Designing the hybrid office

THINK: FLEXIBILITY AND FLUIDITY

COMMERCIAL DIRECTORY 2022-23 PUBLISHED BY February 2023

BOMA Ottawa Commercial Space Directory 2022-23 1 350 SPARKS STREET OTTAWA, ON T 613-237-6373 MICHAEL SWAN MORGUARD INVESTMENTS LIMITED At Morguard, we are committed to matching the right space and right location with your business needs. Backed by over 40 years of real estate experience and an extensive owned and managed portfolio in Ottawa, our team will help you to realize your leasing potential. REALIZE YOUR LEASING POTENTIAL MORGUARD.COM MORGUARD BROKERAGE TSX: MRC TSX: MRT.UN TSX: MRG.UN 215 SLATER STREET LEED Gold Certified Class A Office Building

Properties that make the difference. Richcraft develops and leases commercial retail and industrial space in Canada’s National Capital. From bustling shopping plazas to warehouse or professional office buildings, our portfolio is varied and extensive throughout the region. 613.739.5777 or leasing@richcraft.com

BOMA Ottawa Commercial Space Directory 2022-23 3 Target is an intensity-based reduction of Scope 1 and 2 emissions for the properties that are within our operational control. © 2022 Manulife Investment Management. All rights reserved. Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

in sustainable real estate across our global organization.

to a low-carbon

a greenhouse gas reduction

of 80%

Our vision is to drive leadership

To help lead the transition

economy, we have committed to

target

by 2050.

4 BOMA Ottawa Commercial Space Directory 2022-23 25 36 39 47 54 Contents Contents 6 President’s message 8 BOMA year in review 12 Board of directors, committees and chairs 15 THE HYBRID OFFICE: Flexibility and fluidity are key for designing today’s workplaces 17 FEDERAL GOVERNMENT: What are the criteria around sustainability, accessibility, reconciliation 18 ON THE ROAD TO NET-ZERO: How Ottawa developers are upping their game 24 FACILITIES AND PROPERTY MANAGEMENT: Hiring trends to watch 27 Office real estate listings 49 Industrial real estate listings 54 Retail space listings DOWNTOWN 28 BYWARD 32 CENTRETOWN 33 OTTAWA EAST 34 OTTAWA WEST 37 GLOUCESTER 41 NEPEAN 41 KANATA 44 OUTAOUAIS 48 22 26

BOMA Ottawa Commercial Space Directory 2022-23 5 Scott MacKay scott@facilitiescommercial.com

Vandenbelt

FACILITIES COMMERCIAL INVESTMENTS I PROPERTY MANAGEMENT Facilities Commercial Management offers investment and property management solutions for commercial real estate. We create value for our property owners, investors and partners across Eastern Ontario. Discover more online or call us to talk about your real estate needs. www.facilitiescommercial.com

MacKay scott@facilitiescommercial.com Rick Vandenbelt rick@facilitiescommercial.com FACILITIES COMMERCIAL INVESTMENTS I PROPERTY MANAGEMENT Facilities Commercial Management offers investment and property management solutions for commercial real estate. We create value for our property owners, investors and partners across Eastern Ontario. Discover more online or call us to talk about your real estate needs. www.facilitiescommercial.com 613-723-8944

Rick

rick@facilitiescommercial.com

613-723-8944 Scott

Designing the hybrid office

THINK: FLEXIBILITY AND FLUIDITY

Something Different

Welcome to the 2023 Commercial Space Directory Winter Edition. For many years BOMA produced an annual Commercial Space Directory together with the Ottawa Business Journal and distributed it at the Ottawa Real Estate Forum in October.

The Pandemic changed everything everywhere and that included the Commercial Space Directory, which moved to early in the new year.

It’s time to move back

After considering many factors, it was decided that it was time to move back and publish the annual directory in the fall. We did have commitments to advertisers for a winter edition and so the decision was made to publish two version of the Directory in 2023.

The first, which you are reading now, will be an abbreviated version, with the listings of Office, Industrial and Retail space, but without the property management firms associated with it.

The second, will not be a simple repeat of years past, but rather will be featuring new sections. Back will be the full detailed building listings, but we’ll be adding special sections contributed by government and other associations.

We are already hard at work in developing this new re-born version of the Commercial Directory and find it even more useful than past editions.

6 BOMA Ottawa Commercial Space Directory 2022-23

President’s Message | BOMA 2022-23

COMMERCIAL DIRECTORY 2022-23 PUBLISHED BY February 2023

Glenview Management Limited has long been one of the National Capital Region’s most established and respected owners, developers and managers of commercial and residential real estate.

Since 1966 Glenview has been involved in the construction and management of all facets of real estate in the Ottawa area. From its beginnings, Glenview set new standards for the highest level of quality and professionalism in the development industry.

Our team of professionals brings together years of experience in developing, renovating, leasing, managing and marketing properties of all kind.

Glenview is a family-run company which puts its reputation on the line with every project. We are proud of each and every development we have built over the years. We are even more proud of the trust and appreciation we have earned from the tenants within our portfolio.

Glenview Management Limited

190 O’Connor Street, 11th Floor

Ottawa, Ontario K2P 2R3

613.748.3700

www.glenview.ca

190 O’CONNOR 410 LAURIER 116 LISGAR 170 LAURIER COMMERCIAL • 190 O’Connor Street • 116 Lisgar Street • 410 Laurier Avenue West • 170 Laurier Avenue West • 2733 Lancaster Road • Smyth Medical Centre RESIDENTIAL Imperial Apartments

Back to Normal

That’s the motto for 2023 as determined by the Board of Directors. After three years of no programming or partial programming, the BOMA Board of Directors has set as its goal to offer a full program of activities in 2023. Starting with the BOMA Curling Funspiel and ending with the famous BOMA Holiday Lunch we will be offering 10 different professional development opportunities and 10 different networking opportunities. In addition BOMA committees will continue their work on the industry’s behalf serving as the voice of Commercial Real Estate in helping stakeholders, politicians and all levels of government staff to understand our issues and needs.

Underpinning all that BOMA will be doing in 2023 will be a new Strategic Plan that will run until 2028. The specific projects, programs and goals will be announced as they become reality, but all based on three broad objectives.

ADVOCACY

As the voice of the commercial real estate industry, BOMA Ottawa will be recognized as the industry expert and contribute to strategy and policy development through consultation and information dissemination.

PROFESSIONAL DEVELOPMENT

BOMA Ottawa will be the ‘go to place’ for profesional development and resources for the commercial real estate industry.

MEMBER EXPERIENCE

BOMA Ottawa will deliver a positive and meaningful experiences for members across all lifecycles while supporting the overall needs of the commercial real estate industry.

We hope we meet the expectations of all our members and invite everyone to share you ideas, concerns and issues with us as we refine all of our current programming and develop new initiatives.

Publisher Michael Curran

Editor in Chief

Anne Howland

Advertising

Wendy Baily

Eric Dupuis

Victoria Stewart

Creative Director

Tanya Connolly-Holmes

Graphic Designers

Deborah Ekuma

Celine Paquette

Directory Production

Patti Moran

BOMA Ottawa Staff

Dean Karakasis, Executive Director

Peg Gallison, Senior Manager Events and Member Programs and Listings Coordinator

BOMA Ottawa Office

141 Laurier Avenue West, Suite 1005 Ottawa, Ontario K1P 5J3 Tel: (613) 232-1875

bomaottawa.org

Ottawa Business Journal is a publication of

©2023 Ottawa Business Journal The BOMA Ottawa Commercial Space Directory is published by Ottawa Business Journal on behalf of the Building Owners and Managers Association of Ottawa. This publication contains information considered accurate at the time of printing. However, the publisher and/or BOMA Ottawa are not responsible for any errors or omissions that may occur. Reproduction in any form is prohibited without the written permission of the publisher.

8 BOMA Ottawa Commercial Space Directory 2022-23

YEAR IN REVIEW | BOMA 2022-23

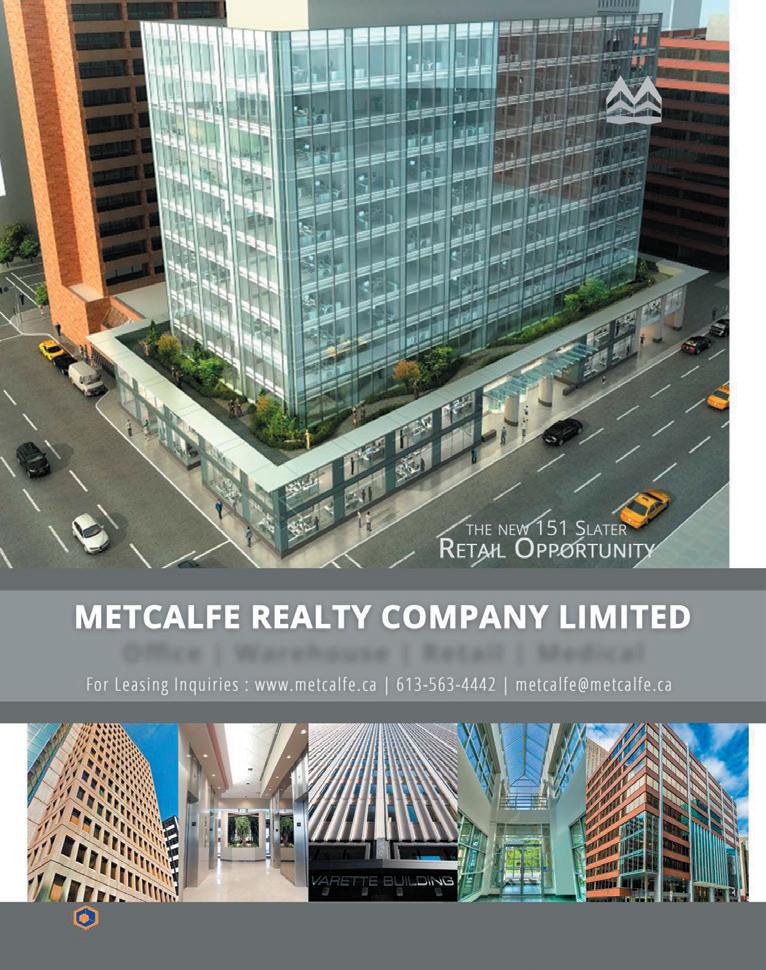

COMMERCIAL DIRECTORY 2022-23 PUBLISHED BY February 2023 THINK: FLEXIBILITY AND FLUIDITY

Designing the hybrid office

Book a meeting room for your team at iqoffices.com It starts with where.™ Find a space for the moments that matter.

10 BOMA Ottawa Commercial Space Directory 2022-23 Our technology partners: Unified communications Managed connectivity Network security goco.ca Business internet everywhere • Business VoIP • SD-WAN • Cloud Call Centre • Direct Routing for Microsoft Teams and much more

Technology

The

Partner for Real Estate

You Us Energy Advisor Plus Part of the Hydro Ottawa Group of Companies. Taking steps toward energy efficiency and sustainability, in a way that’s realistic for your business, doesn’t have to be a struggle. Not with the right partner. Introducing Envari Energy Advisor Plus, a tailored advisory service to help you optimize efficiency, reduce carbon emissions - and hit your targets. You’ve got a business to run. Leave the energy stuff to us. • Trusted experts • Unbiased advice • Building systems assessment • Energy monitoring and reporting • Full management of funding applications • Carbon reduction strategies • Energy savings Ready to get started? Let’s chat: envari.com/plus | 613.321.VARI (8274) Lighting | Mechanical | Electrical

Executive and Board Members | BOMA 2022-23

Executive Committee

Erin Nagy President

Jones Lang LaSalle

Erin.nagy@jll.com

613.566.7062

Directors

Sarah Vandenbelt Vice President

Koble Commercial Real Estate & Brokerage

sarah@koble.ca

613.237.0123 ext. 205

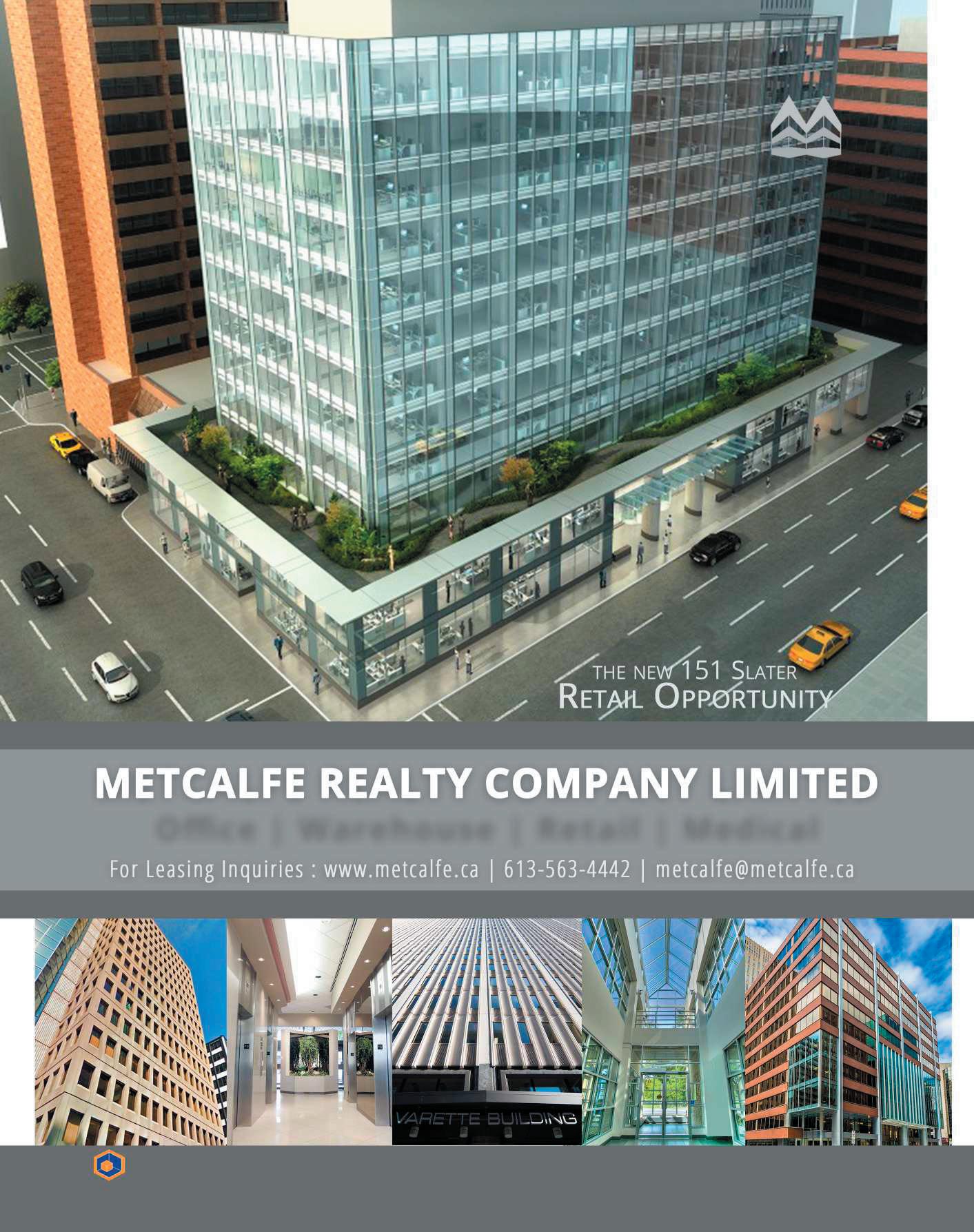

Warren

Metcalfe Realty

jarbuckle@metcalferealty.com

613.230.5174

Colliers International warren.wilkinson@colliers.com 613.683.2207

KATIE BILLINGSLEY

Morguard kbillingsley@morguard.com

613.237.6373

Bart Brennan

Domus Building Cleaning Company

bbrennan@domuscleaning.com

613.741.7722

Director at Large

Paradigm Properties

ahopkins@paradigmproperties.ca

613.728.4111 ext. 221

Shawn Hamilton Past President

Canderel shamilton@canderel.com

613.688.2286

Committees and Chairs | BOMA 2022-23

ALLIED COMMITTEE

Bart Brennan

Domus Building Cleaning Company

613.741.7722

bbrennan@domuscleaning.com

EDUCATION

Jeff Garland, Chair Hays Recruitment Agency

613.288.2064

jeff.garland@hays.com

EMERGING LEADERS COMMITTEE

Sarah Vandenbelt

Koble Commercial Real Estate & Brokerage

613.237.0123 x205 sarah@koble.ca

ENVIRONMENT AND ENERGY

Glenn Mooney, Chair Energy Ottawa

613.225.0418

glennmooney@energyottawa.com

Michael MORIN

District Realty

michaelmorin@districtrealty.com

613.759.8383 x 241

FINANCE

Sarah Vandenbelt, Chair

Koble Commercial Real Estate & Brokerage

613.237.0123 x 205 sarah@koble.ca

GOVERNMENT AFFAIRS

Nancy Meloshe, Chair Stantec

613.726.8028

nancy.meloshe@stantec.com

12 BOMA Ottawa Commercial

Directory 2022-23

Space

Jennifer Arbuckle Treasurer

ASHLEY HOPKINS

Wilkinson Secretary

joseph.pamic@power-tek.on.ca

Paula

QuadReal Property Group paula.partner@quadreal.com

613.690.7391

Jennifer

Skyline Commercial Management Inc.

jpatton@SkylineGRP.ca

613.249.9696

LIFE

Andy Romanowski, Chair

Romanowski Virtual Services Inc.

- Secured Worx

613.286.8228

andrew.j.romanowski@gmail.com

MARKETING

Jeffrey Supino, Chair Allen Maintenance

613.241.7794

jsupino@groupcna.com

SKI

Michael Zanon, Chair

GWL Realty Advisors

613.238.3234

michael.zanon@gwlra.com

TECHNOLOGY

Derrick Hanson, Chair

The Attain Group Inc.

613.739.9424

derrick.hanson@theattaingroup.com

WOMEN@BOMA

Sarah Oakley, Chair Parallel 45 Design Group Ltd.

613.738.7600 x112

sarah@parallel45.ca

BOMA Ottawa Commercial Space Directory 2022-23 13

Patton

Dean Karakasis Executive Director BOMA Ottawa dkarakasis@bomaottawa.org 613.232.1875

SAFETY AND SECURITY

Partner

Joey Pamic Power-Tek Group

613.836.4311 Bob Perkins Perkins Realty perkinsrealty@rogers.com 613.724.7307

ChristiaN J. Witt Baquero Mansteel Limited christianw@mansteelrebar.com 613.732.9791 x 352 Terry thompson Tomlinson Environmental tthompson@tomlinsongroup.com 613.820.2332 x 241

Balance Community Lifestyle

The Right Fit

Safety in our Spaces

Transform the space of your choosing into an ambiance that encourages organizational evolution. Our tailored solutions will speak for you, promoting the internal culture you desire to achieve.

Our enhanced health & safety protocols remain our top priority and commitment to protecting the wellbeing of our tenants, customers, suppliers and individuals accessing our properties.

A community that thrives

Our Services

Beautiful Views

35 years of experience you can trust. Let our team of professionals help you create an environment that checks all the boxes and, most importantly, aligns with your corporate culture. After all, your employees are your most valuable asset!

Gain access to the biggest technological park in Canada, allowing you to connect your business to like-minded organizations and individuals, while discovering resources and opportunities to stay on top of the latest high-tech events, to thrive in this everchanging industry.

A lifestyle your organization needs

Our spaces, amenities and local attractions will provide the balanced lifestyle your employees are craving, while they sustain a healthy life-work balance.

Our Parks, bordered by exceptional green spaces, nature trails, and bike paths, offer the occasion to break away from the office and take work outdoors to one of our many wifi-supported spaces. Take advantage of our soccer fields, ice skating, golf, mini putt, volleyball, or simply take a walk and recharge while enjoying the picturesque sights. All in as little time as it takes you to exit the building.

14 BOMA

Ottawa Commercial Space Directory 2022-23

Linda Sprung, Vice President, Leasing & Marketing [t] 613.591.0594 x3280 [e] lsprung@krpproperties.com [w] krpproperties.com KRP Properties 555 Legget Drive, Suite 300 Ottawa, ON K2K 2X3 Service. Location. Amenities.

Is it worth the commute?

By Brian Dryden

By Brian Dryden

Landlords and property owners looking for a template to design the hybrid office of today will likely be sorely disappointed, experts in the field suggest.

“There is not a one-size-fits-all, there’s no real silver bullet, there’s no overall template,” argues Lisa Fulford-Roy, senior vice-president of client strategy with CBRE.

“Successful and thoughtful hybrid programs are based on what is fundamental to the business in order to achieve its goals,” she continues. “A hybrid office space needs to offer companies flexibility. The traditional office space of the past was often a lot of individual offices for managers, with desks for employees. A hybrid office needs to offer space to experiment with different configurations.”

The COVID pandemic, which required most employees to work from home, only accelerated changes in office design that were already underway, prompted and enabled by technology.

Continued on next page

Tenants are looking for hybrid office spaces that provide ‘moments that matter’

Continued from previous page

“Technology is changing how and when people work. No longer are employees sitting at desks processing paper, but instead are moving around the workplace or offsite as they collaborate with colleagues and clients,” says Michele Fischer, a senior advisor in real estate with Deloitte.

“Most employees do not want to feel tethered to their desks for eight hours per day.”

Fischer agrees that there is no one-size-fitsall template for how to create a hybrid office, which combines remote work with an in-office presence. It all depends on business goals and the expectations of what such an office can do for the company and employees, she says.

“As long as they’re being effective, many employees realize they can work from home and do their jobs and they like the flexibility that that allows,” Fischer notes, adding that employees have to be enticed to return to the office now that the pandemic is not disrupting daily life. “It’s hard putting that genie back in the bottle.”

Her recommendation is that office space use an activity-based work (ABW) model and move away from a traditional office design with dedicated work areas.

“In an ABW environment, employees choose between a variety of different workspaces,” she explains. “Employees do not have a single dedicated workstation and can work in the kind of space that best supports the type of work they are going to be doing on any given day.

“Spaces are designed to create opportunities for a variety of activities, from focused work to impromptu collaboration or more formal meetings,” she adds.

Just as many companies have been examining the pros and cons of a hybrid office, landlords have to think about how to make their properties more attractive to rent in the new reality.

Fischer, who herself works in a hybrid office, says most businesses are considering moving to a hybrid office situation, if they haven’t made the change already. She suggests companies discuss the idea with employees and use a pilot project to determine what works best.

From July 2021 through November 2021, Deloitte conducted an online assessment that garnered responses from more than 8,000 business professionals from hundreds of organizations and asked their preferences for virtual versus in-person work.

Just over 10 per cent of respondents said they want to work almost exclusively virtually,

and just under 10 per cent said almost exclusively in person. At the same time, 22 per cent said they would prefer a bit more in person time, 23 per cent preferred a bit more virtual time, and 35 per cent preferred half and half.

“Planning to make sweeping changes that will affect your organizational culture and performance for years to come could be a risk without a clear understanding if these changes are the right solutions for your organization. Piloting new spaces provides a low-risk and high-reward solution,” Fischer says.

One way to make the physical office attractive to employees, she says, is by emphasizing the social aspect and “celebrating the unplanned by fostering a sense of being together in a post-pandemic office.”

“During the lockdowns, we’ve said goodbye to casual connections or ‘collisions’ where we had impromptu conversations,” Fischer says.

“If we think about the physical space, it really has to deliver on a great experience in order to make it worth the commute, so you’re really competing with the comfort of home that has developed over the past couple of years and then also competing with whether or not it’s worth making the commute in and out of the office,” says Fulford-Roy.

“That doesn’t mean there’s necessarily pool tables everywhere and free food all day everyday, but thinking effectively about what the experience needs to be to connect back to the business priorities, objectives and culture of the organization.”

Fischer stresses the need to create spaces around what she calls “moments that matter” by using the 5Cs (collaboration, community, creativity, coaching and culture). There needs to be space for in-person collaboration and shared workspaces for “teaming,” she adds.

The goal is to provide an “environment rich with opportunities for interaction, connection and socialization,” she notes.

Fischer cautions that remote work reduces opportunities for spontaneous creativity. Equally, she says, engaged employees need strong connections and development opportunities with managers and other team members.

“The 5Cs are meant to represent the common motivations for employees to come to the office – not necessarily to work solo on a spreadsheet or spend the day on calls.

“What spaces do companies need to enable the 5Cs in the physical workplace? In blanket terms, the answer is often more open space, conference space, whiteboard, collaboration and interaction space,” Fischer says.

How the intersection of the physical and digital worlds will impact the workplace

The headquarters location likely will be less dense, with a greater emphasis on shared collaboration space rather than dedicated individual space. Activity-based workplaces will become even more in vogue. Higher-quality build-outs with the finishes, furnishings, technology and amenities that draw employees into the workplace will be more commonplace. Desk-sharing will be integral to satisfy a more mobile workforce that uses the office on a part-time basis, while promoting cost efficiency.

Conference rooms will be designed to create productive environments for in-person and remote workers to engage productively and on a level playing field. There will be techenabled rooms of all sizes with intuitive tools that allow participants to seamlessly connect and collaborate virtually and effectively. Telephone-only conferencing will no longer suffice. Providing meeting participants with the virtual technology to both see and hear each other whether in or out of the office is the way forward.

Mobile apps to connect employees with one another and to navigate the physical environment will become paramount for effective communication and company culture. These include building layouts and access, space booking, food delivery and adjacent amenities. In short, it will be necessary to offer employees the same things they have in the palm of their hands in their personal lives.

Portfolio strategies could become less centralized, providing more locations to satisfy the needs of a more mobile workforce. Creating a network of locations that are easy to access and evoke a feeling of belonging and familiarity for transient guests will be integral to future portfolio strategy. A premium value likely will be placed on flexible space options as a portion of this strategy. Pay-as-you-go “desk pass” systems may be more commonplace in the future. Source: CBRE US

16 BOMA Ottawa Commercial Space Directory 2022-23

Looking to lease to the federal government?

Criteria include standards around sustainability, accessibility, reconciliation

By Brian Dryden

For building managers looking to secure a federal government tenant, there are a host of criteria to consider, not the least of which involve the government’s growing desire to address issues of sustainability, accessibility and Indigenous participation.

The government’s leasing requirements have evolved and become more stringent in recent years to fall in line with government priorities, says Public Services and Procurement Canada (PSPC) senior communications officer Michele Larose.

Starting in 2021, leasing requirements changed to support the Greening Government Strategy, which specifies that all new office leases and lease renewals over 500 square metres must report building energy and water usage, greenhouse gas emissions and waste. By 2030, 75 per cent of domestic office new lease and lease renewal floor space must be in net-zero carbon, climate-resilient buildings.

According to PSPC, building managers wishing to host government offices should first consult the CanadaBuys website, the official site for doing business with the federal government and a single-stop place

to view tender opportunities for leasing space to government clients.

A building cannot be approved as eligible to host government offices before a tender has been posted, explains PSPC, the federal government’s central purchasing agent and property manager. Instead, building managers must wait for a contract to become available.

This applies even when a building has previously hosted government offices. PSPC says it does not maintain a list of buildings that are eligible to house government offices because each office space needed may have different requirements, depending on the contract.

“For each lease space acquisition, specific requirements are determined by the type of occupancy, as well as the operational requirements of the federal tenant that will occupy the space,” said Larose in an email. “Criteria are based on client needs and generally include usage of space area, geographical boundaries, floor loading capacity, start date and lease duration.”

PSPC explains that, when a competitive process for the acquisition of space is undertaken, an expression of interest is published, often in local newspapers and on CanadaBuys, in both official languages. Then, proponents deemed to be compliant are invited to present an irrevocable offer to lease to PSPC.

PSPC uses a grading system to evaluate buildings as

potential hosts for government offices.

The majority of competitive processes use a pass/fail evaluation based on qualitative requirements, PSPC explains. After that, a quantitative evaluation is performed. Complex leasing transactions may include point-rated criteria for the qualitative requirements, followed by a quantitative evaluation.

More recently, PSPC has committed to ensuring the stewardship of federal offices is in accordance with the federal government’s greening, accessibility and reconciliation objectives.

As related to Indigenous participation, the minister responsible for PSPC must work with the minister of Indigenous services and the president of the Treasury Board to create more opportunities for Indigenous businesses to succeed and grow by having at least five per cent of federal contracts be awarded to businesses managed and led by Indigenous peoples.

In addition, PSPC also looks at the building’s accessibility, sustainability and carbon emissions.

PSPC points to the Accessible Design for the Built Environment contained in the Accessible Canada Act.

PSPC also adheres to sustainable building certification requirements, including LEED, BOMA BEST and FITWEL.

LEED (Leadership in Energy and Environmental Design) is an international symbol of sustainability excellence and green building leadership. LEED’s approach helps buildings lower their carbon emissions, conserve resources and reduce operating costs by prioritizing sustainable practices.

BOMA BEST is Canada’s largest environmental assessment and certification program for commercial buildings and recognizes excellence in energy and environmental management.

FITWEL is a green building certification system that focuses on improving, enhancing and safeguarding the health and well-being of tenants in buildings.

PSPC explains that it strives to reduce the carbon footprint of its leased office space to achieve net-zero, climate-resilient leasing operations. According to PSPC, this is done by reviewing building sustainability data, legionella disease management and reporting obligations, and asbestos management.

BOMA Ottawa Commercial Space Directory 2022-23 17

On the road to net-zero: Developers up their game in the name of sustainability

By MIA JENSEN

As Canadian policy-makers across all levels of government search for ways to reduce greenhouse gas emissions, major developers working on projects in Ottawa are taking the lead in the building industry.

According to a recent report from the World Green Building Council, buildings are one of the most overlooked carbon emitters, accounting for nearly 40 per cent of global carbon emissions. Retrofitting existing buildings to improve their energy efficiency is a primary goal of the federal government when it comes to meeting its netzero targets.

While developers and real estate investors are well positioned to play an essential role in fighting climate change, attitudes across the industry have been slow to change, according to Jamie GrayDonald, senior vice-president of sustainability at QuadReal Property Group.

“I think most developers are still pursuing a business-as-usual approach,” he said. “Everyone, including architects (and) mechanical engineers,

are used to doing buildings a certain way. So that’s just the norm.”

As one of several global development companies working on projects in Ottawa with sustainability at the forefront, QuadReal is undertaking a major renovation of the World Exchange Plaza, its downtown office and retail complex at the corner of Metcalfe and O’Connor streets. First built in 1991, the property is one of many that will be modernized not only for functionality and aesthetic, but also for energy efficiency, said Gray-Donald.

The redesign is expected to bring the property up to LEED Platinum standard, the highest certification awarded for sustainability by the Canada Green Building Council.

“What we want to do with our buildings is try and take them to the highest standard,” he said. “This team in particular is very strong at achieving excellent results. In general, we’re strong supporters of green certification, but you can’t stop there. We think net-zero is the next level that needs to be achieved.”

By 2030, 75 per cent of buildings will be

ones that already exist today, rather than new construction. When it comes to updating existing properties to meet emissions targets, Gray-Donald said QuadReal wants to be a leader among real estate investors.

In October, the company announced its plans to decarbonize its entire portfolio by 2050. That includes a 50-per-cent carbon reduction of its Canadian portfolio by 2030 and net-zero emissions for all office buildings globally by 2040.

“We can typically get to be 30 to 40 per cent more energy efficient, but the focus is now shifting to carbon efficiency,” Gray-Donald said. “We look at the lifecycle of major pieces of equipment and buildings and understand when they would typically be replaced. How do we create a roadmap to 2040 to have these buildings be zero-carbon?”

When it comes to buildings, carbon emissions are divided into two primary categories: embodied carbon and operational carbon.

Embodied carbon is attributed to emissions that occur due to the production and transportation of materials, as well as construction, while operational carbon is emissions from everyday use, including heating and electricity.

When it comes to reducing operational carbon, sustainability-focused developers have two main priorities: higher-performing envelopes (building facades that lessen heat transfer in both directions, thereby reducing heating and cooling needs), and tapping into renewable energy sources. This is something that retrofit projects and new developments can achieve.

In Ottawa, a proposed mixed-use sustainable community in LeBreton Flats is building sustainability into its design.

Dream LeBreton is intended to be the first development built into the National Capital Commision’s LeBreton Flats Master Concept Plan. The 2.5-acre Library Parcel site will become home to two residential towers with 601 rental units. Operated in partnership with the MultiFaith Housing Initiative, 41 per cent of those units will be affordable.

The project is pursuing a number of sustainability targets, prioritizing a highperformance building envelope, solar panels and regionally sourced, sustainable materials.

While energy efficiency is a cornerstone of the development, the developers are careful to say that they’re striving for “very close to zero operation carbon” and “low-embodied carbon.”

Local architecture firm Perkins&Will is one of the leading companies for the development. According to global design principal Peter Busby, the specific language stems from the fact that it isn’t really possible to achieve zero carbon right now.

“Generally speaking, electricity across Canada has different carbon footprints,” he said. “So this is an all-electric building, but the carbon footprint

18 BOMA Ottawa Commercial Space Directory 2022-23

does exist. We can’t say zero.”

Achieving net-zero carbon is most difficult in provinces like Alberta and Nova Scotia, which still rely heavily on natural gas and coal to power their electrical grids. But provinces such as Manitoba and Quebec run entirely on hydro electricity, meaning their grid is carbon-free.

Ontario is somewhere in the middle. Approximately 59 per cent of electricity generation in the province is driven by uranium, 24 per cent by hydro, and seven per cent by wind.

“Depending on where you are on the grid, it’s somewhere between eight and 17 per cent fossil-fuel driven, so the carbon footprint does exist,” said Busby.

While the electricity grid is out of their control, the LeBreton project architects hold the reins on everything else.

“There are no fossil fuels being used in this building,” said Busby. “There’s no gas fireplaces, there are no gas appliances, there’s no gas boiler in the buildings; everything is electric.”

They’re also reducing embodied carbon with designs that limit carbonheavy materials like concrete and by bringing in more sustainable options like wood.

“We’ve absolutely minimized the amount of concrete that we’re using,” said Busby. “We will use low carbon concrete and we do use non-concrete finishes wherever we can. We also looked at carpet and glazing and aluminum, for example.”

When Justin Robitaille talks about the LeBreton development, he is most keen to discuss plans to implement an innovative sewer heat recovery system right into the property.

Robitaille is vice-president of development for Dream Unlimited, another of the principal companies overseeing the project.

Dream has set its sustainability ambitions high. Based on current designs, the completed buildings are set to be operationally net-zero carbon, LEED Gold certified, and One Planet Living Accredited. But the cost of reaching these targets can be high.

According to Robitaille, the twobuilding development on the 2.5 acre parcel currently has a price tag of over $300 million.

The sewer heat recovery system will be one of the major investments.

“(The system) involves tapping into the sewer line beneath the site as an energy source to provide all heating, air conditioning and domestic hot water needs for the buildings on a zero-carbon basis,” he said.

TAPPING INTO THE SEWER SYSTEM

These systems have found success in other developments across Canada. In Burnaby, B.C., Canadian-based company SHARC International Systems installed a system in several local buildings, including a 172-unit condominium complex. Depending on the size of the building, the system can cost anywhere from $200,000 to more than $1 million.

The LeBreton property will have the central plant built into the development itself. Utilizing heat recovery chillers and heat pumps connected to the city sewer system, the system will be able to produce enough energy to heat and power most of the building.

To offset the demand on the building’s heating and electrical system, designers are also looking to integrate additional sources of renewable energy, like solar.

The design integrates solar photovoltaic panels into the facade of the building. The positioning of the two buildings, offset from each other and oriented at different angles, is meant not only to maximize the view for both buildings, but also to reduce the amount of shade throughout the day to optimize sunlight-harvesting potential.

“We really tried to optimize the design for solar power generation through placing panels on juliet balconies for instance — which would minimize solar shading — and the orientation of panels to maximize solar availability.”

In the 40 years Busby at Perkins&Will has worked in Canadian architecture, high-cost investments in sustainable technology have been a tough sell. But that’s changing.

“Developers across the country now are really getting it and want to do low carbon,” Busby said. “They see climate change as a threat to their business.”

BOMA Ottawa Commercial Space Directory 2022-23 19

Connect with our team of experts today 613.230.2100 regionalgroup.com EXPERTS IN REAL ESTATE We are a vertically-integrated real estate investment, development & management firm focused on the Ottawa-Gatineau region.

Experts forecast

‘bumpy road’ ahead for Ottawa landlords

By David Sali

Ottawa’s office vacancy rate jumped more than a full percentage point in the fourth quarter of 2022, CBRE says, and many experts predict vacancies will continue to rise in 2023 as employers reassess their need for space in an increasingly hybrid work world.

The capital’s office vacancy rate was 11.1 per cent at the end of December, the national real estate brokerage said in its latest market report.

That’s up from 10 per cent in the previous quarter and more than four percentage points higher than it was in late 2019, before the pandemic triggered a dramatic shift to remote work that hollowed out office towers across North America.

CBRE senior vice-president Louis Karam said Ottawa’s situation mirrors the rest of the country.

Canada’s overall office vacancy rate rose to 17.1 per cent at the end of 2022 after holding steady at 16.4 per cent in the two previous quarters. The only urban areas in which vacancy rates fell in the fourth quarter were Halifax, Waterloo Region and Winnipeg.

“It’s consistent with the rest of Canada,” Karam said of Ottawa’s performance. “It’s not coming as a surprise.”

The fourth quarter saw numerous big chunks of real estate returned to the market, both downtown and in the suburbs.

At 77 Metcalfe St., for example, 130,000 square feet of space became available when NAV Canada’s lease ended last fall, while 57,000 square feet was vacated on Innovation Drive in Kanata and another 40,000 square feet at 560 Rochester St. in Little Italy.

In total, nearly 380,000 square feet of space was put back on the rental block last quarter, including more than 230,000 square feet outside the downtown core. The downtown vacancy rate rose to 12.2 per cent, up from 11.5 per cent in the previous quarter, while the suburban rate increased to 10.2 per cent from 8.8 per cent.

Karam said he expects the city’s vacancy rate to tick up in the months ahead. He cited a number of factors for the continued market turbulence, including the fear that a looming recession will dampen revenue growth and business profits, widespread downsizing amid a massive market correction in the tech sector and “general

uncertainty around hybrid work patterns” that has prompted many employers to press pause on return-to-office plans.

“It’s going to continue to be a bumpy road,” Karam said, adding the federal government’s mandate requiring workers to return to the office two or three days a week that began in January could be the “light at the end of the tunnel” landlords were hoping for to help kickstart leasing activity.

Veteran broker Martin Aass, who represents tenants across the city, said Ottawa will likely continue to be a renter’s market throughout 2023.

“I think it’ll get worse before it gets better for people who own buildings,” said the managing principal at the Ottawa office of multinational real estate firm Cresa.

Aass said more and more landlords are dangling significant inducements in a bid to lure tenants who suddenly find themselves spoiled for choice in what’s traditionally been one of the country’s tightest office markets.

In addition to “goodies” like months of free rent, renovation allowances and more flexible lease terms, some property owners are now offering tenants free parking, he explained, “which is something I’ve never seen in 20 years of real estate.”

Still, Aass said he doesn’t believe the work-fromhome trend will become permanent. Even many hybrid arrangements will gradually fade away, he argued, as more businesses mandate a full-time return to the office.

“I think that the air coming out of the economy is going to make it more likely that employers kind of get what they want,” Aass said.

“I speak to enough senior leaders that say their productivity has been crushed over the last three years. They’re all saying people have got to be together. I just think in time it’ll be back to what it was before COVID. It’s a question of how long it takes.”

Shawn Hamilton, Canderel’s Ottawa-based vice-president of business development, said office tenants are trying to navigate economic headwinds at the same time they’re grappling with the changing nature of work.

“This isn’t unheard of,” Hamilton said. “It’s just a natural reaction to business pulling back a bit in the face of uncertain times.”

20 BOMA Ottawa Commercial Space Directory 2022-23

GENERAL CONTRACTING TENANT FIT UPS COMMERCIAL INTERIORS CONSTRUCTION MANAGEMENT BUILDING MAINTENANCE DESIGN-BUILD PHONE (613) 235-2126 WWW.BMI-IND.COM

Montreal firm floats plan for mixed-use development in Overbrook

A Montreal company plans to build a major mixed-use development in Ottawa’s east end that would include seven highrises with about 1,700 residential units.

Group Oradev recently filed a development application that calls for the industrial building and attached three-storey office complex that currently occupy 400 Coventry Rd. to be torn down and replaced with seven mixed-use towers ranging from 18 to 30 storeys.

The development would also feature a half-acre public park as well as about 1,300 underground and surface parking spots and more than 950 spots for bicycles.

The rectangular-shaped parcel of land spans nearly five acres at the southwest corner of Belfast and Coventry roads, just north of the Queensway about 800 metres west of St. Laurent Shopping Centre and 850 metres from the Tremblay LRT stop at

Ottawa’s train station. It was previously owned by energy giant Enbridge Gas, which currently operates a distribution facility on the site.

In planning documents filed with the city, Group Oradev says the development would be separated into northern and southern blocks by a proposed public road running from east to west.

The northern block would include three highrises of 18, 20 and 25 storeys with a total of 615 residential units ranging from bachelor apartments to three-bedroom units, along with nearly 18,000 square feet of commercial space along Coventry Road. The area would also include a public park and an underground parking garage that connects the buildings.

The southern block would feature four towers – a 23-storey building on the northwest corner, two 27-storey highrises on the eastern end and a 30-storey tower

on the southwest side. All four towers, which would include a total of 1,075 residential units, would also be linked by an underground parking garage.

The application does not specify whether the units would be rentals or condominiums. Group Oradev president Simon Ethier did not immediately return requests for comment from OBJ this week.

The development application prepared by Fotenn said the proposal would “contribute to providing new housing options and price ranges in the OverbrookMcArthur neighbourhood,” adding it “will contribute to achieving residential intensification in an appropriate location at the edge of an existing community, where existing services, such as and including servicing and public transportation, already exist.”

Current zoning allows for maximum building heights of 34 to 90 metres at the site, and the developer is asking for amendments to permit taller highrises. Oradev is also requesting a reduction in required minimum front, rear, corner and interior side lines as well as reduced setback requirements and relief from stepback requirements. — By David

Sali

District Realty is pleased to announce that Ken Halef has accepted the position of vicepresident of operations & finance.

BOMA Ottawa Commercial Space Directory 2022-23 21

District Realty’s new Vice President, Ken Halef

DistrictRealty.com Meet

Morguard acquires stake in Slater Street office complex for $28.1M

By David Sali

Morguard has added another marquee property to its growing commercial portfolio in Ottawa, acquiring a stake in a class-A office tower on Slater Street that is best known as the local headquarters of telecommunications giant Telus.

The Mississauga-based real estate firm said it finalized a deal in late December to purchase a 50 per cent share in 215 Slater St. from TD Asset Management for $28.1 million.

Morguard will also take over property management duties at the nine-storey, 109,000-square foot building at the corner of Bank Street, which was previously managed by Montreal-based Canderel.

The transaction comes on the heels of Morguard’s $64.5-million acquisition last summer of another blue-chip property, softwaremaker Kinaxis’s new 163,000-square-foot head office on Palladium Drive in Kanata.

Morguard now owns or manages more than five million square feet of office, retail and industrial space in the National Capital Region.

Its other notable properties include Performance Court at 150 Elgin St. and the St. Laurent Shopping Centre.

The firm’s Ottawa-based assistant vicepresident of property management and office and industrial leasing, Michael Swan, cited 215 Slater’s prominent downtown location and stable, longterm tenant base as major selling points.

Calling the building a “trophy-calibre asset,” Swan noted that Morguard served as the original property manager at 215 Slater, giving the firm a level of familiarity with the site that helped cement the deal.

“Our building operators know every inch of the building,” he said. “It was something we were comfortable with.”

Telus, which has been the main tenant since the distinctive LEED-gold-certified building opened in 2007, occupies about 80 per cent of the space on a lease which has nearly seven years remaining, with multiple five-year renewal options.

Shipping company DHL and smoothie bar Juice Monkey rent commercial space on the ground floor. The top floor as well as about 2,600 square feet of ground-floor space previously occupied by Second Cup and another retailer are currently vacant.

The transaction comes at a tumultuous time for the commercial real estate industry as it grapples with rising office vacancy rates amid a widespread shift to remote work during the pandemic.

But Swan said class-A buildings remain coveted assets, noting Ottawa’s downtown vacancy rate for office space in that category was still well below 10 per cent at the end of September. He said he expects modern, energy-efficient properties like the Telus HQ will continue to be a magnet for top-flight tenants.

In addition, with few new office construction projects on the horizon, buildings like Palladium Drive and 215 Slater should retain their status as flagship properties well into the future, Swan added.

“We don’t feel there are going to be a lot of new office buildings going up, so we feel that these are good-quality investments that will be trophy assets for a long time,” he explained.

While Ottawa’s commercial real estate market has seen record transaction levels in recent years as investors sought comfort and stability in the capital’s government-based economy, some industry observers suggest rising interest rates and persistent high inflation could dampen the sector’s outlook for 2023.

But Swan said Morguard won’t hesitate to explore more opportunities in the region.

“We believe in the Ottawa market,” he said. “Interest rates and inflation have certainly had an effect on real estate, but we believe the long-term fundamentals are there.”

22 BOMA Ottawa Commercial Space Directory 2022-23

Jennings Real Estate buys Tudor Hall, plans to build multi-residential complex

An Ottawa real estate firm says it’s looking for a new management group to run Tudor Hall after recently acquiring the iconic south-end conference facility and the adjoining land from their original owners.

Jennings Real Estate bought the 1.66acre property just off Riverside Drive near Hunt Club Road from Franco Giammaria and his family, who opened Tudor Hall in the mid-1970s and owned and operated it ever since. Terms of the deal were not disclosed.

Jennings co-owner Ken Jennings said the 20,000-square-foot building tucked beside the Ottawa Hunt and Golf Club on North Bowesville Road will continue to serve as a venue for weddings, banquets, corporate meetings and other gatherings for the foreseeable future.

“It’s an institution,” he added. “It’s somewhere pretty well everyone in Ottawa

has been for a wedding or event or other type of celebration.”

Opened in 1975, Tudor Hall has a capacity of up to 1,000 people. The Giammaria family stopped operating the facility at the end of October and it has remained closed since.

Jennings said his firm is currently talking with several hospitality groups that are interested in leasing and operating the facility. He said the site is zoned for a range of uses, calling it “flexible space for a lot of different users and tenants” due to its variety of rooms that include 12,000 square feet of combined ballroom and meeting space that is unobstructed by posts or columns.

Currently zoning rules also permit multiresidential buildings of up to 14 storeys at the site. Jennings said the company’s long-

term plan is to redevelop the property with rental apartments or condos.

“That neighbourhood is becoming more and more central to the city as the city grows south,” he said. “That area definitely could use some (residential) density. We’re bullish on the city generally and that area in particular.”

Acquiring Tudor Hall is just the latest high-profile deal for Jennings Real Estate, which was founded in 2018 by Jennings and his brother Christian.

The firm made headlines last year when it bought the 12-storey Gillin Building at 141 Laurier Ave. W. and launched a major renovation of the art-deco-style office tower that was built in 1964 and last underwent a makeover two decades ago.

Earlier this year, Jennings Real Estate made its first acquisition outside the National Capital Region, a 12,000-squarefoot industrial complex in the Halifax suburb of Dartmouth.

The company now owns and manages nearly half a million square feet of property. Its portfolio includes several industrial properties in Nepean and Kanata as well as office buildings on Hunt Club and Walkley roads. — By David Sali

BOMA Ottawa Commercial Space Directory 2022-23 23

Fully insured & bonded since 1965 ISO 9001:2015 certified 613.741.7722 www.domuscleaning.com COMPLETE COMMERCIAL, INDUSTRIAL AND RETAIL CLEANING SERVICES Customized environmental, LEED and pandemic protection cleaning programs We provide environments that meet our clients’ needs and contribute to realizing their potential. 613 454-0188 | btbreit.com

Hiring trends to watch for in Facilities and Property Management

Salary expectations: demand for talent continues to rise

As the demand for talent continues to rise, real estate management companies of all sizes must adapt their compensation packages to attract and retain top quality candidates. The 2023 Hays Salary Guide reconfirms that salary is the main motivator for employees to leave their current job and pursue new opportunities.

Recent data collected by Hays shows that the demand for facilities and property management workers has steadily increased over the last few years, with many companies reporting a shortage of qualified candidates to fill open positions.

Our results also show that candidates are expecting a salary increase ranging from 5-15% in 2023 to keep up with the cost of living. Salary expectations, flexibility and purpose are among the top requirements for job seekers in Canada.

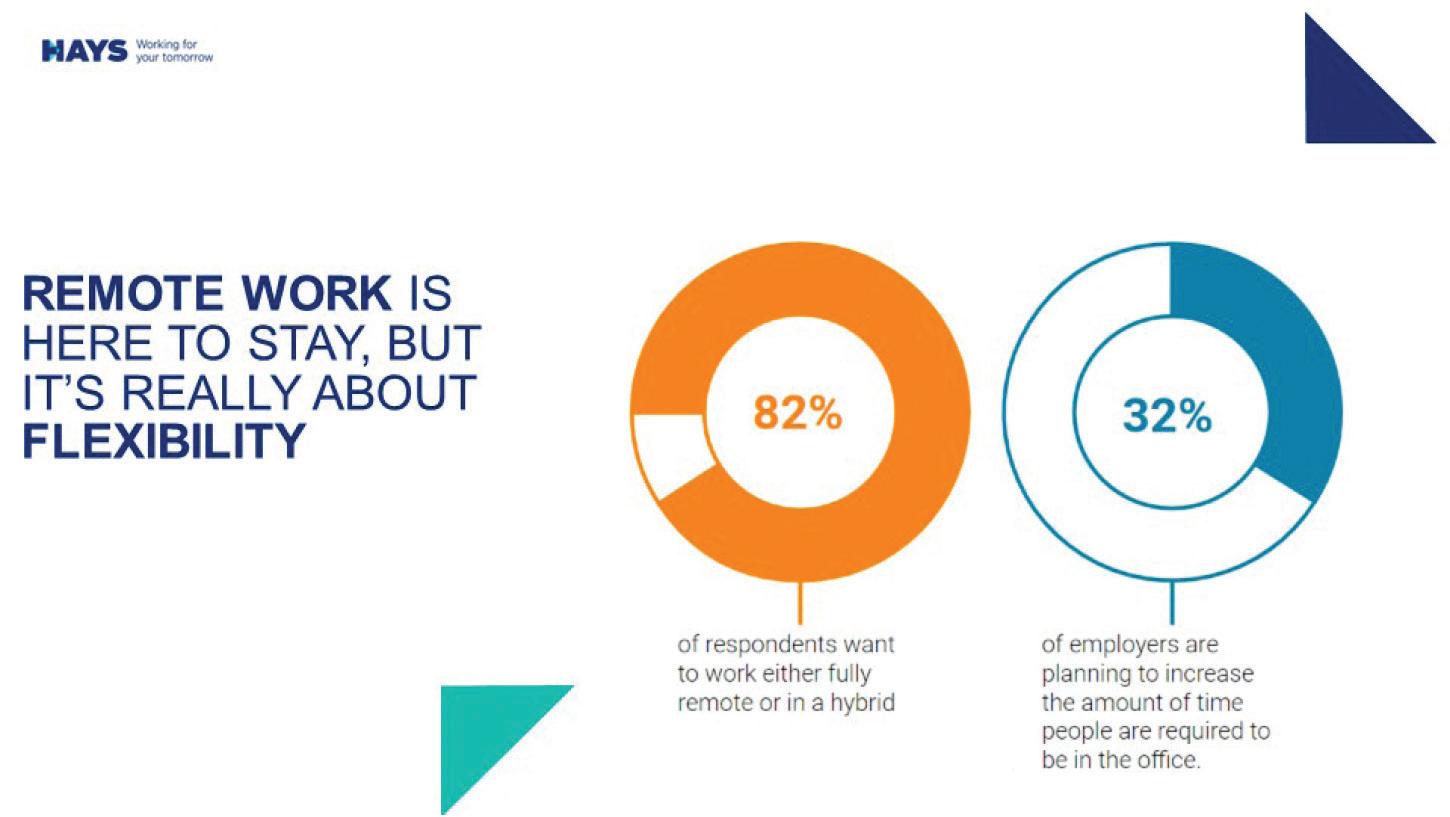

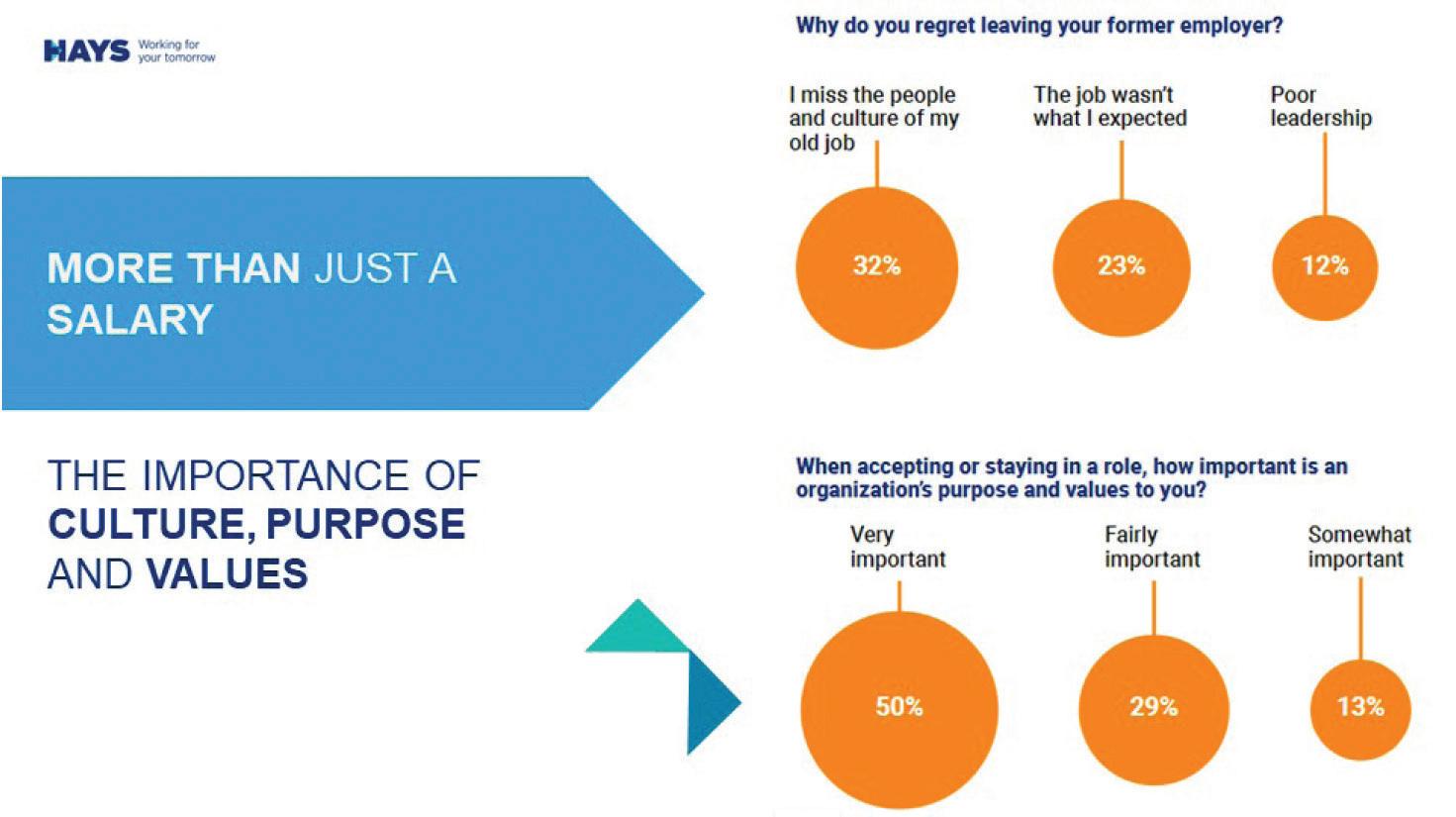

[Figure 1.]

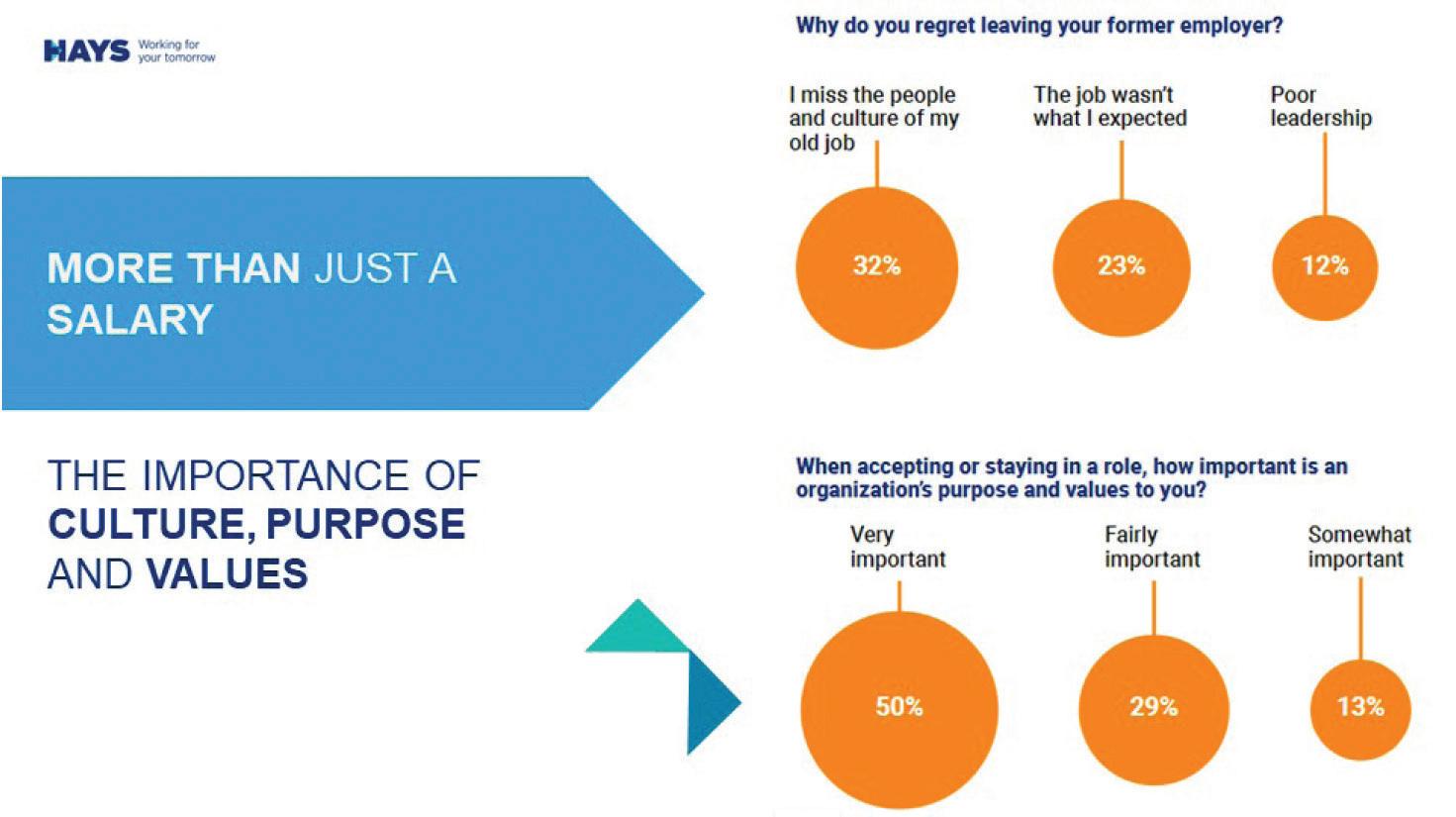

Culture, purpose, and values

We’ve found that people who feel their work is meaningful and aligns with their values are more likely to be satisfied long-term in their jobs. In contrast, people who are solely motivated by salary are often less satisfied with their work and

may be more likely to leave their employer for a higher-paying opportunity. However, salary isn’t everything. In fact, 27% of those who have changed roles over the last 12 months actually regret their decision. Quite simply, they find they miss their previous corporate culture. Another reason people regretted leaving their jobs, surprisingly enough, was that the job was not what they expected. We need to consider whether candidates are willing to move so quickly that they are not doing the proper research beforehand. Or, are companies taking enough time to properly qualify prospective candidates?

24 BOMA Ottawa Commercial Space Directory 2022-23

Are hiring managers taking enough time to fully inform candidates including discussions about venue, culture, expectations, job role etc.? Is the interview process itself appropriate to showcase the job? It’s not unusual in today’s market to see companies reaching back out to previous top-performers to attempt to re-hire them. The precursor to that, and a more effective strategy, would be to identify those top performers while they are already employees and taking appropriate steps to retain them. [Figure 2.]

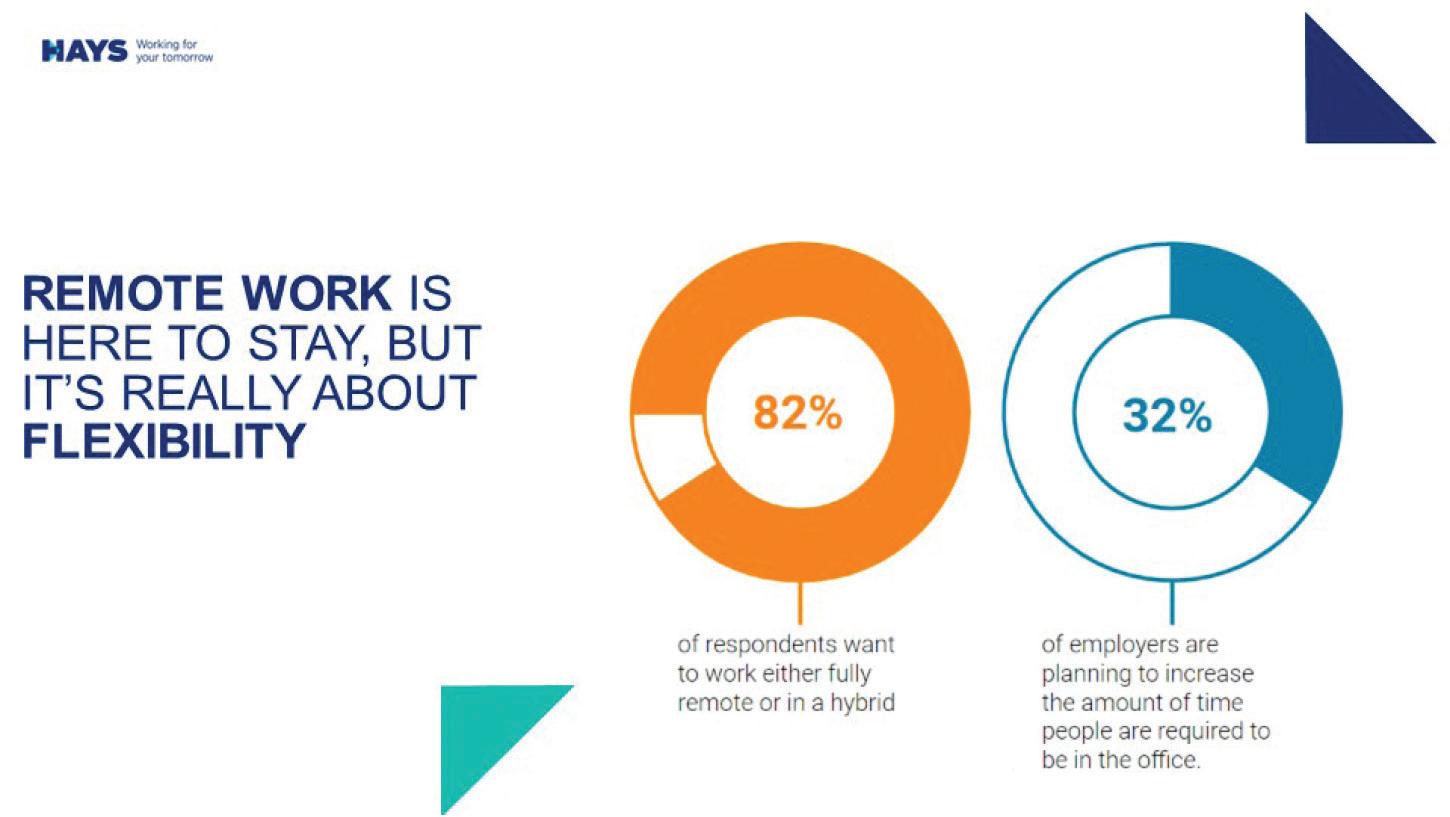

It comes down to flexibility and benefits

Remote work is still a hot topic and it’s here to stay. We often see the working environment as a deciding factor when a candidate faces two competing offers. 82% of respondents want to work either fully remote or in a hybrid environment. In recent years, the trend towards remote work has become more prominent in other industries. Although the property management industry cannot always fully adapt to remote working requests, employers are forced to consider incorporating flexible working conditions when possible.

In addition to salary, comprehensive benefits are of increasing importance to job seekers. As workers seek more flexibility and work-life balance, the most requested benefit is additional vacation time rather than the standard 2-week statutory holiday. Retirement contributions and support for professional study are also highly valued.

“The job market in the facilities and property management industry is extremely favorable right now,” said Steve McVay, Senior Commercial Director at Hays, “we’re looking for candidates with a passion for this field, and a desire to use their skills to make a real impact on the buildings and properties they manage.” The job market in real estate management is looking bright for qualified individuals in the profession. If you’re interested in pursuing a career in this field, now is a great time to consider acquiring additional education, updating your skill set and networking with professionals in the industry. [Figure 3.]

About the Salary Guide

Our research is based on a survey carried out between September 22nd – October 17th 2022 from 5,495 professionals and employers across Canada. To discuss what this means for you and your business, download the guide here: hays.ca/ salary-guide and contact our Ottawa property management recruitment consultant, Georgia Wightman at Georgia.wightman@hays.com

BOMA Ottawa Commercial Space Directory 2022-23 25

Figure 1

Figure 2

Figure 3

Demand for industrial space ‘still huge,’ real estate leaders say

By David Sali

Ottawa’s industrial availability rate rose nearly a full percentage point in 2022 as a number of new projects boosted the city’s warehouse inventory, but rents continued their steady climb amid an ongoing wave of demand, CBRE said in January.

The capital’s industrial availability rate hit 2.6 per cent in the fourth quarter, the real estate firm said in its latest national market report, up 90 basis points from a year earlier.

While that was the biggest jump in any major Canadian city, Ottawa continued to be a red-hot market as 2022 came to a close.

Average net rents rose to $13.61 per square foot in the fourth quarter after cracking $13 for the first time in the previous three-month period, CBRE said.

The average sale price of $300.88 per square foot last quarter is also a record high, suggesting the market is showing no signs of slowing down despite nearly 300,000 square feet of new inventory coming online in 2022 and another

414,000 square feet currently under construction. While that new space will take time to absorb, longtime real estate executive Shawn Hamilton told OBJ it won’t “alter the supply-demand dynamics” of the Ottawa market.

“I would suggest the demand for industrial space is still huge,” said Hamilton, Canderel’s Ottawa-based vice-president of business development. “I don’t anticipate rental rates to come off.”

About 30 per cent of the industrial space now in the pipeline is already pre-leased, CBRE says, “with several deals expected to close in the coming weeks.”

CBRE senior vice-president Louis Karam agreed “demand is still high” for industrial and warehouse property in the National Capital Region, which has become a destination of choice for e-commerce and logistics giants like Amazon and FedEx due to its close proximity to the massive Toronto and Montreal markets.

Karam said the completion of a 131,000-square-foot building at Avenue 31’s National Capital Business Park near Hunt Club Road pushed up the availability rate in the fourth quarter because roughly half the space remains to be leased after FedEx recently occupied the rest of the site.

Still, there was net absorption of nearly 24,000 square feet in the final three months of 2022.

Industrial land has been changing hands at record prices in areas such as Barrhaven and Kanata that weren’t traditionally seen as warehouse meccas, Hamilton added, signalling the flood of new construction is likely to continue for years to come.

“People are looking at the west end with the same lens that they’re looking at the south end as well as the east end,” he said. “This opens up the city for more industrial development.”

26 BOMA Ottawa Commercial Space Directory 2022-23 BUSINESS DIRECTORY

613-321-4842 softwashbutler.com • Pressure Washing • Garage Sweeping • Window Cleaning • Soft Washing • High Dusting • Winter Services

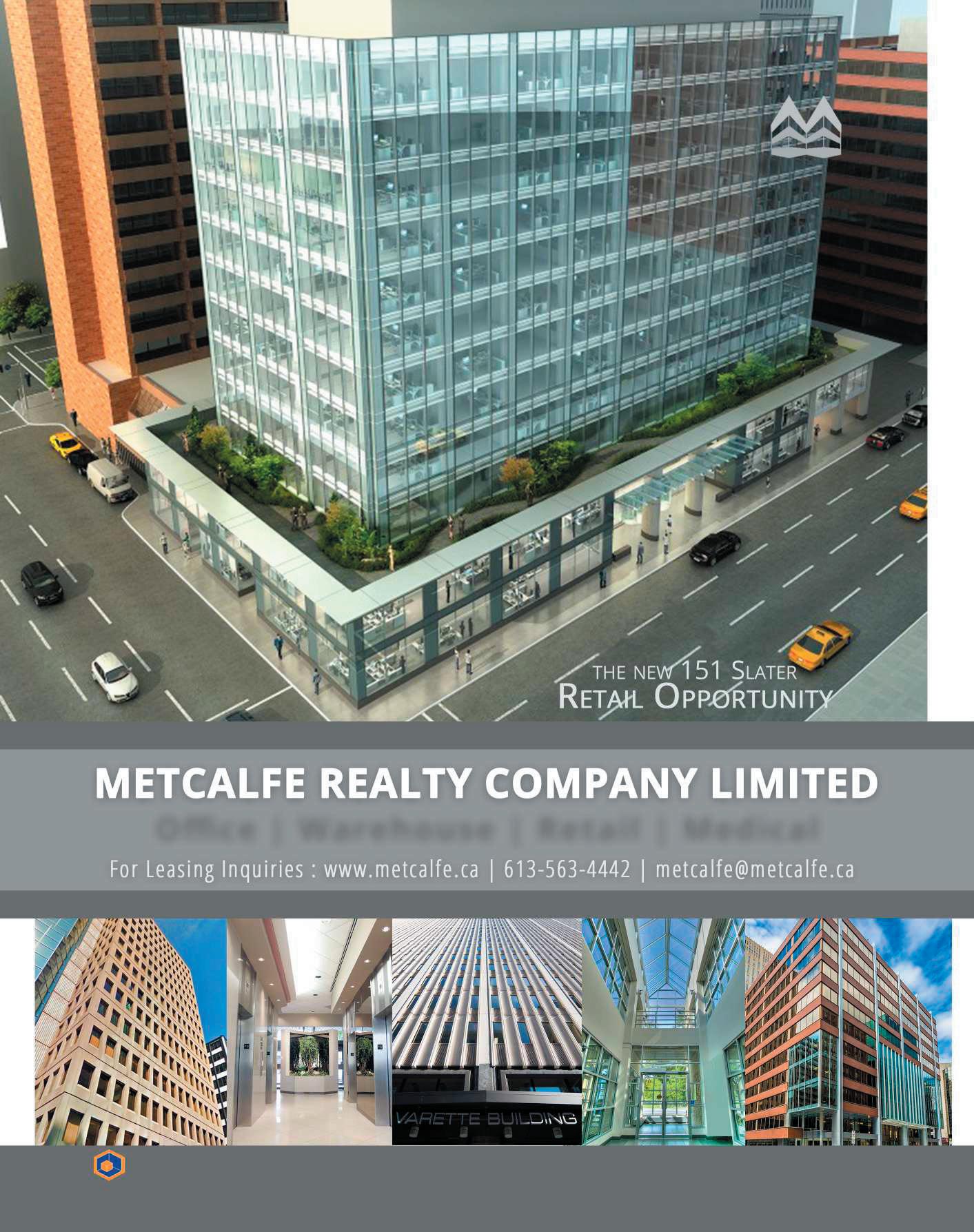

Ottawa’s commerCIal space

DIRECTORY

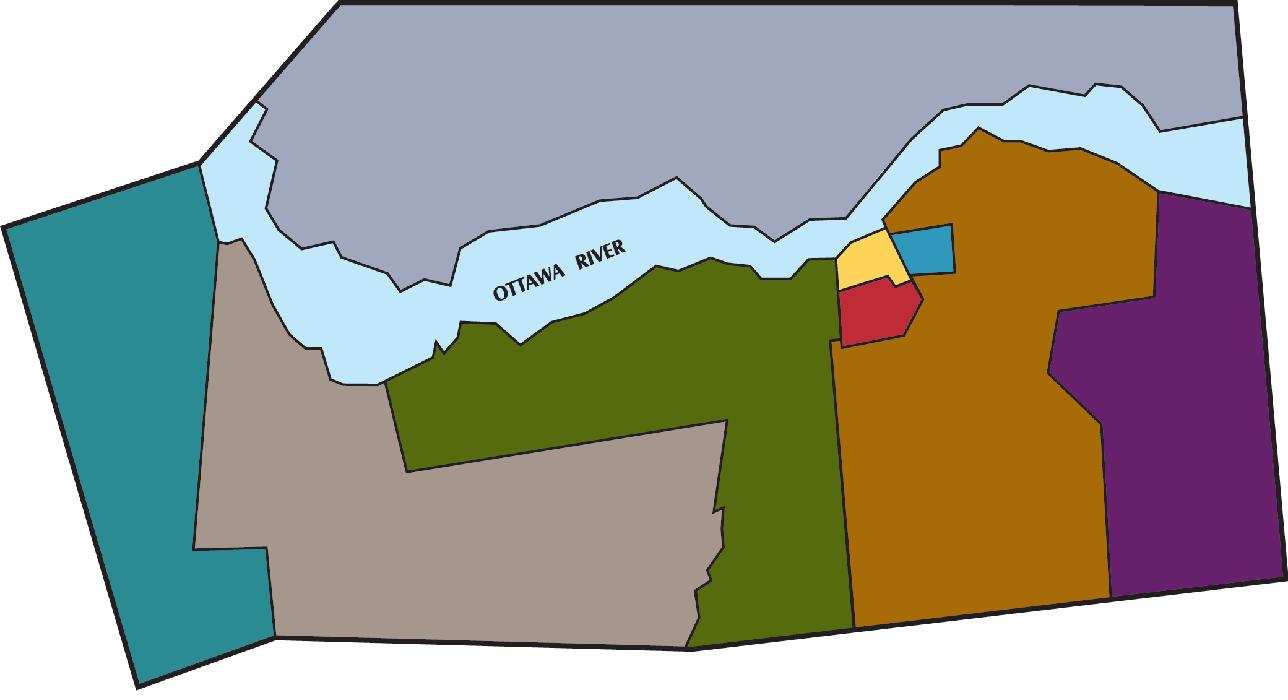

Key facts, figures and contact details on office, industrial and retail space across Ottawa-Gatineau

DOWNTOWN

BYWARD

CENTRETOWN

OTTAWA EAST

OTTAWA WEST

GLOUCESTER

NEPEAN

KANATA

OUTAOUAIS

Note: listings are organized alphabetically by street name. For example, the downtown section starts with properties on Albert Street and ends with buildings on Sparks Street.

BOMA Ottawa Commercial Space Directory 2022-23 27

BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST Fuller Building 75 Albert Street 1960 2007 11 160,290 13,172 Private Eighty-Five Albert 85 Albert Street 1976 Not Provided 15 89,339 6,060 Private 116 Albert 116 Albert Street 1960 Not Provided 10 97,307 10,193 Private Varette Building 130 Albert Street 1970 Not Provided 20 207,656 10,600 Private 250 Albert Street 250 Albert Street 1986 Not Provided 14 186,000 14,000 Private/Public 255 Albert 255 Albert Street 1975 2005 16 210,305 14,000 Private Y 294 Albert 294 Albert Street 1955 2017 6 46,000 8,007 Public Constitution Square Tower III 340 Albert Street 2007 WND 19 352,343 17,800 Private/Public Y Constitution Square Tower II 350 Albert Street 1992 WND 21 414,033 20,000 Private/Public Y Constitution Square Tower I 360 Albert Street 1986 WND 18 323,514 17,000 Private/Public Y Sun Life Financial Centre 99 Bank Street 1978 2018 15 414,000 27,600 Private/Public Y 396 Cooper Street 396 Cooper Street 1961 2013 4 28,940 7,300 Private The Chambers 40 Elgin Street 1994 1994 14 209,904 12,159 Private Y Central Chambers 46 Elgin Street 1890 1994 4 30,739 5,132 Private Y 80 Elgin 80 Elgin Street 1964 2011 7 24,404 Private/Public James M. Flaherty Building 90 Elgin Street 2014 Not Provided 17 585,000 26,000 Private Y Performance Court 150 Elgin Street 2013 Not Provided 21 360,000 16,000 Private/Public Y ONE60 Elgin 160 Elgin Street 1971 2018 26 1,037,355 40,000 Private/Public Barrister House 180 Elgin Street 1985 Not Provided 15 94,102 9,000 Private The Elgar Building 200 Elgin Street 1966 1984 11 142,948 14,400 Private Place de Ville Tower B 112 Kent Street 1967 2017 22 302,478 14,000 Public Minto Place 180 Kent Street 2009 Not Provided 19 383,000 20,700 Private/Public Y Centennial Towers 200 Kent Street 1966 1982 15 398,000 28,000 Private Y 141 Laurier 141 Laurier Avenue West 1964 2000 11 110,000 10,500 Private AT&T Building 150 Laurier Avenue West 1965 2013 5 35,000 7,000 Private/Public Place Laurier 170 Laurier Avenue West 1972 1992 13 119,391 8,650 28 BOMA Ottawa Commercial Space Directory 2022-23 downtown

BOMA Ottawa Commercial Space Directory 2022-23 29 downtown 101-920 Belfast Road, Ottawa, ON, K1G 0Z6 fci.ca @FCI_Ottawa 613.244.6770 Advancing to Meet Your Needs Our audio video systems are feature-rich, easy to use and installed by an expert team. We work closely with you to develop a true understanding and create a unique solution tailored to you. Visit fci.ca or call us to learn more. FCI BOMA Ad 2022_rev.indd 1 2023-01-11 12:58 PM BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST 191 Laurier Avenue West 191 Laurier Avenue West 1975 2006 16 208,500 13,000 Public Laurier House 200 Laurier Avenue West 1986 Not Provided 8 60,000 9,000 Private 219 Laurier Avenue West 219 Laurier Avenue West 1965 2017 14 187,000 14,000 Private Y Manulife Tower 220 Laurier Avenue West 1975 1990 15 127,098 8,689 Private Y Plaza 234 234 Laurier Avenue West 1983 2013 26 461,000 18,000 Private/Public 251 Laurier 251 Laurier Avenue West 1961 2001 & 2011 11 58,203 5,500 Y 269 Laurier 269 Laurier Avenue West 2005 Not Provided 19 387,000 21,000 Private Y 279 Laurier Avenue West 279 Laurier Avenue West 1923 1985 3 27,180 9,060 Private 301 Laurier Avenue West 301 Laurier Avenue West 1945 1993 5 27,000 5,000 Private Y 333 Laurier Avenue West 333 Laurier Avenue West 1992 Not Provided 18 213,000 13,000 Private/Public Y 340 Laurier Avenue 340 Laurier Avenue West 1965 2000, 2013 13 295,000 24,000 Private Narono Building 360 Laurier Avenue West 1968 2007 11 107,200 10,207 Private Y

30 BOMA Ottawa Commercial Space Directory 2022-23 downtown BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST Jean Edmonds Tower South 365 Laurier Avenue West 1973 1995 20 261,000 14,065 Private Leima Building 410 Laurier Avenue West 1977 1999 11 151,100 14,203 Private Minto Place - Enterprise Building 427 Laurier Avenue West 1988 Not Provided 14 209,000 17,300 Private/Public Y 440 Laurier West 440 Laurier Avenue West 1985 2007 3 43,600 13,000 Private Y Manulife Place 55 Metcalfe Street 1987 Not Provided 16 327,022 20,000 Private Y Commonwealth Building 77 Metcalfe Street 1954 1996 12 139,163 11,523 Private Y 81 Metcalfe Street 81 Metcalfe Street 1983 2012 12 57,072 5,100 Private 99 Metcalfe 99 Metcalfe Street 1984 1997 12 158,000 14,000 Private Y The Urbandale Building 100 Metcalfe Street 1968 Not Provided 18 192,472 10,820 Private Y 150 Metcalfe 150 Metcalfe Street 1989 Not Provided 23 109,300 6,200 Private Y World Exchange Plaza I 45 O’Connor Street 1991 2017 19 365,000 21,000 Private/Public Y Sun Life Financial Centre 50 O’Connor Street 1984 2018 17 552,000 33,000 Private/Public Y Export Building 110 O’Connor Street 1970 1999 14 189,543 14,106 Private Sixty Queen 60 Queen Street 1973 1988 16 130,741 9,100 Private 66 Queen Street 66 Queen Street 1900 2008 3 10,105 World Exchange Plaza II 100 Queen Street 2001 Not Provided 16 250,000 20,000 Private/Public Y 131 Queen Street 131 Queen Street 2006 Not Provided 13 329,500 23,538 Private Y Heritage Place 155 Queen Street 1985 2019 14 182,000 13,000 Private Y 181 Queen Street 181 Queen Street 2004 Not Provided 11 252,000 22,000 Private Y Trafalgar Building 207 Queen Street 1925 Not Provided 4 24,300 6,000 222/230 Queen 222 Queen Street 1972 1991 15 205,596 13,500 Private/Public Y Place de Ville Tower A 320 Queen Street 1967 2016 22 262,000 13,000 Public 434 Queen St 434 Queen Street 1979 Not Provided 7 60,000 6,500 Private 66 Slater Street 66 Slater Street 1970 2010 22 244,303 10,700 Public MacDonald Building 123 Slater Street 1963 2014 11 111,023 10,323 Private 130 Slater Street 130 Slater Street 1967 Not Provided 13 139,798

BOMA BEST® Program

BOMA BEST® is a national green building certification program launched in 2005 to address an industry need for realistic standards for energy and environmental performance of existing buildings based on accurate, independently verified information.

Commercial buildings that are BOMA BEST® certified will have a distinct advantage when it comes to attracting and retaining tenants. In most cases, it also costs less to operate and maintain the buildings due to increase in overall building efficiency.

For information regarding BOMA BEST® please contact the BOMA office at (613) 232-1875, or by e-mail at administration@bomaottawa.org.

BOMA Ottawa Commercial Space Directory 2022-23 31 downtown

BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST 150 Slater - The EDC Building 150 Slater Street 2011 Not Provided 18 482,062 26,500 Private Y 151 Slater Street 151 Slater Street 1966 Not Provided 12 147,046 12,000 Private 171 Slater 171 Slater Street 1969 2000 13 152,104 11,955 Private Y 215 Slater Street 215 Slater Street 2007 Not Provided 8 110,000 14,000 Private 275 Slater Street 275 Slater Street 1967 1991 20 235,204 12,254 Private 280 Slater Street 280 Slater Street 1990 Not Provided 18 158,000 9,000 Private/Public Y Jean Edmonds Tower North 300 Slater Street 1971 2016 21 284,000 14,065 Private Y Minto Place - Canada Building 344 Slater Street 1988 Not Provided 18 301,000 18,300 Public Y Hydro Building 56 Sparks Street 1927 Ongoing 10 79,698 9,200 The Bank Building 62 Sparks Street 1937 2007 1 6,225 100 Sparks 100 Sparks Street 1964 2009 10 55,990 5,650 Place de Ville Podium 300 Sparks Street 1971 1993 4 68,000 19,000 Public Place de Ville Tower C 330 Sparks Street 1971 1994 29 580,000 20,000 Public 350 Sparks Street 350 Sparks Street 1974 2018 12 173,000 14,416 Private/Public Y

Space Directory

BOMA Ottawa and the Ottawa Business Journal work together to publish the annual BOMA Ottawa Commercial Space Directory, considered the most definitive guide to commercial real estate in our city.

Please find the latest Commercial Space Directory or a copy of the complete edition can be secured from the BOMA Ottawa office.

BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST Time Square 47 Clarence Street 1983 Not Provided 4 111,000 24,000 Private Y 400 Cumberland Street 400 Cumberland Street 1973 1999 11 174,921 Mercury Court 377 Dalhousie Street 1988 1988 3 48,000 16,000 The Carriageway 55 Murray Street 1872-1983 1999 4 & 6 51,071 10,000 Private Y 100 Murray Street 100 Murray Street 2006 Not Provided 5 49,885 Private Y One Nicholas 1 Nicholas Street 1967 1987 14 130,000 9,800 Albion Executive Tower 25 Nicholas Street 1989 2008-09 12 133,167 10,255 Private/Public Ten Rideau 10 Rideau Street 1916 1983 7 45,445 6,635 Public 107-115 Rideau 107-115 Rideau Street Circa 1930 Not Provided 3 24,000 8,000 32 BOMA Ottawa Commercial Space Directory 2022-23 BYWARD

BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST 280 Albert St. 280 Albert 1965 2015 10 74,226 7,577 Private 100 Argyle 100 Argyle Avenue 1955 Not Provided 3 13,528 4,500 Private Brunswick Building 240 Bank Street 1964 1988 6 30,000 5,000 Private The Primecorp Building 275 Bank Street 1986 2009 4 42,000 11,750 Public 200 Catherine 200 Catherine Street 1986 Not Provided 4 58,700 14,675 Public 240 Catherine 240 Catherine Street 1975 Not Provided 4 44,850 11,150 Private Vered Building 245 Cooper Street 1964 2008 6 32,654 6,000 Private 309 Cooper Street 309 Cooper Street 1969 2008 5 21,120 5,500 Private 331 Cooper 331 Cooper Street 1964 2009 7 30,017 4,500 Private 400 Cooper 400 Cooper Street 1975 1999 9 184,833 18,000 Private/Public Y 100 Gloucester Street 100 Gloucester Street 1961 2013 5 24,832 3,540 Private Killeany Place 150 Isabella Street 1975 Not Provided 13 151,129 10,134 Private/Public 359 Kent 359 Kent Street 1956 2007 6 45,000 8,100 Private 116 Lisgar 116 Lisgar Street 1963 2007 9 44,000 6,700 Private 360 Lisgar 360 Lisgar Street 1968 1998 10 112,330 11,000 Private Y 441 MacLaren 441 MacLaren 1979 2012, 2017 4 27,000 8,500 Private Kenson Building 225 Metcalfe Street 1962 Not Provided 7 71,000 10,595 Private BOMA Ottawa Commercial Space Directory 2022-23 33 CENTRETOWN

BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST Kilborn Medical Centre 1385 Bank Street 1986 Not Provided 5 31,128 5,657 Private/Public 1800 Bank 1800 Bank Street 1989 Not Provided 3 68,803 9,100 Public Belfast Business Centre 720-740 Belfast 1970s 2005, 2016 2 47,000 23,500 Private 470 Charlemagne Boulevard 470 Charlemagne Not Provided 22,364 3030 Conroy Road 3030 Conroy Road 1989 Not Provided 2 27,935 285 Coventry Road (Coventry Square) 285 Coventry Road 2003 Not Provided 5 110,000 22,000 Private 295 Coventry Rd. (Coventry Sqaure) 295 Coventry Road 2004 Not Provided 5 110,000 22,000 Private 525 Coventry 525 Coventry Road 1965 1985 & 2001 1 42,500 42,500 Private Y 1150 Cyrville Road 1150 Cyrville Road 2010 Not Provided 4 58,356 14,589 Private 1392 Cyrville Road 1392 Cyrville Road 2003 2009 2 25,793 19,950 Private 1440 Cyrville Road 1440 Cyrville Road 1979 2018 1 37,499 37,499 Private 2440 Don Reid 2440 Don Reid Drive 1992 Not Provided 2 21,423 12,000 Private Gladwin Crescent 2239-2287 Gladwin Crescent Not Provided 1 76,061 76,061 Private 1350 Humber Place 1350 Humber Place Not Provided 1 37,008 37,008 Private 700 Industrial 700 Industrial Avenue 1976 Not Provided 2 110,047 50,000 Private 2495 Lancaster 2495 Lancaster Road Not Provided 2 135,701 Private 2713 Lancaster 2713 Lancaster Road 1990 Not Provided 2 34,298 17,000 Private 2733 Lancaster Rd 2733 Lancaster Road 1987 2014 2 35,181 16,000 Private 1550 Liverpool Court 1550 Liverpool Court 1973 Not Provided 1 31,635 31,635 Private 34 BOMA Ottawa Commercial Space Directory 2022-23 CENTRETOWN - OTTAWA EAST BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST 177 Nepean 177 Nepean Street 1960s 2004 5 26,132 5,500 Private Vanier Building 222 Nepean Street 1967 2006 11 119,000 11,000 Private 190 O’Connor 190 O’Connor Street 1965 2005 11 55,108 5,100 Private 267 O’Connor St 267 O’Connor Street Not Provided Not Provided 85 Plymouth 85 Plymouth Street 1956 2005 3 27,000 9,000 Private 222 Somerset 222 Somerset Street 1973 2007 7 36,445 6,180 Private

BOMA Ottawa Commercial Space Directory 2022-23 35 OTTAWA EAST BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST 1570 Liverpool Court 1570 Liverpool Court 1972 Not Provided 1 22,200 22,200 Private 1600 Liverpool Court 1600 Liverpool Court 1974 2008 1 32,000 32,000 Private 1155 Lola Street 1155 Lola Street 1980 2009 2 63,781 65,500 Private Place Vanier Towers, C 25 McArthur Avenue 1975 2020 10 150,000 15,000 Private Leomont Building 155 McArthur Avenue 1992 Not Provided 7 120,000 17,385 Private 1480 Michael Street 1480 Michael Street Not Provided 1 64,385 64,385 Private 214 Montreal Road 214 Montreal Road Not Provided 1990 5 43,781 8,262 Private 261 Montreal Road 261 Montreal Road 1990 Not Provided 5 19,210 3,842 Private Sinclair 2160-2170 Montreal Road 2011 Not Provided 1 20,141 2,000 Private 1145 Newmarket 1145 Newmarket 1974 Not Provided 1 32,082 32,082 Private 1171 Newmarket 1171 Newmarket 1976 Not Provided 1 + mezzanine 44,655 Private Place Vanier Towers, A 333 North River Road 1968 2006 17 261,000 16,200 Private Place Vanier Towers, B 355 North River Road 1970 2006 19 237,000 12,756 Private Beacon Hill Shopping Centre 2339 Ogilvie Rd Not Provided 2 92,235 Public Smyth Medical Centre 1929 Russell Road 1983 Not Provided 3 34,873 11,500 Private/Public 2630 Sheffield Road 2630 Sheffield Not Provided 2 47,320 Private 2760-2770 Sheffield Road 2760-2770 Sheffield Not Provided 1 151,466 151,466 Private St. Laurent Business Centre 1400 St. Laurent Boulevard 1985 1997 6 90,000 15,000 Private Y 1730 St.Laurent 1730 St. Laurent Boulevard 1989 Not Provided 8 101,459 12,500 Private Y 2270 St.Laurent Blvd 2270 St. Laurent Boulevard 2012 Not Provided 2 15,424 15,424 Private 2280 St. Laurent Blvd 2280 St. Laurent Boulevard 1989 Not Provided 2 41,939 20,000 Private 2300 St. Laurent 2300 St. Laurent Boulevard 1986 Not Provided 2 40,000 20,000 Private 2355 St Laurent Boulevard 2355 St. Laurent Boulevard Not Provided 72,000 2465 St. Laurent 2465 St. Laurent Boulevard 1989 2001 3 57,246 15,379 Private 2505 St. Laurent 2505 St. Laurent Boulevard 1980s 2004 2 24,878 12,400 Private 1600 Star Top 1600 Star Top Road 2004 2004 4 222,896 55,500 Private

Advocacy

BOMA’s many volunteers play an important role in building strong partnerships with local, provincial and federal government members and staff.

Committee members identify and act on crucial issues that will impact BOMA members, the commercial real estate industry and the business community at large. We serve as a powerful and influential voice in government affairs on legislative issues impacting the commercial building industry.

BOMA monitors and maintains open dialogue with municipal, provincial and federal governments and works to identify, promote and, when necessary, resolve issues affecting BOMA and its members.

36 BOMA Ottawa Commercial Space Directory 2022-23 OTTAWA EAST

BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST 1380-1390 Star Top Road 1380-1390 Star Top Road 1977 1978&1987 1 57,800 57,800 Private 1402-1412 Star Top Road 1402-1412 Star Top Road 1974 2001 1 + Mezzanine 73,814 Private 395 Terminal Avenue 395 Terminal Avenue 2013 Not Provided 8 243,963 29,975 Public Y Richcraft Thurston Centre 2171 Thurston Drive 1989 Not Provided 2 42,600 20,000 Private 2191 Thurston Drive 2191 Thurston Drive 1988 2016 1 + Mezzanine 27,800 Private 2211 Thurston Drive 2211 Thurston Drive Not Provided 24,492 2150 Thurston Drive 2150 Thurston Drive 1988 1992 2 30,989 15,000 Private 250 Tremblay Road 250 Tremblay Road 1968 2006 6 131,519 21,919 Private Y Triole Street 1377 - 1411 Triole Street Not Provided 1 109,000 10,900 Private 1625 Vanier Parkway 1625 Vanier Parkway 2015 Not Provided 10 290,000 29,000 Private 2060 Walkley 2060 Walkley Road 1972 1989 2 30,168 15,084 Private 2200 Walkley 2200 Walkley Road 1985 2011 2 54,000 27,000 Private Y 2204 Walkley 2204 Walkley Road 1991 Not Provided 5 103,400 20,680 Private Y 2370 Walkley Road 2370 Walkley Road 1980 Not Provided 1 316,942 316,942 Private

BUILDING YEAR BUILT/RENOVATED NO. OF STOREYS TOTAL SQ. FT. TYPICAL SQ. FT./FLR PARKING BOMA BEST 80 Aberdeen 80 Aberdeen Street 1940’s 2000 4 54,000 13,500 Private Y Fitzsimmons Building 265 Carling Avenue 1976 2006 8 46,000 6,400 Private Carling Square II 785 Carling Avenue 1976 2008 10 95,800 9,805 Private Dows Lake Court 1 865 Carling Avenue 1994 2003 7 96,326 13,714 Private/Public Dows Lake Court 2 875 Carling Avenue 1994 2003 9 96,809 10,166 Private/Public 1081 Carling 1081 Carling Avenue 1968 2000 8 60,000 7,000 Private/Public 1105 Carling 1105 Carling Avenue 1964 Not Provided 6 25,000 5,000 Private/Public 1335 Carling Avenue 1335 Carling Avenue 1975 2012 6 69,477 11,578 Private/Public Carling Executive Park A 1525 Carling Avenue 1982 Not Provided 7 97,200 14,500 Private/Public Y Carling Executive Park B 1545 Carling Avenue 1984 Not Provided 7 96,600 14,500 Private/Public Y Carling Executive Park C 1565 Carling Avenue 1986 Not Provided 7 97,100 14,500 Private/Public Y Carling Business Centre 1550 & 1451 Carling & Coldrey Avenue 1953 2000 2 125,000 62,500 Private Vail’s Building 1564-1574 Carling Avenue 1956 Ongoing 2 38,152 Private Churchill Office Park 1600 Carling Avenue 1985 Not Provided 8 183,272 25,000 Private Y Carling Corporate Centre I 2249 Carling Avenue 1976 Not Provided 4 43,646 Private/Public Carling Corporate Centre II 2255 Carling Avenue 1974 Not Provided 5 55,031 Private/Public City Centre Towers 250 City Centre Ave 1964 2012-2013 8 59,413 8,110 Private BOMA Ottawa Commercial Space Directory 2022-23 37 OTTAWA WEST 225 Metcalfe St. Suite 708 Ottawa, ON K2P 1P9 O: 613-237-7000 F: 613-235-8910 www.taggart.ca Retail Office Residential New Developments Condominiums

Education

BOMA regularly publishes articles and holds seminars on issues of importance as well as identifying Best Practices created and adopted by the commercial real estate industry through the BOMA educational program. In addition to this, through private sector partnerships, we support and promote alternative courses and programs of interest to the industry in general. BOMA Ottawa is the best source of educational programming for the industry, offering a variety of timely, relevant courses and seminars. We also support the industry’s leading professional designations, RPA® and FMA®, offered by BOMI through classes and study groups.

38 BOMA Ottawa Commercial Space Directory 2022-23 OTTAWA WEST