculture, and aerospace. This year marks a significant milestone as Neotiss celebrates 35 years of excellence in the United States, consistently pushing the boundaries of technology and quality to meet the stringent demands of modern industrial applications.

Renowned for its expertise in producing high-performance welded tubes from titanium, stainless steel, and high nickel alloys, Neotiss is dedicated to providing solutions that enhance efficiency and reliability. The company’s unwavering commitment to research and development ensures it remains at the forefront of the industry, continuously evolving to tackle the challenges of tomorrow. With a global presence and strategically located plants around the world, Neotiss serves its clients with unparalleled precision and responsiveness, all while supporting a greener future. Whether for conventional or nuclear power plants, chemical processing, or automotive and aerospace applications, Silva said that Neotiss’s products are synonymous with cutting-edge advancements, industryleading innovations, quality, durability, and high performance.]

efficiency

More reliability: Built robust, with high precision as the benchmark Innovation and reliability for your success: The KASTOtec

More innovation: Intelligent control and user friendly operation

Smarter storage for maximum space efficiency: UNITOWER More space

More efficiency: Save time with direct access—no additional lifting equipment needed

More flexibility: Modular, heightadjustable supports for up to 3 loading heights

Low in price, high in performance: KASTObloc

More precision: excellent performance for smaller block dimensions or lower plate weights

More safety: perfect for cutting remnant pieces

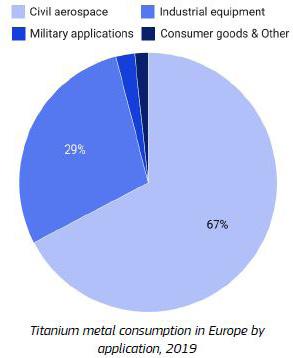

[Editor’s note: This report, an executive summary from European Commission’s Joint Research Centre, Seville, Spain, examines the strategic importance of titanium metal for the European Union (EU) economy and explores the potential for increased circularity in its value chain. It also provides insight into titanium business dynamics in Europe. Recognized as both a critical and strategic raw material under the EU Critical Raw Materials Act, titanium is essential for key sectors such as civil aviation, defense, space, and advanced manufacturing. The supply chain faces significant challenges due to geopolitical tensions, resource dependency, and sustainability demands, with a notable gap between global supply and projected demand. To download the entire report, visit the website: https:// publications.jrc.ec.europa.eu/repository/handle/JRC137082 or contact Alejandro Buesa, European Commission, Joint Research Centre, e-mail: alejandro.buesa-olavarrieta@ec.europa.eu.]. The images in this story come from the European Commission report.]

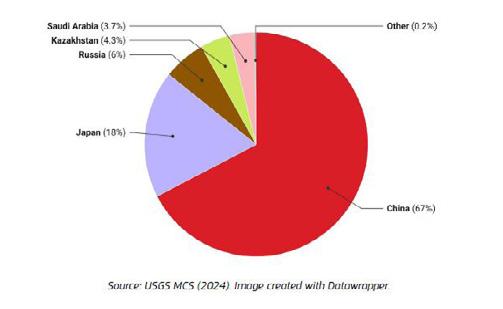

Titanium metal is critical for the European Union (EU) due to its relevance in industries such as aerospace and defense, and in several technologies key to the Green and Digital transitions. The EU currently faces significant challenges due to its heavy reliance on imports for titanium metal products. This dependency exposes the EU to risks of supply chain disruption, particularly as the global landscape is dominated by a limited number of suppliers, including China, Russia, Japan and Kazakhstan, and in light of current global tensions such as the Russian aggression on Ukraine and rising protectionism.

This report suggests several policy options based on the current priorities of the European Union in the context of decarbonization, derisking, reshoring and critical raw materials scarcity, as they are laid down in recent and upcoming policies and guidelines, such as the CRM Act, the Net Zero Industry Act, the Green Deal Industrial Plan, the envisaged Clean Industrial Deal and the Draghi Report.

Titanium Metal Supply Chain

Titanium is an energy-intensive material, and this feature has significant implications for policy recommendations. Secondary material flows play a crucial role in

Ukraine’s high-quality titanium deposits present opportunities for EU value chain integration, but the ongoing war has disrupted production facilities and created uncertainty. Revamping Ukraine’s processing facilities, aligning them with EU environmental standards, and navigating internal debates on privatization versus state control will be key.

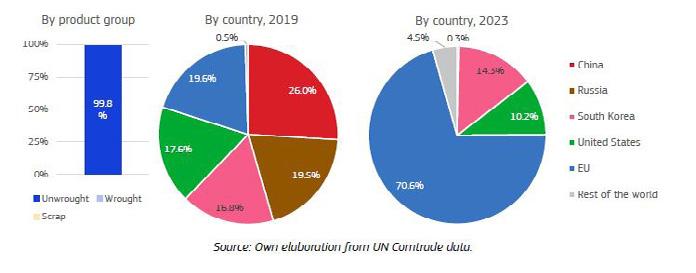

this value chain. In sponge, China’s dominant position has increased significantly over the past decade, accounting for roughly two thirds of global output by 2023. However, the majority of Chinese titanium sponge is not suitable for critical aerospace applications. High-quality sponge required for aerospace is produced in Japan, Russia, and Kazakhstan.

In melted and wrought products, China also maintains a strong leadership. The EU has some capacity for these products, but remains significantly behind other major players. As a result, the EU must import substantial quantities of sponge and semi-finished products to meet domestic demand.

Aerospace is the largest consumer in the EU (67 percent of total demand), particularly for aircraft structures; as a result, titanium demand remains heavily linked to aerospace activity. The defense sector relies on titanium for aircraft,

armored vehicles, submarines and missile systems. Industrial use of titanium spans from chemical processing to marine environments. Emerging applications in additive manufacturing (AM) present significant opportunities to enhance material efficiency, mitigate supply risks, and improve titanium’s circularity.

Fe, Ni, Co, & Cu Alloys

600 Pound Capacity

6" Rounds or 6” x 11” Slabs

Vacuum Arc Remelting

Reactive and Non-Reactive Alloys

6”–20” Crucible Diameters

100–5000 Pound Ingots

R&D Melting

300

Bar Peeling - 0.5" - 6" Diameter

Bar Polishing - 0.5" - 8" Diameter

Lathe Turning - up to 17" Diameter

Saw Cutting - up to 30" Diameter x 5,000 Pounds

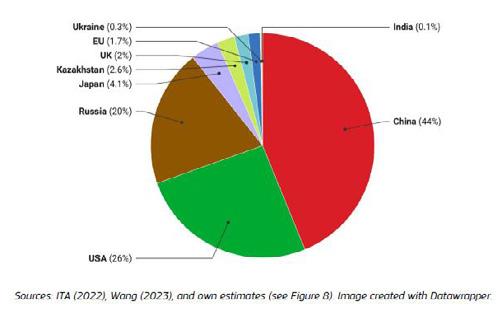

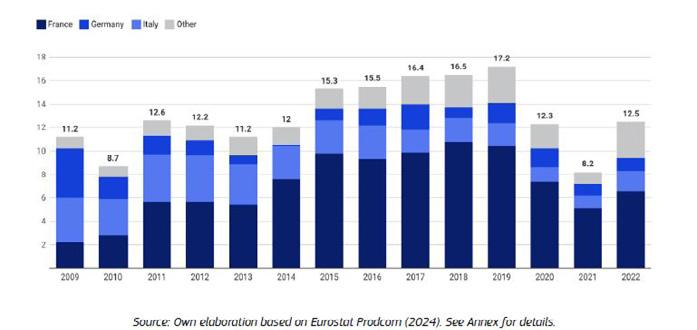

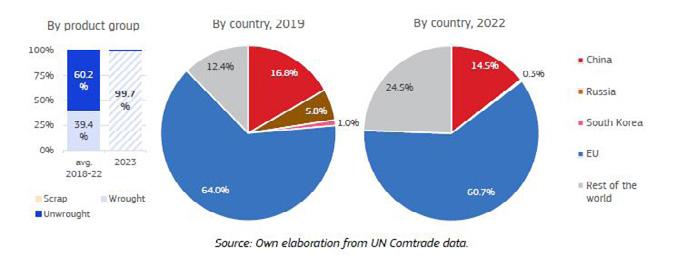

The EU is a net importer of titanium metal, with an overall import-to-export ratio of 10:1 for unwrought products and 6:1 (3:1 by value) for wrought products. Wrought products represent the largest share of the EU’s imports. Buyback agreements constitute a significant obstacle to circularity in the EU. Titanium producers in third countries offer discounted primary titanium in exchange for returning

the scrap after manufacturing parts in the EU. Besides, the lack of titanium production capacity makes recycling scrap within the EU less economically viable.

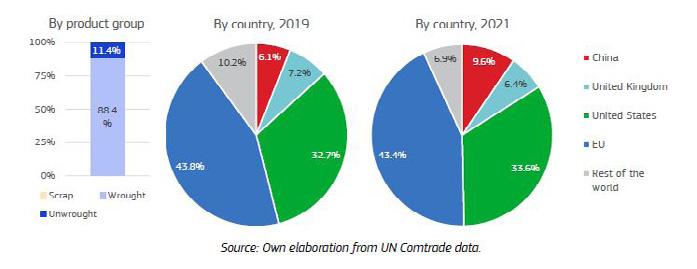

The United States has been the EU’s most important trading partner for wrought titanium products and scrap. Due to the current geopolitical pressures linked to the Russian war in Ukraine, the US is likely to remain the most important source of

wrought titanium imports to Europe. China has the largest titanium ore resources in the world. It is also the biggest producer of titanium metal outputs globally. The high costs and subprime quality of Chinese titanium remain major obstacles for expanding the supply chain for aeronautical applications to China. Russia has become a major supplier of titanium for the aeronautical sector, while also heavily reliant on imported titanium sponge. Kazakhstan has partnered with consumers in Europe and Asia, boosting sponge production and sustaining it effectively. The Russian aggression on Ukraine conflict has redirected most Kazakh exports to the EU, the United States, and South Korea. Ukraine has worked to regain control over the titanium industry after an extended period of Russian control. The EU stands as the primary partner for Ukrainian titanium exports. Export volumes have drastically declined following the Russian invasion in February 2022.

High inventories and lower demand have mitigated impacts of the Russian aggression on Ukraine. In addition, spare capacity in Japan, Kazakhstan and the US, as well as the expanding capacity in China and Saudi Arabia, has filled supply gaps for sponge and ingots. However, Russia’s influence in the global

aerospace industry is substantial. The risk of a global titanium supply chain crisis is further aggravated by the expected rise in demand from the aerospace and defense industry in the coming years, and the few producers worldwide.

The EU has completely made up for the losses of Russian and Ukrainian supply of unwrought titanium products (sponge, ingots and powders), as well as managed the additional demand for imports. Regarding wrought products, increased imports from China, the United States and Japan have met the higher domestic needs in the EU.

Reshoring the midstream titanium industry in the EU, together with fostering recycling

capabilities, is critical for strategic autonomy. However, high energy costs, the lack of access to scrap, and competition from vertically integrated foreign firms constitute major challenges. Policies to lower energy costs, incentivize publicprivate investments, and adopt emerging technologies could reduce energy use and emissions. Transitioning to a cleaner energy mix and leveraging circularity could align reshoring with decarbonization goals, enhancing competitiveness and supporting EU industrial and environmental priorities.

To enable domestic titanium recycling, the EU must secure highquality production scrap, which is hindered by buyback agreements

with the United States. Phasing out such agreements requires simultaneous development of the EU titanium industry and collaborative trade talks to avoid trade tensions. Partnering with U.S. firms on EU recycling infrastructure and accessing advanced American technologies could foster mutual benefits and strengthen the EU’s titanium supply chain resilience.

Ukraine’s high-quality titanium deposits present opportunities for EU value chain integration, but the ongoing war has disrupted production facilities and created uncertainty. Past efforts, including strategic EU-Ukraine partnerships, suggest potential for collaboration post-conflict. Revamping Ukraine’s processing facilities, aligning them with EU environmental standards, and navigating internal debates on privatization versus state control will be key. Post-war reconstruction provides an opportunity for the EU to support Ukraine’s titanium industry, ensuring strategic supply while countering geopolitical risks.

The EU must diversify titanium sponge sourcing by expanding partnerships with countries like Kazakhstan, Japan, and Saudi Arabia. Collaborations under the Global Gateway and Mineral Security Partnership Forum could secure resilient supplies while greening global value chains. Investing in sustainable technologies in extraction countries can reduce environmental impacts. Joint ventures for technological upgrading can enhance resource efficiency and competitiveness, supporting EU industrial decarbonization goals.

End-of-life recycling of titanium in the aeronautical sector is hindered by profitability issues, technical challenges, and stringent regulatory requirements. Policies promoting eco-design could encourage easier

At Kymera International, we’re at the forefront of advanced titanium solutions for the aerospace industry, delivering precision-engineered materials that power the future of flight. Our titanium powders, master alloys, and fully integrated titanium metallurgical products are trusted by leading aerospace manufacturers worldwide to meet the most demanding performance standards.

• Superior Strength & Lightweight Performance – Ideal for critical aerospace applications

• Unmatched Purity & Consistency – High-quality titanium powders and alloys

• Global Manufacturing & Supply Chain Strength – Delivering reliability at scale From high-performance jet engines to structural airframe components, Kymera International is the trusted partner for aerospace engineers and manufacturers looking for cutting-edge titanium solutions.

recovery of titanium from airframes and engines. Greater transparency in material composition and revised recertification systems could unlock greater circularity. Incentives to retain end-of-life (EoL) scrap domestically could ensure economic, environmental, and strategic benefits for the EU titanium industry.

The EU finds itself in a particularly vulnerable position regarding titanium metal as it lacks domestic production capacity for primary titanium sponge, rendering it entirely dependent on imports. This dependency exposes the EU to risks of supply chain disruption, particularly as the global landscape is dominated by a limited number of suppliers, including China, Russia, Japan and Kazakhstan.

China’s dominant position in the production of titanium sponge has increased significantly over the past decade, accounting for roughly two thirds of global output by 2023. However, it is important to note that the majority of Chinese titanium sponge produced is of standard quality, which is not suitable for critical aerospace applications. Highquality titanium sponge, required for aerospace and other specialized uses, is primarily produced in Japan, Russia, and Kazakhstan. This concentration of supply also poses a significant risk for the EU, especially in light of geopolitical tensions that could further jeopardize access to reliable sources of aviation-grade titanium.

Another challenge for the EU concerns the downstream production of titanium melted products and wrought products, where China also maintains a strong leadership position. The EU currently has some capacity for processing titanium metal,

including for melted and wrought products, but remains significantly behind other major players in terms of overall production volume. As a result, the EU must import substantial quantities of both titanium sponge and semi-finished titanium products to meet domestic industrial demand.

Despite these challenges, the EU’s established industrial base and the presence of key downstream processing facilities provide a potential foundation for future growth in titanium metal production and processing. The current geopolitical challenges, coupled with the EU’s dependence on imports of titanium metal products, create a potential risk to security of supply and a possibility of disruption in several critical industries in Europe. Thus it warrants policy intervention, which has already been initiated in recent years with several key policy documents. However, more specific policy considerations concerning the particular value chain of titanium metal could be considered.

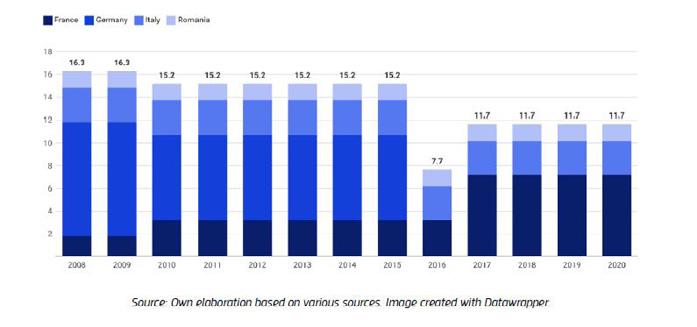

From the strategic autonomy point of view, prioritizing the establishment of a titanium recycling industry within the EU is essential in light of the EU’s near-complete dependence on the import of midstream and upstream segments of the titanium value chain from abroad. However, since recycling would require the same facilities as are currently used for converting sponge into ingots, this would necessitate the relocation of the midstream supply chain and the introduction of advanced titanium remelting capabilities.

While this approach is feasible, it is slow-moving, expensive and presents uncertainties in an already highly competitive market. Previous and ongoing attempts to establish such facilities in Europe

underscore the need for coordinated policy action and public funding support from the EU. For instance, a scrap recycling plant that opened in Germany in 2009 had to shut down due to financial inviability. Currently, EcoTitanium in central France is the only industrial facility in Europe recycling high-grade titanium scrap at 80-20 scrap-tosponge ratios. In addition, there are also VAR facilities in Italy and Romania, but these only allow for 30-percent scrap input material.

These and other EU companies operating in the midstream segment suffer from lack of economies of scale, lack of access to scrap (which is exported to the US), and high energy costs, especially compared to overseas (mainly US) competitors. European companies also cannot match the vertically integrated Russian and Chinese companies, which similarly benefit from lower energy costs and economies of scale.

According to the CRM Act’s recommendations, at least 10 percent of strategic raw materials consumed annually should be extracted and 40 percent processed domestically. That would require the establishment of upstream segments of the value chain within the EU. This is also crucial given that even the most advanced technologies are not capable of recycling 100 percent scrap input, and the sourcing of sponge will remain crucial. Ukraine possesses high-quality titanium deposits (the only other sites in Europe are located in Norway and Greenland), and it has an established processing industry.

Due to the ongoing full-scale Russian invasion, it is still uncertain whether the deposits and processing plants will remain within Ukrainian territory and if (when) Ukraine will join the EU. Therefore, substantial political and economic uncertainties

IperionX is a leading American titanium metal and critical materials company - using patented metal technologies to produce high performance titanium alloys, from titanium minerals or scrap titanium, at lower energy, cost and carbon emissions.

remain with regard to the country’s potential to be a viable part of the EU titanium value chain. However, it is clear that there is appetite on both sides for such a development, as Ukraine’s integration of EU and Ukrainian elements of the CRM value chains had been initiated before 2022.

Major challenges remain even in the event of Ukraine winning the war and joining the EU’s value chains. Ukrainian processing and extraction facilities have suffered in recent years: while extraction companies in central Ukraine have maintained their operations, the ZTMK (Zaporizhzhia Titanium–Magnesium Plant) in eastern Ukraine has suffered Russian bombings and sabotage by proRussian management, leading to human resource losses and decreased production capacity. The Ukrainian facilities are therefore in need of rebuilding and revamping to bring

them in line with the stringent environmental requirements. Post-war reconstruction will be the crucial moment for such efforts, as currently there is no consensus on the future of the Ukrainian titanium industry, with battle still being fought between supporters of privatization and state-industrialists promoting government control of the titanium industry. The EU’s potential investments would have to be carefully weighed against the potential risks in the event of re-privatization of the titanium industry. n

[Disclaimer: This article is a publication by the Joint Research Centre (JRC), the European Commission’s science and knowledge service. It’s authorized under the Creative Commons Attribution 4.0 International (CC BY 4.0) license (https://creativecommons.org/ licenses/by/4.0/). It aims to provide

evidence-based scientific support to the European policymaking process. The contents of this publication do not necessarily reflect the position or opinion of the European Commission. Neither the European Commission nor any person acting on behalf of the Commission is responsible for the use that might be made of this publication. For information on the methodology and quality underlying the data used in this publication for which the source is neither Eurostat nor other commission services, users should contact the referenced source. The designations employed and the presentation of material on the maps do not imply the expression of any opinion whatsoever on the part of the European Union concerning the legal status of any country, territory, city or are or of its authorities, or concerning the delimitation of its frontiers or boundaries.]

After 20 years with Nu-Tech Precision Metals in Arnprior, ON Canada, Sandye is retiring. Prior to Nu-Tech she worked in Sales and Marketing in various fields including electronic components, playground equipment manufacturing, the federal government and a few other businesses along the way. She will greatly miss the friends, colleagues, associates and most of all the customer relationships she grew to cherish in the metals business. She never dreamed her career would take her down a path to be proud to say “We have a 3250 ton extrusion press located at our plant in Ontario” and go on to talk about the extrusion and finishing processes of specialty metals. Continuing on with her love of travel going into retirement she and her husband Shawn AKA “The Roadie” are heading to Alaska shortly and she’s off to Japan later this year with one of her sons. She’ll regularly pop home long enough to enjoy time with her first grandchild Matthew. Feel free to keep in touch at hooktravellers@sympatico.ca

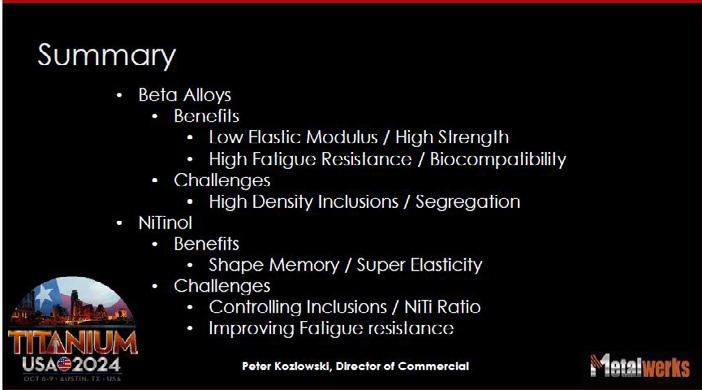

By Peter Kozlowski, Metalwerks Inc.

In the world of medical innovation, materials science is a quiet powerhouse. Behind many of the most advanced medical devices are alloys engineered to work harmoniously with the human body. Among the standout materials are Beta Titanium alloys and Nitinol, prized for their exceptional mechanical properties, compatibility with biological tissues, and transformative potential in modern healthcare.

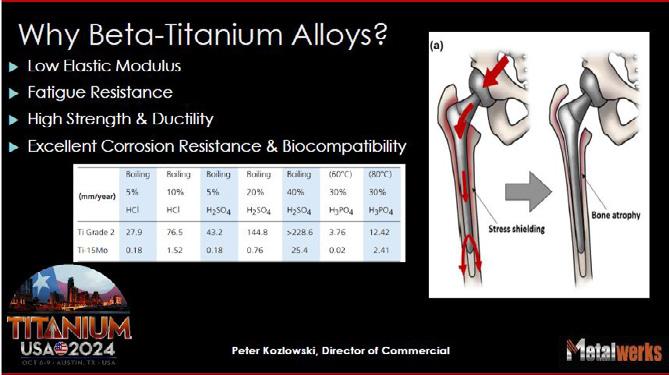

Why Beta Titanium Alloys?

Beta titanium alloys offer an exceptional combination of mechanical strength and biological compatibility. One of their most important features is a low elastic modulus, which closely matches that of human bone. This reduces the risk of “stress shielding,” a condition where overly stiff implants absorb too much mechanical load, causing surrounding bone to deteriorate. These alloys also excel in fatigue resistance. Orthopedic implants are subject to millions of load cycles,

While Beta Titanium alloys excel in strength and resilience, Nitinol adds a different dimension to medical materials—“intelligent functionality.” Composed of nearly equal parts nickel and titanium, Nitinol is known for two extraordinary properties: shape memory and super-elasticity.

especially if bone healing is slow. In such cases, the implant must bear the load longer, and resistance to fatigue becomes critical to avoid mechanical failure.

Biocompatibility and corrosion resistance further enhance their value. In contrast to more common titanium grades, Beta alloys perform better in the body’s harsh environment, reducing the risk of adverse reactions and increasing implant longevity. Beta Titanium alloys are used across a variety of medical devices, including:

Orthopedic Implants: Ideal for load-bearing applications like cannulated nails and spinal rods, where both strength and flexibility are crucial.

Dental Implants: Their durability and compatibility with soft tissue make them a preferred option for long-term dental solutions.

Fracture Fixation Devices: Plates, screws, and nails made from Beta alloys provide strong yet resilient fixation, reducing trauma to surrounding tissues.

How Beta Alloys Are Produced

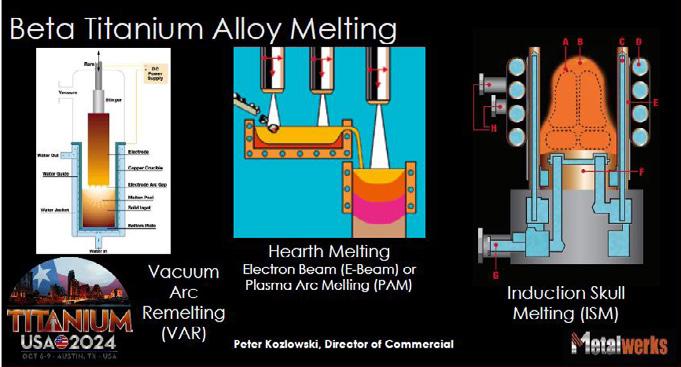

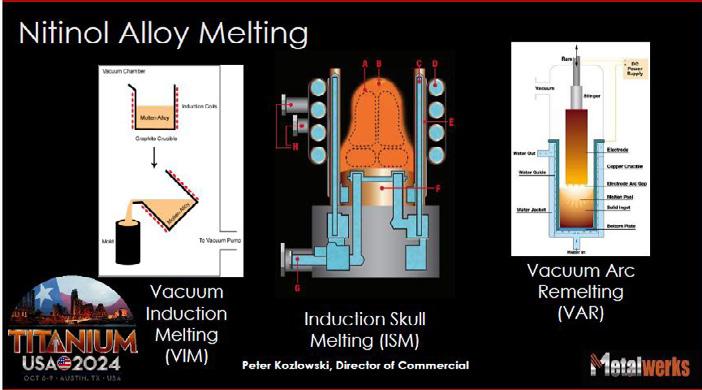

Producing Beta Titanium alloys requires both scientific precision and manufacturing expertise. These alloys are typically created using high-purity raw materials and melted in vacuum conditions to prevent contamination. Three main melting methods are commonly used:

• Plasma Arc Melting (PAM) and Electron Beam (EB) Hearth

Melting: Titanium sponge and alloying elements are compressed into briquettes, then melted in a copper hearth. The molten metal flows into a water-cooled crucible. These methods are effective for processing refractory elements and reducing high-density inclusions (HDIs).

• Induction Skull Melting (ISM): In this method, raw materials are placed in a copper crucible and heated with induction coils.

Master alloys for Titanium Industry.

Nickel based Master Alloys.

Ni, Co, Mo & Fe based Super Alloys Bar Stock.

Equiaxed, Super Alloy Bar Stock suitable for making

Directionally solidified Single Crytsal Investment Casting.

The stirring action creates a highly uniform alloy, minimizing chemical segregation and improving consistency.

• Vacuum Arc Remelting (VAR): Used for both primary and secondary melting, this process forms electrodes from compacted materials, which are then melted in a vacuum. The result is improved microstructure and chemical uniformity, both critical to performance.

While highly valuable, Beta Titanium alloys pose unique production challenges:

• High-Density Inclusions (HDIs): Elements like tungsten and niobium may not fully dissolve during melting. These undissolved

particles can act as weak points under mechanical stress.

• Beta Flecks: Localized concentrations of elements such as molybdenum or vanadium can form during cooling, resulting in uneven mechanical properties.

• Thermal Treatment Sensitivity: Small changes in heat treatment conditions can significantly affect the alloy’s microstructure, impacting strength, ductility, and fatigue life.

One particularly promising Beta Titanium alloy is Ti-15Mo, which is specified under ASTM F2066. In its Beta-annealed condition, Ti-15Mo offers a tensile strength of 690 MPa, with excellent ductility and cold formability. Its elastic modulus is 78

GPa—around 30 percent lower than that of Ti-6Al-4V—making it better suited for compatibility with bone. In its aged (Alpha + Beta) state, Ti15Mo can reach tensile strengths up to 1150 MPa with enhanced fatigue performance. Notably, its fatigue endurance can be as much as 66 percent higher than that of Ti-6Al-4V in notched conditions. It is also MRIcompatible due to its low magnetic susceptibility.

While Beta Titanium alloys excel in strength and resilience, Nitinol adds a different dimension to medical materials—“intelligent functionality.” Composed of nearly equal parts nickel and titanium, Nitinol is known for two extraordinary properties: shape memory and super-elasticity.

Shape Memory: Nitinol can be pre-formed into a specific shape. When deformed at lower temperatures, it returns to its original shape upon heating due to a reversible phase change between its martensite (low temperature) and austenite (high temperature) crystal structures.

Super-elasticity: Unlike traditional metals that permanently deform after minimal strain, Nitinol can stretch up to 8 percent and still return to its original shape. This makes it ideal for applications requiring extreme flexibility and resilience.

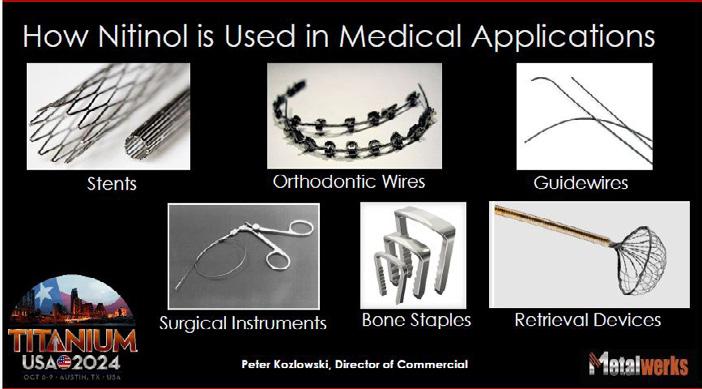

Nitinol is used in numerous cutting-edge medical devices:

• Stents: Delivered in a compressed form and expanded in the body to open narrowed arteries.

• Orthodontic Wires: Provide consistent, gentle pressure for tooth movement.

• Guidewires: Used in minimally invasive procedures to navigate complex anatomy.

• Surgical Instruments: Some tools change shape inside the body to reduce incision size.

• Bone Staples and Retrieval Devices: Utilize shape memory for precise deployment and retraction.

Why Nitinol Is Ideal for Stents Stents are the largest single application of Nitinol. These small mesh tubes are used to keep blood vessels, bile ducts, and airways open. In cardiovascular applications, they prevent arteries from collapsing or becoming blocked again.

Self-expanding stents, often used for peripheral artery disease (PAD), must adapt to twisting blood vessels and withstand repeated motion. Nitinol’s flexibility and fatigue resistance make it the perfect material.

Advantages of Nitinol for Stents:

• Super-elasticity: Handles large strains without permanent deformation.

• Shape Memory: Expands reliably inside the body at body temperature.

• Fatigue Resistance: Maintains performance under millions of cycles.

• Biocompatibility: Forms a

stable oxide layer to reduce nickel release.

• Low Chronic Outward Force: Keeps vessels open without damaging tissue.

Because of its high titanium content and reactivity, Nitinol must be processed in vacuum environments to maintain purity. Common melting methods include:

• Vacuum Induction Melting (VIM): Uses a graphite crucible and induction heating, though carbon contamination can be a concern.

• Induction Skull Melting (ISM): Uses a copper crucible to avoid contamination and improve purity.

• Vacuum Arc Remelting (VAR): Helps achieve chemical uniformity and minimizes inclusions in both primary and secondary melting stages.

Precise control of Nitinol’s composition is critical. Even minor variations—such as a 0.1-percent change in nickel content—can shift transformation temperatures by more than 10°C, affecting performance.

• Oxygen and Carbon Sensitivity: These elements can react with Nitinol during melting, forming oxides and carbides that impair its superelastic and shape memory properties.

• Fatigue Performance: Increased levels of oxygen and carbon degrade fatigue life, especially important in stents and guidewires that experience continuous movement inside the body.

Medical technology is evolving rapidly, and Nitinol is evolving with it. Key trends include:

• Alloying for Performance: Adding elements like copper, iron, tantalum, or manganese to

improve properties such as fatigue life, corrosion resistance, and radiopacity.

• Additive Manufacturing (AM): Techniques like laser beam melting allow for custom geometries and patient-specific devices. Postprocessing is crucial to reduce roughness and stress.

• Surface Coatings: Advanced coatings—such as silver nanoparticles and polymer films—reduce friction, enhance biocompatibility, and offer antimicrobial properties.

• Drug-Eluting Devices: New stents are designed to release therapeutic agents, combining mechanical support with localized drug delivery.

• Smart and Robotic Systems: Nitinol’s shape-changing ability is being used in steerable catheters and robotic instruments for highly precise interventions.

Beta Titanium alloys and Nitinol represent a powerful fusion of metallurgy and medicine. Their properties are enabling less invasive procedures, faster recoveries, and

longer-lasting implants. As the medical field pushes for more adaptable, biocompatible, and highperformance materials, the demand for these advanced metals continues to grow. n

[Editor’s note: Peter Kozlowski is the manager of production and business development at Metalwerks, Inc. (website: https://www.metalwerks. com).. Kozlowski served as a speaker at TITANIUM USA 2025, held last October in Austin, TX. The company, based in Aliquippa, PA, specializes in creating and refining advanced materials such as Nitinol and titanium beta alloys. Since 1998, Metalwerks has supported the medical,

aerospace, energy, industrial, and research and development sectors, turning complex material challenges into commercially viable solutions. According to information on the company website, Metalwerks has five melting furnaces, a complete machine shop and a bar processing center. Its production capabilities include research and development melting, vacuum induction melting, induction skull melting, vacuum arc melting and waterjet cutting services. Koslowski said Metalwerks “is proud to be at the forefront—developing materials that make today’s medical breakthroughs possible and preparing for tomorrow’s challenges.”]

ALEXANDER WEISS

Mechanical and Aerospace Engineering

West Virginia University

Animal Science and Nutrition

West Virginia University

Exercise Science

University of South Carolina: Columbia

Ceramic-

Inert Gas Atomization Equipment

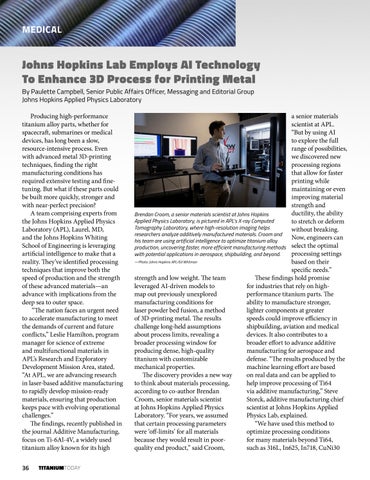

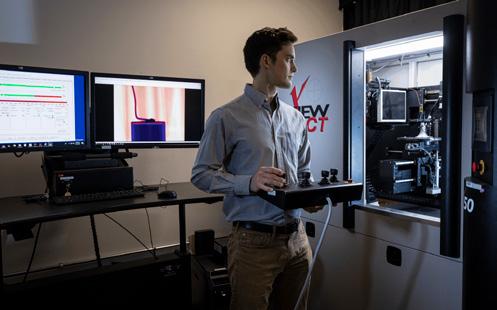

By Paulette Campbell, Senior Public Affairs Officer, Messaging and Editorial Group Johns Hopkins Applied Physics Laboratory

Producing high-performance titanium alloy parts, whether for spacecraft, submarines or medical devices, has long been a slow, resource-intensive process. Even with advanced metal 3D-printing techniques, finding the right manufacturing conditions has required extensive testing and finetuning. But what if these parts could be built more quickly, stronger and with near-perfect precision?

A team comprising experts from the Johns Hopkins Applied Physics Laboratory (APL), Laurel, MD, and the Johns Hopkins Whiting School of Engineering is leveraging artificial intelligence to make that a reality. They’ve identified processing techniques that improve both the speed of production and the strength of these advanced materials—an advance with implications from the deep sea to outer space.

“The nation faces an urgent need to accelerate manufacturing to meet the demands of current and future conflicts,” Leslie Hamilton, program manager for science of extreme and multifunctional materials in APL’s Research and Exploratory Development Mission Area, stated. “At APL, we are advancing research in laser-based additive manufacturing to rapidly develop mission-ready materials, ensuring that production keeps pace with evolving operational challenges.”

The findings, recently published in the journal Additive Manufacturing, focus on Ti-6Al-4V, a widely used titanium alloy known for its high

Brendan Croom, a senior materials scientist at Johns Hopkins Applied Physics Laboratory, is pictured in APL’s X-ray Computed Tomography Laboratory, where high-resolution imaging helps researchers analyze additively manufactured materials. Croom and his team are using artificial intelligence to optimize titanium alloy production, uncovering faster, more efficient manufacturing methods with potential applications in aerospace, shipbuilding, and beyond.

—Photo: Johns Hopkins APL/Ed Whitman

strength and low weight. The team leveraged AI-driven models to map out previously unexplored manufacturing conditions for laser powder bed fusion, a method of 3D-printing metal. The results challenge long-held assumptions about process limits, revealing a broader processing window for producing dense, high-quality titanium with customizable mechanical properties.

The discovery provides a new way to think about materials processing, according to co-author Brendan Croom, senior materials scientist at Johns Hopkins Applied Physics Laboratory. “For years, we assumed that certain processing parameters were ‘off-limits’ for all materials because they would result in poorquality end product,” said Croom,

a senior materials scientist at APL.

“But by using AI to explore the full range of possibilities, we discovered new processing regions that allow for faster printing while maintaining or even improving material strength and ductility, the ability to stretch or deform without breaking. Now, engineers can select the optimal processing settings based on their specific needs.”

These findings hold promise for industries that rely on highperformance titanium parts. The ability to manufacture stronger, lighter components at greater speeds could improve efficiency in shipbuilding, aviation and medical devices. It also contributes to a broader effort to advance additive manufacturing for aerospace and defense. “The results produced by the machine learning effort are based on real data and can be applied to help improve processing of Ti64 via additive manufacturing,” Steve Storck, additive manufacturing chief scientist at Johns Hopkins Applied Physics Lab, explained.

“We have used this method to optimize processing conditions for many materials beyond Ti64, such as 316L, In625, In718, CuNi30

and more,” Storck continued. “The manufacturing optimization can adjust for tradeoffs between manufacturing speed and mechanical properties in laser-based additive manufacturing. In particular, it enables matching the mechanical properties of legacy materials, while maximizing the productivity of laser powder bed fusion (L-PBF) processes.”

Researchers at the Whiting School of Engineering, Baltimore, including Somnath Ghosh, professor and the Michael G. Callas chair in the Department of Civil and Systems Engineering, are integrating AIdriven simulations to better predict how additively manufactured materials will perform in extreme environments. Ghosh co-leads one of two NASA Space Technology Research Institutes (STRIs), a collaboration between Johns Hopkins and Carnegie Mellon focused on developing advanced computational models to accelerate material qualification and certification. The goal is to reduce the time required to design, test and validate new materials for space applications — a challenge that closely aligns with APL’s efforts to refine and accelerate titanium manufacturing.

This breakthrough builds on years of work at APL to advance additive manufacturing. When Steve Storck, the chief scientist for manufacturing technologies in APL’s Research and Exploratory Development Department, arrived at the Laboratory in 2015, he recognized the practice had its limits.

“Back then, one of the biggest barriers to using additive manufacturing across the Department of Defense was materials availability — each design required a specific material, but robust

processing conditions didn’t exist for most of them,” Storck recalled. “Titanium was one of the few that met DoD (Depatment of Defense) needs and had been optimized to match or exceed traditional manufacturing performance. We knew we had to expand the range

This isn’t just about manufacturing parts more quickly. It’s about finding the right tradeoffs between strength and ductility; that is, how much a material can deform without breaking, and overall efficiency. AI is helping us explore processing regions we wouldn’t have considered on our own.

— Brendan Croom, a senior materials scientist at Johns Hopkins Applied Physics Laboratory

of materials and refine processing parameters to fully unlock additive manufacturing’s potential.”

APL spent years refining additive manufacturing, focusing on defect control and material performance. Storck’s team developed a rapid material optimization framework, an effort that led to a patent filed in 2020. In 2021, the APL team published a study in the Johns Hopkins APL Technical Digest examining how defects impact mechanical properties.

This framework, designed to significantly accelerate the optimization of processing conditions, provided a strong foundation for the latest study.

Building on that groundwork, the team leveraged machine learning to explore an unprecedented range of

processing parameters, something that would have been impractical with traditional trial-and-error methods. The approach revealed a high-density processing regime previously dismissed due to concerns about material instability. With targeted adjustments, the team unlocked new ways to process Ti-6Al4V, long optimized for laser powder bed fusion. “We’re not just making incremental improvements,” Storck said. “We’re finding entirely new ways to process these materials, unlocking capabilities that weren’t previously considered. In a short amount of time, we discovered processing conditions that pushed performance beyond what was thought possible.”

Titanium’s properties, like those of all materials, can be affected by the way the material is processed. Laser power, scan speed and spacing between laser tracks determine how the material solidifies — whether it becomes strong and flexible or brittle and flawed. Traditionally, finding the right combination required slow trialand-error testing.

Instead of manually adjusting settings and waiting for results, the team trained AI models using Bayesian optimization, a machine learning technique that predicts the most promising next experiment based on prior data. By analyzing early test results and refining its predictions with each iteration, AI rapidly homed in on the best processing conditions, allowing researchers to explore thousands of configurations virtually before testing a handful of them in the lab. This approach allowed the team to quickly identify previously unused settings, some of which had been dismissed in traditional manufacturing — that could produce stronger, denser titanium. The results overturned long-

held assumptions about which laser parameters yield the best material properties.

The Bayesian optimization model efficiently “learns the mechanical properties and porosity across a large L-PBF processing space, quickly shifting through material possibilities to optimally recommend new processing conditions, which accelerates the process and minimizes the number of experimental measurements we had to perform,” Croom said. “This isn’t just about manufacturing parts more quickly. It’s about finding the right tradeoffs between strength and ductility; that is, how much a material can deform without breaking, and overall efficiency. AI is helping us explore processing regions we wouldn’t have considered on our own.”

Storck emphasized that the approach goes beyond improving titanium printing; it customizes materials for specific needs.

“Manufacturers often look for onesize-fits-all settings, but our sponsors need precision,” he said. “Whether it’s for a submarine in the Arctic or a flight component under extreme conditions, this technique lets us optimize for those unique challenges

while maintaining the highest performance.”

Croom added that expanding the machine learning model to predict even more complex material behaviors is another key goal. The team’s early work looked at density, strength and ductility, and Croom said it has eyes on modeling other important factors, like fatigue resistance or corrosion. “This work has been a clear demonstration of the power of AI, high-throughput testing and data-driven manufacturing,” he said. “It used to take years of experimentation to understand how a new material would respond in our sponsor’s relevant environments, but what if we could instead learn all of that in weeks and use that insight to rapidly manufacture enhanced alloys?”

The success of this research opens the door to even broader applications. The recently published paper focused on titanium, but the same AI-driven approach has been applied to other metals and manufacturing techniques, including alloys specifically developed to take advantage of additive manufacturing,

Storck said. One area of future exploration is so-called in situ monitoring — the ability to track and adjust the manufacturing process in real time. Storck described a vision where state-of-the-art metal additive manufacturing could be as seamless as 3D printing at home: “We envision a paradigm shift where future additive manufacturing systems can adjust as they print, ensuring perfect quality without the need for extensive post-processing and that parts can be born qualified.” n

(Editor’s note: Johns Hopkins APL, Laurel, MD, [website: https://www. jhuapl.edu/] is a not-for-profit university affiliated research center (UARC) that solves complex research, engineering, and analytical problems that present critical challenges to the United States. Scientists, engineers, and analysts serve as trusted advisers and technical experts to the government, ensuring the reliability of complex technologies that safeguard our nation’s security and advance the frontiers of space. The organization also maintains independent research and development programs that pioneer and explore emerging technologies and concepts to address future national priorities.)

PAGELAND, S.C., June 12, 2025 /PRNewswire/ -- ATI Inc. (NYSE: ATI) has brought online a state-of-the-art facility in Pageland, South Carolina to produce titanium alloy sheet. Technically challenging to produce, this material is critical to airframe manufacturers, bringing strength and durability to aerostructure components and assemblies.

“Recognizing the high quality of our products, customers have been asking ATI to add this offering to our titanium portfolio,” said Kimberly A. Fields, ATI President and CEO. “With our Pageland facility fully online and in production, we now offer a full complement of titanium materials, producing quality titanium sheets wider and longer than anyone in the industry.”

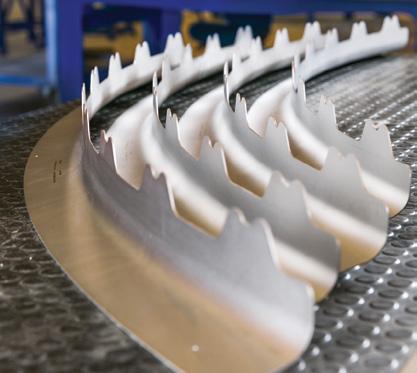

Known in the industry as ‘pack rolled sheet,’ this product must meet exacting industry requirements. Production starts with the best of ATI’s extraordinary capabilities across the enterprise, from melt to rolling. Layers of titanium plate are hot rolled to ultra-thin sheets in gauges as thin as 0.020 inches, at lengths up to 25 feet, with the highest surface quality. “This new offering further extends ATI’s position as an aerospace leader, giving customers

extraordinary manufacturing capability and flexibility,” said Fields.

ATI recently announced a multi-year agreement with Airbus for titanium plate, sheet and billet for narrow and widebody aircraft. The titanium alloy sheet for this engagement will be produced at the Pageland facility. ATI estimates that more than two-thirds of Pageland’s capacity will be under long-term agreements with a range of aerospace customers, including for the titanium alloy sheet for Airbus, with qualifications already underway.

ATI Pageland Operations is vertically integrated, bringing leveling, annealing, finishing and inspection together under one roof at the nearly 125,000 square foot greenfield facility. The highly automated facility was designed with sustainability at the forefront: The electric furnaces align Pageland’s power footprint with the state of South Carolina’s power cooperatives’ goal of moving toward greener power solutions. All-electric furnaces and a highly efficient water-jacketed pickle line result in zero air emissions and minimal wastewater discharge. The investment is included in the company’s existing capital expenditure guidance.

ARIES Manufacturing is dedicated to the supply of complex airframe structure components, in both titanium and aluminum alloys, to leading manufacturers in the aerospace industry.

ARIES Manufacturing is part of the ARIES Alliance, a group of companies focused on developing innovative technology that creates value for the aerospace industry.

Panel mechanical pocket milling, drilling and trimming

Superplastic Forming and Hot Forming for titanium airplane structural and engine components

HSF® process technology for titanium airframe components

Small Business Association recognizes local entrepreneur for excellence in business

ST. AUGUSTINE, Florida (May 20, 2025)—The Small Business Association (SBA) North Florida District has recognized Vested Metals International President and Founder Viv Helwig as the Small Business Person of the Year. The SBA awards recognize outstanding small business owners from across the nation and are part of its National Small Business Week celebration, which takes place May 4th through May 10th. Helwig was honored at the 33rd Annual Small Business Week Celebration on May 9th at the University of North Florida in Jacksonville, Florida.

“Receiving this award is a proud moment for Vested Metals International,” Helwig exclaims. “It underscores our commitment to quality, integrity, community engagement, and customer satisfaction. We are grateful for the support of our community and customers, and we will continue to strive for excellence in all that we do. We truly couldn’t achieve

this humbling milestone without the collaboration of our employees, suppliers, contractors, community, partners of any kind, and ultimately the opportunity our customers give us. We are always striving to improve and excel.”

Helwig chose to set down roots in St. Augustine, Florida where he has built Vested Metals into one of the fastestgrowing privately held companies in the world, receiving numerous accolades from Inc.’s 5000. Helwig was previously named MinorityOwned Small Business Person of the Year in 2020, and North Florida and Florida Small Business Exporter of the Year in 2022 by the SBA for the Northern region of Florida. Helwig is committed to creating and expanding economic opportunity in St. Johns County. The charitable arm of Vested Metals, The Vested Metals

Community Foundation, works to raise funds for a variety of nonprofit organizations that are near and dear to Helwig, including United Way of St. Johns County, THE PLAYERS Championship Boys & Girls Club, and K9s For Warriors. Helwig and his team aim to raise and donate $1 million in 10 years through its annual golf tournament, The Southeast Coil Classic.

Helwig acknowledges there is uncertainty in the market at the moment, but he is ready to tackle it with thought and integrity. “We know many companies have a lot of questions around market uncertainties and tariffs in particular,” Helwig says. “Although we’ve been here before, it still takes navigating intentionally, and we feel that our experienced team is wellpositioned to help our customers do just that. We have a strong inventory base and are positioned well to support our customers costeffectively while we await more clarity on tariffs.”

Hermitage PA, July 14, 2025 –The foundation is now in place at Solar Atmospheres of Western PA for the installation of a state-of-the-art titanium drop bottom water quench furnace. Engineered for precision and performance, this new furnace is rated for a maximum operating temperature of 1850°F ±10°F and is designed to process titanium bar and forging loads of up to 7,500 pounds.

Measuring 14 feet long by 54 inches wide by 48 inches high, workloads will be rapidly transferred into a 7,000-gallon, recirculated water quench tank within seconds—ensuring consistent metallurgical results for demanding aerospace

and industrial applications. This investment marks a significant step forward, opening the door to expanded titanium solution treating capabilities and reinforcing Solar Atmospheres’ commitment to innovation and customer-driven thermal processing solutions.

For additional information about Solar Atmospheres, contact Mike Johnson at 855-934-3284 x2223, email at mikej@solaratm.com, and visit us at solaratm.com.

Our continued investment and expansion has us in the right place to meet your needs.

Our capacities and resources are aligned. We are prepared and well positioned to supply a full range of products including ingot, centerless ground bar, precision coil, additive wire, premium fine wire and shapes – all at competitive lead-times.

We are expertly equipped to address the growing demands of the aerospace, medical, recreation, infrastructure, and industrial markets worldwide. We understand the ever-changing factors of the industries we serve and are committed to supporting the growth of your business.

Product Evaluation Systems, Inc. (PES) is a fully accredited, independent leader in titanium materials testing for aerospace and other applications.

With a dedicated, experienced staff and state-of-the-art testing facilities, we offer full-service capabilities for all of your titanium testing needs, including:

• Mechanical Testing

• Metallurgical Analysis

• Chemical Analysis

PES responds to your needs promptly with personal service, customized solutions and expedient turnaround. We work with clients throughout the United States and Europe on projects of all types and sizes.

To request a free quote for your titanium testing needs and to see a full list of capabilities, please visit our website at www.PES-Testing.com or call 724-834-8848.

Premium Quality, Stability and Reliability.

One-Stop titanium alloy production and service.

A dozen years of titanium alloy production and research experience, with more than 100 patents and achievements to its credit, mastering a number of core technologies; Accredited with Nadcap non-destructive testing certificate and AS9100D, ISO14001, ISO 45001 and other certifications;

Titanium bar/billet

Size range: Φ15-500mm

Grade: Ti6Al4V, Ti-6242, Ti-6246, Ti-38644, Ti-15333, etc.

Titanium wire rod coil

Size range: Φ1.0-20.0mm

Grade: Ti6Al4V, Ti6Al4V ELI, Ti-38644, Ti-6242, Ti-6246, Ti-15333, Ti-422, etc.

Titanium forging

Size range: customized, disc, bar, ring, etc.

L(max):14m, W(max):4m, H(max):4m.

Grade: Ti6Al4V, Ti6246, Ti6242, Ti662, Ti38644, Ti15333, Ti1023, Ti422, etc.

more information, please visit www.tcae.com/en/

By joining the International Titanium Association, you become part of an international network of titanium professionals unlike any other. You will have access to an expanding organization of committees, strategic partners, and international members. Like any investment you make on behalf of your company, you want assurance that it will provide strong returns. An investment in Corporate Membership with International Titanium Association is a wise strategic decision, whether you are a small distributor or a large producer of mill products. Whether you buy from or sell to the titanium industry, our array of benefits will provide just what you and your team are looking for. We are so certain that membership is worthwhile, we provide each Corporate Member with a ROI and engagement scorecard.

Producers & Suppliers of Titanium:

Over 700 in attendance at the 2023 & 2024 Events:

“I’ve attended numerous virtual conferences. You and your team built and executed a conference far better than others. The ability to stop the presentation to read and comprehend slides and rewind and re-listen to speaker commentary was great. The real-time meetings were also well executed.”