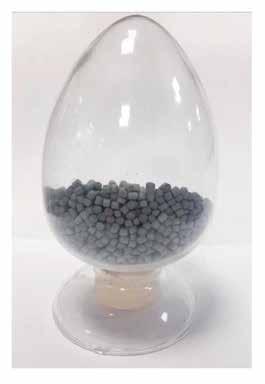

• At RYER, all our feedstocks are manufactured to the highest level of quality, with excellent batch-to-batch repeatability.

• RYER is the ONLY commercially available feedstock manufacturer to offer all five debind methods.

• RYER offers the largest material selections of any commercially available feedstock manufacturer.

• RYER offers technical support for feedstock selection, injection molding, debinding and sintering.

• A direct replacement for all current commercially available catalytic debind feedstocks

• Improved flow

• Stronger green and brown parts

• More materials available and better surface finish

• Custom scale-up factors available

• Faster cycle times

• 65°C / 150°F mold temperature

• Water Debind

• Custom scale-up factors available

• Large selection of available materials

• Solvent, Super Critical Fluid Extraction (SFE) or Thermal Debind methods

• Hundreds of materials available

• Custom scale-up factors available

Publisher & Editorial Offices

Inovar Communications Ltd

11 Park Plaza

Battlefield Enterprise Park

Shrewsbury SY1 3AF

United Kingdom

Tel: +44 (0)1743 469909 www.pim-international.com

Managing Director & Editor

Nick Williams, nick@inovar-communications.com

Group News Editor & Director

Paul Whittaker, paul@inovar-communications.com

Advertising Sales Director

Jon Craxford

Tel: +44 (0)207 1939 749 jon@inovar-communications.com

Assistant Editors

Amelia Gregory, amelia@inovar-communications.com Emma Lawn, emma@inovar-communications.com

Assistant News Editor

Charlie Hopson-VandenBos charlie@inovar-communications.com

Digital Marketer

Mulltisa Moung, mulltisa@inovar-communications.com

Production Manager

Hugo Ribeiro, hugo@inovar-communications.com

Operations & Partnerships Manager

Merryl Le Roux, merryl@inovar-communications.com

Office & Accounts Manager

Jo Sheffield, jo@inovar-communications.com

Technical Consultant

Dr Martin McMahon

Consulting Editors

Prof Randall M German

Former Professor of Mechanical Engineering, San Diego State University, USA

Dr Yoshiyuki Kato

Kato Professional Engineer Office, Yokohama, Japan

Professor Dr Frank Petzoldt

Ingenieurbüro Dr. Petzoldt, Geestland, Germany

Dr David Whittaker

DWA Consulting, Wolverhampton, UK

Bernard Williams

Consultant, Shrewsbury, UK

Subscriptions

PIM International is published on a quarterly basis as either a free digital publication or via a paid print subscription. The annual print subscription charge for four issues is £150 including shipping.

Accuracy of contents

Whilst every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions or for any consequences arising there from. Inovar Communications Ltd cannot be held responsible for views or claims expressed by contributors or advertisers, which are not necessarily those of the publisher.

Advertisements

Although all advertising material is expected to conform to ethical standards, inclusion in this publication does not constitute a guarantee or endorsement of the quality or value of such product or of the claims made by its manufacturer.

Reproduction, storage and usage

Single photocopies of articles may be made for personal use in accordance with national copyright laws. All rights reserved. Except as outlined above, no part of this publication may be reproduced or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner.

Design and production

Inovar Communications Ltd.

ISSN: 1753-1497 (PRINT)

ISSN: 2055-6667 (ONLINE)

© 2025 Inovar Communications Ltd.

Powder Injection Moulding’s transformation from a niche process into a global manufacturing technology has occurred not through sudden disruption but through nearly five decades of incremental refinement and improvement.

Two articles in this issue of PIM International reflect that progress: the continued expansion of INDO-MIM – in particular its North American operation – and the growing importance of Metal Injection Moulding in the production of hinge components for consumer electronics.

Yet behind these success stories lies something less headline-grabbing, but no less essential: the foundational knowledge that underpins the development of the Metal Injection Moulding industry.

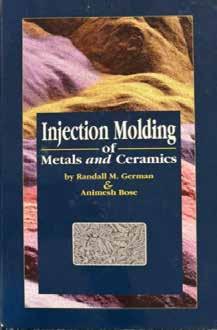

Few have contributed more to this foundation than Randall German, whose legacy was recognised at this year’s MIM2025 conference. As highlighted in our in-depth report, his work – from pioneering research on sintering to the education and training of a skilled MIM workforce – has been instrumental in enabling MIM to achieve commercial success globally.

As the industry explores new frontiers in sinter-based Additive Manufacturing and faces fresh challenges in scale, cost, and performance, the value of this accumulated knowledge and experience only grows. As in most areas of engineering, progress in MIM relies not just on innovation, but on the disciplined application of sound fundamentals.

Nick Williams Managing Editor

Cover image

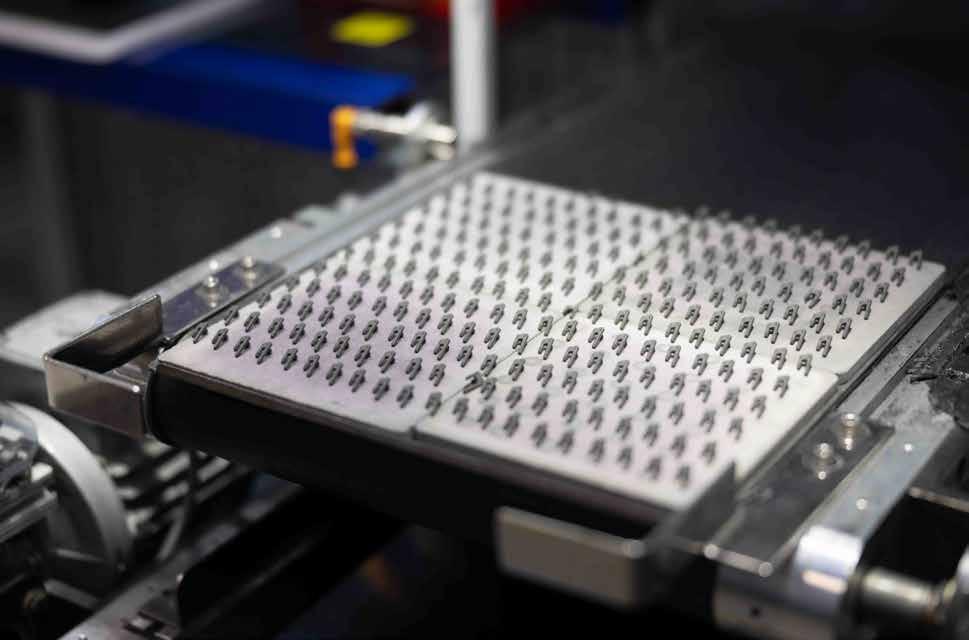

HP Metal Jet Binder Jetting machines at INDO-MIM (Courtesy INDO-MIM)

As the industry leader in debind & sinter batch furnaces and equipment, Elnik Systems is known for precision, performance, and reliability. Our hand crafted furnaces are the gold standard for the MIM and Metal AM industries, delivering superior results for your production needs. When you think Debind & Sinter - Think Elnik. More than a furnace company.

12004 Carolina Logistics Drive, Ste A, Pineville, NC

elnik.com

for expert process engineering and toll services

Remote or In-person process, engineering, metallurgy support

Debind and Sinter Services

You Print It, You Mold It - We Debind & Sinter It”

In person facility walk through, process evaluation, and educational programs

For 25 years, DSH has been the best source for Metal Powder part making process support, Debind and Sinter Services and educational resources.

Our mission is to empower you with the knowledge and expertise to master part processing and unlock your path to success

53 INDO -MIM in North America: Scaling MIM and developing Binder Jetting to meet evolving market needs

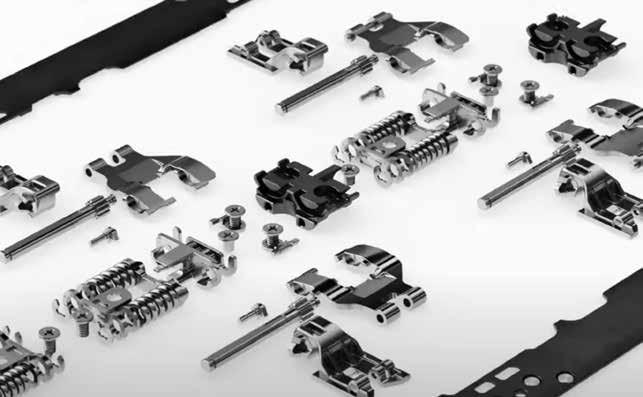

With a portfolio of 12,000 MIM components and annual sales exceeding $350 million, INDO-MIM is among the most widely recognised names in the global Metal Injection Moulding industry. Founded in Bangalore in 1997, the company now supplies customers across five continents.

In 2017, it established a major facility in San Antonio, Texas, to meet rising demand and strengthen supply chain resilience. Bernard North visited the site for PIM International and reports on its development, strategic significance, and INDO-MIM’s increasing investment in Binder Jetting Additive Manufacturing. >>>

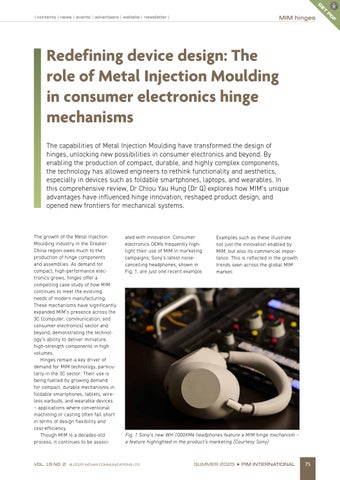

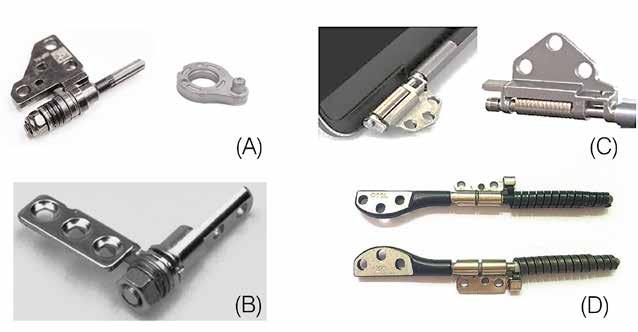

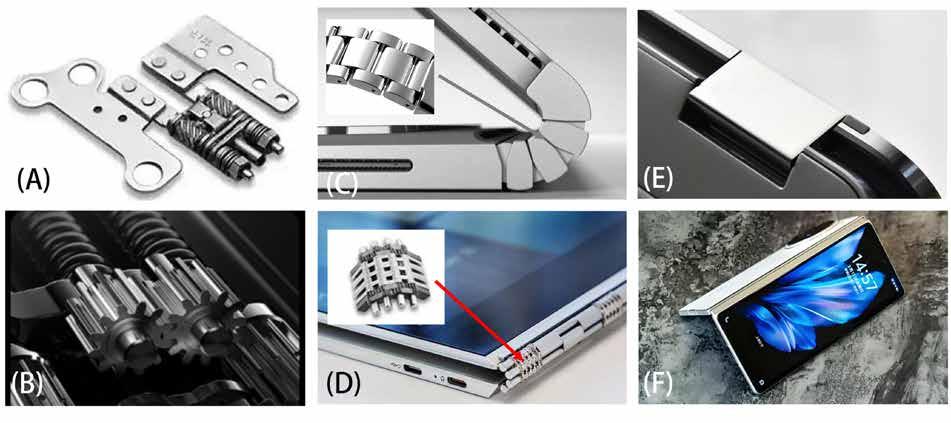

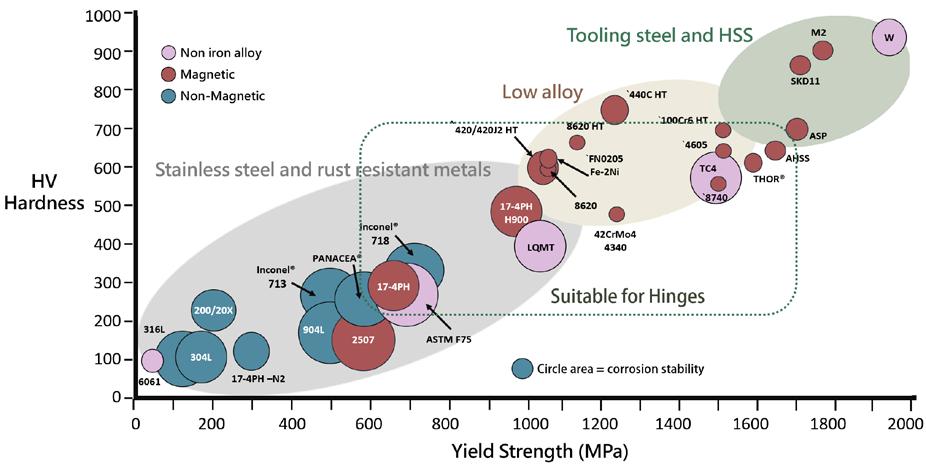

75 Redefining device design: The role of MIM in consumer electronics hinge mechanisms

The capabilities of Metal Injection Moulding have transformed the design of hinges, unlocking new possibilities in consumer electronics and beyond. By enabling the production of compact, durable, and highly complex components, the technology has allowed engineers to rethink functionality and aesthetics, especially in devices such as foldable smartphones, laptops, and wearables.

In this comprehensive review, Dr Chiou Yau Hung (Dr Q) explores how MIM’s unique advantages have influenced hinge innovation, reshaped product design, and opened new frontiers for mechanical systems. >>>

Experience significantly improved printability with Osprey® HWTS 50. This new lean hot-work tool steel powder reduces many of the challenges customers face in hot-work applications. Characterized by lower carbon content it offers higher thermal conductivity together with optimized resistance to tempering and thermal fatigue. With its alloy design philosophy, Sandvik contributes to the shift towards a more sustainable future in several ways.

Learn more and explore how Osprey® HWTS 50 creates opportunities for your business.

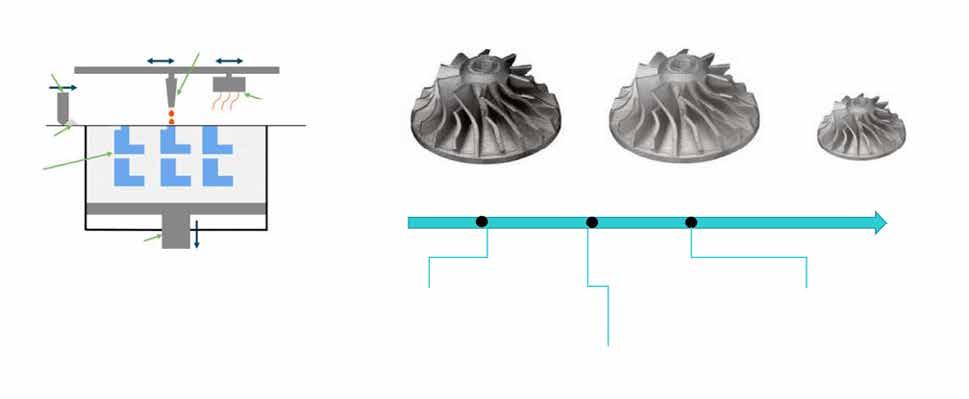

85 Binder Jetting at a crossroads: Dan Brunermer on scale, strategy and the technology’s future

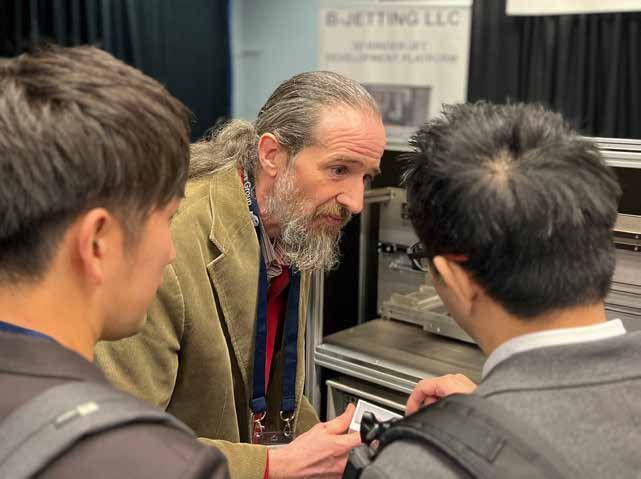

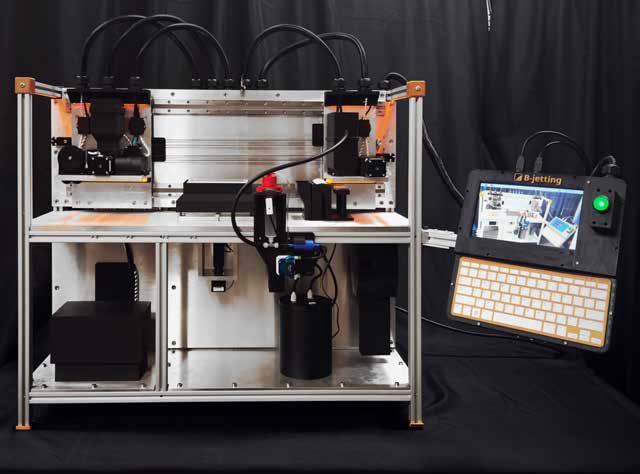

In this wide-ranging interview, Nick Williams speaks with Dan Brunermer, founder of B-jetting LLC and veteran of the metal Binder Jetting (BJT) industry.

Drawing on decades of experience, Brunermer reflects on what past successes reveal about the future of Additive Manufacturing – from the growing demand for custom machines and integrated automation to the economic realities shaping adoption.

This is a candid and insightful exploration of where Binder Jetting stands today – and the challenges and opportunities that lie ahead. >>>

97 Prof Randall M German: Shaping the field of Powder Injection Moulding – a MIM2025 tribute

Held in Costa Mesa, California, the MIM2025 conference marked a significant moment for the Powder Injection Moulding community – not only for its technical programme and strong industry participation, but for a special symposium dedicated to honouring Prof Randall M German’s six-decade career. The tribute brought together former students, collaborators, and leading global experts to reflect on his scientific legacy and personal influence.

Dr Animesh Bose reports from the event, highlighting Prof German’s unparalleled role in the rise of PIM. >>>

09 Industry news

131 Advertisers’ index & buyer’s guide

Discover the leading suppliers of materials and equipment for MIM, CIM and sinterbased AM, as well as part manufacturing and more. >>>

137 Events guide

View a list of upcoming events for the MIM, CIM & sinter-based AM industries. >>>

The PIM International newsletter is sent to several thousand industry professionals worldwide. Register today to ensure you benefit from reading the latest industry news and advances in Metal Injection Moulding, Ceramic Injection Moulding and sinter-based AM technologies.

www.pim-international.com/e-newsletter

Iwaki Die-Casting Co Ltd, headquartered in Yamamoto, Japan, has completed construction and commenced operations at its second Metal Injection Moulding production facility in Kodaira, near Yamamoto.

The company was established as a die casting business in 1968, later adding MIM production in 1988. In addition to manufacturing components, it developed its own in-house MIM feedstock. In 2016, Iwaki Die-Casting consolidated its MIM production facilities in Kodaira.

“Thanks to continuous technological development and investments, we reached the limits of the existing site, prompting the construction of Kodaira Plant No 2 to further enhance our capacity and automation,” stated Akimasa Saito, Iwaki Die-Casting’s Representative Director and president.

“This plant introduces advanced automated systems, including unmanned sintering lines and integrated process control. We aim to build a stable, high-quality production system that can flexibly respond to customer needs and volume changes,” added Saito. www.iwakidc.co.jp

Epson Atmix Corporation, a group company of Seiko Epson Corporation based in Aomori, Japan, has completed construction of a new $38 million metal recycling facility at Kita-Inter Plant No 2. The new centre will recycle used metals from the Epson Group’s operations and the local community to produce raw materials for Atmix’s metal powder products. The recycling facility was first announced in 2022, with construction beginning in 2023.

Atmix will recycle out-of-specification metal powders, metal scraps from its own production processes, and used moulds and metal offcuts from Epson Group operations. These materials will be refined into high-quality raw materials, which will then be used at Atmix’s headquarters and Kita-Inter Plant to

produce metal powders suitable for Metal Injection Moulding.

Epson stated that it is committed to developing environmental technologies that support resource circulation and carbon reduction, particularly through materials innovation. Its Environmental Vision 2050 outlines its goal of becoming carbon negative and underground resourcefree by 2050. Kita-Inter Plant No 2 is expected to play a key role in advancing this goal.

Atmix produces a range of metal powders for a variety of manufacturing processes, including Metal Injection Moulding and Additive Manufacturing. The company also produces magnetic powders for use in power supply circuits, as coils for IT equipment, and for components in hybrid and electric vehicles.

www.atmix.co.jp

At Kymera International, we engineer high-performance metal powders, pastes, granules, and master alloys to power innovation across industries. From additive manufacturing and aerospace to medical, electronics, and beyond—our advanced materials enable breakthrough solutions. With a legacy of metallurgical expertise and a commitment to quality, sustainability, and customer collaboration, we provide tailored material solutions designed to meet the most demanding applications.

PARTNER WITH US AND UNLOCK NEW POSSIBILITIES. Learn more at kymerainternational.com

The MIM division of Japan’s Teibow Corporation has now been formally established as Hamamatsu Metal Works Corporation. The transition was completed on April 1 and follows the announcement from parent company Noritsu Koki Co, Ltd, to separate the two core businesses of its subsidiary Teibow Co Ltd. Hamamatsu Metal Works, and the remaining pen nib business (Teibow Co Ltd.), will operate under the umbrella of Teibow Holdings Co, Ltd.

In recent years, Teibow has identified strong growth potential in its MIM operations, with investments in management resources and the establishment of a new factory for mass-producing MIM components.

Based in Shizuoka Prefecture, Japan, the new president and CEO of Hamamatsu Metal Works Corporation

is Hiroshi Suzuki. “We have been able to reach this important milestone thanks to the customers who have been with us since the days of Teibow Co, Ltd, before the company was spun off, and we would like to express our sincere gratitude to them,” he stated.

www.h-metalworks.co.jp

Nano Dimension ‘exits’ Formatec and Admatec, highlights Desktop Metal’s ‘significant

Nano Dimension, headquartered in Waltham, Massachusetts, USA, has announced it is ‘discontinuing’ its Formatec and Admatec product lines. Reported in its 2024 financial results, and discussed in the accompanying investor call, it was also stated that the recently acquired Desktop Metal business is undergoing a strategic review as a result of its limited liquidity and significant liabilities.

Formatec and Admatec

Formatec was established as a Ceramic Injection Moulding company in Holland in 1996. Through its research into ceramic Additive Manufacturing and a partnership with Energy Center Netherlands, it established Admatec Europe in 2013. Admatec developed its Admaflex Technology, a stereolithography-

based AM process, and launched the Admaflex 130 AM machine in 2016. This machine can process both ceramic and metal.

After some years of small-scale Metal Injection Moulding production of refractory metals such as tungsten, Formatec added a full MIM production line to its portfolio in 2020. Nano Dimension acquired Formatec and Admatec in 2022.

Asked during the conference call about the future of these businesses, Julian Lederman, Chief Business Officer at Nano, stated, “We did look at divestment opportunities on all of them. That is our responsibility and our interest to shareholders to do so. After running processes there, we found that there wasn’t an opportunity to do so, and we ultimately had to make a decision on what is best

for our shareholders. And I think we were very convinced that the best thing to do was discontinue as soon as possible after running that process.”

Discussing the management’s recent assessment and strategic outlook for the company, Ofir Baharav, Nano Dimension’s CEO, stated, “The outcome was a focused commitment to two core product groups: Additively Manufactured Electronics (AME) and surface-mount technology (SMT). At the same time, we made the decision to discontinue non-core product groups, including Admatec, DeepCube, Fabrica, and Formatec.”

These moves, along with broader organisational efficiencies, were said to have enabled Nano to reduce the annualised operating expenses of its core business by over $20 million and increase revenue per employee from $147,000 to 223,000, a 52% gain. “This was disciplined, decisive action – and it delivered results,” Baharav added. www.nano-di.com

Gevorkyan a.s., headquartered in Vlkanová, Slovakia, has reported a successful start to 2025, with Q1 revenues of €20.88 million and statutory EBITDA of €8.35 million, resulting in an EBITDA margin of almost 40%. This represents an increase in revenues of 11.2% and an increase in EBITDA of 14.35% compared to the same period of the previous year. The company reported an operating EBIT of €4.21 million, an increase of 7.15% compared to the same period last year. The profit after tax (EAT) was reported at €2.98 million, representing a 26.32% increase compared to the same period last year.

“Our strong performance in an uncertain economic environment underlines our resilience and ability to use global uncertainties to our advantage,” stated Artur Gevorkyan, Chairman of the Board “We are optimistic about our plans and will combine organic growth with selective and value enhancing acquisitions.”

In the announcement, the company reported that it has won nine new long-term projects in the arms industry for the European and American markets. Following the success at a recent international trade fair, an agreement was signed to develop components for sporting arms in the USA.

Tekna Holding ASA, Sherbrooke, Quebec, Canada, has announced it has received three orders, valued at a total of CA$5.2 million, for titanium powder used in Metal Injection Moulding. The orders are scheduled for delivery in 2025 and 2026.

“These sales have historically been strong contributors to our cash flow, and it is reassuring to now have multiple customers for this material,

signalling an increase in demand and potential for margin improvement,” said Luc Dionne, CEO of Tekna.

The three customers are reported to be Tier 1 component manufacturers based in Asia. They plan to use the titanium powder to mass-produce sub-components such as digital watch cases, hinges, and buttons. Rémy Pontone, VP Sales and Marketing, added, “These orders

At the same time, mass production of components for a $30 million project that the company won in a 2024 tender, has now started.

The first phase of a project for a European manufacturer of optoelectronic devices using night vision, thermal imaging, and laser technology has been successfully completed. In the next phases, development and mass production for new applications in armaments and aerospace will continue.

In the automotive segment, new projects for autonomous robotic taxis have been acquired in the US and Europe. Additionally, after several years of technical and commercial negotiations, the company won a project for the petrol station and oil industry in the USA.

The company reports that it has also received orders from Europeanbased customers, notably one to supply a European plant wholly owned by a renowned Asian brand. Following the rapid and successful completion of development based on specific customer requirements, series production is scheduled to ramp up soon.

As part of investments in new premises, automation and robotisation, Gevorkyan reported that a warehouse and production area were expanded by approximately 1,000 m². In Q1 2025, a project to robotise two calibration presses was also completed, helping further reduce operational costs.

www.gevorkyan.sk

are for material consisting of smaller particles from our existing powder production, which is partly available in our inventory and partly from ongoing production. It plays a key role in our strategy to maximise sales from Tekna’s entire production yield. Through collaboration with our customers, we have successfully qualified this smaller cut size for MIM, improving resource efficiency, increasing sales yield, and significantly expanding our market share within the consumer electronics components industry.” www.tekna.com

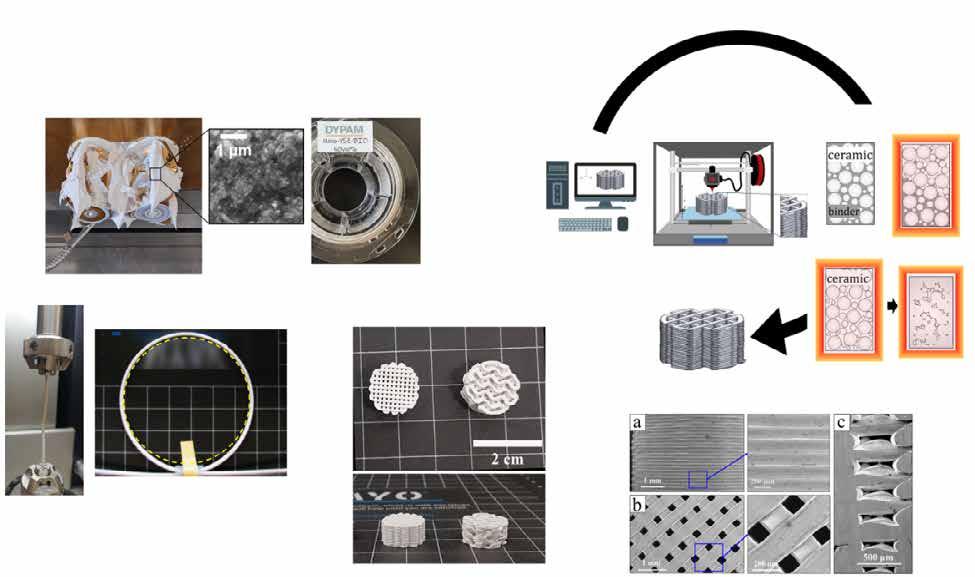

Ceramic Additive Manufacturing (AM) offers a revolutionary step change in design and manufacture for ceramics

The possibilities include the ability to rapidly prototype designs, minimise material wastage and tooling costs, shorten lead times, and produce complex, near-net shape geometries that could not otherwise be obtained through conventional forming methods

From commercially available vat polymerisation techniques to novel AM processes, Lucideon can optimise printing and process parameters as well as develop novel formulations for your applications

Contact us for more information on Ceramic AM development

www.lucideon.com/ceramicam

query@lucideon.com

www.lucideon.com/company/lucideon

Phoenix DeVentures Inc, Dana Point, California, USA, a provider of product development and turnkey manufacturing services in the MedTech sector, has been acquired by INDO-MIM, Bengaluru, India. Following the acquisition, Phoenix DeVentures will continue operations as PDV MedTech, a wholly-owned INDO-MIM subsidiary.

The acquisition is expected to enable the companies to take on a greater variety of projects,

providing customers with more tailored solutions. As part of INDO-MIM, PDV MedTech will also have access to a broader global network, expanding its market presence and allowing customers to benefit from a wider range of resources and expertise.

“The acquisition of PDV MedTech allows us to provide a greater range of services that will increase speed to market, simplify supply chains and provide greater overall value to our customers,”

Phoenix DeVentures Inc, now PDV MedTech, offers a range of turnkey manufacturing services (Courtesy INDO-MIM/PDV MedTech)

Sandvik AB, headquartered in Stockholm, Sweden, has announced the appointment of David Goulbourne as the new President of the Powder Solutions division, effective May 1, 2025. The Powder Solutions division belongs to business area Sandvik Manufacturing and Machining Solutions, part of the Sandvik Group. The division includes the Osprey line of products as well as the Wolfram and

Buffalo Tungsten brands. Goulbourne will also be the President of Wolfram Bergbau und Hütten AG.

Goulbourne brings nearly twenty-five years of experience in the manufacturing industry and an entrepreneurial mindset. Before taking this role, Goulbourne held the position as Vice President Business Unit Solid Round Tools at Sandvik Coromant.

“I am thrilled to join the Powder Solutions division and contribute to

stated Krishna Chivukula Jr, CEO of INDO-MIM. “We share a common goal of helping innovative companies bring new products to market and manufacturing the highest quality medical devices.”

Jeffrey Christian, founder of Phoenix DeVentures, added, “INDOMIM’s and our shared vision of supporting entrepreneurs in Med Tech and their proven capabilities for scale and quality will be an enormous asset to our customers and enable further expansion in this space.”

“This partnership with INDO-MIM brings unparalleled scale and automation, extending our reach from innovative startups to large enterprises,” said Bryant Grigsby, CEO of Phoenix DeVentures.

Combining Phoenix DeVentures’ twenty-four years of experience transforming napkin sketches into commercialised products with INDO-MIM’s state-of-the-art capabilities is expected to drive groundbreaking advancements in the MedTech industry.

The announcement was made during LSI Dana Point, an event that offers industry executives from emerging companies, venture capital and other capital firms, strategics, and service providers an opportunity to meet.

www.indo-mim.com

www.pdvmedtech.com

strengthening and expanding our leadership in the powder manufacturing industry. My focus will be on ensuring that customer value remains our top priority, by continuously developing more sustainable processes and high-quality powder solutions,” said Goulbourne.

He will succeed Alex Nieuwpoort, who has decided to retire after twenty-eight years of dedicated service and significant contribution to Sandvik’s growth and business development. Nieuwpoort will remain with Sandvik until the end of June.

www.metalpowder.sandvik

These two binder systems have excellent characteristics during the production process and combine attractive prices with worldwide availability

High performance as well for the 3D-Printing process based on the water soluble binder system

The Metal Powder Industries Federation (MPIF) has released the 2025 edition of MPIF Standard 35-MIM Materials Standards for Metal Injection Molded Parts. The standard provides design and materials engineers with the latest property data and information to specify materials for components made by the MIM process.

Developed by the MIM commercial parts manufacturing industry, each section of the standard is clearly distinguished by easy-to-read data tables (inch-pound and SI units) and

explanatory information for materials listed.

This edition includes new material standards for:

• MIM-CpTi – Titanium

• MIM-Ti-6Al-4V – Titanium MIM-420 HIPed & HT – Stainless Steel

And updates for:

• MIM-17-4 PH – Stainless Steel Corrosion Resistance

The new standard replaces previous editions and is available to order in both digital and print. www.mpif.org

Nabertherm adds LH..DB furnace line for thermal post-processing and debinding

Nabertherm GmbH, headquartered in Lilienthal, Germany, has introduced its LH..DB furnace range, tailored for thermal post-processing of metal additively manufactured components, as well as the debinding and sintering of ceramic parts.

The furnace series is available in two different sizes, with oven volumes of 120 and 216 litres. This is said to allow heat treatment of all platform sizes of the current binderbased Additive Manufacturing machines. The LH..DB furnace is compact, with the controller, control elements, automatic gassing system, and switchgear integrated directly into the furnace housing. Once connected to the power supply, the furnace is immediately ready for use.

The LH..DB series is not limited to debinding and sintering processes in air: as a hybrid solution, processes under nonflammable process gases can be performed with the optional protective gas box. This allows debinding

of additively manufactured components made of metal or other materials requiring an inert atmosphere up to 600°C. Subsequent heat treatment under inert gas is possible up to 1,100°C.

During processes in air, preheated fresh air dilutes the escaping binder gases so that no ignitable atmosphere is created.

The 2025 edition of MPIF Standard 35-MIM Materials Standards for Metal Injection Molded Parts replaces all previous editions (Courtesy MPIF)

During inert debinding, the safety package monitors the gas flow of the gassing system and ensures reliable purging of the protective gas box.

In addition, the furnace chamber is purged with preheated fresh air independently of the process, improving the heat transfer into the charge and ensuring uniform debinding.

Specifications on each model in the new LH..DB series are available on the company website. www.nabertherm.com

Nabertherm has launched its LH..DB range of furnaces designed for thermal post-processing and debinding in Additive Manufacturing and ceramics (Courtesy Nabertherm)

Tekna Holding ASA, Sherbrooke, Quebec, Canada, has released its 2024 Annual Report, including the company’s 2024 Sustainability Report.

“As we conclude the year, Tekna has made significant progress despite a challenging market, driven by resilience and adaptability,” stated Luc Dionne, CEO. “Key achievements include improving cash flow from operations through effective management of working capital and a favourable litigation settlement.

“We focused on continuous improvement, executing cost-reduction initiatives, and restructuring the management team to boost transparency and performance. Our Systems product line maintained strong

efficiency and margins despite a revenue drop, while Materials saw growth in medical, aerospace, and consumer electronics. We entered the new year with confidence, healthy and with an improving backlog for Materials and good prospects for Systems.”

The cash balance was noted as having improved by CAD 4.8 million compared to the last quarter; net working capital improved by CAD 5.1 million year on year and CAD 2.7 million compared to the last quarter.

Low machine revenues had EBITDA effect of negative CAD 1.6 million in the quarter, compared to

Stratasys Ltd has acquired the key assets and operations of Forward AM Technologies GmbH, based in Rheinmünster, Germany. While continuing to operate under the Forward AM brand, the business will now function as a standalone company within Stratasys, named

Mass Additive Manufacturing GmbH.

Forward AM, the former Additive Manufacturing business of BASF, entered insolvency proceedings in November 2024, having undergone a management buyout in July 2024. The company

Forward AM offers a range of Ultrafuse filaments, including 17-4 PH and 316L stainless steels, for making metal parts (Courtesy Forward AM)

the same quarter last year. In 2024, the EBITDA effect of lower machine revenues was negative CAD 2.9 million compared to 2023.

“At Tekna, we remain committed to sustainability and are proud to share that our energy intensity per kilogram produced has improved to 12.1 kWh/kg (12.4), down from 16.3 kWh/kg in the 2019 baseline,”

Dionne explained. “For the first time, we have completed a comprehensive greenhouse gas assessment, which includes all material scope 3 emissions. This assessment provides us with valuable insights to prioritise our reduction efforts moving forward. Our goal to reduce scope 1 and 2 emissions by 50% by 2030 remains firmly in place. Our vision is to advance the world with sustainable material solutions, one particle at a time.”

www.tekna.com

offers a range of Ultrafuse metal filaments, including 17-4 PH and 316L stainless steels, for the Material Extrusion (MEX)-based Additive Manufacturing process Fused Filament Fabrication (FFF).

Operating as an independent materials business, Forward AM stated that its portfolio will remain open to all partners and platforms, allowing it to provide materials, technical support, and collaboration, regardless of the hardware used.

“With the backing of Stratasys, we now have greater resources and reach to drive innovation, expand our offering, and better serve your needs. This partnership empowers us to do more of what we do best: helping you succeed in Additive Manufacturing,” Forward AM stated in its press release.

“To our customers, partners, and friends: thank you for standing with us. We’re back, and we’re just getting started,” the company added.

www.forward-am.com www.stratasys.com

● GAS AND ULTRASONIC ATOMIZERS FOR SPHERICAL POWDERS WITHOUT ANY SATELLITES for LPBF, MIM, Binder Jetting and other Additive Manufacturing applications. High purity, sphericity and wide range of reproducible particle size distribution.

● WATER ATOMIZERS FOR MORE IRREGULAR POWDERS ideal for recycling/refining process, press & sinter process and others.

● AIR CLASSIFIERS FOR THE PRECISE SEPARATION OF METAL POWDERS into fine and coarse powder fractions especially in the range < 25 µm

IperionX, based in Charlotte, North Carolina, USA, announced that the Board of Directors of the ExportImport Bank of the United States (EXIM Bank) has approved an equipment finance loan of $11 million. Subject to the completion and execution of definitive documentation, this loan will support the significant expansion of IperionX’s advanced titanium manufacturing capabilities.

The EXIM Loan will finance the acquisition of state-of-the-art manufacturing equipment, including advanced Additive Manufacturing systems and precision machining tools. These manufacturing assets will enhance IperionX’s capabilities to produce a broad array of highperformance titanium components, leveraging proprietary and patented technologies at its Advanced Manufacturing Center in Virginia, USA.

This financing initiative is directly aligned with EXIM Bank’s strategic objectives, notably the ‘Make More in America Initiative’ and the China and Transformational Exports Program, which aim to strengthen US manufacturability capabilities, mitigate foreign supply chain vulnerabilities, and bolster economic resilience and national security.

The EXIM Loan provides IperionX with a low-cost, non-dilutive funding pathway to further scale its advanced materials and Additive Manufacturing

capabilities, and underpin a fully integrated, end-to-end titanium supply chain within the United States. Titanium is prized for its superior strength-to-weight ratio, exceptional corrosion resistance, and outstanding performance under extreme conditions, making it critical for advanced industries such as aerospace, defence, automotive, and healthcare. Currently, the US is overwhelmingly reliant on foreign sources for primary titanium (sponge) and titanium minerals, creating significant economic and national security vulnerabilities.

Through its Advanced Manufacturing Center, IperionX is utilising its patented technologies to produce high-value titanium products in Virginia, creating highly skilled American manufacturing jobs and addressing critical supply chain gaps. IperionX’s technology portfolio enables the production of low cost and high-performance near net shape products, semi-finished titanium products, spherical titanium powder for AM and MIM, and angular titanium powder for a wide range of advanced manufacturing applications.

The EXIM Loan directly supports IperionX’s mission to re-shore a lowcost, uninterruptable ‘all-American’ titanium supply chain, essential for both national security and sustained economic growth.

www.iperionx.com

Yuean New Materials, a leading supplier of MIM powders, feedstock, soft magnetic materials and carbonyl iron powders, based in China’s Jiangxi Province, has released its end-of-year results for 2024.

The company achieved revenue of 418 million yuan (approx $58 million), a year-on-year increase of 13.4%. Net profit for the year was 70.29 million yuan (approx $9.8 million), a year-on-year decrease of 12%, with net profit after deducting non-recurring items being 66.53 million yuan, a year-onyear decrease of 8.95%.

The company stated that the main reason for its revenue growth was the increased use of Metal Injection Moulding technology in

sectors such as consumer electronics and automobiles, replacing some traditional forging, casting, and similar processes to produce precision parts. This was said to have driven the company’s related powder product revenue growth and the increase in demand for downstream application products in electronic components.

Revenue from the company’s soft magnetic powder product line was 153 million yuan (approx $21.3 million), an increase of 19.1% year over year. Gross profit margin was 42%, a decrease of 5.4 percentage points year-over-year. The company said the main reason was that the fundraising and investment projects were converted into fixed assets, while production

capacity was still growing, and the operating costs, such as depreciation, increased.

The revenue of the carbonyl iron powder product line was 122 million yuan (approx $17 million), up 6.4% year-on-year, and the gross profit margin was 44.8%, down 4.9 percentage points year-on-year. The decline in gross profit margin was mainly due to the increase in raw material prices and production costs.

Regarding the total volume and development trend of the carbonyl iron powder industry, Yuean New Materials said in an interview with institutional investors in April this year that the global annual demand for carbonyl iron powder is about 30,000 tons, with a compound growth rate of about 20% in the past five years. If the price remains relatively stable, the annual increase in the existing market is expected to be about 10-15%.

www.yueanmetal.com

Tel.: +49 (0) 96 45 - 88 300 kerafol.com/technische-keramik/ cts@kerafol.com

Printy, based in Lučenec, Slovakia, has announced that it is now offering Metal Injection Moulding services for high-precision metal parts, paired with advanced Cerakote ceramic coatings said to result in exceptional performance and durability.

Building on its established Binder Jetting services, Printy’s move into MIM is geared towards offering its customers even higher volume part production.

Combining MIM with Cerakote’s ceramic coatings is reported to provide superior wear and corrosion resistance, thermal stability and chemical protection, as well as enabling lightweight, durable solutions. This is seen as ideal for defence, aerospace, and highperformance applications where both precision and endurance are critical.

www.printy.me

Epson Atmix Corporation, a group company of Seiko Epson Corporation based in Aomori, Japan, has partnered with Epson Europe Electronics GmbH to establish a sales office in Munich, Germany. The new office, which opened on April 1, 2025, is expected to strengthen and expand the group’s metal powder business in Europe.

Epson Atmix is a leading producer of high-quality water-atomised spherical metal powders, suited to both Metal Injection Moulding and

metal Additive Manufacturing. The company’s range includes iron-, nickel- and cobalt-based alloy powders.

Prior to the new sales office, Epson Atmix had been serving the European market directly from Japan. The Munich office will focus on enhancing the sales and service functions, enabling quicker response times to enquiries from across Europe.

www.atmix.co.jp

www.epson-electronics.de

Atomising Systems Ltd (ASL), headquartered in Sheffield, UK, has announced that the seventeenth edition of its two-day course, Atomisation for Metal Powders, will take place in Glasgow, UK, September 18-19, 2025.

The popular short course has been developed for engineers working in both powder production and research and development. It combines up-to-date practical information with theory and will cover

all current atomiser types for most metals, powder types and usages, along with plant design, operation and economics.

Building on previous events, the course will expand its coverage of powder production, testing, and properties for Additive Manufacturing.

ASL’s Tom Williamson, General Manager, and Dirk Aderhold, Technical Director, will present the course.

www.atomising.co.uk

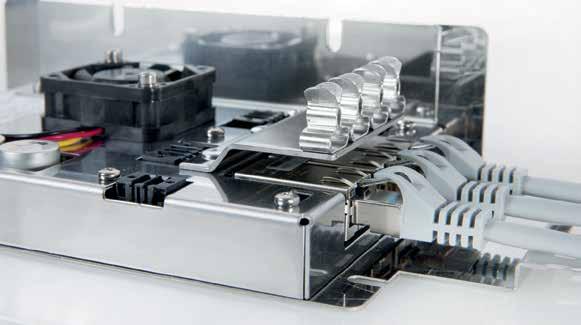

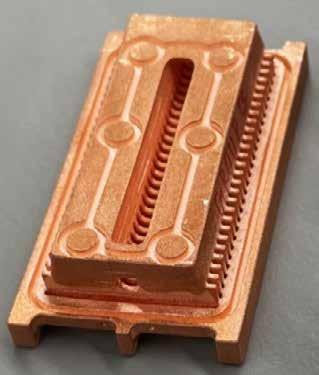

Schunk Sintermetalltechnik GmbH

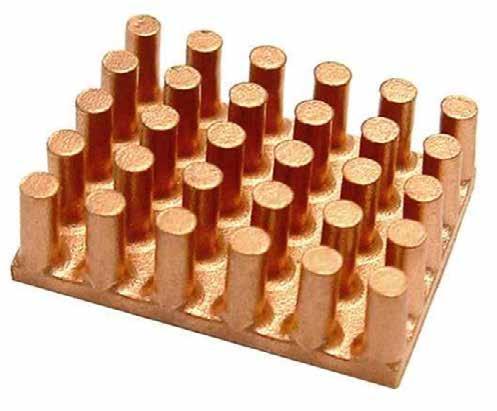

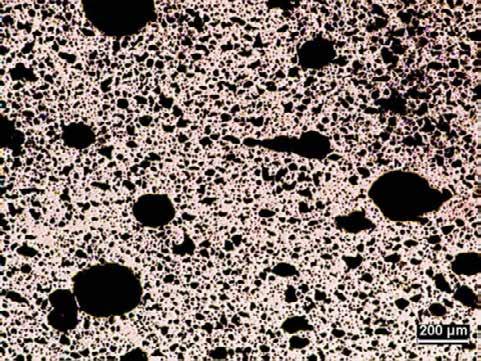

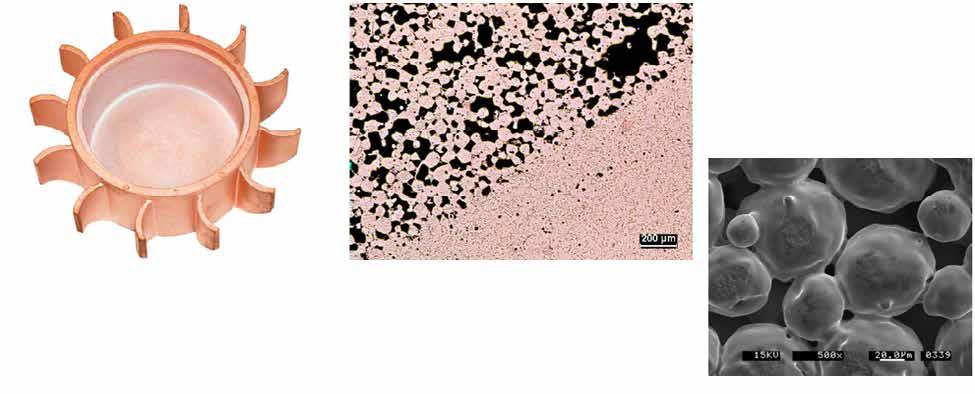

Discover the future of power electronics with our cutting-edge heat sinks, crafted using advanced Metal Injection Moulding (MIM) technology. These innovative heat sinks offer unparalleled thermal management, ensuring optimal performance and longevity for your electronic devices.

MIM allows for complex geometries and superior material properties, resulting in highly efficient heat dissipation. Perfect for high-power applications, our MIM heat sinks are lightweight, durable, and cost-effective. Upgrade your power electronics with our state-of-the-art MIM heat sinks and experience the difference in performance and reliability. Embrace the next generation of thermal solutions today!

� Roßtrappenstraße 62 06502 Thale, Germany

� +49 3947 7 1560 At thorsten.klein@schunk-group.com � schunk-mobility.com

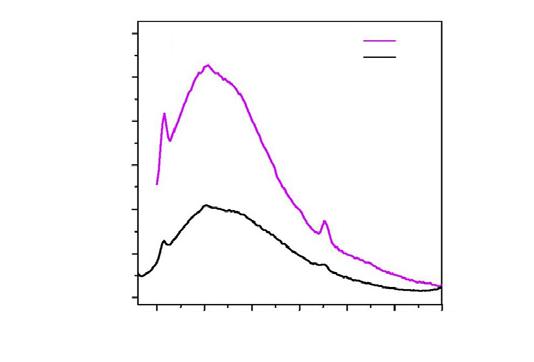

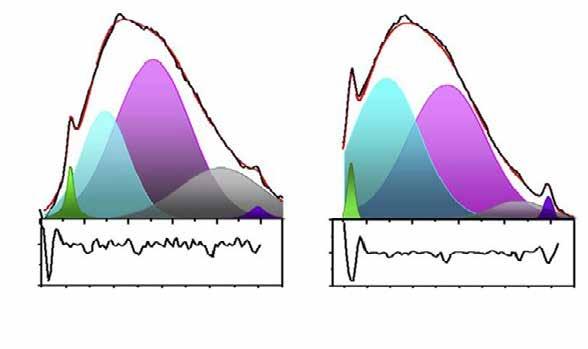

Nanoe, based in Ballainvilliers, France, has announced the acquisition of the Upryze-Shock line of ceramic powder from Saint-Gobain ZirPro, based in Le Pontet, France. The deal includes technology transfer, a portfolio of existing customers, and an exclusive licence on the associated patent and trademark.

Upryze-Shock is a line of ultrahigh-toughness zirconia-based material developed by Saint-Gobain Research Provence R&D centre. It has applications in industrial tooling, especially shock- and wearresistant tooling such as welding location pins, cutting tools, and other high-wear and shock applications. Other possible applications include medical devices and watch components.

Upryze-Shock material is based on a ceria and yttria co-stabilised zirconia, reinforced with alumina in the form of platelets. It allows for a very high toughness compared to traditional yttria stabilised zirconia, with fracture toughness of 14 MPa. m 1/2 compared to a usual value around 6 MPa.m 1/2, while retaining good bending strength (1,000 MPa 4-point bending strength) and hardness (12.5 GPa Vickers hardness), which was traditionally the drawback of ceria-doped zirconia. Guillaume de Calan, CEO of Nanoe, shared, “We’re very happy to be able to add Upryze-Shock material to our already extensive portfolio of high-performance alumina/ zirconia composite powders. It will nicely complement our portfolio, and fits with our strategy of speciality

ceramic raw materials, with high-end, application-specific materials at the heart of this strategy. This transition allows us to keep serving the already existing customer base of SaintGobain, and offer this new material to our customer base as well.”

Frederic Wiss, commercial director EMEA of Saint-Gobain ZirPro, explained, “While Upryze-Shock is technically a great product, it remains a niche material for very specific industries, and did not fit ZirPro strategy anymore. We therefore wanted to find a solution for our customers to avoid supply interruption, and are very happy to partner with Nanoe to avoid such interruption.”

The transition of production from Saint-Gobain facilities to Nanoe was completed in 2024. From 2025 onwards, Upryze-Shock materials can be purchased directly from Nanoe. www.nanoe.com www.zirpro.com

Reliable Vacuum Furnaces for better end-to-end production. From prototyping to high-volume production, Ipsen offers vacuum furnaces in a variety of sizes that accommodate common heat-treatment processes used for AM, such as debinding, sintering, stress relieving and annealing.

Atomik AM, a UK-based advanced manufacturing start-up, has secured a £600,000 investment from the UK’s Northern Powerhouse Investment Fund II, managed by Praetura Ventures, to scale its sustainable materials technologies.

Founded by Professor Kate Black (FREng) in 2022, Atomik AM creates sustainable materials and patented technologies to support scalable

and efficient advanced manufacturing. The company is working with companies including Unilever and Ricoh to transform manufacturing, as well as developing and patenting its own intellectual property.

With the funding, Atomik AM is expected to grow its team by 40% and explore larger premises, as it scales its operations.

Over 6,500 production and laboratory furnaces manufactured since 1954

• Metal or graphite hot zones

• Processes all binders and feedstocks

• Sizes from 8.5 to 340 liters (0.3–12 cu ft.)

• Pressures from 10-6 torr to 750 torr

• Vacuum, Ar, N2 and H2

• Max possible temperature 3,500°C (6,332°F)

• Worldwide field service, rebuilds and parts for all makes

“At Atomik AM, we believe that true innovation starts with putting materials and sustainability first,” explained Professor Black. “This investment will allow us to grow our team and scale our patented technologies, accelerating our ability to deliver cleaner, more efficient manufacturing solutions. From our base in Liverpool, we’re proud to lead this transformation and work with global partners to set a new benchmark for sustainable, materials-led innovation in advanced manufacturing.”

The company also produces inks for 2D sensor printing and specialist pastes used in electronic coatings. It has delivered solutions to help companies remove unnecessary resources, such as water, from their manufacturing processes. Atomik AM has also developed a sustainable process for turning aluminium metal waste into more durable products, with the excess waste from this process then recycled into energy, representing a more endto-end approach to sustainability.

Atomik AM is currently in the process of patenting a series of new and innovative manufacturing products, including a universal binder for Binder Jetting metal Additive Manufacturing. Its universal binder is designed to work across multiple material systems, removing the need for unique formulations for different metal powders. This development could have major implications for manufacturers, particularly those working with a range of materials or looking to switch between materials without overhauling their entire process.

This latest funding also follows a £125,000 investment from Liverpool City Region Combined Authority-backed LYVA Labs, who invested in Atomik AM earlier this year. Akshay Bhatnagar, Head of Investment, LYVA Labs, added, “We are delighted that Atomik has secured investment from NPIF II and Praetura. This is great news for the Liverpool City Region. We are excited to be working with Praetura to support Kate and the team to accelerate the Additive Manufacturing revolution which is underway.”

www.atomik-am.com

Regardless of the complexity of your custom application and formulation, it remains standard for us with our quality systems, technical support, and two proprietary binding systems.

We ensure 100% batch-to-batch consistency, a wide range of alloys, and 36 years of supplying MIM feedstocks for mission-critical parts.

Advanced Metalworking Practices (AMP) manufactures and supplies a wide range of both standard and custom-configured MIM feedstocks for your application. Contact Chris Chapman at cchapman@ampmim.com or 724-396-3663.

Scan the QR code or click here to view our current list of alloys www.ampmim.com/resources

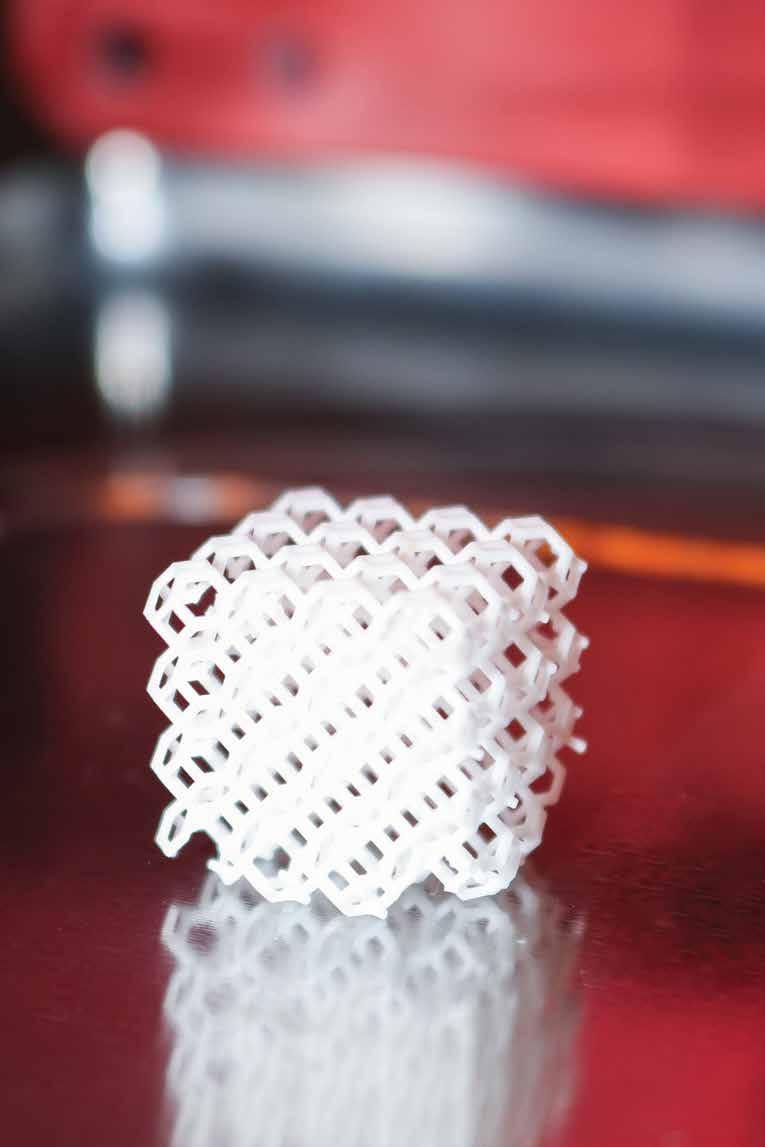

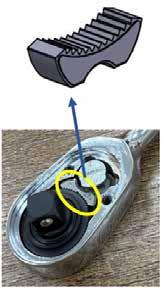

Electronic audio equipment manufacturer Ortofon, based in Nakskov, Denmark, has released its new MC X range of phono cartridges, using Metal Injection Moulding to produce the frame structure.

A phono cartridge is the small, stylus-containing device mounted at the end of a turntable’s tonearm. Its main function is to convert the mechanical vibrations from a record’s grooves into an electrical signal that can be amplified and played through speakers.

Traditionally, Ortofon used an extruded aluminium core followed

by machining. With the MC X series, however, the company has turned to Metal Injection Moulding to improve precision and design flexibility.

The new MC X series features honeycomb-structured stainless steel fabricated via MIM. According to the company, this refined structure ensures superior mechanical stability, providing the basis for precise and accurate sound reproduction.

After the moulding and sintering processes, the cartridges are surface treated by Physical Vapour

Each of the cartridges in the MC X range features a different stylus material and/or shape (Courtesy Ortofon)

Deposition (PVD) to enhance appearance and extend material integrity.

“With this production method, new shapes and ways of designing the structure open up the possibilities,” Peter Wieth Hjordt, Ortofon Product Director, told What Hi-Fi?

The cartridges also include coils wound with silver wire and a newly developed system that integrates a pole cylinder into the rear magnet yoke. These enhancements are designed to optimise the signal path and improve clarity.

The MC X range consists of four cartridges, each offering a different stylus and price point. The cartridges are designed to be compatible with a large number of tonearms and turntables.

www.ortofon.com

Ortofon’s new phono cartridge series is distinguished by its MIM honeycomb pattern (Courtesy Ortofon)

Seco Tools, headquartered in Fagersta, Sweden, has introduced a new self-service carbide tool recycling system in an effort to make the recycling process simple, more transparent and efficient. The digitalised buy-back programme, available in a number of its markets, enables customers to easily return used carbide tools and contribute to a circular economy.

The new web-based service, accessible through customers’ My Pages accounts, offers a streamlined approach where users can request price quotes for their used carbide tools, order free recycling containers, book shipments, track orders, monitor CO 2 savings, and receive a sustainability certificate. By recycling used carbide tools, Seco helps reduce reliance on virgin raw materials such as tungsten,

cobalt, and tantalum. This approach is said to lower energy consumption by 70% and cut CO 2 emissions by 64%.

“We are committed to making carbide recycling easier and more accessible for our customers. This digital transformation enhances efficiency while ensuring we meet our ambitious sustainability goals,” stated Malvina Roci, Circularity Manager at Seco.

This service is already available in several markets, with ongoing expansion planned across Europe, the Americas, and Asia Pacific.

www.secotools.com

Granutools, based in Awans, Belgium, has introduced its GranuCharge At Line (AL), an instrument designed to measure electrostatic charges in powders during flow in real time and directly on the production line.

The new GranuCharge AL is designed to measure electrostatic charges in powders (Courtesy Granutools)

Electrostatic charging is a common challenge in powder processing industries such as Additive Manufacturing, and metal powder handling. This phenomenon affects powder flowability, causes handling difficulties, and can even present safety risks.

Unlike traditional lab-based methods, the GranuCharge AL provides instant access to the charge per mass measurement through an integrated load cell combined with a Faraday cup connected to a highly sensitive electrometer. As powder flows through the process and into the device, the GranuCharge AL automatically captures the accumulated electrostatic charge, delivering high-precision results with minimal setup, all without stopping production.

GranuCharge AL allows users to assess how equipment such as hoppers, feeders, and blenders influence electrostatic charge accumulation to optimise material handling and process design. It also enables users to monitor charge effects on powder spreadability in Powder Bed Fusion machines or during nozzle flow in Directed Energy Deposition (DED), helping to improve powder bed quality and process reliability. Additionally, the GranuCharge AL identifies charge build-up hotspots on production lines in real time, enabling swift corrective actions without interrupting operations.

GranuCharge AL is reportedly the only compact instrument capable of real-time electrostatic charge measurement under true process conditions. This innovation helps industries reduce downtime, optimise materials, and enhance process reliability by providing critical data precisely where it is needed.

www.granutools.com

William Rowland, headquartered in Barnsley, UK, has announced it is celebrating its 195 th anniversary this year, marking almost two centuries in the metals industry. Founded in 1830 by Jonathan Rowland, the company has evolved into a global supplier of metals and alloys, serving a diverse range of sectors including civil aerospace, defence, automotive and EV, energy, Additive Manufacturing, petrochemicals, and electronics.

In addition to its revert alloy and refined metals businesses, William Rowland is an established supplier of metal powders in different particle sizes, shapes and alloys. The company offers gas-atomised metal powders specifically designed for Additive Manufacturing, including Inconel 625, 713 and 718 nickel-based powders possessing high strength properties and resistance to elevated tempera -

tures. It also offers Hastelloy X, a nickel-based alloy that has exceptional strength and oxidation properties, and F75, a cobalt chrome alloy.

With the support of its parent company, AMC Group, William Rowland recently invested in a state-of-the-art headquarters and recycling centre in Tankersley, which has enabled it to expand and diversify its offerings even further.

Recent investments in key plant room equipment are said to have reinforced the company’s commitment to precision, efficiency, and minimising waste. The company is also placing a greater focus on scrap and recycling supply chains, reducing its carbon footprint while recirculating valuable metals back into the industry.

www.william-rowland.com

CeramTec GmbH, headquartered in Plochingen, Germany, has announced that Dr Carla Kriwet will become the group’s new CEO and President Medical, by the end of 2025 at the latest. It was also confirmed that Dr Hadi Saleh, the current CEO, will transition to a new role as nonexecutive director of the company’s Supervisory Board.

Dr Kriwet, who will join CeramTec in July 2025, is reported to bring experience from leading a number of successful global businesses, including serving as CEO of BSH Hausgeräte GmbH, CEO of Fresenius Medical Care AG and CEO of the Connected Care division at Philips NV.

Dr Saleh and Dr Kriwet will work closely together in an effort to ensure a smooth and effective transition for CeramTec.

“CeramTec would like to thank Dr Hadi Saleh for his successful leader -

ship, passion and commitment over the past decade,” the company stated. “We look forward to his continued contributions as a member of our supervisory board.”

www.ceramtec-group.com

Dr Carla Kriwet will take over the roles of CEO and President Medical of CeramTec by the end of 2025 (Courtesy CeramTec)

first long-term study shows 92% success rate for additively manufactured bioceramic implants in mandibular surgery

Lithoz, based in Vienna, Austria, has shared its first scientific long-term study on additively manufactured bioceramic patient-specific implants (PSI), which showed a total success rate of over 92% achieved with Lithoz’s LithaBone TCP 300 tricalcium phosphate material.

Processed on a Lithoz CeraFab machine, these implants display the high medical standards of Lithoz technology, which, as of recently, have been produced under an ISO 13485 certified quality management system.

This study, which evaluates the healing success of LCM-manufactured ceramic implants in human bodies over a follow-up period of five years, is expected to support the expanded use of ceramic Additive Manufacturing in surgery.

Complex/miniature medical device components

High temperature stainless steel/superalloy automotive parts

Advanced ceramics with high density, high wear and tear resistance, and high precision.

Micro MIM/CIM

Materials customization and RnD.

Lithoz’s first scientific long-term study on additively manufactured bioceramic patient-specific implants showed a total success rate of over 92%, achieved with Lithoz’s LithaBone TCP 300 tricalcium phosphate material (Courtesy Lithoz)

In a minimally invasive approach, fourteen patients between seventeen and fifty-seven years of age suffering from dysgnathia were treated with patientspecific implants produced on a Lithoz CeraFab machine to prevent antegonial notching. Delivering ideal osteoconductivity and osteoinductivity, the study clearly confirmed the implants’ potential to reconstruct and bridge healing gaps occurring after surgical bone-cutting intervention (‘osteotomy gap’) due to their interconnected pores. The study also found that the rapid growth of new bone tissue in the beta-TCP implant was promoted.

Prior to this study, surgeons had yet to find an ideal solution to the postoperative development of mandibular lower border defects and irregularities following bilaterial sagittal osteotomy (BSSO).

Dr Johannes Homa, Lithoz CEO, shared, “This first-ever long-term clinical follow-up study marks a historic moment for the entire Additive Manufacturing industry! These results are not only about celebrating a great achievement for our Lithoz LCM technology. By clinically proving a success rate of over 92%, we’ve set a game-changing milestone in the history of surgery to establish the 3D printing of patient-specific bioceramic implants as a fullyfledged alternative alongside traditional surgical interventions.”

The clinical paper’s conclusion states “the feasibility and potential of the ß-TCP gap PSI concept as an innovative and promising approach to prevent antegonial notching after BSSO at primary surgery and in the long-term.”

www.lithoz.com

The European Powder Metallurgy Association (EPMA) has appointed Adeline Riou as its new president. Riou, who serves as Market Development Director – Metal Powders at Aubert & Duval, France, succeeds Ralf Carlström of Höganäs AB, Sweden, who is stepping down after six years as the association’s president. The EPMA also announced Steven Moseley, Chief Scientist Hard Materials & Key Expert at Hilti, as its new Treasurer.

The appointments were confirmed during the association’s General Assembly. Every three years, the EPMA Statutes require members to elect a new president and treasurer, both subject to a maximum of two terms.

“I’m very pleased that Adeline accepted the appointment as President of EPMA,” stated

Carlström. “Her long experience within the Powder Metallurgy field, combined with her dedication, will be a very valuable asset for EPMA in the future.”

Riou has worked in the field of metal powders for close to thirty years, having been at Aubert & Duval since 2018 and at Erasteel for twenty-two years. Over that time, she has been very active within EPMA, where she initiated the EuroHIP sectoral group in 2009 and the EuroAM sectoral group in 2013 before joining EPMA Board and Council in 2023.

president, succeeding Ralf Carlström (right) (Courtesy EPMA)

She served as co-chair at the WorldPM2022 Congress and received the EPMA Distinguished Service Award in 2023. Riou is also the co-author of the EPMA’s Introduction to HIP technology and Introduction to AM technology publications.

“I am very happy and deeply honoured to have been elected as EPMA’s new president and even more so as the first woman to hold this position,” added Riou. “Many thanks to Ralf Carlström for the opportunity and for the excellent work and new ideas implemented in the last six years to strengthen the EPMA, in particular to recover from the challenging Covid crisis.”

www.epma.com

Our experienced team is ready to solve your toughest thermal processing challenges and will design, manufacture, install and maintain

Furnace you’ll ever own.

FEATURES

• Metal or Graphite Hot Zones

• Metal and Graphite Retorts

• Debinding & Sintering

• Trapping Systems to Suit The Best Thermal Processing Solution for the Powder Industry

APPLICATIONS

• Additive Manufacturing

• Metal Injection Moulding

• Ceramic Injection Moulding

• Powder Metallurgy

Yoshio Uetsuki, Executive Director of Japan Powder Metallurgy Association (JPMA), has announced his retirement, effective May 23, 2025. Tetsuya Sawayama, formally of Kobe Steel and a JPMA board member, was announced as the new JPMA Executive Director.

“I would like to express my deepest gratitude for the exceptional support received during my term in office,” Uetsuki stated. “I will treasure all the happy memories I shared with you all.” www.jpma.gr.jp

The Verder Group, headquartered in Haan, Germany, has announced the establishment of Verder Scientific Iberia, the company’s thirteenth sales facility. Located in the city of Eibar in the Basque Country, with sales and service representatives across Spain, the new facility will be the central hub for all operations in Spain and Portugal. Verder Scientific Iberia is a joint venture with Neurtek, the company’s distributor.

With the partnership, Verder is also integrating the Retsch brand into the new organisation, which was previously managed by Biometa.

Verder Scientific Iberia will be equipped with a modern demonstration laboratory and service centre, ensuring hands-on technical support and training opportunities for its customers.

This strategic decision is said to reinforce Verder’s commitment to market expansion and closer customer engagement. It allows the company to enhance its market presence, improve support, and achieve synergies across its product lines. www.verder.com

The EROWA PM Tooling System is the standard interface of the press tools between the toolshop and the powder press machine. Its unrivalled resetting time also enables you to produce small series profitably.

www.erowa.com

Japan’s MIM industry serves customers around the world with innovative, high-performance engineered components. These are used in a wide range of applications, from industrial machinery to automotive, medical and more. Contact us to discover how we can support your MIM applications.

CASTEM Co.,Ltd. www.castem.co.jp/en

IWAKI Diecast Co.,Ltd. www.iwakidc.co.jp

JUKI Aizu Corporation www.jukiaizu.co.jp

Nakahara Precision Co.,Ltd. www.nprec.com

Nippon Piston Ring Co.,Ltd. www.npr.co.jp

Oriental Chain Mfg.Co.,Ltd. www.ocm.co.jp

OSAKA Titanium technologies Co.,Ltd. www.osaka-ti.co.jp

Osaka Yakin Kogyo Co.,Ltd. www.osakayakin.co.jp

Pacific Sowa Corporation www.pacificsowa.co.jp

Repton Co., Ltd. www.repton.co.jp

Taisei Kogyo Co., Ltd. www.taisei-kogyo.com

Teibow Co., Ltd. www.teibow.co.jp

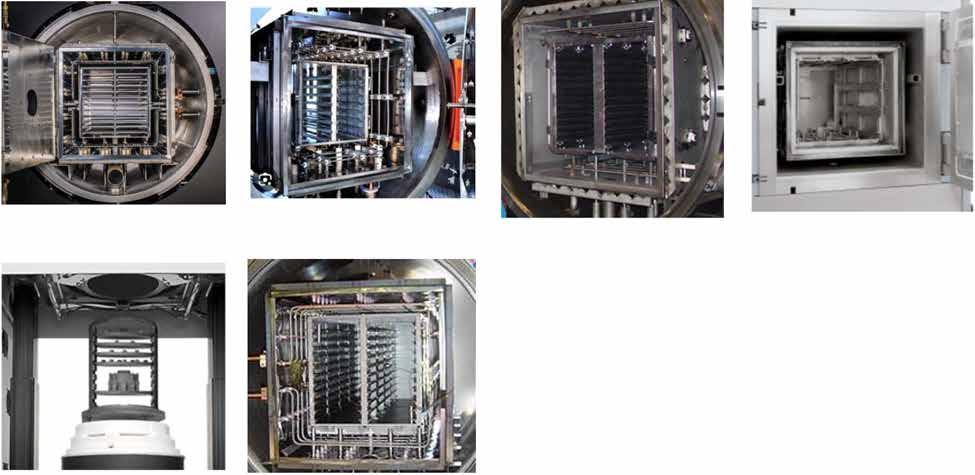

TAV Vacuum Furnaces, based in Caravaggio, Italy, highlighted the work of its Performance Lab, a key strategic resource within the company’s R&D department, in a recent blog post.

The laboratory is equipped with a range of highly specialised furnaces designed to support R&D activities focused on refining heat treatment processes. Through its range of technical features, the company can perform numerous fundamental tests on metals and ceramics, including common heat treatments, sintering, brazing and thermochemical treatments.

In addition to research and development activities, the TAV Performance Lab also serves as a technology transfer platform, allowing the company’s customers to save money on their R&D activities and become operational with tested

and qualified processes directly after the furnace installation phase.

“Our commitment to research and development offers a concrete response to the most advanced industrial challenges and needs,

ensuring our customers always have cutting-edge products and processes,” the company explained. “We offer the opportunity to carry out dedicated test runs and this collaborative approach allows us to develop tailor-made solutions that perfectly meet specific needs, ensuring toplevel performance.”

www.tav-vacuumfurnaces.com

Bodycote plc, headquartered in Macclesfield, Cheshire, UK, has announced that the Science Based Targets initiative (SBTi) has officially validated its upgraded science-based carbon reduction target. This milestone is said to highlight Bodycote’s commitment to taking decisive action against climate change and driving efficiency across its global operations.

In 2022, the company became the first major heat treatment company to set a science-based carbon reduction target. The upgraded target builds on Bodycote’s earlier success in reducing its energy use and carbon emissions, committing to a 46% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline. This new goal marks a major step forward from the previous target of

a 28% reduction by 2030, which was achieved six years early in 2024.

Bodycote provides advanced material solutions that address complex challenges, supporting customers in cutting emissions and achieving their decarbonisation targets. For instance, outsourcing heat treatment to Bodycote using a low-carbon thermal processing technology enabled a customer to lower carbon emissions by up to 90% per part, while also enhancing product performance.

Lily Heinemann, Chief Sustainability Officer at Bodycote, remarked, “Achieving SBTi validation for our enhanced target reflects our enduring commitment to sustainability and the measurable progress we’ve made. By exceeding our previous goal ahead of schedule

and setting ourselves this higher bar, we’re demonstrating that bold climate action is both achievable and essential. We are excited to continue leading efforts to make a meaningful impact on the global climate challenge and support our customers to achieve their goals.”

Over the past three years, Bodycote has achieved a 29% reduction in Scope 1 and 2 emissions, positioning itself strongly to meet the ambitious 46.2% reduction goal by 2030. In 2024, Bodycote launched a new integrated strategy that aligns its business objectives with longterm sustainability commitments. With clear objectives extending to 2030 and beyond, the group is delivering measurable environmental and social impact across all stakeholders. This commitment is further reflected in its strong performance in key ESG ratings, including an A-leadership rating for CDP Climate in 2024 and an AA rating from MSCI. www.sciencebasedtargets.org www.bodycote.com

TekSiC, based in Linköping, Sweden, has announced its new Xforge HT, a modular high-temperature induction heating furnace. The Xforge HT is designed for various high-temperature heat treatment applications, such as post processing of additively manufactured components, sintering, various diffusion treatments, material testing etc.

offering a modular solution that can be customised to each customer’s unique requirements.”

• Metal or Graphite Hot Zones

• Metal and Graphite Retorts • Debinding & Sintering

APPLICATIONS

“The Xforge HT represents the next step in our evolution as a company,” stated Joachim Tollstoy, CEO of TekSiC. “This product is a result of our dedication to innovation, designed with the flexibility to meet the specific needs of processes in high temperatures, low pressures, and introduction of process gases. We engineered it to provide the highest performance in the most demanding environments while

Our experienced team is ready to solve your toughest thermal processing challenges and will design, manufacture, install and maintain the Best Sintering Furnace you’ll ever own.

The Xforge HT is designed for high-temperature performance, reportedly able to stably exceed 2,500°C. Its pressure and gas management system is said to enable the precise regulation of the processing environment, allowing optimal conditions for complex heat treatment applications. The machine’s design is also focused on versatility, enabling the next generation of high-vacuum environments while allowing the controlled introduction of multiple gases, including hydrogen. Its advanced control algorithms enable precise thermal management, even making it possible for processing refractory metals such as tungsten, niobium, and tantalum.

• Additive Manufacturing

• Metal Injection Moulding

• Ceramic Injection Moulding • Powder Metallurgy

Throughout its development, Xforge HT underwent industrial reliability testing at customer sites over several years, demonstrating its ability to function during extreme high-temperature applications. Additionally, Xforge HT is CE-marked, certifying compliance with EU health, safety, and environmental standards. www.teksic.com

Our experienced team is ready to solve your toughest thermal processing challenges and will design, manufacture, install and maintain the Best Sintering Furnace you’ll ever own. APPLICATIONS

• Additive Manufacturing

• Metal Injection Moulding

• Ceramic Injection Moulding • Powder Metallurgy

Main Street, Adamsville, PA

Waygate Technologies, a Baker Hughes business based in Hürth, Germany, has introduced its Phoenix Nanotom HR (High Resolution) computed tomography (CT) system. The new system is designed to make advanced X-ray imaging technology accessible to a broader range of users and is reported to be ideal for applica -

tions across numerous fields, including Additive Manufacturing, material science, semiconductor and electronics inspection, battery technology research, geoscience, life sciences, and cultural heritage preservation.

As part of the new product introduction, Waygate also announced a technology collaboration with

X-ray equipment supplier Excillum, Kista, Sweden. Through this collaboration, Phoenix Nanotom HR will use a new high-resolution nanofocus X-ray tube supplied by Excillum for high imaging resolution and contrast across the full voltage range (40-160 kV).

“We are excited to present our Phoenix Nanotom HR here at Control 2025 and announce our strategic collaboration with Excillum,” said Ludovic Milosevic, General Manager Radiography Systems at Waygate Technologies. “Leveraging Excillum’s nanofocus source, the new HR version delivers up to five times better resolution than our existing stateof-the-art Nanotom M. That puts it on par with advanced optical magnification scanners – but with a simpler system, faster learning curve, greater flexibility, and at a better price point than comparable solutions.”

With its 300 nm focal spot technology, the Phoenix Nanotom HR is said to enable high geometric sharpness and detail detectability down to 50 nanometres (0.05 microns). It also allows for high contrast in high- and low-absorbing materials within a single image. The company states that high resolutions can be achieved 3-5x faster than with the Nanotom M or optical solutions, thus reducing scan times for samples requiring 120 minutes for 0.5 µm resolution to as little as forty minutes, or from one hour to ten minutes.

The Phoenix Nanotom’s user interface, featuring automated focal spot selection, is designed to increase ease of use. It allows users to explore sub-micron particles, design deviations, manufacturing issues, material flaws, and geometric structures.

In addition, the system is capable of 24/7 operation with a reportedly excellent stability, effectively reducing the need for maintenance work to a quarter of standard industry levels.

www.waygate-tech.com

The Manufacturing Intelligence division of Hexagon AB has launched MAESTRO, a new coordinate measuring machine (CMM) engineered to meet the rising productivity demands of modern manufacturing and the increasing quality requirements. The CMM’s digital-first architecture offers rapid measurement routines, an intuitive user experience and seamless data integration. With modular software and hardware, it is designed to scale with evolving production needs, making it ideal for aerospace, automotive, and high-precision manufacturing environments where there is a high demand for accuracy.

MAESTRO features a newly developed digital architecture, incorporating digital sensors, a single cable system, and a completely new controller and firmware. Together, these new capabilities increase

throughput, streamline the complete measurement operation, and ensure future-ready connectivity for modern production environments.

“Manufacturers told us they needed a next-generation system that tackles rising quality demands and skills shortages,” stated Jörg Deller, General Manager Stationary Metrology.“By rethinking our hardware and software from the ground up, rather than iterating on existing systems, we’ve had the freedom to create a high-accuracy inspection solution that is so intuitive that anyone from expert to new hires become significantly more productive. Meeting the needs of industry headon, MAESTRO’s digital backbone also makes it straightforward to integrate into modern connected factories, so stakeholders can improve quality quickly and definitively.”

Pilot users report dramatic productivity gains and reduced inspection lead times, helping to avoid production bottlenecks and to keep apace with fast-changing customer requirements. Customers have tested various sensors, ranging from high-speed laser scanning to tactile probes, with consistently strong results in both R&D and production applications.

Hexagon’s software tools and services, such as PC-DMIS and the Metrology Mentor, Metrology Asset Manager, and Metrology Reporting Nexus Apps, were developed in tandem with MAESTRO to create an integrated system that significantly boosts productivity from part loading to analysis, compared to isolated component solutions. The end goal is to deliver ease-of-use and fast workflows, from programming, execution, and usage to reporting and collaboration with colleagues in design and manufacturing.

www.hexagon.com

more? Engineered for precision, surface quality and easy machine handling –ideal for prototypes and small series.

Material Options (Metal)

Material Options (Ceramics)

Build Envelope

Quantity

Tolerance capability

CONTACT FOR MORE DETAILS

17-4PH, SS 316, Tool Steel M2 & S-7, Inconel 625, 4140

Alumina 99.5%, Zirconia

~ 300 grams max, Footprint equivalent of baseball size or less, 0.02” (0.50 mm) wall thickness minimum

10~50 samples based on footprint. Larger quantities up to 1,000 pcs welcome depending on the part size.

Within 2% of the feature size, 2~3 Ra Surface finish, Option of finishing to closer tolerances available.

NORTH AMERICA Email: Mukund.N@indo-mim.com Ph: +1 (210) 557-1594

EUROPE Email: InfoEU@indo-mim.com Ph: +49 1732656067

ASIA Email: InfoHQ@indo-mim.com Ph: +9198459 47783 / +91 98450 75320

ISO 9001:2015 / IATF 16949:2016 / AS

OptiMIM, a Form Technologies company with headquarters in Portland, Oregon, USA, has announced a strategic joint venture with Vasantha Tool Crafts Pvt Ltd, a division of the Vasantha Group based in Hyderabad, India. Together, the companies have established OptiMIM Global, a new entity to enhance manufacturing capabilities, expand market presence, and deliver advanced MIM solutions to industries worldwide.

“Partnering with Vasantha Tool Crafts Pvt Ltd aligns with OptiMIM’s mission to deliver world-class precision metal components with superior performance,” stated Marc Riquelme, President of OptiMIM & Signicast.

“This joint venture enables us to leverage Vasantha’s deep expertise in mould design and manufacturing to further enhance our offerings and

provide even greater value to our customers worldwide.”

By combining OptiMIM’s MIM technology with Vasantha’s expertise in precision mould design and high-accuracy manufacturing, the collaboration is expected to expand the market for complex metal components across the automotive, medical device, consumer electronics, industrial, defence, and aerospace sectors.

Dayanand Reddy, Managing Director, Vasantha Tool Crafts, added, “We are excited to join forces with OptiMIM to push the boundaries of MIM technology. Our complementary strengths in high-precision manufacturing and innovative design will drive new possibilities for our customers across various industries.”

In addition to OptiMIM’s strong presence in North America, Vasantha has established operations in India,

The newly formed OptiMIM Global will serve a wide range of industries (Courtesy OptiMIM)

Europe, and the USA. The partnership will bring together a large team of highly skilled and experienced professionals to create a robust infrastructure and streamlined operations. Combining research and development efforts is also expected to accelerate advancements in materials and MIM technology. www.optimim.com www.vasantha.com

CMG Technologies, Woodbridge, UK, recently celebrated fifty years in business. Established in 1975 as a fibre optic specialist, the company began its Metal Injection Moulding journey in the early 2000s, trading under the names Europlus and Egide UK, before becoming CMG Technologies after its 2013 management buyout. In 2023, CMG became part of the INDO-MIM group.

“Today is both a proud moment and significant achievement for our business and everyone who has been involved in its journey over the years,” stated Rachel Garrett, Managing Director. “Like with every business, we have been on a rollercoaster through the years, but have always been lucky to have an

The CMG Technologies team celebrates 50 years in business (Courtesy CMG Technologies)

incredible team that provides us both stability and innovation to move forward.”

Throughout its history, CMG has provided MIM and Additive Manufacturing solutions for numerous high-profile clients and made headlines during the COVID-19 pandemic for its work producing parts for ventilators.

Under Garrett’s leadership, the company has received national attention for its adoption of a four-day working week and its support of a healthy work/life balance.

Garrett added, “One thing that has never changed over the years is our company culture, which is hugely important to us. We’re a close-knit team that supports one another. We have shared so many highs and lows together, including the loss of my father [founder Chris Conway] in 2018, and are proud to keep his legacy alive through everything we do.”

“CMG Technologies are continuing to advance and we look forward to plenty more years of innovation and teamwork,” she concluded.

www.cmgtechnologies.co.uk

Emery Oleochemicals, headquartered in Cincinnati, Ohio, USA, has achieved ISO 50001: Energy Management Systems certification at its manufacturing facility in Cincinnati. In May 2025, the Ohio Chemistry Technology Council (OCTC) recognised this certification, honouring the company with an Award for Excellence in Environmental Performance.

In 2024, Emery launched a comprehensive Energy Management System (EnMS), including initiatives such as steam trap testing and repair, ozonator efficiency studies, steam boiler tuning, and employee training focused on eliminating wasteful energy practices. These actions are said to have already delivered results – most notably, per the company, a 25% reduction in nitrogen oxide (NOx)

emissions, or 16 tons annually, due to improved boiler performance.

Emery’s Energy Committee is now focused on setting new targets and identifying additional energy-saving opportunities for 2025 and beyond.