By the Hand$ of Grenadian$

By the Hand$ of Grenadian$

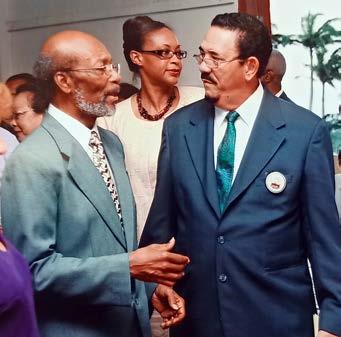

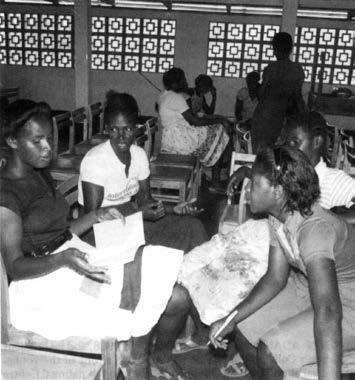

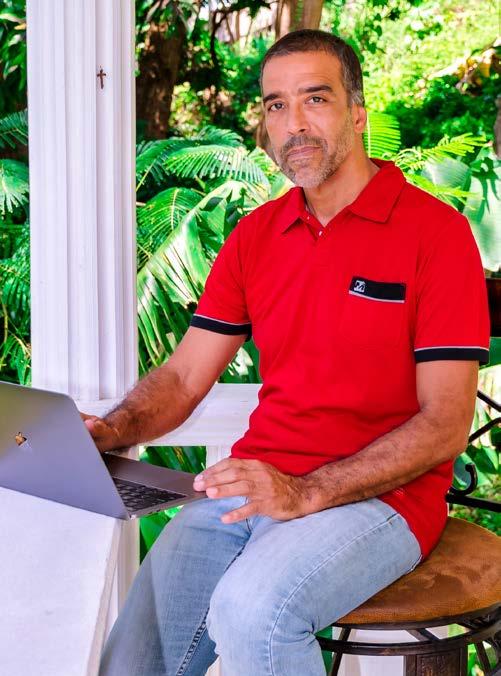

Photo: Reynaldo Bernard

Simon Lee

Photo: Reynaldo Bernard

Simon Lee

By the Hand$ of Grenadian$

By the Hand$ of Grenadian$

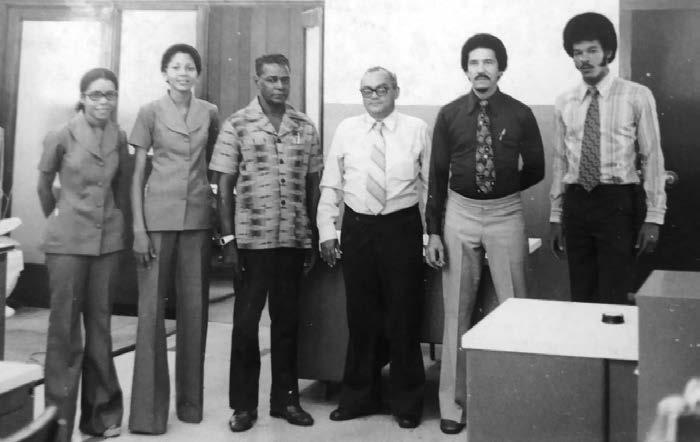

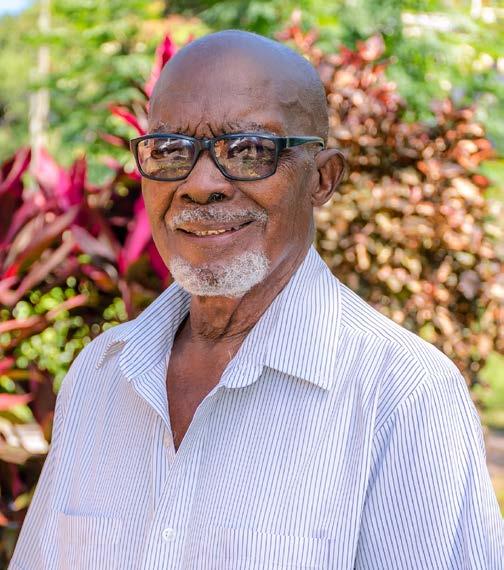

Photo: Reynaldo Bernard

Simon Lee

Photo: Reynaldo Bernard

Simon Lee

Copyright © Grenada Co-operative Bank Limited, 2022

All rights reserved. Except for use in review, no part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, any information storage or retrieval system, or on the internet, without permission in writing from the publishers.

www.grenadaco-opbank.com

First Edition

Researched and written by Simon Lee, edited by Alice Besson

Design & Layout by Paria Publishing Company Limited

Printed by The Office Authority Limited

ISBN: 978-976-8244-48-2

With Grenadian pride, we improve the lives of our customers through the provision of high quality financial services while ensuring a fair return to our shareholders and contributing to the well-being of the citizens where we operate.

Historical map of Grenada by Bryan Edwards

Photo: Paria Publishing

Historical map of Grenada by Bryan Edwards

Photo: Paria Publishing

Foreword

Part 4:

Evlyn Joyce Camp

Claudette Sylvester-Forteau

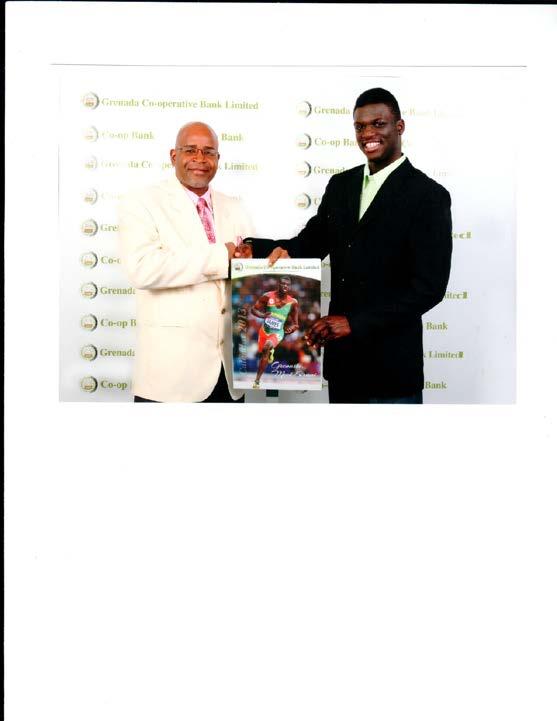

Roger Duncan Kirani James

Shane Regis

Andy Matheson

Jabari Fleary

Livingston Krumah Nelson

Christopher De Riggs Floyd Dowden

Michael Julien

Keith Clouden

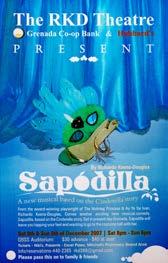

Richardo Keens-Douglas

Darryl Brathwaite

Lucia Livingston-Andall

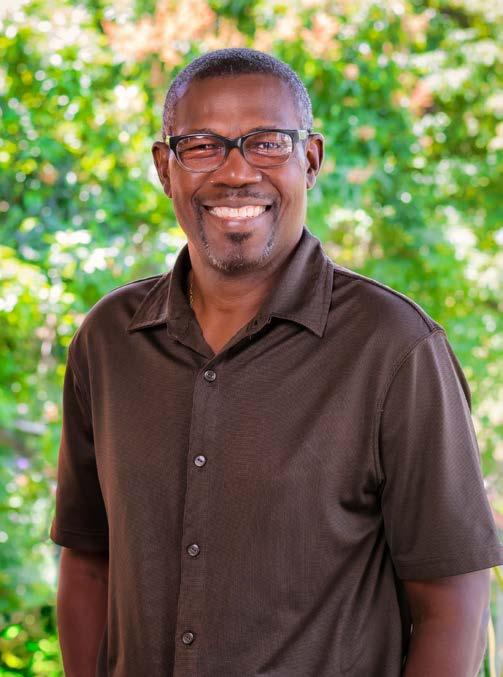

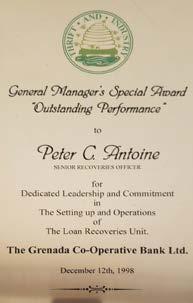

Carlton Peter Antoine

Rudolf ‘Rolf’ Hoschtialek

Devon Matheson

Elwyn McQuilkin

Gerald Keens-Douglas

Jerome Thomas

Francis Urias Peters

Dhannyram Lalsee

Raleigh and Agnes Monteram

Willvorn Grainger

Brenda Williams

Claudia De Allie

Richard W. Duncan

Evlyn Joyce Camp

Claudette Sylvester-Forteau

Roger Duncan Kirani James

Shane Regis

Andy Matheson

Jabari Fleary

Livingston Krumah Nelson

Christopher De Riggs Floyd Dowden

Michael Julien

Keith Clouden

Richardo Keens-Douglas

Darryl Brathwaite

Lucia Livingston-Andall

Carlton Peter Antoine

Rudolf ‘Rolf’ Hoschtialek

Devon Matheson

Elwyn McQuilkin

Gerald Keens-Douglas

Jerome Thomas

Francis Urias Peters

Dhannyram Lalsee

Raleigh and Agnes Monteram

Willvorn Grainger

Brenda Williams

Claudia De Allie

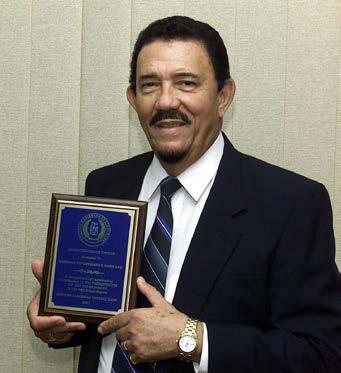

Richard W. Duncan

Grenada Co-operative Bank Limited wishes to thank all who contributed to this book and made its production possible.

We especially thank Richard W. Duncan and Roger Duncan for their unrelenting pursuit of this project over several years, and Sharon Christopher whose expert input was indispensable in making this book a reality.

We also are grateful to our interviewees who shared their memories with us: Carlton Peter Antoine, Darryl Brathwaite, Evlyn Joyce Camp, Keith Clouden, Claudia De Allie, Christopher De Riggs, Floyd Dowden, Richard W. Duncan, Roger Duncan, Jabari Fleary, Willvorn Grainger, Rudolf ‘Rolf’ Hoschtialek, Kirani James, Michael Julien, Richardo Keens-Douglas, Pastor Gerald Keens-Douglas, Dhannyram Lalsee, Lucia Livingston-Andall, Andy Matheson, Devon Matheson, Elwyn McQuilkin, Agnes and Raleigh Monteram, Livingston Krumah Nelson, Francis Urias Peters, Shane Regis, Claudette Sylvester-Forteau, Jerome Thomas and Brenda Williams.

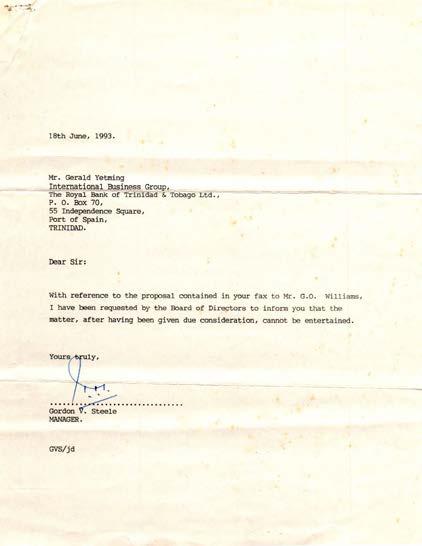

We mourn the loss of Gordon V. Steele and Cosmo St. Bernard who passed away at the time of writing, so we were unable to speak with them.

We also wish to thank Carlton Peter Antoine for project oversight and support and Aly-Terese Wilson for her support.

To our Chairman Darryl Brathwaite we say a particular thank-you, as many of the images in this book came from his personal collection. We also thank Michael Jessamy for allowing us to reproduce some of his photographs. All the way from Australia, Ludo Kuipers generously sent us his photos of the 1980s that were published on his website ozoutback.com.au. Reynaldo Bernard of Unique Photography took a number of the captivating photos in this book, adding to its appeal and value.

Special thanks also go to Simon Lee for conducting the interviews, researching and writing the text, and to Alice Besson and her company Paria Publishing Co. Ltd. for editing the text, supportive research and writing, and the design and layout of this book. Both Simon Lee and Paria Publishing also contributed photographs and other images to the book, for which we are grateful. Last but not least, thanks to our proofreaders and fact-checkers Floyd Dowden, Julia G Lawrence, Carlene PhillipFrank, Roger Duncan, Alyssa Bierzynski, Jarelle Amade, Magdaline Antoine and Denise Mohammed.

St. George’s Retail Banking Unit, and two buildings down the street, GCBL’s Head Office on Church Street

Photo: Reynaldo Bernard

St. George’s Retail Banking Unit, and two buildings down the street, GCBL’s Head Office on Church Street

Photo: Reynaldo Bernard

It is a privilege for me to be at the helm of Grenada Co-operative Bank Limited at this point in its history. Its establishment in 1932 as a locally owned financial institution represents what can only be described, some ninety years later, as both fortuitous and insightful. With this in mind, I welcome the reader to enjoy BytheHand$ofGrenadian$:ATaleof Commitment, Fortitude & Leadership.

The Bank has been on an arduous journey from its inception. The founding fathers heard the plight of the working-class plantation workers who could not afford to save, purchase property, or even educate their children. These noble men yielded to the call by taking the initiative of coming together to establish a bank for and on behalf of the people.

As the Bank celebrates its 90th year of existence, as Grenadians, we should all be cognisant of the fact that it is our collective initiative to ensure the viability and longevity of this national icon for future generations of our dear nation.

At Co-op Bank, we can boast of having assembled some of Grenada’s finest professional men and women as custodians of the people’s Bank. It is against this backdrop that the Bank embarked on its most ambitious project to date. On October 12, 2021, Co-op Bank confirmed that it had entered into a definitive agreement (subject to regulatory approval) to acquire the banking operations of CIBC FirstCaribbean in Grenada.

This momentous event, in my humble estimation, could only have been a dream in the imagination of the Bank’s founding fathers during their quiet reveries. The African proverb “If you want to go fast, go alone. If you want to go far, go together” bears much resonance in this moment. At this juncture, ninety years ago, we decided to go together, as a people, consolidating our pennies to build each other, our communities, our families, and Grenada. Encapsulated in this book, readers are given a brief overview of the Bank’s history, its stories and the Grenadian pioneers who contributed to its continued existence.

As Managing Director and current steward, I am eternally indebted to the previous generation of leaders who, with their respective team members, steered this enterprise through the turbulent times. It is now our obligation to continue the journey moving forward, continuously serving the Grenadian community. Grenada Co-operative Bank Limited, to me, represents the best we can build as a people, and I am proud to be a small part of this meaningful tradition of excellence. The Management team and I are fully committed to the future development of the Bank and the broader Grenadian community; indeed, it’s our moral obligation. As you dip into the pages of By the Hand$ of Grenadian$: A Tale of Commitment, Fortitude & Leadership, may it engender a sense of pride and appreciation for the sacrifices of those who came before, and reinforce what Co-op Bank means to us.

Birdseye view of the town of St. George’s and its historic landmarks, including Co-op Bank at the centre.

Photo: Reynaldo BernardIt is ironic, I suppose, that 90 years after its establishment when my granduncle, Sam W. Brathwaite, became a founder and first Manager of the Bank, that I am here writing this introductory note as current Chairman of the Board of Directors. As a Board, we continue to build upon the foundations laid by the founders of Grenada Cooperative Bank Limited. It is therefore our fiduciary responsibility and moral obligation to maintain, enhance and prudently manage the investment of the four thousand odd shareholders. By the Hand$ of Grenadian$:ATaleofCommitment,Fortitude&Leadership is one way we’ve decided to celebrate and capture such a momentous occasion. We wish that the pages of this book fill you the reader with a sense of pride, joy and appreciation that together, we have built a ship (Co-op Bank) that sails through all seasons as we celebrate the Bank’s 90th anniversary.

Grenada Co-operative Bank Limited, since 1932, has been governed and managed by Grenadians and it remains so today. These individuals through their wit, determination and professional acumen proved that we could build and sustainably develop a Bank that represents and caters to the needs of the average man. It is important to note that at the onset, sound

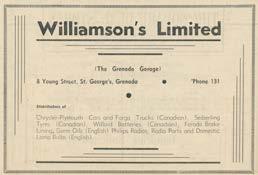

governance has been one of the key pillars of Grenada Co-operative Bank Limited’s success; Sam Brathwaite, W.E. Julien, Arnold Williamson, C.F.P. Renwick, J.B. Renwick, R.O. Williams, Simeon A. Francis, T.E. Noble Smith, Joshua R. Phillips, P.G. Hosten, and P.M. Francis started this tradition of good governance. It would be remiss of me to not be sufficiently minded to highlight upon reflection the proverb “If we don’t know where we’ve come from, we won’t know where we’re going”. By the Hand$ of Grenadian$: A Tale of Commitment, Fortitude & Leadership serves as an avenue for such self-reflection. It showcases how much, and for how long, Grenada Co-operative Bank Limited has touched the lives of almost every Grenadian, one way or the other. On the cusp of such a significant milestone, the Board of Directors is committed to following international standards in the development and implementation of its governance practices and procedures.

On behalf of the Board of Directors, I would like to thank every Grenadian, past and present, who has contributed to the development of the Bank. It is our honour to have this opportunity, at this moment in time, to continue to guide the Company into the future.

In the Anglophone Caribbean we do not spend enough time and effort, as I think we should, to understand our success over time. It is also true that celebrating each other’s triumphs, or even our own, does not come readily.

Grenada Co-operative Bank Limited, wholly owned, controlled and managed by Grenadians, is a Grenadian icon, having out-competed its rivals, both local and foreign.

The learning organisation concept postulates that an organisation, as a living organism, survives by extracting the needed nutrients from the environment, mutating as the environment changes to ensure its continued existence. Co-op Bank has not just survived, it has thrived in the nine decades of serving the Grenadian people, businesses and institutions.

Understanding how the Bank has not only adapted to the changing environment, but also helped to shape it, is a line of enquiry pursued in the pages that follow.

Celebrating our founding fathers, pioneers, business leaders, trailblazers, entrepreneurs and visionaries, acts as a source of inspiration and motivation for the movers and shakers of tomorrow. Everyone who walked through the physical or virtual doors of Co-op Bank—employees, Directors, shareholders, customers and service providers—should feel profoundly proud of their association with, and contribution to, the Bank’s success.

By adding to the body of literature on the history and performance of iconic Grenadian enterprises, the Bank has cemented its place in the documented history of Grenada.

The pan-Caribbean movement to provide banking services to the poor and financially disenfranchised, which began in the early 20th century, led by Captain A.A. Cipriani et al., came of age at different points in time in the respective territories. Where many institutions such as co-operative banks and building societies have either failed, been acquired or have stagnated, at 90, Co-op Bank holds the singular honour as the most successful independent indigenous bank of that ilk.

Along the way, many individuals and institutions have contributed to our success. It was not simply our own doing. The iconic Co-op Bank that we know and have come to admire benefitted from advice, insights and support from across the Caribbean, especially the Eastern Caribbean.

As early as 1997, Dr. Basil Springer and St. Anthony (Tony) Proute of System Consulting Limited of Barbados assisted us in laying down our Strategic Plan.

Denby De Freitas and Laura Antoine, retired bankers from Barclays Bank, held our hands; likewise, Ian Fraser, banking consultant of South African heritage with background in National Commercial Bank (Grenada) and Royal Bank; Lera Gooding of Royal Bank of Canada

This book should act as an inspiration to employees of all financial institutions in Grenada who choose to dedicate their careers to the profession and the transformation of their business.

heritage mixed with Grenada Bank of Commerce and RBTT Bank’s insights joined forces with Celia Palmer of Barclays vintage and Roy O’Neale of Scotiabank as consultants and advisors along the way. So, in a sense Co-op Bank is a cross-pollination of multiple cultures and approaches to banking, management and strategy.

There has been a high level of co-operation and collaboration among indigenous banks. We readily share with each other any aspect of banking technology, strategy, finance, human resource management, payment services, credit, audit or risk management, which the other has mastered. Our Bank has benefitted immensely from those acts of sharing. National Commercial Bank (St. Lucia), now Bank of St. Lucia, has been the most forthcoming—Brian John, Joanna Charles and Estherlita Cumberbatch were among the most accommodating.

First Citizens Bank of Trinidad & Tobago and its Deputy CEO Sharon Christopher were supportive and inspirational.

This book should act as an inspiration to employees of all financial institutions in Grenada who choose to dedicate their careers to the profession and the transformation of business and industry.

Of the many lessons we have learnt, here is the one that we hope all leaders will take away. Striving to be bigger than the competition is not a strategy. The best strategy is endeavouring to improve the quality of customer experience day by day, week by week, month by month, year by year, and decade by decade.

As Co-op Bank continues its transformational journey, so does the indigenous banking movement. It is our hope that this book provides some nuggets to bolster our resolve as indigenous bankers to build strong, successful and stable banks that create value for their shareholders and contribute significantly to the growth, development and prosperity of our people.

“For the younger folks to truly understand that the world did not start yesterday.”

(Richard W. Duncan, Managing Director Grenada Co-operative Bank Limited 2008–2021)

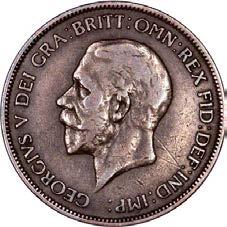

A 1932 penny with the profile of King George V on the obverse and the allegorical Britannia on the reverse.

Date: June 11, 2021.

Location: St. George’s.

It’s a torrid Friday afternoon in St. George’s. Church Street simmers and my black outfit is smart, but I’m sweltering in it. No work for me today or for all employees in any of our five branches. Instead, we line both sides of elegant Church Street from the new head office up the punishing gradient to the Tower Hive flagship branch and around the bend to the Anglican Church.

We’ve all come to pay our last respects to Gordon ‘Knocky’ Steele, former Managing Director of Grenada Co-operative Bank Limited, who resigned back in 2008, when I was still in pigtails at Springs primary school; blissfully unaware that within a decade I would be a frontline teller at the Spiceland Mall branch of the ‘Penny Bank’, which Steele had transformed into becoming Grenada’s successful and only indigenous bank.

The strains of Andrea Bocelli’s “Time to Say Goodbye” drift up the narrow street, announcing the arrival of the hearse preceded by an immaculately white-tunicked police motorbike escort. Beneath the Georgian church’s cream and red brick tower solemn pall-bearers slide the coffin out from the hearse and carry it slowly toward the porch. The church’s bright white interior, with its shining wooden beams and brightly coloured stained-glass altar window, is packed with family, friends and dignitaries, including the Governor General and Minister of Health.

I listen carefully to the opening tributes, hoping to gain a picture of this man I never knew but to whom I probably owe my job, along with all the life-changing opportunities it brought me. What emerges is an exceptional figure, not only in terms of reinventing the Bank, but as a deeply caring human being who, as his successor Richard W. Duncan said, “affected so many lives in so many ways”, or as Floyd Dowden put it, “taught me life.”

The empathy, compassion and humility—all the tributes mentioned echoed what I had heard in the village: from the ever convivial ‘Bush’, the Mong Mong master cook, or ‘Food’, the former tailor, mariner, Scoutmaster and bus driver, whom ‘Knocky’ had helped out with a post-Ivan loan, and gap-toothed ‘Funky’ who maintained ‘de boss’ garden.

Today has piqued my curiosity, not just about Knocky and his legacy, but also about the Penny Bank and its history, which I realise is as much a part of Grenada as my own family’s history.

The shimmering mirror of the silent noon sea shatters. Earth moans, groans and roars, ripping the water’s surface in fiery columns of molten lava shooting up beyond eyeshot into an azure sky. The sizzling sea heaves and thrashes like an enraged monster; its mouth an immense churning cauldron wreathed in steaming clouds, spewing rock and belching stinking gases.

From this fury emerges a smouldering cone, showering massive embers, thrusting skyward, forming a mountain top, an island in the sea that in a far-off future would be named “Grenada”— Grenada, which rises in all her stunning lush green beauty from the shimmering turquoise waters of the southeast Caribbean Sea, her dependencies Carriacou and Petite Martinique some 27 miles to the north. Only 21 miles from tip to top and 12 miles across, blessed with a gentle tropical climate and cooled by bracing sea breezes, with pure air redolent of spice aromas, her topography and history have been defined by her volcanic origins.

The spine of the steep central mountain ridge running north to south and rising to the 2,757 ft heights of Mount St. Catherine spreads limbs of rugged peaks east and west seaward, sheltering deep fertile valleys rich in volcanic soil. Mysterious mist-wrapped Grand Etang, low-lying Lake Antoine and sedate St. George’s harbour are just some of many extinct volcanic craters, part of Grenada’s prolific portfolio of natural sites.

From white beaches like Grand Anse’s world-renowned languorous two-mile stretch, to the black sands of secluded La Sagesse bay; from the shaded forest waterfalls of Concord, Annandale and Mt. Carmel, to the hot springs at River Sallee, Grenada’s natural beauty is complemented by the elegance of its capital St. George’s, “The prettiest town in the West Indies”. St. George’s retains small town charm and is unique in the Caribbean for its delightful Georgian architecture, a reminder

of the major role the town played in regional and global history.

First settled by Amerindians from the South American mainland on their way up the islands and sighted by Columbus on his third voyage of 1498, Grenada’s modern history begins with French settlement in 1649, which was fiercely resisted by the Kalinago defending Camerhogne—‘Land of Abundance’. By May 1651, the Kalinago were driven north and the last forty surviving warriors leapt off the cliff at Sauteurs.

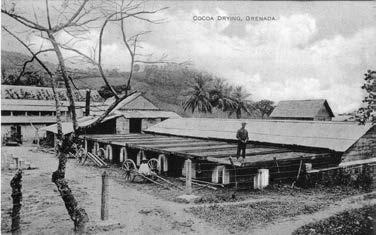

Initially run as a commercial venture, Grenada became a French colony in 1674. Fort Royale—town and fort—were established in 1705/6 and the island divided into six parishes: Basseterre, Gouyave, Grand Pauvre, Sauteurs, Mégrin and Marquis. The 1700 population of 835, including 525 slaves, grew to over 13,000 by 1753, with 83 sugar plantations worked by nearly 12,000 slaves. Cocoa, coffee and cotton cultivation

along with sugar, rum and tobacco production drove increasing prosperity for the plantation owners.

As the battle between European colonial powers for possession of the wealth-producing Caribbean territories escalated, Grenadian waters became part of a marine theatre of war. During the Seven Years War of 1756–63, the British established supremacy in the Caribbean, not only ruling the waves but also seizing French possessions: Guadeloupe, Martinique and then Grenada in 1762. French creole culture, however, despite the loss of patois, continued to be a distinctive element of contemporary Grenadian identity in the Roman Catholic majority religion, place names, architectural heritage, folklore, music, dance and cuisine.

Apart from the brief French interregnum (1779–83) Grenada remained in British hands until independence nearly 200 years later. As the repercussions of the French Revolution played out in the Caribbean, Republican commissioner Victor Hugues introduced the bloodthirsty guillotine to the islands. Julien Fédon, supplied with arms by Hugues, headed a group of wealthy Roman Catholic Free Coloureds and an army of former slaves in a daring revolt against the British. With their intimate knowledge of the impenetrable interior and lightning guerrilla strikes, Fédon’s troops controlled the entire island except for St. George’s from March 1765 until June 1796,

when, surrounded at the heights of Belvedere Estate, they were defeated by superior numbers.

The British, in their second term as colonial rulers, rigorously re-programmed Grenada as an English colony, with English as the official language and the Church of England the sole state religion, leading to an exodus of many French creoles and their slaves to Trinidad. Representative government was established with a Legislative Council and a House of Assembly but in reality, power and control remained in the hands of the British Governor, as elected local assemblymen were notorious for their absenteeism from assembly meetings.

Following Emancipation in 1838, labour shortages, exacerbated by a growing peasantry’s preference for subsistence farming, the rapid decline of the inefficient sugar industry and abandoned estates led to various initiatives to import indentured labour: Africans freed from slave ships; labourers from Malta, Madeira and India. Another scheme led to an influx of ‘poor white’ Barbadians, who settled in Mt. Moritz from 1861, adding more flavour to an increasingly cosmopolitan society.

Along with these arrivals, the post-Emancipation period heralded the emergence of a vibrant local middle class. Ambitious and increasingly wealthy from investment in the developing cocoa and spice bonanza and as successful merchants, traders and entrepreneurs, it was this evolving middle class that set the tone for Grenada’s subsequent development. Religious, respectable, industrious, and propelled by reverence for education, they made upward social mobility a reality. This highly educated middle class initiated a culture of love of country and community, commitment to progress and betterment for all, which not only produced brilliant men and women in the coming years but also laid the foundation for Grenada’s future. Education opened the avenue for advancement, as doctors, lawyers and professionals returned from studying abroad to take up important positions on their return. It was leading figures of this class who would later become the founders of GCBL.

At the advent of the 20th century and through to independence, agriculture and the ever fertile land continued as the mainstay of the entire society’s economy and development. This is the era when Grenada became known

as the ‘Spice Isle’, as cocoa and nutmeg production revived fortunes after the decline of King Sugar in the 1880s. Grenada became a significant player in the global network trading in these highly prized commodities, stimulating the opening of new trading houses, and development in transport and communications. In addition to the annual two-crop cocoa yield and the success of nutmegs and spices, coffee, cotton and bananas, rubber and even kola nuts were also cultivated. Adding to all this abundance was what the English novelist Anthony Trollope observed in his 1859 travelogue The West Indies and Spanish Main: “Grenada is headquarters of the world for fruit.”

Agriculture wove all sections of society inextricably together, bonding them to the rhythms of the land in a shared culture of festivities and traditions, grounding them in stability and fortitude capable of weathering the coming storms of modernity. Prosperity generated by the cocoa and spice boom undoubtedly contributed to the success of smallholders, who now took their rightful place in a slowly but inexorably modernising society.

Grenada embarked on the 20th century, its Crown Colony status—voted for by the House of Assembly in 1876—still intact, but under pressure from some sections of the rising middle class. They called for a return to a representative system in central government to augment the limited local self-governance of the semi-elected Town Boards set up in 1900, responsible for water supply, sanitation and maintaining byways.

Two leading figures promoting self-governance and a Federation of the British West Indies, T.A. Marryshow and the brilliant lawyer Charles ‘Jab Neg’ Renwick, established The West Indian newspaper in 1915 as a vehicle for the cause.

A gifted orator, Marryshow followed in the footsteps of his mentor W.G. Donovan, who had long campaigned for selfgovernment and West Indian unity. Renwick’s popularity and social influence secured increasing support from the educated middle class, resulting in the formation of the Grenada Representative Association in 1917. The Association’s efforts brought partial constitutional reform, including enfranchisement for eligible women and a new Legislative Council, with a minority of five locally elected members in

1925. Both Marryshow and Renwick were elected. Soon both of them would also be instrumental in founding GCBL.

Considerable progress in infrastructure and public works had already been made under Governor Walter Sendall (1885–1890): the existing road system was repaired and the highway from St. George’s to Grand Etang reconstructed and resurfaced; the prison and colony hospital much improved; unpopular excise laws that encouraged smuggling, removed; ten square miles of land between St. David and St. George’s supplied with water; a tunnel connecting the Carenage to Market Square constructed; a Hospital Board and much enlarged Education Committee established along with the Botanical Gardens and a regulatory committee; primary education was improved with increased grants and government schools set up in densely populated areas. In the early years of the century, this extensive programme of public works continued with bridge building, creating access to previously isolated rural communities. The pace of change in Grenada accelerated noticeably.

The education system introduced in the mid-19th century was restructured and greatly improved. In 1900, there were only three secondary schools—St. Joseph’s Convent, Anglican St. George’s

Cocoa and Nutmeg

“One may observe the settlement of peasant proprietors on allotments cut out of abandoned sugar estates and the creation thereby of a body of contented labourers, where, a few years ago, there were only desolation and acacia scrub.”

Land settlement added impetus to the economic and social development of the peasantry who, since Emancipation, had been founding rural villages, markets, farming co-operatives and friendly societies. Their hard-earned savings received a major boost with the opening of the Panama Canal zone in 1906, when more than 1,500 labourers took advantage of the high wages offered, sending back remittances that were invested in land, houses and small businesses. The produce provided by small holdings would prove vital in feeding the nation in the coming Great War of 1914–18 and into the 1930s, when the Moyne Commission was impressed both by the size of the peasantry and by “its ability to alleviate distress during trade slumps and to supplement their cash earnings by homegrown foodstuffs.”

37 primary schools. Poor primary school attendance was addressed by offering bonuses to teachers for improved numbers. An ordinance of 1907 reclassified primary schools into Infant, Lower Division and Combined schools, and principals’ salaries were regulated accordingly. By 1913 there were 51 primary schools (22 Roman Catholic, 11 Anglican, 5 Methodist, 2 Presbyterian) and a ‘Ragged School’ for the poorest children established in St. George’s. The Grenada Boys’ Secondary School and The Victoria High School for Girls (which eventually became the Anglican High School) added to secondary provision. The institution of an annual Island Scholarship in 1916, covering expenses for university study abroad, demonstrates the value increasingly placed on education as a means of betterment. More advances came with the appointment of a Director of Education in 1925 and an ordinance establishing Pupil Teachers’ Centres in 1926. Schools were reclassified again in 1931, with manual training centres now offering handicraft, agriculture and industrial courses. Twenty poor children annually were given a chance of secondary education through government scholarships.

A population of just over 63,000 at the turn of the century soon included some 8,000 peasant farmers, settling on small land lots created by dividing abandoned or debt-ridden sugar plantations. The 1909 Handbook was pleased to note one of the earliest schemes at Bellevue in Carriacou:

The First World War elicited a wave of patriotism, both for the defence of Grenada and support of the Mother Country, which began appropriately with the Legislative Assembly voting for the gift of £6,000 worth of cocoa for His Majesty’s forces. Men enlisted in the Grenada Volunteer Force, joining volunteers from St. Lucia and St. Vincent to form the first contingent from the Windward Islands of the British West Indies Regiment, which embarked for England in August 1915, followed by another detachment in November. Costs for the Grenada contingent were met by a cocoa export tax. Among those who enlisted were W.E. Julien and J.B. Renwick, two more GCBL founders, who both rose through the ranks to become sergeants. W.E. Julien was awarded the Distinguished Conduct Medal for bravery in the field after leading his platoon to capture an enemy bridgehead in the Jordan Valley, Palestine on September 22, 1918.

After the first telegram (1871), telephone and inter-island telegraph introduced in the 1880s, modernity most loudly announced its arrival in Grenada with the coming of the automobile, as this schoolboy’s reminiscence of a morning in 1907 vividly recalls:

“A sound as of thunder fell on my ears. Louder and louder it grew... What was this mechanical ‘monster’ belching billows of thick blue-black smoke from its rear; its inside

filled with white, pink-faced ladies with hats from which hung fascinators? And who was this white uniformed and gloved driver with cap and visor, steering this horseless vehicle along the macadamised roadway?”

The arrival of cars and other motor vehicles prompted more road improvements (‘oiling’ or resurfacing with pitch from the La Brea Pitch Lake in neighbouring Trinidad) and the Main Road and Byway Ordinance of 1916, which banned constructing buildings or planting coconut trees too close to roads, as falling coconuts were rightly deemed a danger to traffic! The horse and mule mail coach between St. George’s and Grenville gave way to a motor coach, which also took passengers, but poor roads on the leeward coast meant mail was still delivered by steamboat.

Other markers of modernity were slower coming: the hospital was first lit up in 1925 and by 1928 a hydroelectric plant, powered by water from the Annandale River, was supplying St. George’s, with extensions down to Woodlands and Grand Anse in the 1930s. Wireless stations (Old Fort and Carriacou) built in 1925 now connected Grenada to the world. The telephone system, modernised in 1927, expanded rapidly, while a Central Water Authority established in 1928 began the process of delivering pipe-borne water island-wide. From the skies came the first aircraft: an American flying boat in 1924, followed by a whole squadron of American amphibian planes that beached at Queen’s Park in 1927. The slow, laborious system of unloading cargo by lighters outside St. George’s roadstead was finally superseded in 1938 with the construction

of an 850 ft pier, allowing vessels to berth quayside and unload directly to storage sheds.

While agriculture would continue as the economy’s mainstay, modernisation began shaping diversification. A soap factory opened in Tempe in 1911, then an ice factory. There was a brief period of whaling, with a factory on Glover Island commissioned in 1925 but abandoned by 1928. The fledgling tourist industry prior to the First World War was formalised with a Tourism Committee in 1928 and boosted by the Golf Club of Grenada founded in 1925, with courses at Queen’s Park and then Pearls.

Apart from a dip in world cocoa prices early in the 1920s, by 1925 the slump was over and cocoa and nutmeg exports once again provided prosperity at home. The amalgamation of Grenada’s Department of Agriculture with Trinidad in 1925 greatly improved services to farmers, resulting in healthier crops and livestock. Bananas were introduced as another export crop in 1929, purchased quayside by The Canada Banana Company. The revived sugarcane cultivation supplied the Sugar Factory, built in 1936 to produce muscovado sugar and rum for local consumption.

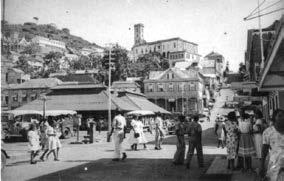

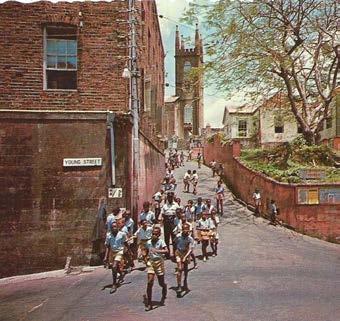

So this is the historical backdrop to the Grenada where the story of GCBL starts. Now we can zoom into the location where it all began: St. George’s. It was here, among the cobbled streets, soaring steeples and spires, dizzying hills, bustling Market Square and stevedores’ clamour on the wharf, that the Bank had its genesis. St. George’s irresistible charm combines architectural elegance with a stunningly rugged natural setting, epitomising the spirit of Grenada. Climbing the hills of St. George’s requires physical and mental stamina, a certain will and determination to reach the heights. It’s entirely appropriate that this is the home ground for a local financial institution with humble beginnings, which went on to overcome all obstacles and become Grenada’s eminently successful indigenous bank, contributing to the development of Grenadian society and culture at all levels. Rooted in the rich past, the Bank has embraced the challenges of growth, establishing the proud legacy of a better future for all.

It’s possible to read Grenada’s entire history strolling through St. George’s, from the extinct volcanic craters that created the harbours, to the earliest European settlers whose imposing fortifications still command the towering heights. The hand of God provided a perfect setting for human hands to construct this utterly unique harbour town. A good anchorage with access to fresh water and an area to careen boats was literally a godsend. There are other possibly more impressive harbour cities, particularly in the Spanish Caribbean—Santo Domingo, Havana and San Juan, but nothing can compete with St. George’s small-scale charms. That scale has remained, so that the town still lies within the boundaries set by the French in 1700 along with many of the structures erected since the Great Fire of 1792, having weathered many storms.

While there are many delightfully elegant Georgian buildings in Jamaica and Barbados, St. George’s is the only entire town in the English Caribbean defined by a Georgian architectural heritage. That heritage was built from the bricks and tiles shipped in as ballast and then used to transform a trading centre with little more than wharves, warehouses, a few essential civic buildings and fortifications into an environment reflecting the wealth the island generated. While the overall impression is dominated by clean neoclassical Georgian lines, there are splashes of Regency exuberance and ornateness in the wrought iron balconies and striped awnings, punctuated by colourful tropical Gothic Revival edifices of the Victorian era.

The scintillating hues of the graceful façade of the Old Priory, thrown into relief by the quiet simplicity of the restored Anglican Church on Church Street, are a treat for any eye.

Although the development of the Esplanade and the cruise ship terminal have changed the face of old Bay Town, and Hurricane Ivan slightly rearranged the skyline, St. George’s remains distinctly identifiable from 19th century traveller’s descriptions. Here’s one from Henry Coleridge, nephew of the English poet

Samuel Taylor Coleridge, famous for his epic poem The Rime of the Ancient Mariner, who had this to say in 1825:

“The Harbour is one of the finest in the West Indies... The town covers a peninsula which projects into the bay. Fort George stands on the point, the spired church on the isthmus; within is the Carenage full of ships and the wharfs of the merchants surrounding it; beyond it lie three or four beautiful creeks...the great Lagoon, and Point Salines shooting out a long and broken horn to the south west. Over all, and commanding everything in the vicinity, tower the Richmond Heights, which are crested with fortifications of prodigious extent.”

Another traveller, Charles William Day, perfectly captured the pedestrian experience in 1854 with an artist’s eye and a humorist’s wit:

“St. George’s may fairly be called the City of Steeps... the streets are paved with small hobbling pebbles which...make a pedestrian mince his steps, like a dancing master troubled with corns. The hollow of Market Square, to which these steeps so abruptly descend, seems to be shrunk into a bowl, so stifling and suffocating is it after the boisterous flurries of wind to which the upper streets are subject.”

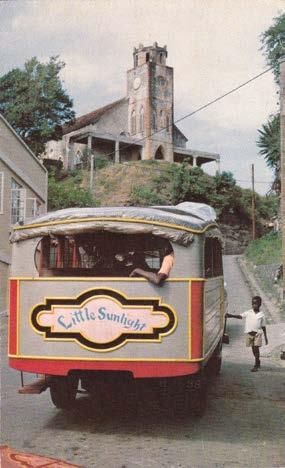

Most of the cobblestones have gone, but negotiating ‘the steeps’ remains a feat not recommended for the faint of heart or foot. Fortunately, we don’t have much climbing to do: a short amble off the Carenage will take us up Young Street, past Arnold Williamson’s garage to a small office obliquely opposite the Antilles Hotel, now a part of the National Museum. If we’re lucky we should find Sam Brathwaite, first Secretary/Manager of the recently founded GCBL collecting deposits and scribbling frantically in a large battered ledger.

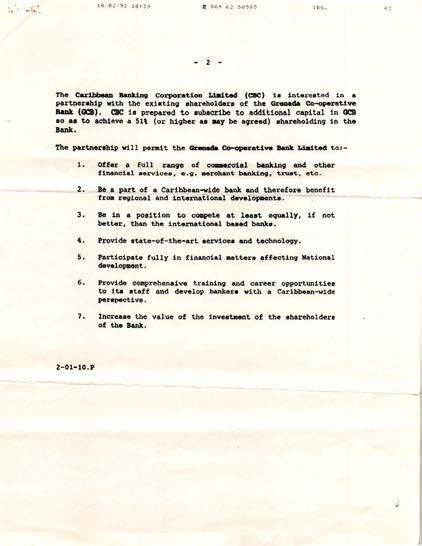

On October 12, 2021, Grenada Co-operative Bank Limited, in the 90th year of its existence, began an exciting new chapter in its history by becoming part of a consortium to acquire the banking operations of CIBC FirstCaribbean in Grenada as well as in Dominica, St. Kitts and Nevis, and St. Vincent and the Grenadines. The consortium consisted, besides Grenada Co-operative Bank Limited, of the National Bank of Dominica, the St. Kitts-NevisAnguilla National Bank and The Bank of St. Vincent and the Grenadines—all indigenous banking operations in the Eastern Caribbean. The press release read:

“The consortium members are market leaders in their respective territories, offering the full spectrum of commercial banking services and electronic channels. As at 30 June 2021, they held an aggregate deposit base of $6.4 billion (approx. US$2.36), representing a 53% market share in their combined markets. Collectively, they have been serving the people of the Eastern Caribbean Currency Union for a combined period of over 200 years. The consortium’s customer base includes consumers, small and middle-market businesses, large corporations, statutory bodies and central governments; and remain committed to helping their customers succeed.”

What makes this acquisition (subject to regulatory approval) so significant in the context of this book

is that CIBC FirstCaribbean was the successor organisation to Barclays Bank Dominion, Colonial and Overseas (DCO). When GCBL was founded in 1932, Barclays had already been active in Grenada for almost a century, dating back to the Colonial Bank, which had come to the Caribbean in 1837/38 to administer British financial interest in the region in the aftermath of the abolition of slavery in the British Empire. In the 1930s, banking services at Barclays were, however, completely inaccessible to the average Grenadian, which is where the founders of GCBL saw a market need and created an institution that has stood the test of time.

As such, it is not without historical irony that 90 years later, a local organisation that was founded on the principles of a co-operative, where poor men, women and children could open an account with a penny and buy a share with a dollar, would have sustainably grown so much that it would be able to acquire the remainder of the assets of the once mighty Barclays Bank DCO.

Grenadians have always had a fighting spirit in them, a rebellious spirit that fought the injustices of colonial and post-colonial rule. Acquiring what was left of the Colonial Bank in Grenada by a bank that is truly a ‘child of the soil’ brings this part of colonial history to an end. It is to be hoped that with this new chapter in the history of the Bank, it will continue to contribute to the well-being of citizens through the provision of high quality financial services.

Before commercial banks were established in Grenada, financial services for planters were provided by local merchant houses like Lushington & Law and Thomson & Hankey.

Following Emancipation, there were short-lived efforts at creating indigenous banks in the British colonies: the Jamaica Planters Bank in 1839 and the West India Bank, based in Barbados, in 1840. Although a branch was opened in Grenada, by 1848 the West India Bank had been liquidated and slipped without trace from local history.

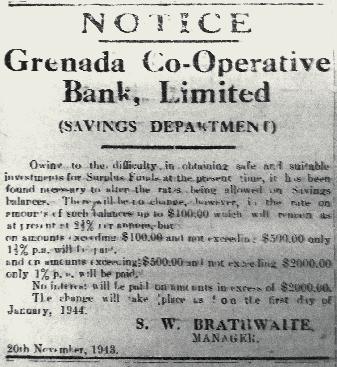

At the time when Grenada Co-operative Bank Limited was founded, against the global financial backdrop of the Great Depression following the Wall Street crash of 1929, Grenada’s banking industry was largely limited to two foreign-owned institutions: the British Barclays Bank DCO (Dominion, Colonial & Overseas), and the Royal Bank of Canada (RBC).

Barclays was the successor institution to the Colonial Bank, which had been established in Grenada in 1837 to service British colonies in the Caribbean. Its first office was on Melville Street, St. George’s.

A Grenville branch was set up in 1879. In 1889, its St. George’s branch relocated to Church Street. In 1916, the Colonial Bank expanded into West Africa and the wider British Empire. In 1925, Barclays Bank DCO acquired the Colonial Bank’s assets, and for many years it was Grenada’s premier bank.

RBC opened its first local branch in 1913 (in what is today the House of Chocolate) on Young Street,

St. George’s, directly opposite what would be GCBL’s first office (in the building that presently houses the Marketing and National Importing Board).

Shortly after Emancipation, around 1839, the first Government Savings Banks were established in various British Caribbean colonies to promote thrift, savings and the opportunities for betterment. These banks could be viewed as the first ‘Penny Banks’, in the Caribbean, as they accepted deposits as small as one penny. However, the situation in Grenada was different: the Government Savings Bank was established only in 1881, much later than in other Caribbean territories, and apparently with different deposit regulations. An 1889 article in The Grenada People outlined:

“In Jamaica, Trinidad, British Guiana...The working men are able to save from one penny upwards...The Government Savings Bank, unlike kindred institutions in other colonies, is virtually closed to the classes that it is intended to benefit...We do not think there are 20 labouring men amongst the depositors.”

In Grenada the minimum deposit was one shilling (the workers’ average daily wage) to open a savings account, but interest was only payable on deposits of £1 (20 shillings) and above. These provisions put the Government Savings Bank beyond the reach of most workers, creating the necessary vacuum for GCBL to fill in the following century.

and Penny from the Victorian Era (19th Century)

Co-op Bank was for EVERYBODY!

By the 1930s, currency had mostly become standardised, with all official accounting kept in British sterling: pounds, shillings and pence (plural of the famous ‘penny’); £5 notes and the farthing (a quarter of a penny) appeared most regularly in circulation.

The route to standardisation had been bumpy. During French colonisation of Grenada, the French ‘stampee’ or ‘black dog’, stamped with ‘C’ for colonies, circulated. After 1787, Spanish silver dollars were cut into ‘bits’ and stamped with ‘G’, designating them official currency. Anchorage coinage, struck on the Spanish dollar, circulated briefly from 1822, was

Maybe a future customer of the Bank?

partially replaced by British coins from 1825. In 1835, the Commissioner of Compensation for Slaves provided a conversion table:

one Doubloon 180 shillings

one Johannes 60 shillings

one Guinea 52 shillings and 6 pence

one Sovereign 50 shillings

one Dollar 10 shillings

In 1838, when the Apprenticeship period came to an end and full Emancipation came into force, an Imperial Order in Council established the official rate of 4/2d (four shillings and two pence) to one British West Indian dollar.

However, throughout the remainder of the 19th century, a variety of coinage and notes still circulated, mostly Joes (or Johannes), dollars and bits. Silver coins, including the groat (worth four pence and legal tender until 1914) were used in small payments, while bank notes, issued by the commercial banks like the Colonial Bank or later Royal Bank of Canada, covered larger transactions.

Gold currency had virtually disappeared by the start of the First World War, which curtailed fledgling tourism and its trickle of foreign gold.

Without access to formal banking arrangements, the majority of the population in Grenada had to rely on alternatives like the ‘sou sou’ system to access credit and cash. Sou sou, like other communal endeavours such as ‘len han’, ‘gayap’ and ‘maroon’, where villages or small communities pooled labour resources for major tasks like clearing land, planting, harvesting or building houses, was another aspect of the communal culture utilised in founding and developing free villages after Emancipation, often on the outskirts of former estates. The combined contributions of sou sou members were drawn on by individual members on a rotation basis; with one member taking everything in the communal kitty.

Another alternative to achieve savings were the friendly societies, where regular savings could be made against lump sum payments to cover sickness, injury and, most importantly, funeral and burial expenses. The first friendly society was established in St. George’s in 1868, and by 1932 there were 54 of these organisations. The friendly society model had developed in England and Scotland during the Industrial Revolution towards the end of the 19th century and much like the Caribbean sou sou, it was originally based in small village communities. The Reverend Henry Duncan, a Scottish minister credited with opening the very first British savings bank in 1810, actually launched

the Ruthwell Savings Bank in the rooms of the local friendly society he had revitalised.

Finally in the way of alternatives there was the Grenada Building and Loan Association, founded in 1925 by Messrs. Arnold Williamson and Willan Edward Julien, two GCBL founding fathers, in an attempt to improve housing stock for the lower classes. Maybe this is the second institution that former Prime Minister of Grenada George Brizan regarded as one of ‘two peasant banks’ when he wrote briefly about GCBL in his book Grenada – Island of Conflict. While the Building and Loan Association was not strictly a bank, it did provide limited financial services, and George Brizan is correct in linking the two as pioneers of indigenous banking for those excluded from the formal sector.

There are some obvious similarities in the ethos underlying friendly societies, savings and penny banks, and the co-operative movement which included the credit unions. The community spirit of poverty reduction, self-help and improvement through thrift and temperance, also inspired the founders of Grenada Co-operative Bank Limited. However, while in Britain the co-operative movement was started by workers (the Rochdale Pioneers of Lancashire, North England, who in 1844 set up a co-operative to buy affordable quality food and provisions, donating the surplus to the community), the earlier friendly societies and savings banks were all founded by middle-class philanthropists,

many, like Henry Duncan, with strong religious convictions. It’s no coincidence that the first Sunday schools and temperance societies were also founded in this period.

The emphasis on self-help through thrift, rather than dependence on state poor relief, and resulting community pride in improvement, reflects Victorian morality, aspirations to respectability and pride in achievement. These virtues were championed by Scottish writer Samuel Smiles, who in 1859 published his best-seller Self-Help, in which besides observing “Heaven helps those who help themselves” he also noted “A penny is a very small matter, yet the comfort of thousands depends upon the proper spending and saving of pennies.”

Although the temperance aspect may have fallen on some deaf ears in Grenada, as a Crown Colony, British values, social as well as moral, permeated the emerging Grenadian middle class, many of whose professionals had studied in England. When we meet GCBL’s founders, this element of philanthropy, undoubtedly influenced by British precedent, becomes apparent.

Robert Owen (1771–1858), a Welsh-born self-made textile manufacturer, is regarded as ‘The Father of the Co-operative Movement’. His cotton mill workers in New Lanark, Scotland, benefitted from good working conditions, adequate housing and education for themselves and their children. Opposed to religion, as a social reformer committed to eradicating poverty, he contended that people were shaped by their circumstances, hence his emphasis on education. He also attempted to reverse the subordination of workers to machinery, a de-humanising feature of Britain’s Industrial Revolution especially harsh on child labour. Having established selfcontained co-operative communities based on the model of the New Lanark village in Indiana, USA, and in Britain, Owen became the voice of the emerging Labour and Trade Union movement, leading a campaign for the formation of the Grand National Consolidated Trades Union in 1834. Opposition from employers, the government and the courts swiftly ended the movement, but his community ideas laid the basis for the consumer’s co-operative movement, which spread worldwide. Dr. William King (1781–1865), an English physician, was also instrumental in developing the early co-operative movement. His focus was more practical than Owen’s, his monthly periodical The Co-operator giving the advice “to form a society within society” starting with a shop since “We must go to a shop everyday to purchase food and necessities...so why then should we not go to our own shop?”

What began with the Rochdale Pioneers shop of 1844—the first official co-operative society—quickly spread, driven by the principles of solving common problems by combined action, worker empowerment through shared business ownership and democratic control.

The first co-operative banks were established in Germany by Franz Schulze-Delitzsch (1852) and Friedrich Raiffeisen (1864). Like the early British penny and savings banks, their origins were the friendly societies. Significantly, the International Co-operative Alliance founded in 1895 aimed specifically at ending the conflict between capital and labour by promoting co-partnership between employers and workers.

The co-operative movement soon became associated with progress, offering educational opportunities and supporting local projects. Its members were viewed as ‘people of action’, much like the ‘movers and shakers’ who founded Grenada Co-operative Bank Limited.

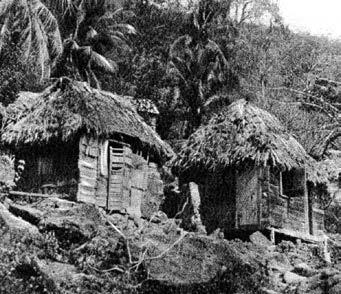

Grenada’s agricultural produce gave rise to a number of specialised co-operatives.

(Picture: Stark’s Guide)

Date: June 29, 1932

Location: Office of Renwick & Payne solicitors, 9 Church Street, St. George’s.

Lightning splits the dark morning sky over town, as lashing rain beats the rooftops in frenetic Big Drum rhythms. An ear-splitting thunder follows, as a torrent swirls down Church Street, hurtling into Halifax Street to swell the flood in Market Square.

The bulky forms of W.E. Julien and Simeon ‘Bigs’ Francis, huddled together under a large umbrella, loom round the corner from Young Street, splashing towards refuge in the office of solicitors Renwick & Payne, where they have an appointment with Mr. Renwick, one of the partners of the firm. Tumbling over the threshold and shaking themselves off like a pair of bedraggled bears, they peer into the dimly lit interior.

“Look what the storm toss up,” comes the mocking tone of Charles ‘Jab Neg’ Renwick from the depths of a worn leather armchair, his well-cut features now defined in the weak glow of a table lamp.

“Welcome to a scene from Caravaggio, or more likely ‘Rumbrandt’,” adds Teddy Marryshow’s rich disembodied baritone from somewhere in the gloom.

Through the dense fug of cohiba cigar, fruity pipe tobacco and Temple cigarette smoke, Francis barely makes out Jab’s tooth-framed grin, Marryshow’s felt fedora nodding in approval, Arnold Williamson toying with an automobile part and Sam Brathwaite methodically filling his pipe bowl like a meticulous elf.

“Gentlemen! Once again you’re called to the bar!” Renwick declaims theatrically, emerging from his seat to produce a crystal decanter of rum from the shadows of a mahogany sideboard. Sam passes around shot glasses, which are liberally filled and raised amid purple blue plumes of smoke.

“One for the weather and a next for the Bank,” proposes Simeon Francis, ‘the wealthiest man’ in Grenada, firing his

shot in a one and easing his corpulent frame into Renwick’s vacated armchair. “But Neg, before bank business, it have we business. The small matter of St. Leonards, which you done lost to me in our last game of cards. Not so?”

“Lost? How lost, Bigs? You must scrutinise the terms of the bet, which, as I recall, only applied to the property itself and not the land it stands on. So if you can levitate St. Leonards from its spot in St. Paul’s and set it down, where shall we say— on top of Everybody’s Store or even Grand Anse beach, fix to suit. M’lud—I rest my case.”

“Why you the devil self!” roars Francis good humouredly, slapping a shovel-sized hand on his knee.

W.E. Julien mops his rain-streaked face with a paisley neck scarf, drops into a Morris chair and scans the gathering now coming into focus.

“But where everybody? Where Hosten? Where Grant? Otway and your brother, Renwick? And where Noble Smith hmm? How this go work?”

“Well them stuck in the mud in country, or they horse refuse to budge in lightning, or if they town men they can’t swim or don’t want to get they trousers wet. Don’t worry with them, who reach, reach. We could proceed and Sam, Sam you’ll take some notes, yes? For the lost goats.” Marryshow, on a roll, is in no mood to let a thunderstorm, hell or high water dampen proceedings. “The Articles of Association for the formation of Grenada Co-operative Bank Limited are being drawn up in Trinidad as we speak, but just so there’s no question of fait accompli, I throw the floor open for comment and discussion. How say you, Julien?”

W.E. rises to his impressive full height, thumbs contemplatively wedged in waistband, his patrician head, wreathed in smoke, almost scraping the ceiling. An accomplished cricketer, like a batsman at the crease he surveys the field.

“Listen! Everything is possible given belief, determination and the people’s trust. When Barclays refused me a loan to start my business, it was the small retailers of St. George’s who advanced me the cash I needed. If you believe in your people and you trust them and they trust you, you can achieve unimaginable things, unimaginable things. The colonial authorities don’t think we’re capable of meeting financial obligations, repaying loans, that we’re lazy and irresponsible. But listen! You know we’re all Grenadians, we cannot let these people keep suppressing us all the time. We have got to show them we are as good, or better than them in banking. We have to show them that and furthermore, if we help each other everybody will do well: the small farmer will do well; the small shopkeeper will do well; people who need homes will get their money to buy their homes. Let’s do it I say!”

A murmur of assent ripples through the room. Arnold Williamson wraps his car part in a rag, puts it to one side, remarking in his slow basso profundo, “We’ve already started our journey; we’re on the road to the future, the future of Grenada. And we must ensure we’re in the driver’s seat, our hands must be on the steering wheel and it may well be we have to lay the road ourselves. We’ve already made inroads in representation—several of us are elected members of the Legislative Council, Renwick here sits on the Executive Council. Old Bulldog—yes you, Marryshow—is famous regionally and in London as the leading campaigner for West Indian Federation. Together, we form a powerful group of planters, estate owners, businessmen, financiers, merchants, politicians and professionals. We’ve proved ourselves willing and capable of addressing our people’s needs, that’s why Julien, myself and others set up the Building and Loan Association back in ‘25: to provide loans for the lower classes to put roofs over their heads. With a co-operative bank, we can do far more, provide opportunities for both the lower classes and ourselves to grow, improve and develop our Grenada. But

it will need all shoulders to the wheel and I can provide the necessary wheels from my garage right round the corner. What you say, Sam?”

Sam, neat as a pin, straightens his bow tie, his philanthropic nature softening the punctiliousness of a former accountant.

“Obviously the foreign banks have no interest either in investing here or making their services available to ordinary Grenadians, or even extraordinary Grenadians like Teddy here, who they’re always blanking. Likewise, the Government Savings Bank seems to have deliberately put itself beyond the reach of the lower classes. So it’s up to us to make our own future, we can’t wait on London for that.” Sam pauses, sucking on his pipe stem, measuring his audience. “Williamson’s right, we’re already on the road; we tackled the housing problem with the Building and Loan Association. When I saw people walking to town from St. Paul’s, it wasn’t difficult to start the Penny Bus Company just two years back; it’s a success because it meets the need for cheap transport. Now the lower classes need access to financial services, which will improve the lives of themselves and their children and open a way for them to be part of our growth. We’re agents of our own destiny, so let’s have the Bank. I have some accounting experience, I could handle the books to begin with; so let’s sign the articles when they reach and find an office.”

Arnold Williamson nods benignly: “I believe I can assist with that too.”

Solid if soggy leather shoes stamp the pine floorboards in unanimous approval. Marryshow doffs his fedora and gives a low bow. Mr. Bigs replenishes the empty shot glasses, which are raised “To Co-op Bank!” Jab Neg Renwick offers round a box of cohibas; carefully clipping the end of one and lighting it with total satisfaction, he blows a pungent smoke circle overhead, raps his knuckles on the cigar box, declaring “Motion carried! Case closed!”

Abrief announcement in The West Indian newspaper of July 27, 1932 heralded the coming to come of Grenada’s first indigenous bank:

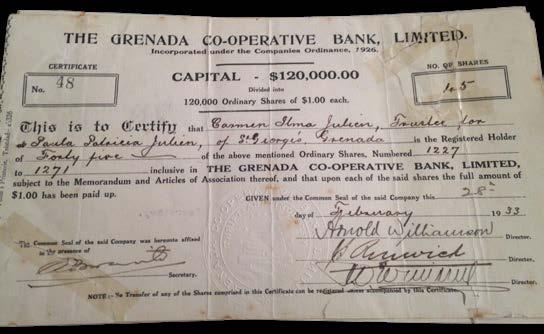

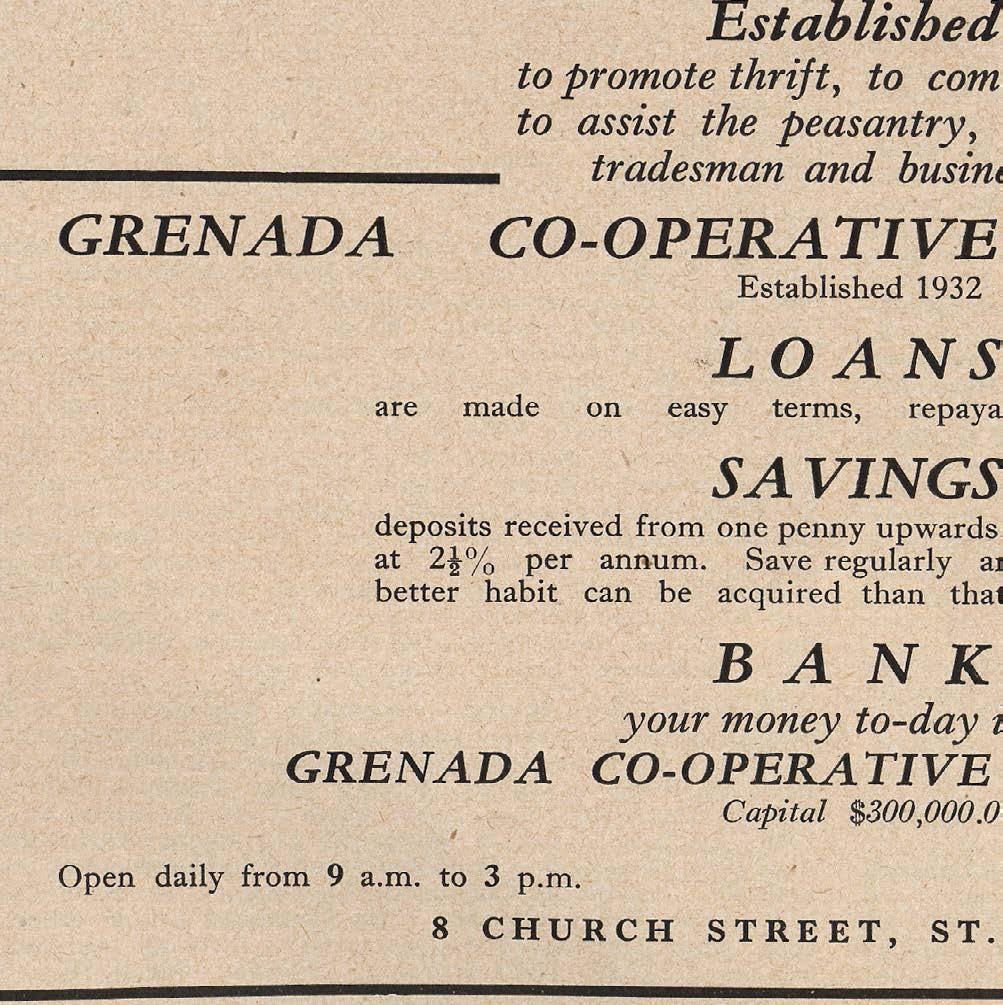

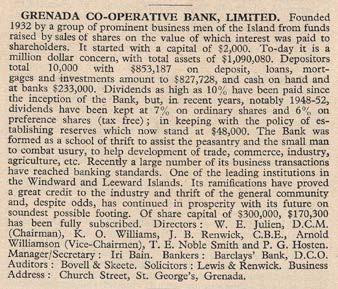

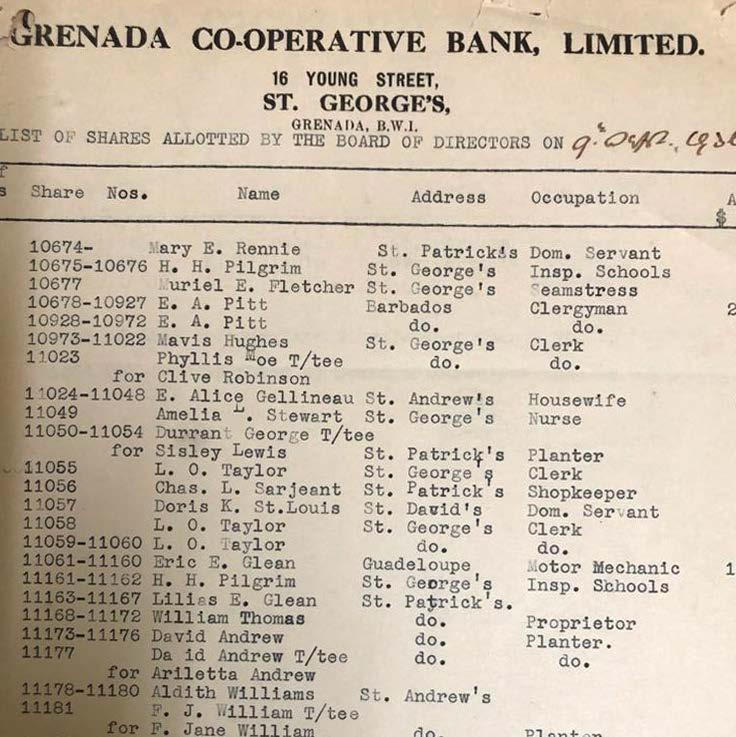

“Grenada Co-operative Bank Limited was duly registered here yesterday. The bank has a nominal capital of £25,000 divided into 120,000 shares of $1 each. It is expected that business will commence within the next two months, an appreciable number of shares having already being subscribed for.”

This tantalising snippet of news, in all likelihood written by The West Indian’s founder/managing editor, the great Theophilus Albert Marryshow, begs several crucial questions: who were the founders? And what was their motivation for starting a bank at a time when both the local and world economies were in the grip of the Great Depression? The answers to this prequel give us insights into the pan-Caribbean movements and ideas that shaped British Caribbean territories from the late 19th century up to independence, and particularly into Grenadian fortitude and determination.

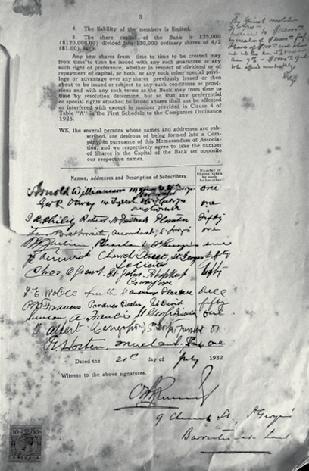

Starting a bank in Grenada in 1932 required complying with the following Companies Ordinance of 1926 stipulation:

“No company...of more than 10 shall be formed for the purpose of carrying on the business of banking, unless it is registered as a company under this ordinance.”

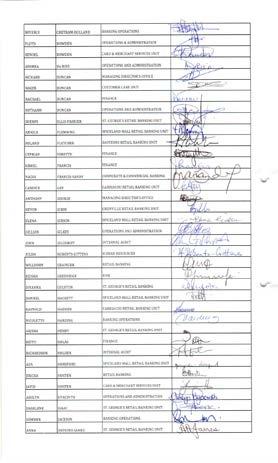

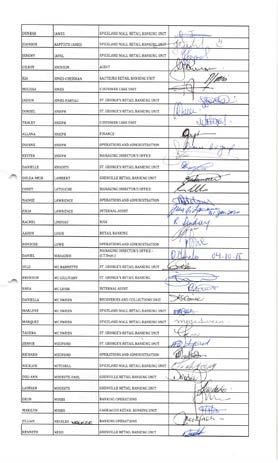

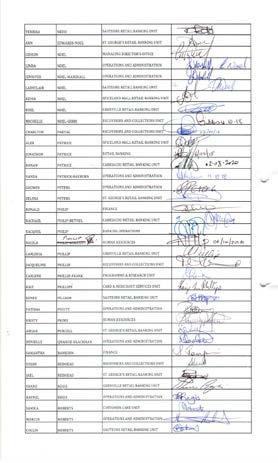

In order to register, a Memorandum of Association, along with a list of specific Articles of Association, had to be submitted. A look at the list of the names appearing in three early sources (the June 29, 1932 meeting to discuss establishing a bank, the July 26, 1932 Memorandum of Association, and the document outlining the Board of Directors) tells us who the official founders were. At the first discussion meeting we see ten signatures:

• Charles Felix Percival Renwick of St. George’s (prominent barrister, Executive Council member, who would act as the Bank’s first legal representative)

• George W.R. Otway of St. George’s (auctioneer, politician and labour activist)

• John Byron Renwick of St. George’s (solicitor and younger brother of C.F.P.)

• Joshua R. Phillip of St. Patrick (planter)

• P.M. Francis of St. David (produce dealer)

• Thomas Egbert Noble Smith of St. Andrew (planter, merchant, politician)

• Willan Edward Julien of St. George’s (merchant, Legislative Council member);

• Simeon Augustine Francis of St. George’s (financier)

• Pilton George Hosten of St. Patrick (planter, merchant) and

• Samuel Brathwaite of St. George’s (accountant). Between them, these ten signatories pledged 850 shares towards the necessary nominal capital required for start-up.

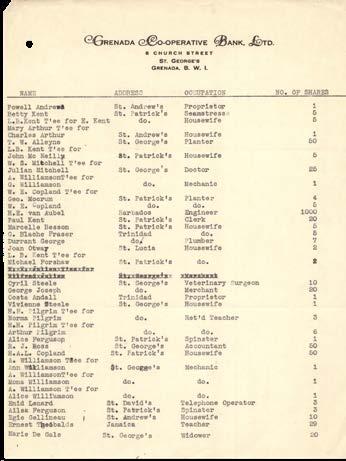

1932 Memorandum of Association

1932 Certificate of Registration

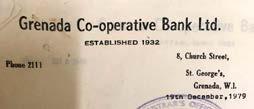

The 1932 notice in The West Indian.

On the Memorandum of Association, C.F.P. Renwick signs as legal representative and witness. In addition to the original June 29 signatories, there are three new names: Arnold Williamson of St. George’s (politician, labour activist, garage proprietor and automobile salesman), Charles Grant of Gouyave (shopkeeper and labour activist), and last but not least the indefatigable T.A. Marryshow of St. George’s, who had links with the Trinidad Co-operative Bank, established in 1914, which gave invaluable practical assistance in setting up GCBL—paying it forward, so to speak, since the Grenadian bank was later able to assist its counterpart in St. Lucia to get their organisation off the ground.

The Board of Directors document tells a slightly different story. There is no Charles Grant, likewise no G.W.R. Otway. T.A. Marryshow is also missing, but given his extensive public and private interests—journalist and editor, Legislative Council member, politician, labour activist, founder of the Literary & Debating Society, singer and sweetman—this is hardly surprising. The quota of ten is made up with the addition of businessman Ronald Oswald Williams of St. George’s.

The three documents make it clear that the founders were men of substance from different walks of life— planters/agriculturists, professionals, merchants and businessmen. As driven, astute, ambitious men they

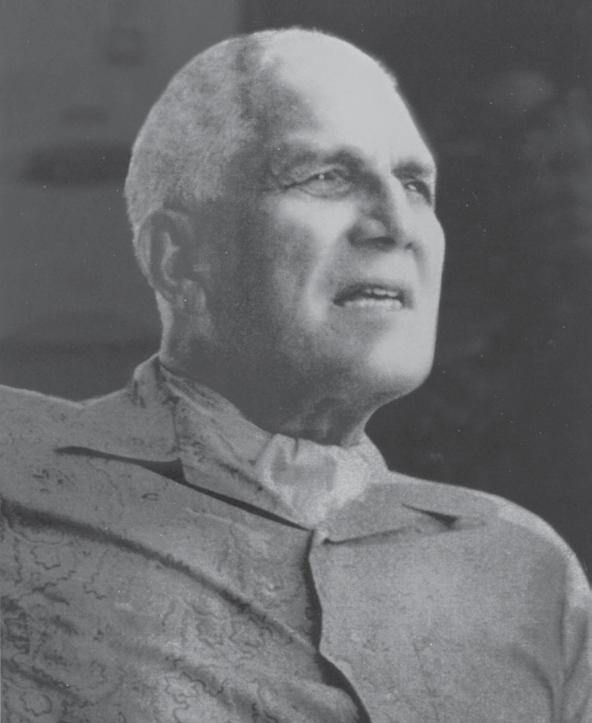

“Once you believe in your people, unimaginable things are possible.”

Willan Edward Julien, D.C.M., Founder

realised that their network, with its multiple urban and rural roots, was more than capable of mobilising an indigenous alternative to the colonial financial system. Their objectives were not only financial, but can be viewed as part of the co-operative mindset developing throughout the British Caribbean at the time.

The initiative for representative self-government and active participation in local administration began in the second half of the 19th century, and by the 20th century it embraced the idea of West Indian unification. Self-government was a pan-Caribbean preoccupation, as was for example highlighted in Trinidadian C.L.R. James’ The Case for West Indian Self-Government (1932), an essay published along with James’ biography of Captain Arthur Cipriani, the Trinidadian ‘friend of the barefoot man’, who served in the same British West Indies regiment as GCBL founders W.E. Julien and J.B. Renwick.

As early as 1915, in the first edition of The West Indian (a title deliberately invoking regional identity), the newspaper founded by the ‘Father of Federation’ T.A. Marryshow and financed by C.F.P. Renwick, the editorial hoped for the day when “the West Indies Dominion will take its place...in the glorious Empire”. Marryshow renounced this brand of ‘Mother Country’ patriotism and turned against Britain in 1931 when it granted Dominion status along with autonomous parliaments to Canada, Australia, New Zealand and South Africa, but refused the same for the British West Indies, even after Caribbean contributions to the First World War effort.

The co-operative bank movement was another pan-Caribbean initiative, aimed at alleviating poverty by encouraging thrift among both urban and rural families. Jamaica led the way in 1905 with two loan

societies, which evolved into the People’s Co-operative Bank, followed by the Trinidad Co-operative Bank founded in 1914.

The motivation for the Trinidad bank was very similar to the situation in Grenada. Many black and coloured businessmen could not source capital for starting or sustaining businesses and were squeezed out of the market by larger concerns or bankrupted by voracious moneylenders. The journalist E.M. Petioni, writing in the Trinidad Mirror newspaper (as quoted by Prof. Selwyn Ryan in his article “Black Entrepreneurship in Trinidad: From Trinidad Cooperative Bank to First Citizens Bank”), convinced a group of black professionals to form a bank in the hope

“that blacks and coloured folk, whether they were small agriculturists, shop keepers, or artisans would escape the clutches of the money lender and in time become independent and in a position to acquire property.”

As a journalist, advocate of Federation and leading figure of the West Indian intelligentsia, T.A. Marryshow had connections in Trinidad, and he was instrumental in seeking guidance and assistance from the Trinidad bank in establishing Grenada Cooperative Bank Limited. The Trinidad bank’s second president, Dr. A.H. McShine, ‘the poor man’s friend’, was an ophthalmic surgeon, philanthropist and a leading voice in pan-Caribbean co-operative banking, actively encouraging other islands to set up their own

banks. The Memorandum and Articles of Association for Grenada Co-operative Bank Limited were drawn up and printed in Trinidad, where Sam Brathwaite, its first Secretary/Manager, travelled in April 1933. While there, Brathwaite also arranged for Trinidadian accountants Hunter, Smith & Earle to be the Bank’s auditors, with Lucas Kerr acting for them as local agent.

The experience of black and coloured businessmen in Trinidad was replicated in Grenada, most notably in the case of W.E. Julien who, when refused a loan by Barclays, used his Grenadian networking skills to launch his highly successful business in 1923. There were some offensive insinuations that Marryshow had personal reasons for backing GCBL; unlike the other founders he had neither flair for, nor interest in, money-making. His loan applications were repeatedly turned down by both Barclays and Royal Bank of Canada. He forgot to pay his taxes and at the time the Bank was founded, the Colonial Secretary Sir Hilary Blood spitefully remarked that he “was always on the verge of bankruptcy” and that “all his moveable property is mortgaged to the hilt”. Marryshow may have been somewhat inept when it came to his personal finances, but he was never selfseeking. When delegated by the Legislative Council to go to London to lobby for increased representation in 1932, he refused local funding for his travel expenses and organised a lecture tour in the United States to pay his way. It was the idea of GCBL and what it could achieve that he was interested in, not the money, as after founding, he played no further active role.

It’s most likely that the founders were motivated by a combination of regional ideas and local circumstances, amongst them the colonial authorities’ grip on local taxes (Marryshow had led a march of 10,000 in 1931

protesting against the Customs Amendment Order, which would have caused more hardship with raised food prices) and foreign-owned banks’ exclusivity. We get a broader picture of the founders’ motivations by looking at various accounts of the founding, the personalities involved and the trajectory of the times.

A good indication of the founders’ mindset is concisely presented in one of the Articles of Association: “To carry on business (of banking) as capitalists and financiers”, which casts Grenada Co-operative Bank Limited in a different mould to most early co-operative banks, small community ventures that provided loans for agricultural or industrial equipment or, as in Trinidad, for land settlement.

Several founders, especially W.E. Julien and Simeon Francis, were already extremely successful businessmen, movers and shakers who owed their fortunes to daring, determination and seizing previously unseen opportunities. They were what we now call ‘critical thinkers’, but thinkers who took action. They were also gamblers who enjoyed high stakes, including their own property and lands, so the Bank looked like a good risk—an opportunity for many wins: benefitting the lower classes not just with loans but once they were shareholders, with profit sharing on investments made by ‘capitalists and financiers’.

They cleverly leveraged the exclusivity of the foreignowned banks and the Government Savings Bank to their advantage by financially enfranchising every Grenadian, bringing a whole new, previously ignored sector into the local economy and redefining the local proverb: ‘One one cocoa full basket’—if during the

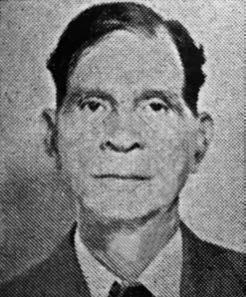

Thomas Egbert Noble Smith

Thomas Egbert Noble Smith

cocoa harvest you patiently add cocoa pod after cocoa pod to your pannier, you will end up with a full basket!

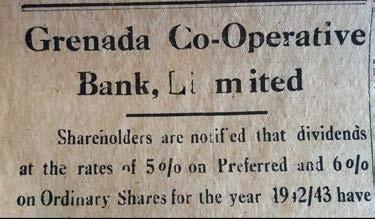

The foreign banks offered 2% interest on savings accounts (to those who could afford the £1 deposit) while the Government Savings Bank, hoping to attract more than its existing 3,700 depositors, offered 3.5%. Some local charities and friendly societies invested funds in the Government Savings Bank, which in turn were invested in British and other markets—another loss to the local economy. Besides, the Government Savings Bank was strictly for saving, it did not give loans. GCBL was able to capitalise, first by appealing to large numbers of depositors everyone else had ignored, and then by investing in the Government Savings Bank at an attractive interest rate! GCBL was just as business savvy when it came to choosing its own

banker, Barclays, which did three times more business than RBC and had far more banknotes in circulation.

While the founding of GCBL cannot be attributed solely to any one individual—as we’ve seen it was a collective effort riding on the trajectory of the times— Brathwaite must be credited for initiating the idea, turning discussion into reality, and for acting as the Bank’s first Secretary/Manager from inception until 1947.

Sam Brathwaite was inspired by a family tradition of service to the less fortunate. Both Brathwaite’s track record and his DNA speak for themselves. His family’s philanthropic tradition reveals much about the man, as Darryl Brathwaite, his great nephew and current Chairman of the Bank’s Board, explains:

“Margaret Brathwaite, the mulatto daughter of Miles Brathwaite, owner of Three Trees

Plantation, St. Phillips, Barbados, was given her manumission papers by her father and a small farm with which to support herself. She married Addo, a freed slave from Ghana and widower, who also had a small farm he inherited from his first mulatto wife. On July 2, 1821, Margaret wrote a letter to their children, instructing them to assemble annually on that date to hold a thanksgiving function for the good fortune the family had enjoyed (i.e. to be freed before Abolition, literate, financially independent and good Christians). This practice is continued to today, and instilled a sense of gratitude, philosophy and philanthropy in all the ensuing descendants. Typically, most

Brathwaites enter community service. The men would be bookkeepers, clerks and ministers and the women teachers. Sam’s parents migrated from Barbados to Grenada in the 1860s, when people were being offered attractive land deals in Grenada to lure them away from Barbados which was becoming overpopulated.”

Darryl Brathwaite’s contemporary take on the family legacy tells us a lot about the tradition of philanthropy that inspired his great-uncle Sam, and about intergenerational development—which are both prominent features of GCBL’s story:

“Margaret was very lucky, getting her freedom before Emancipation, along with some property. So we follow her philosophy—if you’re fortunate, you must help the community. You have taken a big jump and so you pull the others along. Her initial gift was enough to carry us for 200 years. We have all inherited land. You know that you’re going to inherit a piece of land. You are part of this huge family which makes sure that everybody is okay; you feel very, very secure, and you know that what you have to do with your time now is make sure you could help others in the community.”

When Sam Brathwaite retired from his position as an accountant in the public service in 1930, he started the Penny Bus Company the same year. Married to a St. Lucian, Maude Osbourne, after successfully launching and running Grenada Co-operative Bank Limited for five years, he spent some time in St. Lucia in 1937 to help his father-in-law, real estate developer J.D.B. Osbourne, establish the St. Lucia Co-operative Bank. So we can see a pattern here. Like T.A. Marryshow, Sam

Brathwaite was committed to improving conditions for the poor and didn’t look to profit from the Bank. He was never a major shareholder; service apparently was his reward. Lacking the capital to start up the Bank, it was natural for him to approach those who did, like W.E. Julien and Simeon Francis, and to mobilise the philanthropic inclinations of C.F.P. Renwick and his enormous social influence to persuade powerful members of the community, like P.G. Hosten and T.E. Noble Smith, to join the Bank venture.

Darryl Brathwaite gives us more insights on Sam’s achievement and his self-effacement:

“That culture is how Sam Brathwaite ended up starting the Penny Bus. He said the poor people from St. Paul’s can’t be walking to town. Same thing with the Bank, and that’s also how he started Co-operative Bank in St. Lucia. Unfortunately for him, he paid a high price because imagine, the other guys with him were struggling with their own businesses. Williamson was starting up his garage, W.E. Julien, all these guys were building at that point in the 1930s. Sam didn’t have enough money to start a bank, so he told the others ‘If we all put some cash together, we’ll have the capital to at least start. Don’t worry, I’ll run it—all the years I spent in the Ministry of Finance, I have the experience.’ He was on his own, they couldn’t really help him with financial decisions. He got his relatives, nieces, cousins to come and work as cashiers and clerks. What he should have done, if he was really thinking business, was to become the major shareholder. But he wasn’t concerned, he just wanted to see this thing get off the ground. And people who had no money were

coming and putting whatever they had in the Bank and giving shares to their children, because they thought this was the way out. So the loyalty that Grenadians have to the Bank is incredible, you can’t buy that kind of brand loyalty.

“What happened to poor Sam is they couldn’t find a manager to come and work—it was a lot of work for little monetary reward. He worked nearly until he died. He retired early from the public service, because he wasn’t feeling strong, but then he got into this project and he got stuck in it! They tried to find other managers but they couldn’t; some guys would come and start and say ‘Boy, this is too much’ after a year and leave. So Sam had to stay on and the Directors on the

Board really couldn’t help him manage, they had other skills, that wasn’t their forte.

“There are no photos of him in the Bank, no documentary evidence that Sam was the man in the Bank—the problem is the Brathwaites are too self-effacing, we’re happy to stay in the background and get the work done.”

Willan Edward Julien must have been an inspirational force in making the Bank a reality, and the fact that he chaired the Board from inception right through to 1969 shows it remained close to his heart, despite his many other interests and obligations. Julien was a living example of the fortitude and determination we have come to associate with GCBL.