1 minute read

Agribusiness at a Glance – November 2024

throughout October.

• Barley and oats also experienced downward pressure.

Overview

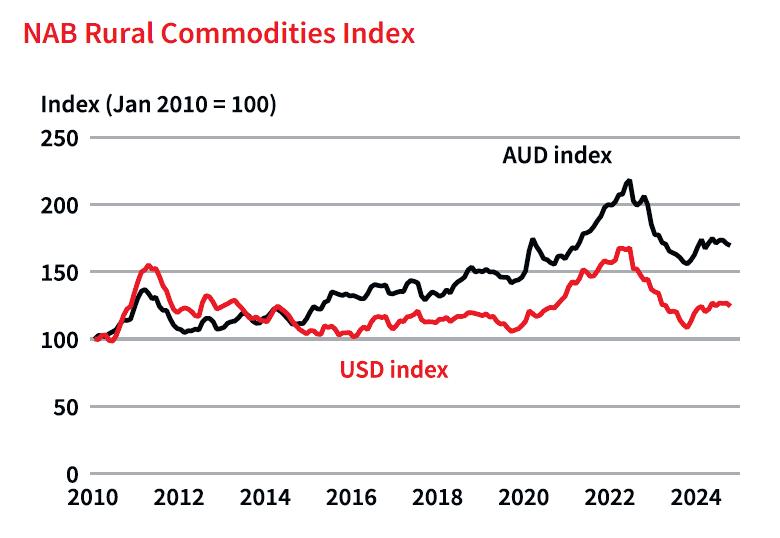

Rural Commodities Index

The NAB Rural Commodities Index saw a slight decline in October:

• Down 0.8% monthon-month in Australian dollar (AUD) terms.

• A larger decline of 1.8% in US dollar terms, refecting the AUD’s partial retreat after its September gains.

Commodity Trends

Performance among agricultural commodities was mixed:

• Cattle prices softened

• Wheat prices stabilized after recovering from their late-August lows.

Rainfall and Climate Outlook

October Rainfall Rainfall conditions varied signifcantly across the country:

• Weak rainfall was observed in Tasmania, western and eastern Victoria, south-eastern New South Wales, southern Queensland, south-western Western Australia, south-eastern and northern South Australia, and inland

Northern Territory.

• Strong rainfall occurred in most of Western Australia, western South Australia, and northern regions of the Northern Territory and Queensland.

December–February Projections

According to the Bureau of Meteorology (BoM):

• Above-average rainfall is expected across most of eastern Australia.

• The remainder of the country is likely to experience broadly average rainfall.

• Northern and eastern Australia are forecast to record unusually high minimum temperatures. Climatic conditions, measured by the El Niño-Southern Oscillation (ENSO) index, are expected to remain neutral in the near term but may approach El Niño thresholds by midautumn 2025 without crossing into El Niño conditions.

Economic and Currency Outlook

Interest Rate Forecast

NAB has revised its forecast for the Reserve Bank of Australia (RBA)’s frst rate cut, pushing it back to May 2025 (from February). This adjustment refects stronger-than-expected labour market conditions.

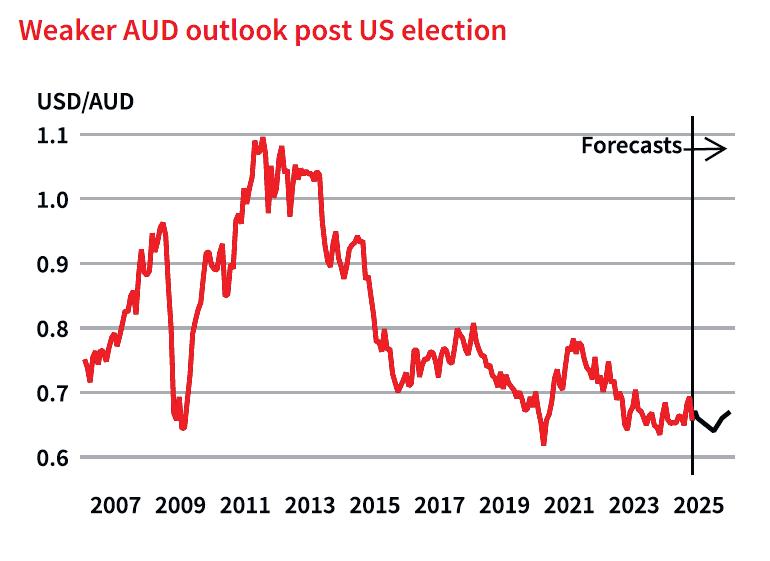

Australian Dollar Outlook

The forecast for the AUD/USD exchange rate has been lowered:

• End-2024: Revised to US66 cents (down from US69 cents), driven by: o The continued strength of the US economy. o Anticipated policy shifts under the newly elected US administration, including potential tariff increases.

• 2025: AUD is expected to weaken in the frst half of the year, reaching US64 cents by the end of Q2 before rebounding to US67 cents by year-end.

Global Context

Uncertainty surrounding US economic policy under the new administration adds to the complexity of global market dynamics. Potential tariff increases and other policy changes could have signifcant implications for trade and commodity markets. This report highlights the mixed performance of Australia’s rural commodities, variable climatic conditions, and evolving economic forecasts, offering insights into the challenges and opportunities ahead for the agribusiness sector.