6 minute read

Market Outlook

Spring Market Outlook:

Tracking Trends

By Matthew Naeyaert, GreenStone Capital Markets Senior Credit Analyst, and Nick Jablonski, GreenStone Capital Markets Credit Manager

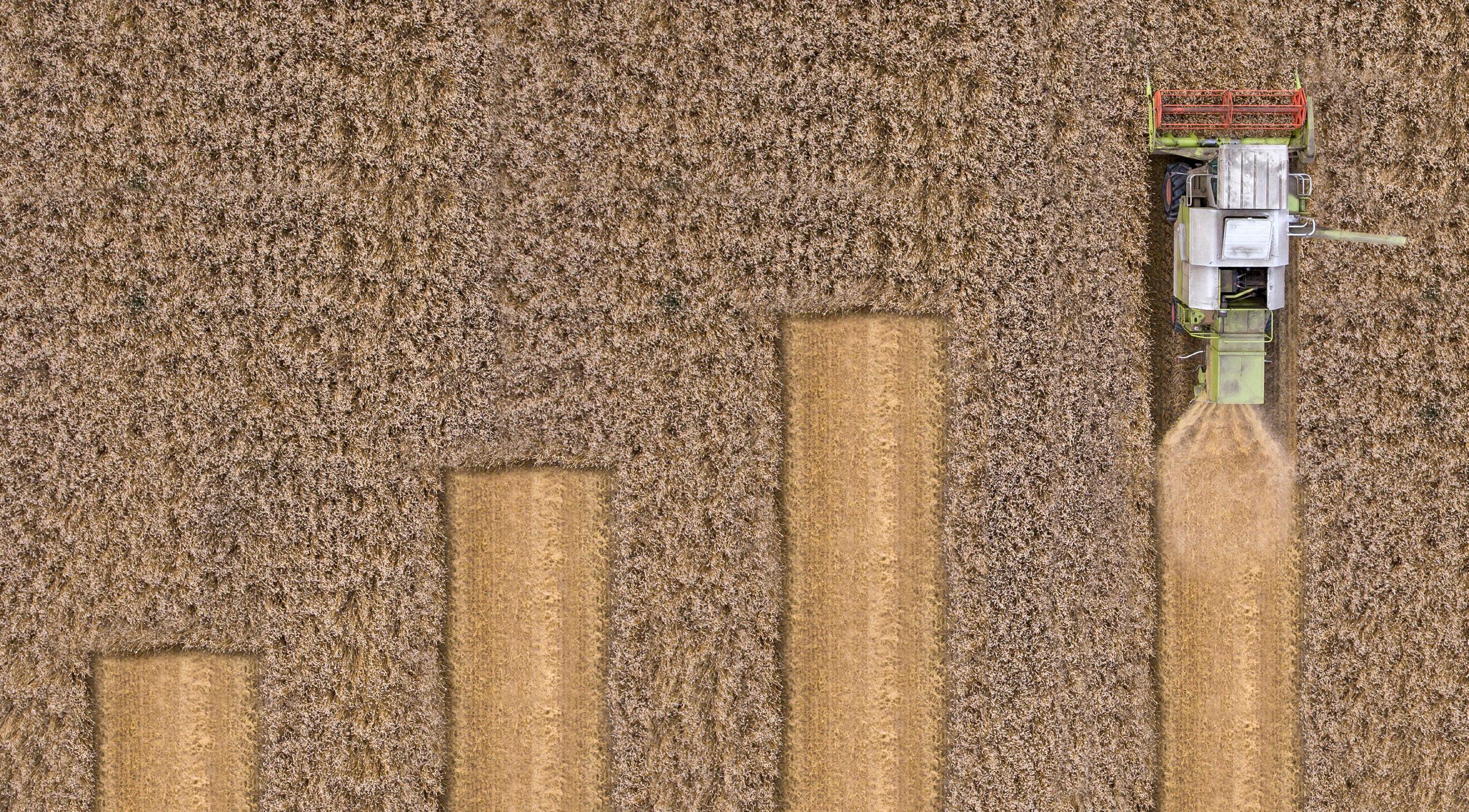

The recent surge in commodity prices deserves top billing from a credit perspective so far this year given its direct impact to the financial performance of many ag producers and processors alike. Grain prices have increased markedly over the last few months due to strong international demand for U.S. corn and soybeans, particularly from China, and an expected small South American crop.

Likewise, strong housing starts and home renovation activity with total ag exports now forecast at a record $157.0 billion, or has driven dimensional lumber futures over $1,000/mbf, up an increase of over $21 billion (15%) from FY 2020. Exports to from $400/mbf in October. Hog, cattle, chicken and dairy China in FY 2021 are forecast at a record $31 billion, reflecting prices have also seen run ups to varying degrees. While this strong shipments of U.S. soybeans, corn, wheat, cotton, and recent commodity price strength has been a much-needed chicken paws in particular. development for producers in several key segments, it has While the recent uptick in export demand is a welcome also meant rapidly rising feed costs for those in the animal development for many in the ag community, prudence dictates protein space. Many of these borrowers face rising feed costs caution. As anyone who has followed the Ag industry for at the same time as weak long knows, commodity

foodservice/restaurant “ markets, and export activity is hurting their demand in particular, can top-line, creating a recipe reverse course quickly for sharp losses. Ensuring when geopolitical factors adequate liquidity has become a primary concern Much of the recent change. For example, a strong U.S. growing for producers with commodity exposure, as commodity price surge season combined with more favorable weather swelling balance sheets can easily result in an can be attributed to in South America and changing internal factors unexpected “cash crunch”. Whether commodity prices increased international within China could make the global grain situation ultimately take another leg up or retreat from temporary highs as supply/ demand factors normalize remains to be seen, but the volatility experienced so far this year is top-of-mind for actors throughout the agricultural economy. Much of the recent commodity price surge can be attributed to increased international demand for demand for U.S. agricultural products. This increased demand has varied from country to country, but increased demand from China in look markedly different next year. While we are not saying that these particular events will unfold, it is important to remember that the size and unpredictability of the Chinese market make it a double edge sword for ag producers. While those operations with a commodity focus are undoubtedly benefiting U.S. agricultural products. This increased demand particular has been the from the recent runup in prices, prudent operators has varied from country to country, but increased key storyline in grain and will take a long-term approach and lock in demand from China in particular has been the livestock markets. favorable margins at opportunistic times. key storyline in grain and The current export livestock markets. Large demand surge aside, U.S. purchases of U.S. grain by Chinese importers became more agricultural products remain well positioned on the global frequent starting in the fourth quarter of 2020, and the trend stage from a long-term perspective. A growing middle class has continued into 2021. Demand for grains within China throughout the developing world will increasingly demand new is strong at the moment for numerous reasons, including and expanded proteins in their diet, which poses a promising accommodative credit policies and the fact that their opportunity for U.S. agriculture in the years to come given domestic hog herd is being rebuilt following the 2018 swine its ability to produce a consistent, high-quality product at an flu outbreak that upended the country’s food supply chain. affordable price. These large grain purchases have only been accelerated by Long-term interest rates have become a major variable from a the expectation of a light South American grain crop due to macroeconomic perspective, as rapidly rising government bond weather concerns. It should also be noted that a generally yields have triggered increased concerns around inflation. While weakening U.S. dollar has been a tailwind for exports as consumer price and interest rate trends are worth monitoring well, making U.S. agricultural products relatively more closely, it is important to note that the global economy has been competitive on the world stage. While exports to China have operating in a low interest rate/low inflation environment for understandably received the headlines, U.S. agricultural sales decades, meaning that while interest rates have begun to rise to Mexico, Japan, Korea and other major trading partners they are starting from near zero and remain at relatively low also remain relatively strong. This strength is reflected in the levels from a historical perspective. Given that fact, a moderate USDA’s revised forecast for U.S. agricultural trade in FY 2021, rise in government bond yields and inflation expectations can

reasonably be viewed as a sign of optimism around long-term growth expectations for the U.S. economy. That being said, a record expansion of the monetary base, rising raw material costs and an accommodative credit environment all make consumer price metrics worth monitoring closely. The labor market continues to recover gradually, with service sector jobs in the entertainment, leisure and hospitality segments continuing to show the most weakness. At this point excess slack in the labor market is the biggest factor leading many economists to downplay the concerns around medium to long term inflation discussed above. Most forecasters are anticipating that the labor market will continue to gradually improve throughout the year as the economy reopens from COVID-related lockdowns. The housing market deserves mention as well, as both new single-family starts and existing home sales remain robust. While the residential housing market is generally stable, homebuilders are increasingly warning that rising raw material costs could begin to limit new build activity, a development which would push more prospective buyers into an existing home marketplace with already low inventory levels. Mortgage rates will be a key factor for the housing market as well, as the recent uptick in interest rates has begun to filter through to the residential mortgage market. While mortgage rates remain extremely low from a historical perspective, if they continue climbing it could put a damper on the demand side of the housing market at some point. While overall business bankruptcies in the U.S. have actually trended lower over the past year (thanks in large part to government support), we continue to see borrowers in various industries that are facing stiff headwinds due to COVID and the related travel restrictions. In particular, those producers/processors with a heavily food service/restaurant-oriented business model have suffered disproportionately as Americans have shifted to eating more of their meals at home. Given steady vaccination progress there is increased optimism in the marketplace that restaurants and other affected businesses will be able to ease capacity restrictions and return to a more normal operating environment by the second half of the year. The continued reopening of restaurants and other customer-facing businesses, combined with easing travel restrictions, could have positive downstream effects throughout the economy and fuel strong economic activity for the remainder of the year. The record amount of stimulus provided to consumers in 2020 could also drive robust consumer spending during the second half of the year, as the relatively high savings rates seen over the last year give way to a return to more normal discretionary spending patterns. ■

SOURCES:

www.cmegroup.com www.inquirer.com www.farmpolicynews.illinois.edu www.farmprogress.com www.usda.gov www.ers.usda.gov www.bls.gov www.latimes.com www.statista.com www.bloomberg.com