1 minute read

Requirement of financial literacy courses to take place

By Elly Meteer & Lauren Veitengruber SECTION EDITOR & STAFF REPORTER

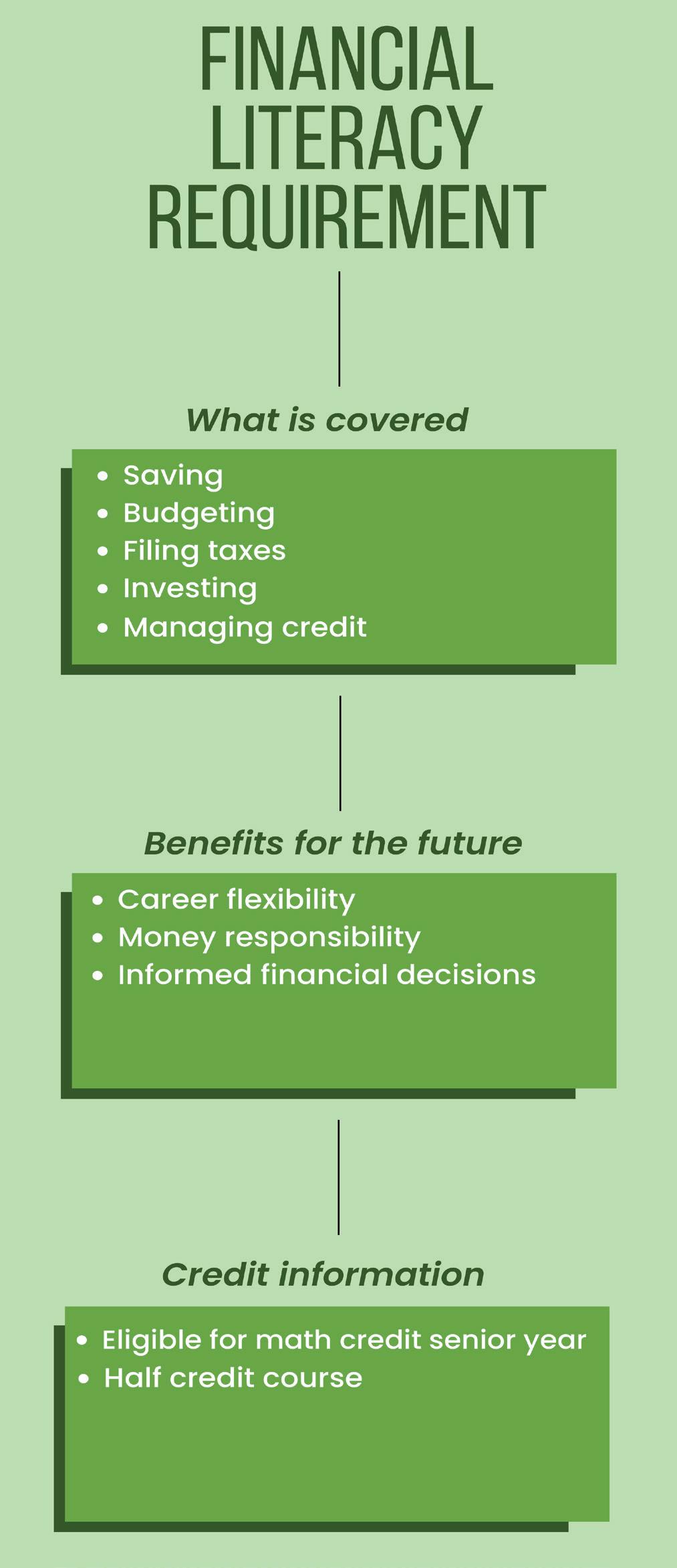

This state-wide change to curriculum will come into effect starting for freshman entering high school in the year 2028.

Advertisement

The main goal for the new financial literacy requirements are to assure that Michigan teens will have financial confidence and a general understanding of their finances. Business teacher Brian Levinson expresses the important benefits of taking a finance course, as it will be helpful in the future.

“Regardless of what you go into, whether you are a doctor, architect or a sales person, you are going to have money to manage,” Levinson said.

Similar to Levinson, financial advisor Melissa Fradenburg also believes learning how to make wise financial decisions is essential upon approaching adulthood.

“Knowing how to handle money responsibly can help [students] avoid things like credit card debt and overspending as a young adult which will set them up for home ownership, career flexibility and retirement,” Fradenburg said.

Fradenburg did not study financial literacy in high school, and she says that this led her to face many obstacles later in life, as she lacked information about important financial concepts.

“I know I could have used this knowledge as a teen,” Fradenburg said. “I graduated college with credit card debt and also missed some school loan payments in my early twenties.”

In order to provide students with the information they need for the future, the finance course at North covers various topics that aim to help students harness a basic understanding of financial and monetary concepts. These include credit, investing, savings, money management and understanding consumption. Along with these concepts, Levinson believes that one of the most important topics covered is “paying yourself first.” This means that students are taught to put their money directly into the bank rather than spend it right away.

“If you are not good at being disciplined and putting money into a savings account or into an investment, have it automatically taken out of your paycheck so you never see it,” Levinson said.