15 minute read

Building momentum

Sue Read Later Life Lending Manager

or many advisers Equity Release has a chequered history but it’s odd to think that the first plan was in 1965 before Pickles discovered the World Cup in a hedge and when houses were typically valued at £4,000. F

Advertisement

Since then so much has changed in terms of the growth of equity value, range of life time mortgage products and growth in the market, and of course a commitment to standards and safeguards for consumers established by the Equity Release Council and its predecessor trade body Safe Home Income Plans.

We now have a number of customer safeguards including a No-Negative Equity guarantee, a promise of tenure for life and the freedom to move to a suitable property. Of course all potential equity release customers must now have independent legal advice before they enter into any agreement which provides an additional safeguard.

Thanks to product innovation alongside a low interest rate economy we are now seeing borrowing solutions to meet the challenges of an ageing population, demands for intergenerational fairness and ease of access to property wealth.

According to the Equity Release Council, older age groups are not just the biggest owners of property; they also depend the most on its contribution to their overall finances. Bricks and mortar accounts for 40p in every £1 of household wealth for those aged 65+, rising to 47p among the over-75s versus 35p across the nation. The report suggests these shifting trends are driving a change in attitude among the over-45 homeowner population with this generation facing multiple financial challenges as they seek to live longer, healthier lives while

balancing their needs with providing support for younger generations.

Later Life Lending is a market which is building momentum. Initial reports indicate £3.9 billion was unlocked over the course of 2019 – a strong but steady performance with a small dip of 3% from 2018’s record high with 44,870 new customers in 2019. Q4 alone welcomed 11,866 new customers the highest number over the course of the year.

This growth in the equity release market has been driven by genuine consumer needs among the UK’s ageing population in response to wide-ranging financial challenges. Common uses of housing wealth include supplementing pension incomes, paying for social care, paying off existing debt, supporting family members and meeting lifestyle costs.

The Later Life Lending Market has come a long

way in the past 10 years and continue to evolve very rapidly and once siloed specialist areas, are increasingly merging along the holistic pathway. At the same, as the market continues to grow there is a need for mortgage advisers to have a broader view of the later life market. There is therefore an opportunity for advisers looking to evolve their proposition to continue to serve a growing number of customers, and maintain an adequate supply of highquality advice.

A new market, whatever its size, will have its attractions and as a Network we feel we have the path to competence to support those who are already active participants or are looking for an entry point or referral model. Whatever the route advisers choose to take, we know that safeguards and regulation will eventually make later life lending a mainstream solution, satisfying a customer need and delivering a great outcome for all.

Call: 03300 552 651 Email: support@hlpartnership.co.uk 25

t’s interesting when you analyse the performance of a commission department, the number of transactions the people in the team process, the level of automation you can achieve, and how dependent you are when passing money on from a lender or insurer to an adviser firm on an accurate statement delivered to the right place in a timely manner. I

As the Network matures and becomes larger of course you start to see volumes of renewal commission on protection policies grow, as firms become more productive on mortgages you see the growth of non-indemnity cases, and of course the more members that become comfortable with selling home insurance, the more we see repeat payments. So overall as a department we are now processing more than ten thousand transactions a week and of course this does throw up questions on payments whether commission that is missing, an amount which is different to that what is expected or a client delivers an unanticipated clawback. The level of questions in comparison to the amount of transactions we process is small, but we do treat every query raised as a matter of real importance.

Strategic Goals There are two key strategic goals for me in my role. The first is to add more automation to our commission processing systems and I appreciate that this has been on the roadmap for some time now and has probably had a number of false starts. Investment in systems is underway with the end result that we reduce the level of manual commission processing and increase the levels of visibility of payments.

Finance Counts

The second strategic goal is to improve the quality of communication the commissions team has with those members that need to question a commission payment. In the past, the team has strived to resolve the issue before making contact and in many cases this has meant waiting for responses from the lender or provider.

Delays in responding can create frustration and make it appear nothing is happening which is not normally the case. It is in all our interests to keep members informed about the progress of their query, and deliver a great service as we all know how demotivating it can be to work hard to convert a mortgage or put a protection case on risk only to have to wait to be paid.

Communication is key Whilst we can automate much of our own activity, we still have statements to process, and until such time as we become a paperless industry, there will continue to be discrepancies over the money we receive into our bank account and missing statements that we know makes it difficult to allocate commission. And of course, when a Mortgage or Protection Club is involved, which generates additional revenue for you, there may well be a delay as money passes via the third party.

So my commitment to all members of the Network is that I and the Commission Team will press on with our objectives to simplify payment processing and improve communication on those occasions when we have not got an immediate response to your query. That way the small proportion of questions we receive as a team will diminish over time and we can focus on improving our service to ever higher levels.

Peter Cobley Finance Director

Finance Counts

Technology, for intermediaries

id you know in the month of February alone, mortgage research was up and advisers are leading the charge? • 1,035,518 mortgage searches • 186,122 ESIS created • 356,345 mortgage products viewed All of the above happened, in just one month. D

We are seeing the same amazing bounce. Users of our SOURCE platform are researching the mortgage market are showing their worth for February. It is truly amazing to witness this. At Twenty7Tec, we provide intelligent mortgage sourcing, for intermediaries focused in quality advice. We expect to return the right product, first time and don’t see multiple searches for the same thing.

Throughout 2019 we listened to feedback from our HLP partners, to help shape our sourcing system and create something that you would be confident using. Already delivering enhancements to the user experience and integration types, plus true cost calculations have been paramount with the developments delivered amongst product and criteria changes.

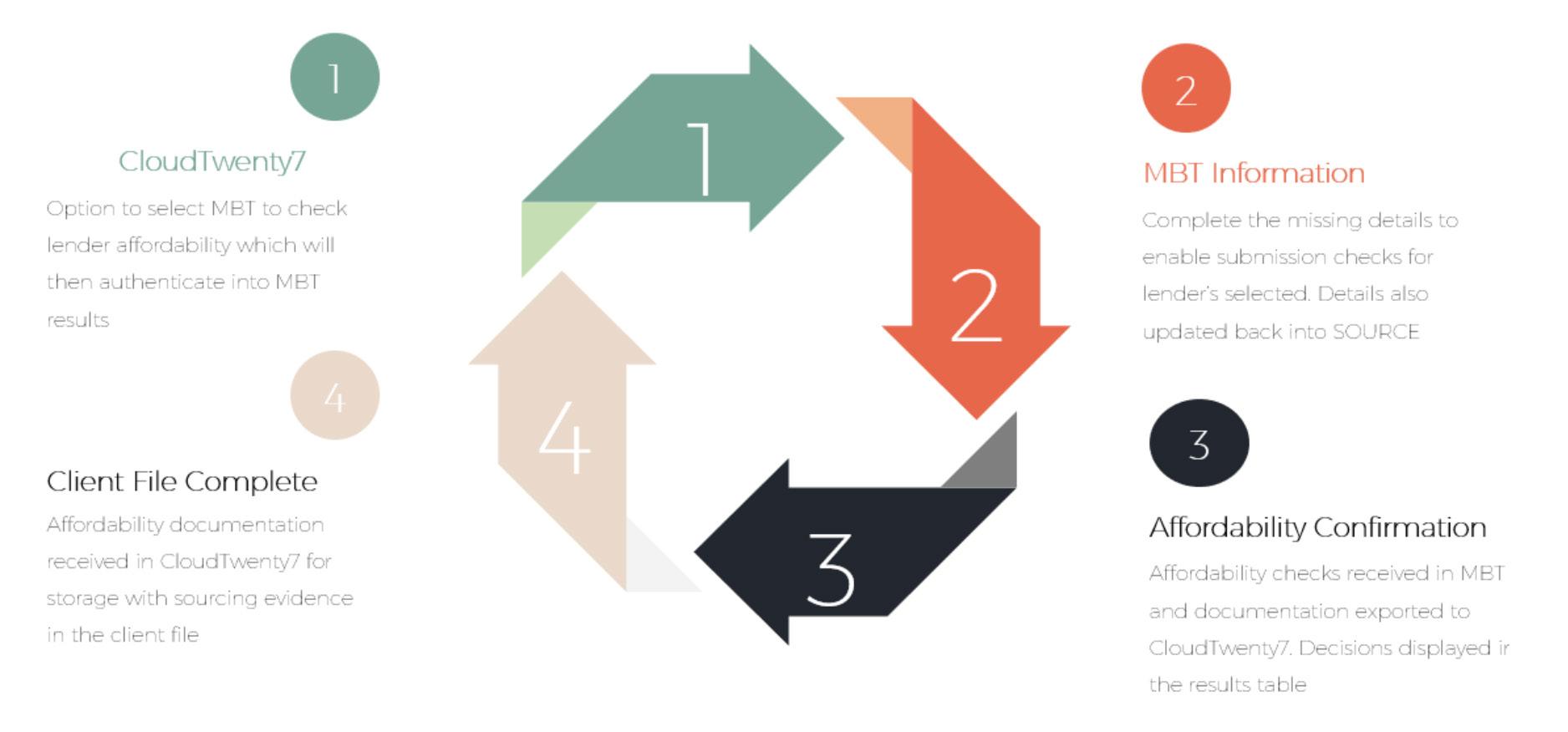

As we head into 2020, we are excited to unveil our latest integration. Twenty7Tec and Mortgage Broker Tools (MBT) have integrated MBT Affordability into CloudTwenty7. The integration will enable users to seamlessly perform real-time affordability research alongside product sourcing, providing you with the latest technology to support your product recommendations. MBT Affordability provides advisers a single, well designed calculator that automatically and intelligently completes individual lender calculators, collating the results on a single screen. There are no approximations or estimates as the approach ensures accurate affordability results each time.

This is the first step in our integration journey with MBT, and we intend to lead the way in innovation by constantly enhancing the user experience and journey.

Spring 2020 will continue to be incredibly busy at Twenty7Tec as we put the finishing touches to Criteria sourcing. This will enable the opportunity to source against lender criteria, with the facility to include multiple options per query. The ability to display lenders and criteria and apply further filters to refine lenders, and search and see all criteria for a lender. All in a single platform, with a single use of data. Lender and Product criteria sourcing, all in one place.

focused on quality advice...

Start sourcing via criteria or product, apply alternate filters to combine the two for a comprehensive set criteria and product sourcing results. Documents will be produced to reflect search parameters applied, filtering and lender criteria will provide a detailed and compliant research file. Throughout 2020 – Apply, our application submission system, will continue to lead the way with lender integrations. More lenders are being add this year, with some of the top 10 already in pilot. As 360 looks to integrate Apply into it’s CRM, you will very soon be able to benefit from Apply and it’s API integrations with lenders.

Data delivers a long term goal

30 e all know that the world of technology is moving forward at a fast pace and as lenders and providers align their systems the speed of change is only going to increase through time. W

For HLP as a support business to its growing adviser base it’s of paramount importance that maintain the levels of support and education. This means not only do we need to provide insight and training for members so the service they offer customers is seen to be modern and multi-channel, but also for HLP staff with the aim of bringing synergies with advisers.

Of course, in todays’ connected world, the opportunities to educate and communicate enhancements to our systems isn’t restricted by bricks and mortar training rooms, projectors and hotel wifi. That’s why at HL Partnership we are developing a webinar programme where we can bring together advisers and staff in an on-line event, delivering engaging and topical content where participants can submit questions without having to leave their office, using their PC, Laptop, tablet or mobile.

The developments we have planned for this year don’t stop with training. Digital developments are opening up new services and facilities such as electronic signatures for fact finds and applications, new integrations with home insurance providers, further enhancements with mortgage sourcing in preparation for straight through processing and continued updates to the sales process via the fact find.

We know that many organisations are starting to understand the true value of a data centric approach. The more we know about our customers, the more information we have about the type and nature of customers, the greater the value of the business. Whether you work alone or a multi adviser firm, we know that the income potential from a client bank can be assessed, and from there a future income can be calculated. Understanding a customer’s profile allows those that own the data to diversify their business model, follow a customer through their

Sajid Kadri IT Development Manager

lifecycle and ultimately maximise the value. We often hear from our business partners about the high cost of customer acquisition so why wouldn’t you want to know everything you can about your client which in turn allows you to understand the real return on investment.

For many advisers, there isn’t necessarily the time to reflect on the quality of data being captured on the customer, it’s normally about what data is required to process a mortgage or insurance application, and the opportunities to collect information that might deliver a sale in the future overlooked.

Simple information such as renewal dates for insurance creates a future contact strategy, end dates of loans possibly opens up budgets for insurance sales and estimated retirement dates delivers pension referrals or possible later life lending opportunities. So when the fact find is in progress take a step back and see the customer record as the here and now and in the future – ask yourself what data do you need to offer your customer a great service in five, ten or even fifteen years in the future. This is nothing new, we all know that companies such as Netflix and Amazon Prime deliver content tailored to the viewer’s preferences and family members can see what each other are watching. They achieve this through data capture, data driven by the quality, its completeness, consistency, accuracy and timeliness. They create a competitive advantage by knowing their customers, anticipating their needs and delivering services which a customer may be thinking about but have yet to buy.

We know that in the future, the more we know about our customers, with the data easily accessible and in a format which can be used to create value, our business models will be robust and sustainable.

If we ignore data and understand the bare minimum about our customers, the greater the risk that competitors will have a negative impact.

It’s up to all of us to grasp the opportunity that the digital landscape delivers. 31

Legal and General wanted to celebrate the heroes that make a difference to peoples’ lives so they created the Hero in the Middle competition. To praise the intermediaries that go above and beyond for their clients and their families. The ones that pull out all the stops and are determined to serve and help others; providing financial advice that makes the world a better place.

And congratulations to Charlotte and Vera for being heroes for their customer…

id you know in the month of February alone, mortgage research was up and advisers are leading the charge?

• 1,035,518 mortgage searches • 186,122 ESIS created • 356,345 mortgage products viewed

All of the above happened, in just one month.

Heroes in the middle

Grow your business Refer your secured loan enquiries to Fluent

This advert is for professional Intermediaries only and has not been approved for customer use.

Why modern lending

needs more common sense

ur world is changing at an incredible rate. We’re living longer, healthier lives, having multiple careers and enjoying opportunities previous generations could never have dreamed of. O

And while all of this is great news for the individual, it’s rather challenging for lenders, many of whom are relying on the same lending criteria they’ve used for years. At Together, we think it’s time to rethink lending, and as a specialist lender, we’re proud to be leading the way. And when - as they say - the only constant is change, should all lenders be following suit?

It’s perhaps the world of work that’s changing the most, with the latest figures from the Institute of Employment Studies supporting some of the thinking behind Together’s most recent lending criteria. In the last three months, growth in self-employment has outstripped growth in employment overall, with an extra 120,000 entrepreneurs now in business. Add to that the number of ‘slashies’ (those of us with multiple income strands and ‘side hustles’) and you’ve got a growing number of people rejecting the 9-to-5 to carve their own unique career path.

Our ageing population is also a factor in our evolving economy. The same bank of stats show that the over-65s are staying in work longer, with employment in this age group up by nearly 50 thousand to 1.33 million. And with uncertainty in the wider economy, this group are increasingly looking for different ways to supplement their income beyond statutory retirement age.

This growth in investments from the over-60s inspired us to change our first-charge residential

Richard Tugwell, Group Intermediary Relationship Director, Together

needs more common sense

mortgage lending criteria – our borrowers can now take out a loan that runs up to their 85th birthday. We also specialise in short-term lending such as bridging loans, which are often accessed by older customers to fund their property investment ambitions or bridge the gap in property chains as they move on to a new home for a new stage in their lives.

We lend to customers approaching retirement age and even those drawing a pension, because we look at the whole picture, rather than relying on tickboxes to tell us whether a borrower is a safe bet.

In these changing times, nothing is certain. So it’s vital that lenders keep on the front foot and adapt their models to fit with how customers are living their lives. At Together, we call this ‘lending for the new normal’, because there is no such thing as ‘normal’ these days. We’re a specialist lender because we don’t think one size fits all, and we’re experienced enough to make a pragmatic, human decision on every single case.

We pride ourselves on being able to lend to customers with complicated circumstances, often working with multiple complications at once, and work closely with brokers to find the right solution for their clients.

Modern life is complicated enough without lenders making life even more difficult. So, as our world continues to change, so will we.

Have a complicated case you need some help with?

Get in touch with our broker sales team on 0372 291 2844 or visit togethermoney.com/partners/ financial-intermediaries/