Greetings,

We’re excited to have you as a GLCU member! Follow the steps below to transition your Vibrant account(s) to Great Lakes Credit Union (GLCU).

1. Make note of your new GLCU account number(s) and corresponding share/loan ID(s).

Please note your 8-digit account number below, which will be used to locate your account with a GLCU representative at one of our branches or by phone, as well as the number you will need to enroll in online banking and the number that will appear on your account statements.

Member Number:

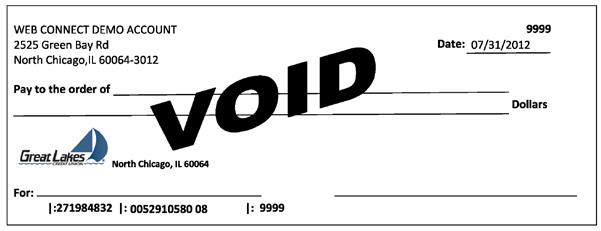

For direct deposits and/or ACH withdrawals, please use your member number above with the appropriate 2-digit share ID appended to the end of that number:

Savings:

Checking:

GLCU Routing Number:

2. Update any direct deposits and/or ACH withdrawals with your new account number(s) before February 28, 2025, (GLCU direct deposit form is enclosed). Please note that we will ensure all direct deposits and/or ACH withdrawals are posted to your new GLCU account in a timely manner for the first two months following the transition.

• Contact your employer or any other entities that deposit funds directly into your account and provide them with your new GLCU account number with an effective date of March 1, 2025.

• Update your account information for any automatic withdrawals, such as utility bills, subscriptions, or loan payments.

3. Ensure your email address is up to date with Vibrant Credit Union before February 28, 2025, (GLCU eCommunications form is enclosed).

4. Enroll in online banking at GLCU.org and download our free mobile app starting March 1, 2025, at 5PM CT.

• Visit GLCU.org and click on the “Enroll in Online Banking” link. Follow the prompts to create your online banking account.

• Download the GLCU mobile app and log in using your new online banking credentials.

5. Sign up for free bill pay within our digital banking platforms starting March 1, 2025, at 5PM CT.

• Once logged into online banking, navigate to the Bill Pay section.

• Enroll in the Bill Pay service by following the on-screen instructions.

• Add your payees (utility companies, credit card providers, etc.) and schedule your bill payments.

6. Activate your new GLCU tap-to-pay debit card, starting March 1, 2025, at 5PM CT.

• Your new GLCU tap-to-pay debit card will arrive in mid-February.

• Beginning on March 1, 2025, at 5PM CT, follow the activation instructions provided with your new debit card to activate it for purchases and withdrawals. You may activate your card by calling (866) 902-6628 and selecting option 1 from the main menu.

• Set your new PIN during activation. Your Vibrant PIN will not carry over to your new card.

7. Sign-up for optional Overdraft Services starting March 1, 2025, at 5PM CT:

• Overdraft Protection Opt-In Program: The Overdraft Protection Program transfers money from your other GLCU accounts to cover overdrafts. You must have sufficient funds in the other account(s) to cover the transfer.

• SafetyNet Opt-In Program: In addition to our Overdraft Protection Program, we offer SafetyNet. We will pay the check if you do not have enough funds in your account to cover it. This overdraft service provides qualified members the opportunity to have overdrafts by check, automatic debit, or in person paid up to a pre-determined limit. We can also cover your ATM or Visa debit card transactions when you Opt-in. Each time you use SafetyNet Overdraft Protection, your checking account will be charged a $30.00 fee. A deposit is required within 30 days to cover the owed balance. SafetyNet is a service that Great Lakes Credit Union provides to our members. There is no obligation on the part of GLCU to pay any check where funds are non-sufficient, but simply an effort on the part of GLCU to provide a service.

• To Opt-In to either or both of these services: Visit our Danville branch or call us to speak with a representative about adding any one of these services to your account.

Key Dates:

• Bill Pay: Vibrant bill pay will be unavailable beginning on February 28, 2025, at 5PM CT. All payments scheduled for after this date and time will not process.

• ATM: Access to Vibrant ATM will be disabled February 13, 2025, and available on February 24, 2025.

• Debit Cards: Vibrant debit cards will continue to work until February 28, 2025, at 8PM CT. GLCU debit cards will be available for activation starting on March 1, 2025, at 5PM CT.

• Checks: Avoid writing Vibrant checks after February 15, 2025. For members who have written at least one Vibrant check within the past 12 months, a new book of GLCU checks will arrive by the end of February and will be available for use starting on March 1, 2025.

• Online Banking and Mobile Deposit: Access to Vibrant mobile deposit will end on February 28, 2025, at 5 PM CT.

• External Transfers: Vibrant External transfers will be unavailable beginning on February 28, 2025, at 5 PM CT.

• Online and Mobile Banking Enrollment: Enrollment for GLCU online and mobile banking will be available starting on March 1, 2025, at 5PM CT.