Mastering Adulthood:

Life skills courses that make everyday challenges easier

Clever ways to cut costs on property tax

Boom in apartment living for families

Life skills courses that make everyday challenges easier

Clever ways to cut costs on property tax

Boom in apartment living for families

What’s behind the surprising rise in adulting courses? (And they might be more useful than you think).

The fact a YouTube clip explaining how to change a light bulb has been watched more than 39,000 times says a lot about our diminishing life skills. Not to mention the four million people who have watched how to change a tyre.

At the risk of sounding like your nanna, it seems that common knowledge isn’t really that common anymore.

It’s Gen Z copping the heat, with claims they’re the most life-challenged generation in history, flying the nest with little knowledge about how to do everyday tasks from cooking and cleaning to basic home maintenance.

The problem is so bad, two universities in Canada made international headlines this year after adding Adulting 101 online classes to their curriculum in order to help students struggling with living away from home for the first time.

This life-skills crisis isn’t confined to North America. Aussie medical student Mai Abdelmawgoud told the ABC recently that when she moved out of home in regional Victoria to take up a medical degree interstate, she realised she didn’t even know how to change a light bulb. While high school had prepared her for university, she says, it hadn’t really prepared her for life.

Mai isn’t alone in feeling the education system could do better, with several petitions in Australia and New Zealand urging schools to embed more life skills such as how to apply

for a loan, or what a credit score is, into the curriculum.

But is it just schools who are responsible? What about parents? And Gen Z themselves?

Depending on who you listen to, everyone seems to get a fair share of blame: it’s helicopter parents; it’s schools ditching home economics and manual arts; it’s the housing crisis, meaning kids live at home for longer, often without shouldering their share of household tasks.

But whatever the cause, the solution could actually be surprisingly helpful for all of us, because everyone from universities and councils to private organisations and TAFEs are putting together useful short courses to help us all improve our adulting.

Onkaparinga Council, on the southern outskirts of Adelaide, was an early adopter, first launching in 2019 three-week crash courses in How to Adult. These covered topics such as: Can you get a refund on a car you bought on Marketplace? What are your rights as a renter? And how on earth do you change your MyGov password?

Whether you’re looking to sign your kids up or do one yourself, it’s a simple way to upskill because, truth be told, it’s not just Gen Z that struggle to change a tyre or fix things around the house.

Now, there’s less stigma around asking for help. As one commentator noted – ignorance isn’t bliss, it’s expensive. Which is why upskilling can save you more than it costs. Here are a few ideas on where to get started.

Ever feel like you need a translator when you try to tackle anything finance related? Learn to demystify everything from salary sacrifice to compound interest. TAFEs around the country run financial literacy short courses to help teenagers (and adults) better understand their own finances.

There are a huge number of private organisations running car maintenance programs aimed at absolute novices, taking drivers through things like how to:

• Change a tyre, fuse or headlight, or jump start a car with a flat battery.

• Understand mechanic lingo.

• Replace wiper blades and filters (fuel, air and even ones you didn’t know existed, like pollen filters).

• Understand systems such as brakes (rotors, pads and shoes) and air-conditioning (including when re-gassing is needed).

• Check fluid levels and perform preventative maintenance.

Again, it’s TAFEs providing the know-how but there are some fantastic courses that can help householders take their skills to the next level and make big savings on hiring tradies for simple tasks. An eight-week basic home building and maintenance course offered through SA TAFE includes:

• Instructions on the safe use of general hand and power tools.

• Fit skirting and architraves.

• Door repairs, fitting door locks, handles and latches.

• Wall repairs.

• Basic wall and floor tiling.

Luckily, there’s plenty of inspiration online, so it’s a great time to get Googling.

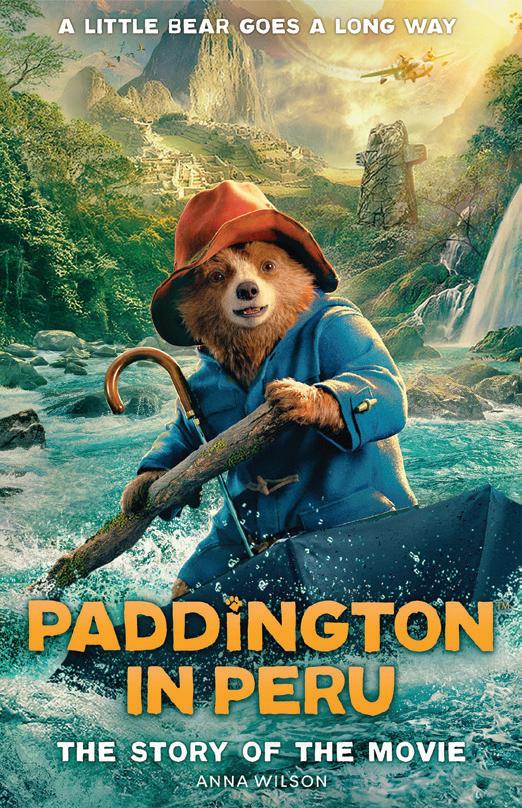

Paddington in Peru is the third film in the beloved film series, following Paddington and the Brown family’s adventures in the lush jungles of Peru in search of Aunt Lucy. Packed with charming moments, humour, and Antonio Banderas as a treasure hunter, the storyline delves into the importance of family and friendship, with Paddington remaining as adorable and endearing as ever. The movie is now available for purchase or rent via digital platforms.

As the size of an average house block shrinks and the price skyrockets, units are becoming a viable alternative for families.

Once upon a time, units were a stepping stone for singles and families on their way to home ownership.

These days, an increasing number of families are happy to stay put in apartments for the long term, with developers noting the shift in demand as families prioritise convenience and cost over space.

In recent years, plans for several capital city apartment complexes have been redrawn at the 11th hour, with developers ditching one-bedroom units to incorporate more three and even four-bedroom homes. One inner-Brisbane project slashed total unit numbers from 157, which had been approved by the council, down to 129 to incorporate more multiple-bedroom apartments.

Price growth reflects this shift in demand, with apartments eclipsing houses in key markets over the past year. In Brisbane, unit prices climbed 12.9 per cent (to a median of $708,000), compared to houses, which were up 6.9 per cent (to reach a median price of $1,051,000), in the year to June 2025, according to PropTrack’s Home Price Index. It was a similar story in Perth where unit prices were up 12 per cent compared to 7.1 per cent for houses. In Adelaide and Sydney growth for units and houses was roughly similar, at just under 10 per cent, and just over 3 per cent respectively.

Government regulators are getting onboard, too, with unit construction seen as the answer to Australia’s housing crisis. In May, the Victorian Government launched the Great Design Fast Track, which, as the name suggests, delivers fast approval to developments that tick priority boxes, including those that are family-friendly. The Government is also offering stamp-duty concessions to off-the-plan buyers to support unit development (see our stamp duty story in this issue).

For home buyers, the surging interest in apartment living is the combined result of several factors, including spiralling house prices, shrinking block sizes, growing commutes and some higher quality apartment developments. As big backyards become a thing of the past, many families are weighing up the benefits and costs of moving into conveniently located complexes with communal space and perhaps even a pool or gym.

Holiday fails, flight delays and suitcase dramas, we want to hear them all. As Euro summer winds down and Aussies return home, we want to hear your holiday fail stories. Share your biggest holiday fail for a chance to win $1,000.

How: in 350 words or fewer, send your answer to: havencompetitions@afgonline.com.au placing holiday fail in the subject line.

Include: your name, address, email, phone number and the name of your mortgage broker.

Dates: opens on August 4 and closes on October 10.

Winner: will be decided on October 11 and notified by telephone after this time.

Terms and conditions: visit http://bit.ly/HavenWin

Among the upsides are:

• More free time, with savings on commuting, home maintenance and upkeep of gardens/pool.

• Access to communal areas such as pool decks, gyms and saunas. However, this also brings up a potential con: high body corporate fees.

• Generally better security than free-standing homes.

• Usually located with easy access to parks, transport, schools, restaurants and entertainment hubs.

On the downside:

• Research has identified low stock of the 3-4 bedroom units most sought by families.

• Storage can be an issue, with some kitchen and bedroom designs not allocating sufficient cupboard space.

• Reduced privacy.

• Lack of communal play spaces and poor soundproofing can cause issues.

• Keep an eye out for any maintenance red flags, as this may require a large contribution to the complex’s building fund.

• Although units have experienced strong price growth in the past year, historically they have lower capital growth than homes.

• Body corporate fees in high-end complexes with facilities such as pools and gyms can be upwards of $20,000.

For house buyers struggling to stretch their budget, apartment living is worth considering, particularly if any tax breaks apply. Never say never. And when in doubt, why not try what our case study couple did and try before you buy by renting out your existing home to cover rent in an apartment for a year.

This Brisbane family says swapping their large family home for an innercity unit has been a lifestyle game-changer.

Will and Natalie believe they’ve won an extra 10 hours of leisure time each week by ditching their suburban home for an inner-city unit.

About 18 months ago they moved, with their three children, from a five-bedroom, three-bathroom house with a swimming pool in suburban Brisbane into a three-bedroom, two-bathroom inner-city unit.

Although initially sceptical about the significant compromise on space, Will is now adamant, saying: “It’s easily the best thing we’ve ever done. We love it”.

The clincher has been finding an apartment directly across the road from their children’s inner-city high school. It means the kids now walk to school, gifting everyone a more relaxed start to the day and cutting out hours of shuttling back and forth in traffic jams.

Will says it was a life-stage change that prompted the move, as the couple’s children one by one left their local primary school and started at an inner city high school. The logistics of varying pick-ups, drop-offs and sporting commitments meant they were spending upwards of 10 hours a week in the car and calling on grandparents for help.

They had been toying with the idea of a move when they spotted a new development with family-sized apartments across the road from their children’s school. It seemed ideal, but rather than burning their bridges, they rented out their home and rented the unit.

“We just wanted to give it a go,” says Will. Within a year, they’d sold their house and are now on the hunt for a four-bedroom unit.

There have been compromises, Will says. But they have all been worth it. The family had a massive cull that involved many trips to the dump. But even that has been an unexpected positive. “It’s not been a bad thing to get rid of a whole heap of stuff we never used,” Will says.

And learning to live a more minimalist life has brought happiness and saved money.

Had the children been younger, they probably would have missed the pool and backyard more, Will says. But it’s not something that has been an issue, with school sport filling the gap.

A massive bonus for Will has been the security of living in an elevated unit and peace of mind that brings.

The main difficulty, he says, is a shortage of four-bedroom units (or at least ones that don’t come with a luxury price tag), as developers play catch up with demand.

Creating a sustainable kitchen is easier than you think with the right eco-friendly tools. Here are some top picks to help you save the planet and possibly some cash over the longer term too!

Glass Containers: Perfect for storing food, these containers are free from harmful BPA chemicals found in plastic. Plus, they’re durable and recyclable.

Bamboo Utensils: A fantastic alternative to plastic, bamboo utensils are both durable and biodegradable, making them a smart choice for any green kitchen.

Stainless Steel Straws: Reusable and easy to clean, these straws help reduce plastic waste and are perfect for your favourite beverages.

Beeswax Wraps: Keep your food fresh with these compostable wraps, which are a fantastic replacement for single-use plastic wrap.

Silicone Baking Mats: These mats eliminate the need for aluminum foil or parchment paper, making your baking sessions more eco-friendly.

Compost Bins: Reduce food waste effortlessly by collecting your scraps in a countertop compost bin and transferring them to a larger compost system.

Cast Iron Cookware: Long-lasting and free from toxic nonstick coatings, cast iron cookware retains heat well for even cooking and is a timeless addition to any kitchen.

Reusable Coffee Filters: Switch to reusable coffee filters or a French press to cut down on disposable paper filters and plastic pods.

We asked for your funniest DIY fails, and you delivered. From crooked shelves to rogue paint jobs, the entries had us equal parts impressed and amused. But one story flushed out the competition.

Congratulations to Mandy, who’s taking home $1,000 for her hilarious tale of a well-meaning toilet fix that didn’t quite go to plan.

“This story involves determination, YouTube overconfidence, a very pregnant woman, and a toilet that got the last laugh. It all started when I began my maternity leave. I figured, why not knock out a quick DIY project before the baby arrives? You know, really get into that nesting spirit. Our toilet had been running constantly, and I thought, how hard could it be to fix a toilet? I watched a few YouTube tutorials that made it look super easy so I waddled down to Bunnings and got everything I needed – or so I thought.

Fast forward to me proudly following step-by-step instructions, only to end up with water pouring all over the toilet floor. I still don’t really know what I did, but I had obviously missed a very crucial step. Things escalated quickly. The toilet was now not just running – it was weeping, sobbing, possibly screaming. And I would have turned off the water, except… I couldn’t reach the tap. You try leaning behind a toilet when you’re the size of a watermelon with legs.

With my hubby at work and no way to stop the Great Flood of 2022, I called him in a panic. He put calls out to his mates and eventually someone showed up and turned off the water, but by then I had a soaked floor, a broken toilet, and a bruised ego. Oh – and a plumber on speed dial.

Moral of the story? Stick to nesting that doesn’t involve plumbing, leave that one to the experts... But hey – I tried. Even funnier, it’s 3 years later and the toilet still runs, it’s been fixed 4 times since we moved in, but now I can easily turn the tap off, all I’m buying from Bunnings is a sausage with a bun.”

HAVEN MONEY

Are there options to avoid it?

State Governments around the country have widened stamp duty exemptions in an effort to fire up the struggling housing sector. But could this widely unpopular tax ever be abolished all together?

Last year Federal Housing Minister Clare O’Neil backed calls for stamp duty to be scrapped, labelling the State-based duty a bad tax that discouraged people from moving to homes that better suited their needs as their life changes.

The Housing Industry Association’s Stamp Duty Watch report, released in June, estimated stamp duty costs had jumped 55 per cent since 2019, now adding around $31,000 to the cost of an average home. But State Governments collect tens of billions in stamp duty that they’re not keen to delete from their budgets.

We look at the pros, cons and alternatives, as well as which States are offering home buyers some of the best options to avoid, or at least minimise, the hefty tax.

Stamp duty (also known as transfer or conveyancing duty) has been around since the 1860s, and is a tax levied on the purchase of property to help State Governments fund infrastructure and services used primarily by residents, such as roads, hospitals and schools. Each State sets its own stamp duty rules and rates, levying a percentage of the purchase price of properties, often on a sliding scale.

The reason it’s copping so much criticism lately – apart from the fact no one loves paying tax – is that house prices have rocketed, and that means stamp duty has too.

Hitting homebuyers with added tax costs in the middle of a housing supply crisis and cost of living crisis isn’t exactly popular. Which is why many States have been carving out exemptions, mainly for first home buyers, although some have extended them to off the plan buyers, to support the struggling construction sector.

These shifting duties means buyers in some States are forking out tens of thousands more in tax on median-priced homes, meaning it may pay off to look further afield.

Haven has crunched the numbers for capitals around the country (see our State-by-State analysis below)1. Melbourne easily ranks as the highest for stamp duty by percentage, with transfer duty of 5.4 per cent adding a whopping $44,150 to the cost of a median-priced $818,000 home. Queensland and the ACT came in joint lowest with a rate of 2.9 per cent.

1 Figures calculated using median capital city home prices (including houses and units) according to PropTrack’s Home Price Index, June 2025.

The case for and against

The upside of stamp duty includes:

• It funds essential services and infrastructure.

• It has a nod to equity in that buyers of more expensive homes pay more tax.

• It can help discourage property speculation.

Among the negatives are:

• It discourages movement. Empty-nesters may prefer not to downsize and growing families find it difficult to upsize.

• Some say the duty penalises the young who may move more often, and benefits those who can afford a forever home first up.

• It increases in line with rising property prices.

• Critics say it is an inefficient tax because it relies on sales turnover in property.

Alternatives methods of raising tax that have been floating include lifting GST or phasing in a broad-based annual property tax for all households.

Rates State by State

Here’s how stamp duty rates and concessions compare around the country.2

Queensland

Brisbane median home price: $908,000.

Stamp duty (based on median home price): $26,710.

Rate: 2.9 per cent.

Exemptions: On May 1 this year, Queensland abolished stamp duty for all first home buyers building or buying a new home, with no price or income caps. Buyers are also able to rent out a room and retain their owner/occupier stamp duty concession.

New South Wales

Sydney median home price: $1,182,000.

Stamp duty (based on median home price): $47,602.

Rate: 4.0 per cent.

Exemptions: First home buyers can access full stamp duty exemption for new or existing homes valued at $800,000 or less under the First Home Buyers Assistance scheme (lifted from $650,000 on July 1, 2023).

Victoria

Melbourne median home price: $818,000. Stamp duty (based on median home price): $44,150.

Rate: 5.4 per cent.

Exemptions: First home buyers pay no stamp duty on homes valued at $600,000 or less, regardless of whether it is a new or established property. To encourage downsizing, pensioners can also access stamp duty exemptions if they buy a new home valued at $750,000 or less that will become their principal place of residence. To support the construction industry there is also a temporary duty concession for off-the-plan purchases entered into before October 21, 2025.

2 Median home prices sourced from PropTrack Home Price Index June 2025. Stamp duty calculated using online state-based transfer duty calculators.

Adelaide median home price: $837,000.

Stamp duty (based on median home price): $39,865.

Rate: 4.7 per cent.

Exemptions: In 2024, the Government abolished price thresholds for first home buyers to access stamp duty exemptions if they build or buy a new home, acknowledging rapid rises in valuations had rendered caps unworkable. First-time buyers do not have to pay duty regardless of the value of the property they buy or build.

The State’s Liberal Opposition has announced plans to extend concessions to established properties if elected in March 2026.

Perth median home price: $836,000.

Stamp duty (based on median home price): $34,170.

Rate: 4.1 per cent.

Exemptions: In April this year, thresholds for first homebuyers to access stamp duty concessions were lifted to $700,000 for Perth metro properties.

Like Victoria, the WA Government is also offering concessions to all buyers, not just first-timers, purchasing off-the-plan until June 30, 2026. Those who buy before construction commences may access full stamp duty exemptions for properties valued up to $750,000 and concessional rates up to $850,000.

Darwin median home price: $525,000.

Stamp duty (based on median home price): $25,988.

Rate: 5.0 per cent.

Exemptions: The Territory’s House and Land Package Exemption (HLPE) allows first-time buyers to avoid paying any stamp duty, with no income or house-price thresholds. In an effort to bolster construction, existing homeowners who enter a contract to build or buy a new home in the NT before September 30, 2026 can access a $30,000 FreshStart grant. This can also be used for relocatable homes.

Canberra median home price: $836,000.

Stamp duty (based on median home price): $24,282.

Rate: 2.9 per cent.

Exemptions: Stamp duty concessions are available to first-home buyers subject to income and price thresholds. Income thresholds start at $250,000. The current price threshold is $1.02 million and will be indexed to local inflation.

Pensioners looking to downsize can also access significant concessions, with property purchases up to $1.02 million exempt from stamp duty.

Hobart median home price: $656,000.

Stamp duty (based on median home price): $24,878.

Rate: 3.8 per cent.

Exemptions: First-home buyers are eligible for stamp duty exemption for new and existing home purchases up to $750,000. Supporting mobility and construction, concessions of up to 50 per cent are available to home buyers who buy off the plan, and to pensioners downsizing within Tasmania, provided they are moving to a cheaper property.