7 minute read

Pepperstone Indonesia Review 2025: Pro, Cons, Legit Legal, Safe, a good broker?

Pepperstone Indonesia Review 2025: Pro, Cons, Legit Legal, Safe, a good broker?

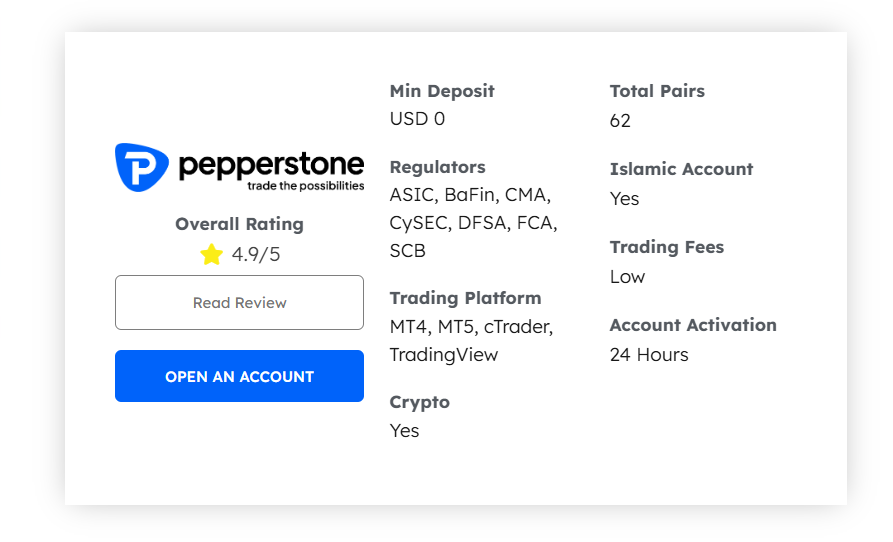

Pepperstone is a well-established online forex and CFD broker that has earned global recognition since its inception in 2010. With its headquarters in Melbourne, Australia, the broker offers services to traders worldwide, including those in Indonesia. In this review, we will analyze whether Pepperstone is a suitable, safe, and trustworthy option for Indonesian traders in 2025. We’ll explore its pros, cons, safety, and overall suitability for traders in Indonesia.

Overview of Pepperstone

Pepperstone provides trading services across multiple financial markets, including forex, commodities, indices, stocks, and cryptocurrencies. Known for its competitive spreads and advanced trading platforms, it caters to both beginner and professional traders. Indonesian traders can access a variety of account types, tools, and features designed to enhance their trading experience.

Key Features of Pepperstone for Indonesian Traders

1. Regulation and Legal Status

Pepperstone is regulated by several top-tier financial authorities:

ASIC (Australian Securities and Investments Commission): As an Australian broker, Pepperstone is regulated by ASIC, a strict regulatory body ensuring fairness and transparency.

FCA (Financial Conduct Authority): The broker is also authorized by the UK’s FCA, further solidifying its global legitimacy.

CySEC (Cyprus Securities and Exchange Commission): Pepperstone is also regulated in Europe.

DFSA (Dubai Financial Services Authority): Pepperstone is authorized to operate in the UAE.

Despite the broker not being regulated by Indonesian authorities directly, the global regulations ensure a high level of trust and security for Indonesian traders.

2. Trading Platforms

Pepperstone offers a range of industry-leading platforms:

MetaTrader 4 (MT4): The most popular trading platform, ideal for forex and CFD trading, featuring a robust suite of tools, charts, and automated trading options.

MetaTrader 5 (MT5): The next-generation platform that offers more timeframes, enhanced order types, and multi-asset trading capabilities, making it suitable for diverse trading strategies.

cTrader: Known for its user-friendly interface, speed, and advanced charting features, this platform is excellent for professional traders and scalpers.

These platforms ensure that Indonesian traders can access flexible and powerful tools to trade efficiently.

3. Trading Instruments

Pepperstone provides access to a wide range of financial instruments:

Forex: Over 60 currency pairs, including popular major pairs (EUR/USD, GBP/USD), minor pairs, and exotic currency pairs like IDR/JPY.

Commodities: Including gold, oil, and silver, among others.

Cryptocurrencies: Access to popular cryptos like Bitcoin, Ethereum, and more.

Indices and Shares: CFDs on leading global indices and stocks, providing diversification options for traders.

This diverse range of instruments allows traders in Indonesia to create diversified portfolios and take advantage of various market movements.

4. Leverage

Pepperstone offers high leverage options, up to 1:500 for forex trading, which can magnify potential profits (and risks). The leverage provided by Pepperstone is particularly beneficial for active traders in Indonesia looking to maximize their capital.

5. Account Types

Pepperstone offers a variety of account types to suit different trading needs:

Standard Account: This account type offers variable spreads starting from 1.0 pips, with no commissions. It's suitable for beginner traders who prefer simplicity.

Razor Account: Known for raw spreads starting from 0.0 pips, this account type comes with a small commission per trade, making it ideal for more experienced traders and scalpers.

Islamic Account: Designed for traders who follow Islamic finance principles, this account provides swap-free trading, with no interest or overnight fees.

Pros of Trading with Pepperstone in Indonesia

Highly Regulated

Pepperstone is regulated by reputable authorities such as ASIC, FCA, and CySEC, which ensures a high level of legal protection for Indonesian traders.

Competitive Spreads and Low Costs

The broker is known for its low trading costs, especially for Razor Account holders, where spreads can start from 0.0 pips, along with very low commissions.

Multiple Trading Platforms

The availability of MT4, MT5, and cTrader provides flexibility for different trading styles and preferences.

Fast Execution and Low Latency

Pepperstone is renowned for fast order execution and minimal slippage, which is especially crucial for active traders and scalpers.

Educational Resources

The broker offers webinars, tutorials, and market analysis to help traders enhance their skills and stay informed about market trends.

Local Payment Methods

Indonesian traders can fund their accounts using local payment methods such as bank transfers and credit/debit cards. However, methods like MPesa, which is popular in Kenya, are not available in Indonesia.

Customer Support

Pepperstone provides excellent customer support, available 24/5 through multiple channels, including live chat, email, and phone support.

Cons of Trading with Pepperstone in Indonesia

No Fixed Spread Account

While spreads are competitive, Pepperstone doesn’t offer fixed spreads, which some traders may prefer for better predictability in trading costs.

Limited Promotions

Compared to other brokers, Pepperstone offers fewer promotions and bonuses, which may be a disadvantage for traders seeking incentives like deposit bonuses.

No Proprietary Trading Platform

Unlike some brokers, Pepperstone doesn’t offer its own proprietary trading platform, relying on third-party platforms like MT4, MT5, and cTrader.

No Weekend Support

Customer support is available only during weekdays, which might be inconvenient for traders who wish to resolve issues over the weekend.

No Indonesian Rupiah (IDR) Account

While Pepperstone supports multiple currencies for trading, Indonesian traders are required to fund their accounts in other currencies like USD or AUD, which could incur conversion fees.

Is Pepperstone Safe and Legit for Indonesian Traders?

Yes, Pepperstone is safe and legitimate for Indonesian traders. Here’s why:

Regulated by Reputable Authorities: Pepperstone’s regulation by ASIC, FCA, and CySEC ensures the broker adheres to strict financial standards, offering protection for client funds and transparency in operations.

Client Fund Protection: Client funds are segregated from company funds, reducing the risk in the unlikely event of the broker’s financial difficulties.

Data Protection: The broker uses SSL encryption to secure sensitive client data, ensuring that personal and financial information is safe.

Reputation and Trust: With over a decade of experience in the industry and a reputation for providing reliable services, Pepperstone is a trusted name in online trading.

Who Should Use Pepperstone in Indonesia?

Beginner Traders: Pepperstone’s user-friendly platforms like MT4 and educational resources make it a good choice for those just starting their trading journey.

Experienced Traders: For traders with more experience, the Razor Account offers raw spreads and low commissions, making it ideal for those who prefer low trading costs and advanced tools.

Scalpers and Day Traders: With fast execution and minimal slippage, Pepperstone is a great choice for short-term traders.

Investors Looking to Diversify: The wide range of trading instruments available makes Pepperstone suitable for those looking to diversify their portfolios across various assets.

How to Open a Pepperstone Account in Indonesia

Visit the Website: Go to www.pepperstone.com.

Create an Account: Fill out the registration form with your personal details, including name, email address, and phone number.

Verify Your Identity: Upload the necessary documents for identity verification, such as a government-issued ID and proof of address.

Select Account Type: Choose the account type that suits your trading needs—Standard, Razor, or Islamic.

Deposit Funds: Fund your account using available deposit methods like bank transfer, credit cards, or e-wallets.

Start Trading: Once your account is funded, download the platform of your choice (MT4, MT5, or cTrader) and begin trading.

Conclusion: Is Pepperstone a Good Broker for Indonesian Traders?

Pepperstone is a solid and reliable choice for Indonesian traders in 2025. With its robust regulation, competitive spreads, advanced platforms, and excellent customer service, it caters to both beginner and professional traders. While there are a few drawbacks, such as limited promotions and no Indonesian Rupiah account, the overall trading experience is exceptional.

Rating: ★★★★☆ (4.5/5)

For traders in Indonesia looking for a regulated, well-established broker with low costs, high leverage, and a wide range of instruments, Pepperstone is definitely a good option to consider.

Read more: