Estate Planning

RFC®, RFA®, Association

Colin Barrett, RFC®, FL Michael Bartolotta, RFC®, NY Lesley Batson, RFC®, FL Vivian E. Brooks, Association, OH James V. Danovich, RFC®, AZ Christopher Phil Gann, RFC®, TX Henry Harris, RFC®, TX Alana L. Kahan, RFC®, IL Steve L. Long, RFC®, MT Paige T. Lunghino, RFC®, NY Anna M. McCormick, RFA®, IL Glanconne B. Meadows, RFC®, NC Kirby Morrison, RFC®, CA

Paul A. Pollatz, RFC®, MI Ryan Reyes, RFC®, FL Frank A. Schiro, RFC®, FL Denise A. Setzer, RFC®, VA Keisha Marie Smith, Association, OH

Brandon Scott Smith, RFC®, VA Jordan Cale Smith, RFC®, LA Joshua Charles Wilson, RFC®, DE Jared Brett Wingate, RFC®, FL David C. Wolfe, RFC®, WV

China 51 new members Taiwan 91 new members

John M. Sparks, RFC®, TX

Archimedes C.E. Faulkner, RFC®, TX Don K. Williams, RFC®, CO

www.iarfc.org/publications/register 146 N. Breiel Boulevard P.O. Box 506 Middletown, OH 45042-0506 (800) 532-9060

Chair, H. Stephen Bailey, Ph.D., MRFC® Vice Chair, Michael Jay Markey Jr., MRFC® Treasurer, Monroe Diefendorf Jr., RFC® Secretary, Michelle K. Blair, RFC® Trustee, Mary T. Moose, RFC® Trustee, Barry L. Dayley, MRFC® CEO, Leonard Simpson, RFC® COO, Charlotte Isbell

President, Bradley K. Maples Sr., MRFC® Executive VP., Lisa Ford, MRFC® Vice President, Lemuel W. Kornegay III, RFC® Treasurer, Stephanie Yates, MRFC® Secretary, Gregory Kurinec, MRFC® Director, Robert Laraia, RFC® Director, Paul Wharf, RFC®

Greater China Development Chair (China, Hong Kong, Macau, & Taiwan) Liang, Tien Lung, RFC®

Greater China Development Vice Chair Liang, Han-Ying, RFC®

Greater China Development CEO Lin, Chien-Hung, RFC®

Hong Kong and Macau Honorary Chair Samuel W. K. Yung, RFC®

Hong Kong and Macau, Chair Teresa So, RFC®

Hong Kong and Macau, Executive Director Allan Wan, RFC®

Taiwan Chair Liang, Tien Lung, RFC®

MRFC CERTIFICATION BOARD

Chair, Robert Lawson, MRFC® Vice Chair, Mary Anne Redmond, MRFC® Treasurer, William Peterman, MRFC® Secretary, Craig Lemoine, MRFC® Director, Julie Friend, Public Member

President, Gamalielh Ariel O. Benavides, RFC® Executive VP., Grace De Vera Escobar, RFC® Vice President, Ismael Melendres, Jr., RFC® Treasurer, Ma Arlene M. Baguyo, RFC® Secretary, Atty. Nicasio C. Cabaneiro, RFC® Director, Cynthia Rimando, RFC® Director, Allan Tamayo, RFC®

Chief Operating Officer, Charlotte Isbell Editorial Coordinator/Public Relations, Susan M. Cappa Director of Membership Services, Vicki Caplinger Membership Services, Judi Nelson and Rachel Gibbs Information Technology, Randy Kriner

United States — www.iarfc.org

China — www.iarfc.cn

Hong Kong — www.iarfc-hk.org

Indonesia — www.iarfcindonesia.com

Philippines — www.iarfc.org/about/philippines Taiwan — www.iarfc.org.tw

The average reader has more than four years of experience in financial services and possesses at least one professional designation/credential. Articles benefit the reader by providing specific planning techniques, practice management suggestions, or educational content about financial services which might include advisory professional responsibilities, industry news, insurance, investment, software, or compliance. For the entire Register General Article and Editorial Policy, visit www.iarfc.org/register.

Editorial Coordinator Susan M. Cappa editor@iarfc.org

Editorial Advisory Committee

Michelle Blair, RFC® Lemuel W. Kornegay III, RFC®

The Register is published by the International Association of Registered Financial Consultants® 2022 and circulated around the world.

It includes articles and advice on technical subjects, economic events, regulatory actions, and practice management.

The facts and opinions in the IARFC’s Register articles represent the author’s views and are not endorsed by the publisher.

The IARFC makes no claim as to accuracy and does not guarantee or endorse any product or service that may be advertised or featured.

The IARFC makes no claim to the current status of any designation or credential that is issued in the titles of contributors listed in the Register other than those issued by the IARFC® (RFA®, RFC®, MRFC®) Articles, comments, and letters are welcome via email to: Susan M. Cappa, editor@iarfc.org

Pay close attention to this issue - especially to the changing of the guard of the Trustee Chair Position. Sadly, we say goodbye to our extraordinary leader Dr. H. Stephen Bailey, MRFC® as he decides to move on. He is an extremely caring individual who has strengthened the Association at all levels.

Being that I am at the Home Office, I have personally experienced the impact he has made on the IARFC during his tenure as Chair and CEO. And it has been significant. For most of us who try to reach a quality of life situation between work and home, Steve paid close attention to what his Team needed. Consultants are always trying to find that balance for clients to make their dreams come true. Steve has taken that to heart when dealing with the IARFC Team and made significant improvements. It was an uplifting change that consolidated our group and kept our home/work life more manageable.

On the wider Association level, he made us rethink the norm, challenged us by creating a more professional IARFC and constantly dogged us with fulfilling our tasks. We always laughingly were glad to see him go out the door back to Charlotte, NC after his quarterly visits so we could take a breather and figure out how to implement his dreams and ideas. So Steve, from all of us, we loved our time with you and thank you for giving your time and effort.

Starting in January of next year, we will be working with Barry Dayley, MRFC® as he assumes the role of Trustee Chair. We already have experience working with Barry and can’t wait to get started on his agendas for the Association.

Both individuals wholeheartedly support the IARFC. It will be bittersweet to let Steve go, but exciting to see what comes next. Check out their thoughts on pages 8 and 9.

This time of year brings about the nominations and final selection for the awards presented by the IARFC. Via different processes, candidates are vetted for recognition.

Nominations can come from the IARFC leadership including the International Chapters, the members themselves, the Register Editor, and even from the Home Team.

Honoring individuals in such a manner speaks to the passion and willingness to serve the Association and the Financial Services Community at large. With this dedication, the Association stays relevant to its membership in appreciating the value of specific individuals.

In the upcoming months, look for the exciting news of Award results.

Loren Dunton Lifetime Achievement Founder’s

Ambassador (individual Chapters) Members

Editor’s

Contact: (513) 424-3481

Steve...We Will Miss You!

Susan M. Cappa, Editorial Coordinator

It’s time to wrap up my time with the IARFC. Throughout the past 6 years, I have worked diligently as your CEO and Trustee Chair. When I first took the leadership position in the Association, I experienced a lot of sleepless nights, ruminating over hard decisions. These included upsetting the status quo by letting long-time employees go, and then stepping back to let people who knew their stuff, take over.

Internally I lobbied to improve the working atmosphere: upgrade locations, add benefits, and most importantly, create a family environment from which people could thrive and not just put in time. We navigated moves, infrastructure changes, employee benefit perks, and even COVID where we all had to adapt to a remote setting. I am most proud of how our team just rolled with the punches.

Association-wise my time was spent in organizational changes that cut through every part of our operations. There were redefinitions of “how we used to do it”, leadership challenges in all chapters, and a concentrated effort to improve the visibility of the Mission of the IARFC. It has been a long journey of figuring out just what was the IARFC and where we were headed.

The main goal of increasing the number of members has yet to be realized to my satisfaction, but I feel the pieces are in place to support and sustain a significant increase. I complement those who have worked hard in following my sometimes out-of-the-box suggestions.

The people who have stepped up in leadership roles have shown promise. In short, they care. I may have been challenging at times, but they all seem vested in bettering the IARFC. My hope is that they will be infused even further by the new leadership coming and will continue to bring positive solutions to the table.

The Philippines were the big surprise. They recognized that there was an opportunity for a chapter rebirth and now communicate consistently with the Home Office. Covid restrictions stayed around a lot longer for them, but they are getting back to normal. Greater China, always a leader in our

international community, has continued their support and sets a high bar of professionalism through their leaders. Hong Kong and Macau will be coming out with exciting news here shortly.

I have never worked with a better group of individuals. I frustrated them at times, I know, but they pushed back and made me defend my position consistently. It was great to have dynamic people on which to bounce ideas. Most of all, they gave a damn. I will miss them.

As I wind up my time with the Association, I am particularly pleased that Barry Dayley, MRFC® of Money Concepts will be stepping up as Trustee Chair. He is an excellent person for the position. With his organizational background, his passion for the IARFC, and his proven high standards for achievement, he will continue to set the bar high for the entities that lead the membership. I have gotten us to where we are walking, he will set the pace running!

It has been my honor to serve with all these groups of talented, delightful people. I will be watching and applauding every success that is sure to come in the future.

H. Stephen Bailey, Ph.D., MRFC®

Contact: (704) 563-6844 chairman@iarfc.org www.iarfc.org

Since joining the IARFC in 2008 and becoming a Registered Financial Consultant, I have been impressed by the inclusive nature of this excellent Association serving members in the investment, insurance, and financial planning business. It stands out as a “non-profit association of proven financial professionals, formed to foster public confidence in the financial services profession, where all members adhere to a clear code of ethics.” This, coupled with a culture of professionalism, “empowers financial consultants to make a transformational difference in the lives of the families, businesses, and communities they serve.” It is this Mission that drives us to assist thousands of members around the globe, including members in the United States and Canada, China, Hong Kong, Macau, Taiwan, and the Philippines.

My involvement in the governance of the IARFC began in 2016, when H. Stephen Bailey, Ph.D., MRFC®, our outgoing Chairman, encouraged me to participate in the Association as a member of the Board of the Master Registered Financial Consultant program. Shortly after, I was elected Chairman and worked together with a great board and executive team to get the MRFC certification fully accredited by the NCCA. Currently the MRFC is among a few recognized by FINRA as accredited designations.

As we look to the future of the IARFC, our challenges and opportunities in many ways mirror those of the profession. We have reached a point in America where there are more financial consultants over the age of 70 than there are under the age of 35. Multitudes of current consultants need to transition their business to a younger generation. Better training and support are needed for young people seeking to be part of the financial planning profession. Regulatory changes continue to add complexity to our business requiring better training, reliable information, and support. Built into each of these challenges is the opportunity to become a better, more sustainable association as we craft and implement long-term solutions.

Our main objectives in the next three years will be two-fold.

First, accelerated growth in overall IARFC membership worldwide, with a push to attract both a greater number among those starting out in the profession, and representatives of insurance companies and independent

advisors or RIA’s. We would also like to increase the number of MRFC certificants by at least five times.

Second, enhanced ethical accountability and support not only for the IARFC but for the profession overall. Working with our local chapters, we are confident in the achievement of these goals.

We have an exciting future as we grow together and we ask for your support in our Mission of empowering more financial consultants to make a “transformational difference in the lives of the families, businesses, and communities they serve”.

Contact: (561) 472-2000 ext 85050 bdayley@iarfc.org www.iarfc.org

For stepping up and working through Association infrastructure challenges that seemed unsurmountable at times. Your day-to-day dedication made a difference to the IARFC and to the Home Office Team that greatly benefitted from your strong leadership.

My hope is to build upon your achievements and further increase IARFC visibility and membership. Accept my deepest admiration for a job well done.

I know you will be available whenever I need support and guidance.

It has been enlightening to have frank and open discussions with the Strategic Planning Group. These experienced consultants see the needs of the Association in a different context. They ask us to look at policies, procedures and programs in a different light. All their suggestions were taken into consideration - resulting in changes being enacted. Other items may only need tweaking. It all is focused on bettering communication between the Association and the members and increasing membership.

The IARFC YouTube Channel needed work. Committee members felt there should be a new channel and invite members to create videos that would be of value to members – creating a “library” of sorts. Much work has been done to accomplish this goal. You will see further in the Register on page 14, a call for member videos. Current videos have been regraphiced and a plan is in place for developing more topics.

To focus more on what the Association has to offer, the Committee thought a booklet/brochure on “How to maximize benefits of the Association/designations and credential”. This should also come in an eversion.

Committee mentioned that the Register should go back to monthly distribution. They all agreed that is was a great opportunity for members to write, be visible and then share it with clients and prospects. There is something about the published written word that is impressive.

While we are still maintaining an Editorial Calendar, more effort is being made to invite writers. If an editorial theme does not fit your imagination, contact the editor and discuss the possibilities of your ideas being included.

There needs to be more avenues of publicizing the path to the more experienced designation - starting with the RFA. It makes sense to get college student plugged into a system where they can advance to higher designations. We have marketing material that promote it through the National Financial Plan Competition, but we just need ways to attract more young professionals. The RFA is a plus for their resumes.

Thanks to the Strategic Planning Group members who are contributing to the betterment of the IARFC!

David Kinder, RFC® Jeremy Nason, RFC® David Guttery, RFC®

The IARFC announces the promotion of Vicki Caplinger in the IARFC Home Office to the Director of Membership Services. She will be responsible for the Membership Team that provides support and assistance to members and prospects. Vicki also is the US Chapter Board Liaison and the Coordinator for the IARFC National Financial Plan Competition. (View her updates on the NFPC on page 28)

Last Register I discussed the results of the National Financial Plan Competition. Now we are gearing up for the upcoming competition in 2023.

With the excitement of the forthcoming competition, we face the challenges of lining up Corporate Sponsors and Individual Donors for the same. If you know of anyone, or any companies that might be a good fit for these roles, let us know. The 2023 Competition will be held in Orlando, FL. Having a Corporate Sponsor at the hometown level would be fantastic!

We encourage IARFC members to donate to this worthwhile cause as well.

All those who support the competition will be listed on the IARFC Plan

Comeptition page of the website.

We are on the lookout for Regional Directors. These well connected leaders work on expanding the membership and receive compensation for their successful efforts. It can be a steady source of income for those who can attract like-minded individuals.

If you are interested in becoming a Regional Director or know of someone who is interested, please let us know. Dr. Constance Craig-Mason, MRFC® is doing a wonderful job with the Regional Directors and needs to fill the open slots in various regions.

Smarsh and Actiance combined in 2018, creating the leading, pure-play archiving provider. Two companies with legacies of innovation complemented each other well, and their individual award-winning solution sets combined together to create the Connected Suite.

With on-prem and cloud capture solutions, as well as multi-tenant and private, single-tenant archiving options, Smarsh can meet the needs of companies ranging from the world’s largest banks and government agencies to singleoffice broker-dealers.

Link: www.smarsh.com

Contact Person: Tom Lynch Mobile: (609) 661-8562

Attend our weekly live demo: Sign up at: www.smarsh.com Watch it work!

One of the unique features to grow and build a presence online is called LinkedIn Live. LinkedIn Live allows a person to live stream video to an audience. It is quite simple to set up but you will need some preparation first before you begin live streaming.

The good thing about live streaming is that you have the live but also the recording. You can repurpose this content with the whole livestream or clips and bites to share on other social media platforms and in emails.

The criteria for Live Video access are:

• Audience base

Members and Pages with more than 150 followers and/ or connections are eligible to be evaluated for LinkedIn Live access.

• A history of abiding by our Professional Community Policies

We want to ensure our members have a safe, trusted, and professional experience on LinkedIn, as defined by our Professional Community Policies. Only members, Pages, and their admins that have a good standing record will be considered for Live Video access.

• Geography

LinkedIn Live is not available at this time for members and Pages based in mainland China.

Use these guidelines when streaming your live videos:

• Avoid selling or promotional streams.

• Do not use pre-recorded content. All streams should be live and happening in real time, or you may confuse members and potentially betray their trust.

• Live stream for at least 15 min. Shorter streams won’t give enough time to build an audience base and encourage interactions. You can share shorter videos from your homepage.

• Avoid talking about how to use LinkedIn on LinkedIn. No meta streams.

• Avoid sponsor logos that dominate the video. If you must use sponsor graphics, keep them small.

• Don’t keep your audience waiting for more than one or two minutes with long “starting soon” screens.

• Keep your content professional. All live content is publicly visible and should be appropriate for a LinkedIn audience.

Also with LinkedIn Live you need a 3rd party app/software to livestream. A few that are popular are:

• Streamyard

• Restream

• Zoom

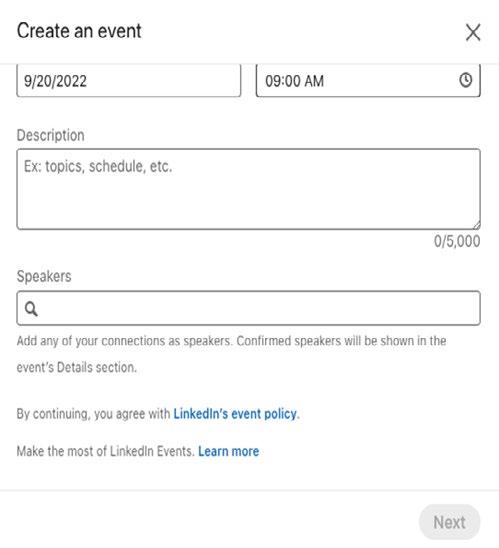

The set up is pretty simple.Here are screenshots to set up the Linkedin Live Event:

On a desktop computer click events on the left hand column:

Step 1: Click add events

Step 2: Click and create an event

Step 3: Upload an image

Step

Step

After all the information is filled in, the “Next” button will turn from gray to blue. You will hit next and save.

As new issues of the Register go into production, the Editorial Advisory Committee is reaching out to give our membership the opportunity to develop articles and/or videos that coincide with the topics as posted in the Editorial Calendar. This is a great way to support your business, while contributing to the education of both our members and consumers. As a published author in the Register, the exposure could lead to obtaining a new strategic partner, working with a client through a referral, or enriching your profile by posting it on your own LinkedIn page. Writing for the Register allows you to share information and expertise with the members on best practices. This showcases the Association’s commitment to the membership by focusing on the distinguished professionals who belong to the IARFC.

Are you looking for more consumer familiarity with your practice?

Filming a video is your chance to deliver a personal presentation on your specialty, via the Association’s YouTube channel. We are revamping our YouTube channel to include current videos from our membership that appeal to the consumer — your target market! Think of it as a vehicle putting you and your business in front of a multitude of viewers with just one video.

We would like to encourage you to review the 2023 Editorial Calendar and address

are interested in communicating about, whether it be in the form of an article or video. Your participation is greatly appreciated in growing the Association’s exposure and strengthening our visibility to both the financial professional and consumer.

Editorial Committee: Michelle Blair, RFC®, Lemuel Kornegay III, RFC® Leonard Simpson, RFC®

With the current state of the market, you might feel that the best thing you can do for your clients right now is to review their asset allocation or discuss historic returns, find new investments, or buy and sell stocks. Although we know that communication with your clients during times like these is imperative, it is difficult for some consultants to pick up the phone or schedule the meeting while their clients’ accounts are tumbling. During the last bear market, we significantly increased our client base as new clients came to us, when their own consultants were not reaching out to them. One woman told us, “I have a financial consultant, but she never contacts me,” to which I replied, “Then you don’t have a financial consultant”.

If you do not want to have your client conversations focus on falling returns or the bad economy because you are worried about how your clients may be rethinking their relationship with you, we find that times like these are the best time to discuss Estate Planning and secure your client and consultant relationships.

As we know, a strong estate plan is more than just a will or some life insurance, nor is it simply the distribution of your client’s assets after they die. If these are the main bullet points of your estate planning strategy as a financial consultant, all you are doing is trading the depressing discussion of the client’s investment losses for the depressing discussion of your client’s death.

Estate Planning should be a fundamentally positive discussion of how to best use their assets during the client’s lifetime; how to adjust to a changing economy or a changing lifestyle; how to protect the goals and plans that the client has for all stages of their life, and then, after death.

More importantly, working with the client on their estate planning is a great way to secure the client relationship. As consultants, we actively participate in the process. We begin with a detailed questionnaire that we work on together with the client, which gives a real insight into their financial and lifestyle goals for now and an understanding of their financial goals for when they are gone.

We use this information to begin a conversation with their estate planning attorney, and we make sure we are actively taking part in said conversation. For those clients that don’t have an estate planning attorney, we have a list of attorneys that we trust to do a good job and keep us in the loop.

We ask the client to prepare a “Family Letter” that they will share with their heirs that includes much more information than what is contained in a will, such as funeral arrangements, what they want in their obituary, and the names of friends or associates for the heirs to reach out to who may not see the obituary, such as those who are out of the country. It can also include their plans for assets prior to their death, such as charities they would like to contribute to during their lifetime, gifts they may want to make while they are still alive, and a list of websites and passwords in case someone needs to take over control of their computer.

We then invite the client, client’s family, or other heirs to join us in our offices for a “Family Meeting”. This gives us the opportunity to meet other family

Estate Planning should be a fundamentally positive discussion on how to best use client’s assets during the their lifetime; how to adjust to a changing economy or a changing lifestyle; how to protect the goals and plans that the client has for all stages of their life, and then, after death.

members and demonstrate that we are an integral part of the client’s financial life; this builds trust with those who may be responsible for the clients while they are still alive and who will receive their assets after they pass.

We have often been told after these meetings how grateful the participants are to have had the opportunity; how happy they are to have a chance to discuss things they really wanted to know but did not want to bring up at the Thanksgiving dinner table; and actually, have been told many times that the family is glad we care so much about them and they feel like we are one of the family.

At our firm, we require our clients to designate a “Trusted Personal Contact” and to provide us with a copy of their Financial Power of Attorney. When their estate planning is completed, we request that the attorney provide us with the proper beneficiary designations for all of our client’s accounts so that they coordinate with the client’s wishes in conjunction with the decisions they made in their will. We provide the clients a copy of their beneficiary arrangements to keep with their documents and suggest that they get hard copies of any arrangements made for accounts or insurances that are not under our control.

We have come to this arrangement with our clients as we have realized over the years that most of the major issues we have had to address with our clients, that cause both client and consultant the greatest stress, is improper estate planning. We have had to watch clients with incomplete planning have no one to address their finances when they are disabled. We have seen business owners watch their businesses fail when there is no one to handle operational issues when they cannot. We have seen clients designate juveniles as beneficiaries with no trustee; leave everything to one child to share with the others; and, thinking that personal planning documents are all that is needed when someone owns a business. These are big mistakes that have big consequences.

I have heard that some studies say only 33% of Americans even have just a will. The fact is that the other 67% are going to die just like the 33%, and will be leaving behind something that someone else has to deal with. As their

financial consultant, you can be a hero to the family by being the one who knows that everything is under control, because you have stressed the importance of estate planning. If you assume that because your client has a CPA, attorney, business manager, and insurance agent, that all of this is done, remember what happened to the estates of Prince, Michael Jackson, and even Howard Hughes. They all died without a will.

We do hear the objection from our clients: they don’t want to spend money on estate planning, because they have “no estate”, somehow believing that an estate is a house in the Hamptons. We laughingly tell them that ownership of anything means they have an estate, and if they have a dog or a cell phone, then they own something. Again, we don’t want to just concentrate on what will happen to the dog and the phone when they die, but what if they are disabled? Who gets the dog?

Good financial planning cannot be good if a large part of the planning isn’t done. While it is important to help our clients see their money grow and plan for them to not outlive their income, that is not the whole plan. Having the right people and processes in place, making sure legal documents are in order so the people and the processes work, providing the client with the sense of well-being while they are alive, and ensuring that, when they do pass, their wishes are fulfilled, is truly a great plan.

Recently I visited a client of mine in a nursing home. He was contented and comfortable, and more importantly felt that he was prepared financially and emotionally for whatever happened. A life well lived; sufficient income, final planning all completed. His family came to visit often. He told me he was grateful that none of them would be burdened when he was no longer here, and that they would not have the stress of having to take care of all the “arrangements”. Everything was done. It made me feel glad that I was part of this process.

When I want to begin a discussion about estate planning with my clients, I tell them the story about the greatest

gift my mother gave me. Although she only had a high school education and made minimum wage most of her life, she was a hard worker and a planner. My father passed away when I was very young, and she raised me and my brother all on her own. Having a will was very important to her because she worried what would happen to us if she should pass away. Thankfully, it didn’t happen until she was almost 90, but being the planner she was, she took the time in her later years to do her estate planning and final arrangements. The day she passed away, my brother and I went to the funeral home to find that we only had to sign one piece of paper. Everything was done and paid for. This was most certainly a final, parting gift as it allowed us to spend our time over the next few days with family and friends, reminiscing about my mother’s life and reminding ourselves that this was just like our mom, always wanting to be in control of her own life.

Once I finish my story, I ask the client if they would like to be able to do the same for their family, and they almost always say yes. The discussion of estate planning begins, and our relationship is taken to a higher level. We truly become their consultants.

The Musuneggi

For over 40 years, Mary Grace Musuneggi has been helping individuals and small business owners develop comprehensive strategies for pursuing their financial goals. An award-winning entrepreneur and Chairman & CEO of The Musuneggi Financial Group, Mary Grace is also a financial educator, award-winning author, and motivational speaker who frequently lectures on financial planning and lifestyle issues.

Group,

2 www.mfgplanners.com

Ben Franklin was born in 1706 and is known as the “father of American insurance.” We proudly continue this tradition of protecting people.

Legacy and transition are important concepts to those in Financial Services and are integral to a successful succession plan. From the client’s perspective, it means continuity and longevity in the guidance they receive during their financial journey. In this issue, we explore a generational consulting firm embarking on its own succession plan and coming out as a rebranded entity that serves the future. As the firm sunsets its former name Lang Financial, Founder Stacy Kahan, RFC® officially passes the leadership reigns to her daughters, CEO Cara D. Kahan, RFC® and President Alana Lang Kahan, RFC® under the firm’s new name: 1706 Advisors.

Register: First, give us the historical roots of Lang Financial. How does your father/grandfather fit in this picture?

Stacy: My father, Stanford Lang, started in the insurance business, as an agent, in 1959 with New York Life. After a number of years, he decided to open his own brokerage. He became an official entrepreneur by opening Lang Kruke Financial Group in Cincinnati, OH, with the goal of better serving corporate and individual clients as an independent agency.

I inherited my father’s love of and knack for insurance and took insurance classes as a business major in college. After graduation, I moved to Chicago and worked at a number of large insurance and finance houses for ten years. Then, I decided to open Lang Financial Chicago and run it as a sister company to my dad’s. While we never owned each other’s businesses, we were each other’s sounding boards for years.

In the mid-2000s, my daughter Cara joined the business; a few years later, my daughter Alana joined as well.

Cara: We’ve been in business for over 30 years and are continuing to grow and modernize. 1706 Advisors is built on experience and constantly

innovating. We have a modern approach to insurance, group benefits, and strategic planning that’s connected to what’s happening in the world today.

Register: Cara and Alana… Discuss the life lessons you have learned from your grandfather and mother that transition to helping clients.

Alana: My mother, we always said, is our grandfather in a woman’s body. They each have a knack for understanding the person in front of them and giving them their undivided attention. People feel special around them.

Feeling understood allows people to open up and tell us what is on their minds. With that trust established, we can help them put a plan in place for their personal goals and dreams and help them protect their families and businesses.

Register: Relate your own personal journeys on how you settled into a career in Financial Services.

Stacy: My father was my hero, and I always admired how he cared so deeply about helping others. He started every conversation with “How can I help?” which made a big

impression on me. I followed in his footsteps to study insurance and began to make my own way after college. Working for some larger firms was a great experience. Still, I loved the idea of running an independent agency and being able to provide in-depth, personal advice and attention to my clients. There were ups and downs along the way, but I started getting repeat business, referrals, and more clients.

Then my father’s health started to decline. He was diagnosed with Parkinson’s disease and Dementia and eventually needed full-time care. It was such a gift to our family that he had planned ahead and had long term care insurance in place to help cover his care during an emotional and challenging time.

Cara and Alana with Grandfather Stan

A Family of RFCs: Cara, Stacy, and Alana Kahan

That’s one thing I love about what I do. I meet people and learn about their hopes and dreams, and then put plans in place to help them. Sometimes they never need the insurance or benefits, but if they do, it can be life changing.

Cara: When I graduated college with a marketing and entrepreneurship degree, I was not sure what I wanted to do. I ended up working for a large family business in Chicago. Each day, I would see this family come together and work towards a common goal.

During this time, I talked to Stacy’s personal coach, Leo, as I was working to determine my career path. After talking and talking and talking, Leo told me to build a list of what I wanted out of a job and my life from that job. He said, “Ignore the day-to-day, but 30 years from now, what do you want to have done for people?” So, I created a list. On the list were things like – work/life balance, helping people, making changes in people’s lives, providing guidance to someone, etc., etc. Then one afternoon after work Leo and I talked about my list. And I will never forget the first words Leo said to me after reviewing it. He said, “Cara, I hate to tell you this, but I think the insurance business is your place.” I was shocked. We continued to talk about what it meant to be in the insurance business and how it was the perfect career for me.

Later that week, I met with my mom and said, “I know you are looking for a new account manager. Can I apply?” She was surprised, and the rest is history.

Alana: I have always been a numbers person. I gravitate towards the definitive and love the story that numbers can hold. But I’ve also always been a people person. I love to travel and explore other places, cultures, and experiences that differ from my day-today. From the beginning, financial services fit my personality – numbersbased yet relationship-based, and an ever-changing industry that allows me to meet people from all walks of life. It was and is a perfect fit. At the end of the day, we help people using financial tools. We allow people to follow their path and dreams while ensuring their eco-system and the overlap between

their professional or personal lives are financially protected from life’s uncertainties. As insurance brokers, we get a peek into how people tick, what they value, how they operate, and what their objectives and aspirations are. This mix of math and personal relationships has allowed me to flourish, helping me and creating my life path and journey and helping those around me.

Register: What strengths do each of you bring to 1706 Advisors?

Cara: The 1706 Advisors leadership team is the perfect mix of personalities and strong attributes. Stacy is an entrepreneur in every way possible –a true visionary. She leads development, makes sure we keep growing, and finds the most modern yet strategic solutions for our clients and prospects. I am the analytics – my ethos is driven by data, and I am deliberate and organized in my tactics. All decisions are wellthought-out and backed by facts that put our clients and business in the best position possible. Alana focuses on ensuring our clients, their employees, and family members are taken care of with the most optimal solutions. She will go to bat for anyone, advocating on their behalf with insurance carriers so their stories are told, and they aren’t “just a number.”

If you want someone on your team to back you up, Alana is the person you want.

Register: Let’s learn more about 1706 Advisors. It’s foundation of longevity looms organic. How does that impress your clients and prospects?

Cara: The fact that we have been in business more than 30+ years provides a level of confidence for our clients. Clients want to feel valued. We have learned that an independent agency with strong partnerships gives the client the best of both worlds. On the one hand, we’re independently owned and operated, giving us the freedom to make our own decisions and provide customized solutions while offering the most personal client experience. On the other hand, we’re a Partner Firm of United Benefits Advisors (UBA), a nationwide community of firms. With UBA’s additional resources, brain power,

and negotiating skills, we compete with large insurance houses, providing cutting-edge solutions to our clients.

Register: What changes have been made along the way and what key elements have stayed consistent?

Cara: Independence allows us to be nimbler and more malleable in the ever-changing insurance landscape. We always maintain a client-first philosophy, and that has never changed. We continuously adapt to industry and economic changes, so our clients are always getting the most up-to-date information, benefits, and choices.

Register: Explain why you feel insurance is much more dimensional than just policies.

Alana: Insurance is a multi-dimensional planning process that includes assets, liabilities, cash flows, debt, medical history, personal and professional goals, and much more. As consultants, we take a holistic approach to our client’s needs, wants, and objectives. Insurance is simply the tool we use to solve problems, whether it’s an employee retention tool, a family protection tool, or a business protection tool.

Register: Relate a policy story that has helped, healed, or saved clients.

Stacy: One, in particular, stands out. Joel is both our client and our friend and has a life-long relationship with our family. Years ago, we were working with him to protect his business, and he pushed back on getting disability insurance. We see this all the time –people think “it won’t happen to me.” Joel’s CFO at the time had a different opinion. He told me that I made such a compelling case that he got the disability coverage anyway, even though Joel hadn’t agreed. A few years later, Joel broke his neck in an accident and lost the use of his legs. Joel told me, “Because of your passion and persistence, I’ll never have to sell my house or rely on the generosity of friends and family – and neither will my children. I will be financially independent for the rest of my life, and I owe that to you Stacy.” Stories like Joel’s are why we find so much meaning in what we do at 1706 Advisors.

Register: Why do you feel your clients stay with your firm? What do they value the most?

Cara: There are many reasons we have a retention rate of over 90%:

• First, we believe in straight talk and building authentic, genuine relationships with our stakeholders.

• We approach every client situation holistically, so all areas of a person’s life are considered and covered.

• We’re problem solvers! We find clarity in the complex and work tirelessly to find the right solution.

• We have a data-driven approach but believe in exceptional client service and personal attention.

• Our client’s lives and businesses change over time. We help them update or change their protection plans so there aren’t any coverage or benefit gaps.

Register: Daydream about the future of 1706 Advisors. What are your goals and aspirations for the firm?

Alana: To grow while staying clientfocused. We want to continue changing the insurance industry and how our clients relate to the industry. Our goal is to make people feel empowered by their financial decisions. These decisions can make tremendous differences in people’s lives and their businesses.

Register: Moving to IARFC membership, what are the reasons that you became a Registered Financial Consultant?

Stacy: One of the hardest parts of the financial service industry is finding like-minded people with the same standards and values. When we found the IARFC, I knew this would be a community of like-minded individuals from whom we could learn and grow. The IARFC is continually focused on learning to make our industry stronger.

Register: How important to you are the ethical standards of the Association?

Cara: In our business, we are nothing more than our reputation. Reputations are built on having an extremely high ethical standard. We take comfort in knowing that the IARFC’s pillars are built around the highest ethical standards, and

we will always have a professional association to align with.

Register: What can the IARFC do to help promote their members to the general public?

Alana: It is fabulous that everyone in the financial services profession knows (or should know) of the IARFC. It would be amazing if we could continue to spread the word about the Association’s standards so when people hear “IARFC,” they immediately know it represents consultants of the highest caliber and ethical standards.

Register: On to family dynamics… How do you relate as family working together? When does business stop and family time start?

Alana: We are so fortunate to have business partners that are also family. There is an inherent trust that was first built around family camaraderie, and this trust carries into our business. We have one common goal, which is to protect clients. To do that, we know we need to maintain a strong business organization. We have worked very hard over the past ten years to create boundaries, and we know those boundaries must be protected, respected, and honored. We are business partners, mothers, and sisters – that relationship is

sacred, and we work daily to support each other in all aspects of our professional and personal lives.

Register: What does a “time out,” “I disagree” situation look like?

Stacy: Of course, we are human and go beyond the normal business boundaries. In those moments, we take a step back, pause and take a deep breath. In a professional setting, we are business partners first, and if we need to reconvene later as a family, we will do just that.

Register: Lastly, what are your hobbies, interests, passions that drive you outside of work?

Cara: We all love to travel, connect with family and friends, and enjoy the outdoors. To us, having the ability to ground ourselves and take a moment to relax and re-examine our successes and failures is imperative. We all love a great adventure and spending time together…I know it’s surprising; we really like each other!”

•

•

•

•

•

•

The benefits of the “Package Pricing” allows IARFC members to receive ALL the CE units needed to renew their license for the low price of $29.95. The Success CE package price is good for 365 days.

Save time and money while enjoying the best quality service and support!

Getting your CE credits has never been easier or more convenient, with SuccessCE’s easy-to-complete content. Try us today and you will be pleased!

Website: https://www.successce.com Phone: (949) 706-9453 Email: Info@successce.com

both the

Register for the

and Fall

in the

and then take the

in the back of the Journal for reference. Once you have registered, you will receive an email with a link to access the quiz.

Two (2) units of

to

who achieves a score of 70% or higher

quiz. Only one quiz

IARFC member is allowed. IARFC CE Guidelines for Professional

Up to five (5) units may be claimed for

ten (10) units.

In the 40 years that our busy estate planning boutique law firm has been in business, we have interacted with hundreds of financial consultants. Lawyers sometimes have a bad reputation in the financial industry because lawyer’s services are viewed as an unnecessary expense. However, financial consultants are not usually licensed to practice law, and the inclusion of an estate plan into a person’s financial plan is a wise decision to ensure that the person’s wishes and goals are accomplished upon disability or death. Through the healthy collaboration of the financial consultant and the estate planning lawyer, clients can be rest assured that there is a team in place to give the clients peace of mind that their legal and financial affairs are in order.

The primary way that our firm encourages collaboration between the financial consultant and estate planning lawyer is through the participation of the financial consultant in all of the lawyer’s material meetings with the clients. The initial planning meeting in which the clients relay their goals and wishes about the disposition of their assets upon death is especially important for the financial consultant to attend. Often the financial consultant has worked with the clients for many years, so the financial consultant knows a lot about the family dynamics and spending habits, which is important information to facilitate the discussion

between the clients and the estate planning lawyer about to whom, and how much, an inheritance should be left to beneficiaries.

Many times, it is the financial consultant who not only can provide valuable input about the decisions surrounding the distribution of a clients’ estate upon the clients’ death, but it is the consultant who can make recommendations about the most responsible person(s) to put in charge as executor or trustee in the client’s estate planning documents. The financial consultant can often provide insight about which family member(s) would be the most responsible estate representative based on the way the family member(s) manages his/her own financial affairs.

Often a widow whose husband handled all the finances during the marriage is unaware of the couple’s assets and how much they are worth. In addition, the wife is sometimes completely clueless about the bill paying, bank accounts, taxes, and insurance matters. Many times, it is the financial consultant who has the information needed to assist the living spouse and the estate lawyer with the questions about the surviving spouse’s current financial condition. The financial consultant can also work with the estate lawyer to develop a summary of assets to assist with settling the deceased spouse’s estate, and to help the surviving spouse develop a plan for financial stability now that his or her spouse is deceased.

One of the main reasons our firm encourages the involvement of financial consultants in the estate planning process is this: it is often the financial consultant who is on the front line of defense in ensuring that our clients’ beneficiary designations are done correctly, especially when a trust is involved in a clients’ estate plan. Incorrectly designating the beneficiary(s) on assets is one of the main factors why a decedent’s estate must be administered through the probate court, and this activity is often directly guided by the financial consultant.

Assets managed by a financial consultant are often required to be probated after a client dies because the client’s assets under the management of the financial consultant are not titled properly to avoid probate. When a trust isn’t funded properly or the beneficiary designations on an account are not completed, one of the main reasons why the trust or the estate plan was created in the first place is often defeated. If the financial consultant turns a blind eye to this important final step in estate planning (trust funding), the decedent’s estate assets may have to be probated before the assets can be distributed. The extra costs associated with probating the estate will reduce the amount of money in the estate (and usually the amount of money the financial consultant manages) and could tie up the estate

assets from being distributed for a long time. In addition, probate sometimes costs exorbitant attorney fees. This specific example of having missing or incorrect beneficiary designations is just one demonstration of the important role that a financial consultant plays in one’s estate planning.

Effective, comprehensive estate planning requires clients to disclose everything about their finances to the estate planning lawyer. All the skeletons in the closet must come out for an estate planning lawyer to effectively assist clients with getting their affairs in order. The financial consultant can work with the estate planning lawyer to integrate all the client’s investments into the estate plan, ensuring that no assets are left unaccounted for when the client dies. The financial consultant can often also advise the estate planning lawyer of the clients’ qualified and nonqualified assets, so that the necessary tax planning can be integrated into the client’s estate plan.

The standard operating procedure at our estate planning firm is to involve the financial consultant in the estate planning process from beginning to end, as much as possible. At a minimum, we strongly suggest that the financial consultant attend the initial meeting at the beginning of the estate planning process. In addition, for clients who obtain trust(s), our firm provides thorough instructions specifically designed for the financial consultant that are customized to reflect the clients’ specific estate planning details outlined in the trust. The trust funding letter, as we call it, is a great tool for the financial consultant to use to guide clients in assigning the correct beneficiary designations for assets that should be funded into the newly created trust.

While most of this article discusses the importance of the collaboration between the financial consultant and the estate planning lawyer, beware: not all estate planning lawyers are created equal. In Ohio, a lawyer can become certified through the Ohio State Bar Association (OSBA) as a Certified Specialist in Estate Planning, Trust and Probate Law.

Becoming an OSBA Certified Specialist is a rigorous process involving obtaining peer recommendations, taking an additional amount of Continuing Legal

Education (CLE) classes in the area of certification, and then sitting for an exam that tests the candidate on advanced topics that pertain to the certification area. The credential adds credibility to the professional that often separates the consultant or lawyer from his or her colleagues.

When it comes to estate planning, clients do not want to hire a general practitioner who practices in many different areas of law or rely on a website that does not prepare statespecific legal documents. To be an excellent estate planning lawyer, one must have a skilled knowledge of the trust code and the laws that pertain to descent and estate distribution in the state where the lawyer practices. The lawyer should also have an in-depth knowledge of federal and state estate taxes and Medicaid laws, too, to assist clients with asset protection planning, a component of estate planning. A lawyer can prepare a simple will, but a simple will may be insufficient to cover all the bases for a blended family, a person who is receiving disability benefits, a couple in a second marriage, or a single person with “fur babies.” In most of these examples, a simple will would not suffice and a more thorough will, like the comprehensive wills that our firm creates, would be more appropriate for covering all the bases to protect the client and carry out the clients’ wishes.

Instead of hiring a general practitioner, by hiring an OSBA Certified Specialist in Estate Planning, Trust and Probate Law, clients can have the reassurance that the lawyer who is handling their estate planning has the most up-todate knowledge and credentials. All the partners at our firm, Roberson Law, are OSBA Certified Specialists in Estate Planning, Trust and Probate Law. In addition, our partners go through the extra step to maintain the specialist certification year-after-year. The certification we have obtained gives our clients peace of mind in knowing that not just any lawyer who is licensed to practice law is being trusted with the important task of getting the clients’ estate planning affairs in order.

One final point to note about a financial consultant’s involvement in the estate planning process is that there have been occasions when a financial consultant will overstep their legal boundaries and will engage in the unauthorized practice of law. A financial

consultant’s unlawful act of practicing law usually happens when a financial consultant advises their clients that they do not need a trust or advises the clients to do a beneficiary designation against a lawyer’s recommendation. Only in a handful of instances in our firm’s history have we dealt with a consultant who will instruct clients to go against our recommendations because the financial consultant believes that they know better than we do. It is always an unfortunate situation when disagreements occur between the estate planning lawyer and the financial consultant because, in the end, it is the client who suffers.

As reinforced repeatedly in this article, our firm’s belief is that the financial consultant is an important team member to assist with clients’ estate planning. The partnership between the estate planning lawyer and financial consultant is an important one to provide the client with the most holistic approach to the client’s planning needs.

When legal and financial professionals work together, the outcome is the formation of a team that can provide the most comprehensive help for legal and financial wellness, and peace of mind, not only for individuals today, but also for their loved ones now and in the future.

Nancy Roberson, Attorney

Attorney Nancy Roberson has been practicing law in the areas of Estate Planning, Trust, and Probate Law for over 35 years. In addition to practicing law and teaching the Elder Law course for the University of Dayton Law School, Nancy is the president of Roberson Law, a boutique law firm in Dayton, Ohio that has received numerous awards for the integrity and excellence by which the firm operates.

Roberson Law info@dayton-attorney.com www.robersonlawdayton.com

The 2022 International Series of the Philippines Tuesday Podcast has concluded. These can be heard by the Philippines Home page at www.iarfc.org/about/philippines. A big THANK YOU to Bong Escobar who has handled the recording and post production of these podcasts and Grace Escobar, RFC® who handles the organizational details.

For the first issue of the Register, due out February 2023, we intend to explore more on the value of an international connection. The editor is looking for articles that would reflect the importance of communication and sharing best practices between Chapters. Any inquiries about submitting an article for publication can be addressed to editor@iarfc.org.

A

The Importance of the Competition

Analyzing data from a fictional family financial case narrative, the students work through a three part process that includes:

• Case narrative and plan development

• Plan presentation of recommendations

• Financial plan delivery.

The importance of this experience is to take lessons and concepts learned in class and apply it to real world scenarios.

Professors may use the competition as part of their curriculum or as an extra credit activity. Students walk away with an appreciation of plan development, interacting with clients, and providing professional service.

Encouraging the NextGen of Consultants

The shrinking number of financial consultants equates to a shortage of up and coming professionals. A job outlook statistic from the Bureau of Labor Statistics sees a 7% faster than average growth in job outlook for 2018-28. This becomes an important statistic when attracting the next generation to a career in financial services. What better way to support an industry that encourages this career interest than to reach students at the collegiate level?

Corporate Involvement

Corporate Sponsorship gains positive visibility and advertising. A short webinar that details Competition Phases and Sponsorship is available upon request.

Corporate Sponsorship Levels

• $10,000 - Diamond

• $5,000 - Platinum

• $2,500 - Gold

• $1,000 - Silver

For more information on Corporate Sponsorship, contact Vicki Caplinger (513)

or

Visit https://www.iarfc.org/events/nfpc for

information on the

itself.

an IMPACT by supporting the next generation of

professionals!

International

(513)

Middletown,

Vicki Caplinger, Director of Membership Services Vicki oversees the Membership Services Department that provides support and assistance to members and prospects of the IARFC. As the US Chapter Liaison, she works with the US Chapter Board of Directors to facilitate communication and Board Meeting preparations. US Chapter involvement also includes communication and coordination with the Region Directors for the 11 regions in the US. In her role as coordinator for the National Financial Plan Competition, she enjoys seeing the next generation of financial consultants network with the experienced members of the Association.

It seems as if we just wrapped up the 2022 National Financial Plan Competition in Cincinnati and now I find myself in the midst of planning the 2023 Competition. Next year we will be headed to Orlando, FL for the Finals. If you check the Plan Competition section of the IARFC website, it will give the latest information. We are glad to welcome back “regular” participants and introduce the University of Arizona, as a new entrant into the Competition brought in by Dr. Patrick Payne, a former Competition professor.

Thanks to Barry Dayley, MRFC®, who created the “fictional family” narrative for this upcoming Competition. Sometimes I wonder where our consultants get their inspiration from for the case study - a family situation perhaps? A client family with the facts rearranged? No matter, this can be tedious writing that takes time and thought. After we get the narrative, the numbers are put into a Planning Software to at least give us a baseline for comparison.

The Competition is funded through Corporate efforts and each year we need contacts to approach. Maybe someone can direct me to a company headquartered in Orlando. We would love to have a Corporate Sponsor be front and center in their own city. For now, returning as Corporate Sponsors are Money Concepts International and Envestnet MoneyGuide.

Members can participate on an individual level. Scan the QR Code below which takes you right to the IARFC Store and send in a donation. It’s a great way to celebrate your successful career by helping others get started.

Thanks to Dr. Craig Lemoine, MRFC® for his service on the MRFC Certification Board.

Effective January 1, 2023, he will be stepping down from the Board after serving many years as first a Board Member, and then Board Chair. He has provided valuable input in meetings and helped solve many Certification issues brought to the Board for consideration. Dr. Lemoine also fills the position of Editor of the Journal of Personal Finance – an academic publication offered by the IARFC.

Nominations are open for an MRFC who is interested in influencing MRFC policies and procedures. If you wish to serve on the Board, contact the MRFC Liaison at charlotte@iarfc.org.

Nominating

FMG Suite is the industry’s leading automated marketing platform for financial professionals providing an all-in-one integrated suite of marketing tools. It creates a standout online presence with beautiful websites to connect with clients and attract new business through their evergrowing, FINRA-reviewed video and article content library, automated email and social media campaigns, and lead generating, gated content.

IARFC Members will have

to several

•

or

•

•

• Member of

• Adhere to IARFC

• Most importantly, they must have contributed to the growth of the IARFC membership by referring

and by holding or attending events that additionally help expand (above and beyond)

visibility of the Association.

Nominations Accepted From: IARFC members: RFA®, RFC®, RFC® Retired, or MRFC®.

Fill out

on a separate sheet of paper and explain why the nominee should be considered for the Founder’s Award.

Submissions are due by November 30,

Nominee:

Founded in 1984, the IARFC fosters and enhances the growth of our

members and the clients we serve by

information, education and

IARFC

strengthen the financial services profession through

promotion of

focus on their continuing professional education.

behavior by our members

As a daughter, mother, soon-to-be grandmother, and insurance broker for almost 40 years, talking about the future planning of a family is clearly dependent upon the relationship that the family has. Most families, unfortunately, never come to understand that the demise of the family leader has not just monetary consequences but emotional as well, and very little is ever discussed about any planning that has been created and what it means.

We, as insurance brokers, come upon this objection early in our careers, understanding that people are uncomfortable talking about their death and the creation of proper planning with the language that tells your family and loved ones your final wishes. It’s hard to believe that 67% of people have no estate plan per a 2022 survey from caring.com. Even only 50% of people have a simple will. This is leaving your family open to confusion and ultimately misunderstandings.

In our society, we even see it with people who are famous. You would think that they have a team of people around them to make sure they do the right thing – proactively plan. What we know, through experience, is that people have an aversion to discussing this topic. Look at Prince, Diana Princess of Wales, and Aretha Franklin, to name only a few. If they could have faced their demise, someday, they could have done

better. Done better by fulfilling the dreams they had and focusing on a legacy to those they love.

Discuss Early Educating your family on inheritance and future planning allows them to make informed financial decisions throughout their lifetime. It also allows you to “teach” them about the importance of respecting and being responsible for the family’s well-being financially, spiritually, and emotionally.

I like to think of it as a trial period. This mentoring phase will show your beneficiaries what is expected of them to continue the tradition.

It’s a Teaching Moment Often, families keep the financial picture a family secret. Personally, I have never understood why we are not teaching our children how to respect money. Fifty-five percent of people carry credit card debt in our country today which does not allow the building of wealth. This, in my opinion, is the most important lesson we need to follow and teach our children. Be wise about your spending.

At the beginning of my career, earning only $17,000 and $22,000 annually during my first two years as an agent, I knew I had to pay myself first. What does this mean? Put money into savings then, pay my bills. Well, we know this requires living below your means. Not a

fun scenario for anyone BUT the most important lesson learned.

The Compound Effect of Money. The compound effect of money is an amazing phenomenon. Compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid.

Compounding thus can be construed as interest on interest – the effect of which is to magnify returns to interest over time, the so-om “miracle of compounding.”

Today, we are seeing young adults just making it. Living too high, accumulating credit card debt early, but wanting independence. We are seeing a trend in them getting smarter which helps in generational planning.

It is often said that children “mirror what they see in front of them” which encompasses a broad range of personality traits, management of money, and how relationships are formed and grow. Your legacy is written through estate planning documents. It says how you want your legacy spoken to the people it impacts.

A positive impact on the next generation begins during the life of the grantor. Showing the family your wishes is always best displayed by how a life is

led and ensuring that the beneficiaries, most often the children, understand how to fulfill those wishes.

An interesting book by Dr. Masaru Emoto discovered that crystals formed in frozen water reveal changes when specific, concentrated thoughts are directed toward them. He found that water from clear springs and water that has been exposed to loving words shows brilliant, complex, and colorful snowflake patterns.

In contrast, polluted water, or water exposed to negative thoughts, forms incomplete, asymmetrical patterns with dull colors. The implications of this research create a new awareness of how we can positively impact the earth and our personal health. So just imagine that showing and demonstrating your wishes through loving words and gestures can change the impact of your family dynamic.

These documents can be defined as a list of instructions to guide your loved ones as to how to manage your affairs if you are gone, or simply unable to manage them yourself. A properly drafted estate plan allows you to protect your property, your loved ones and yourself:

• Last Will and Testament governs the distribution of assets which are solely in your name, through a legal process known as probate.

• Living Trust lets you distribute your possessions to people and charities after you die. The assets inside of the trust are “owned” by the trust escaping probate at death.

• Durable Power of Attorney (POA) gives the authority for someone to manage your affairs while you are alive.

• Healthcare Power of Attorney allows someone you trust to make medical decisions for you.

• Living Will specifies the desired medical care if you lose the ability to communicate.

An estate attorney creates the above documents to ensure your wishes are fulfilled. An estate lawyer can be especially helpful in identifying any weak points in your planning and help you make the best decisions for your estate when you are gone. Here are three reasons that you should consider hiring an estate lawyer:

1. Beneficiary Protection

2. Avoid Court

3. Reduce Family Conflict

You want someone who is asking lots of questions to challenge your current thought process and ensure your wishes are written down in your documents.

Having a family meeting is preferable when sharing your dreams with your family. I would imagine this is difficult for most families but has multiple positive effects. First, getting in front of any animosity reduces family conflict. And the planning effect. Your family can plan since they will know what to expect.

We sat in my parent’s house 20 years ago while my dad handed out binders labeled “Estate Plan.” Within this big black binder was a letter of his wishes and his estate planning documents. He explained what responsibility each of us would have in fulfilling his dreams when he was no longer here.

He was not sick or injured when this happened. This was just good planning.

Totum is the only multidimensional risk tolerance questionnaire and toolkit that helps advisors understand how much risk their clients can comfortably take based on their life situation. With Totum, you can easily customize how you engage with your clients and have in-depth discussions about their Risk Preferences, Risk Capacity, and Portfolio Risk.

This risk clarity closes prospects faster, helps win additional assets from existing clients, and serves as a necessary reassurance when anyone has doubts.

The Totum Risk toolkit includes the multi-scoring risk questionnaire, integrations, analytics, model marketplace, and custom reporting with an IPS all for $99/month. Get career details including projected growth and wages, daily tasks, recommended education and skills and much more.

your wishes through loving words and gestures can change the impact of your family dynamic.

Kahan, RFC®

Advisors

You can learn a lot about life by watching your birdhouse. The bird couple shops around, deciding on your birdhouse. They go through the process of nesting. For birds this means finding twigs, because there is no version of IKEA for birds, at least not yet. The young birds are born. Eventually they leave the nest, find mates and repeat the process for themselves. Your client thought their nest was empty until suddenly one or more of their children returned. What now?

As an insurance professional, you do not see how this problem concerns you. They aren’t your children. You didn’t send them back to their parents. Here is the issue: You are working with your client, implementing their financial plan, step by step. Suddenly their grown child moves back home. Your client promotes this event to crisis stage and will not direct any attention to financial planning until this crisis is resolved or at least downgraded.

This problem can happen at different stages in life. The Gen Y child moving back home after college is one example. In 2019 Forbes reported 50% of Millennials were making that move. (1) Covid had an effect too. According

to a 2020 article from CNBC 39% of younger Millennials were planning on returning to the nest. (2)

OK, it’s an unexpected development. Your client might be thinking this is a permanent move. They are haunted by thoughts about the 2006 movie “Failure to Launch.” How should your client approach the situation?

• This can be a good strategy. If their child lives at home, they can save money for a down payment for their first home or accelerate paying down their college loans.

• If they do not have a job, they could use the house as their office and headquarters for their job hunt.

• Your client should avoid confrontation, but set a timeframe for how long their boomerang child will be staying. This can always be revised, but a “checkout time” should be established up front.

What can the consultant do in the meantime? This is an opportunity to be understanding and compassionate. Your client needs a sounding board. Lending an ear will help to strengthen your relationship. Your client knows you

are trying to help and not getting paid for your time.

What else can the consultant do? They can work through “what if” situations with the client, working together to seek solutions. What kind of job does their child want? What profession has their education prepared them to join? If they are following in the client’s footsteps, can the parents make connections for them? As their consultant, can you help through your connections?

Does their child have a plan? This situation can be viewed from the perspective of an executive who has received a severance package. They have a place to land while they search for their next position. Is their child getting help with their job search or are they going it alone? The college alumni office should be able to help.

As their consultant, you are not a therapist, but you should remind your client they are doing something wonderful for their child. They have helped them achieve a soft landing. Is their child appreciative of the help they are getting? Is your client being supportive in their efforts? At work you know the difference between a sales manager who helps you do business

and one that always asks: “How much business did you bring in today?” If their child has a plan and is making the effort, their parents should be supportive.

This example looked at the recent college graduate who returned home, the 20-year-old on the doorstep of your mid 40’s couple. This problem can happen to clients of all ages. Your Baby Boomer client, now in their 60’s, could find their 40 year old child returning home after getting divorced. In this situation, their child might be settled in their career, but need emotional support after the divorce. It’s a different king of healing.

What are your objectives as their consultant? You want the problem to be solved, the bird to fly from the nest once again. You are being supportive towards your client, but their child must solve the problem. Both you and the client can help, but remember when you are making introductions, you do not know the child as well as you know the client. You want the crisis alert to be downgraded, so your client returns their attention to implementing their own financial plan, preparing for their own future.

(1) https://www.forbes.com/sites/zackfriedman/2019/06/06/ millennials-move-back-home-college/?sh=4920f001638a (2) https://www.cnbc.com/2020/08/05/39-percent-of-youngermillennials-say-covid-19-has-them-moving-back-home.html

Randy Kriner, Information Technologies Team Member for the IARFC, additionally coordinates the Strategic Alliance Committee for the Association. The purpose of the Committee is to oversee the development of strategic alliances with other associations and institutions. It also ensures the relationships with other alliance partners do not violate the IARFC Code of Ethics or construe a conflict of interest.

The International Association of Registered Financial Consultants (IARFC®) is announcing a strategic alliance with Riskalyze, a company with a mission that “empowers clients to invest fearlessly”. Along with other Association benefit offerings, this cross-purpose investment platform provides members with a 10% discount for products and services.

With that mission in the forefront, Riskalyze powers the world’s first Risk Alignment Platform and was built on a Nobel Prize-winning academic framework. It is transforming the advisory business industry by allowing investment advisors to capture a quantitative measurement of client risk tolerance and use that data to acquire new clients, capture and meet expectations, and quantify suitability.

Consultants, wealth management firms, and asset managers can combine the power of the Riskalyze platform through:

• Risk Alignment – leveraging the power of the Risk Number® to set expectations with clients, document a fiduciary approach and grow business.

• Portfolio Analytics and Research – tapping into sophisticate analytics at the security account, and portfolio level to craft the perfect investment strategies for clients.

Bryce Sanders is President of Perceptive Business Solutions Inc. He provides HNW client acquisition training for the financial services industry. His book, Captivating the Wealthy Investor is available on Amazon.

Contact: (215) 862-3607 brycesanders@msn.com www.perceptivebusiness.com

• Trading – monitoring clients’ accounts to make great decisions when and where attention is needed.

• Compliance – giving home office and compliance officers the tools needed to standardize business around a common language of risk.

“At Riskalyze, we share IARFC’s vision to empower financial professionals for more meaningful interactions with clients and to provide the best financial advice possible. By setting better expectations, documenting and showcasing a sense of fiduciary care, we’re excited to help IARFC members best illustrate their firm’s expertise through the lens of risk”.

Dan Prendergast, Riskalyze, Director of Growth MarketingP.O.

Middletown,