5 minute read

2023 in the Rearview Mirror, 2024 in the Crystal Ball

Looking back on 2023, there were a few surprises that continue to prevent identifying fully what the new, post-COVID normal will be for the filtration industry. Let’s look at the trends coming out of the COVID-19 pandemic, the surprises we’ve seen this year, the impact of those surprises, and some things to watch for in 2024 and beyond.

The COVID-19 pandemic has changed consumer purchasing behavior for nonwoven products that were critical during the peaks of the pandemic: wipes and filtration. At CIDPEX 2023 and World of Wipes 2023, INDA shared that North American nonwoven consumption for wipes has taken a positive step-change with growth rates increasing from a pre-pandemic 3.2% to a post-pandemic 4.8%. This has shifted the percentage of nonwoven used for wipes from ~10% in 2019 to 12% in 2023.

INDA attributes this step-change in large part to consumers who previously were not users of wipes having been introduced and acclimated to them during the peak pandemic period. These consumers were introduced to wipes via the disinfectant category, acknowledged the convenience they provide, and then adopted them for household cleaning, cosmetic, and personal hygiene uses.

A similar COVID-19 inspired step-change has occurred for filter media and filtration. Prior to the pandemic, consumers had a basic awareness of indoor air quality issues. For three years, consumers have been inundated with education around indoor air quality, ranging from the state of air quality in hospitals, schools, businesses, and transportation to discussions regarding what is most appropriate for homes. Early in the pandemic, much focus was on what was necessary in terms of filter change frequency and maintenance, with news reports indicating that some school systems had two-thirds of facilities with “dirty or poorly maintained ventilation systems – (and) about half had air filters that hadn’t been replaced in years prior to October, rather than twice a year as recommended.”

The narrative quickly changed to the efficiency and capability of filters in schools and public places. “Dr. William Bahnfleth, an engineering professor at Pennsylvania State University and the chair of ASHRAE’s epidemic task force, says the professional society’s prior recommendations to schools would help protect against body odor but not COVID-19.” Faced with such messaging, consumers began demanding better IAQ for their children’s schools AND began to consider their own home filter media change frequency and upgrading the media used to improve protection. These marketplace reactions, along with a pandemic-driven spike in demand for the media used for facemasks, have created a lasting shift in the percentage of nonwoven used for filtration purposes, moving to 11% in 2023.

Considering production assets, since 2017, there has been a net increase of ~80 nonwoven manufacturing lines, of which ~20% are devoted to filtration, with another ~29% capable of producing various filtration related nonwovens (in addition to materials for non-filtration products). Assets dedicated to producing substrates for wipes made up another ~10% of the net increase in machines.

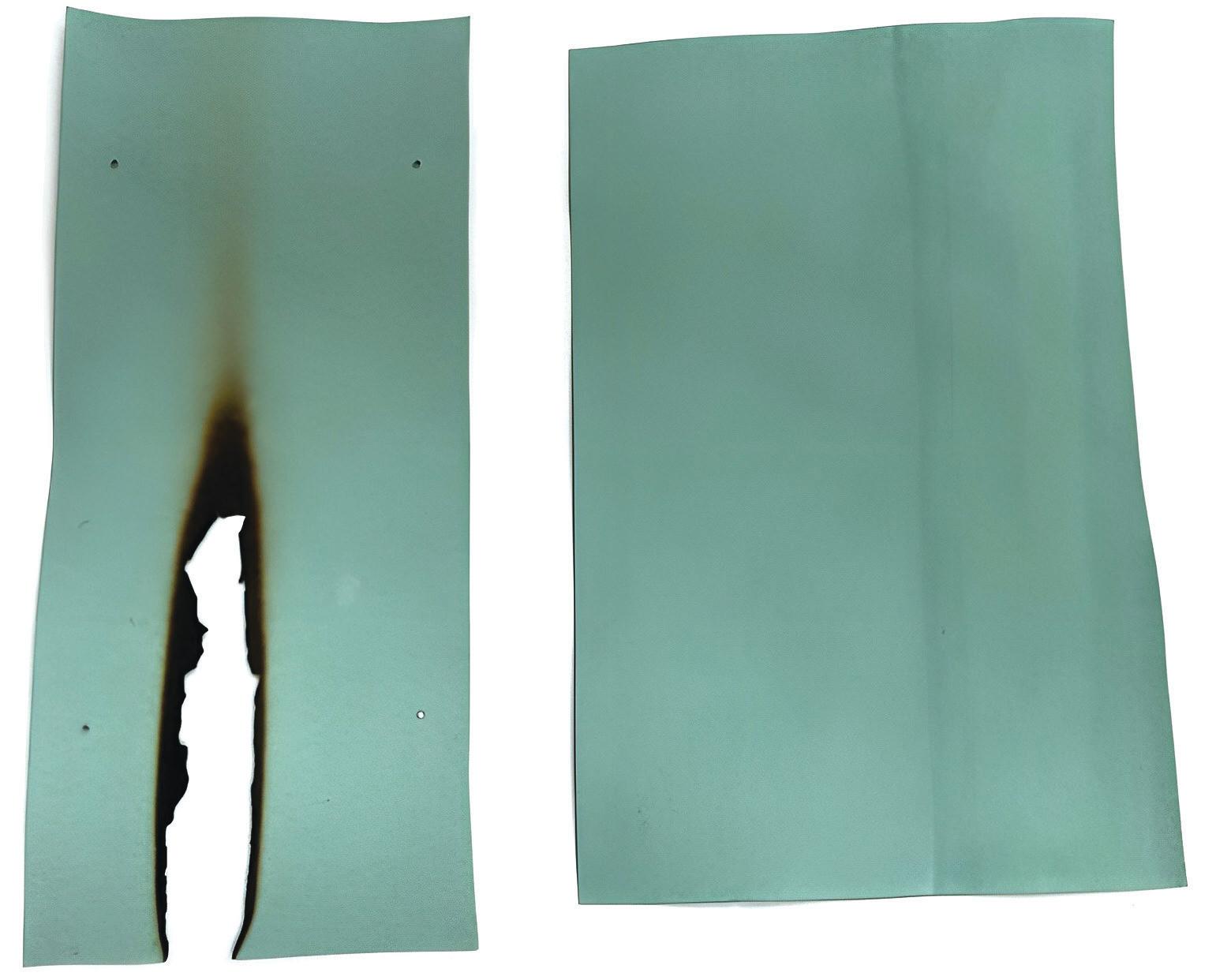

One surprise of 2023 was the rapid pace at which a new standard for control of infectious aerosols was developed and implemented by ASHRAE. ASHRAE 241 was fast-tracked and adopted in less than a year and is already being promoted to school boards and parents, “With the school year approaching, we need a proper plan to ensure our schools are healthy environments. We now have ASHRAE standard 241 to control infectious aerosols. Here’s how it can be implemented at school.” Aligning to CDC guidance recommending MERV-13 or better performance for control of infectious aerosols, ASHRAE 241 includes as mandatory, the previously optional filter media conditioning step disclosed in ASHRAE 52.2 Appendix J, that involves discharging the filter media. As this effectively eliminates the use of electret charging of filter media to achieve MERV-13 performance, there is an anticipated shift in filter in the future. MERV-13 performance can be accomplished without electret charging via increased filter media surface area –either finer fibers or increased filter depth or a combination of both. Both approaches have the potential to increase energy consumption due to increased pressure drop across the filter.

This also may pose an unintended challenge to public entities that are balancing the desire to provide better protection against infectious aerosols by adhering to the CDC/ASHRAE 241 target of MERC-13 performance AND local edicts to improve public building energy efficiency. Regardless, in the short term, there is potential to see shifts in filter media production asset technology and/or increases in the volume of filter media produced. ASHRAE 241 notably does not consider the potential of smart air filtration systems that may monitor filter performance over time or as electret charging is naturally dissipated. This may be revisited in the future as such filtration systems become more available and commonplace.

The second significant surprise impacting filtration was the impact of Canadian wildfires over a broad swath of the Midwest, Northeastern, and Mid-Atlantic United States. While similar phenomena have been experienced more locally in California and other western states, Greece, and Australia in recent years, the Canadian wildfires of 2023 impacted a significantly larger, heavily populated region. News outlets reported spikes in sales of air filters, N95 and KN95 respirators, and air purifiers. For the contaminants in the wildfire haze, experts recommend N95 and KN95 respirators, even those with exhalation valves, over surgical masks. While N95 and KN95 respirators provide adequate particulate protection, there are opportunities for improvement in surgical masks to meet this particularly air quality challenge and to potentially optimize N95/KN95 respirators for extended outdoor use.

Finally, a third development in 2023 will have impact on the filtration community in the future – the announcement of a proposed national standard for PFAS levels in drinking water. Already, the U.S. Geological Survey has suggested that more the 50% of United States tap water is contaminated with various PFAS chemicals. It has even been suggested by some commentators that as many as 99% of public drinking water providers would fail against the proposed EPA targets. Should this occur, it is likely to drive growth in home drinking water filters and purifiers which are typically reverse osmosis or activated carbon based.

Unanticipated events have created opportunities for innovation and market growth in coming years, as well as potential shifts in filter media production. Updated data on market outlook, supply and demand, and prognostication on the impact such events as seen in 2023 may have in out years is tracked and available from INDA.

References:

Hays, Emily, “Ignored School Filters Pose Health Risks”, New Haven Independent, February 25, 2021, https:// www.newhavenindependent.org/ article/schools_report_filters_vents.

Greenblatt, Mark; McMillan, Nicholas, “School Air Filters: Not COVID-19 Ready,” Scripps News, July 27, 2020, https://scrippsnews.com/stories/ school-air-filters-not-covid-19-ready.

Snider, Mark; Garcia, Cindy, “INDA North American Nonwovens Materials Annual Study 2022.”

Fox, Joey, “Keeping Kids in School with Clean Air using ASHRAE 241,” It’s Airborne, August 25, 2023, https:// itsairborne.com/keeping-kids-inschool-with-clean-air-e82efcd43e86.

Kelly L. Smalling, Kristin M. Romanok, Paul M. Bradley, Mathew C. Morriss, James L. Gray, Leslie K. Kanagy, Stephanie E. Gordon, Brianna M. Williams, Sara E. Breitmeyer, Daniel K. Jones, Laura A. DeCicco, Collin A. Eagles-Smith, Tyler Wagner, “Per- and polyfluoroalkyl substances (PFAS) in United States tapwater: Comparison of underserved privatewell and public-supply exposures and associated health implications,” Environment International, Volume 178, 2023.

By Bob McIlvaine President The McIlvaine Company

Bob McIlvaine is the president of The McIlvaine Company, which is helping filter suppliers understand the true cost of their products and the impact on the Serviceable Obtainable Market. He can be reached at rmcilvaine@ mcilvainecompany.com or +1 847.226.2391.