3 minute read

Future proof your retirement

Whether it’s creating wealth for your future, planning for your retirement, investing in shares, expert advice when it comes to your superannuation, risk assessment and estate planning, Pool and Partners Investment Services provide a wide range of services that can enhance and secure your financial position both now and in the future.

Based in Maroochydore, but servicing clients Australia-wide, their focus is delivering thoroughly researched strategies tailor-made to your individual needs.

Advertisement

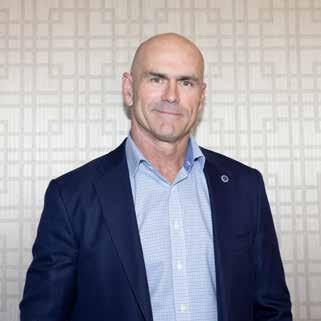

At the helm of Poole and Partners Investment Services, founder and director Kirk Jarrott has been heading up the investment division for almost two decades and is dedicated to building long lasting relationships with his clients and developing a strategic financial plan that is secure and attainable.

“It’s more than a business; it’s a family affair.

“Quite often we are looking after several generations of a family, from our older clients, to their children and grandchildren,” says Kirk.

“I am passionate about ensuring our clients are engaged and empowered when it comes to their finances.”

Beginning his career as an accountant in 1989, Kirk moved to investment services in 2000, as a stockbroker for three years before joining the business. During this time he also lectured at Maroochydore Tafe on the stock market. His vast practical and technical knowledge allows him to provide his clients with direct equity investments, investments through Self-Managed Funds and estate and retirement planning.

“Life experiences can have a dramatic financial impact on people’s lives. That’s why it’s so important to make sure all the boxes are ticked when it comes to being adaptable and able to move when a client’s life changes,” says Kirk. “It’s about building wealth in a tax-effective structure and helping clients have more of a hands-on approach when it comes to their superannuation fund. That might be through investing in direct shares or buying their business premises through their superannuation.”

Kirk is joined by highly skilled and motivated advisor Hayden White, who has been part of the Poole and Partners Investment Services for over 10 years. With extensive knowledge and expertise in providing clients with direct equity investment advice, superannuation, personal investment and all other areas of financial planning, Hayden is a specialist in all forms of life insurance products.

Portfolio Management

Poole and Partners offer tailored financial advice, investment and financial planning solutions. In today’s rapidly changing economic and political environment, the successful management of a portfolio of shares and interest-based investments requires supervision, accurate and up to date information, with an ability to incorporate the latest in technology to deliver a transparent and liquid investment portfolio.

As a fee-based service, it provides clients with lower overall management costs and complete impartiality in investment selection. Poole and Partners has skilled and experienced advisers who are well qualified to provide the complete range of financial and investment services so necessary today.

Services include:

• Portfolio management

• Tailored financial advice

• Investment and financial planning

• Online access – investment portfolio management service

Insurance Services

Without doubt, you are the most vital asset in the creation of a lifestyle and earning an income. That is why personal insurance is so important. When something goes wrong, say if you have an accident, fall ill or someone passes away, it can be a time of great stress. The last thing you want to be dealing with is financial issues. Additional pressure from mounting bills or money worries simply exacerbates your stress, when you should be focused on healing and recovery.

If you are either an employee, self-employed, small business owner, have family members or dependents who rely on the income you earn, have debt such as a mortgage, you need to consider personal insurance to protect your loved ones if you fall ill or pass away.

Type of insurance offered:

• Life insurance

• Total and permanent disablement insurance

• Income protection insurance

• Trauma protection/Critical illness insurance

• Child/Life trauma protection insurance

• Business expenses insurance

• Buy/Sell insurance

Planning for Aged Care

Are you struggling to make informed decisions about upcoming Aged Care, either for you and your partner or maybe for loved ones? When it comes to accessing aged care, a clear roadmap means peace of mind. Acknowledging a need for aged care is often an emotional time. The stress can lead to family conflicts, fuelled by the three G’s of aged care – grief, guilt and greed. Making incorrect decisions under pressure is time consuming and can be costly for you. By utilising Poole and Partners Aged Care Advice Service, you can relieve the pressure and have confidence, knowing you’re choosing the correct pathway.

Services include:

• Money Management

• Identifying funding options

• Aged Care Services package