7 minute read

Pepperstone Vs IC Markets: Review compared which is better?

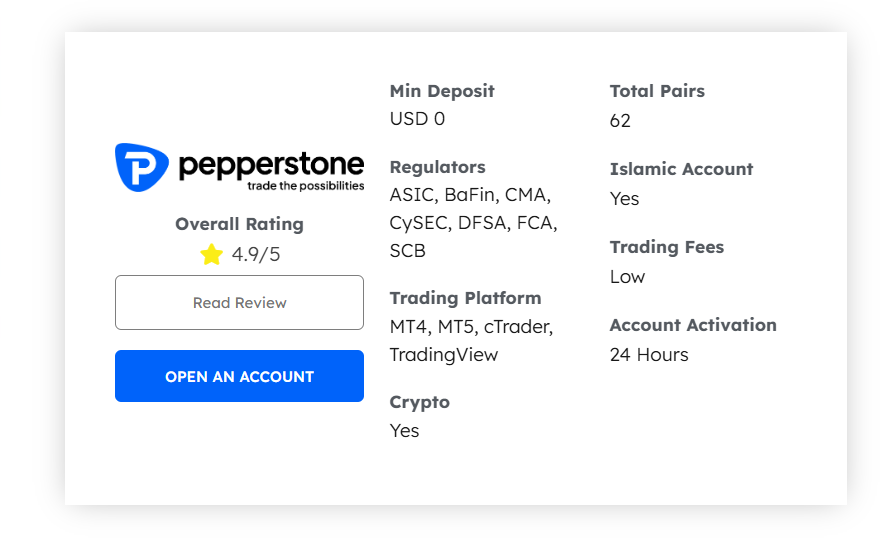

Both Pepperstone and IC Markets are well-established brokers in the forex and CFD trading industry. They have a strong reputation for offering competitive pricing, fast execution, and a range of trading platforms. However, despite their similarities, there are key differences between these two brokers that traders need to consider when choosing between them. In this detailed comparison, we'll evaluate Pepperstone vs IC Markets across various factors such as regulation, trading platforms, spreads, commissions, account types, and more.

Open Account Trading 🏅Pepperstone

1. Regulation and Safety

Pepperstone:

Regulation: Pepperstone is regulated by top-tier financial authorities:

ASIC (Australia): The Australian Securities and Investments Commission ensures that Pepperstone adheres to strict financial standards and provides protection to traders.

FCA (UK): The Financial Conduct Authority (FCA) in the UK provides strong oversight for Pepperstone’s operations in Europe.

CySEC (Cyprus): Pepperstone is also regulated by CySEC, giving it additional credibility in Europe.

Investor Protection: Pepperstone keeps client funds in segregated accounts, and it participates in the Financial Services Compensation Scheme (FSCS) in the UK, which provides protection for traders' funds up to £85,000.

IC Markets:

Regulation: IC Markets is also regulated by reputable authorities:

ASIC (Australia): IC Markets is licensed by ASIC, ensuring it meets high regulatory standards for client protection.

FSA (Seychelles): IC Markets is regulated by the Financial Services Authority of Seychelles, offering an additional layer of oversight for international clients.

CySEC (Cyprus): Like Pepperstone, IC Markets is regulated by CySEC for operations in Europe.

Investor Protection: IC Markets keeps clients' funds in segregated accounts and is also compliant with AML and KYC regulations, ensuring secure financial operations.

Winner: Tie – Both brokers are highly regulated, ensuring safety and security for traders.

See more:

2. Trading Platforms

Pepperstone:

MetaTrader 4 (MT4): The most popular trading platform, known for its user-friendly interface, advanced charting, and automated trading features (via Expert Advisors).

MetaTrader 5 (MT5): A newer version with more timeframes, additional order types, and access to multiple asset classes beyond forex.

cTrader: Known for its low-latency execution and smooth interface, favored by scalpers and day traders.

TradingView: Provides advanced charting tools and social trading features, integrated with Pepperstone’s accounts.

IC Markets:

MetaTrader 4 (MT4): IC Markets also offers MT4, which is widely used for forex trading due to its advanced technical analysis tools and automation features.

MetaTrader 5 (MT5): Similar to Pepperstone, IC Markets offers the upgraded MT5 platform, which supports more timeframes, additional order types, and more diverse trading instruments.

cTrader: IC Markets offers cTrader as well, which is popular among traders looking for low-latency execution and advanced order management tools.

Winner: Tie – Both brokers offer the same range of industry-standard platforms: MT4, MT5, and cTrader.

3. Spreads and Commissions

Pepperstone:

Standard Account: Offers variable spreads starting from 1.0 pip with no commissions.

Razor Account: Provides raw spreads starting from 0.0 pips, but with a small commission per trade (typically $3.50 per $100,000 traded).

IC Markets:

Standard Account: Offers variable spreads starting at 1.0 pip with no commissions.

True ECN Account: Provides raw spreads starting at 0.0 pips, with a commission of $3.50 per $100,000 traded.

Winner: Tie – Both brokers offer similar pricing structures with competitive spreads and commissions.

4. Leverage

Pepperstone:

Leverage: Pepperstone offers leverage up to 1:500 for forex traders, depending on the regulatory jurisdiction. However, leverage may be limited for certain regions due to local regulations (e.g., in the EU and UK, the maximum leverage is 1:30).

IC Markets:

Leverage: IC Markets also offers leverage up to 1:500 for forex trading, but like Pepperstone, it is subject to local regulations. Traders in the EU and UK may be limited to 1:30 leverage.

Winner: Tie – Both brokers offer high leverage (up to 1:500), but it is subject to region-specific limitations.

5. Account Types

Pepperstone:

Standard Account: For beginners, offering variable spreads starting from 1.0 pip, with no commission.

Razor Account: For more experienced traders, offering raw spreads starting from 0.0 pips with a small commission.

Islamic Account: Swap-free accounts for traders who follow Islamic finance principles.

Demo Account: Practice trading with virtual funds before committing real money.

IC Markets:

Standard Account: Similar to Pepperstone, offering variable spreads starting from 1.0 pip, with no commission.

True ECN Account: Offers raw spreads starting from 0.0 pips, with a commission fee of $3.50 per $100,000 traded.

Islamic Account: Swap-free accounts for traders who need to adhere to Islamic finance guidelines.

Demo Account: A demo account to practice trading without risk.

Winner: Tie – Both brokers offer similar account types, including standard, ECN, Islamic, and demo accounts.

6. Customer Support

Pepperstone:

Support Channels: Offers 24/5 customer support through live chat, email, and phone.

Languages: Support is available in multiple languages, including English, Spanish, French, German, and others.

Help Center: Comprehensive online resources, including FAQs, tutorials, and guides.

IC Markets:

Support Channels: Offers 24/7 customer support through live chat, email, and phone.

Languages: Support is also available in multiple languages, such as English, Chinese, and Arabic.

Help Center: A well-stocked help center with FAQs, video tutorials, and trading guides.

Winner: IC Markets – IC Markets offers 24/7 support, which can be crucial for traders needing assistance outside of regular business hours.

7. Deposit and Withdrawal Methods

Pepperstone:

Deposit Methods: Offers a range of payment methods, including bank transfers, credit/debit cards, PayPal, Skrill, and Neteller.

Withdrawal Methods: Fast withdrawals with no fees for e-wallets and cards; bank transfers may take longer.

IC Markets:

Deposit Methods: Offers a variety of payment options, including bank transfers, credit/debit cards, Skrill, Neteller, UnionPay, and more.

Withdrawal Methods: Generally fast, with minimal fees for e-wallets and cards. Bank transfers may take up to 3-5 business days.

Winner: Tie – Both brokers offer a wide range of payment methods with fast processing times and low fees.

8. Education and Research

Pepperstone:

Offers a variety of educational resources, including webinars, articles, guides, and market analysis.

Provides market news and daily research reports to keep traders informed of market trends.

IC Markets:

Provides educational resources such as articles, video tutorials, and trading guides.

Offers market analysis and news updates to help traders stay informed about global financial markets.

Winner: Tie – Both brokers offer good educational resources and market analysis tools to assist traders in improving their skills.

Conclusion: Pepperstone vs IC Markets – Which is the Better Broker in 2025?

Both Pepperstone and IC Markets are excellent brokers, each offering unique strengths. They both provide competitive spreads, high leverage, robust trading platforms, and strong regulatory oversight. The decision between the two largely comes down to personal preferences and specific needs:

If you value 24/7 customer support, IC Markets would be a better choice.

If you prioritize strong regulation in multiple jurisdictions and advanced platform options, Pepperstone may be more suitable.

Final Verdict: Tie – Both brokers are solid choices for traders in 2025, with similar offerings and excellent reputations. The best choice depends on individual preferences regarding support, platform features, and trading conditions.