Charlotte | Q1 2024

contents

OVERALL MARKET REPORT

The luxury real estate market in the Charlotte region continued to flex its muscles in most areas of the city and its surrounds as the first quarter came to an end

COMMUNITY UPDATES

SouthPark

Myers Park & Eastover

Lake Wylie & The Palisades

Providence, Weddington & Waxhaw

Ballantyne & South Carolina

Center City Luxury Condos & Townhomes

FORECAST

While interest rates have remained high, much of the market appears to have adjusted to the “ new normal”

PODCAST & VIDEOS

From market forecasts, interviews, and marketing ideas, join the team at Ivester Jackson I Christie's for the latest in the Carolinas luxury real estate content

Luxury Market in Charlotte Shows Continued Strength

The luxury real estate market in the Charlotte region continued to flex its muscles in most areas of the city and its surrounds as the first quarter came to an end. In almost every area and luxury price segment, closed unit sales were either on par with last year ’ s first quarter, or up significantly. Additionally, pending contracts being placed were nearly in balance with active inventory in most areas, indicative of days on market of roughly one contract cycle or around 45 days

There are exceptions to these patterns which will be discussed below in each of these sub-market reviews, with a few areas seeing some inventory building in certain price ranges, while others show continued scarcity and will likely see multiple offers moving through the spring Areas in which inventory appears to heading towards high levels of scarcity include; the highway 16 Providence Road corridor, and some ranges in Fort Mill, as well as the upper luxury ranges in Myers Park and Eastover.

SOUTHPARK

Another high demand area, this segment saw slightly mixed results, with the mid-market range below $1 million up slightly and the $1 million to $2 million range off from last year ’ s first quarter, while the ultra-luxury segment above $2 million surged, with 16 homes closing vs 11 in last year ’ s first quarter While active inventory to pending contracts remained at about a 45 day supply, it’s likely that ratio may drop if spring demand outpaces new listings arriving to market.

SOUTHPARK AREA Q1 HOMES

SOLD & SHOWINGS

MYERS PARK & EASTOVER

Perennially in high demand, the Myers Park and Eastover area continues to see both sell-through and pending contracts outstrip available inventory Heading into the second quarter this month, there were 28 homes pending over $1 million in value with just 15 remaining on the market. This quarter will likely see some increased listing activity, but with inventory already constrained, it’s likely this area ’ s arriving listings will be hotly contested by buyers

MYERS PARK Q1 HOMES SOLD & SHOWINGS

LAKE WYLIE & THE PALISADES

While this area also saw solid sell-through with increases over last year, the winter months did see some inventory rise, with roughly 45 days of active listing inventory present in both the sub-million, and million dollar plus segments The million dollar segment heads into the second quarter with 24 pending contracts and 33 remaining active listings, pushing more towards 50-60 days’ worth of absorption.

LAKE WYLIE & PALISADES

Q1 HOMES SOLD & SHOWINGS

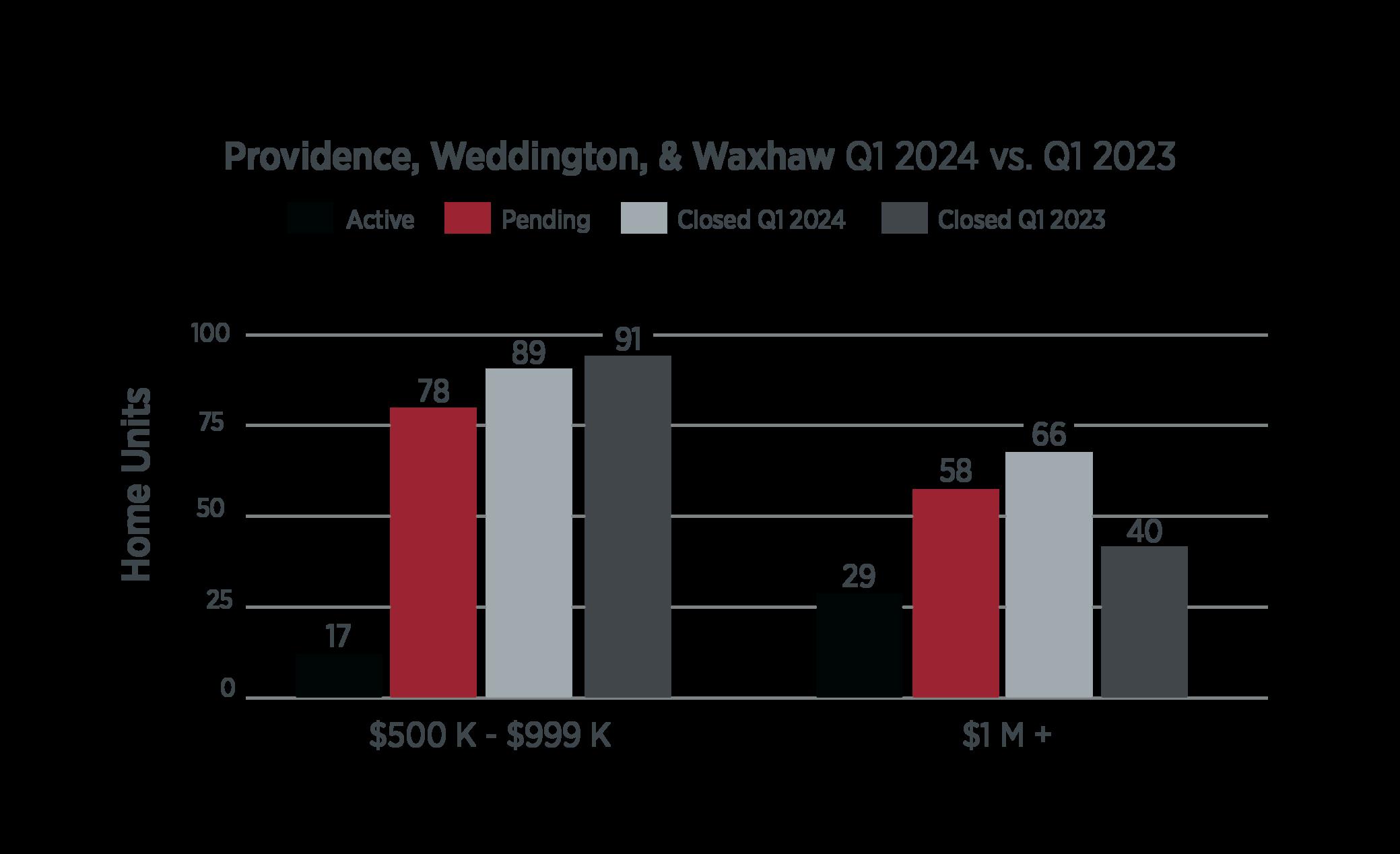

PROVIDENCE, WEDDINGTON & WAXHAW

While sell-through in the lower luxury range was flat compared to last year, a surge in pending contracts has pinched inventory down significantly heading into the second quarter The luxury range above $1 million currently shows 58 homes under contract while 29 remain active This points to conditions in the second quarter that will also reflect the highly contested interest in more updated and recently built listings, which will likely see multiple offers.

PROVIDENCE,WEDDINGTON & WAXHAW Q1 HOMES SOLD & SHOWINGS

BALLANTYNE & SOUTH CAROLINA

Sell-through along the state line below Charlotte saw very solid activity in the mid-market luxury segment just below $1 million in value. While unit sales were down 40% in the first quarter compared to last year in the lower range, the million plus range rose slightly. A surge in pending contracts nearing the end of the first quarter now has available inventory back down to less than 20-30 days’ worth of absorption

BALLANTYNE & SOUTH CAROLINA Q1 HOMES SOLD & SHOWINGS

CENTER CITY LUXURY CONDOS & TOWNHOMES

The burgeoning market for multi-family luxury lock and leave housing product near the city center continues to trend upward in activity and price point. While 64 units in the midmarket range closed compared to 50 in last year ’ s first quarter, the luxury range over $1 million also pushed upward with 14 closings vs 8 last year. Most impressive is the absorption rate of luxury offerings over $1 million in list price. Currently, there are 41 pending units in that price segment with just 15 active listings remaining. New construction projects will continue to provide inventory options, but this price point and market has surged in the past 18 months at a pace well beyond the previous several years.

CENTER CITY CONDOS & TOWNHOMES

Q1 HOMES SOLD

market appears to have adjusted to the new normal

While interest rates have remained in the high 6% range, much of the market appears to have adjusted to the “ new normal”, with near full employment and solid economic conditions driving housing activity Showing activity, while down from the frenzied highs of the Covid years, remains very active overall, with some high demand areas likely to see some multiple offer battles again this spring. At the ultra-luxury level, some record setting prices are being met with some resistance Inventory has crept up somewhat in certain areas, and while listing prices have also continued to escalate, some attempts have been met with resistance and price decreases before leading to executed to secure contracts. This dynamic is not necessarily reflective of a declining market but more so a need to come off what may be an attempt at a record high list price to one more closely aligned with trailing comparable sales data.

For Market Forecasts, Interviews, and Marketing Ideas, Join the Team at Ivester Jackson | Christie's for the Latest in the Carolinas Luxury Real Estate Content.

Where will you

center yourself next?

Charlotte

Mockingbird Lane, Suite 900

Lake Norman

North