6 minute read

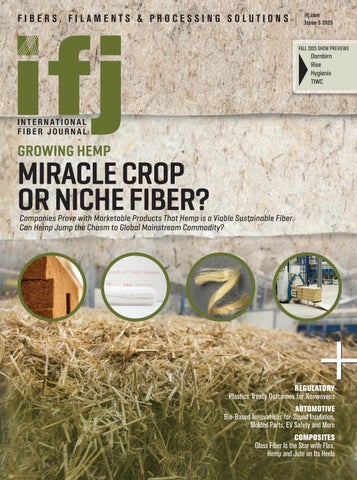

HEMP HEMP Emerging Star Climate-Smart Bast Fiber

Companies in the Supply Chain Share Strategies for Hemp as an Industrial-Scale Fiber

By Caryn Smith, Publisher and Chief Content Officer, IFJ

Hemp is often referred to as a “miracle fiber." It is exceptionally strong, very durable, and provides numerous environmental benefits. It is so strong that it has a tensile strength up to eight times that of cotton. The fibers do not degrade; they only get softer, and with each textile wash, they maintain structural integrity.

Growing the fiber requires less water than cotton, and rainwater meets most of its needs. It is naturally disease-resistant, thereby reducing the need for pesticides. It offers soil enrichment benefits, and can remediate soil polluted with heavy metals. The finest aspect of this versatile fiber is that it sequesters a substantial amount of carbon dioxide, making it carbon-negative during the growth process.

The fiber has been in use for thousands of years, yet the transition to modern industrial production has been slow, technically speaking. Yet, the numerous benefits of hemp fiber are attracting corporate investments that confirm it is worth the hard work, and is driving product development across the globe.

Hemp Hot Spots

The global market for hemp-based products was valued at US$1.8 billion in 2023 and is projected to reach US$16.2 billion by the end of 2033. Sales of hemp-based products are projected to skyrocket at a CAGR of 24.5% from 2023 to 20331. Major producers are China, France, Canada. Combined efforts in Europe have also dominated the industrial hemp market, with a 31.04% share in 20242, supported by large-scale hemp cultivation in countries such as France and the Netherlands. Emerging markets include India, specifically the provinces of Uttarakhand and Himachal Pradesh, and Vietnam, a rising producer of industrial hemp.

In the United States, the industrial hemp market is projected to grow significantly, reaching an estimated value of US$8.38 billion by 20323, driving product adoption across industries such as pharmaceuticals, food and beverages, textiles, cosmetics, and others.

Current thriving niches include fashion, construction, and automotive, with China providing these industries 73,000 metric tons of hemp fiber4. European countries utilized over 45,000 metric tons of hemp fiber5 in insulation and hempcrete for energy-efficient housing. The fashion industry saw a 30% increase in hemp-fabric utilization for denim, outerwear, and everyday garments, primarily driven by urban millennials and Gen Z consumers.

Hemp bio-composites surged in the automotive sector, where companies like Mercedes-Benz and BMW are using hemp-based door panels and dashboards in over 1.3 million vehicles. Hemp packaging for cosmetics and consumer goods saw a 25% increase in orders across North America and Western Europe. Rising niche applications include acoustic panels, filters, and nonwoven geotextiles.

In North America, over 20,000 acres are dedicated to fiber-specific hemp crops in 2024, up 15% from 2023, with the U.S. increasing fiber-focused cultivation by 17%6. The U.S. market continues to grapple with significant regulatory roadblocks, inadequate processing infrastructure, and low profit margins for growers.

Advocacy groups, such as the National Industrial Hemp Council (NIHC), are moving the needle on U.S. industrial hemp. NIHC held its Global Industrial Hemp Fiber Summit at North Carolina State University’s Wilson College of Textiles for the first time in July. This new collaboration brought approximately 200 leaders from across the industrial hemp value chain – researchers, educators, growers, processors, manufacturers, brands, and policy- makers – for the multi-day event. Attendees even visited Biophil Natural Fibers, a rising hemp facility located in Lumberton, NC, to see their working-scale decortication and premium fiber production.

“The Summit proved what NIHC has always believed: When we bring the right people together, we create the conditions for real growth,” said Patrick Atagi, President and CEO. “This is how we build a sustainable, world-class U.S. hemp fiber industry.”

Investments Are Paying Off at IND HEMP

Collaboration is a key ingredient at IND HEMP, and this North Central Montana, U.S.-based company is making strides. “Supply chains need collaboration and partnership, especially with a new and developing material,” says Gregg Gnecco, Brand and Marketing Director. “IND HEMP has been fortunate to establish relationships with our customers' development and engineering teams to identify specific needs. We often trial multiple grades to find the right fit and co-develop our standard specifications to match the needs of various production systems.”

Currently, the company has integrated its IH Gold Decorticated Technical Hemp Fiber in Hempitecture’s Hempwool® and PlantPanel® X insulation manufacturing, on an airlaid nonwoven system. Additionally, needle-punch Platinum fiber is utilized in the headliner of a limited-run vehicle at one of the top three U.S. automakers. The company's Hurd Fiber has been compounded into plastics and was used in the front and rear molded fenders of the Livewire Electric motorcycle, a Harley-Davidson brand. IND HEMP’s Platinum fiber is verified to meet the European Standard by a leading needle-punch nonwoven manufacturer that services the European auto industry.

IND HEMP invests in its R&D initiatives to prove usability and compatibility for downstream customers. In early 2025, the company conducted a trial project using spunlace hydro-entangled nonwovens for both wet and dry wipes, in collaboration with the Nonwovens Institute (NWI) at NC State University. “This trial allows potential customers and manufacturers to see, touch, feel, and understand that our fibers will work in their processes, eliminating the initial risk of testing on their lines without a baseline understanding of compatibility,” says Gnecco.

IND HEMP and NWI successfully demonstrated the compatibility of hemp fiber with carded spunlace hydroentangled systems at the roll scale. Tests blended IND HEMP Premium Cottonized hemp fiber with cotton and then with wood-based Lyocell in blends. This grade of fiber is the same as required for spinning into textiles and presents what IND HEMP considers the finest hemp fiber nonwovens made in the U.S. to date.

IND HEMP's natural fiber decortication and processing facility in Fort feet of processing equipment built processing both hemp fiber and flax fiber crops. IND

“This kind of testing is necessary as manufacturers consider adopting new materials. We can answer the inevitable questions, ‘Will your hemp fiber break my machines and shut down my line? Is it commercially viable to run at scale? Can you consistently supply necessary volume at approved specifications?’” says Gnecco. “This is why we are committed to spending our R&D dollars to prove viability and compatibility, so that our customers can spend their R&D dollars optimizing adoption for product and market fit.”

At IDEA® Show in April, IND HEMP showcased their spunlace hydro-entangled nonwovens test rolls in multiple material blends and grams per square meter (GSM) to highlight the fibers material compatibility with various systems. These samples facilitated conversations beyond possibilities into viable pathways for products or applications. From these discussions, combined with feedback from the WOW Show, which focuses on wipes, IND HEMP identified the next steps for R&D. They have since contracted with SENW and NWI for next steps of development and additional testing. These results will be presented on in a session at the RISE conference in October.

“We are performing deeper material property testing, working with Southeast Nonwovens for comparative testing on specific existing product targets,” says Gnecco. “From here we will work NWI for finishing tests such as perforations, folding et. We will complete this research in Q3/ Q4 2025, and be ready for companies that are planning development trials with this material.”

IND HEMP identified wipes and dry towels as a focus of hemp applications due to increased usage since the pandemic,

HempWool is a thermal insulation material made by Hempitecture, made with IND HEMP’s IH Gold Decorticated Technical Hemp Fiber. The circular material is composed of 90% natural fiber and serves as a safe and non-toxic alternative for sustainable home insulation throughout the build, including ceiling, floor, walls, and partition walls, as well as in vans, RVs, and modular homes. HempWool is safe to touch and to handle without gloves. Hempitecture

PlantPanel® X, split-insulation wall and roof assemblies, is used with either a rain screen cladding or roofing material. With 100% biobased and recycled content, and utilizing IND HEMP’s IH Gold Decorticated Technical Hemp Fiber, PlantPanel X is a sustainable, low-carbon continuous insulation solution. Hempitecture and rising environmental initiatives to eliminate manmade synthetic petroleumbased fibers, i.e., plastic. “Technically, hemp’s absorption and strength performance add value to natural fibers and provide a sustainable alternative to synthetic fibers,” says Gnecco. “The renewability benefits of hemp at a product’s end of life are significant. Also, hemp is the leading carbon-sequestering, sustainably produced crop today.” Growing global regulations, such as the UK’s ban on wet wipes containing plastic, which takes effect in 2026, are also contributing factors.

IND HEMP is an advocate for the U.S. hemp fiber market. “The reemergence of common-sense hemp fiber advocacy in the U.S., the resurgence of committed hemp farmers, and accelerated overseas growth present a multitude of economic opportunities, added to hemp's environmental benefits," shares Gnecco.

"Hemp as an industrial commodity provides U.S. farmers a cash rotation crop to boost bottom lines and improve soil health," says Gnecco. "Processing facilities provide rural jobs and economic development opportunities in small-town America. Furthermore, products can perform better, last longer, and have a more environmentally friendly end of life. Hemp blends well with other natural fibers for spinning/textile and nonwovens applications. For example, when a 70:30 cottonhemp blend is spun into fabric to make a shirt, the hemp fiber adds more than twice the abrasion and tensile strength compared to cotton alone, resulting in a shirt that lasts longer and wears better. In fact, we provide life cycle analysis data on all of our supplied materials for manufacturing partners to determine the carbon footprint in their ESG calculations.”