10 minute read

Selling the standards

ack in 2018 the Financial Conduct Authority (FCA) launched their Mortgage Market Study (MMS) to evaluate the effectiveness of the measures implemented as a result of the Mortgage Market Review (MMR; 2014) and to identify any potential consumer harm that resulted from the measures taken. B

The Study was designed to check that MMR hadn’t created a barrier for firms wishing to create tools to help customers choose a mortgage, thereby potentially stifling innovation in the market. The FCA wanted to ensure customers who were in a position to execute their own mortgage didn’t find it difficult to do so. They also wanted to check that for those having to seek advice could it be that it may have led to poor outcomes in terms of price and costs. Following a lengthy consultation with trade and industry bodies, mortgage firms and lenders on proposals, the Final Rules have now been published and came into effect from the end of January. As was feared towards the latter stages of the consultation period, the FCA brought into effect significant changes in line with the manner in which it conducted the study; that is to repeal some of the provisions of the MMR in terms of ensuring advice was at the forefront of the way

Advertisement

Gavin Earnshaw Compliance Director

consumers sought out the best deal for their situation. We saw a major relaxation opening up ‘execution only’ as something the FCA now support in line with their desire to see the UK lead the Fintech revolution for banking and financial services. In short the FCA have put innovation ahead of customer outcomes.

Whilst many will not agree with the changes having seen the value that advice delivers in terms of great customer outcomes, the FCA have changed their guidance on what constitutes a regulated activity, how filtering tools can remain outside of the threshold of advice and how the results of such filtering tools can influence the customer’s decision.

The FCA has also removed the prescriptive requirements that were in place for firms in relation to execution-only sales policies and

08 have also clarified that they are comfortable with differing distribution channels within the same businesses charging different fees based on the relative cost of the distribution (i.e. execution only vs. advised sales channels).

Finally, a new rule which has been introduced requires a firm to explain why it is recommending a mortgage that is not the cheapest available from its product range that it feels meets the customer’s needs and circumstances. This means that you must clearly explain the product choice and price and why it is the best advice for your customer.

New Competition? You may think that these changes are a relaxing of MMR and a potential return to the dark days of 2008 with consumers helping themselves to ever-increasingly unaffordable loans through self-certification and non-disclosure, but as we all know applying for a mortgage is not a simple process.

There will be organisations out there rubbing their hands with glee and designing their masterplan to take a large chunk of the intermediary market. With the new rules I don’t doubt that there will be some success.

However, many customers now see advice as core to the mortgage process and they truly value the relationship they have with their Adviser. What the new rules offer is an increase in the amount of interaction firms can have with customers before a sale has to be treated as advised, so there are areas we can embrace.

HLPartnership remains committed to the advised model as we feel that this offers the best outcomes to your customer base and these new rules do not impact our strategy in this regard. We will continue to explore and implement new tools for firms to help them and their customers evaluate product choice and suitability of recommendations that make the whole experience of working with an adviser to find the right mortgage both simple and enjoyable.

Suitability of Advice When it comes to product choice and price, there is little impact as a consequence of the new ‘why not the cheapest’ rule. In reality, this standard is already applied within firms and captured in the sales process, designed to ensure thorough product research is carried out and documented on the file. Our internal compliance team will assess whether the mortgage recommended is right for the customer and that you provide customers with a suitability letter setting out your recommendation and why a mortgage has been recommended where it may not appear to be the cheapest from the sourcing results. We will however publish further policy that will give guidance on how to demonstrate this better within the letter.

We work in a market that is both heavily regulated and constantly changing to meet the needs of consumers. Whilst we may not agree that a reintroduction of execution-only sales is the right direction of travel, and we lobby heavily through our trade body - AMI - to challenge decisions where we feel the risk of customer detriment increases, there is the need to adapt and work within the new framework. Ultimately we all have customers who look for help and guidance, and it is up to us to continue to promote the value of the Adviser and the benefits they bring both financially and emotionally.

You can read the original consultation paper here: https://www.fca.org.uk/publication/ consultation/cp19-17.pdf

You can read the full policy statement with final rules here: https://www.fca.org.uk/publication/ policy/ps20-01.pdf

Call: 03300 552 651 Email: support@hlpartnership.co.uk 09

Neil Hoare Commercial Director

don’t think it will have escaped your attention that there has been a ever growing proportion of mortgage business now being delivered by advisers which is purely product transfer (PT). Looking at the numbers of PT’s being advised on by HLP Firms, they now account for just over one in five of all mortgages written by HLP members, and its anticipated they will total over £1.5bn in borrowing in 2020 in the Network alone. I Call, Call, Call again for £70bn The first point to make is that data is key to the longevity of an adviser firm, if you don’t know a customer has a mortgage coming up for review, then you can’t design a retention strategy. We need to call it a retention strategy as in this

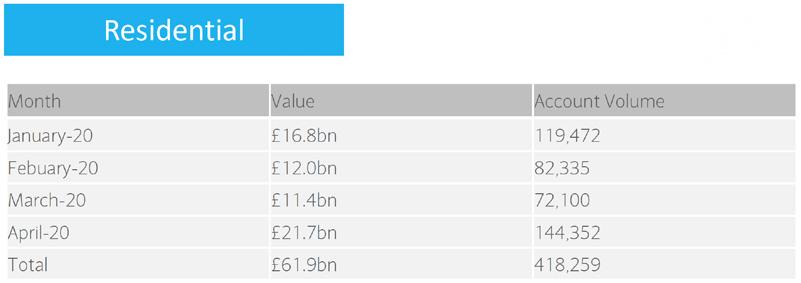

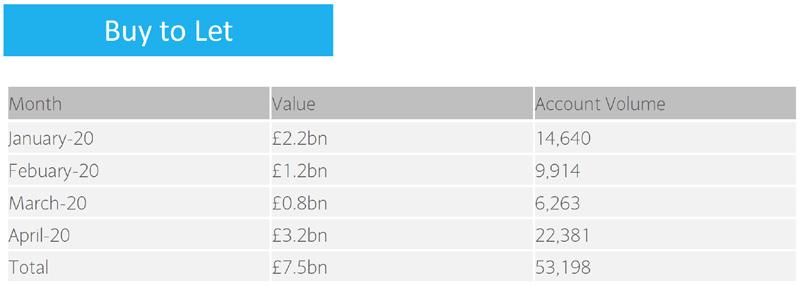

Indeed analysis by Barclays has indicated that between January 2020 and April 2020, over £61.9 billion worth of residential mortgages and almost £7.5 billion worth of buy-to-let deals in the whole market will have come to the end of their terms. The opportunity for client engagement supporting them with their remortgage needs has never been greater.

Based on the numbers ask yourself how does the sales model need to change from the traditional lead generation, advice, recommendation and application now that for many firms there is a recurring income stream sitting within their own client bank?

modern day connected world there will be plenty of encouragement from companies who have the data for customers to seek alternatives to the traditional adviser route that may be cheaper and in many cases less obtrusive. In the past, criticism has been placed firmly at the door of Lenders about their own retention strategies when it comes to business originally introduced to them via the intermediary channel. We need to recognise that, now that PTs are becoming more common place in the intermediary channel, competition will rise not necessarily from Lenders but those on-line businesses that offer cuddly toys, dancing superheroes, and suggest they can calm fears over money worries.

Call: 03300 552 651 Email: support@hlpartnership.co.uk The first step in any retention strategy is to have your information in one place and that means your CRM. Work out the value of the product transfer for your business and dedicate time to constructing an early warning system so you know exactly when and which client will be due for review. The average mortgage in the HLP Network is £196k and the worst gross proc fee for a PT is 0.2%, so each case, if the customer elects to go with the rate switch product is worth just under £400 a case. How many of these do you have sitting in your client bank whether it’s on the HLP CRM system, on a separate spreadsheet, in a filing cabinet, a diary or in a pile of paper, if you know that each is going to be worth £400 then the simple message is how much income do you know you can generate just from your client bank alone, when and what is the contact strategy?

Then it’s about communication, making sure you are front of mind when the time comes to bank the £400 the lender is going to give you just for doing what you said you would in the suitability letter. The power of three always comes to mind when communicating to people, tell your customer that they need to talk about their expiring mortgage deal, tell them again and for good measure tell them once more.

Many of us will remember the famous speech from Tony Blair who used the phrase Education Education Education, and we knew that the focus for the Government was education. Be proactive and have a message that reminds the customer of the value you add to the process and don’t be afraid to tell them, tell them again and do it once more for good measure. After all many customers have long memories and most likely don’t trust their bank as they do you, their adviser and need the reassurance that the action they are going to take with a sum of money that keeps them in their home, is the right course of action.

Of course we mustn’t forget that there is the insurances to review and all the expert advice that comes with a strong adviser/customer relationship that’s been built on years of solid guidance and support.

So the message is take time out of your day to look at the potential of your client bank and build an business plan based on what you know you can create, design a communication plan aimed purely at retention, and be proactive, proactive and proactive with your Product Transfers. If there was a £400 bank note, I’m sure you would make sure each of them was in a safe place so understand how many notes you have and don’t let those cases slip away just because a customer chose to value a cuddly toy more than great financial advice. 11

Product features - early information as promised

e are delighted that, via Solution Builder and iPipeline, members now have access to an innovative tool to help advisers to help find the best policy for their customers, quickly demonstrate why they may W

not have selected the cheapest, and to clearly highlight these features to their customers.

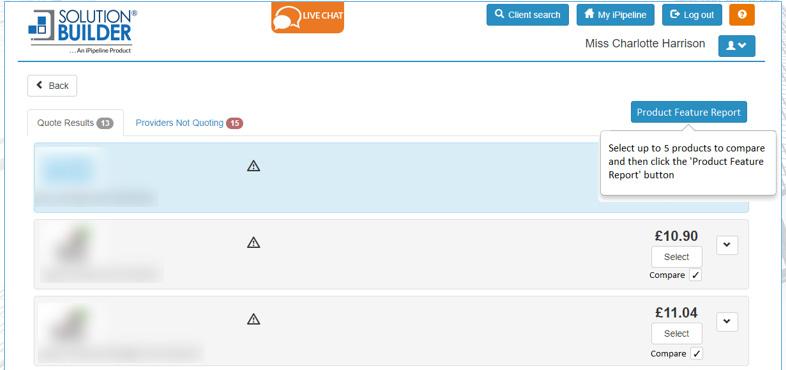

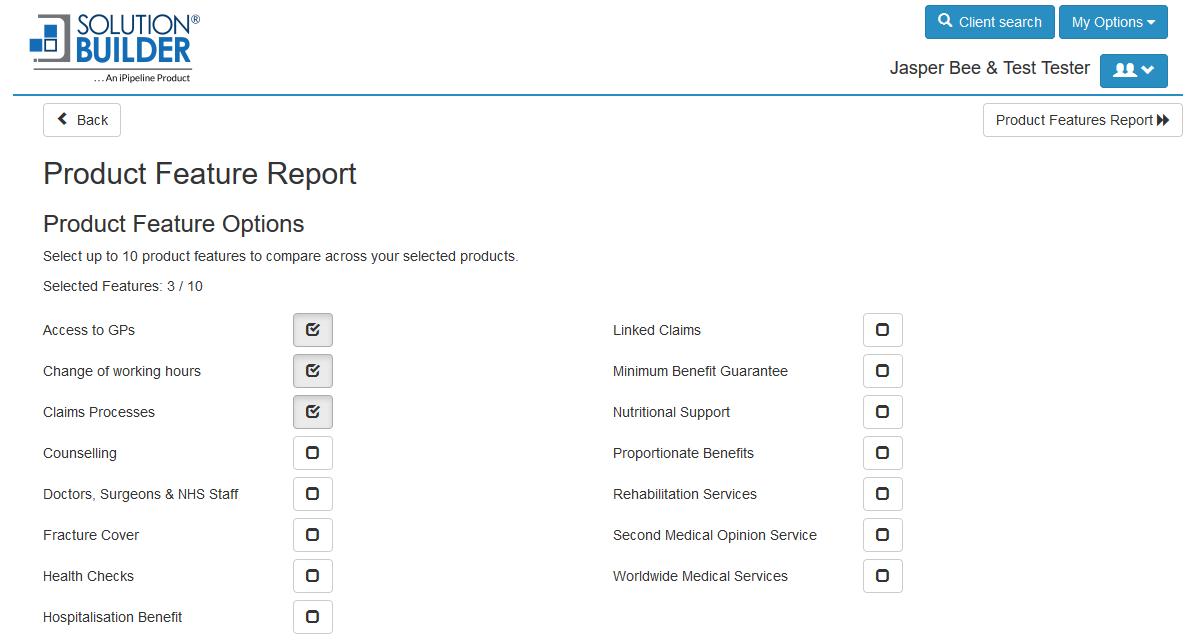

Called “Product Features”, Solution Builder now allows advisers considering Life Insurance, Critical Illness Insurance, Income Protection and Business Protection to compare the top ten commonly used Features across selected insurers in three simple steps.

Step 1: Select up to 5 products you are interested in comparing:

Step 2: Select up to 10 features your client is interested in:

Step 3: Produce a report is produced which you can print and download:

The example report just shows how it can help you give the customer the information they need to make the right decision, and really helps advisers get protection done.