2002 $

2001 $

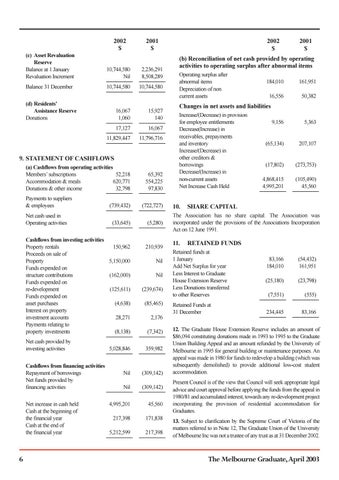

(c) Asset Revaluation Reserve Balance at 1 January Revaluation Increment

10,744,580 Nil ___________

2,236,291 8,508,289 ___________

Balance 31 December

10,744,580 ___________

10,744,580 ___________

(d) Residents’ Assistance Reserve Donations

16,067 1,060 ___________

15,927 140 ___________

17,127 ___________

16,067 ___________

11,829,447 ___________

11,796,716 ___________

9. STATEMENT OF CASHFLOWS

2001 $

(b) Reconciliation of net cash provided by operating activities to operating surplus after abnormal items Operating surplus after abnormal items Depreciation of non current assets

184,010

161,951

16,556

50,382

Changes in net assets and liabilities Increase/(Decrease) in provision for employee entitlements Decrease(Increase) in receivables, prepayments and inventory Increase/(Decrease) in other creditors & borrowings Decrease/(Increase) in non-current assets Net Increase Cash Held

9,156

5,363

(65,134)

207,107

(17,802)

(273,753)

(a) Cashflows from operating activities Members’ subscriptions 52,218 Accommodation & meals 620,771 Donations & other income 32,798 ___________

65,392 554,225 97,830 ___________

Payments to suppliers & employees

(739,432) ___________

(722,727) ___________

10.

Net cash used in Operating activities

(33,645) ___________

(5,280) ___________

The Association has no share capital. The Association was incorporated under the provisions of the Associations Incorporation Act on 12 June 1991.

Cashflows from investing activities Property rentals 150,962 Proceeds on sale of Property 5,150,000 Funds expended on structure contributions (162,000) Funds expended on re-development (125,611) Funds expended on asset purchases (4,638) Interest on property investment accounts 28,271 Payments relating to property investments (8,138) ___________

(7,342) ___________

Net cash provided by investing activities

359,982 ___________

5,028,846 ___________

Cashflows from financing activities Repayment of borrowings Nil Net funds provided by financing activities Nil ___________ Net increase in cash held Cash at the beginning of the financial year Cash at the end of the financial year

6

2002 $

210,939 Nil Nil (239,674) (85,465) 2,176

(309,142) (309,142) ___________

4,995,201

45,560

217,398

171,838

5,212,599 ___________

217,398 ___________

11.

4,868,415 4,995,201 ___________

(105,490) 45,560 ___________

SHARE CAPITAL

RETAINED FUNDS

Retained funds at 1 January Add Net Surplus for year Less Interest to Graduate House Extension Reserve Less Donations transferred to other Reserves

(7,551) ___________

(555) ___________

Retained Funds at 31 December

234,445 ___________

83,166 ___________

83,166 184,010

(54,432) 161,951

(25,180)

(23,798)

12. The Graduate House Extension Reserve includes an amount of $86,094 constituting donations made in 1993 to 1995 to the Graduate Union Building Appeal and an amount refunded by the University of Melbourne in 1995 for general building or maintenance purposes. An appeal was made in 1980 for funds to redevelop a building (which was subsequently demolished) to provide additional low-cost student accommodation. Present Council is of the view that Council will seek appropriate legal advice and court approval before applying the funds from the appeal in 1980/81 and accumulated interest, towards any re-development project incorporating the provision of residential accommodation for Graduates. 13. Subject to clarification by the Supreme Court of Victoria of the matters referred to in Note 12, The Graduate Union of the University of Melbourne Inc was not a trustee of any trust as at 31 December 2002.

The Melbourne Graduate,April 2003