Director Journal

SPECIAL STATUS

How much should board observers be allowed to see?

How much should board observers be allowed to see?

The ICD-Rotman Directors Education Program is the leading educational program for experienced board directors seeking to advance their contributions to Canada's boardrooms and beyond.

A joint initiative of ICD and Rotman, this comprehensive program offers both a national and local perspective, through leading business schools across Canada. With the goal of building competencies deemed necessary to be an effective director in today's challenging world, the DEP provides insight from both an academic and real-world, director lens perspective. Course participants benefit from the rich experience of their peers in navigating their role within complex board dynamics. Completion of the DEP and success in the ICD led examination process, leads to the highly recognized ICD. D designation, within a one-year timeframe.

Interested experienced directors are encouraged to submit their application to the ICD, along with references, for consideration into the program.

Call 416.593.3325 or email education@icd.ca for a personal consultation.

Think beyond the boardroom.

UPCOMING DEP START DATES

TORONTODecember 9, 2024

January 16, 2025

January 27, 2025

February 7, 2025

February 27, 2025

March 27, 2025

April 3, 2025

April 4, 2025

Application process is now open and is subject to availability. Application deadlines are 4-6 weeks before the class start date.

Editorial

EDITOR

Simon Avery

ART DIRECTOR

Beth Leonienco-Burke

CONTRIBUTORS

Jeff Buckstein, Virginia Galt, Gordon Pitts, Serge Rivest, Barbara Smith, Shirley Won

Rahul Bhardwaj - President and CEO

Richard Piticco - Chief administrative officer

Jan Daly Mollenhauer - Vice-president, sales, marketing and membership

Gigi Dawe - Vice-president, policy and research

Shannon Hunt - Vice-president, education

Kathryn Wakefield - Vice-president, chapter relations

Patrick Masset - CEO

Beth Leonienco-Burke - Creative Director

Bob Gallant - VP, Sales & Marketing

Building trust and confidence in Canadian organizations is imperative. At the Institute of Corporate Directors (ICD), we believe that this starts with the right leadership and good governance. Directors must lead by being informed, prepared, ethical, connected, courageous and engaged with the world. In the pages that follow, you will find thoughtful and provocative articles that explore these essential leadership qualities.

Bâtir la confiance envers les organisations can- adiennes est primordial. À l’Institut des administrateurs de sociétés (IAS), nous croyons que cela commence par un bon leadership et une bonne gouvernance. Les administrateurs doivent gouverner en étant informés, préparés, intègres, connectés, courageux et ouverts sur le monde. Dans les pages qui suivent, vous trouverez des articles réfléchis et provocateurs qui explorent ces qualités de leadership essentielles.

1601 – 250 Yonge Street, Toronto, Ontario M5B 2L7 T: 416-593-7741 F: 416-593-0636 E: info@icd.ca ISSN 2371-5634 (Print) www.icd.ca ISSN 2371-5650 (Online)

The ICD welcomes a diversity of opinion for inclusion in Director Journal. The contents of this publication do not necessarily reflect the opinions of the ICD, its partners, its sponsors, or its advertisers. Readers are encouraged to consider seeking professional advice and other views. To request reprints of articles, please contact info@icd.ca

Seeking an edge....................................................................................................

Big investors are pushing boards on sustainability, Rahul Bhardwaj warns

Gender parity 2158, tipping point predictions, two-faced workers, the end of double-dipping, succession pains, the U.S. miserly wage

Recent board appointments across the country

Nancy Hopkins says the best way to bring directors together is to get them outside the boardroom

What’s with all the observers on boards these days? Governance experts are raising the alarm

A veteran director says bogged-down boards need a streamlined approach to managing the unknown

Brian Lechem’s vision more than 40 years ago changed Canadian governance

In The Privacy Fallacy, author Ignacio Cofone argues that outdated laws leave the public susceptible to digital exploitation in the age of AI

In praise of building relationships, limiting risk and watching the watchers

DISCUSSIONS ABOUT GOOD governance these days are usually prefaced by references to accelerated challenges and risks. Technological change, societal unrest, geopolitical tensions and economic uncertainty all colour the conversation. But in our latest ICD Fellow profile (page 10), seasoned director Nancy Hopkins offers a refreshing take on the subject. Effective leadership from the boardroom, she says, begins at the personal level, where directors can build strong and trusting relationships with each other. This doesn’t mean constructing a board with old friends and cronies. It’s about attracting people with a diversity of knowledge, skill, experience, gender and ethnicity – and then connecting them so they can work together in the best interests of the organization.

In a Q&A with the magazine (page 30), veteran corporate director John Caldwell makes the case that boards have focused too much on risk over the past few years, so much so that some are now beginning to question the value of “this time-consuming activity.” Risk oversight is evolving to the point where directors now want a more straightforward approach that measurably improves performance. The scope of an organization’s risk universe should contain no more than 20 exposures, advises Caldwell, who shares a matrix to help boards categorize those risks.

Simon Avery Editor savery@icd.ca

Another trend garnering attention among boards and regulators is the growing presence of board observers, especially at technology companies, who are granted access to the boardroom without incurring any fiduciary responsibilities to other stakeholders. In our cover story, “Who’s watching the observers?” (page 20), business writer Virginia Galt says large companies in particular are keen to use the observer model these days as a means to monitor their investments and keep abreast of new developments. The push has critics calling for more guidelines and tighter controls. For now, though, it will be up to individual directors to ensure that appropriate restrictions are imposed.

That’s just a partial sketch of what’s inside this edition of Director Journal. Delve in further for a broader range of stories and insights – and keep an eye out for our next issue in November, which promises new features and a refreshed design.

DE NOS JOURS, LES discussions sur la bonne gouvernance sont généralement précédées de mentions sur l’accélération des défis et des risques. Le changement technologique, l’instabilité sociale, les tensions géopolitiques et l’incertitude économique teintent toutes les conversations. Mais dans notre plus récent portrait de Fellow de l’IAS (page 12), l’administratrice chevronnée Nancy Hopkins propose un point de vue rafraichissant sur la question. Un leadership efficace du conseil, ditelle, commence au niveau personnel, quand les administrateurs bâtissent des relations solides et de confiance les uns avec les autres. Il s’agit d’attirer des gens avec une diversité de connaissances, de compétences, d’expériences, de genre et d’ethnicité et ensuite de les réunir pour qu’ils travaillent ensemble dans le meilleur intérêt de l’organisation.

Lors d’une séance de questions et réponses avec le magazine (page 30), l’administrateur d’expérience John Caldwell soutient que les conseils ont trop mis l’accent sur le risque au cours des dernières années, à tel point que certains remettent en question la valeur de « cette activité chronophage ». La surveillance du risque a évolué à un point où les administrateurs désirent maintenant une approche directe qui mesure la performance. L’ampleur de l’univers du risque d’une organisation ne devrait pas compter plus de vingt formes d’exposition, assure M. Caldwell, qui partage une grille afin d’aider les conseils à catégoriser ces risques.

Une autre tendance qui attire l’attention des conseils et autorités réglementaires est la présence croissante d’observateurs au conseil, surtout chez les entreprises technologiques, à qui on accorde un accès au conseil sans qu’ils soient soumis à des devoirs fiduciaires. Dans notre article principal, Virginia Galt explique que les grandes entreprises en particulier recourent largement à ce modèle pour surveiller leurs investissements. Certains exigent aujourd’hui de nouvelles lignes directrices et des contrôles plus serrés envers ce modèle. Pour l’instant, du moins, il reviendra à chaque administrateur de s’assurer que des restrictions appropriées soient imposées.

Ce n’est qu’un aperçu de cette édition du Director Journal. Vous y trouverez d’autres articles et points de vue. Et ne manquez pas notre prochain numéro de novembre, lequel promet de nouveaux articles et un nouveau design.

Like it or not, big investors are pushing boards harder

THE WORLD HAS CHANGED a lot this year – conflicts are raging in Europe, the Middle East and parts of Africa; central banks have begun cutting rates to steer their economies away from recession; technological advances have led to a wide rollout of generative AI experiences and the first commercial spacewalk; and, for the second time in history, U.S. voters have the option to elect a female president.

The winds of change are also sweeping through the corporate governance community globally, with particular significance for Canada. I had the opportunity recently to participate in large group discussions with directors and investors from Asia, Africa, Europe, South America and North America. While sentiments varied widely, their behaviour was coalescing in some important ways, especially on ESG (environmental, social and governance) issues. It’s fair to say that ESG matters are evolving into a sustainability conversation.

Rahul Bhardwaj LL.B, ICD.D President and CEO, The Institute of Corporate Directors

Many jurisdictions are embracing both the diversity and environmental sustainability aspects of ESG in response to the demands of large investors. Pension funds, sovereign wealth funds and other institutional money managers want to see specific policies and, in more cases, net-zero plans from the companies in which they invest. They understand that economic interests need to be addressed, but they also seek assurances and disclosures around sustainability. These conversations between investors and boards of directors are happening today and change is taking hold rapidly. Already, we are seeing the accounting and legal professions building their capacity to handle this transition.

There are challenging but necessary speedbumps on the road to greater sustainability. For boards it’s critical to understand that the status quo is shifting, and falling behind on developments may limit access to global capital down the road.

To stay ahead of the issues, directors must keep themselves informed. The information is “need to know” even if it’s not “nice to know.” The Institute of Corporate Directors will continue to serve as an education platform and a respectful forum in which members can share insights and acquire information as conversations evolve.

LE MONDE A BEAUCOUP changé cette année : des guerres font rage en Europe, au Moyen-Orient et en Afrique; des banques centrales ont commencé à réduire leurs taux pour tirer leurs économies d’une récession; des avancées technologiques ont mené à un large déploiement d’expériences en IA générative et à une première sortie commerciale dans l’espace; et pour la deuxième fois dans l’histoire, les électeurs américains pourraient élire une femme à la présidence.

Les vents du changements soufflent sur la gouvernance partout dans le monde, en particulier au Canada. J’ai eu récemment l’occasion de participer à de vastes discussions avec des administrateurs et investisseurs d’Asie, d’Afrique, d’Europe et d’Amérique du Sud et du Nord. Même si les sentiments varient, leurs comportements se rejoignent beaucoup, en particulier sur les enjeux d’ESG (environnement, social, gouvernance). Il est juste de dire que les questions d’ESG évoluent vers le développement durable.

Beaucoup de secteurs adhèrent aux notions de diversité et de développement durable contenues dans les ESG en réponse aux exigences de grands investisseurs. Les régimes de retraite, les fonds souveraines et autres gestionnaires de fonds institutionnels désirent voir des politiques précises et des plans net zéro chez les entreprises dans lesquelles ils investissent. Ils comprennent l’importance des priorités économiques, mais recherchent aussi des assurances et des informations relatives au développement durable. Ces conversations se tiennent aujourd’hui et les changements sont rapides. Déjà, avocats et comptables se donnent les capacités de gérer la transition.

Ce sont des situations contrariantes mais nécessaires sur la route du développement durable. Ils est essentiel que les conseils comprennent qu’en prenant du retard sur ces questions, ils risquent de limiter leur accès au capital.

Pour demeurer à l’affût de ces questions, les administrateurs doivent se tenir informés. L’Institut des administrateurs de sociétés continuera de jouer son rôle de plate-forme de formation et de forum de discussion respectueux où les membres partagent leurs points de vue et accèdent à de l’information à mesure que la conversation évolue.

COMPILED BY Jeff Buckstein

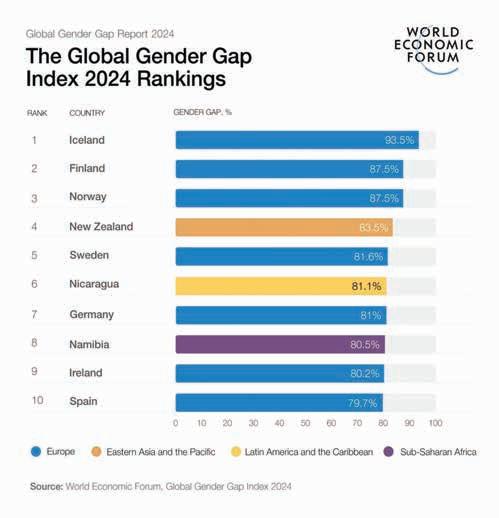

GENDER PARITY is within reach – for your great, great, great grandchildren.

Today, only 68.5 per cent of the global gender gap has been closed, following just a 0.1-per-cent improvement over the past year, according to the “Global Gender Gap Report 2024,” published by the World Economic Forum.

But hope springs eternal. With more than 60 national elections scheduled in 2024, and the largest global population in history poised to vote, there is potential for significant improvement in top leadership positions, which have remained largely inaccessible. In the United States, for instance, Democratic presidential candidate Kamala Harris could become the first-ever female to win the White House.

The WEF report did note some bright spots, including a doubling of the female representation in the field of AI development since 2016 – although women are still significantly underrepresented in the science, technology, engineering and mathematic (STEM) fields.

All told, says the report, it will take five generations – another 134 years – to close the gender gap at present rates of progress.

The slow and incremental gains highlighted in this year’s report underscore the urgent need for a renewed global commitment to achieving gender

parity, particularly in economic and political spheres, says Saadia Zahidi, managing director of the World Economic Forum.

“We cannot wait until 2158 for parity. The time for decisive action is now,” she says.

“ANYONE CAN SPOT A TIPPING POINT after it’s been crossed,” notes The Economist, citing the 2008 financial crisis and Covid-19 pandemic.

“The real trick is to spot them before they happen. But that is fiendishly difficult.”

That’s where artificial intelligence comes in. The article, entitled “AI can predict tipping points before they happen,” says AI could help decode the factors that make it possible to identify a tipping point as it is approaching, to mitigate the damage caused by crossing that line. It profiles computer scientists in China who say they have applied AI machine-learning algorithms to accurately predict the onset of tipping points in complicated systems. That could one day help address real world problems such as predicting floods and power shortages.

The scientists describe producing artificial neural networks designed to analyze simplified theoretical systems where tipping points were known to occur. For example, they used a model ecosystem to simulate abrupt changes, such as a decline in harvested crops or the presence of pests.

When the researchers were satisfied their algorithms could predict critical transitions in their systems, they applied them to the real-world problem of how tropical forests turn to savannah, which has tremendous implications for both humans and wildlife in those regions.

Mysteries remain, however. Only the algorithm knows what specific features and patterns it identifies to make predictions. The team in China is trying to discover exactly what those are, which could help improve the algorithm further and allow better predictions in many fields, from infectious outbreaks to the next stock market crash.

PRETENDING TO BE SOMETHING we are not to conform to workplace expectations may be more common than you think, according to a recent article in the Financial Post.

Patricia Faison Hewlin, an organizational researcher at McGill University, has studied this subject for 20 years, and observed strong pressure among employees to conform. She found that at least 60 per cent of employees report “sometimes” or “almost always” creating facades in the workplace, leaving them emotionally exhausted and less engaged in their work.

Perhaps surprisingly, those feelings were widespread across the working world, not just in traditional buttoned-down industries such as banking or finance, but also among lawyers, teachers, flight attendants and even in the arts, where one might expect greater tolerance for individualism.

However, the freedom to “be yourself” in the workplace can be good for everyone. Hewlin’s study found that people who believe they can be authentic create benefits for themselves and their employers, including better overall personal wellbeing, more energy and enthusiasm for their work, and greater motivation to stay.

“It creates a wonderful pathway for creativity, for sharing information and just positive work performance in general,” she said.

THE COVID-19 PANDEMIC shuttered many bricks-and-mortar businesses, with devastating economic consequences for employees. But for some workers in other businesses and industries – high tech being a prime example – the opportunity to work remotely provided unprecedented advantages.

According to Business Insider’s Jacob Zinkula, some employees with questionable ethics moonlighted with multiple employers, sometimes more than doubling their salaries through a mix of secret remote full-time and contract jobs. The practice was lucrative, with some making up to $1-million a year.

But those gravy days have largely come to an end, with return-tooffice mandates, and many industries, including IT, experiencing hiring slowdowns.

Those lucky enough to find employers who are hiring are discovering it is harder to land a remote job. On top of that, employers have grown wise, with some rolling out employee-monitoring software that has made it more difficult for job jugglers to avoid being detected.

The article speculates that the future of remote work could be in the form of hybrid working arrangements, which generally aren’t a tenable arrangement for overemployed workers. Those mandatory trips into the office – and prying eyes – will severely hamper their ability to sneak in those extra gigs.

“OF ALL THE DECISIONS that a company’s board of directors makes, choosing the next CEO is arguably the most crucial,” says the Harvard Business Review. “A failed CEO succession can disrupt employees’ work, cause senior talent to jump ship, damage the company’s reputation, erase enormous value, and ruin the careers and legacies of the outgoing CEO, the board, and the designated successor,” say Dan Ciampa and Adam Bryant.

Given the stakes at hand, it stands to reason that the key parties in this process should be fully aligned on getting succession right. But in reality, the situation is complicated with multiple agendas at play.

For example, the outgoing CEO may be eager to burnish his or her legacy by leaving on their own terms and timeline, rather than the board’s, or to play a more significant role in choosing their replacement. This is at odds with what the board’s agenda should be: to pick the right CEO for today, but also a leader capable of growing as the company changes. The board also

needs to establish a power dynamic with the incoming CEO to ensure director primacy.

Nor are all CEO successions of a uniform nature. Strategic successions take place after a merger or acquisition, when the CEO of one of the companies must become the leader of the newly merged entity. Forced successions occur when the incumbent CEO leaves immediately because of health or performance problems, resulting in a quick turnover with new leadership.

Planned successions occur over a period of time when the board and current CEO initiate a search for a new person to take the helm. These changes are the most complex, because they involve an overlap process, with a transition and taking-charge phase between the outgoing and incoming leaders.

But then, “no succession is easy. Because the process involves people in positions of power, the dynamics are political in nature and therefore difficult to manage,” the article says.

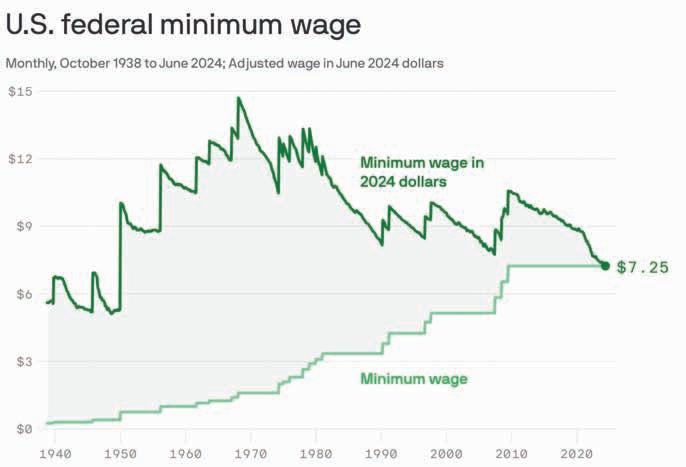

THE U.S. FEDERAL minimum wage has stayed the same for 15 years, since it rose to US$7.25 an hour on July 24, 2009. Canada’s federal minimum wage, in comparison, is $17.30 an hour.

It turns out that relatively few U.S. workers earn US$7.25 an hour. The U.S. Bureau of Labor Statistics reports that 1.6 million people earned the minimum wage in 2019, which dropped to 869,000 in 2023, about 600,000 of whom are women.

But those numbers don’t tell the full story, according to an Axios News article written by Emily Peck and Felix Salmon. When taking into account actual earnings, only 81,000 workers earned exactly $7.25 an hour as a base salary. The rest made less than that because many worked in services where they were tipped for their labour in order to make it up to or past the minimum wage.

It gets even worse for low-wage workers because the minimum wage is decreasing with inflation. When adjusted in 2024 dollars, the minimum wage today is worth less now than at any time since 1949. And it turns out many more American workers, beyond those officially making minimum wage, are struggling.

Many have urged the government to more than double the minimum wage to US$15 an hour. Today, there are about 17 million people in the United States earning less than US$15 an hour, according to the Economic Policy Institute’s low-wage workforce tracker. All told, these statistics paint a grim picture of poverty in the United States.

Data: Bureau of Labor Statistics, FRED; Chart: Thomas Oide/Axios

What board members do together outside the boundaries of the boardroom is fundamental to what goes on inside, says ICD Fellow Nancy Hopkins.

BY Liam Richards

Whether she’s serving on a community board or that of a global corporation, ICD Fellow NANCY HOPKINS knows the value of establishing good relations among her fellow directors. In conversation with business author Gordon Pitts, she discusses the importance of increasing diversity, building trust and uniting the culture of the board

Qu’elle siège au conseil d’une communauté ou à celui d’une multinationale, la Fellow de l’IAS NANCY HOPKINS connaît la valeur des relations avec ses collègues administrateurs. Avec l’auteur Gordon Pitts, elle évoque l’importance d’accroître la diversité, de bâtir la confiance et d’unir les cultures du conseil

“BOARDS SHOULD GO DRINKING TOGETHER,” Nancy Hopkins has often said, while conceding that, in an age of broadening diversity, a barroom tipple may not be everybody’s cup of tea.

It’s simply her way of emphasizing that boards of directors need to have active social lives if they are to be effective. Hopkins, a 40-year veteran of corporate and non-profit boards, does not advocate ribald bacchanalia, with directors dancing on boardroom tables, but she sees the governance value in spending “responsible good times together.”

It could be a convivial dinner, or social drinks of the beverage of one’s choice, but she’d no doubt be happy with

« LES MEMBRES DU CONSEIL devraient prendre un verre ensemble », dit souvent Nancy Hopkins tout en admettant qu’en cette ère de diversité accrue, l’alcool ne soit pas nécessairement la tasse de thé de tout le monde.

C’est sa manière de souligner que les administrateurs d’un conseil doivent mener une vie sociale active pour être efficaces. Mme Hopkins, qui siège depuis quatre décennies aux conseils d’entreprises et d’organisations à but non lucratif, ne prône pas des bacchanales où les administrateurs danseraient sur les tables, mais elle perçoit une valeur de gouvernance dans le fait de passer « du bon temps ensemble de façon responsable. »

Il peut s’agir d’un repas convivial ou d’un verre pas

Scrabble sessions or bowling nights out – whatever brings directors together as complete and complex human beings.

What board members do together outside the boundaries of the boardroom is fundamentally critical to what goes on inside, she maintains. It is particularly meaningful when new members, recruited for their community or ethnic representation, often feel alone as they are parachuted into this group of strangers – an isolation that is only exacerbated by the practice of impersonal electronic meetings.

Directors need to truly know their fellow board members, not just as cardboard archetypes – for example, “the person who had this brilliant career in, say, technology and is CEO of a significant tech company.” They need to get to know them as people to build that all-important relationship of trust, she insists.

Hopkins, who was inducted this year as a Fellow of the Institute of Corporate Directors, sees this as another stage in the evolution of governance thinking since she joined her first board in the 1980s. First, there was a focus on process – such as getting proper materials to the board in a timely way, for example. Then, the conversation shifted to the ability of the board to function independently of management.

Now, she says, good boards have a better grasp of who should be on the board – people representing a diversity of knowledge, skill and experience, gender and ethnicity, with a continuing focus on the work of the organization.

That takes us to the next task at hand – “how to get that diverse group of exceptional individuals working well together.”

This should be the mission of the board chair, in particular, but with strong buy-in from all directors in taking mutual responsibility for building the culture of the board.

She sees the challenge close-up as a Western Canadian director who has observed the increasing search for Indigenous candidates for board positions. It is part of the recognition of reconciliation as an important societal issue, but also serves to reflect the communities where companies do business.

At Cameco Corp. – the big Saskatchewan uranium miner where she served as director for 24 years – a long record of Indigenous directors is an outgrowth of the company’s mining presence in northern Saskatchewan. “It is so important for these communities to look at the faces on boards and see themselves reflected there in some way,” says Hopkins, who chaired Cameco’s compensation, audit and governance committees.

nécessairement alcoolisé, mais elle se contenterait de séances de scrabble ou d’une partie de quilles – n’importe quoi qui, en somme, réunisse les administrateurs en tant qu’êtres humains.

Ce que les administrateurs font hors des limites de la salle du conseil est essentiel à ce qui se passe à l’intérieur de celle-ci, croit-elle. C’est particulièrement important lorsque de nouveaux membres, recrutés pour leur représentation communautaire ou ethnique, peuvent se sentir isolés quand ils sont parachutés parmi un groupe de gens qu’ils ne connaissent pas.

Les administrateurs doivent véritablement connaître leurs collègues, pas seulement comme archétypes, mais aussi comme personnes avec qui il importe de bâtir des relations.

Mme Hopkins, qui a été intronisée cette année à titre de Fellow de l’Institut des administrateurs de sociétés, considère cela comme une autre étape dans l’évolution de la gouvernance depuis qu’elle a siégé à son premier conseil dans les années 1980. Il y e eu d’abord un accent sur le processus. Puis, la conversation a ensuite glissé vers la capacité du conseil de fonctionner indépendamment de la direction.

Aujourd’hui, dit-elle, les bons conseils ont une meilleure prise sur le genre de personnes qui devraient y siéger – des gens représentant une diversité de connaissances, de talents et d’expériences, de genre et d’ethnicité, avec un accent continu sur le travail de l’organisation.

Cela nous mène à la prochaine tâche à accomplir – « comment faire en sorte qu’un groupe diversifié de personnes exceptionnelles puisse travailler ensemble. »

Ce devrait être la mission de la présidence du conseil, en particulier, mais avec un solide appui de tous les administrateurs s’engageant dans la responsabilité mutuelle de bâtir la culture du conseil.

Ce défi, elle l’a vu de près comme administratrice de l’Ouest du Canada qui a observé la recherche croissante de candidats autochtones pour des postes au conseil. Il s’agit en partie de la reconnaissance de la réconciliation comme enjeu social important, mais aussi de refléter les communautés où les entreprises mènent des activités.

Chez Cameco Corp. – la grande minière d’uranium de Saskatchewan dont elle fut administratrice pendant 24 ans –la longue lignée d’administrateurs autochtones découle de la présence de cette entreprise dans le nord de la Saskatchewan. « Il est tellement important pour ces communautés de se voir reflétées de quelque façon dans les figures du conseil

But in conversations across the region, she is also hearing – second-hand, she concedes – that incoming Indigenous members feel isolated at first when thrust into this group of established directors. Bridging that gap is an essential task, if the boards are to perform well.

Yet the increasing use of Zoom and other electronic channels makes this adaptation much more difficult. “You don’t get to know the other people around the table.” She appreciates the advantages of cost and convenience – which drive this practice even in a post-pandemic era – but worries that remote governance prevents the necessary relationship-building.

The subject takes her back 20 years when she chaired a board where almost everyone came to meetings from out of town. She would schedule committee meetings for the first day, followed by a board dinner at night, and full director meetings the following day.

The dinners were attended by all and the conversations were energetic and enjoyable. She didn’t totally understand the process then, but she could grasp that the board that spent time together and knew each other as individuals could reach difficult decisions where there was a considerable divergence of opinion. There was “a conversation where the minority could see their views were heard and respected.” Members could hold intense discussions without damaging relationships and maintained a continuing trust in each other, she observed.

She concedes that when there is an evening board dinner or social event, it is often hard to get every individual – especially the local directors – to make the effort to attend, and yet those non-attendees are often the ones who feel most isolated.

Grit McCreath, who worked with Hopkins on the University of Saskatchewan board more than a decade ago, says Hopkins embraces a credo of work hard and play, if not hard, at least with a flair for fun. As chair, one of Hopkins’ strengths was “taking new members like me under her wing.” Her welcoming approach, plus a strong director’s orientation, strengthened the board’s chemistry, says McCreath, now the university’s chancellor.

In building better boards, Hopkins also appreciates the evolution of procedural norms in the boardroom. She argues that the most important governance advance in the course of her career has been the scheduling of routine in-camera sessions with board members only, without the presence of management. In some of the sessions, the boards may want the CEO present.

d’administration. »

Mais lors de conversations avec des gens de la région, elle a aussi entendu parler d’administrateurs autochtones fraîchement nommés qui se sont d’abord sentis isolés lorsque plongés parmi ce groupe d’administrateurs établis. Il est essentiel de combler ces lacunes si on veut que les conseils soient performants.

Mais l’usage croissant de Zoom et d’autres canaux électroniques rend cette adaptation beaucoup plus difficile. « Ce n’est pas une façon de connaître les gens autour de la table », dit-elle. Elle apprécie les avantages reliés au coût et à la commodité – qui soutiennent cette pratique même à l’époque postpandémique – mais elle s’inquiète de ce que la gouvernance à distance empêche le nécessaire établissement de relations personnelles.

Cette question la ramène vingt ans en arrière, lorsqu’elle présidait un conseil dont presque tous les membres étaient éloignés du lieu de réunion. Elle organisait alors des rencontres de comités le premier jour, suivies d’un repas du conseil le soir et d’une réunion de tous les administrateurs le lendemain.

Ainsi, chacun participait aux soupers et les conversations étaient énergiques et agréables. Elle ne saisissait pas complètement le processus alors, mais elle pouvait comprendre qu’un conseil dont les membres passaient du temps ensemble et se connaissaient en tant que personnes étaient en mesure de prendre des décisions malgré des divergences d’opinions considérables. Il y avait « une conversation où la minorité comprenait que son point de vue était entendu et respecté.

» Les membres pouvaient s’engager dans des discussions intenses sans porter atteinte à leurs relations et en maintenant une confiance mutuelle.

Elle admet que lorsqu’il y a un repas du conseil ou un événement social en soirée, il est souvent difficile de faire en sorte que chacun – en particulier les administrateurs locaux –fasse l’effort d’y assister et ainsi les absents sont souvent ceux qui se sentent le plus isolés.

Grit McCreath, qui a travaillé avec Mme Hopkins au conseil de l’Université de Saskatchewan il y a plus de dix ans, affirme que celle-ci adhère à un credo alliant le travail ardu et le plaisir. En tant que présidente du conseil, l’une des forces de Mme Hopkins consistait à « prendre sous son aile les nouveaux venus comme moi ». Son approche accueillante et une solide orientation d’administratrice ont renforcé la chimie au sein du conseil, soutient Mme McCreath, qui est aujourd’hui présidente du conseil.

Similar to the separation of the chair’s role from the CEO position, the practice advances the ability of the board to operate independently of management. Board members have an important duty to share among themselves whether there are any reservations about management and its approach. These frank conversations are often hard to achieve in the presence of management, which knows considerably more about the business than the directors.

“It enables the board to deal with, for example, a CEO who is a bully – because there are some of those around – or a CEO who just can’t get the job done,” she says.

Hopkins’ two-decades-plus tenure on the Cameco board would not be considered best practice by today’s standards of term limits. She acknowledges that the problem with long-serving directors is “people drink the Kool-Aid and lose the ability to

En bâtissant de meilleurs conseils, Mme Hopkins apprécie également l’évolution des normes de procédures. Elle soutient que l’avancée la plus importante en matière de gouvernance a été l’organisation de séances à huis clos réunissant seulement les membres, sans la présence de la direction.

Tout comme la séparation des rôles de président du conseil et de chef de la direction, cette pratique favorise la capacité du conseil d’accomplir sa tâche indépendamment de la direction. Les membres du conseil ont une importante mission à se partager, qu’il y ait ou non des réserves quant à l’approche de la direction. Ces conversations franches sont souvent difficiles à tenir en présence de la direction, qui en connaît bien davantage que les administrateurs à propos de l’entreprise.

« Cela permet au conseil, par exemple, de gérer un chef de la direction qui fait preuve d’intimidation ou qui ne fait pas son travail », explique-t-elle.

The common practice today of scheduling in-camera meetings has been a game-changer, giving boards greater independence from management, says Nancy Hopkins.

‘The nuclear industry is a critical part of our societal needs to reduce carbon emissions, but we’ve been plagued by some jurisdictions in the world not doing a great job of operating plants properly.’

« L’industrie nucléaire est un élément essentiel de nos besoins sociétaux, mais nous avons été salis à cause de certains pays qui n’ont pas géré leurs usines de façon appropriée. »

be objective.”

But in her view, the company she served as a director was a kind of client, comparable to her legal clients in her Saskatoon law practice. To serve effectively as a lawyer or a director, she has to be totally objective with her long-term clients. “I can’t drink the Kool-Aid.”

“I think the critical thing is to evaluate board members on their performance,” she says, noting the evolution of director evaluation to methods of peer assessment and 360-degree processes. Evaluation is only as strong as the culture around the table and the willingness of the board to deal with members who are underperforming – and “that is significantly influenced by the chair.”

Her period at Saskatoon-based Cameco was a rollercoaster, cycling from optimism about the role of nuclear energy in mitigating climate change – uranium is the major nuclear fuel – and concerns around safety, particularly in the wake of the 2011 disaster at Japan’s Fukushima nuclear power plant wrought by a powerful earthquake and tsunami.

“It is a business that is plagued by misinformation,” she says, noting that board members need to distance themselves from the public debate. “Anything a board member says, the company ends up wearing. … You have to be very careful.” The board has a duty to make sure management has a coherent communications plan.

From her perspective as a former director, she says, “The nuclear industry is a critical part of our societal needs to reduce carbon emissions, but we’ve been plagued by some jurisdictions in the world not doing a great job of operating plants properly.” She hopes that countries learn from experience, and from others’ track records, on how to operate nuclear plants safely on a long-term basis.

Hopkins has a wide breadth of experience, from a big public company to police and airport boards. Sometimes, her choices are very personal. She remembers eight years ago, sitting at her law firm desk, when she got a call from a former board colleague saying that Arthritis Society Canada was looking for a new director from Saskatchewan.

The phone call came just as Hopkins was wrestling with her mother’s difficulty in inserting her hearing aid because of arthritis. “I decided the universe was sending me a message and this is something I need to do,” she says.

Her mother died earlier this year at age 102, and Hopkins continues her passionate association with the Arthritis Society, now as chair. She is highly motivated by the effects of this medical condition on families and their stricken members,

La présence de plus de deux décennies de Nancy Hopkins au conseil de Cameco ne serait pas considéré comme une meilleure pratique selon les normes actuelles sur la durée des mandats. Elle reconnaît que le problème des administrateurs qui s’éternisent à leur poste est que « les gens boivent le KoolAid et finissent par perdre leur objectivité. »

Mais selon elle, l’entreprise où elle siégeait était une sorte de client, comparable aux clients de sa pratique de droit à Saskatoon. Pour être efficace comme avocat ou administrateur, il faut être totalement objectif avec ses clients à long terme. « Je suis incapable de boire le Kool-Aid. »

“Je pense que l’essentiel est d’évaluer les administrateurs selon leur performance », dit-elle, soulignant l’évolution des méthodes d’évaluation par les pairs et les processus à 360 degrés. L’évaluation est aussi forte que la culture autour de la table et la volonté du conseil de se charger des administrateurs qui ne font pas le travail. »

Son mandat chez Cameco fut une montagne russe, oscillant entre l’optimisme sur le rôle de l’énergie nucléaire pour minimiser les changements climatiques – l’uranium est le principal combustible nucléaire – et les inquiétudes quant à la sécurité, en particulier dans la foulée du désastre de la centrale de Fukushima en 2011.

« C’est une industrie minée par la désinformation, déplore-t-elle, soulignant que les administrateurs doivent se distancer du débat public. Tout ce qu’un membre du conseil peut dire peut se retourner contre l’entreprise. Il faut être très prudent. Le conseil doit s’assurer que la direction a un plan de communication cohérent. »

À titre d’ancienne administratrice, elle dit : « L’industrie nucléaire est un élément essentiel de nos besoins sociétaux, mais nous avons été salis à cause de certains pays qui n’ont pas géré leurs usines de façon appropriée. » Elle espère que les pays vont tirer les leçons de l’expérience afin de gérer leurs centrales nucléaires de façon sécuritaire à long terme.

Mme Hopkins jouit d’une large expérience. Parfois, ses choix sont très personnels. Elle se souvient qu’il y a huit ans, dans son cabinet juridique, un ancien collègue du conseil l’a appelée pour lui dire que la Société de l’arthrite du Canada était à la recherche d’un nouvel administrateur de la Saskatchewan.

L’appel est venu juste au moment où sa mère éprouvait des difficultés à insérer son appareil auditif à cause de l’arthrite. « J’ai décidé que l’univers m’envoyait un message », dit-elle.

Sa mère est décédée cette année à l’âge de 102 ans et Nancy Hopkins poursuit son engagement passionné auprès

Chair of Arthritis Society Canada, corporate and commercial lawyer

Born in Elrose, Sask.; based in Saskatoon. 70 years old.

EDUCATION

Law degree, University of Saskatchewan, 1978.

Bachelor of commerce (computer science major), University of Saskatchewan, 1977.

CORPORATE CAREER

Lawyer with Saskatoon firm McDougall Gauley LLP since 1979, focusing on corporate and commercial law (taxation and computer law, corporate governance, and mergers and acquisitions).

DIRECTORSHIPS

Arthritis Society Canada and the Canada West Foundation (both since 2016).

Past board experience covers a broad spectrum of organizations, beginning with a Saskatoon credit union in the mid-1980s.

Her most high-profile engagements include:

Director of the Canada Pension Plan Investment Board, 2008 to 2017.

Director at Cameco Corp., one of the world’s largest uranium suppliers, 1992 to 2016.

Member of the University of Saskatchewan board of governors, 2005 to 2013 (vice-chair of the board of governors and chair of the governance committee, 2005 to 2010; chair of the board, 2010 to 2013).

Served as an active public director in accounting professional organizations, including CPA Canada (2016 to 2022), the former Canadian Institute of Chartered Accountants (now part of CPA Canada) and the former CA institute in Saskatchewan.

In recognition of her contributions to the chartered accounting profession – undertaken as a lawyer and board member, not an accountant – she was awarded an honorary CA designation in 1997.

OTHER DIRECTORSHIPS HAVE INCLUDED:

Growthworks Canadian Fund Inc., a retail venture capital fund, 2003 to 2014.

Saskatoon Airport Authority, 2003 to 2013 (chair 2009 to 2013).

SGI Canada, a property and casualty insurer based in Regina, 1998 to 2008 (chair 2004 to 2008).

Saskatchewan Police Commission, chair 1998 to 2001.

Saskatchewan Legal Education Society Inc., inaugural president and director 1994 to 1998.

Canadian Tax Foundation, governor 1990-1993.

Présidente du conseil, Société de l’arthrite du Canada

Avocate, droit commercial et corporatif

Née à Elrose, Saskatchewan; demeure à Saskatoon. 70 ans.

FORMATION

Diplôme en droit, Université de Saskatchewan, 1978

Baccalauréat en commerce (majeure en science informatique), Université de Saskatchewan, 1977

CARRIÈRE EN ENTREPRISE

Avocate au cabinet McDougall Gauley LLP de Saskatoon depuis 1979, spécialisée en droit des affaires et commercial (fiscalité et informatique, gouvernance, fusions et acquisitions).

MANDATS D’ADMINISTRATRICE

Société de l’arthrite du Canada et Fondation Canada West (tous deux depuis 2016).

Son expérience au conseil couvre un large éventail d’organisations, à commencer par la coopérative de crédit de Saskatoon au milieu des années 1980.

Ses principaux mandats :

Administratrice à l’Office d’investissement du Régime de pensions du Canada, 1992-2016.

Administratrice de Cameco Corp., l’un des plus gros fournisseurs d’uranium au monde, 1992-2016.

Membre du conseil des gouverneurs de l’Université de Saskatchewan, 2005-2013 (vice-présidente du conseils des gouverneurs et présidente du comité de gouvernance, 2005-2010; présidente du conseil, 2010-2013).

Elle fut active comme administratrice représentant le public au sein d’organisations professionnelles comptables, dont CPA Canada (2016-2022), l’ancien Institut canadien des comptables agréés (aujourd’hui intégré à CPA Canada) et l’ancien CA Institute de Saskatchewan.

En reconnaissance de sa contribution à la profession de comptable agréé – menée en tant qu’avocate et membre du conseil, non comme comptable – elle a reçu une distinction honoraire en 1997.

AUTRES MANDATS D’ADMINISTRATRICE :

Growthworks Canadian Fund Inc., un fonds de capital de risque de détail, 2003-2014.

Saskatoon Airport Authority, 2003-2013 (présidente du conseil 2009-2013).

SGI Canada, un assureur de biens et dommages de Regina, 1998-2008 (présidente du conseil 2004-2008).

Saskatchewan Police Commission, présidente du conseil 1998-2001.

Saskatchewan Legal Education Society Inc., présidente inaugurale du conseil et administratrice 1994-1998 Fondation canadienne de fiscalité, 1990-1993.

from senior citizens like her mother to young people whose lives are turned upside down.

Hopkins says she will “age out” of her directorship next June. At the moment, the society is trying to increase the diversity of its board. “We know it is a challenge and something we need to work on.”

She also knows that recruitment is just the beginning. Next will come the essential process of making the new members feel truly part of the board. She clearly has some ideas on this.

GORDON PITTS is a Toronto journalist whose latest book, Unicorn in the Woods: How East Coast Geeks and Dreamers Are Changing the Game, was longlisted for a National Business Book award.

de la Société de l’arthrite, dont elle est maintenant présidente du conseil. Elle est hautement motivée par les effets de cette condition médicale sur les familles, qu’il s’agisse d’aînés comme sa mère ou de jeunes gens dont les vies sont bouleversées.

Elle quittera son poste en juin. Elle sait aussi que le recrutement n’est que le début des défis que l’organisation devra surmonter. Il y aura ensuite le processus essentiel d’intégrer pleinement les nouveaux administrateurs au conseil. Elle a des idées là-dessus.

GORDON PITTS est un journaliste de Toronto dont le plus récent ouvrage, Unicorn in the Woods: How East Coast Geeks and Dreamers Are Changing the Game, a été sélectionné pour le National Business Book Award.

Tech-industry investors are increasingly demanding a seat at the board table without assuming the responsibilities of a full-fledged director. The practice is drawing scrutiny from U.S. regulators and needs more attention in Canada, VIRGINIA GALT writes

De plus en plus, les investisseurs en technologie exigent un siège au conseil sans assumer les responsabilités d’un véritable administrateur. Cette pratique fait l’objet d’un examen de la part des autorités réglementaires américaines et devrait susciter plus d’attention au Canada, écrit VIRGINIA GALT

THE GROWING PRESENCE OF board observers – who have been granted access to the boardrooms of innovative tech startups at the behest of investors – has become a talking point in governance circles. Board observers have no decision-making authority, no fiduciary duty and no voting rights, but they do have access to board documents and deliberations.

The practice has garnered considerable attention since Microsoft Corp. placed a director observer on the board of ChatGPT developer OpenAI Inc. and subsequently withdrew its observer this past July, under scrutiny from the U.S. Federal Trade Commission. While the FTC is concerned about Big Tech’s impact on the competitive landscape, some directors and academic researchers are raising concerns about the effect on corporate governance when a big investor is monitoring every move.

It’s a disturbing development, says veteran corporate director Peter Dey, who created Canada’s first corporate governance guidelines for boards of publicly traded companies. Board deliberations are highly confidential and highly sensitive, and directors have a legal fiduciary obligation to act in the best interests of the company.

“If you are a private company and you have big shareholders on whom the company depends for its survival, you have to listen to those big shareholders and they may be able to negotiate access to board deliberations,” Dey says. “But at some point, directors have to kick everybody out and talk unimpeded. … If you have that discussion with director observers [in the room], it may not be as candid as it should be.”

LA PRÉSENCE CROISSANTE d’observateurs – qui ont accès au conseil d’entreprises technologiques en démarrage à la demande d’investisseurs – est devenue un sujet de discussion dans les cercles de gouvernance. Les observateurs au conseil n’ont pas d’autorité décisionnelle, d’obligation fiduciaire ni de droit de vote, mais ils ont accès aux documents et aux délibérations du conseil.

Cette pratique a suscité beaucoup d’attention depuis que Microsoft Corp. a placé un administrateur observateur au conseil du développeur de ChatGPT OpenAI Inc. et l’a ensuite retiré en juillet dernier à la suite d’un examen de la Commission fédérale américaine du commerce (FTC). Alors que la FTC se préoccupe de l’impact des grandes entreprises technologiques sur l’environnement concurrentiel, certains administrateurs et chercheurs universitaires soulèvent des inquiétudes quant à l’impact sur la gouvernance d’entreprises de gros investisseurs qui surveillent tous leurs mouvements.

Il s’agit là d’une évolution troublante, affirme l’administrateur chevronné Peter Dey, qui a créé les premières lignes directrices au Canada à l’intention des conseils de sociétés cotées en bourse. Les délibérations d’un conseil sont hautement confidentielles et sensibles et les administrateurs ont l’obligation juridique d’agir dans les meilleurs intérêts de l’entreprise.

« Si vous êtes à la tête d’une société privée dont la survie dépend de gros actionnaires, vous devez les écouter, explique M. Dey. Mais à un certain moment, les administrateurs doivent faire sortir tout le monde et s’exprimer sans entrave. »

‘At

some point, directors have to kick everybody out and talk unimpeded. … If you have that discussion with director observers [in the room], it may not be as candid as it should be.’

- Peter Dey, corporate director

« À un certain moment, les administrateurs doivent faire sortir tout le monde et s’exprimer sans entrave. »

Microsoft said in July that its “limited role as an observer” on the OpenAI board was no longer necessary because Microsoft – which has invested more than US$10-billion in OpenAI – was satisfied with the performance of the new board and confident about the direction of the company. Apple Inc., which announced a partnership with OpenAI in June, cancelled its plans to place an observer on the board after Microsoft pulled out.

In January, 2024, the FTC launched an inquiry to determine whether competition laws need to be updated to curb the dominance of Big Tech in the generative artificial intelligence domain. Microsoft, Amazon.com Inc. and Google parent company Alphabet Inc. were ordered to disclose their investments, partnerships and agreements with smaller AI developers. “History shows that new technologies can create new markets and healthy competition. As companies race to develop and monetize AI, we must

Microsoft a déclaré en juillet que son « rôle limité en tant qu’observateur » au conseil d’OpenAI n’était plus requis car Microsoft – qui a investi plus de 10 milliards $ US dans OpenAI – était satisfaite de la performance du nouveau conseil et confiante dans la direction de l’entreprise. Après le retrait de Microsoft du conseil d’OpenAI, Apple Inc., qui a annoncé un partenariat avec la même entreprise en juin, a renoncé à son intention d’y placer un observateur.

En janvier 2024, la FTC a déclenché une enquête pour déterminer si les lois sur la concurrence devraient être actualisées afin de freiner la domination des grandes entreprises technologiques dans l’intelligence artificielle générative. Microsoft, Amazon.com Inc. et la société mère de Google Alphabet Inc. ont été forcées de divulguer leurs investissements, partenariats et ententes avec de plus petits développeurs d’IA. « L’histoire montre que les nou-

guard against tactics that foreclose this opportunity,” said FTC chair Lina Khan.

In Canada, it is unusual for operating companies to invest in startups, although it happens from time to time, says lawyer Andrew MacDougall, a partner and corporate governance specialist at Osler Hoskin & Harcourt LLP. “If you are a startup and you have a big player investing in you, you do have to think about whether that big player may be a potential acquirer, could be a potential competitor or could be a potential threat.”

In the venture capital/startup space, it is common for investors to serve as directors or to negotiate director observer status on the boards of developing companies in their portfolios. “The investor clearly has a very strong interest in the governance of the organization because of the amount of capital they put in,” MacDougall says.

It’s the deployment of observers by very large entities that has

velles technologies peuvent créer de nouveaux marchés et une saine concurrence. À mesure que les entreprises s’engagent dans une course pour développer et monétiser l’IA, nous devons nous prémunir contre des tactiques qui verrouillent ces opportunités », soutient la présidente de la FTC Lina Khan.

Au Canada, il est rare pour des sociétés exploitantes d’investir dans des entreprises en démarrage, même si cela arrive, dit l’avocat Andrew MacDougall, associé spécialiste de la gouvernance chez Osler Hoskin & Harcourt LLP. « Quand on gère une jeune pousse dans laquelle un gros joueur investit, on doit se demander si celui-ci pourrait être un acquéreur, un éventuel concurrent ou une menace potentielle. »

Dans l’environnement du capital de risque/entreprises en démarrage, il est commun pour des investisseurs d’entrer aux conseils d’entreprises en croissance figurant dans leur portefeuille ou d’y négocier un statut d’observateur.

attracted skepticism from academic researchers and corporate governance guardians like Dey, who sees this practice as “compromising the integrity of our governance systems.”

The use of board observers is not only prevalent, but on the rise, says a team of U.S. law professors at the forefront of research on the topic. And the players are getting bigger, with more corporations now viewing director observer roles as a means to exert influence without the fiduciary responsibilities and liabilities associated with board membership, say Nizan Geslevich Packin of City University of New York and Anat Alon-Beck of Case Western Reserve University in Cleveland. A recent National Venture Capital Association survey found a “pronounced preference among larger, sophisticated investors [with more than US$500-million in assets under management] for leveraging this governance model,” write Packin and Alon-Beck, whose work has been summarized in the Columbia Law School Blog, the University of Oxford Law blog and on the Forbes.com website. Their research on board observers has been accepted for publication by the Illinois Law Review.

Typically, in the smaller emerging high-tech realm, investors and companies will build safeguards into their contracts if the board agrees to have director observers at the table, MacDougall says. Director observer agreements should be carefully considered and mutually beneficial, with the terms clearly set out in the contract, he adds. “Because they are not subject to fiduciary duties like directors, there will be some restrictions imposed on the observer with respect to disclosure generally, so that they are limited in terms of who they may disclose information to. … Directors also have to be sufficiently mindful of situations where you may need to exclude the observer because of privilege or conflicts of interest or other reasons.

“There will [also] be protections in favour of the observer, and there will often be directors and officers’ insurance coverage in case there should be a claim.” It’s unlikely that such a claim would succeed, because observers do not have decision-making authority, but they could get wrapped up in litigation and therefore would need their costs covered, he says.

Often an investor will ask for a board seat or an observer role as a condition of the investment, says corporate director Irfhan Rawji, a board member at Canadian Western Bank and managing director of Toronto-based Relay Ventures, an early-stage venture capital fund. The boards of venture-backed companies tend to be small. If all the directors’ seats are taken, an observer can still gain valuable insights “by hearing the colour commentary and the strategic discussions in the boardroom,” says Rawji. Boards also look at what else an observer might bring to the table – are they bringing unique knowledge, mentorship? Do they have an extensive network that might be helpful to the business?

“If you are growing and you might need to turn to your existing investors for additional capital, you are going to be interested in having their viewpoints,” says MacDougall.

Mais c’est le déploiement d’observateurs par de très grandes entités qui soulève du scepticisme chez les chercheurs et les gardiens de la gouvernance comme M. Dey, qui considère cette pratique comme « compromettant l’intégrité de nos systèmes de gouvernance. »

Le recours à des observateurs au conseil n’est pas seulement fréquent, mais en hausse, affirme une équipe de professeurs de droit américains à l’avant-garde de la recherche sur le sujet. Les joueurs sont de plus en plus gros, davantage de sociétés considérant désormais le rôle d’observateur comme un moyen d’exercer une influence sans assumer les responsabilités fiduciaires et les engagements associés au poste d’administrateur, soutiennent Nizan Geslevich Packin de la City University de New York et Anat Alon-Beck de la Case Western University de Cleveland. Une enquête récente de la National Venture Capital Association indique qu’il existe une « préférence marquée chez les investisseurs plus importants et plus avertis (plus de 500 millions $ US en actifs sous gestion) pour profiter de ce modèle de gestion », écrivent Mmes Packin et Alon-Beck.

En général, dans l’univers des plus petites entreprises technologiques émergentes, les investisseurs et les compagnies établissent des garanties dans le cadre de leurs ententes lorsque le conseil accepte des administrateurs observateurs à sa table, explique M. MacDougall. De telles ententes devraient être préparées avec soin et mutuellement profitables, avec des clauses claires dans le contrat, ajoute-t-il. « Parce qu’ils ne sont pas soumis à des obligations fiduciaires, certaines restrictions d’ordre général seront imposées aux observateurs en matière de divulgation, de sorte qu’ils ne pourront divulguer des renseignements qu’à un nombre limité de personnes. » Les administrateurs devront aussi tenir suffisamment compte de situations où ils devront exclure l’observateur en raison de privilèges, de conflits d’intérêts ou d’autres motifs.

« Il y aura aussi des mesures de protection en faveur de l’observateur, poursuit-il, et souvent une couverture d’assurance pour les administrateurs et membres de la direction en cas de poursuite. » Il est improbable qu’une telle poursuite réussisse, parce que les observateurs n’ont pas d’autorité en matière de prise de décision; mais ils pourraient être impliqués dans un litige et doivent se protéger, dit-il.

Il arrive souvent qu’un investisseur demande un siège ou un rôle d’observateur au conseil comme condition d’investissement, explique l’administrateur de sociétés Irfhan Rawji, membre du conseil de la Canadian Western Bank et directeur général de Relay Ventures de Toronto, un fonds de capital de risque en démarrage. Les conseils d’entreprises financées par le capital de risque tendent à être réduits. Si tous les sièges d’administrateur sont occupés, un observateur peut toujours glaner des renseignements précieux « en écoutant les analyses et discussions stratégiques », soutient M. Rawji. Les conseils recherchent aussi ce qu’un observateur peut apporter d’autre à la table. Savoir unique, mentorat?

Sometimes the room can become quite crowded. It’s up to the board chair to remind observers that they are ‘just that, observers,’ not active participants.

- Irfhan Rawji, managing director of Relay Ventures

Il arrive que la pièce soit pas mal pleine. Il revient alors au président du conseil de rappeler aux observateurs qu’ils ne sont « que ça : des observateurs », et non des participants actifs.

ICD-ROTMAN WORKING EFFECTIVELY WITH YOUR BOARD: A PROGRAM FOR SENIOR EXECUTIVES.

A two-day in-person experience that optimizes board interactions for organizational success. Attendees will gain a deeper understanding of management’s role, practical tools for engagement, and strategies to maximize boardroom effectiveness.

HUGH ARNOLD, PH.D

Adjunct Professor, Rotman School of Management, University of Toronto

MATT FULLBROOK

Board Advisor and Educator at Fullbrook Board Effectiveness

PROGRAM: November 13-14, 2024

APPLY BY: October 16, 2024

LOCATION: Rotman School of Management, Toronto

TO APPLY, VISIT EDUCATION.ICD.CA/BDP25

For a personal consultation email education@icd.ca.

Sometimes the room can become quite crowded. It’s up to the board chair to remind observers that they are “just that, observers,” not active participants, says Rawji, who has served in director roles and in observer roles at the companies backed by his firm. “What happens on venture-backed boards is that you can get quite a handful of observers. If you are on a board that has five directors and five observers and everyone wants to act as a director, that’s a lot of voices in the room for an early-stage, fast-growing company.”

Corporate governance researcher and advisor Matt Fullbrook says the Microsoft-OpenAI situation is so unusual that it should not influence other boards’ decisions about whether it would be advantageous to have board observers. Boards should decide in advance what material observers can have access to and what’s off limits, what discussions they can be privy to and when they should be asked to leave. “What are the lines we don’t want to cross?”

There could be some benefit to having barrier-free access to a major shareholder if directors want another perspective, says Fullbrook, an executive-in-residence at the University of Toronto’s Rotman School of Management. Of course, there is the risk of angering shareholder observers if board decisions don’t go their way. “But let’s be real here. These are corporate boards with a job and a board observer with no authority.”

While board observer arrangements are covered by contracts

Dispose-t-il d’un large réseau susceptible d’être utile à l’entreprise?

« Si votre entreprise est en croissance et que vous pourriez devoir vous tourner vers vos investisseurs actuels pour un ajout de capital, vous serez intéressés à connaître leurs points de vue », croit M. MacDougall.

Il arrive que la pièce soit pas mal pleine. Il revient alors au président du conseil de rappeler aux observateurs qu’ils ne sont « que ça : des observateurs », et non des participants actifs, affirme M. Rawji, qui a siégé comme administrateur et comme observateur à des conseils d’entreprises soutenues par sa firme. « Ce qui se produit à des conseils d’entreprises financées par du capital de risque, c’est qu’on peut se retrouver avec plusieurs observateurs. Si vous siégez à un conseil comptant cinq administrateurs et cinq observateurs et que chacun veut se comporter comme un administrateur, cela fait beaucoup de voix pour une entreprise en démarrage en pleine croissance. »

Le chercheur et conseiller en gouvernance Matt Fullbrook soutient que la situation Microsoft-OpenAI est si rare qu’elle ne devrait pas influencer les décisions d’autres entreprises quant à la présence d’observateurs à leurs conseils.

Il pourrait y avoir certains avantages à ce qu’un actionnaire majeur ait un libre accès au conseil si les administrateurs désirent entendre un autre point de vue, souligne M. Fullbrook, un cadre en résidence à la Rothman School of Management de l’Université

‘As corporate governance evolves, and the role of board observers expands, there is an increasing need for a thorough examination of the ethical implications of board observers’ influence, potential conflicts of interest and the impact on corporate transparency and accountability.’

« À mesure qu’évolue la gouvernance et que s’élargit le rôle des observateurs au conseil, un examen rigoureux s’impose des implications éthiques de ces observateurs, de leur influence, des éventuels conflits d’intérêts et de leur impact sur la transparence et la reddition de comptes », concluent les chercheuses.

between investors and the startups they are funding, there is a need for tighter controls, write Packin and Alon-Beck.

“The increasing reliance on board observers calls for more robust guidelines and regulatory frameworks to support their constructive engagement in governance and ensuring that their influence enhances rather than undermines the integrity of corporate governance. … Regulators should certainly consider whether notifier requirements should also expand to cover outside director observer or informal advisory appointments that access competitively sensitive strategies.”

Further research will also look at power dynamics and “the chilling effect” of big corporate shareholders sitting in the boardroom.

“As corporate governance evolves, and the role of board observers expands, there is an increasing need for a thorough examination of the ethical implications of board observers’ influence, potential conflicts of interest and the impact on corporate transparency and accountability.”

VIRGINIA GALT, a former business and education reporter for The Globe and Mail, covers legal, education and management issues for a number of publications.

de Toronto. Bien sûr, il y a le risque de mettre en colère les observateurs si les décisions du conseil ne vont pas dans leur sens.

Même si les ententes relatives aux observateurs sont l’objet de contrats entre les investisseurs et les entreprises qu’ils financent, il faut des contrôles plus serrés, écrivent Mmes Packin et AlonBeck.

« Le recours croissant à des observateurs appelle des lignes directrices et des cadres réglementaires plus robustes pour faire en sorte que leur influence rehausse l’intégrité de la gouvernance plutôt que de la miner, soulignent les auteures. Les autorités réglementaires devraient examiner si les exigences imposées au déclarant ne devraient pas s’étendre à l’observateur externe qui a accès à des stratégies sensibles sur le plan concurrentiel. »

Des recherches plus poussées étudieront la dynamique du pouvoir et « l’effet paralysant » des gros actionnaires siégeant à la table du conseil.

« À mesure qu’évolue la gouvernance et que s’élargit le rôle des observateurs au conseil, un examen rigoureux s’impose des implications éthiques de ces observateurs, de leur influence, des éventuels conflits d’intérêts et de leur impact sur la transparence et la reddition de comptes », concluent les chercheuses.

VIRGINIA GALT, ancienne journaliste du Globe and Mail spécialisée en économie et en éducation, couvre les questions juridiques, d’éducation et de gestion pour un certain nombre de publications.

Are you a board director or Executive Director of a registered charity dedicated to community improvement? Apply now for the ICD-RBC Foundation Scholarship. This needs-based financial assistance* will provide you with the opportunity to attend the ICD-Rotman Governance Essentials Program, a foundational program to build the necessary skills to serve on boards effectively.

Apply now at EDUCATION.ICD.CA/RBC25

Several years ago, enterprise risk ranked near the top of board priorities. Companies adopted various risk management and risk oversight frameworks and tools, and invested considerable time developing and analyzing risk universes. Management’s risk monitoring and board reporting was a regular quarterly exercise. But over the past few years, board attention to risk oversight has dissipated. Director Journal sat down with veteran corporate director JOHN CALDWELL to discuss how risk oversight has evolved. Il y a plusieurs années, le risque d’entreprise figurait parmi les grandes priorités du conseil. Les entreprises ont adopté divers cadres et outils de gestion et de surveillance du risque et ont investi beaucoup de temps dans le développement et l’analyse des univers du risque. La surveillance du risque par la direction et le conseil étaient des exercices trimestriels. Mais ces dernières années, l’attention du conseil à cet égard s’est dissipée. Le Director Journal s’est entretenu avec l’administrateur de sociétés chevronné JOHN CALDWELL de la façon dont la surveillance du risque a évolué.

Why do you think directors’ attitudes to risk management are shifting?

There are several reasons for risk being de-emphasized. Risk universes expanded, became unwieldy, and needed more prioritization. Impact analyses became too theoretical, and mitigation plans seemed superficial and not action-oriented. In a stable economy, enterprise performance has been reasonably solid, leading boards and management to question the value added to this time-consuming activity. Also, risk management needed a clear linkage to improving enterprise performance.

Pourquoi pensez-vous que l’attitude des administrateurs à l’égard de la gestion du risque est en train de changer? Il y a plusieurs raisons pour lesquelles l’accent sur le risque a diminué. Les univers du risque se sont élargis, sont devenus plus complexes et doivent davantage faire l’objet de priorités. Les analyses d’impact étaient devenues trop théoriques et les plans d’atténuation semblaient superficiels et peu orientés vers l’action. Dans une économie stable, la performance de l’entreprise a été raisonnablement solide, ce qui a poussé les conseils et les

Given the importance of risk management, is there a way to address the shortcomings of ineffective board processes?

Boards will still acknowledge that their mandates include risk oversight but need help finding an effective and efficient process to fulfill their responsibilities. However, a more straightforward approach is required — one that is easily understood, underpinned by common sense, and adds value by connecting to performance.

Start with the premise that the emphasis on risk oversight is on improving performance while protecting against material downside consequences.

A risk universe still needs to be developed based on the materiality of the potential exposures. It should be segregated into categories aligned with the structure of the board and committees. The impact and probability of occurrence analyses should be simple, steeped in judgment, and balanced by opportunity. Mitigation plans must be actionable with assigned management accountabilities. Monitoring is ongoing.

How should directors determine which risks they should pay attention to?

The board should set parameters for which risks are to be included in the risk universe. To link risk with performance, the first parameter should consist of all exposures materially adversely affecting performance. The second parameter is to identify risks that threaten enterprise viability or destroy significant value.

You mentioned that the size of risk universes has become unwieldy. Typically, how many risks should qualify for board attention?

Using the two parameters we discussed, for most organizations, the entire universe should include no more than 20 exposures; ideally, less.

Is there an effective way to categorize risks for the purpose of identification? Should the full board be involved in overseeing all risks, or should some or all be allocated to committees?

The most efficient way to provide oversight is to categorize exposures so that certain risks can be allocated to committees. Some risks should remain with the entire board.

For ease of identification and board assignment, establish a risk universe matrix as seen in Figure 1.

Strategic risks should separate strategy formulation from strategy execution. Typical organizational risks include ineffective leadership, insufficient competencies and depth, and failure to attract, retain and motivate talent. Financial risks include liquidity, capital structure and capital availability. Operational exposures vary by the nature of the enterprise but generally are risks associated with the day-to-day running of the business. External risks include all exposures the enterprise cannot control.

directions à mettre en doute la valeur ajoutée de cette activité chronophage. En outre, la gestion du risque nécessitait un lien clair avec l’amélioration de la performance.

Compte tenu de l’importance de la gestion du risque, y a-t-il une façon de gérer les failles des processus inefficaces du conseil?

Les conseils admettent encore que la surveillance du risque fait partie de leur mandat, mais doivent trouver un processus efficace et efficient pour le faire. Toutefois, il faut une approche plus simple, facile à comprendre, soutenue par le sens commun et qui ajoute de la valeur en la reliant à la performance.

Commençons par la prémisse selon laquelle l’accent sur la surveillance du risque est lié à l’amélioration de la performance tout en protégeant l’entreprise des inconvénients matériels.

Un univers du risque doit encore être développé en fonction de la matérialité d’expositions éventuelles. Il devrait être divisé en catégories alignées sur la structure du conseil et des comités.

L‘impact et la probabilité des analyses d’occurrences devraient être simples, ancrés dans le jugement et contrebalancés par l’opportunité. Les plans d’atténuation doivent être réalisables en fonction des responsabilités assignées à la direction. La surveillance est continue.

Comment les administrateurs devraient-ils déterminer quels risques ils devraient surveiller?

Le conseil devrait établir des paramètres pour lesquels les risques devraient être inclus dans l’univers du risque. Pour relier le risque à la performance, le premier paramètre devrait porter sur toutes les expositions susceptibles d’affecter la performance. Le second consiste à identifier les risques menaçant la viabilité de l’entreprise.

Vous mentionnez que le risque est devenu une affaire complexe. Généralement, combien de risques devraient attirer l’attention du conseil?

Selon les paramètres évoqués, pour la plupart des organisations, l’univers au complet devrait comprendre pas plus de 20 expositions éventuelles. Idéalement, moins.

Y a-t-il un moyen efficace de catégoriser les risques à des fins d’identification? Le conseil au complet devrait-il être engage dans la surveillance de tous les risques?

Le moyen le plus efficace d’offrir de la surveillance consiste à catégoriser les expositions de sorte que certains risques soit attribués à des comités. Certains devraient concerner tout le conseil.

How should boards go about analyzing risks more efficiently?

In most cases, impact and probability determination do not require extensive analysis. If a risk is in the matrix, it has the potential for a material impact. The probability of occurrence is judgmental. But duration is essential. Determining the likelihood of occurrence over too short a period can lead to erroneous conclusions. A five-year duration is likely to yield substantially different results. Finally, the risk universe should be scanned to determine if any exposures are interrelated. That is, if one exposure occurs, it triggers another.

Earlier, you stated that mitigation plans seemed superficial and not action-oriented. What approach would you recommend? Mitigation includes actions designed to lessen the exposure by reducing the impact or likelihood of occurrence. Extensive detailed plans are unnecessary. Just answer this question: What actions must we take to lower the risk? Because external risks cannot be controlled, mitigation should include post-occurrence response plans and protective initiatives such as balance sheet strength and insurance coverage.

How should boards monitor risks?

Monitoring risks involves considering whether exposures change and mitigation plans are less effective. It mainly requires board vigilance. However, well-thought-out metrics and early warning indicators can be beneficial.

What are your thoughts on the risk oversight process?