We pay homage to the Goose that lays the Golden Eggs and our quest to find and publish stories of sound technology in Bitcoin, cryptocurrency, and digital assets. We created this magazine for all levels of experience for the crypto-curious, wealth-minded individuals, business owners, and asset managers who want to discover sustainable income sources and profit centers. GOO$E readers are curious and crave stories of success, innovation, and creativity about emerging leaders, innovative projects, and potentially profitable ideas.

Potential is the keyword. Do not take any of this information as financial advice. Be responsible, do your research and seek professional advice when needed.

The growth projections for Bitcoin, cryptocurrency, and blockchain technology become enormous when you think of it as the evolution of the Internet. It will take time and the power of healthy network growth will make this an exponential technology. And, from time to time we may feature an undiscovered, potential gem.

In the decentralized world, these opportunities are available to all willing to learn, do research, take strategic risks, and get into the game. Some content is sponsored - we allow brands to control their narrative.

We understand the challenges of staying informed about innovation and finding new wealth opportunities and strategies. We hope GOO$E magazine will be a source of cutting-edge information

for you and inspire you to do more research.

A decentralized GOO$E model for subscribers and contributors coming soon.

Thanks for reading, subscribing and joining the GOO$E community.

Papa_Goose

© 2023 GOO$E Magazine. All rights reserved Scan and Subscribe www.goosemag.com | hello@goosemag.com | @GooseMagHQ Welcome to GOO$E Magazine - A Community-Powered Brand

LETTER FROM PAPA GOOSE

Censorship and sound money - The 2 major catalysts for people to get involved in Bitcoin. It’s not a motivator to many because we have fiat money dependence - a growing disease. Bitcoin is a movement started by a passionate few wanting true freedom. Then movements evolve into leaders solving real problems. The masses take notice and participate too. Leadership and innovation, fighting for a better system for the people got us to today - it is just the beginning.

Will you be one to jump on the lifeboat soon or will you be one to join the party after the masses? We’re excited to help you disconnect and discover more throughout these pages.

The cryptocurrency and blockchain industry has gone through plenty of ups and downs which parallel the beginnings of the dotcom and Internet evolution. The demise of FTX and others in this nascent digital economy mimics the banking failures of 2008 - the problem that Satoshi Nakamoto built the Bitcoin network to solve and

give us options. Leaders and entrepreneurs continue to buildlet’s find the good ones together. We encourage you to keep it simple and think of this new revolution as an evolution of the Internet, the way it was intended to be - more decentralized.

Bitcoin and other cryptocurrencies can get to places around the world where fiat currency cannot. Think outside of your fiat comfort zone and put yourself in the place of people in unstable, third-world countries that don’t have a choice but to look for another currency to conduct commerce with each other and earn a living.

We will publish stories from this point of view - the search for sound technology in Bitcoin, cryptocurrency, blockchain, and digital assets. The biggest challenge will be the criteria we develop to include the blockchain trilemma while exploring what else is developing. NFTs, DeFi, MetaVerse, Data Transmission, and more are all relevant parts of the technology. We’ll find some good ones and some won’t make it - don’t take anything as financial advice. Along the way let’s have

fun, make money, and build relationships with each other.

It is all an experiment and no one really knows who will win. This is technology at its finest in a free market - we will see what the markets want - what the people want!

As George Gilder, describes in his book, Life After Google, whoever owns the networks wins! Now you get to own your piece of the networks. This is the inherent incentive that is built into decentralized networks. Own a piece of the community network that you help build!

The lesson in the fable of the Goose that Laid the Golden Eggs - Don’t be greedy - Don’t kill the Goose! We will mix in articles on how to be the best stewards of our assets, living a digital lifestyle. Let’s all be personally responsible so new laws don’t encroach on our freedoms - compliance is freedom insurance.

Cheers to the People!

Papa Goose

Who is Satoshi Nakamoto?

How to Safely Get into Crypto

What’s Your Risk of an IRS Tax Audit?

Banking on the Future How Financial Institutions Can Successfully Navigate the Web3 Revolution

The Rise of Women in NFTs & Crypto

Debunking Bitcoin Myths

DISCLAIMER: Articles within this publication mention specific companies, crypto projects, crypto exchanges, and other entities. Some articles are sponsored and contributors may hold crypto assets mentioned. These mentions are purely for illustrative purposes and are not meant to be construed as a public endorsement of these firms in any way, especially as an investment. While the opinions of GOO$E Magazine and its contributors are shared, no portion of these articles are meant to be construed as investment advice, an official market outlook, or personalized recommendations for your situation. Past performance is not indicative of future results. Investing has risks and loss of all your principal may occur. The aforementioned risk is exponentially increased when cryptocurrencies are involved. Before taking action on any information shared in this article, you should consult with a qualified & licensed investment, tax, legal, or other professional counsel.

Magazine Design by SmartFem Media Group

Content

In Times of Uncertainty: The Questions to Ask

Rise of the Pseudonomynous Leader The Rise of the Datapreneur The Rise of the Young Bitcoin User 18 38 22 44 06 26 10 30 14 35

The

Charlie Stivers has been a business owner since 2001. His roots from working on the family farm grew values of personal responsibility and self-reliance. Inspired by his economics professor, his passion for technology can be traced back to his preprofessional days when he felt like Alex P. Keaton carrying around the newspaper’s business section full of tech stories and innovations in the late 1990s.

He bought his first dotcom stocks in 1998 which led to him getting professionally licensed in 2001 and beginning a long professional career. Seeing the struggles of retirees preparing for retirement he authored the book, Social Security Success Guide, in 2016 helping them optimize retirement income for their golden years as a speaker and adviser.

As 2020 and pandemic lockdowns brought us extended time at home; he chose to focus on cryptocurrencies. He now works full-time on speaking fluent Bitcoin and crypto and has developed a passion for helping others discover and learn the potential of blockchain technologies. He believes the future of decentralization and digital assets will be sustainable when built on sound technology by responsible leaders.

GOO$E was started to help onboard new users safely and be a trusted resource of education for all levels. His vision is to build GOO$E into a community-powered publication.

He enjoys activities with his 2 children, exploring Colorado outdoors, and traveling. He may be seen on a river with a fly rod or with his rescue Frenchie, Gidget.

Charlie Stivers ~Publisher @cgstivers

Charlie Stivers ~Publisher @cgstivers

A statue in Budapest dedicated to Satoshi Nakamoto

Statue of Satoshi Nakamoto, creator of bitcoin, erected in the Graphisoft Park in Budapest. The statue made of bronze and aluminum alloy by Tamás Gilly and Réka Gergely was inaugurated on September 16, 2021 at the initiative of the Hungarian Crypto Academy. (Budapest, District III, Záhony Street)

By Charlie Stivers

A statue in Budapest dedicated to Satoshi Nakamoto

Statue of Satoshi Nakamoto, creator of bitcoin, erected in the Graphisoft Park in Budapest. The statue made of bronze and aluminum alloy by Tamás Gilly and Réka Gergely was inaugurated on September 16, 2021 at the initiative of the Hungarian Crypto Academy. (Budapest, District III, Záhony Street)

By Charlie Stivers

When you think of leaders of historical significance in business and society, what most of them have in common is they brought a technology or product to the masses. Their creation is the beginning of a movement that further evolves our way of life. Bill Gates didn’t invent the computer – he made it affordable and easy for all of us to use computers with his software. Henry Ford didn’t invent the car – he developed the assembly line to make vehicles available to the masses at a lower cost. Satoshi Nakamoto is the pseudonymous leader or group that brought Bitcoin and the beginning of blockchain technology to millions of users. There were others before that tried digital currencies, like e-Gold. Satoshi was the first to develop blockchain

technology that combined a peer-to-peer digital currency on a recorded public ledger in a decentralized database, known as the Bitcoin blockchain. This digital technology was special because it prevented double spending of the currency with a recorded time stamp. As a digital asset, it has a built-in incentive for the users to help it grow and its scarcity makes it more sought after, thus more valuable, and considered by many as the only - sound currency. Therefore, you see the headlines feeding the frenzy, while Bitcoin leaders, advocates, and investors continue to spread the story. Some continue to innovate on top of the foundation of the network. It’s not only about the asset BTC, but it is also about the future of the Bitcoin network!

Bitcoin involves 2 components that should be distinguished. The unhackable blockchain network

is referred to as the Bitcoin blockchain with a capital “B”, and the digital currency is bitcoin with a lowercase “b”, or its ticker symbol, BTC. The security lies in its huge, decentralized network where copies of blockchain reside on several thousand nodes. To hack it would require changing the code and history of the blockchain on all nodes though out the global network.

Key Point - There will only ever be 21 million BTC.

Satoshi Nakamoto started his project in 2007 as a solution to the market crash and global collapse of our economic system. He presented the Bitcoin whitepaper on October 31st, 2008, announcing his decentralized, P2P digital cash system to bypass the flawed, and sometimes corrupt, centralized banking system.

GOO$E Magazine 7.

The great wonder, “Who is Satoshi Nakamoto?” is still to be determined in many minds. Would you want to be public about creating a currency to bypass and severely disrupt big government financial systems? The wealth in the original Bitcoin wallet is estimated to be worth billions. To this day, those bitcoins have never moved from that wallet. Is he alive or dead? That depends on who you think Satoshi is.

Some speculate it is a group of people, a secretive government branch like the CIA or NSA, or a cipher punk like the late Hal Finney who was a cryptographer who lived just blocks away from Dorian Satoshi Nakamoto. Finney assisted with testing the blockchain system and participated in the first bitcoin transfer with Nakamoto.

Dorian Satoshi Nakamoto, a California resident, under a similar name was working in secretive banking and government roles, cast uncertainty and doubts after answering confusing questions and made statements to the press who were chasing him down for the story. He stated he was no longer involved in that project and turned it over to others. In an askme-anything interview on Reddit, he stated he misinterpreted the question from reporters thinking they were talking about his past roles and work with banks and the government. Later that day, a message from Nakamoto’s P2P Foundation appeared after never having a post for 5 years stating, “I am not Dorian Nakamoto.” To further confuse the authenticity of the account’s post, months later the same account posted it had been hacked!

Nick Szabo has been thought of as Nakamoto due to his BitGold creation before Bitcoin and a stylometric process comparing his publications to the Bitcoin whitepaper noting similarities.

The rest of the story is filled with drama surrounding Dr. Craig Wright who claimed he is Satoshi publicly several times starting in 2016.

Let’s honor Satoshi and assume he has passed through the pearly gates in the great metaverse. Keep building on the Bitcoin network and stacking those Sats!

GOO$E Magazine 8.

Image credit: By Fekist - Own work, CC BY-SA 4.0, https://commons. wikimedia.org/w/index.php?curid=110217593

In Times of Uncertainty: The Questions to Ask

The 2022 crypto winter has left many crypto enthusiasts out in the cold with mounting losses, rug pulls, scams, and massive thefts. The FTX bankruptcy has affected many large and small investors and shocked the entire industry. Coupled with inflation in global fiat currency markets there is a general sense of despondency and pessimism in some circles. Those that are holding on for dear life (HODL) are wondering if they made the right decisions with their financial resources. Long-term crypto investors that have been watching the ebb and flow of crypto assets have seen bear markets before and are urging patience, noting that is important to shift the narrative

about engaging in crypto investing. To make this mental shift it comes down to two key questions:

• How can we, collectively, act to apply principles of sound fiscal management in this arena with uncertain regulations, multiple, competing blockchains, and complex protocols?

• More importantly, how can we act individually in this context to safeguard our futures in light of such uncertainty?

The first question is one that can be addressed by looking at some of the macro trends in global geopolitics and public policy. These topics will be addressed in a subsequent article. This article will address the second question to help readers find footing in the

quicksands of these times.

Selection of Blockchain Ecosystem

Veterans of blockchain investing in both currencies and token varieties (fungible and nonfungible) often invoke the mantra to “do your homework” (DYH) when evaluating the myriad of features of engagement. Some of the most fundamental aspects for entry into these markets include having foundational knowledge about:

• What type of exchange to register for,

• Whether to use a hot or cold wallet, and

• Whether to bank on “proof of work” or “proof of stake” protocols.

GOO$E Magazine 11.

There are multiple detailed resources online for answering these questions. Here I want to walk you through some of the most basic features at a high level to help you on your DYH path.

Types of Exchanges

A decentralized exchange, or DEX, is a trading platform for crypto assets. There are three key features that users should watch for when selecting a DEX.

1. Is the DEX decentralized or centralized in its structure?

2. Is the DEX in a country that requires pre-screening of participants with Know Your Customer (KYC) / Anti-Money Laundering (AML) processes?

3. Is the DEX collateralized? If so, with what kind of asset?

ONE: The underlying philosophy of blockchains is the notion of decentralization. And, in general, many of the organizations that have emerged to service that market sector have adopted that philosophy. Not all, however. One of the observations made by technology reviewers about famous failures like the November 2022 collapse of the FTX Exchange is that the governance and control apparatus was highly centralized. This led to poor management and risky investments by inexperienced leadership. A more decentralized organizational structure for a DEX is believed to be less vulnerable to such pitfalls.

TWO: The KYC regulatory requirements stem from regulatory authorities under the US Patriot Act. Originally passed to help agencies monitor terrorism financing, it was later extended

to DEXs seeking to license within the US. There are two key rules governing KYC through oversight by the Financial Industry Regulatory Authority (FINRA). These are Rule 2090 and Rule 2111. The US Financial Crimes Enforcement Network (FinCEN) requires customers and financial institutions to comply with KYC standards for the prevention of AML. Investors outside of the US are often subject to US laws given the role of the US dollar in global markets; even in blockchain-based currencies. Investors in crypto DEXs are encouraged to read the terms and conditions posted on their websites to make sure they are fully aware of their policies regarding KYC/AML compliance.

THREE: DEXs that hold a form of collateral to back up the holdings of cryptocurrencies and token assets are more likely to be able to withstand periods of high liquidity during a bear market than those that do not collateralize their holdings. DEXs typically collateralize their holdings with a fiat currency, gold, or a stable coin (i.e., a crypto coin that is pegged to a fiat currency). Those that collateralize with a selfattested token (e.g., the FTT as in the case of the recent FTX

crash) are vulnerable to volatile swings in the market and rapid rates of withdrawals by spooked customers. The recommendation is to ascertain the type and level of collateralization of your DEX before investing.

The above are not the only DEX topics a potential investor should research before investing, but they do give you a starting point.

Hot or Cold Wallets

One of the first adages I heard when starting to explore the world of crypto was “Trust No One” in the blockchain world. That is the real takeaway from this article that I pass on to you. And when it comes to hot versus cold wallets, that is played out by distinguishing between non-custodial and custodial ownership.

When a user creates a wallet, either directly through a DEX or by using one of the many online browserbased wallets on the market; these are called hot wallets. The reason they are considered hot is because there are many ways in which nefarious threat actors can hack into a computer or mobile device and steal digital assets from a browser.

For example, hackers can use an Attacker-in-the-Middle hacking technique where they infect a device and intercept traffic going to and from your browser-based wallet. Or they can use one of the many browser-based injection techniques such as those detailed by MITRE’s Common Attack Pattern Enumeration and Classification System (CAPEC).

It is for these reasons that most sophisticated users purchase cold

GOO$E Magazine 12.

storage wallets an example of which is pictured here. These are physical drives external to your computing device that can be plugged into a port for transfer of digital assets. Once the assets are transferred out of the hot wallet to the cold storage wallet the security of the system depends upon the ability of the user to retain custody of the device and, importantly, the PIN and recovery phrase given when the device was activated. Always write down these two things and store them in a safe location.

Types of ‘Proofs’ in Blockchain Technologies

Fundamental to the idea of a blockchain is its mathematical proof of what is called a “decentralized ledger”. Satoshi Nakamoto posted the famous Bitcoin white paper on October 31st, 2008. His mathematical proof was based on a proof of work algorithm that called for solving complex equations that enabled “miners” an opportunity to create new coins that would be registered on the ledger and confirmed at any node. This led to the development of large-scale, energy-intensive mining operations located all around the world, primarily in areas with low-cost energy resources. In parallel, an alternate blockchain community emerged that took the original proof of work concept and extended its functionality with features called “smart contracts”. These were, in

essence, additional fields and side chains that could be confirmed using additional mathematical proofs. This work was based on the Ethereum blockchain which, at that time, was also based on a proof of work algorithm.

Then, in 2015 the Bitfury group proposed an alternative approach called “proof of stake”.

“The main declared advantages of proof of stake approaches are the absence of expensive computations and hence a lower entry barrier for block generation rewards.”

This emphasized an ownership stake in the chain and a verifiable and transparent mechanism for confirming that ownership stake. Several alternative communities of interest have emerged based on both the proof of work and proof of stake algorithms. And, with alternate blockchain-based distributed ledgers extending the concept of “smart contracts” this led to an explosion of alternative coins (e.g., Altcoins) and the flourishing of digital art and sales channels for these assets.

It is the mission of this magazine to help readers sort through the noise surrounding these various features of blockchain technologies supporting distributed ledgers, so we do not kill the golden goose. There was wisdom in the fairy tale.

Jane Ginn, MSIA, MRP is a cyber threat analyst and the Co-Founder of the Cyber Threat Intelligence Network (CTIN). She specializes in hunting for malicious activity on computer networks and devices and has trained hundreds of cyber threat hunters currently working in business, industry, and government. She served as the Secretary of the Cyber Threat Intelligence Technical Committee during the development of the global standards for sharing cyber threat information. She was subsequently awarded the Distinguished Contributor Award by OASIS-Open in 2020. She also served on the EU’s Threat Landscape Stakeholders Group. She currently serves on the Board of Directors of the Cyber Resilience Institute. Plus, she is the Commercial Facilities Sector Chief for a state Infragard coalition. She is currently applying her cybersecurity knowledge to threats in blockchain communities. She holds a master’s degree in information assurance (MSIA) from Norwich University.

@CTIN_Global

GOO$E Magazine 13.

Datapreneur The Rise of the

The Constellation Founding Team

**Founding Team from top left to bottom right: Benjamin Diggles, Mathias Goldman, Ben Jorgensen, Wyatt Meldman-Floch, Altif Brown

The Constellation Founding Team

**Founding Team from top left to bottom right: Benjamin Diggles, Mathias Goldman, Ben Jorgensen, Wyatt Meldman-Floch, Altif Brown

It’s estimated that people produce 2.5 quintillion bytes of data every day, with the average person creating 1.7 Mb of data every second. Which sites we visit, what music we listen to, our spending and healthcare habits - and much, much more are continuously tracked by businesses looking to target advertising or customize products.

Who owns this data? The organizations tracking us do. Everyone has heard that “data is the new oil,” and boy is it valuable. An anonymized healthcare record is worth anywhere from $1500 to $5000 per person according to a 2020 study by E & Y. Whether it’s small-to-medium sized businesses

or behemoths like Facebook and Google, the world of Web2 creates siloed and centralized databases, primarily used for the self-interest of the organizations tracking us.

Well, things are about to change. With advancements in Web3 by companies like Constellation Network, the world’s data will soon be tokenized on an underlying interoperable infrastructure and shared across diverse businesses and diverse use cases. Best of allthe individuals providing the data can retain ownership and manage the use of their data for direct compensation.

Goodbye http. Hello hgtp.

How will this work? Constellation provides an open Web3 framework

that focuses on the interoperability of systems that play well with existing Web2 applications. Our technology is capable of tokenizing any data type on a massive scale, allowing anyone to own a piece of the web or build data-driven products and services.

Over the last five years, Constellation has developed an alternative blockchain network and Layer 0 infrastructure technology, called Hypergraph, that is faster, cheaper, and more secure than traditional Layer 2 blockchain infrastructures with stacked solutions, like Solana or Polygon. The Hypergraph provides an infinitely scalable framework for developers to build Layer 1 applications, like Bitcoin or

GOO$E Magazine 15.

Powered by Constellation Network

Ethereum, that can actually run on top of our network with any data dependency.

Just as the http protocol transfers data at the application layer on the Internet, our hgtp protocol (Hypergraph Transfer Protocol) transfers data at the infrastructure layer, supporting decentralized data-sharing around the world.

And hello USAF

Through our approach, we have secured multiple working contracts with the United States Air Force. This has not only validated our

technology, but has allowed the U.S. government the ability to explore new use cases for blockchain technology, such as data assurance.

“After going through a forensic deep dive with the Air Force Research Laboratory, which gives the gold stamp of approval to projects that are either vetted, ready to be absorbed, or denied,” says Benjamin Diggles, Constellation’s Chief Revenue Officer. “I was really happy to see we were validated and approved as a secure and scalable blockchain that is DoD ready.” Diggles

continues, “It doesn’t matter what company we work with in the commercial space, you’re not going to get a bigger stamp of approval than that. And this opens up the door to many, many opportunities.”

Constellation is the first vertically stacked Web3 ecosystem with the DoD-validated decentralized network infrastructure (Hypergraph) forming its foundation. In addition to the Hypergraph itself, we provide documentation and support for developers to build flexible Web3 applications on our protocol. We offer the Lattice Gateway where

GOO$E Magazine 16.

projects in our ecosystem can market their technology and cryptocurrency to our community. In Fall of 2021, we added a hardware division featuring the Dor Traffic Miner, or DTM, a hardware data validation node on our network that gathers data for buyers and compensates data providers with cryptocurrency rewards.

DTMs and Datapreneurs

Good data not only fuels the advancement of technology, it empowers the world at large. Constellation’s mission is to

provide tools and opportunities for datapreneurs everywhere to contribute honest data for a better future, starting with the ground truth—foot traffic.

Constellation’s DTM is a first-of-itskind battery-operated hardware device that an individual can peel and stick in any doorway to gather foot traffic data and earn cryptocurrency rewards. Now in partnership with Helium, FourSquare, and Snowflakeindividuals can deploy DTMs to collect data for interested buyers and get rewarded in our $DAG cryptocurrency.

“With the introduction of our DTM, now the crypto community can own a Dor device to collect foot traffic from any location and earn rewards,” says Michael Brand, CEO of Dor Technologies and Constellation’s COO, “Our play is about combining data from everyone’s devices anonymously and using it in aggregate to help individual retailers or other data buyers. As an independent third party, stores are actually happy to give us their data. They can’t see financial info about their competitors, but we can anonymize it to help them grow their businesses and insights without sacrificing their privacy.”

Every DTM purchaser receives an NFT you can register on our Lattice Gateway platform to start earning daily $DAG rewards right away. Additional bounties will be available when DTM devices ship later this year and in Q1 2023.

The Bigger Picture

Ben Jorgensen, Constellation’s CEO, adds “We view that anything can be a node on the Hypergraph,

offering value and resources back to the network. This is an open platform agnostic to any ecosystem, data source, or project regardless of the chain the token is minted on. The Node Manager on our Lattice Gateway platform ties rewards and bounties to a designated data source. By connecting a data source such as a Twitter account, a health monitor watch API, Constellation Network’s Hypergraph nodes, or a Dor Traffic Miner, we create programmatic rewards tied to data feeds.”

How can you get involved?

Check out our website at ConstellationNetwork.io and follow us on Twitter @Conste11ation to find out more about our technology and our upcoming equity rounds (coming Q1 2023). Discover the companies building with our solutions. Consider purchasing one DTM or several to become a datapreneur and gather as much data and crypto rewards as possible. Join the Lattice Gateway at Lattice.is to utilize our node management platform and interact with ecosystem projects to participate in early token allocations and fund promising startups launching on the Hypergraph.

Twitter @Conste11ation GOO$E Magazine 17.

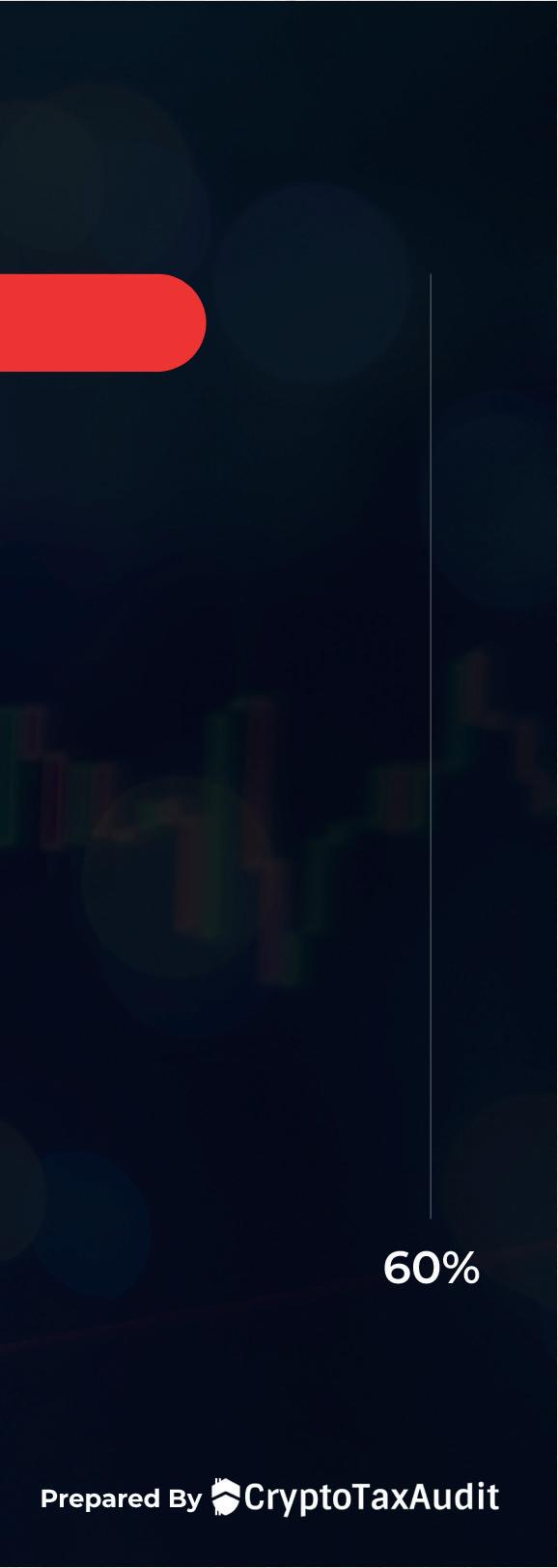

What’s Your Risk of an IRS Audit?

by Clinton Donnelly LLM EA, president and founder of CryptoTaxAudit

by Clinton Donnelly LLM EA, president and founder of CryptoTaxAudit

What are the odds that you’ll be audited by the IRS? Let’s start with some facts.

WHO GETS AUDITED

Back in 1963, nearly 6% of all U.S. taxpayers had their tax returns audited. It seemed that everybody knew someone who had been audited. The figure is lower today, but there’s more to the whole story. People with incomes over $500,000 are selected for audits up to 10 times more frequently. If you trade or invest in cryptocurrencies, that number is even higher.

THE IRS GETS $80 BILLION

The IRS Commissioner claimed in April 2021 that there were over $1 trillion in unreported taxes due, a number that he blamed in

large part on crypto traders. With that statement, the IRS effectively vilified all crypto traders. Why would the commissioner do that? It’s simple. He wanted more money from Congress, and he succeeded.

In August 2022, Congress awarded the IRS $80 billion in new funding over the next 10 years with the authorization to hire 87,000 new agents. That funding roughly doubles its operating budget and more than doubles the number of agents. What’s more, Congress stipulated that $46 billion be used for enforcement involving digital assets monitoring and compliance, by the IRS agents that carry badges and guns.

The new funding will also modernize IRS technology infrastructure, making it easier

to track, analyze, and profile U.S. taxpayers. With all these changes, the number of audits, especially crypto tax audits, will increase substantially.

With these dramatic upgrades to the IRS, how can you reduce your risk of an IRS audit, especially if you hold cryptocurrencies?

TOTAL POSITIVE INCOME

Of all the audit avoidance strategies that exist, the most important thing you can do is to account for all of your Total Positive Income or TPI, in your tax return.

What is TPI? Simply put, TPI is your income without expenses. Yet TPI also includes trading proceeds, including crypto gains from trades, swaps, and sales.

GOO$E Magazine 19.

Crypto exchanges have begun reporting your activity to the IRS over recent years. These reports, however, don’t necessarily account for your expenses, so each time you trade, swap, or sell cryptos, the IRS considers that a proceed. And proceeds contribute to TPI. For frequent traders, the Total Positive Income including trading proceeds can be extremely large.

For example, let’s say you buy $10,000 worth of bitcoin. A week later you sell the bitcoin to buy another crypto that’s worth $10,001. That’s a $1 gain, yet the proceeds are $10,001. If you do one trade a week for one year, gaining $1 each time, you’ll have proceeds

HOW THEY KNOW

The IRS knows about your TPI. They get information from the various forms that get filed and submitted to the IRS by employers, brokerages, crypto exchanges, and other companies. These are typically disclosed using forms W-2, 1099, and K-1.

The IRS has also gone to court to get customer records from U.S. crypto exchanges that didn’t comply voluntarily. If you bought cryptos at a U.S. exchange, it’s likely that they know about you too. The data they have maps crypto wallet addresses to your KYC information, so they know who

TPI AUDIT RISK

The growing risk for crypto traders isn’t just conjecture. Recent IRS statistics show very high audit rates for TPI above $500,000. As the simple example above shows, a trader with cryptos that may only be worth about $10,000 could trigger a $500,000 or greater TPI level.

Here’s actual data from 2019 showing the risk of getting audited by the IRS based on TPI. Based on this data, we added the audit risk projection for a 6-year period. As you’ll see, the chance of being selected for an IRS audit over the next six years ranges from 4% to

of $521,326. That’s the TPI, and that’s what crypto exchanges report to the IRS. Yet, during that same year, the value of your crypto is only worth $10,052 since your expenses are not included in your TPI.

owns which wallets. And with the transparency of the blockchain, the distributed public ledger of all crypto transactions, the IRS can easily track the movement of your cryptos.

over 50% at the highest TPI levels.

Remember, TPI is not how much you keep, it’s your income plus your proceeds without regard to your costs and expenses. So, your risk level may be higher than you thought.

GOO$E Magazine 20.

These fresh audit rates reflect the IRS’ commitment to Congress to dramatically ramp up audits on the wealthy. It’s also easier for the IRS to shakedown crypto traders than the ultra-rich who can use a phalanx of lawyers to befuddle the IRS accountants.

6 YEAR AUDITS

Normally, the IRS gets only 3 years to audit you after filing your return. They get 6 years if they can show you underreported your income by at least 25%. Because of the high TPI numbers for crypto traders, the 6-year window is very easy for the IRS to hit.

If your return is considered fraudulent, then there’s no time limit. And, the criminal prosecution threshold is quite low.

Did you answer NO to the virtual currency question on your tax return? Did you report only some of your crypto income? Did you choose not to report any of your crypto trades? If so, then you have no protection and the IRS has no statute of limitation.

WHAT YOU CAN DO?

When it comes to TPI, be sure to account for all of it. In fact, if you report more TPI on your tax return than the IRS was expecting, that’s good. The IRS shouldn’t bother you with an audit based on underreporting.

Note that Total Positive Income has a major impact on your likelihood for an IRS audit, yet there are also other ways to reduce your risk, techniques that we share regularly with our clients.

DEFEND YOURSELF TODAY

Regardless of your reporting strategy, nothing completely protects you from an IRS audit. The exact method for determining who is selected for an IRS audit is a closely guarded secret. So, you need proper defense.

Founded in 2015, CryptoTaxAudit defends crypto traders and investors during IRS crypto tax audits, appeals, and when necessary, in tax court. The company has an experienced team of crypto tax experts including CPAs, enrolled agents, forensic accountants, and gain calculation staff.

CryptoTaxAudit protects its clients with Audit Defense, its flagship membership service. Audit Defense was created in response to the growing cost of defense against the virtually unlimited IRS enforcement budget, where crypto audit defense can cost taxpayers from $50,000 to $100,000 or more, due to the complex nature of crypto tax returns and the IRS’ tenacious focus on crypto owners.

The IRS has their team of crypto tax experts. Shouldn’t you? Become an Audit Defense member today and gain peace of mind, available at CryptoTaxAudit.com.

Clinton Donnelly, LLM, EA, is the founder and president of CryptoTaxAudit. Clinton holds an advanced law degree in international financial planning including taxation and is an enrolled agent, a federally authorized tax practitioner. He is also regularly engaged in dozens of ongoing IRS crypto tax audits, each of which often spans several years. Clinton wins virtually every audit, often leading to the IRS paying significant tax refunds due to his aggressive defense and the amended tax returns that his company prepares for his clients underdoing IRS audits.

Clinton created the company’s Bulletproof Crypto Return Methodology, a powerful set of filing and disclosure techniques, to protect his clients from IRS crypto audits. He has filed over 1,200 tax amnesty returns with a 100% success rate and has helped over 1,150 crypto traders and investors in reporting cryptocurrencies properly on their taxes.

GOO$E Magazine 21.

Goose Magazine 22.

The Rise of Women in NFTs & Web3

If you had asked me 5 years ago where I thought I’d be, I would have most likely said managing a thriving social media agency. Instead, I’m working in Web3 and NFTs. I have always been interested in new technology and always try to be ‘in the know.’ Cryptocurrency and NFTs were an entirely new animal for me. I started hearing about it all when Joel Comm and Travis Wright developed an interest and decided to launch the Bad Crypto Podcast in July 2017. I listened but mostly glazed over when they started talking about cryptocurrency. Eventually, they had a need for someone to help with their social media and that was right up my alley. So, I took over managing

the social media platforms for the Bad Crypto Podcast; this was the beginning of my journey into blockchain, Bitcoin, and NFTs.

As the social media manager, I listened to every show to get more information to help determine

what to post on the various platforms. As I was doing this I was also learning about cryptocurrency. In this role, I started attending crypto conferences around the world, including Blockchain Paris, World Crypto Con in Las Vegas, Bitcoin Miami, and many more.

I noticed (how could I not?) that there weren’t many women in the space. I remember thinking many times how there was never a line in the women’s restroom (unheard of at large events normally). In particular, I remember being in Las Vegas at World Crypto Con and there not being another woman in the restroom. Crazy! At this point, I decided we needed to change that and start to bring more women into the space. As the Producer of

GOO$E Magazine 23.

the podcast, I actively sought out women in the industry to bring on as guests in the space.

Fast forward to 2020 when Joel and Travis launched The Nifty Show covering NFTs.

Again, they started talking about these jpegs and how they were going to change the world. The first time I heard about them was when they did a show about Cryptokitties and I thought how stupid it was to be breeding digital cats.

Little did I know, eventually, I would find myself obsessed with NFTs. It took me some time to figure it out and honestly, it was my cohost JeNFT who really sparked my interest.

We were chatting about NFTs and she talked about the womenfocused projects she was looking into. This got me excited and started thinking that this was the way to get more women into NFTs.

We decided to launch our own YouTube channel and podcast early

in 2022 covering women doing cool shit in the world of NFTs. On our channel, we help women get started through tutorials, cover the current events in the industry, and interview women who lead projects, are artists, or work in the space. Our goal is to shine a light on women in NFTs.

Since launching the podcast I have been invited to speak at the Non-Fungible Conference, Lisbon, NFTNYC, and most recently NFTLondon. My focus is to help women understand why NFTs are important, get started collecting, and invite friends and our audience into the space as this is how we will get NFTs into the mainstream.

Let’s do this ladies, let’s get the ladies’ room lines out the doors at the next crypto, blockchain, and NFT event!

Please follow @TheNiFTyChicks on your favorite social media platform; be sure to subscribe on YouTube or your favorite podcast player.

www.TheNiFTyChicks.io

Erin Cell has been in the blockchain and cryptocurrency industry for over four years as the Producer for the Bad Crypto Podcast and The Nifty Show. She has spoken across the US on social media before fully diving into the crypto & NFT space. She recently launched a new YouTube show and Podcast with her co-host JeNFT, called The NiFTy Chicks, which focuses on shining a light on women in the NFT space.

Twitter:

@erincell

@TheNiftyChicks @fame_ladies

GOO$E Magazine 24.

@NylaCollection

Lea Woodford, CEO SmartFem Media Group Take your business to the next level with Personal branding by Luxury Media Brands. For more info contact Lea@SmartFem.com

With Web 3.0 hype and user growth increasing every year due to tech innovation, the informed investor, regardless of crypto affinity, has become increasingly curious about adding exposure to this phenomenon in their portfolio. Of course, with any emerging technology, separating exciting opportunities from scams can be a daunting challenge. When it comes to exposing your portfolio

to blockchain/web3 (web3), there are countless ways to integrate it into your portfolio, some more conventional than others. These methods of gaining exposure include, most commonly, the purchase of digital assets such as cryptocurrencies but can also entail investing in companies that are integrating blockchain into their current practices to gain a competitive advantage. We’ll explore the different ways to expose your portfolio to Web3 in

a way that is as safe and secure as possible.

DIGITAL ASSETS

The most common, although not always most desirable, way of adding web3 exposure to one’s portfolio is through investment in digital assets. A digital asset, in its most simple form is anything that exists in a binary format that comes with the right to use. The definition of digital assets has evolved from photos, videos, data,

How To (Safely) Expose Your Portfolio To The Blockchain & Web3 Revolution

GOO$E Magazine 26.

and more to mean digital property that exists, usually, in the form of a cryptocurrency/crypto asset on a blockchain.

CRYPTOCURRENCY

A cryptocurrency is a digital asset designed to work as a medium of exchange of value that uses cryptography and blockchain technology to record and secure transactions while building a decentralized currency system of users. The most prominent blockchain use case and brand is the Bitcoin blockchain.

TOKENIZED PROPERTY

A token is a unit of value that has a protocol on an existing blockchain. Tokens can allow investors and owners to raise funds, similar to going public (ICO), on the blockchain. Through innovations in

Blockchain technology, the ability to “tokenize” assets has allowed for the ownership of assets to be split up and sold on the blockchain. Not unlike shares of a company trading on stock exchanges, the ability to tokenize assets has allowed the ownership of potentially anything to be securitized and traded. For example, a milestone for the digitization of real-world assets into tokens happened in 2018 when 18.9% of the resort hotel St. Regis Aspen was tokenized into the Aspen Coin.

METHODS FOR BUYING CRYPTOCURRENCY AND TOKENIZED PROPERTY

The most common and, arguably, safest way to buy cryptocurrency is through a reputable cryptocurrency exchange. Current consumer consensus has dictated that the

Coinbase exchange is the most reputable firm to exchange fiat currency (i.e. US Dollars) for cryptocurrency. The Coinbase exchange, however, is very limited in its offerings of crypto assets which is part of the reason it is safer than some of its smaller counterparts. Buying Bitcoin on Coinbase is as easy as making an account, entering your bank information, and making a purchase. Another prominent cryptocurrency exchange is the Binance exchange headquartered in Malta. This exchange, according to volume metrics from coinmarketcap.com, is the world’s largest cryptocurrency exchange. Binance is not as easy to use as a fiat gateway, or a primary exchange for fiat-to-crypto and crypto-to-fiat transactions, but is excellent for crypto-to-crypto trading because it has a wide range of tokens and currencies listed on its platform. Of course, when using a centralized exchange such as Coinbase or Binance you’re exposed to significant risk because of your dependence on that central entity. While trading on the exchange, it’s crucial to enact the proper security protocols such as a strong password, private internet network, and two-factor authentication using an app, not SMS. Once your transactions are complete on the exchange, we recommend transferring your crypto assets into a wallet that is in your control. Leaving your assets on the exchange leaves your funds vulnerable to hacks of the exchange, poor risk management, raiding of the coffers by employees (*ahem* FTX *ahem*), and other potential risks. Leaving your assets on an exchange is not recommended.

GOO$E Magazine 27.

P2P - A less common way to buy cryptocurrencies is through peerto-peer networks which many Bitcoiners prefer. These services connect individuals looking to buy/ sell cryptocurrency with other individuals looking to sell/buy cryptocurrency. These networks are preferable if you desire no intermediary like Coinbase. Unfortunately, due to the peer-topeer nature of these transactions, they come with a higher risk of getting scammed. Two prominent peer-to-peer networks are LocalBitcoins.com and Paxful.

CONCLUSION & PRACTICAL APPLICATION FOR YOUR PORTFOLIO

Investors looking to gain blockchain exposure in their portfolio must consider the different ways that one can, directly and indirectly, invest in web3. If an investor would like to directly invest in blockchain, they should research what cryptocurrencies or digital assets they would like to buy and place their orders on a reputable exchange, then transfer to their wallet.

For the crypto-curious investor, there are several guidelines I recommend following. Most importantly, you must never invest more than you can afford to lose in this extremely speculative sector. Once you’ve identified the prudent amount of your portfolio to allocate to these high-risk assets, it’s crucial to do your research on investment opportunities and diversify the sources of your information. Unfortunately, this space can be very “tribal” and individuals’ favorite crypto projects are often treated like their favorite sports team. Develop your criteria and

DISCLAIMER: This article mentions specific companies, crypto projects, crypto exchanges, and other entities. These mentions are purely for illustrative purposes and not meant to be construed as a public endorsement of these firms in any way, especially as an investment. While the opinions of Ascent Personal Finance LLC, a registered investment advisor, and Zechariah Schaefer, a licensed investment advisor, are shared, no portion of this article is meant to be construed as investment advice, an official market outlook, or personalized recommendations for your situation. Past performance is not indicative of future results. Investing has risks and loss of principal may occur. The aforementioned risk is exponentially increased when cryptocurrencies are involved. Before taking action on any information shared in this article, it’s crucial you consult with the appropriately qualified & licensed investment, tax, legal, or other professional counsel.

28.

GOO$E Magazine

fundamental analysis of a project’s strengths and weaknesses. Once you’ve invested your funds, ensuring you have an airtight security protocol is your next step.

If you have an amount invested in crypto you want to protect, we recommend transferring your crypto off of centralized exchanges to cold wallets (Trezor, Ledger, etc.) that you have control over. The phrase “not your keys, not your crypto” has never been wrong and, unfortunately, was most recently reinforced through the FTX debacle. Finally, once you’ve invested and stored your cryptocurrency, it’s imperative to build a system that allows you to keep track of your crypto assets for portfolio management, tax planning, and tax minimization purposes.

For prospective investors with lower risk tolerance and who want

exposure to this revolutionary technology, it may make sense to focus on blue-chip cryptos like bitcoin. To avoid suffering the same fate as the bagholders of Pets.com, the FTX bankruptcy, and similar ventures, they likely must invest in established companies that are integrating web3 to widen their competitive advantage.

Past performance is not indicative of future results, but let’s look at the parallels from the Internet. In the same way that the companies that integrated the Internet effectively in the 2000s experienced significant growth compared to their slower-moving competitors, companies that are effectively integrating web3 to gain competitive advantage are positioning themselves to dominate their competitors in the mid-far future.

Zechariah Schaefer runs

Ascent, a wealth management and tax firm serving successful crypto investors. He offers a comprehensive service, covering clients’ complete financial picture as well as crypto-specific expertise, he helps them to intentionally manage their growing wealth, reduce taxes, invest wisely, and more. The unique approach he and his firm take, along with building 10,000+ LinkedIn followers through engaging napkin presentationstyled infographics, has resulted in features in Forbes, CNBC, Investopedia, and others.

www.linkedin.com/in/zechariah-schaefer/

GOO$E Magazine 29.

The Rise of the

Pseudonymous Leader

History has shown us that great leaders can rise up as a oneman army or lead a revolution, often under the protection of anonymity. The impact true leaders fighting for freedom and independence can start the foundation of a country or begin movements that shape society. Leaders so passionate about their message or purpose often risk their own lives or freedoms in hope of a better way of life for all, wouldn’t you agree?

Pen names or aliases are less commonly referred to as a pseudonym. Pseudonymity has been popularized by gamers and cypherpunks in the digital world - one of the most famous being Satoshi Nakamoto, the creator of Bitcoin. America’s earliest roots and values were penned by Publius,

the author of The Federalist Papers, seeking ratification of the Constitution, later revealed to be collective writings from Alexander Hamilton, James Madison, and John Hay. Pseudonymity allowed these founders a shield of protection to “do only good everyday” or DOGE, the popular meme coin, with another pseudonymous founder. Would America’s history be different if the identities of The Federalist Papers authors were known? We can assume Bitcoin would have never made history if its creator was known. Disrupting power and control gets a lot of attention that a one-man army cannot defend against.

Investors playing in the highly volatile decentralized finance (DeFi) space are watching with similar interest, as the interest paid to Pluribus, to what is being

developed by Forex_Shark. Forex, the creator of DeFi apps Drip and Animal Farm, is one of a number of a new breed of pseudonymous business founders that have sprung up through the advent and high adoption of get-rich-quick schemes in the DeFi space. While a number of these founders, such as Forex, are creating projects for the long term, there are many who do nothing but set up projects with the sole intent of using their anonymity to fleece investors of wealth and disappear into the crypto ethers. So, who are these pseudonymous founders, why the secrecy, what are their projects and how do we know what to look for in crypto so that we are not on the receiving end of another one, in a string of rug pulls?

We will discuss what we look for in creating criteria for fundamental

“This power over the purse may, in fact, be regarded as the most complete and effectual weapon with which any constitution can arm the [people’s] immediate representatives.”

GOO$E Magazine 31.

~James Madison, The Federalist Papers

analysis of DeFi projects while telling the Forex story. What we look for first is the leadership of a project and the vision they are communicating to the community they want to build. If this develops the way Forex envisions, we could see the proven use case of non-custodial DeFi, without the oversight of greedy founders with ego-driven ambition, while remaining anonymous.

Doxxing, or publicly documenting personal information via the Internet, oneself has given a false sense of security to investors as we have seen from the demise of Luna and FTX. For the undoxxed, increased scrutiny and sophistication within crypto communities has made it challenging for these individuals to launch short-lived schemes and hide investor capital. Experienced crypto leaders are pulling together to self-govern and expose bad actors.

We have experienced the journey along with Forex because of his communication with the community. The thousands of members that have made enormous profits got clouded by delays in rollouts of the next update to Animal Farm. Protocol investors appreciate tips on best practices and timely information, which Forex has greatly improved. Millions of funds have been committed - many investors believe what is coming will be revolutionary in this space. Animal Farm is about to hit the Top 10 DeFi projects according to DefiLlama. There are over 130,000 DRIP wallets currently, with plans to go over 1 million in the ecosystem.

Let me share with you what

Forex has hard-coded into the foundation of what he is building - The right culture and values! Greed is one of the biggest threats to crypto and any project trying to build successfully on blockchain technology. DeFi is considered high risk for many reasons - one huge sell order can trigger fear of an imminent collapse. DeFi is about investors being able to take their risk capital or idle coins and tokens, and pledging them as loans or liquidity to earn a yield on that investment. What Forex has done is combined elements of traditional financial (TradFi) models and rebuilt those models on the blockchain using smart contracts, cutting out the need for middlemen - banks and insurance companies. Talk about disruption and getting attention from the wrong people!

reward good user behavior and penalize poor interaction. He has eliminated the greed factor and added a “code” of valuespatience, personal responsibility, self-reliance, and good economic stewardship. Lastly, at any time the user can hold the $DRIP, and $AFP (PIGS) tokens in their wallet to participate in market swings with liquidity or they can deposit them into the contracts. Players trade full access to those tokens for a potentially better yield and/or future payout. It is your choice how YOU play the game.

LEADERSHIP

Drip Network is a communitydriven platform that Forex designed to grow on its own wordof-mouth advertising. There are

He also saw that the crypto communities develop their own culture. Like any business, its leadership spreads culture through the organization. With smart contracts, you can, in effect, preprogram the foundation of culture. A reason we see value in Animal Farm is it supports our lesson of don’t kill the goose that lays the golden eggs. The key here is building DeFi platforms with smart contract technology that cannot be changed. What also cannot be changed is how the game operates. He has put in limitations that help control human behavior around money within the contract. The contracts

no developer fees. He became independently wealthy through his own trading and developer skills, then built a discord community to spread what he was doing to help others. We also trust him because no one in his past has said anything to discredit him and his actions are consistent with this. He has embraced being a leader to many. As you listen to his interviews, one can tell there are characteristics of a savant creating his masterpiece to give to the world.

He maintains his pseudonym, Forex_Shark. The term Crypto Twitter uses to describe this shield is #Anons. He has not doxxed

GOO$E Magazine 32.

himself publicly due to the fact that he is disrupting financial models and needs to protect himself and the ecosystem. We assume he is (North) American with English as his native language. He could have made off with millions or quit at any time over the last 18 months. Without showing his face, he attends countless interviews and communicates consistently within the community as a leader. Unlike public-facing business leaders, Forex knows investors’ options are un-staking when possible and selling if leaders are not held accountable to their timelines and their word. The beauty of this is that developers have an incentive and carte blanche to develop what they feel the community wants according to their timelines. The downside is that investors’ funds can be locked up for months. The minor concerns we witness are the delays and he innovates as he goes with no clear roadmap to build a perfect ecosystem. Some with less patience have moved on and have doubts while others know technology and financial models take time to build the right way.

NETWORK FOUNDATION

An active and loyal community - to sustain the rise of a pseudonymous founder they need support from their team and community. Healthy community involvement is another key factor in Drip and Animal Farm’s success. An affiliate component rewards referrals like most organically grown models. 10% of the initial deposit goes to the person who invited you only one time. What’s unique is anyone in the community can share Drip with another and increase everyone’s bags. There are fun contests, voting on dank

memes, and rewards shared for participating. As a result, the Drip community has attracted over 130,000 wallets or players to its ecosystem because of its simple story.

The Drip Faucet contract is an annuity or certificate of deposit model that runs on the $DRIP token, paying out 1% daily of deposited funds. Like an annuity, you deposit your funds in exchange for a stream of income over time. It has been operating and yielding 1% since April 2021. You can claim or re-compound that 1% daily ROI. As of the end of December 2022, the token has decreased in excess of 95% during this bear market. Yet, holders who compound daily see their token holdings double about every 75 days, which has eased the decline. Forex sees the inflation and is creating an added utility to increase buying pressure and decrease selling pressure. Will Animal Farm and the supporting gamification that is coming into play soon attract enough new investors to bolster liquidity? Let’s explore those pieces of the ecosystem below and how Forex innovates.

THE ANIMAL FARM

community-owned, non-custodial protocol. The theme of this project is based on, you guessed it, the book, Animal Farm, by George Orwell. For those of you not familiar with this work, Animal Farm is a fable warning about Communism told through farm animals who rebel against their farmer wanting freedom, equality, and happiness. The theme has pulled the community together in anticipation of the next rollout of the game. Memes and creative content of dogs and pigs’ likenesses from the book have been spread throughout social media.

The Drip Garden was the first component of Animal Farm adding more utility and liquidity to Drip. Then the announcement came for the Manor Farm which ultimately would change to Animal Farm. The $AFP (PIGS) and $AFD (DOGS) tokens are the native tokens in the ecosystem. Yield Farming in crypto is investing in income-producing digital assets to create passive income and steady profits.

The community wanted more and he got busy building on, what Forex considers his “masterpiece” with the creation of Animal Farm, a

We saw the next step of his vision when he announced PIGS token holders in the Pig Pen can be owners with governance rights of Animal Farm. By staking PIGS you reap rewards in a non-native token, in this case, the Binance

GOO$E Magazine 33.

Smart Chain’s stablecoin, $BUSD. What having a stablecoin provides is easing the selling pressure on PIGS, letting investors hold the asset while still profiting from yield. Yield comes from the fees collected transacting with the protocol plus collateral rehypothecation as a source of fresh capital to fight Ponzi-like models. Rehypothecation was a prevalent tool used by hedge funds to maximize gains from their clients’ capital and rebate back a portion of those yields to them. It was too risky for global regulators and centralized models. In a decentralized model, Forex uses a portion of the liquidity within Animal Farm, buys $CAKE, and deposits it in pools within Pancake Swap that generate a 30-40% APR. He then rebates that back to the Pig Pen holders in $BUSD. You don’t have to sell PIGS to take profits! This is one of the best strategies we have seen for a generous high-yield reward system. Most protocols emit their own native token as yield which leads to inflationary circulation and deflationary prices.

Next came the Piggy Bank. It is a user-customized, timed annuity contract. There was a bot attack within the original $DOGS contract and Forex had to pause Animal Farm. He quickly saved millions from being drained from the contract. The token contracts had to be re-issued as $AFD and $AFP.

The exploit was a true test of his character and he spent the next 6 months rebuilding. He could have walked away and given up. He reformulated the tokenomics and released V2 of Animal Farm with key functionality for $AFD that rewards holding and severely penalizes selling after a pump in

price. His plan is to be the yield farm protocol for staking your idle blue chip coins and earning $AFD and $AFP tokens.

For further research, reference community updates on Medium and the wiki page:

Pen, the development team, and marketing.

ANOTHER LEGACY IN THE MAKING?

www.medium.com/@f0r3x_shark www.dripcommunity.wiki/

WHAT’S NEXT?

A key component of building a successful network is attracting new users and keeping the community and user base coming back for more. Users already visit both the Drip.community and AnimalFarm.app DApps (decentralized applications) on a daily basis to compound their gains and claim profits along the way. His long-term vision includes use cases of lending, insurance, and privacy. He is managing community expectations and planning more features to include a digital scratch-and-win lottery ticket called, “Scratchy” that can be whitelabeled for additional revenue, a more professional Drip interface, and two other games involving Animal Farm. A portion of the fees generated will go to DRIP, the Pig

You know you are doing something right when countless devs are copying you or forking off of your code. Community developers are creating tools to support the ecosystem and its users. Check out https://dripfi.app for a simple interface to determine your holdings and yield values. Is the Animal Farm becoming a paragon of decentralized finance? The model to duplicate to invest capital, print tokens with liquidity, and take profits? Currently, it’s one of the few, if not the only project to create a massive feedback loop to take profit without having to sell the native tokens.

What all these pseudonymous leaders have in common is what George Orwell said was his reason for writing Animal Farm, “to fuse political purpose and artistic purpose into one whole”. Pluribus and the Federalist Papers historically accomplished this by leading and uniting the people to ratify the US Constitution. Satoshi Nakamoto was the catalyst for the potential of blockchain or distributed ledger technology by creating Bitcoin as a solution to central bank failures and beginning a quiet revolution hidden in plain sight. Leaders like Forex are innovating further to continue the fight for financial freedom.

*Authors in this article have been participating in Forex_Shark projects and the community-grown ecosystem since December 2021.*

GOO$E Magazine 34.

The Rise of the Young Bitcoin User

A Day of Supporting Financial Education and Business in Middle School

By Charlie Stivers

Hey Mister, I accept Bitcoin!

This was the day’s mantra shouted by business students at Thrive Prep Charter School’s entrepreneur assembly for middle school kids. I was invited to help a few Denver-area bitcoiners teach the kids how to use digital wallets on the Lightning Network so they could all do business together. At the end of the entrepreneur fair, you could tell most of the 7th and 8thgrade mini-business boys and girls all felt a sense of achievement and some added excitement looking at their Sat’s balance in their wallets.

From a barbers chair and shoe shine booth to a smoothie stand and eyelash extension stylist, these kids were inspired to create their own businesses and make some extra money. The sats they began stacking in their wallets were an easier way to collect payments.

100 MILLION (SATS)

SATOSHI’S = 1 (BTC) BITCOIN

The day started with Anthony Feliciano and Mark Maraia showing me the Muun wallet functionality. Super easy download, set your PIN, fund your wallet from another bitcoin stash, and secure the wallet another day in private. I discovered that the previous week they taught the students a series of lessons on money and bitcoin and how they could become sovereign or autonomous entrepreneurs. The event was sponsored by WeStrive who contributed $50 in seed capital to each little entrepreneur to start their businesses. The Rocky Mountain bitcoiners group raised about $500 in BTC to be distributed to all the participants. We had fun funding their Muun wallets with Sats and showing the vendors how to create invoices to get paid.

We all gathered in the school’s gymnasium - vendors were set up just like science fair exhibitors, but these kids were ready to do business together. The buyers scurried around us in anticipation of having

GOO$E Magazine 36.

portions of bitcoin in their wallets ready to send to their friends for goods and services they wanted. It was fascinating to see how easy it was for the 12 and 13-year-old digital natives to “get it” and start using it intuitively. Even their proud teachers had fun buying crafts and homemade treats from their students with their wallets.

THE BITCOIN TAKE-AWAY

This event was the perfect real-life scenario of how microtransactions can work effectively for a peer-topeer transaction with BTC. Each Lightning Network transaction was literally transferred in a flash. On a $5 transaction or 0.00030510 sats (BTC) the processing fee was $0.04. Less than a credit card transaction! Beyond P2P, this gives an undeniable use case for businesses of any size. With the expensive fees and delayed settlement times inherent with blockchain transactions, users have wondered if the blockchain could handle micro-transactions, $10 or less, like we do every day. Fast settlement and low fees - This is the first step in seeing Bitcoin transactions become ubiquitous. People who only think Bitcoin is a store of value need to take a look at what is being developed on Bitcoin’s layer 2, the Lightning Network.

Hey Mister! The kids proved that it works - they accept bitcoin now too!

GOO$E Magazine 37.

Banking on the Future

How Financial Institutions Can Successfully Navigate the Web3 Revolution

By Zemfira Khisaeva

By Zemfira Khisaeva

As the digital landscape undergoes a shift to decentralized infrastructures powered by AI and immersive technologies, the banking sector finds itself at a crossroads. Adaptability, innovation, and collaboration have emerged as the triumvirate of success. Embracing this powerful trifecta becomes not only a competitive advantage but survival itself. Leadership among legacy banks, legislators, and regulators has an opportunity to support policies that drive innovation and cooperation; archaic models will face further digital financial migration to decentralized models or institutions that support the people.

Over the past two decades, technological advancements have led to the emergence of Web3-based technologies such as blockchain, NFTs, smart contracts, immersive “metaverse” environments, and artificial intelligence. These technologies transform how individuals and businesses socialize, learn, work, and transact financially. However, immense, untapped potential exists for digitalizing, transferring, and safeguarding blockchain assets, presenting a unique opportunity for many businesses.

WEB3: THE KEY TO UNLOCKING WEB3 POTENTIAL IN BANKING

The emergence of Web3 promises significant advancements for the

banking industry with a focus on enhanced security, transparency, and growth opportunities.

Increased security and transparency are one of the most immediate advancements from adopting this technology. The inherently decentralized and transparent blockchain technology not only increases security by reducing the risk of fraud and cyber-attacks but also promotes transparency by providing a clear record of transactions that can be accessed by all parties involved.

Technology can also streamline and automate many processes, increasing efficiency and reducing operational costs. Processes that are complex in their current form, such as loan approvals or cross-border payments, can be

GOO$E Magazine 39.

streamlined by smart contracts and DeFi platforms.

“In addition to creating efficiencies in existing processes, Web3 presents a significant opportunity for banks to develop innovative financial products and services that lead to new revenue streams.”

EARLY-MOVER ADVANTAGES AND UNTAPPED OPPORTUNITIES

In addition to creating efficiencies in existing processes, Web3 presents a significant opportunity for banks to develop innovative financial products and services that lead to new revenue streams. Early adopting banks can cater to the changing needs of their customers, such as seamless crossborder payments, instant settlements, and fractional ownership of assets. These types of products and services can offer greater convenience, security, and accessibility to customers, in turn leading to increased loyalty and market share.

Traditional exchanges can leverage Web3 technology to increase accessibility for small investors by reducing transaction costs, improving liquidity, and shortening settlement times. Crypto exchanges can integrate crypto/equity pairs, expanding their offerings and generating trading fees. Investment firms can tokenize traditional financial products, providing more secure options in regulated marketplaces. Hedge and venture

funds can tokenize their portfolios, offer fractional ownership, and broaden investor pools. Finally, global retail investors can invest in traditional financial products with minimal capital while accessing new opportunities using fiat or crypto holdings.

OVERCOMING CHALLENGES TO MAINSTREAM ADOPTION

While there are many compelling reasons to adopt Web3 technologies, Digital Asset technologies are facing challenges in gaining mainstream adoption, as does any technology early in its lifecycle. Two significant challenges specific to Digital Assets are compliance and onboarding.

Compliance issues arise as many of these technologies operate in a regulatory gray area, unlike traditional financial systems that are subject to established

regulations and standards. This lack of oversight can expose users to risks they may need help understanding, making it essential for banks to navigate this landscape carefully and responsibly.

Onboarding presents another challenge, as integrating these new technologies into existing banking systems requires a delicate balance between innovation and familiarity. Traditional financial institutions must find a way to adopt these new technologies without disrupting their established business models while simultaneously providing all the benefits of Web3 and preserving all the features valued by customers and required by regulators.

Complex onboarding processes, limited bridge security, and the technical knowledge needed to manage funds using a single seed key can be daunting for everyday users. Therefore, banks must develop userfriendly solutions that can bridge the gap between the old and the new, making the shift to Web3 seamless and accessible for all.

To bring Web3 mainstream, we need clear regulations, a strong focus on UX/UI, and education of both the TradFi institutions and the developer community. Even the most knowledgeable and powerful influencers within “Crypto” do not understand the existing global economic systems, financial infrastructures, and how large and small institutions actually operate.

GOO$E Magazine 40.

KEY STRATEGIES TO NAVIGATE DIGITAL TRANSFORMATION

Banks striving to stay ahead of the curve and capitalize on the potential of Web3 technology must adopt a proactive and comprehensive approach to navigate this digital transition effectively. To succeed, financial institutions should focus on three fundamental aspects of their strategy: stakeholder collaboration, experimentation, and cultural adoption.

Stakeholder collaboration

Banks should actively engage with various stakeholders within the Web3 ecosystem, including technology partners, regulators, and other financial institutions. This collaboration can lead to valuable insights, shared best practices, and the development of standardized solutions, ensuring a smoother integration of Web3 technologies into existing systems and processes.

Experimentation

Embracing experimentation is crucial for banks to identify areas of opportunity and address potential challenges that may arise during the transition. By establishing innovation labs or partnering with fintech startups, banks can test and iterate Web3based products and services in a controlled environment. This process allows financial institutions to refine their offerings and develop effective strategies for scaling and deploying these technologies on a broader scale.

Cultural adoption

To ensure a seamless transition to Web3 technologies, banks must foster a culture of continuous learning and upskilling among their employees. This includes investing in training programs and other educational resources that enable employees to develop the skills and knowledge needed to navigate the changing landscape. Encouraging cross-functional collaboration and empowering employees to contribute ideas for leveraging Web3 technologies can also help drive innovation and accelerate adoption.

The financial sector stands at a critical juncture, with the Web3 revolution poised to redefine the industry’s future. Banks can confidently navigate this transformative era by embracing stakeholder collaboration, experimentation, and cultural adoption. As financial institutions chart their course through these uncharted waters, the proactive adoption of Web3 technologies will not only shape their competitive advantage but will also determine their ability to thrive amid the relentless waves of change.

Zemfira Khisaeva Co-Founder and President of yWhales, an ecosystem focused on shaping the business of Web3 and helping its members expand their perspectives, accelerate their progress, and seize the monumental opportunity to create a better human experience.

Zemfira and the yWhales team develop solutions in the enterprise blockchain space through its five divisions: Communities (outreach, collaboration, and education); Ventures (due diligence, value creation, and rapid capital deployment); Solutions (consulting, strategic planning, and onboarding); Labs (innovations connecting the real and digital world); and Digital Assets (TradFi to DeFi focused on compliance, security, and regulation).

GOO$E Magazine 41.

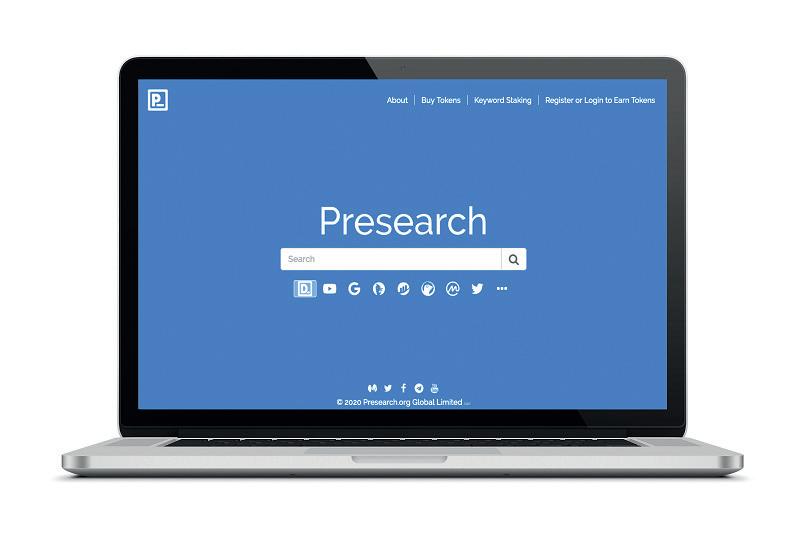

Presearch is a community-powered, decentralized search engine that provides better results while protecting your privacy and rewarding you when you search. Presearch's ads model is dedicated to creating significant value for marketers who would like to reach Presearchers. Join the Presearch community and help us build a decentralized alternative to the big tech search monopoly.

Debunking Bitcoin’s 5 Biggest Myths

By Nick Donaldson

By Nick Donaldson

The price of bitcoin has fallen to a twoyear low and many people are concerned about it. However, many people are considering allocating a portion of their portfolio to crypto. In making this decision they will be confronted with several common myths about Bitcoin’s underlying value proposition, historical performance, and regulatory status that cloud their thinking such as:

• Bitcoin does not have any intrinsic value.

• Bitcoin isn’t secure.

• Bitcoin is too volatile.

• Bitcoin is illegal.

• Bitcoin is used only by criminals.

These misconceptions act as impediments to people making educated decisions about their financial future so it’s important to do your own research. This article aims to clear the way and get them the answers they need.

MYTH #1: BITCOIN DOES NOT HAVE INTRINSIC VALUE.

The most common misconception about bitcoin is that it is not real. In some circles, there is a belief that bitcoin has no intrinsic value due to:

• It isn’t issued and backed by a central bank.

• It has no long-established history of serving as a store of value like gold.

• It’s not a raw material used in the production of goods such as jewelry.

• Due to its digital nature, you can’t touch or feel bitcoin.