SCRIMP & SAVE

Are you suited to the FIRE lifestyle?

START EARLY

It's never too soon to start saving

20-YEAR HOLIDAY

Victoria Harris on retirement planning

CRYPTO QUESTION

Importance of a balanced debate

A MATTER OF TIME

Martin Hawes on the art of decumulation

THE ‘R’ WORD

Maybe it’s time to ditch the term ‘retirement’

9 772744 608002 ISSN 2744-6085 NZ$11.95 INC. GST

Contents

IN THIS ISSUE

8. Contributors

Meet some of our expert contributors.

10. What We Like

Must-have coffee-making accessories and an art auction you won’t want to miss.

12. Essentials

Our picks for brightening up your world this spring.

14. Women and Money

Victoria Harris looks at retirement as a 20-year holiday. But will you be drinking tap water or a piña colada?

16. Going Up, Going Down

Economist Cameron Bagrie has the latest on the NZ economy.

20. The Art of Decumulation

Accumulating retirement savings is a popular topic but Martin Hawes looks at the best way to successfully manage your retirement decumulation.

24. It’s All in the Planning Retirement can seem a long way off but the time to plan for it is now. The sooner you consider what you want your golden years to look like the better, writes Amy Hamilton Chadwick.

32. The Low-down on Reverse Mortgages

Heartland Bank explains the financial relief over-60s can access if a reverse mortgage suits their situation.

34. Heard of the FIRE Acronym?

Ben Tutty explains how it works and looks at the benefits and sacrifices of the FIRE way of life.

40. The Road Map to Early Retirement

Pie Funds’ Mike Taylor looks at the need for diversification and due diligence when it comes to your retirement nest egg.

42. An Alternative Type of Investment

A much bigger audience of art collectors has opened up through technology, Joanna Mathers explains.

45. Building Your Retirement Income

New Zealand-owned Alpha First explains how wholesale mortgage investment can boost your retirement income.

46. Is Crypto Just Getting Started?

Increased regulation for digital currency might lead more investors to consider this asset class, Rupert Carlyon of Kōura Wealth has the details.

48. Alternative Words for Retirement

If we can change the language around retirement maybe we can change our perception of it too, writes Clarissa Hirst.

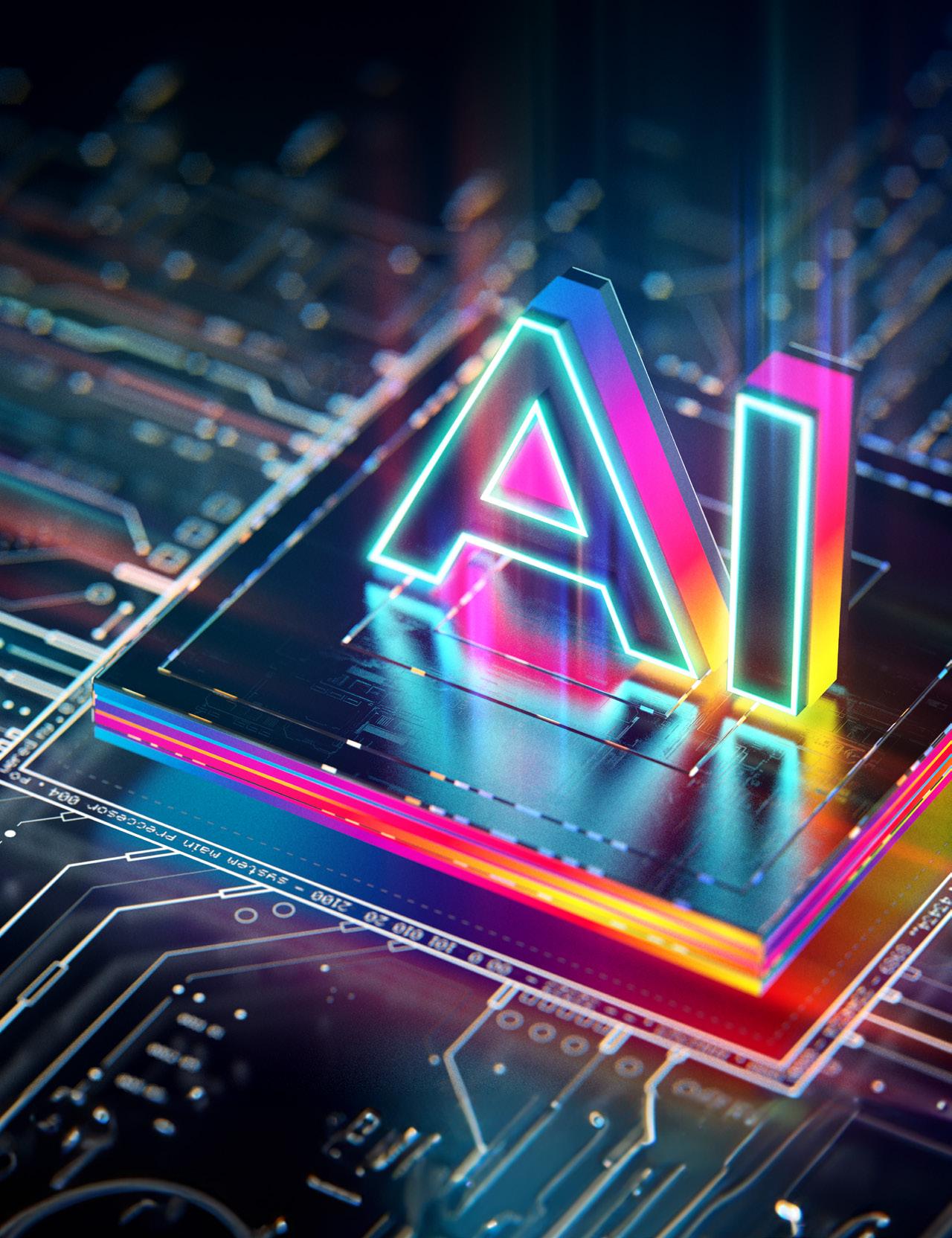

52. AI and the Stock Market

There’s no doubt AI is big news. Andrew Kenningham looks at its potential effects for investment and who the big winners and losers might be.

55. The Best Insurance Cover is Flexible

Asteron Life looks at insurance needs now and into retirement and the importance of future-proofing your cover.

56. Snapshot

What’s impacting the global economy right now?

58. KiwiSaver Could be Funding Infrastructure

A lot of our KiwiSaver funds are being invested offshore when they could be helping with local infrastructure projects, writes Simplicity’s Sam Stubbs.

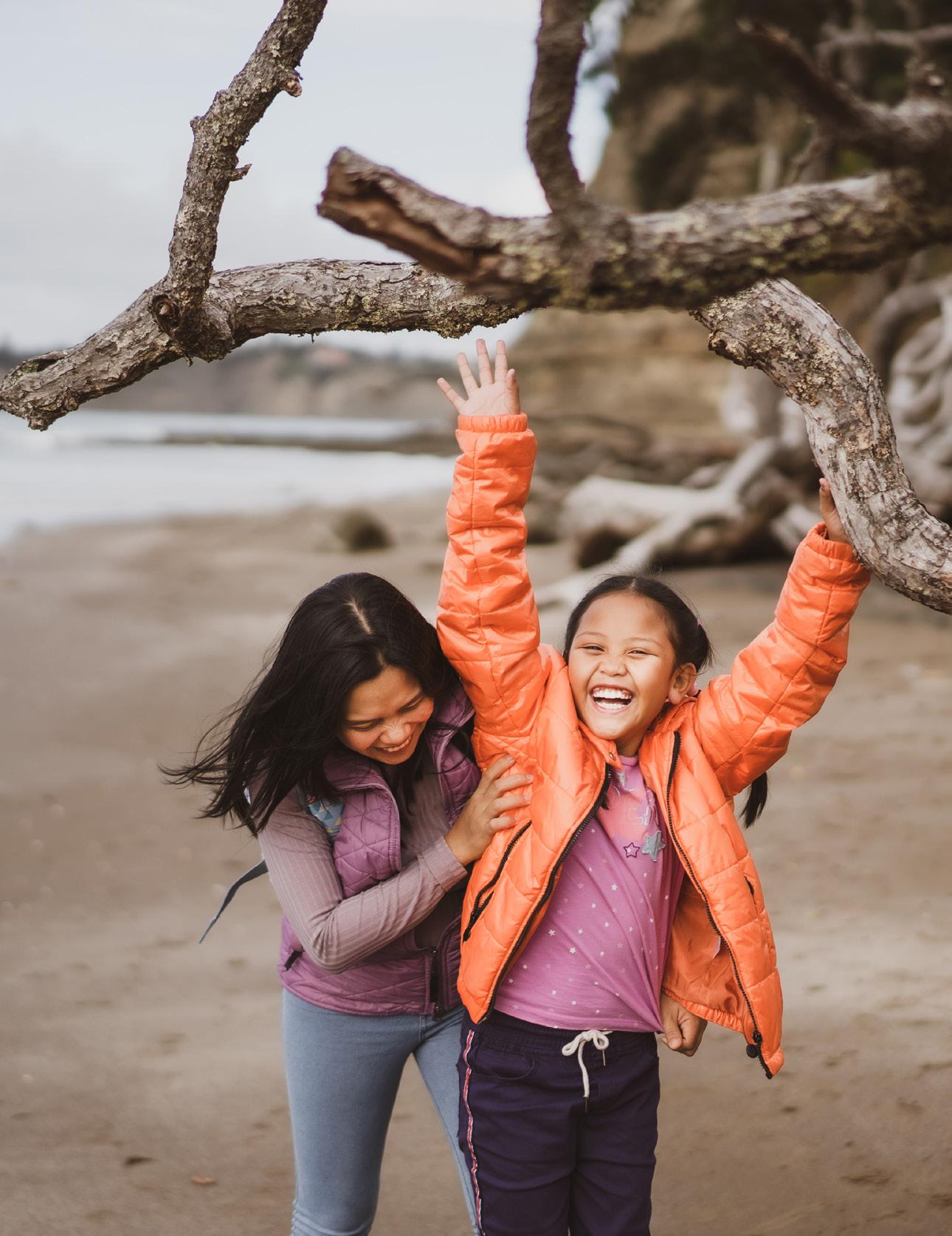

60. A Man is not a Retirement Plan

Money Mentalist Lynda Moore encourages women to be savvy with money to protect their future financial security.

62. How Safe is NZ Super?

Ed McKnight with a useful explanation of how NZ Superannuation is funded and why this might mean less in the pot down the track.

64. Maximising Your KiwiSaver

If you joined KiwiSaver and haven’t given it much more thought David Copson’s article is a must read.

66. KiwiSaver Funds for Local Projects

Booster looks at ways your retirement savings can support local innovation.

SPRING 2023 | INFORMED INVESTOR 2 INFORMED INVESTOR

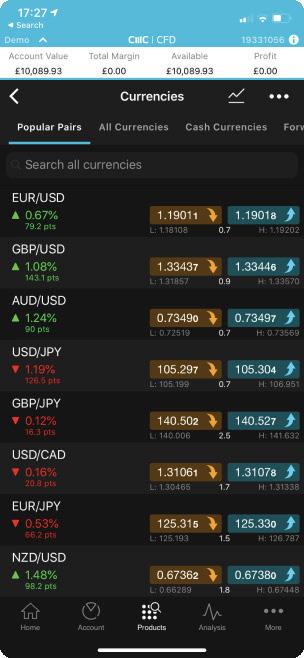

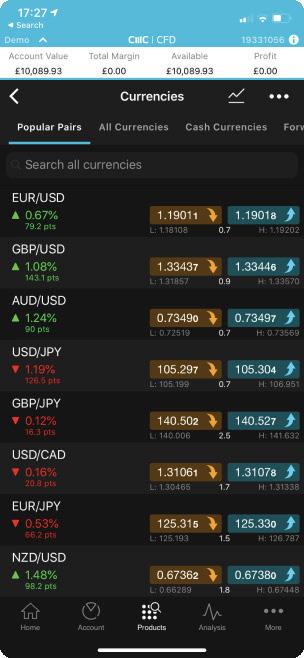

We’re more than a tourist in New Zealand.

Trade on the platform trusted by 1 million traders for over 30 years.

With derivative products you could lose more than your deposits. You do not own or have any interest in the underlying assets. Investing in derivative products carries significant risks. Seek independent advice and consider our PDS and the relevant Terms and Conditions of Trading at cmcmarkets.co.nz when deciding whether to invest in CMC Markets products. CMC Markets NZ Limited (CN 1705324).

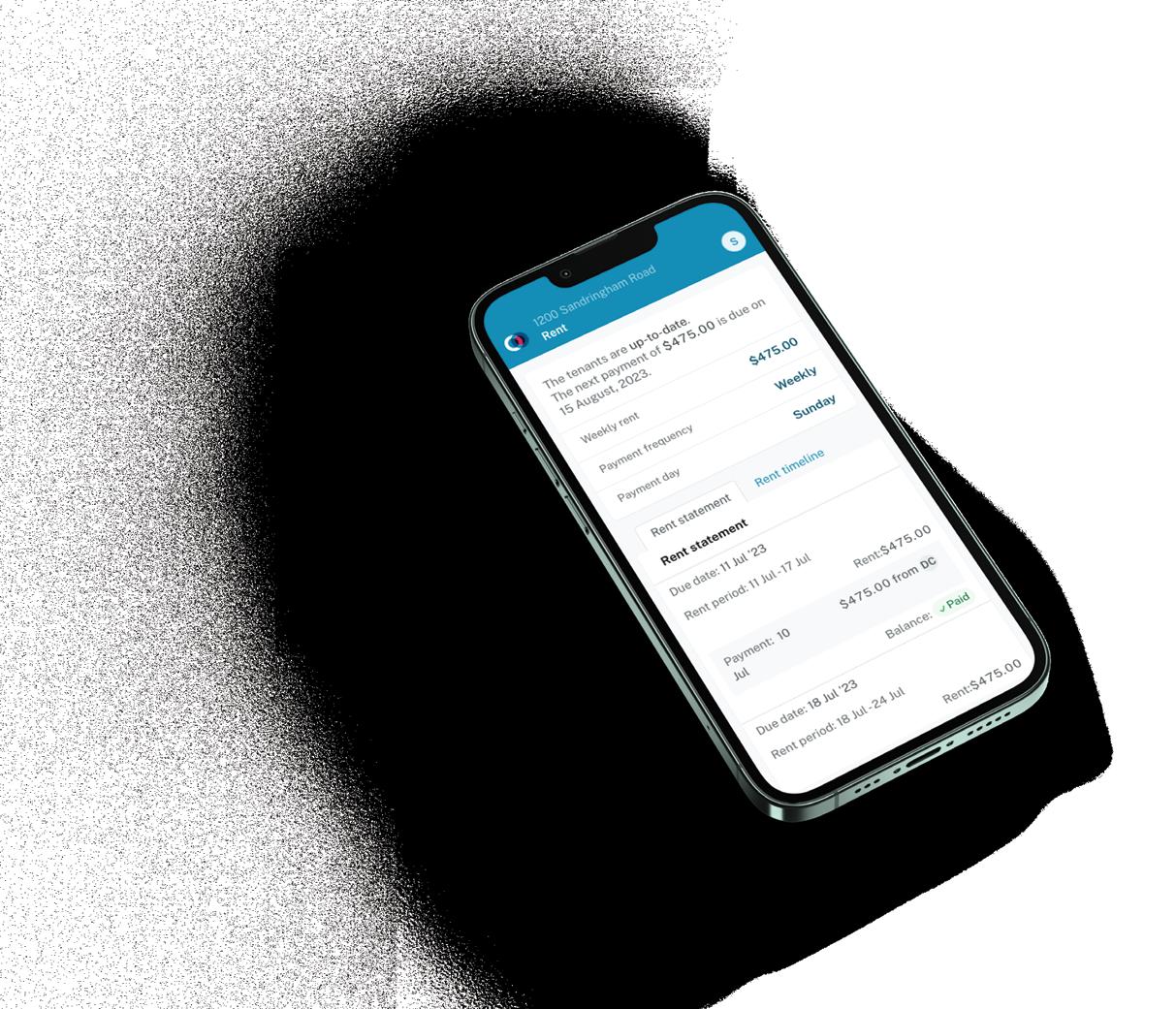

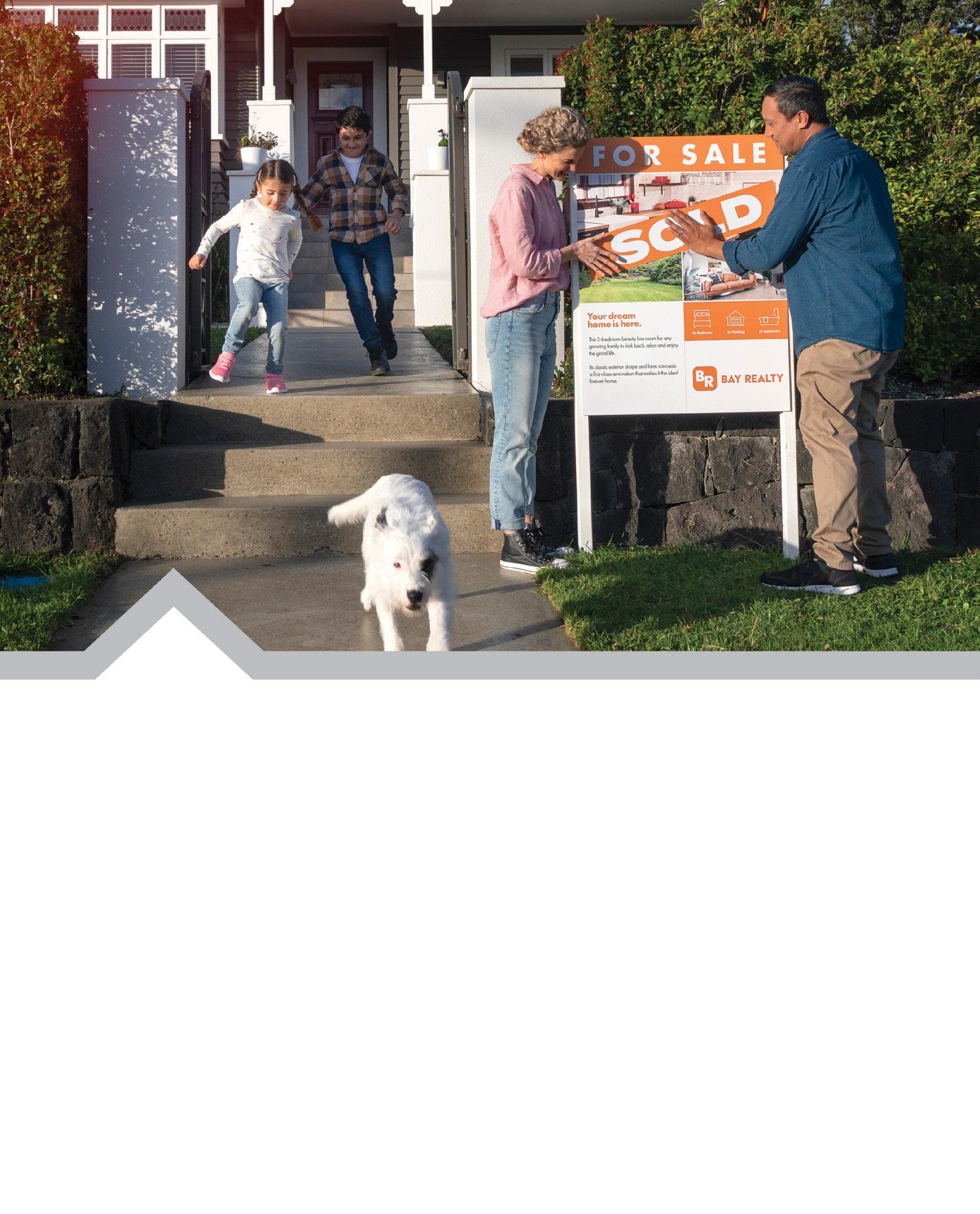

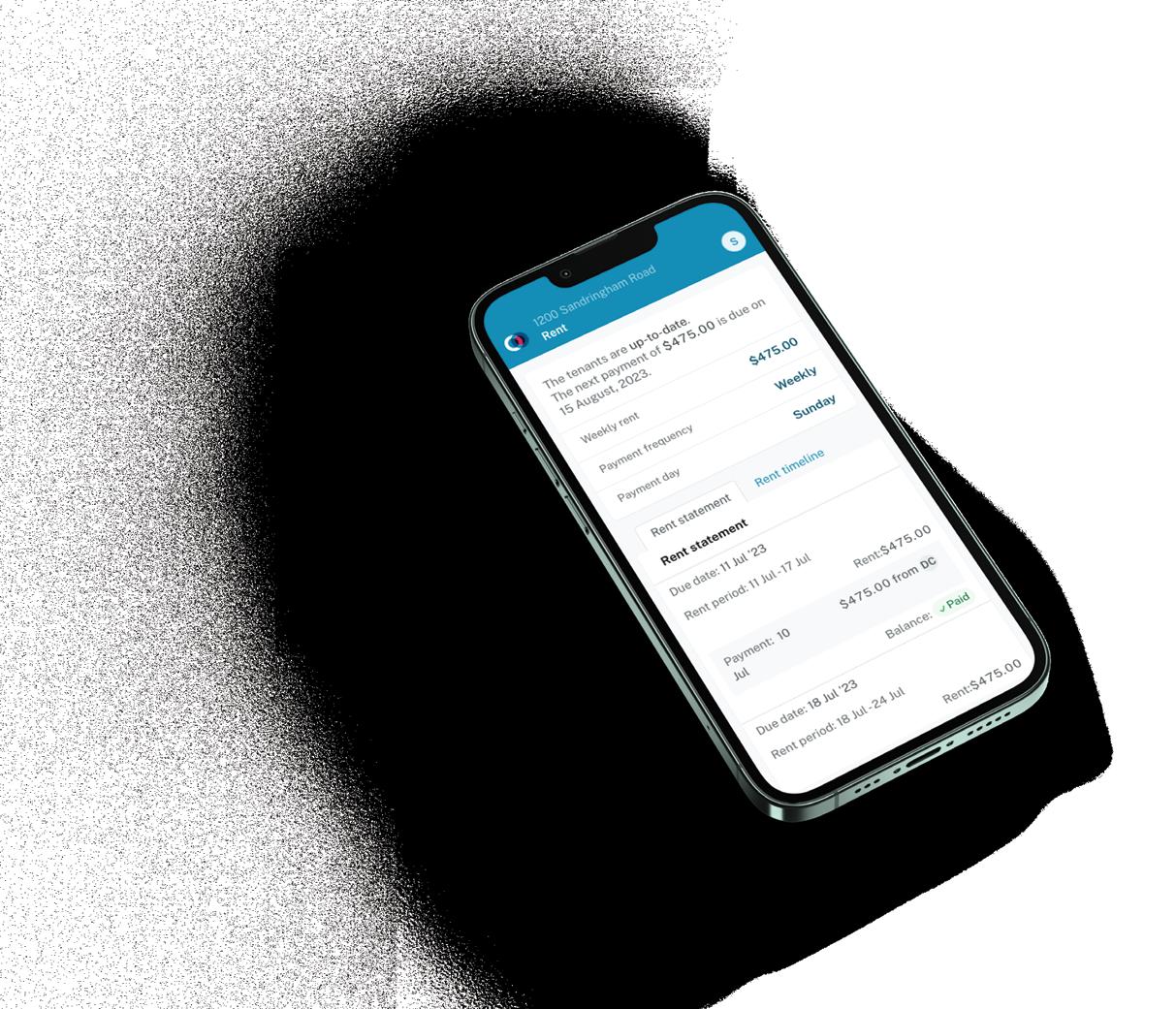

68. Short and Long-Term Property Management

Are you missing out on a side hustle with your empty spare room? Eric Hammond explains the benefits of short and long-term lets to build those retirement savings.

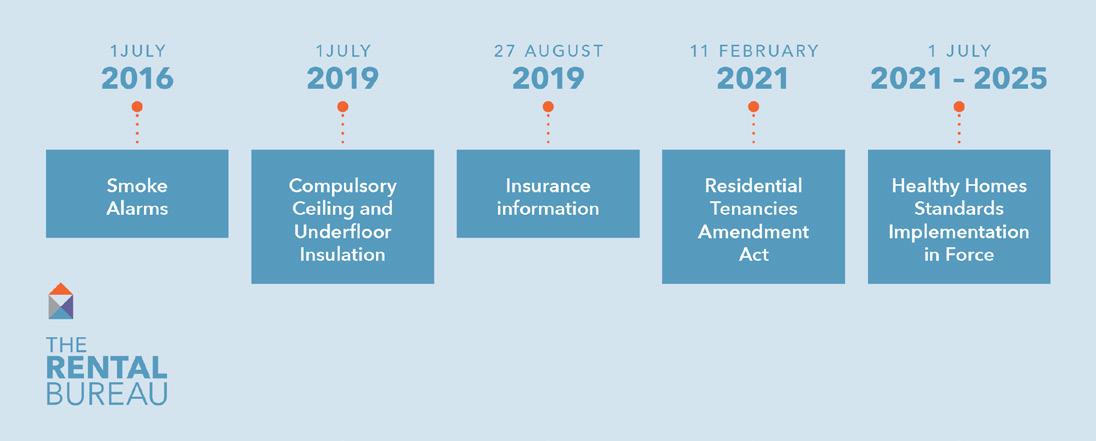

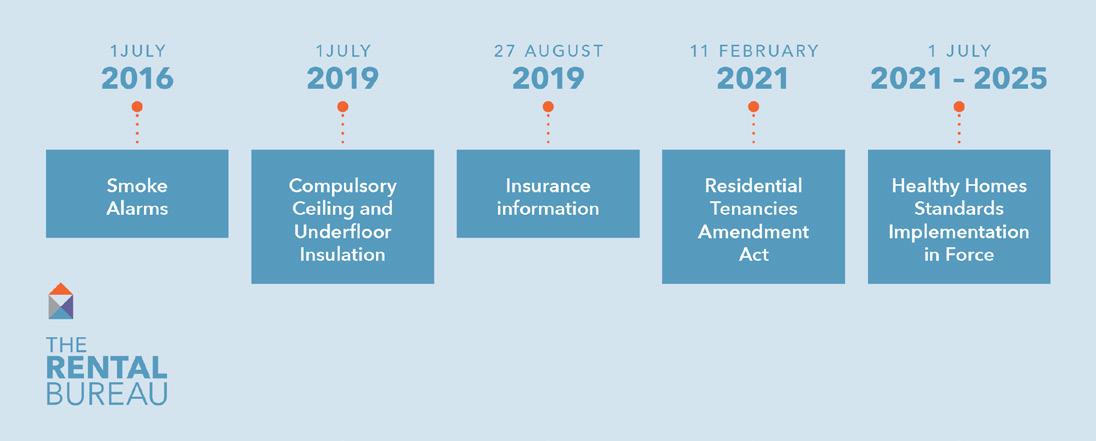

71. Property Management is Changing

The Rental Bureau looks at legislation, the increase in property managers, and the future for the industry with regulation on the horizon.

72. The Next Phase of the Property Cycle

What might be in store for the rest of 2023 and into 2024? Kelvin Davidson from CoreLogic explores the likely future trends for our property market.

74. Shining a Light on Commercial Property

If you haven’t got the deposit or time to devote to owning a residential investment property you might want to consider a ‘bite-sized’ commercial property investment.

77. Smart Property Management Alternative

Looking for a different way to manage your rental property? Keyhook might suit you.

78. Retire Early with Short-term Rentals

Airbnb could be a way to achieve financial freedom sooner, writes Stefan Nikolic.

80. What can you Spend in Retirement?

Without a good nest egg it could be less than you think. Andrew Nicol has an eye-opening look at the cost of retirement life.

84. The Great Wealth Transfer

Protecting your wealth and its future are important considerations. PMG Fund’s Matt McHardy has some sage advice.

86. Restaurant Review: Somm

You don’t need to travel far for a top-notch cellar-door experience, Joanna Mathers has found one in the heart of the city.

88. Motoring: Maserati Grecale Trofeo

It turns out you can have it all with a compact SUV, Liz Dobson discovers.

90. Fashion Update

The fresh styles of spring.

92. Retirement Wellness Starts Now

Resolution Retreats’ Casey Mackwell looks at healthy habits to take us up to and through retirement.

94. Resort Life Without the Travel

A staycation at Cordis Hotel Auckland leaves Joanna Mathers feeling refreshed and relaxed.

86 88

Contents 80 72

SPRING 2023 | INFORMED INVESTOR 4 INFORMED INVESTOR

To find an adviser, visit asteronlife.co.nz

insurance that’s here for you when it really matters.

Asteron Life. Supporters for life. Life

Changing our View of Retirement

Retirement – it’s a word loaded with clichés and misconceptions. But with life expectancy shooting up, and the likelihood of possible decades ahead of us past retirement, it’s something we need to plan for.

Retirement can be a time of joy, of reinvention. Given the right conditions, it can be a time of travelling, learning, community engagement. But without money, it can be harsh. This, our spring issue, is dedicated to retirement. It looks at everything you need to focus on to ensure financial wellbeing after work has finished, explores whether we need to reimagine what retirement looks like, and asks whether it’s a word we should ditch altogether.

In our lead story, Amy Hamilton Chadwick explores the retirement question in depth. She discovers that 40 per cent of New Zealanders 65 or over are living on superannuation only; at just under $1,000 a fortnight before tax, it’s not much.

Amy looks at ways in which to build wealth before retirement; and meets a man whose life and focus changed after the company he managed went under in his mid-50s, and he had to recreate a new career from the ground up.

She also explores the three big life shocks that can see you heading down the path of poverty if you’re not prepared: relationship breakdowns, redundancy, and surprise health problems. It’s a must-read with plenty of useful gems.

Clarissa Hirst has a different take on the topic; she looks at the word “retirement” and the negative connotations around it. She explains that the word “retire” derives from the French verb retirer, which means “to retreat”. This

Editor

Joanna Mathers

Art Director

Mark Glover

Account Manager

Stephanie Bryant – 021 165 8018

idea, of retirement as a time to retreat from life and slowly fade away, can prevent young people from planning for it at all. Clarissa argues that we should change the narrative; looking at the opportunities retirement can bring, rather than the downsides.

“If young people can envision a more optimistic future,” she posits, “maybe they’ll be more inclined to prepare for it.”

Alongside our focus on retirement (or whatever else you want to call it) we have our usual smorgasbord of sensational regular features. I take a resort-style holiday in the heart of Auckland; we look at the latest spring fashions; and explore what’s been happening around the world that’s likely to shape the economy.

Our amazing contributors (Martin Hawes, Cameron Bagrie et al) offer their seasonal words of wisdom, and we introduce a new contributor Rich Lyons to the team. As the retail investment manager of Oyster Property Group, he’s got many insights into commercial property funds and what they can offer savvy investors.

We hope you enjoy this issue of Informed Investor and that you get a chance to spend time outdoors as we head towards summer.

All the best.

Published by: Opes Media

Informed Investor

33 Federal Street, Auckland Central, Auckland.

www.informedinvestor.co.nz

Informed Investor is an investment magazine published quarterly by Opes Media. You need Informed Investor’s written permission to reproduce any part of the magazine.

Advertising statements and editorial opinions in Informed Investor reflect the views of the advertisers and editorial contributors, not Informed Investor and its staff.

Informed Investor’s content comes from sources that Informed Investor considers accurate, but we don’t guarantee its accuracy. Charts in Informed Investor are visually indicative, not exact. The content of Informed Investor is intended as general information only, and you use it at your own risk: Informed Investor magazine is not liable to anybody in any way at all. Informed Investor does not contain financial advice as defined by the Financial Advisers Act 2008. Consult a suitably qualified financial adviser before making investment decisions.

Informed Investor magazine does not give any representation regarding the quality, accuracy, completeness or merchantability of the information in this publication or that it is fit for any purpose.

Joanna Mathers Editor

Resident economist

Ed McKnight

Printer Webstar

Retail Distributor

Are Direct

This magazine is subject to NZ Media Council procedures. A complaint must first be directed in writing, within one month of publication, to the email address, stephanie@informedinvestor.co.nz. If not satisfied with the response, the complaint may be referred to the Media Council PO Box 10-879, The Terrace, Wellington 6143; info@mediacouncil.org.nz. Or use the online complaint form at www.mediacouncil.org.nz. Please include copies of the article and all correspondence with the publication.

To advertise in Informed Investor, you must accept Informed Investor magazine’s advertising terms and conditions. Please contact Stephanie@informedinvestor.co.nz about advertising.

Informed Investor is printed on environmentally responsible paper. The paper is produced using elemental chlorine-free pulp, sourced from sustainable and legally harvested farmed trees. The magazine is recyclable.

PRINT ISSN 2744-6085

DIGITAL ISSN 2744-6093

SPRING 2023 | INFORMED INVESTOR 6 EDITOR’S LETTER

† All figures are before tax. Since inception percentage is calculated from inception date 24/08/21 to 30/06/23 and is presented as an annualised return. * Early stage company investing is generally considered the riskiest type of equity investing. You may lose some or all of the money you invest. Withdrawal fees may apply. Booster Investment Management Limited is the manager and issuer of the Booster Innovation Scheme, Booster Innovation Fund (Fund). The Product Disclosure Statement for the Fund is available on www.booster.co.nz We’ve boosted over 30 Kiwi start-ups from idea to reality. Join the journey as they take their next steps toward going global. Investment offer now open. Invest today via NZX or at booster.co.nz

Meet Some of Our Contributors

CAMERON BAGRIE

Cameron is the managing director of Bagrie Economics, a boutique research firm. He was previously chief economist at ANZ, a position he held for over 11 years.

MARTIN HAWES

Martin is the chairman of the Summer KiwiSaver Investment Committee. He’s an authorised financial adviser and offers his services throughout New Zealand.

ANDREW NICOL

Andrew is an authorised financial adviser and the managing partner of Opes Partners. He has more than 15 years’ experience in banking, finance, and property.

KELVIN DAVIDSON

Kelvin joined CoreLogic in March 2018 as senior research analyst, before moving into his current role of chief economist. He brings with him a wealth of experience, having spent 15 years working largely in private sector economic consultancies in both New Zealand and the UK.

ANDREW KENNINGHAM

Andrew is the chief Europe economist for Capital Economics. He was previously an economic adviser for the United Kingdom Foreign Exchange.

CHRIS SMITH

Chris is the general manager at CMC Markets. He has more than 15 years’ investing experience in financial markets, global equity, commodity, and forex markets.

UP FRONT

SPRING 2023 | INFORMED INVESTOR 8

CLARISSA HIRST

Clarissa is the FSC’s head of content, communications and marketing. She also runs point on the FSC’s research, diversity and inclusion initiatives, media and government relations, and consumer projects.

RICH

LYONS

Rich is the retail investment manager of Oyster Property Group. He is responsible for overseeing both retail and wholesale equity raising for transactions, the growth of Oyster’s investors, and continuing to improve Oyster’s service offering to investors.

MIKE TAYLOR

Mike is the founder and CEO of Pie Funds. He’s also portfolio manager of Pie Funds’ Chairman’s, Global Growth 2 and Conservative funds.

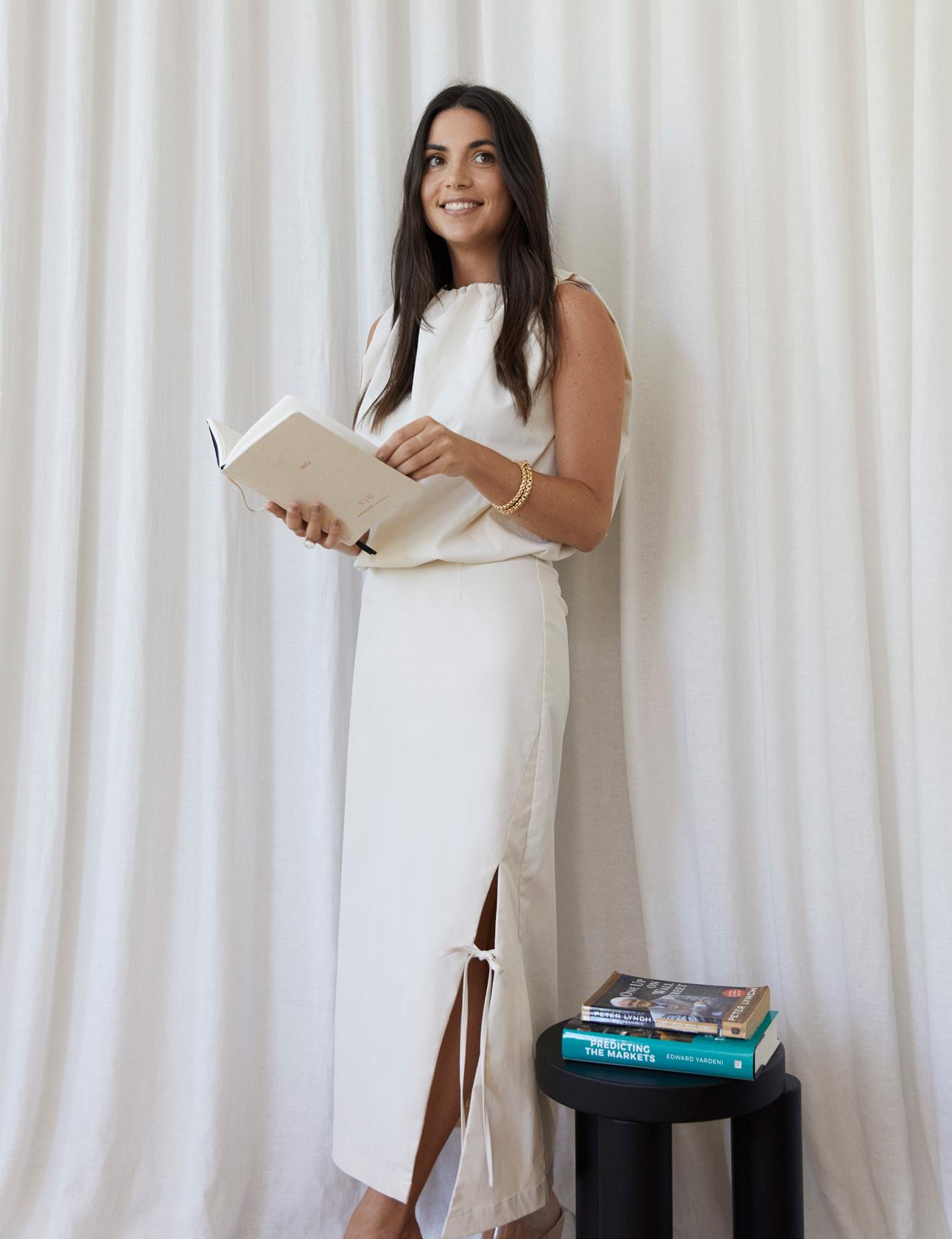

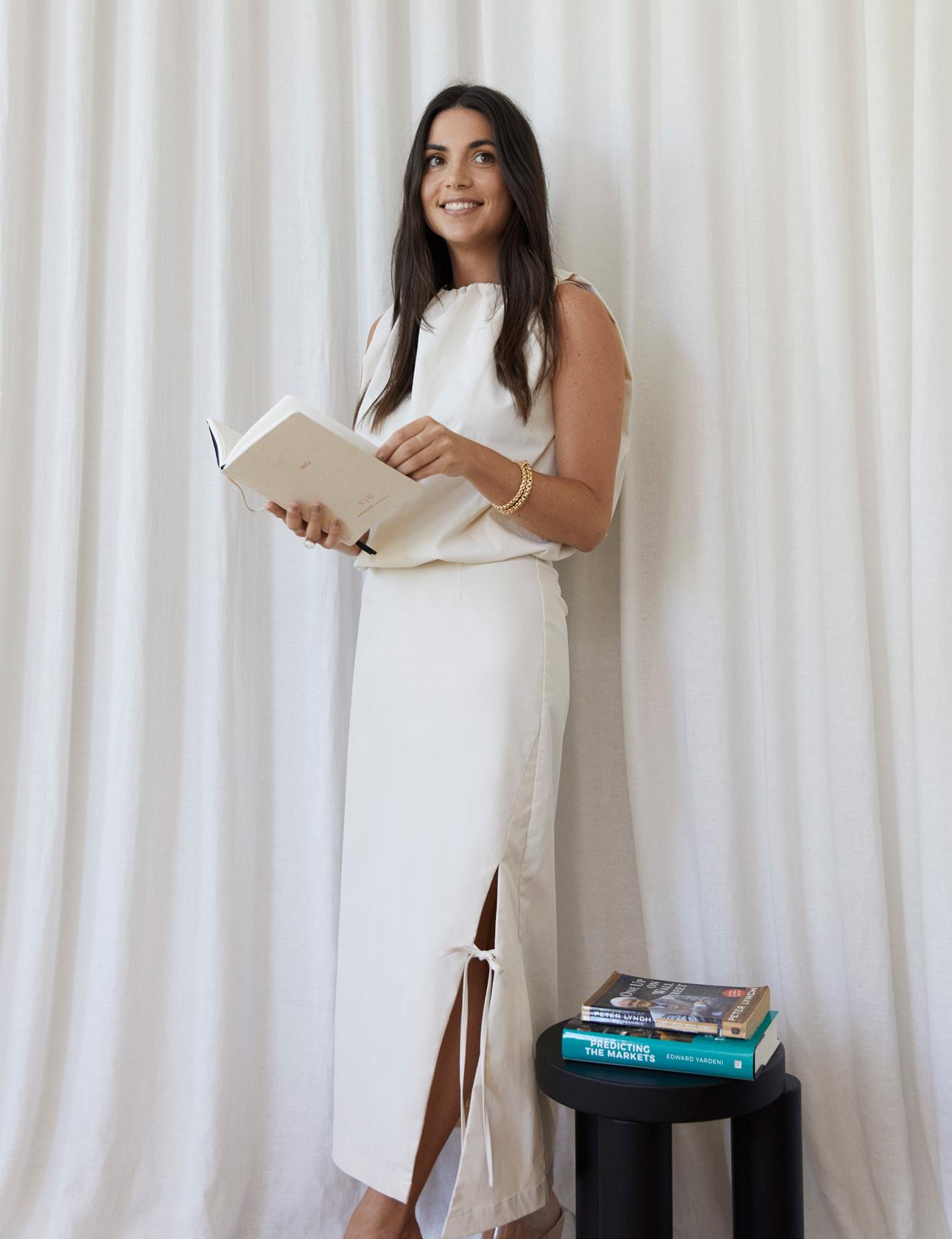

VICTORIA HARRIS

Former portfolio manager at Devon Funds, Victoria is co-founder of The Curve, a digital platform aimed at educating women around money.

years in her own accounting practice before co-founding blends psychology and neuroscience with money

BEN TUTTY

Ben is an Auckland-based but not Auckland-bound property investor and freelance writer. He’s travelled and worked across Asia, Europe, and Australasia, writing for some of the biggest names in property and finance.

CONTRIBUTORS

SPRING 2023 | INFORMED INVESTOR 9

What We Like

A showcase of trends, technology and luxe living.

Coffee for fashionistas

Encapsulating the fusion between fashion and coffee, Dolce & Gabbana has joined forces with Bialetti to reimagine the iconic Moka Express. In celebration of the brands’ Italian heritage and shared love for the morning ritual, the alliance sees a makeover to the stovetop with Dolce & Gabbana’s vision and the charm of carretto siciliano.

Bialetti x Dolce & Gabbana’s limited edition Moka Express is available now in three-cup and six-cup at Sabato or online at Bialetti.co.nz.

Objects of desire

Art+Object auctions are an education in art. Their saleroom viewings are glorious affairs – displayed as exhibitions, they feature some of the best art and design works in Aotearoa.

In mid-September, a significant auction will take place here, when they present Gary Langsford and Vicki Vuleta’s personal collection for sale. Gary Langsford is a New Zealand arts icon, having founded the Gow Langsford Gallery in 1987, and Vuleta is an interior designer who runs Design55. They are downsizing and moving out of Auckland and selling many of their beautiful works.

This presents art lovers a with a unique opportunity to see, and bid on, pieces from some of the world’s leading artists. The collection includes works by Damien Hirst, Judy Millar, Thomas Ruff . . . even Pablo Picasso.

The auction will take place at 6pm on Tuesday, September 19 at the salerooms at 3 Abbey Street, Newton; and online at live. artandobject.co.nz. For more details visit art+object.co.nz

UP FRONT

SPRING 2023 | INFORMED INVESTOR 10

New chatbot for investors

As Kiwis increasingly turn towards selfdirected investing, Tiger Brokers has launched its AI-powered chatbot TigerGPT for the New Zealand market. One of the first of its kind in the industry, TigerGPT is also available in Australia and Singapore. It introduces features that allow investors to research stocks, summarise key insights from earnings calls and releases, and extract pertinent company news and sentiment analysis in seconds based on questions asked by users in the Tiger Trade app. The chatbot is updated weekly. TigerGPT was developed by Tiger

Brokers’ research and development services and engineers to revolutionise investor experience on a larger scale. It demonstrates the crucial role of AI and machine learning in today’s investment industry and is a significant advancement in Tiger’s efforts to empower investors to increase investment efficiency.

Users no longer need to rely solely on keyword searches or sifting through vast amounts of information to find relevant and concise content.

There is a suite of new features to streamline the process of pre-investment decision-making, including personalised stock research which enables investors

to quickly filter stocks based on their own criteria, and show trending market topics. Another key feature is the ability to summarise highlights from earnings calls and releases, offering a comprehensive overview of a company’s performance. Leveraging Tiger Trade’s access to premium data and research, TigerGPT adds data including support and resistance indicators, stock trend analysis and economic calendars.

The full version of TigerGPT is now accessible in NZ through the Tiger Trade app.

WHAT WE LIKE SPRING 2023 | INFORMED INVESTOR 11

Spring is in the Air

Let’s brighten things up and welcome the new season.

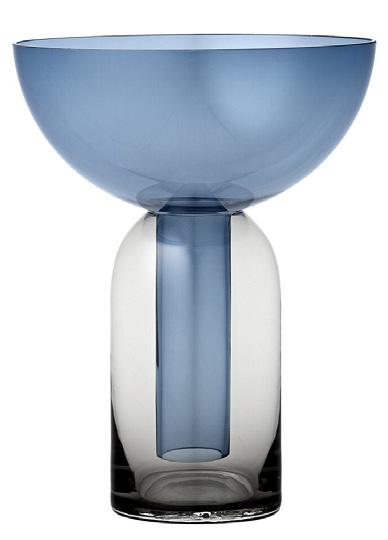

ESSENTIALS 6 4 2 1 7 3 5

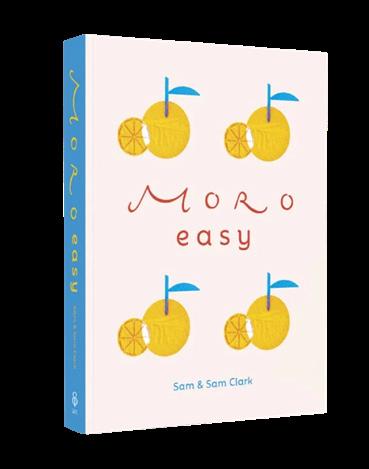

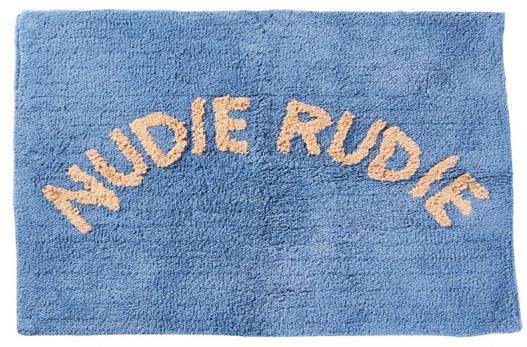

1. Gorman Sour Straps cylinder vase – gormanshop.co.nz, 2. Merle table lamp – www.achomestore.co.nz, 3. Folded bookend – infinitedefinite.com, 4. Freedom Lune fabric daybed - www.freedomfurniture.co.nz, 5. Superette Sage and Clare Tula Nudie bathmat – superette.co.nz, 6. Freedom Palm Springs fabric occasional chair – www.freedomfurniture.co.nz, 7. Slow Torus vase small – www.slowstore.co.nz, 8. A&C Moro Easy – www.achomestore.co.nz

8 SPRING 2023 | INFORMED INVESTOR 12

Bright accents and cooling whites for hip home highlights.

Make it Pop resene.co.nz/colorshops

Resene Wonderland

Resene Skydiver

Resene Supernova

Resene Pursuit

12 13 14

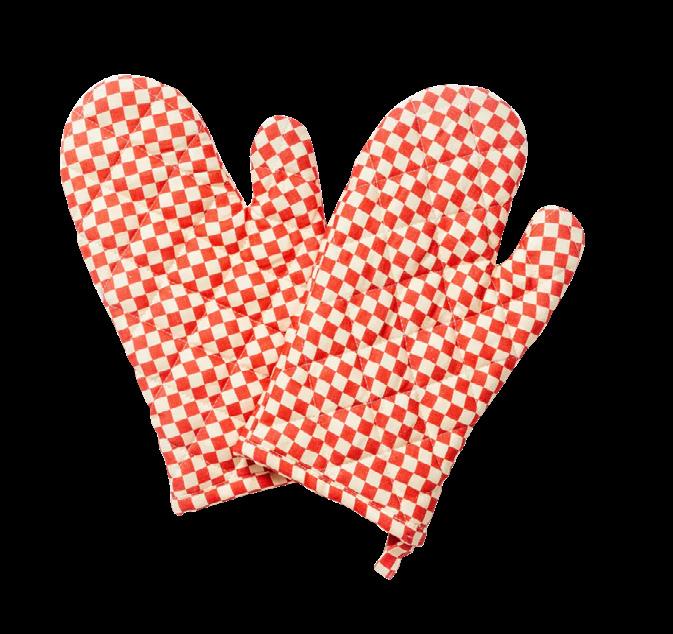

9. Father Rabbit Bonnie and Neil oven mitts – fatherrabbit.com, 10. Frank Green 34oz reusable bottle – superette.co.nz, 11. Ellis Brooklyn Bee eau de parfum – www.meccabeauty.co.nz, 12. Adairs Daisy Mustard Rust rug – www.adairs.co.nz, 13. Crisp Pen Pen Desk Tidy red – crisphomeandwear.co.nz, 14. Adairs Archie Violet Marle towel range – adairs.co.nz, 15. Coffee Supreme x Maruhiro Hasami block mug tall – coffeesupreme.com, 16. Kit: Universal face lotion – www.meccabeauty.co.nz

Can you Afford a 20-year Holiday?

Having a financial plan can lead to retirement success – and maybe the odd piña colada beachside too, writes Victoria

Personally, I couldn’t afford a 20-year holiday right now. But I could if I had the right financial plan in place, and enough time. And so could you. They say the average length of time we’re in retirement is 20 years. This is a period of time where we are not earning and so are essentially on – a 20-year holiday.

Pension, retirement, superannuation – whatever you want to call it – they all sound pretty boring to be honest. I don’t know about you, but whenever I hear these words, I don’t get that excited. I get flashes of old people, grey hair and community living. However, with the population now leading fitter and healthier lives, the word “retirement” should bring flashes of drinking wine in magical vineyards, cruising on a boat in the Caribbean or relaxing on a beach in the Med.

Exciting phase

We are trying to change the view of retirement as an exciting phase of life. A time where you get to relax, have fun and enjoy the part of your life you have worked so hard for. However, in order to enjoy your “20-year holiday”, you need a financial plan. Nobody will be paying you a salary, so you need to ensure you have enough to pay yourself.

So, how much does a 20-year holiday cost?

A rough rule of thumb suggests you will need 80 per cent of your current salary for every year of your holiday. This will allow you to live your current lifestyle, while on holiday. If you’re

Harris of The Curve.

currently earning $100,000 per year, you will need $80,000 each year, for 20 years. This is $1.6 million. It sounds like a lot but if you’re 30 years old, and haven’t saved anything for your 20-year holiday yet, you only need to invest $700 a month to achieve this by the time you’re 65 years old*. This is only really 8 per cent of your salary and totally doable if you set your mind to it and be disciplined.

Getting started

I mentioned you need a plan, but you also need time. The sooner you start contributing to your 20-year holiday fund, the less you will have to save due to the magical thing called compound interest.

Taking the $1.6m figure, if you waited another 10 years and didn’t start putting money aside to your holiday fund until you were 40 years old, you would need to contribute more than DOUBLE. You would need to put aside $1,500, instead of $700 per month in order to enjoy your holiday. Having a financial plan for any goal is key. Retirement should be exciting, not scary or overwhelming. You don’t want to wake up in a panic the day before your holiday, stressing about how you’ll afford it. Be prepared. Have a plan. And stick to it. Because the only thing you should be stressing about on holiday, is whether to order a piña colada or aperol spritz.

*assuming an average return of 8 per cent per year

The sooner you start contributing to your 20-year holiday fund, the less you will have to save due to the magical thing called compound interest.

WOMEN & MONEY

SPRING 2023 | INFORMED INVESTOR 15

Going Up, Going Down

Economist Cameron Bagrie takes a good, hard look at New Zealand and how we’re going as a nation.

What is sustainable?

The (RBNZ) Committee noted in their most recent OCR decision that “after recent falls house prices are now around sustainable levels”. Adjusted for inflation, house prices are now back at 2019 levels. House prices didn’t feel sustainable back then! The median sale price is still 7.5 times median household income, although it did get up to a multiple of 9.

The R word

Recession? Are we in one? Two quarters of negative growth say so. Continued low unemployment and rising incomes says otherwise. Has the past five years been normal or abnormal? I would say abnormal and a return to normality beckons. That’s a reset and for those conditioned to low interest rates, it’s a big wake-up call. The economy is still operating at a high level of activity, and the level is not consistent with getting inflation to 2 per cent.

The R-word #2

Reset and a repair job. The economy is facing one and I’m not just talking about potholes. Inflation, an 8.5 per cent current account deficit, poor school achievement, rising concerns over crime/law and order, $1.6 billion deficits across local authorities, a poor health system, and fiscal (government) operating deficits, are all gauges of imbalance and an economy that has strayed out of its economic lane.

Taxing times

Government tax revenue is now undershooting expectations, coming in $2.3 billion below forecast in the 11 months ended May 2023, with company tax 10 per cent below expectations. Tax revenue is almost $6 billion below the forecast made in late 2022. The 2023 Budget had lower tax forecasts, and numbers are still undershooting that. The economy is being blamed, but inflation looks the real culprit. Inflation or higher costs hit businesses as well as households.

Jobs

With the profit cycle turning, attention will turn to costs. The number of people on a benefit has risen 8,000 since the start of May.

Staying the course

On hold is the message from the Reserve Bank when it comes to the official cash rate (OCR), with inflation heading lower and the risks noted as balanced. Interest rates can still move even though the OCR need not change. Fixed lending rates are a function of the outlook for the OCR. A key reason fixed lending rates have moved up in the past month is because expectations the OCR could fall in 2024 have been pared back. Term deposit rates have moved up too, which has been good for savers.

SPRING 2023 | INFORMED INVESTOR 16

UP FRONT

Coming down

The annual inflation rate has eased to 6 per cent. The direction of travel is lower. Inflation remains sticky though with non-tradable (domestic) inflation 6.6 per cent and various core measures of inflation around 6 per cent. Six per cent is a long way from the 2 per cent target for inflation. The real inflation rate to households is the cost of food and it is still showing double digits.

Finding a base

The housing market is showing signs of finding a base, with prices now broadly stable month-on-month, days to sell receding from highs and volumes picking up (from low levels). Migration, rising incomes, interest acceptance and loan-to-value ratio changes are pointed to as positive factors. The delayed impact of higher interest rates as fixed loans refix will act as a headwind. One factor not talked about for housing is the switch. Building consents are declining. Construction costs have risen 20 per cent and existing house prices have fallen 15 per cent from their peak. This screws the scrum towards buying existing stock.

Why limited strain?

Bank non-performing loans for housing remain low with around 0.3 per cent of total loan defined as non-performing. Yet we see the media reporting stress. When interest rates fell many borrowers kept payments unchanged, meaning they paid more in principal, getting ahead of their mortgage schedule. Higher interest rates are now biting, but being ahead to start means borrowers have a bit more time on their side before the real stress hits and they fall behind.

Question?

Optimists point to the property market being on an upwards and positive price path. Will inflation continue to come down if that takes place? I doubt it. It might be the cue for even higher interest rates.

The lag in monetary policy

According to the Reserve Bank, “Average mortgage rates on outstanding loans have increased from about 3 per cent in early 2022 to about 5 per cent currently.” With current mortgage rates near 7 per cent, monetary policy is having a delayed effect. Around $170 billion of mortgages are refinancing in the coming year.

Still coming in or already here?

May showed a net migration monthly inflow of 4,938, which is strong but shows an easing trend (previously 7,633). Annual migration rose to 77,809. One thing to note about migration is that the government recently made it possible for some migrants on work visas who had already been living in New Zealand for a period to apply for a special resident class visa. So, the numbers are not strictly new arrivals.

SPRING 2023 | INFORMED INVESTOR 17 Correct as at 25 July 2023.

MARKET INSIGHTS

While Bagrie Economics uses all reasonable endeavours in producing reports to ensure the information is as accurate as practicable, Bagrie Economics shall not be liable for any loss or damage sustained by any person relying on such work whatever the cause of such loss or damage. Data and information have been gathered from sources Bagrie Economics believes to be reliable. The content does not constitute advice.

SPRING 2023 | INFORMED INVESTOR 18 UP FRONT

Retirement

/ri-‘tī(-ə)r-mənt/noun

‘Withdrawal from one's position or occupation or from active working life.’

– Merriam-Webster Dictionary

‘I see retirement as just another of these reinventions, another chance to do new things and be a new version of myself.’

QUOTE & DEFINITION SPRING 2023 | INFORMED INVESTOR 19

– Walt Mossberg, American journalist

The Art of Decumulation

For some, a perfectly executed decumulation of wealth means the cheque to the undertaker bounces. Regrettably, perhaps, few people can manage such exquisite timing, writes Martin Hawes.

A lifetime of finance comes in two stages.

The first stage (the accumulation) is about growing wealth; the second stage (the decumulation) is about using your savings and investments to give yourself a good steady income in retirement.

It may come as a surprise to learn that the second stage – decumulation – is by far the harder.

Decumulation is hard because most people in retirement now spend not just the returns from their investment capital, but actually spend the capital itself i.e., they augment the returns that they get by running down their savings and investments.

To decide how much to spend means there is a fundamental tension between spending enough to have the best retirement possible but without spending so much that the money runs out before you do.

For some, a perfectly executed decumulation would mean that the cheque to the undertaker would bounce – that is you would go out on the last dollar.

The rate of drawdown

Regrettably, perhaps, few people can

manage such exquisite timing. Instead, we may overspend and run out of money (most people’s greatest fear) or we play it safe and underspend and forgo things and experiences that we could have had (which is what people do).

The rate at which you can draw down on the portfolio is probably around 5 per cent p.a. That means that if you had $300,000, you could draw around $15,000 p.a. for about 30 years before the money was all gone. This is a rough guide – the figure is probably somewhere from 3.5 per cent to 6 per cent and depends on such things as your age, life expectancy, investment returns, and whether you will increase drawings with inflation.

This is not a matter of simply drawing on the cash returns (dividends and interest) as people used to do – instead you will continue to draw on the portfolio at a steady rate regardless of what is happening in the markets (after all, you need to buy groceries and meet your other regular expenses). This can be quite uncomfortable for some people as they watch the decline of their investment capital.

SPRING 2023 | INFORMED INVESTOR 21 INVESTMENT

‘The best store of wealth invented is the diversified portfolio.’

should extend to investments outside New Zealand.’

The drawdown rate assumes that you have adopted a conventional investment strategy. This would be a well-diversified portfolio with money spread across all the main asset classes.

There are a few retirees who adopt different strategies – e.g. they buy a rental property with the aim of living off the rent, or they invest solely in term deposits and roll these over as they mature.

Accessing capital

Neither of these investment strategies is a good idea: rental property is a single asset which may not perform – e.g., houses are subject to politics with changes to the taxation or possible rent controls. Moreover, property is an asset class where it is difficult to access capital; unlike more liquid investments, you cannot draw cash from property on a regular basis.

Nor is the term deposit strategy right for retirees. The after-tax returns from term deposits are volatile; in the last couple of years gross returns from term deposits have varied between less than 1 per cent to more than 5 per cent. In any event, the returns from term deposits after tax very often do not keep up with inflation (they certainly haven’t in the last few years).

The best store of wealth invented is the diversified portfolio – and this is the best approach for retirees. This means that you have exposure to all the main asset classes (shares, listed property, fixed interest and cash) and that within these asset classes you have a wide range of investments (i.e. you own shares, many fixed interest investments, etc.)

Each asset class may perform differently depending on the prevailing economic conditions. Retirement may be for 30 years or longer, and over that time anything may happen. The whole point of a diversified portfolio is that one investment class will perform while others are not.

Global shares Diversification should extend to investments outside New Zealand. For example, most likely you will have global shares in your portfolio to cover you from something bad happening to NZ. Think about a major biosecurity breach (e.g., foot and mouth disease) and think further about what would happen to your retirement in the resulting economic and currency collapse – international investments would act as a kind of insurance.

In most cases this will mean using managed funds of one sort or another. For example, you may use a KiwiSaver fund – people over 65 can put money into a KiwiSaver and take it out again. Some people may establish an investment account through a

financial adviser and have them make their investments.

A small number may take a DIY approach, but be careful with this: few people have the skills or are prepared to devote the time to managing their own investments. You will only have one retirement and getting your investment strategy and drawdown rate right is critical. If there was ever a time to get some good advice, this would be it.

Martin Hawes is a financial author and speaker. He is not a Financial Advice provider nor a Financial Adviser. The information contained in this article is general in nature and is not intended to be financial advice. Before making any financial decisions, you should consult a professional financial adviser. Nothing in this article is, or should be taken as, an offer, invitation or recommendation to buy, sell or retain a regulated financial product.

SPRING 2023 | INFORMED INVESTOR 22 FEATURES

‘Diversification

Cashflow feeling the squeeze? 4.9 out of 5 Rated ‘Excellent’ from over 1500 reviews Available on the Web, iOS & Android in rent reconciled through myRent $664M 5 star reviews by our landlords 1,373 NZ‘s most trusted landlord software 24,000 landlords Save $2,000+ on management fees using myRent. *

It’s All About Planning for the Golden Years

It’s never too soon to start picturing the kind of retirement you might want and thinking about what you can do to make it happen, writes

Amy Hamilton Chadwick

Are you on track for retirement? It’s perhaps the fundamental financial question for anyone aged over 45 because the stakes are so high. Get it wrong and you could be living a hard-scrabble existence into your 70, 80s, and 90s.

But it also goes beyond just the financial questions. Once you do retire, what will you do with your time? Do you want to work at all? Do you want to travel? What are your priorities in your later life?

It’s never too soon to start imaging the kind of retirement you might want, and thinking about what you can do to make your ideal retirement possible.

NZ Super isn’t enough

An astonishing 40 per cent of Kiwis aged 65-plus have almost no income other than their superannuation, according to Older People’s Voices, a report by Te Ara Ahunga Ora Retirement Commission (TAAO). Those individuals told researchers they often had to forgo essentials, including food, health or power.

“It’s a huge concern,” says David Callanan, general manager of Corporate Trustee Services at Public Trust. “NZ Super is there to

maintain a minimum quality of life – people find a way to live on it, but it’s pretty tough and they tend to be living hand to mouth.”

He says more people could avoid this position by planning ahead for retirement, particularly when it comes to KiwiSaver. Increasing your contributions can have a small impact on your life now but will make a significant difference once you stop working. Callanan would like to see higher employer and employee contributions – mandatory employer superannuation contributions in Australia, for example, are 11 per cent. He would also like to see help for people in default funds to engage more with their savings and consider switching to a highergrowth option.

“You can’t just wing it; you have to have a plan for retirement, so you can continue your quality of life beyond your working years,” Callanan says. “Use the power of accumulation and long-term investing – the sooner you start, the sooner you get the benefit of the accumulation. When you get a pay rise or change jobs, it’s the perfect time to think about whether you can increase your KiwiSaver contribution.”

SPRING 2023 | INFORMED INVESTOR 25 RETIREMENT

‘Those feeling comfortable in retirement tended to be disciplined and careful; they owned homes, saved money, and invested in KiwiSaver.’

The kind of work you want

That pay rise or job change might also be a catalyst for thinking about how you’ll work after you turn 65, if at all.

When the company Ian Fraser managed went under, he was in his late fifties, and he was surprised by how difficult it was to find another job. He had expected it to be an easy process after a good career in management, but instead it was a struggle. That experience led him to set up Seniors@Work in 2019, a job platform specifically for those aged 50-plus. It’s been growing rapidly over the past four years. Fraser is now 71, and still enjoying work. He likes the mental challenge, and he appreciates the income; he and his wife are paying off the mortgage and like to visit their two adult children in London. He mixes up a few different part-time jobs, working around 30 hours a week, with a plan to step back a bit once he turns 75. He’s not the only older Kiwi who’s enjoying work. The 2023 Working Seniors Report found that more than half (51 per cent) of those aged 50-plus say they are “very satisfied” or “extremely satisfied” with their job, and 81 per cent believe that staying in the workforce longer is a good thing for Kiwi seniors.

If you plan to work beyond 65, think ahead, says Fraser. You won’t be able to do a physical job into your 70s, so you may need to pivot towards a lower-impact role. And don’t expect to be able to walk into your dream job, even if your career has been an impressive one. “The dynamic is different, and recruiters are only interested in your last 10 or 15 years of experience, so rethink your CV,” he advises.

Heartland Bank Limited’s responsible lending criteria, T&C’s, fees and charges apply.

forfinancial freedom in retirement? If you’re over 60, a Heartland Reverse Mortgage could help take the stress out of everyday expenses, along with covering home repairs, consolidating debt and much more. If you want to find out how you can live a more comfortable retirement, call us on 0800 488 740 or visit us at heartland.co.nz FEATURES

Looking

“Take up any opportunity to upskill if it’s offered, and consider your transferable skills, don’t shy away from them.”

Financial literacy a boost

You should also take any opportunity to upskill your financial knowledge, because this can have a significant impact on your long-term wealth. Understanding the basics of managing your money, including how and why to invest in different types of assets, leads to more positive outcomes regardless of your level of formal education.

One United States study estimated that people who are financially literate will retire with 30 to 40 per cent more wealth when compared to those with no financial literacy.

“This is a very high number, but it’s also not surprising,” author Dr Annamaria Lusardi told a podcast in 2022. “We might have the same income, we might have the same education, but if I invest in stocks and you don’t invest in stocks, 20 years later we might indeed look very different.”

This was echoed by respondents in Older People’s Voices, who were asked what advice they would give their younger selves. Their suggestions included “start learning about money when you are young,” and “be responsible for your own financial literacy”.

How assets can support you

The Older People’s Voices report found that those feeling comfortable in retirement tended to be disciplined and careful. They owned homes, saved money, and invested in KiwiSaver, property and other assets (and inheritances helped, too). As those disciplined savers know, the right investments can set you up for a high-quality retirement that includes travel, restaurant meals and plenty of treats for the grandchildren.

Income-producing assets can give you passive income – money that keeps flowing in even when you’re not working. This means investing in assets like shares (including via KiwiSaver), property, or a business. There are varying levels of risk in each approach, but the sooner you start the more time you have to recover if something goes wrong. Once you stop working, these assets can continue providing you an income, or you can sell them and use the profits to meet your costs.

Your home isn’t (usually) an incomeproducing asset, so you may need to work a little harder to make use of the equity you’ve built up over the years. You can turn your equity into cash by downsizing or borrowing against it – plan ahead and do your homework so you understand how and when these strategies can work.

“In our research, people told us they would like to downsize but they couldn’t find suitable properties,” says Dr Suzy Morrissey, director, policy and research, TAAO. “That generally means a property in the right area that is accessible. You might want a house that’s on one level, for instance. I live in Wellington, so here it might mean a house that doesn’t have 30 steps to the front door. Staying in the family home sounds nice from an asset perspective, but it’s not always the most appropriate place for older people.”

She adds that Kiwi retirees are often “asset rich, cash poor”, but home equity release products aren’t necessarily well-regarded by the public, even though they can be very useful in certain circumstances. While they won’t suit everyone, it’s worth finding out more about them to understand if they could be a way to fund the later years of retirement.

‘Whether you want to travel extensively, quit work and play golf full-time, or pay for your grandchildren’s education, the sooner you start planning the better.’

SPRING 2023 | INFORMED INVESTOR 27 RETIREMENT

Doing nothing the biggest risk

Not sure how to get started on investing for your retirement? Ask yourself what you want your retirement to look like, says Lisa Dudson, financial expert and author of Good with Money. That’s the question Dudson asks her clients, and as long as the result is a realistic one, she uses the answer to come up with financial targets, then creates a road map to help put them on the right path.

“That gives you a rough plan, then you need to do regular check-ins where you re-check your numbers and what you want your lifestyle to look like – variables do come along so you need to be nimble.”

These days there’s a lot more flexibility in the way we can live and work, which can help you achieve the kind of lifestyle you want.

One of Dudson’s clients wanted to quit his job and spend more time travelling. After asking a few questions, Dudson suggested that instead of quitting his job, which he still enjoyed, he should negotiate with his employer to work remotely for four weeks a year. Along with his annual leave, that allowed him to keep earning a full-time salary while enjoying an enviable lifestyle of regular travel and adventure.

Whether you want to travel extensively, quit work and play golf full-time, or pay for your grandchildren’s education, the sooner you start planning the better. Talk to a financial adviser, boost your financial education, set your goals and get yourself on track.

“I meet a lot of people who have procrastinated for so long that they’ve done nothing for years, and they’ve missed out on a lot of opportunities to take advantage of the power of compounding over time,” says Dudson. “Unfortunately, a lot of people are immobilised by fear – but doing nothing is a huge risk. Don’t get yourself tied up in knots, just make a start. Anything is better than doing nothing.”

Close Look at the FIRE Movement

The FIRE movement – financial independence, retire early – has captured imaginations around the world. Why not retire when you’re in your thirties or forties? FIRE makes this possible: you live frugally for years, saving up a lump sum and investing it in such a way that you can live off the passive income. You never need to work again, although your spending will be tightly restricted.

Although retiring early can be a dream come true, life tends to get in the way of even the most impressively well-laid plans. One unnamed IT professional used the lean FIRE method to retire at 37 with US$950,000 in assets. He found that the first few years of reading, relaxing and travelling were brilliant. However, he was hit by two of the big three life shocks: his marriage broke down and he had health problems. With higher-than-expected costs, he re-entered the workforce five years later.

“Yeah, without my former partner I became depressed and anxious and again struggled with one of the great questions that terrorises us all: purpose,” he writes at LivingaFI.com. “I realised I needed more out of life. The discomfort; that growing sense of unhappiness, the creeping edges of depression just out of my direct line of sight as though it’s hiding in the periphery at all times. That discomfort did exactly what it was supposed to do. It prompted me to make some major changes that

The Three Big Life Shocks

Even if you are currently heading for a comfortable retirement, major life events can change the direction.

“The three big life shocks are: a relationship breakdown, a serious health problem or disability, and redundancy,” Dr Suzy Morrissey says. “When someone has been on track for retirement and then they’ve been derailed, it’s usually by one of these.”

As much as possible you want to take care of your relationships and your health, but these big life shocks can still happen. It may be worth considering income insurance and health insurance, Morrissey

moved me in the right direction. As far as failures go, it was a good one.”

He met someone new and set about building a new life. He’s still financially independent, because his assets grew during those five years to US$1.3 million, but he’s working so he can support a higher-spending lifestyle and possibly children. It’s a great reminder that an important aspect of FIRE is the financial freedom to choose, not necessarily the ability to lie on the beach all day.

“All of my saving and investing in my 20s and 30s has positioned me to do whatever I wanted, more or less. It has given me freedom to make choices, exactly as I’d hoped it would all along.” suggests, to mitigate the financial impact of either of these problems.

A separation later in life can throw a spanner into all your financial plans. When home-owning couples separate and sell their house, there’s often not enough cash left over for both parties to each buy another house.

“When you go through a separation, you’ll probably engage a lawyer, but you should also think about engaging a financial adviser,” says Morrissey. “Think about the assets you’re taking, and which ones are appreciating assets, and what their value is, including your KiwiSaver, because that’s relationship property and it can be split in a separation.”

SPRING 2023 | INFORMED INVESTOR 28 FEATURES

‘I meet a lot of people who have procrastinated for so long that they’ve done nothing for years, and they’ve missed out.’

Get in touch with our team to nd out more about PMG funds and investment opportunities 07 578 3494 pmgfunds.co.nz With a track record of stability, continuity and performance, we value growing relationships as much as we value growing returns. We invest alongside our clients, sharing both the risks and returns, our directors and team have skin in the game too. Established over 30 years ago, PMG Funds is one of New Zealand’s largest licensed commercial property fund managers. The information in this advertisement is of a general nature and was current as at 15 June 2023. It is not intended to be regulated nancial advice for the purpose of the Financial Markets Conduct Act 2013, and does not take your individual circumstances and nancial situation into account. PMG does not provide nancial advice. Please seek advice from a licenced nancial advice provider before making any investment decisions.

5 PRINCIPLES FOR GROWTH

Guy Thornewill Head of Global Research

Michelle Lopez Head of Australasian Equities and Portfolio Manager

NZ OFFICE AU OFFICE UK OFFICE

Mike Taylor Founder and CIO

How we find quality growth companies

Investing in the stock market can be risky. There’s a lot to consider, requiring an examination from the bottom-up of stock-specific risks while also studying the broader top-down influences in the geography and sector a stock operates in.

In our 15 years of investing at Pie Funds, five key principles have provided us with a robust investment process. Our investment teams use these principles to help identify potential areas of risk, ways to reduce those risks and help build resilient portfolios that can perform even when the markets are tough.

Principle One: Skin in the game

Our staff, directors and shareholders are invested in our funds, so we treat it like it’s our money as well, and look for this level of commitment from the founder-led companies we invest in.

Principle Two: Fundamentals

We examine a company’s fundamentals, approaches and practices, looking for long-term viability and growth potential.

Principle Three: We invest in people

We invest in quality businesses with proven management teams. If the people change, we review our investments.

Principle Four: We like to see tailwinds

We look for emerging market leaders and get in early, so we’re there for the ride up.

Principle Five: Plan for a rainy day

We’re long-term thinkers and are ready to act when we see a threat or opportunity.

These principles – combined with having investment teams based not only locally, but also in Sydney and London to meet directly with potential business leaders in-person – help us identify stocks we think will outperform the market in the long term. We stick to these principles whether markets are up or down.

Our core investment objective, which has not changed since Pie Funds launched, is to find high-quality growth companies with strong balance sheets and great management teams. And our five principles help us deliver that objective to our clients.

Funds Management Limited

the manager of the funds

the Pie

Management Scheme.

disclosure

please

Any advice

given by Pie

Management Limited and is general only. Our advice relates only to the specific financial products mentioned and does not account for personal circumstances or financial goals. Please see a financial adviser for tailored advice. You may have to pay product or other fees, like brokerage, if you act on any advice. As manager of the Pie Funds Management Scheme investment funds, we receive fees determined by your balance and we benefit financially if you invest in our products. We manage this conflict of interest via an internal compliance framework designed to help us meet our duties to you.

Contact us on 09 486 1701 or email clients@piefunds.co.nz to find out how we can help you.

PIEFUNDS .CO.NZ

Pie

is

in

Funds

To see the product

statement,

visit www.piefunds.co.nz.

is

Funds

Reverse Mortgages Can Be a Sensible Option

For Kiwis over 60 years old, with enough equity in their own home, there are options that can provide financial relief.

Living through challenging financial times is difficult for many Kiwis, with the increased cost of living. Seniors are especially hit hard with inflation sitting at 7.1 per cent.

With high interest rates on credit cards and personal loans, it’s understandable that people are hesitant to borrow money, especially once they retire. However, for Kiwis over 60 years old, with enough equity in their own home, there are sensible ways that can provide financial relief.

This is where accessing some of the equity in your home with a reverse mortgage can be a sensible option, to help fund a more comfortable retirement.

According to Stats NZ, the cost of living for the average Kiwi household increased 7.7 per cent in the 12 months to March 2023. This follows an 8.2 per cent increase in the 12 months to December 2022.

For many, it can be a real struggle to fill up the shopping trolley, pay the electricity bill or book a hairdresser, let alone make those well needed home improvements or grab a well-deserved getaway. Some retirees are in a position to draw down on their savings, like KiwiSaver or other investments. However, this still may not be enough.

Tight times

Research by Te Ara Ahunga Ora Retirement Commission shows 40 per cent of people aged 65 and over have virtually no other income besides NZ Super. And another 20

per cent have only a little more. Even with NZ Super, close to one in three people don’t think they will have enough for retirement unless they continue working past 65.

With a Heartland Reverse Mortgage, the total loan amount, including accumulated interest, is repayable when you move permanently from your home. This could occur when you sell your property, move into long-term care, or pass away.

Heartland Bank general manager, retail, Keira Billot, says: “The amount you can access depends on your age and the value of your home. You have the flexibility to repay the loan partially, or in full, at any time without paying penalty charges.

“You can use the money for a number of things. However, we are seeing an increasing number of customers using their reverse mortgage to consolidate debt, such as paying off credit cards or their standard mortgage, taking the pressure off having to make regular repayments.

“The most common reason people take out a Heartland Reverse Mortgage is for home improvements and repairs. Debt consolidation is now the second most common reverse mortgage loan purpose, which demonstrates the financial difficulties over 60-year-olds are facing as they enter retirement.”

Easy to manage

A Heartland Reverse Mortgage is easy to

manage and provides protections, such as no regular repayments until you sell or leave your home, lifetime occupancy, and a no negative equity guarantee, which means the amount required to repay the loan will never exceed the net sale proceeds of the property.

A Heartland Reverse Mortgage can also be used to top up your monthly income, with an Easy Living Monthly Advance. You can also take a reverse mortgage against a secondary property, such as an investment property or holiday home. A Secondary Property Loan provides you the same benefits of a reverse mortgage on your primary home.

A reverse mortgage is not for everyone, but in many cases it can be transformational. To be eligible you need to be over the age of 60, own your own home outright, or have a standard mortgage that can be paid off by the reverse mortgage. Heartland’s customers must seek independent legal advice, and are encouraged to seek independent financial advice and speak to family.

Heartland Bank is the leading provider of reverse mortgages in New Zealand and for the past 20 years has helped more than 22,000 Kiwis enjoy more freedom in their retirement.

Applications are subject to loan approval criteria. Heartland Bank Limited’s responsible lending criteria, fees and charges apply.

HEARTLAND BANK

SPRING 2023 | INFORMED INVESTOR 33

The Benefits and Rules of a Good FIRE

Ben Tutty settles in to examine the flames fanning a very different way of living.

You know the drill. You’re going to work for almost 50 years until you’re 65 and retire for 20 or 30 (sigh). But what if it could be different? Financial independence retire early, or FIRE, is a way of living that has enabled many to break free from the traditional 40 or 50-year working life. Glorious as that may sound, there’s no such thing as a free lunch (or retirement) and FIREing can require significant sacrifices. Is it all worth it?

Ruth aka The Happy Saver is New Zealand’s most prominent FIRE fan. She lives in Alexandra with her partner Jonny and teenage daughter and held $422,000 in broad-based index funds as of May 2023.

She’s 49 and Jonny’s 50, but they’re both semiretired and work two days a week at super flexible, relaxed jobs that fit nicely around their lifestyles. Ruth also blogs at happysaver.com about her journey. When I asked her if she was happy, there was no hesitation.

“What’s not to like? I’m chuffed, sometimes I still can’t believe it. Life should be balancedand that comes from being able to choose how you live it.”

INSIGHTS SPRING 2023 | INFORMED INVESTOR 35

Hard to disagree with that. But how do Ruth and other FIRE adherents actually make it happen?

Obviously, FIRE requires a chunk of change. To build their wealth FIRE adherents usually do three things:

1. increase their income

2. decrease their expenses

3. invest as much as they can.

Hustles and spending

To increase their income FIRErs might pick up side hustles, rapidly advance in their careers, or even choose the most lucrative career path possible so they can FIRE. They may also be mindful of their spending (and in some cases extremely frugal) to ensure the gap between their income and costs is as wide as possible.

Last of all FIRErs will usually invest 50-70 per cent of their after-tax income into savings and investments, typically broadbased index funds with low fees (Ruth does around 30 per cent). And then when it’s finally time to retire they use something called the 4 per cent rule.

This widely-used rule assumes that if you can live off just 4 per cent of your nest egg per year in retirement it should outlast you. This rule is based on American research so it’s not as proven in New Zealand as it could be, plus some US financial advisers say 3.3 per cent is more accurate in the current economic climate.

To give you an idea of how much you might need: if you were to live off $50,000 a year, you’d need $1.25 million to retire, according to the 4 per cent rule.

FIRE is an amazing concept, with a lot of good ideas to offer, but there’s no denying it’s harder for Kiwis today than it was in the past.

For one, New Zealand’s median house price was around 3.2 times the median income back in 2001. In 2021, it was 9.3 and in 2023

it’s 7.17, according to REINZ and interest. co.nz. That means a mortgage will eat up a much larger portion of your income that might have otherwise been savings and make FIREing more difficult.

The cost of living is also rising much faster than wages and renting for life is more common (which of course makes FIRE harder). Ruth personally benefited from much lower house prices and admits it’s harder now, but she’s confident it’s still possible. It just takes sacrifice.

The sacrifices

Like any financial philosophy FIRE is not without its risks and drawbacks, according to James Blair, wealth director at Lighthouse Financial, an Auckland financial advisory. He agrees it’s got harder for young

people, but reckons it misses the point.

“Financial independence is not a crazy concept. There’s nothing wrong with wanting freedom, but the hardcore FIRE community will live on maybe 10 to 30 per cent of their income.

“They sacrifice the best years of their life for this magical future. They won’t do as many trips or have those special experiences, just to rush to retirement. I think if you hate your job that much, you’re clearly doing the wrong thing.”

On the flipside Blair draws attention to rising credit card default rates and the popularity of Afterpay. Lots of Kiwis have trouble with living in the moment a little too often and racking up debt that they’ll

SPRING 2023 | INFORMED INVESTOR 36 FEATURES

‘If you were to live off $50,000 a year, you’d need $1.25 million to retire, according to the 4 per cent rule.’

pay for later. Blair reckons it’s all about finding a balance, a middle ground that works for you, which is somewhere between FIRE and YOLO (you only live once).

“We believe in holistic financial planning. It’s not about more property, more money, more shares. It’s all about what’s important to you and your family. Making short and long-term goals, then prioritising them.

“The reality is everyone wants to achieve everything, but you’ve got to choose and make sacrifices.”

Blair’s way sounds good too. And if you wanted to FIRE, chances are he’d be able to help you make it happen. But he says most of the successful, happy people he knows don’t want to stop working.

“Ideally your identity as a person is tied into something you care about. Working is not linked to income. And while it’s nice to have that freedom, it’s really about finding that match between your passion and your skillset.”

Blair isn’t just talking; he clearly means what he says. When I asked him if he would change anything if money wasn’t an issue he said: “My life wouldn’t look much different. I’ve got an eight-month-old son and a wife at home so maybe I’d spend more time with them and travel a little more. But I’ve got the sweetest job. I get to help people live the lives they want to live.”

It’s not all or nothing Ruth says Blair has a point when it comes to

hardcore FIRE adherents, but most Kiwis aren’t keen on doing things that way. “Nobody wants to be that person who brings the cheapest bottle of wine to a BBQ and takes half home. The people I meet doing FIRE in NZ are not like that. They’re 30 or 40 and going about life as usual. They’re not miserable.”

For Ruth, FIRE is all about having f$#k you money: the freedom to do whatever she wants. She works two days a week in a friend’s business in a way that fits around her lifestyle and allows her to spend plenty of time doing what she wants to do. Both her and Jonny hang out with their daughter frequently, help out the community and spend more time doing things that don’t make money.

SPRING 2023 | INFORMED INVESTOR 37 INSIGHTS

“There’s something to be said about having parents who are present, surely.”

And while she says she’s definitely had to make choices, she doesn’t feel as if she’s sacrificed anything at all. “Some people try and say with FIRE you can have everything, but you can’t. Just like you can’t keep eating chips and chocolate if you want to lose weight.

“With that said, I don’t feel as if I’ve given up anything that I really want. It’s all about feeling content with what you’ve already got. And when you’re always content, that’s when happiness really comes.”

FIRE also stands for freedom

Ruth explains that if you can be content, you don’t need as much to retire as you may think. The oft-quoted figure of $1 million is way over the top for most people, she reckons. You also don’t need to stop work completely; FIRE is more about having the freedom to do whatever you want.

“I personally love working so FIRE for me is continuing to work because I like it. I like the customers and I also love writing my blog. It’s exposed me to thousands of Kiwis who are changing their lives.

“Another Kiwi FIREr I know is a 39-year-old engineer who’s completely stopped working. He lives in Central Otago and occasionally he’ll run bike trails for tourists during the summer because he loves it.”

Ruth admits FIRE may not be for everyone. But with that said, four out of 10 Kiwis are unhappy in their jobs and completely disengaged, according to culture coach Shane Green. Ruth reckons people often stay in jobs like this because they think there’s no other option, when there clearly is.

“What has become of us if we want to spend 40-plus hours a week toiling, usually for someone else. And why is it that if many of us did have more freedom, we wouldn’t know what to do with it?”

SPRING 2023 | INFORMED INVESTOR 38 FEATURES

‘FIRE is an amazing concept, with a lot of good ideas to offer.’

We lease, we sell, we manage, and we know how to increase the value of your Commercial Property. When results matter, you’ll want to talk to our specialist team. 0800 367 5263 | pb.co.nz/commercial Commercial Real Estate Property Brokers Ltd Licensed REAA 2008 PB057378

The Road to an Early Retirement Deserves a Good Map

The ebbs and flows of profits, property valuations and share markets can muddy someone’s ‘clear’ vision of their path to FIRE, but there are strategies to help, writes Mike

Taylor

The desire to have enough money to retire early isn’t a new one, but the number of roads you can take to get there has definitely grown in the last decade or so. The advent of new technology has created a lot of opportunities for entrepreneurs and generated increased discussion on the idea of being financially independent and retiring early (FIRE).

But an element the discussions sometimes gloss over are the truths about getting to that point. You can do as much forecasting as you want, plugging figures into calculators and projecting returns, but you won’t be able to forecast shifts in markets, crises or the rise and fall of companies. It’s important to remember you aren’t guaranteed a 10 per cent annual linear return. The ebbs and flows of profits, property valuations and share markets can muddy someone’s "clear" vision of their path to FIRE.

Some people try to address this by mapping out a more conservative overall return estimation, but that still leaves you potentially vulnerable if all your eggs are in one basket. Some years will be better, some may be quite worse – it’s important to plan ahead to try and handle these situations and ensure a drop in one area won’t torpedo your retirement goals.

Diversification so important

This is where diversification comes into play. By splitting your money across several different areas, you reduce your risk. While

this may be touched on from a high level by proponents of FIRE (or those discussing retirement in general), the details of what diversification looks like are all too often skimmed over.

Anyone worth their salt that’s covering FIRE or retirement should be hammering home the idea of diversification, and the right kind of diversification at that. It’s about investing what you have wisely, across several asset classes – including property, shares in different markets, cash, bonds and even alternatives – you can find just about anything in an ETF these days. And you should do all this without overly exposing yourself to one particular area. Don’t just put all of it into a single tracker fund and close your eyes.

This diversification is also important from a global perspective. Economic cycles happen at different paces across the world, meaning a lull in one market can see great opportunities in another. An example of this is how tech stocks in the United States essentially wrestled the S&P 500 back into a bull market in June, while NZX and ASX markets lagged. So, when looking at managed fund providers, be sure to find one that has exposure to different global markets.

The importance of due diligence cannot be overstated. If the company you’re investing in or the house you’re buying isn’t fundamentally sound, your money can quickly turn to smoke. For us, we use

five key principles to guide our investment choices. These principles are designed to help us ask the right questions, allowing us to determine the suitability of assets and investments.

Due diligence

And just like with the theoretical house or company, you need to do your due diligence when picking a fund manager. Talk to those you’re considering entrusting with part of your retirement nest egg, read reviews and find out as much as possible so you can be confident they’ll have your best interests at heart. You want to make sure they’re focused on long-term growth and don’t just follow the latest trends.

Planning for a safe and

secure

retirement isn’t a pipe dream, whether you end up retiring early or decide to work well into your 70s.

But the key to securing it is to look at all your options, ensure your eggs are wisely spread to avoid potential risks, and to try to work unexpected volatility into your planning. So, whether you’re embracing the FIRE concept or are just looking to safeguard your retirement, putting some of your money into a managed fund is a wise option, along with investing in other areas.

SPRING 2023 | INFORMED INVESTOR 41 PIE FUNDS

*Mike Taylor is the CIO and Founder of Pie Funds. You can view our disclosure documents on the Pie Funds website. For personalised financial advice, please speak to a financial adviser.

The Art of Engagement

Technology opened the arts to a new audience over lockdown, and it’s changing the way we collect, as Joanna Mathers explains.

Covid lockdowns thrust so many of life’s pleasures out of reach. Dining out, attending concerts, travelling overseas –stuck inside our homes, the world retracted within our walls.

Technology took on an outsized importance at this time, the internet facilitating connections to life outside our houses. The art world wasn’t exempt from the tsunami of digital. We were deprived of real-life encounters, and new technologies were welcomed, including those that allowed us to engage with the arts.

New York’s Metropolitan Museum of Art partnered with wireless network operator Verizon to provide anyone with an internet connection access to digitally rendered galleries, offering online access to nearly 50 works of art. Art Basel, the world’s most exclusive art fair, launched virtual viewing rooms; interest was so overwhelming that the site crashed.

A recent Art Basel report revealed that online-only sales peaked in 2021 at $13.3 billion; 85 per cent higher than in 2019.

Aotearoa hasn’t been immune to this trend. When Auckland’s Art+Object auction house introduced online-auction technology they increased their audience in the process.

“I don’t have any specific figures,” says Leigh Melville, managing director and part owner. But suffice to say that we have seen a significant increase in people taking part in our auctions, now that they are held both online and in person,”

Embracing the virtual New Zealand’s active artistic community has long been championed by passionate collectors. They are prepared to spend large amounts to secure works by their favourite artists.

But the rarefied air of the auction room, where people “in the know” spend millions on exclusive artworks, can be intimidating. And lockdown provided a unique opportunity for new or curious collectors to engage.

Art+Object had been dabbling with the idea of online auctions prior to the Covid lockdowns, as Melville explains. But there had been resistance because “we were founded on the concept of presenting art in a meaningful way”, and in real life.

So, when Covid reached our shores, there was a level of pessimism around what it would mean for their auctions.

Like so many workplaces, Art+Object “pivoted” fast-forwarding their online offerings and creating an app through which the public could engage with auctions. And this change expedited huge growth in registration for auctions.

“It was a big change for us, but the technology was embraced and the online auction appealed to a wide range of people. There’s no hierarchy and it’s not intimidating.”

Market broadens

Established collectors may have been at home in the “real world” auction house, but

for Millennials and Gen Z online auctions offer a comfortable alternative. The Hiscox Online Art Trade Report reveals that 71 per cent of worldwide online sales were made by people under the age of 54, with 47 per cent being between 18 and 34.

It’s apparent that the move to digital has significantly broadened the reach of art collection. Instagram, for example, allows artists to communicate directly with the public. “Instagram is a great friend of the artist,” Melville agrees.

Nevertheless, there is still a significant market for the celebrated names, which Melville speaks of as a “flight to quality” even amid economic downturn.

“The best pieces will always find a home, even in recession,” says Melville.

And while Melville doesn’t like to talk about art in terms of “investment”, she acknowledges that the right works have the

SPRING 2023 | INFORMED INVESTOR 42 FEATURES

power to exponentially increase in value. She uses the example of a work owned by celebrated collectors Tim and Sherrah Francis entitled The Canoe. They bought this Colin McCahon painting for just $500 in 1969.

When the Francis’ collection was sold posthumously at Art+Object in 2016, it changed hands for a [then] record price for a New Zealand painting of $1.35 million. And Michael Parekōwhai’s A Peak in Darien sold for a record $2,051,900 at an Art+Object auction in 2021.

Investing in ourselves

These figures are an indication of the importance local collectors place on local art. “We like our own art,” says Melville. “Local collectors don’t tend to be great collectors of art from overseas.”

There is immense pride in the quality and “punch-above-our-weight” nature of the art

of Aotearoa; an acknowledgement of how hard our artists work to be seen.

Melville points to our offerings on the international stage as an example. Simon Denny’s 2015 work at the Venice Biennale Secret Power, an incisive look at Five Eyes was lauded by many leading international news outlets as one of the most important national pavilions that year.

Don Binney’s work has seen significant increase in value recently, she says, with a piece selling for over $1 million. And contemporary artists like Michael Parekōwhai, are also fetching high prices at auction.

Starting out

That level of investment is likely to be beyond the means of new collectors. But younger people, who may have had their eyes opened to the potential of art via

Instagram et al, are likely to increase their art education through online or real-life auctions.

“It’s a great way to view the bodies of works of a range of artists, alongside different art forms,” says Melville.

Galleries (large and small) provide the opportunity for viewing a wide range of art forms and gaining an understanding of the works that resonate with them.

Prints were traditionally an entry-level art option, but these have become desired objects in themselves, especially limited editions of celebrated artists. It’s possible to purchase inexpensive works from student artists or engage in a shared ownership model.

But Melville says the best advice for new buyers is to go with the gut. “If you like it, buy it.” And make sure you do your research (online or IRL) before you invest.

SPRING 2023 | INFORMED INVESTOR 43 PASSION INVESTING

Building Your Retirement Income

Alpha First is a New Zealand-owned family-run mortgage investment firm which is proud of the way it does business.

Many experienced investors nearing retirement look for wholesale investment opportunities that will achieve sound returns at an acceptable level of risk.

They know that choosing the right investment will generate additional income and help diversify their portfolio. But when examining how wholesale investment providers operate, it’s important to know they don’t all work similarly.

Alpha First is a family-run mortgage investment firm based in Cambridge. They are 100 per cent New Zealand-owned and are proud of the key differences that set them apart.

“Firstly, we are not a managed fund, nor do we pool investor funds,” says Alpha First Mortgage Investments’ managing director, Olivia Fraser. “We are also not reliant on bank debt to fund our loans. Instead, our investors fund 100 per cent of the loan amount and receive the indicated interest rate.

“Our investors choose the opportunities they wish to invest in, so they can customise their portfolio. Some investors wish to invest in commercial developments only, while others may prefer townhouses, land subdivisions or rural land projects. Investors know exactly where and what their funds are secured over at all times.”

Monthly income

Fraser also points out Alpha First is not a finance company and does not pass costs onto investors by deduction from their interest, so projecting a monthly income is achievable.

Alpha First was founded in 2016 and presents investment opportunities that are secured by first mortgages over the borrower’s property. In turn, investors value the security of property-backed loans, the transparency around loan structure and borrower details, the monthly interest payments they receive – and, of course, the attractive returns generated. Fraser says investors have complete control over their investment decisions, and stringent safeguards are in place to ensure money is handled appropriately at all times. Law firm Simpson Grierson ensures all securities are in place, each loan is documented correctly, and investors are registered on the first mortgage over the security property. All funds are held and dispersed via Alpha First’s trust account, which is operated by Ellice Tanner Hart Lawyers.

Alpha First always takes a conservative approach to loan to value ratios and only in rare circumstances would they exceed 55 per cent LVR.