COUNTRY MARKET COMMENT

Might changes imposed by social restrictions be a positive turning point for our towns and villages?

Extraordinarily high levels of sales and lettings activity, even in the absence of overseas demand.

NEW HOMES & DEVELOPMENTS

Wealthy buyers: what do those who can afford whatever they want, really, really, want?

N O 47 WWW. UKMARKETREVIEW .CO.UK 2021

LONDON MARKET COMMENT

Country Market Comment

THE SAVIOUR OF RURAL VILLAGES?

As our growing retired population relocates to market towns, more flexible approaches to working are allowing young families – so often the heart of village community life – to loosen their big city ties. Could this be a turning point?

3

Main photo: Devon £1,250,000 guide (Exeter)

Front cover: Chester, £1,200,000 guide (Chester)

By 2025 – barely more than three years away – the ONS estimates that the UK will be home to well over a million more people aged over 65, compared with last year. This growth in retiree numbers is four times the increase in adults under 65 and nationally significant because, in contrast with past generations, most of them now own a house. They have no mortgage, a decent pension and a plan to live healthily for another 20 years or more. Low maintenance homes in market town centres with good shops and services, are highly attractive to retired buyers. In recent years, this has pitched them into head-on competition with commuting-oriented families, all looking to buy in good towns, handy for the train station. Flexible working has changed this in ways which should last and might grow. Not many amongst the great tide of buyers moving out from major cities expect a complete and lasting switch to working from home. But a high proportion already know that they will not be expected to be at the office, travelling at peak times, every day. This has generated a willingness to look further afield, boosting demand in villages which have long suffered from an exodus of the young. Will it be enough to reinvigorate the clubs, pubs and, most importantly, schools? It’s too early to say but, either way, the families that have already made the move, are the best news many villages have had over the last year. The grandparents, meanwhile, with their disposable incomes and fondness for traditional shopping, are just what the market towns need.

OVERPRICED COMPETITION IS GOOD

Given the massive demand over recent months, extending even into the New Year lockdown, the news that values have not risen dramatically is often greeted with surprise. Values have increased in most areas, but in few by much more than general inflation. This is because credit and affordability constraints are still tight, and because supply increased greatly, too, making for a remarkably active market. Pricing strategy is thus still central to selling without delay at the best price. Competition can help you here, if your competitor is overpriced. Your house looks better value, so everyone comes to see it , not the rival. You sell quickly, whilst the overpriced house languishes, pushing the owners to lose confidence, eventually selling at below its real value. The trick is to know the true maximum value of your property – and have a strategy to get it. Whether you are selling with a dream of moving to a rural idyll, or to a town centre penthouse, without a buyer at the price you need, it will remain just a dream.

Top: Cornwall £1,200,000 guide (Truro)

Below: Surrey £1,950,000 guide (Oxted)

Opposite page: Cheshire £4,500,000 guide (Alderley Edge)

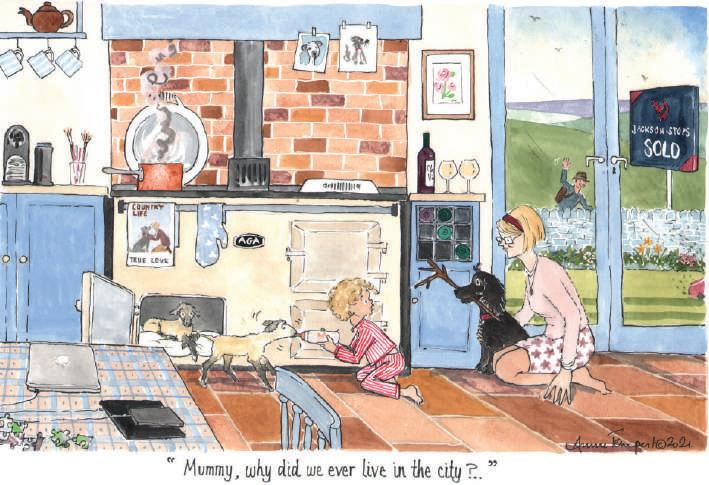

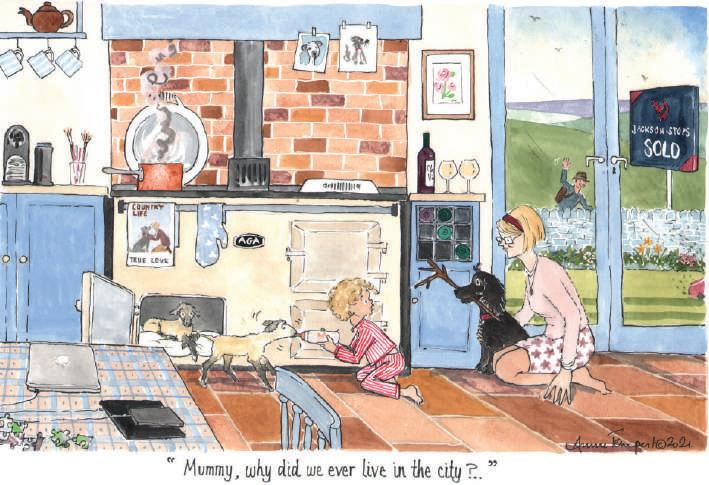

Below right: Our latest specially commissioned cartoon from Annie Tempest, whose Tottering-byGently has appeared in Country Life since 1993.

UK Market Review | N 0 47; 2021 4

Country Market Comment

HOLIDAY RUSH

Those that have made their move are fortunate to have avoided what has become a stressful rush to complete before the scheduled end of the Stamp Duty ‘holiday’. Recent months have been quite extraordinary, with supply and demand being so high that, for the first time in living memory, sales volumes have reached record highs in all regions, at the same time (in our experience and confirmed by the RICS). But a sale agreed is not a sale completed. Legal process is the big problem here: the huge number of deals going through has caused average conveyancing times to rise alarmingly. Three months from agreement to exchange is quite common. It’s not all the fault of the lawyers. All those involved in searches, title checks and mortgage matters, are taking longer to respond.

5 UK Market Review | N 0 47; 2021

This is frustrating because it is physically possible to exchange contracts in just a few days and, where no mortgage is involved, exchange often takes place within two or three weeks. To avoid wasting time it is vital that sellers prepare. Delays arise when title deeds can’t be found, contracts have not been drafted in advance and – often – when owners simply fail to realise that, until they return queries about their property, their lawyers can’t do much. For listed properties, matters are more complex still (as explained on page 15).

Despite the frustrations of lockdown, the early months of the year remain an especially good time to sell, because buyers begin looking immediately, whilst sellers just begin thinking about selling and wait for better weather. Come to the market promptly and you'll find plenty of buyers and much less competition.

ORDERLY EXPECTATIONS

Feedback from buyers and sellers alike indicates that, despite widely shared acceptance of the probability of higher taxes and modestly rising prices, the broad desire to secure a more balanced lifestyle will remain. The trends forced through by our collective responses to the pandemic will continue, if less dramatically. This augurs well for the remainder of the year.

Above: Devon £1,200,000 guide (Taunton)

Left: Yorkshire £1,250,000 guide (York)

Below: Sussex £3,650,000 guide (Mid Sussex)

Opposite page: Kent £2,995pcm (Cranbrook)

UK Market Review | N 0 47; 2021 6

PET SOUNDINGS

Landlords explore their options as tenants looking for dog-friendly country homes become, in many instances, the majority.

The markets for both genuinely rural rentals and for homes in smaller towns continue to be dominated by tenants who temporarily (or possibly permanently – typically they themselves don't know) want to leave a large city. Most, though, face greatly limited choice, because they want to keep a dog. On the day of launching one property onto the market, our Sevenoaks office received enquiries from fourteen potential tenants. Every single one was a dog owner. This recent phenomenon has collided head-on into 2019 legislation which, in effect, prohibited landlords from charging an additional deposit for cleaning and repairs once dog-owning tenants depart. In response, an even greater proportion of landlords than before, took the obvious route: No pets allowed. Today, this applies to the great majority of rental properties.

Now though, with most landlords showing dogs the ‘No Vacancies’ sign and so many tenants being dog owners, supply and demand is working its magic.

Premiums of £25 or more per pet, per month, are being agreed, as are all sorts of terms around what to do about nuisance barking, damage to home and garden and more. Provided pet and property are suitable (and that the dog owners recognise their natural inability to detect the smell of their own pet), there is rarely a problem. Increasingly, the position of landlords is leaning away from ‘No pets’ and towards ‘Pets considered’.

ACTIVITY HIGH, SOME PRESSURE ON RENTS

As the historically high levels of activity persist, we do have concerns about shortages of stock. These might drive rental increases to the higher end of predictions, but there are so many factors, good and bad, entering the mix over the coming months that they may well cancel each other out. As our chart shows, perhaps the most remarkable point about changes in rents across the country, including London, since 2015 is how similar and undramatic they are. For landlords and tenants, such stability might be unexciting, but is surely welcome.

7

Country Rentals

100 115 110 105 NORTH EAST LONDON EAST MIDS 2015 2016 2018 2017 2019 2021 2020

This chart shows the regions with the highest and lowest growth, plus London. After six years, the spread is just 11.2%. Source: ONS Index of Private Housing Rental Prices / Jackson-Stops.

GROWTH IN RENTS SINCE 2015

What will £1,000,000 buy in the country?

WHAT WILL £1,000,000 BUY IN THE COUNTRY?

More than four times the current UK average house price of £249,600 (Land Registry), what a million pounds secures, varies greatly across the country.

This page, clockwise from the left: Devon excess £1,000,000 (Barnstaple) Somerset £895,000 guide (Taunton)

Denbighshire £975,000 guide (Chester)

£935,000 guide (Shaftesbury)

Norfolk £925,000 guide (Burnham Market)

Bedfordshire

£1,200,000 guide (Woburn)

Kent £1,000,000 guide (Oxted)

Examples from our offices outside London

9 UK Market Review | N 0 47; 2021

This page, clockwise, from above: Dorset

London Market Comment

VOLUME OF LETTINGS UP 52%

An astonishing twelve months have seen our teams notch up record volumes as social changes push demand higher than ever. Amongst the turmoil, two other facts stand out: almost all the demand is home-grown, and both capital values and rents have proved remarkably stable.

11

Main photo: Radnor Walk SW3 £4,000,000 (Pimlico)

The pandemic cut visits to London from overseas to, at times, near zero. Heathrow has reported a 73% drop in passenger numbers for 2020. Other London airports, more reliant on tourists, will have fared even less well. Given the degree to which overseas demand for London property used to dominate, you could be forgiven for assuming that the overall number of property transactions would be dramatically lower than usual. Indeed, for holiday lets, you’d be correct: lettings of London properties listed with Airbnb (numbering over 87,000) collapsed, pushing landlords into the longer term market. In every other category however – longer lets and sales of all kinds of property, including pieds-à-terre with no outside space – volumes are up, to an extraordinary degree. This reflects the turmoil in home and office life and the constantly shifting extent to which Londoners expect pre-pandemic ways, to return. That turmoil also explains the stability in values: supply and demand have risen, more or less, in step. Capital values, are up. This suggests that the market will cope well

with the end of the stamp duty holiday and the introduction, also on 1 st April 2021, of an additional 2% stamp duty for foreign buyers –taking their marginal rate above £1.5 million, to 17%.

ZERO VOIDS & ’REAL-TIME RENTS’

The rental market is naturally more fluid than the sales market, so quicker to respond. Moves in and out of lockdowns have thus seen fluctuations, creating opportunities for landlords and tenants alike. For both though, an empty property is simply a waste, a lost opportunity. To minimise voids, we monitor trends across our portfolio, daily. This encompasses thousands of properties. We then cross-reference those trends with daily reports from our local teams. The result is near real-time, empirical evidence, of patterns in supply and demand. It showed us, for example, that when a second lockdown looked likely, the majority of tenants giving notice were not leaving London, but moving locally, to a larger home. It showed us that stable

Opposite page: Dorsted Road SW19 £8,500pm (Wimbledon)

Below: Weybridge £2,250,000 guide (Weybridge)

UK Market Review | N 0 47; 2021 12

London Market Comment

demand for smaller central London apartments, was about to be more than matched by a flood of newly available properties, courtesy of the nonexistent holiday let market. Such information enables us to calculate the best rent and term achievable for any given property on any given day, securing almost zero voids, on the most commercially viable terms.

OUTLOOK: RESILIENCE OF A 24HR CITY

Belatedly recognising the strength of a diverse economy, the chief executive of Canary Wharf

Group said early this year * that he wanted the Docklands financial office district to become a “ 24/7 city where people live, work and play ”, with a thorough mixture of different kinds of businesses and many more residents. Happily, the resilience and sheer attractiveness of non ‘single function districts’ is something of which central and other London areas have long been aware. Estates such as Grosvenor and Portman have actively promoted this model by, for example, ensuring small independent shops valued by residents have affordable rents, and by making streets and green spaces more practical for families with young children. Even the City – having experienced the ‘offices only’ route – has encouraged a trend towards a larger resident population, resulting in 79% growth since its admittedly tiny 20th century low of under 6,000. Pre-Covid, its daily commuters exceeded 500,000.

Recent times have been difficult, but the changes happening as a result include many positives which will enhance London life. To encourage employees back, offices are being made more attractive and (partly to allow for a measure of permanent social distancing) less densely packed. The pressure on peak commuting times, strained by outer London population growth even greater than the 14% average **

13 UK Market Review | N 0 47; 2021 EAST MIDLANDS EAST OF ENGLAND LONDON NORTH WEST SOUTH WEST 70 52.5 35 17.5 0 -17.5

This graph shows percentage year-on-year change in the monthly number of completed sales across five regions, including London, for the year to October 2020. Source: Land Registry / Jackson-Stops.

JUNE PEAKS: STRIKINGLY SIMILAR PATTERNS % CHANGE IN MONTHLY SALES, OCT 2019 TO OCT 20

of the last decade, looks unlikely to return to pre-pandemic extremes, making travel more pleasant. And, everywhere, we have noticed a greater appreciation of local community.

The confidence that such factors instil is fuelling the increase we are seeing now in new purchases by landlords and the readiness with which UKbased individuals are buying and renting. We expect capital values to remain stable and rise modestly over the coming year. Rents are harder to predict. Especially in outer areas, they will be affected a little by when credit restrictions on first time buyers, are eased. Stepped-up during the frantic market of 2020, they forced many to keep renting. They will buy as soon as they can, reducing demand. A bigger factor, though, is the holiday market. We’re working hard to show all those former Airbnb landlords just how much easier and simpler life is, in the longer term market. Even so, an inevitable shortage of holiday lets will one day tempt some back, creating a broad upward pressure. When mass tourism will return, however, is anyone’s guess.

FORCED 990 YEAR LEASE EXTENSIONS

Following recommendations from the Law Commission, the government has announced

that “ Millions of leaseholders will be given the right to extend their lease by a maximum term of 990 years at zero ground rent ” (Housing Secretary Robert Jenrick, 7/1/21). There is little doubt the mere promise of this reform has already deterred most new house builders from inserting terms which, notoriously, allowed ground rents to double every few years.

As well as eliminating ground rents, the Law Commission proposals include forcing freeholders to extend leases to 990 years (instead of 90) and to accept a price for that extension calculated in a new way that is much more favourable to leaseholders. An example given by the Law Commission reduces the payment required by 40%. If such rules applied to the central London estates – where many leases are below 80 years and marriage values can run into millions – the long-term effects could be dramatic. However, much detail has to be worked out and the government has yet to indicate when the new legislation might become law (suggesting it will be at least two years). If your lease is approaching the 80 year mark, do not delay.

*FT, 11/1/21

**UN / Mayor of London

Opposite page: Suffolk £1,100,000 (Ipswich)

Lovingly restored to preserve its extraordinary history and atmosphere, this Grade II listed house with medieval origins dates mainly from around 1592.

UK Market Review | N 0 47; 2021 14 London Market Comment

Above: Hampton Wick £2,995,000 guide (Teddington)

SPEED UP YOUR SALE

A check list particularly relevant to listed buildings and country houses to be sold for the first time in many years.

Many causes of delay which arise after agreeing a sale – some of which prevent it from happening –are best dealt with before you even begin marketing.

• Check that the title is registered with the Land Registry. You can do this (for a £3 fee) via the gov.uk website, or ask your solicitor. If it is registered, download the title plan (another £3).

• If it is not, you must find the deeds. The closure of bank branches and merger of solicitors have made lost title deeds a more frequent problem. If there is a mortgage outstanding, they are probably with the lender. If not, they might be with the solicitor or bank used for the purchase.

• Use the title plan to check that all boundary fences and walls are shown correctly. Do not get into a boundary dispute as this would have to be disclosed to a buyer. Tell your solicitor instead.

• Make sure you own the right of access to your property or, if reached via a private lane or track, that you have a formal right of way. If in doubt, do not approach the neighbour: this could preclude you from getting insurance cover, if required. Again, tell your solicitor.

• Gather planning permission and building regulation certificates. If you live in a listed building or in a conservation area, you will need copies of consents for alterations. Remember that listed building consent is needed for interior alterations, as well as exterior.

• Ideally, have written evidence from the contractor, or ‘before’ and ‘after’ photographs, to

prove that like-for-like repairs to a listed building did not require consent.

• Take advice on what repairs you should do before marketing. Major work can look more daunting and costly – to surveyors as well as buyers – than it is, so it’s worth either fixing it or, to bring some certainty, obtaining quotes.

• For leasehold property, provide your agent with a copy of the lease so they can check for restrictions which buyers care about, such as prohibitions on pets and hard floor coverings.

Owners sometimes box up old papers, only to find they are needed to complete the sale. Ask your solicitor for a standard seller’s enquiry form. This will tell you what will be asked for, so you can find it easily – before it is ‘boxed & buried’.

For further information, contact Dawn Carritt of the London Country Houses & Estates office on 020 7664 6646 or dawn.carritt@jackson-stops.co.uk

15

New Homes & Developments

THE FINAL FRONTIER

The most expensive new homes reconcile the fashion for big, open plan, combined use rooms, with the need for additional quiet places for home schooling and working. They have what everyone wants: space.

16

17

Gloucestershire

4,700 sq ft £2,550,000 guide (Chipping Campden)

For months now, media commentators have made much of our apparently growing desire to “connect with nature”. To some extent, this is certainly true. Many more people are going for long country walks, watching nature programmes on television and buying bird feeders. But might that be just because there has been little else to do?

Even our most well-heeled new homes buyers have had their wings clipped. First class is less of a privilege, when you have nowhere to fly to. They have to stay at home. For the very wealthy, that home can be much closer to their vision of perfection, than the rest of us can afford. So what do they buy? Rarely is it a remote country lodge with woods, meadows and streams ripe for rewilding with butterflies, bats and beavers. Most often, it is what the rest of us want: somewhere private, convenient for both attractive countryside and a nice town, expertly designed and built to a lasting, beautiful standard. The only real difference is space. Wealthier buyers, buy much more of it. Indoors.

How much space is that? Research by insurers LABC Warranty suggests that UK homes built since 2010 average just 730 square feet – the lowest in 90 years. The Cotswold house shown on the previous page is well over six times that. The kitchen alone is over 900 square feet. It also has space for ‘essentials’ such as a utility room, en suites for every bedroom and separate dressing rooms. The Wilmslow house shown above has more than twice as much space again: enough for a guest wing, sauna and gym. There is even a subterranean games and cinema room, in which to watch all those nature programmes.

HIGH DEMAND FOR HIGH QUALITY

At slightly less illustrious levels, high demand for new homes persists, even in the face of periodic restrictions on personal movement. All buyers considering homes over £500,000 have at least double the UK average house price to spend and tend to be experienced home owners. We expect the products of the more specialist house builders who cater for them to continue to sell swiftly and at a premium.

UK Market Review | N 0 47; 2021 New Homes and Developments

Above: Cheshire 10,055 sq ft £3,500,000 guide (Alderley Edge)

18

Right: Suffolk plot only, £795,000 guide (Ipswich)

HELP-TO-BUY CHANGES

One of many property-related changes effective from 1 st April 2021 is that new rules apply for the government’s Help to Buy scheme, which provides five year, interest free loans for new homes buyers of up to 20% of the purchase price (40% in London). From 1 st April, the scheme will be restricted to first time buyers only and new, regional maximum purchase prices, will apply. Outside London (£600,000), these range from £186,100 in the North East to £437,600 in the South East.

LENDERS SHOW CONFIDENCE

In a clear sign of confidence in the outlook for capital values, Accord (part of Yorkshire Building Society) has broken ranks, being the first to return to offering 5x income at 90% loan-to-value (LTV). Simultaneously, mainstream lenders including Barclays and Virgin have reduced their interest rates for 90% LTV loans. As well as indicating their confidence, this also puts downward pressure on rates for lower risk loans. Borrowing 90% of your purchase price is still relatively expensive. The best two year rate currently available is 3.24% – more than three times the 1.05% best rate at 60% loan-to-value. This equates to a difference of £182.50 per month, per £100,000.

BARRIERS FOR BRITISH EXPATS

IN EU Lenders who were keen to lend to British EU residents buying UK property, are now turning them away. We have had several instances of this from different lenders, including one case which clearly demonstrated that financial status is not the issue. It appears to be a blanket policy change, even though the same products are still available to expats outside the EU, from the same lenders. One manager said "Yes this is due to Brexit. As far as we are aware it is a permanent change in policy”. Despite this, we believe these moves reflect nervousness over new bank account and passporting arrangements which will be resolved. In the meantime, given that over a million UK citizens live in the EU, it is important to note that we do still have lenders who will look at such loans.

POST-LOCKDOWN LIVELINESS

The nature of our business means that we have been able to continue during lockdowns. Throughout, demand has been extraordinarily high and given added urgency by several government deadlines falling on 31st March. Our workload now suggests that, after that date, the overall market – including the top end – will continue to be unusually active if, hopefully, a little less fraught.

For independent advice, contact Private Finance on 0870 600 1650 or jackson-stops@privatefinance.co.uk.

UK Market Review | N 0 47; 2021

Private Finance

www.privatefinance.co.uk

Above: Devon 4,600 sq ft £1,500,000 guide (Exeter)

A SENSE OF CALM Baroness Helena Morrissey DBE

When we married 30 years ago, Richard and I had a romantic vision of a large family and a place in the country; a dream that seemed a very remote possibility when we were struggling with our first newborn in a tiny Battersea flat with negative equity. But after managing to ‘trade up’ a couple of times in London, we started looking for a place in the country where our growing family could run in the garden. Our search was both vague and rather grand, involving leafing through the pages of Country Life, but one advertisement caught our eye. The picture wasn’t very encouraging – a muddy field with a long red brick house some way in the background – but it was very close to our eldest son’s school. The property turned out to be old almshouses, listed and completely unmodernised, and the field in front was then lent out to a neighbour for horse grazing. Richard called the agents and they were even more discouraging; he was told it was really only suitable for property developers and it was expected to be divided into flats or small houses. But I was intrigued and booked a morning off work to attend one of the viewing days. The inside of the 300-year-old property was a complete mess, but the chapel and the walled back garden were wonderful and it had

an amazing ambience, a sense of calm. I called my husband and said we just had to buy it and luckily after seeing the house for himself, he agreed. The process went to auction after five buyers said they would pay the low asking price and we just hazarded a guess and won. We didn’t even organise a survey until we exchanged – but the guy I called, randomly from the telephone directory, turned out to have surveyed the property before for the charity that owned it and talked us through the whole building. Everything felt meant to be. It took years to make it into a home – not least because we kept running out of money – but it was the best decision we ever made. This year we celebrate twenty years of living in what truly is our family home, a place we have made our own (some of the rooms have been put to unusual use – there’s a ‘rock band’ room and a tiny theatre where our children spent hours putting on plays when they were small). During the pandemic, it has become a place of sanctuary; 13 of us were together for the first lockdown, including our two young grandchildren, and it was a lovely reset moment for family life. Now, once again, we are working and schooling from home and grateful that we have such a special place to do that.

| LETTINGS | NEW

ukmarketreview.co.uk | jackson-stops.co.uk | Edited and produced by RealBranding.Agency

HOMES West Country Barnstaple 01271 325153 Blandford 01258 433002 Bridport/Dorchester 01308 423133 Exeter 01392 214 222 Shaftesbury 01747 850858 Sherborne 01935 810141 Taunton 01823 325144 Truro 01872 261160 Yorkshire York 01904 625033 Harrogate 01904 625033 Thirsk 01904 625033 London Holland Park 020 7727 5111 Mayfair 020 7664 6644 Pimlico 020 7828 4050 Richmond 020 8940 6789 Teddington 020 8943 9777 Weybridge 01932 821160 Wimbledon 020 8879 0099 Central Northampton 01604 632991 Woburn 01525 290641 Country Houses 020 7664 6646 New Homes 020 7664 6649 South East Canterbury 01227 781600 Chichester 01243 786316 Arundel 01903 885886 Emsworth 01243 370300 Cranbrook 01580 720000 Dorking 01306 887560 Midhurst 01730 812357 Mid Sussex 01444 484400 Oxted 01883 712375 Reigate 01737 222027 Sevenoaks 01732 740600 Tunbridge Wells 01892 521700 Winchester 01962 844399 Woking 01483 322135 East Anglia Burnham Market 01328 801333 Bury St Edmunds 01284 700535 Chelmsford 01245 806101 Ipswich 01473 218218 Newmarket 01638 662231 Norwich 01603 612 333 North West & North Wales Alderley Edge 01625 540340 Chester 01244 328361 Hale 0161 9288 881 Cotswolds, Hereford & Worcs Burford 01993 822661 Chipping Campden 01386 840224

SALES

PROPERTY EXPERTS SINCE 1910

Dame Helena Morrissey DBE is a financier, campaigner, author and mother of nine. Described by Fortune magazine as one of the world’s 50 Greatest Leaders, she was the FT Person of the Year in 2017.