DRAFT BUDGET 2022-23

GOLDEN PLAINS SHIRE COUNCIL

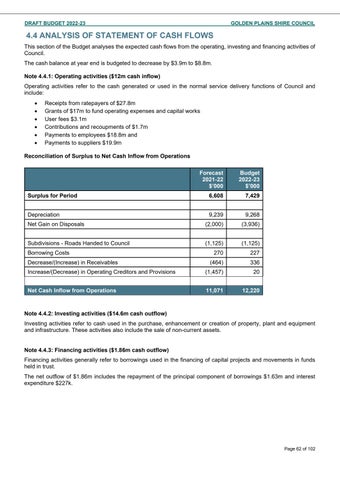

4.4 ANALYSIS OF STATEMENT OF CASH FLOWS This section of the Budget analyses the expected cash flows from the operating, investing and financing activities of Council. The cash balance at year end is budgeted to decrease by $3.9m to $8.8m. Note 4.4.1: Operating activities ($12m cash inflow) Operating activities refer to the cash generated or used in the normal service delivery functions of Council and include: • • • • • •

Receipts from ratepayers of $27.8m Grants of $17m to fund operating expenses and capital works User fees $3.1m Contributions and recoupments of $1.7m Payments to employees $18.8m and Payments to suppliers $19.9m

Reconciliation of Surplus to Net Cash Inflow from Operations Forecast 2021-22 $’000

Budget 2022-23 $’000

Surplus for Period

6,608

7,429

Depreciation

9,239

9,268

Net Gain on Disposals

(2,000)

(3,936)

Subdivisions - Roads Handed to Council

(1,125)

(1,125)

270

227

(464)

336

Increase/(Decrease) in Operating Creditors and Provisions

(1,457)

20

Net Cash Inflow from Operations

11,071

12,220

Borrowing Costs Decrease/(Increase) in Receivables

Note 4.4.2: Investing activities ($14.6m cash outflow) Investing activities refer to cash used in the purchase, enhancement or creation of property, plant and equipment and infrastructure. These activities also include the sale of non-current assets. Note 4.4.3: Financing activities ($1.86m cash outflow) Financing activities generally refer to borrowings used in the financing of capital projects and movements in funds held in trust. The net outflow of $1.86m includes the repayment of the principal component of borrowings $1.63m and interest expenditure $227k.

Page 62 of 102