Long Layovers have a Greater Purpose

GTRMAG.COM GTRMAG.COM Avolta strengthens in the Americas p. 8 Change in leadership at ASUTIL p. 16 Lima Airport to debut airport city concept p. 20 JUNE 2024 VOL 36 · NO 4

JUNE 2024 · VOL 36 · NO 4

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Company Inc. The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor. June 2024, Vol 36. No. 4. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Company Inc.

GLOBAL TRAVEL RETAIL MAGAZINE

Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER

Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT

EDITOR-IN-CHIEF

Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR

Laura Shirk laura@gtrmag.com

SENIOR WRITER Alison Farrington alison@gtrmag.com

SENIOR EDITOR Wendy Morley wendy@gtrmag.com

ART DIRECTOR Jessica Hearn jessica@globalmarketingcom.ca

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

Cruising to new heights

This ASUTIL issue marks the mid-point in our annual production calendar and we are pleased to report 2024 has been an exciting year in travel retail. Across the industry, brands, retailers and associations are making headlines for their ongoing push for innovation, creative partnerships and sustainability efforts. Considering the potential for growth in the channel, we expect the second half to offer similar news.

In an exclusive interview with Avolta President & CEO LATAM & Caribbean Enrique Urioste (on page 8), we learn about how the company is performing in the Americas and adapting to local consumer trends and economic conditions. He underlines Brazil’s key role in Avolta’s growth in Latin America and the integration of retail and dining experiences. Right now, the retailer is in the midst of negotiating a major new food and beverage operation in the country.

With the new state-of-the-art passenger terminal at Jorge Chávez International Airport on track to open in December, we also connect with Lima Airport Partners (LAP) for an update. LAP is on a mission to introduce the “airport city” concept to South America. The real estate development plan will see the integration of airport operations and smart infrastructure with the capital city.

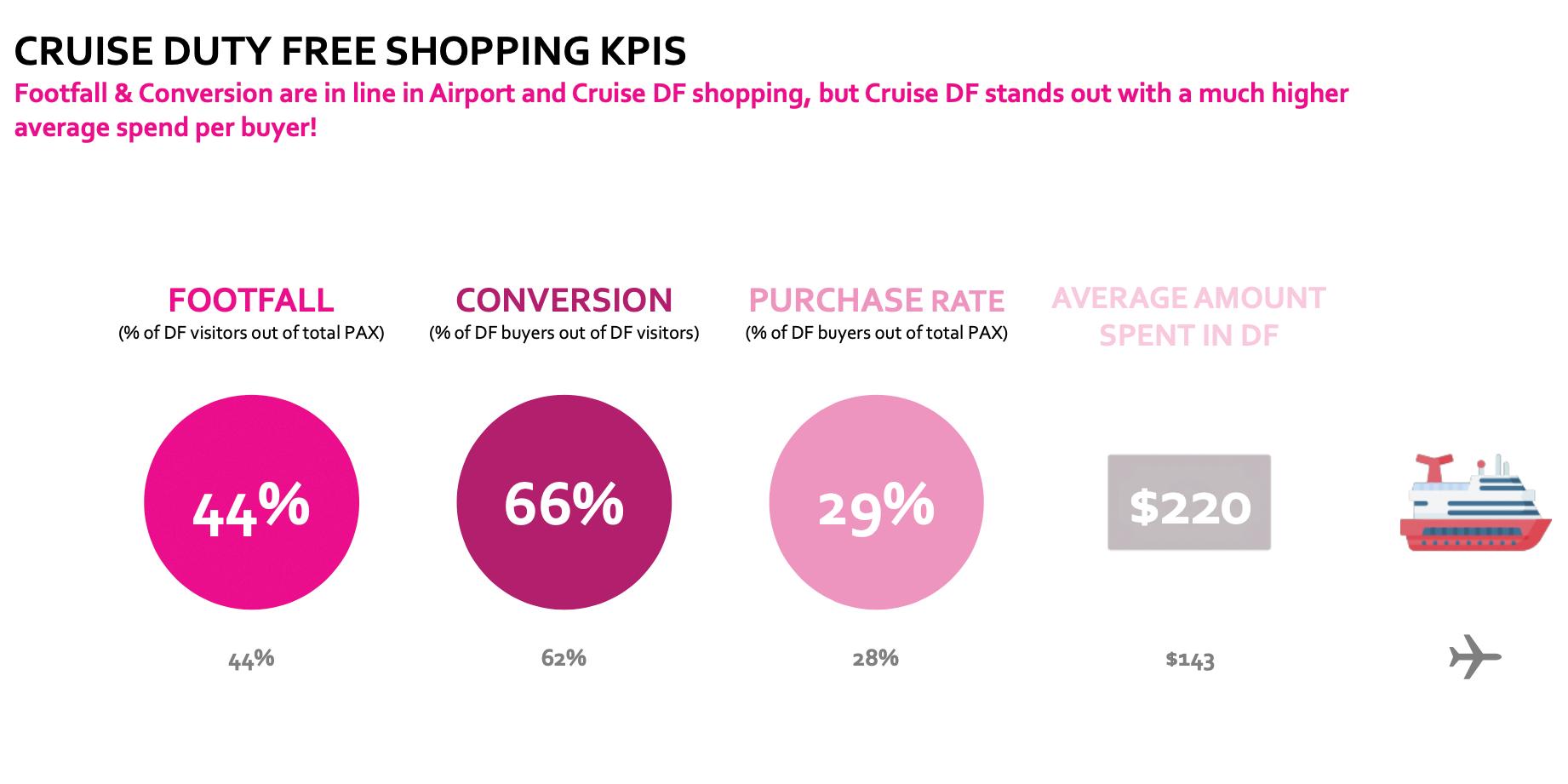

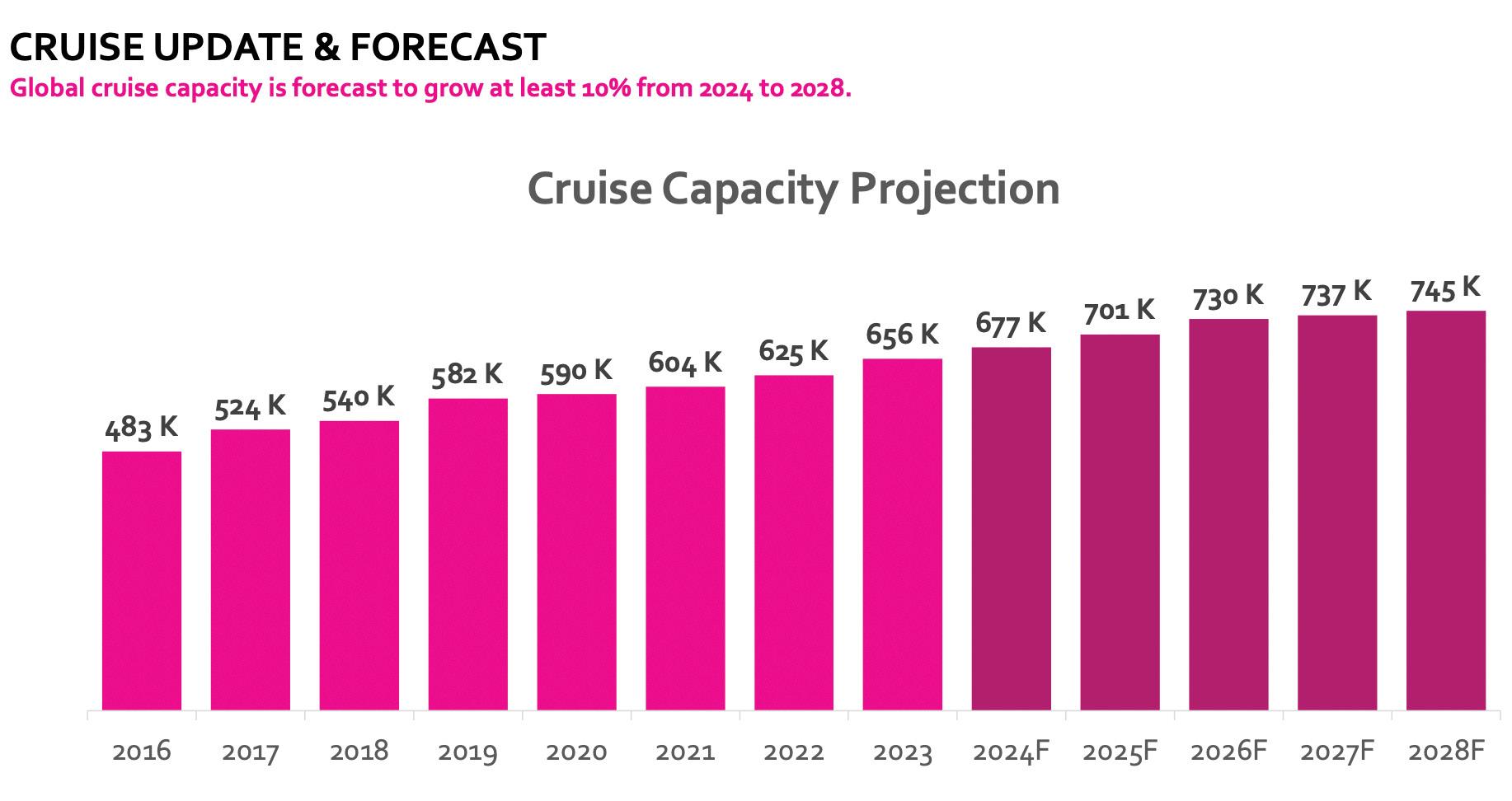

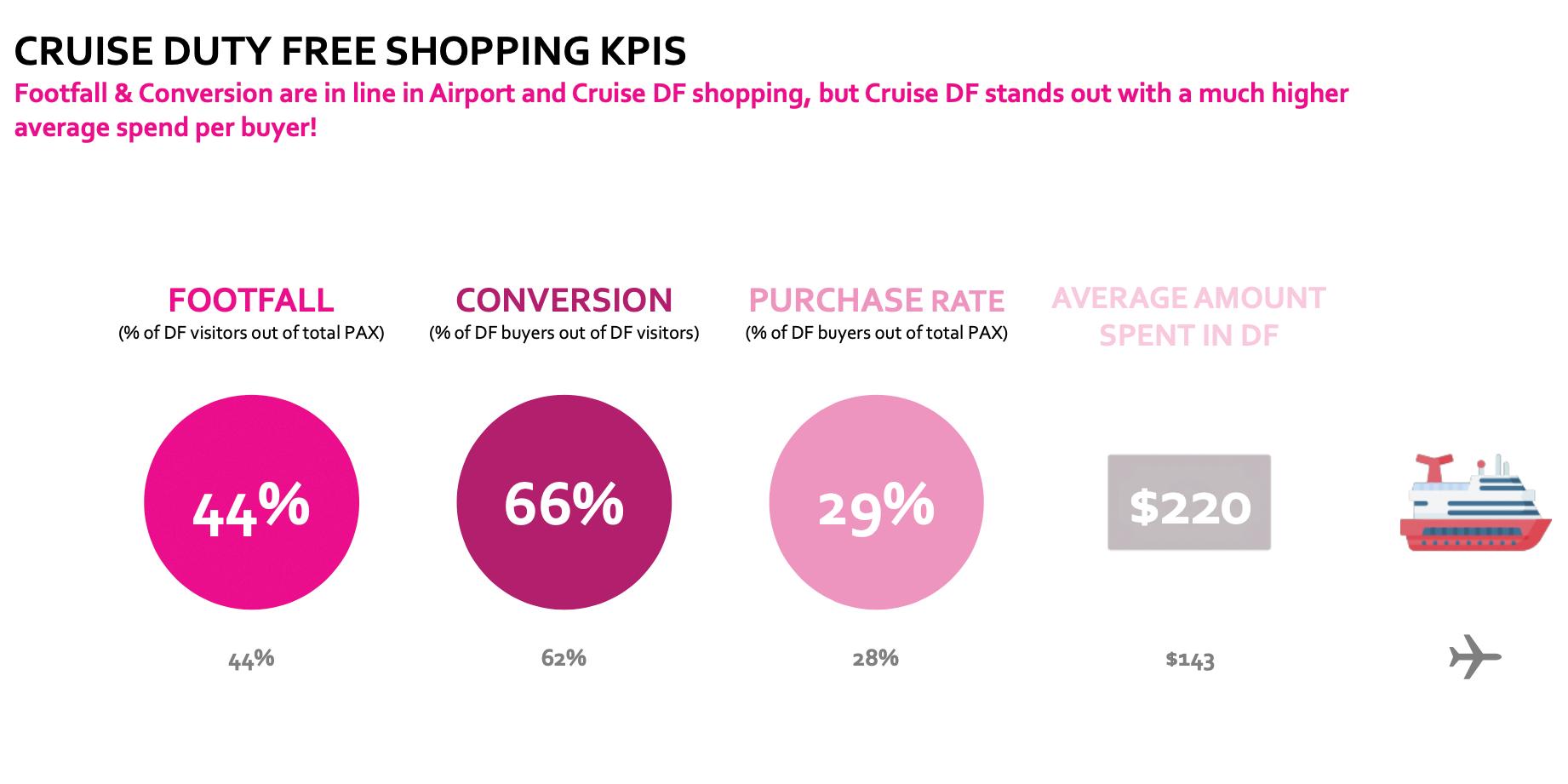

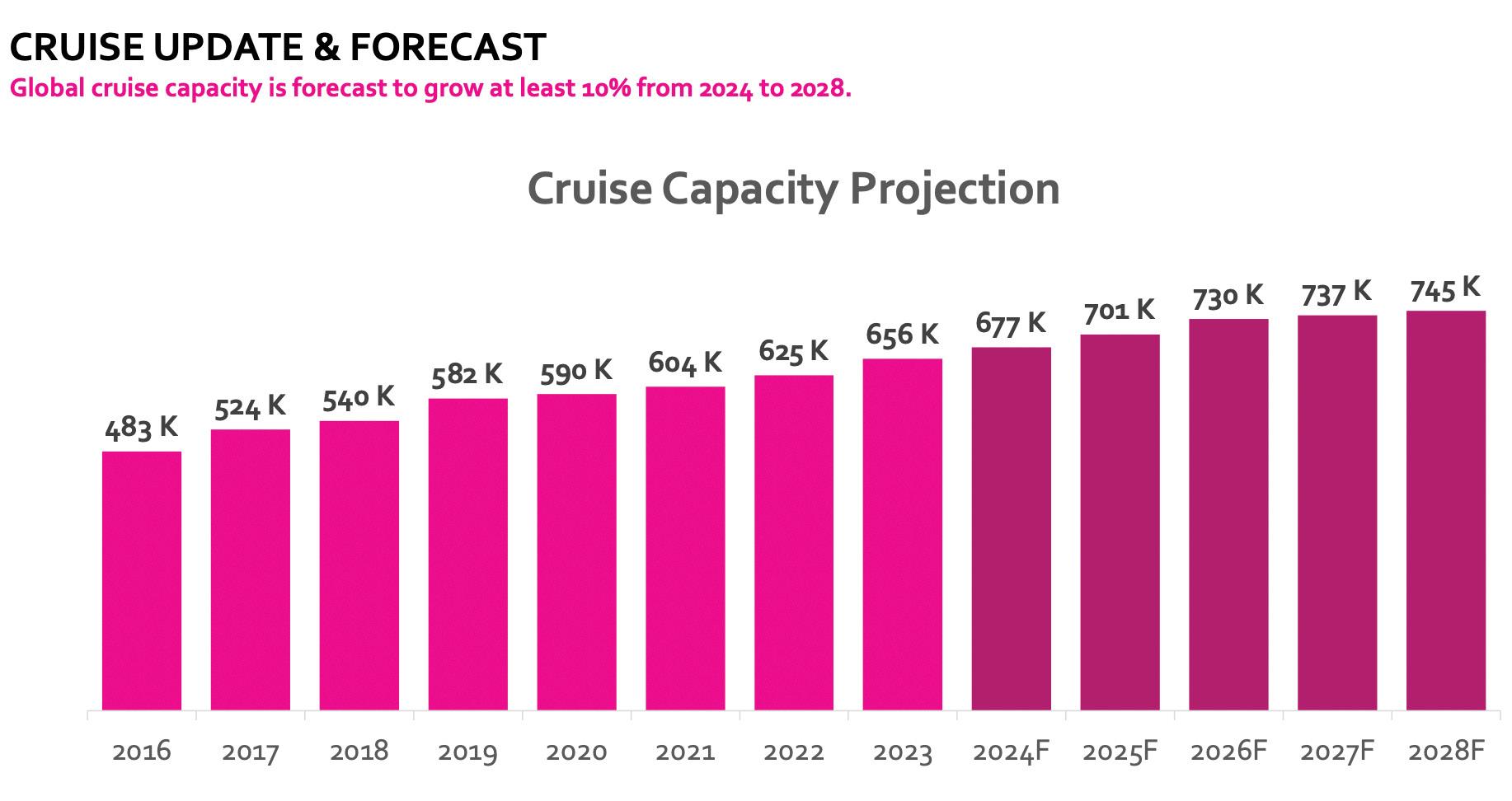

Featuring in our Cruise Report (on page 28) is data from Cruise Lines International Association and m1nd-set, which reveals global cruise capacity will grow at least 10% from 2024 to 2028, reaching 745,000 cruisers. Experts from across the travel retail channel in cruise weigh in on the experience-driven travel option that offers unparalleled dwell time and often underutilizes its number one tool: sales staff.

In other news, we look to the future of aviation, while zeroing in on Latin America. Peter Cerdá, Regional Vice President for the Americas at IATA, discusses the dynamic aviation landscape of the region and air travel as a critical pillar of connectivity and economic growth. He offers the fostering of cost-competitiveness and collaborative partnerships as solutions to help combat the challenging operating environment.

Plus, read about the change in leadership at ASUTIL in an interview with new Secretary General Carlos Loaiza-Keel (on page 16), see coverage from this year’s Summit of the Americas (on page 34) and catch up on retailer news and more. We invite you to share this issue (available in print and online) with colleagues and across your channels.

Global Travel Retail Magazine will be on location in Bogotá to deliver news from the conference. See you soon and safe travels!

Kindest regards,

LAURA SHIRK Deputy Editor laura@gtrmag.com

LAURA SHIRK Deputy Editor laura@gtrmag.com

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 3 Letter from the Editor

M OROCCANOIL.COM

A WORLD OF OIL-INFUSED BEAUTY

WHAT’S INSIDE

Top Stories

8 Avolta in the Americas

Highlighting Avolta’s strengths in the Americas, the company’s President and CEO LATAM Enrique Urioste offers an upbeat view of the future, adapting to local consumer trends and economic conditions

16 A lasting legacy

Under the new leadership of Carlos Loaiza-Keel, ASUTIL gears up for its conference in Bogotá, Colombia, highlighting the association’s proactive strategies in successfully navigating travel retail complexities and fostering regional economic growth

Features

AIRPORTS & AIRLINES

20 Welcome to airport city

With the purpose to establish greater connectivity and accessibility, Lima Airport Partners and the new Jorge Chávez Airport in Lima, Peru, will introduce the “airport city” concept to South America; plus, the passenger terminal scheduled to open in December and LAP’s retail strategy

RETAILER NEWS

24 Expansive horizons

As Motta Internacional eyes growth through strategic brand partnerships, airport expansions and joint efforts with other retailers for a common purpose, Vice President Jose Ignacio Lasa outlines the promising trajectory of Attenza Duty Free across Latin America

26 Gaining momentum

16

Global Travel Retail Magazine’s coverage of this year’s Summit of the Americas; IAADFS welcomed more than 1,200 delegates to West Palm Beach, Florida, in April and announced its move to Miami in 2025 8

According to the release of its Annual Results, ARI experienced strong growth and significantly high turnover in 2023 resulting in a “remarkable performance”

CRUISE REPORT

28 Taking control in cruise

Featuring information from Cruise Lines International Association, m1nd-set and key industry experts, Global Travel Retail Magazine reports on the potential of the cruise channel; with a look at the importance of sales staff, product assortment and data sharing

LATIN AMERICA UPDATE

32 The future of aviation

Providing an update on Latin America, Peter Cerdá, Regional Vice President for the Americas at IATA, discusses the dynamic aviation landscape of the region and air travel as a critical pillar of connectivity, economic growth and social progress

SUMMIT OVERVIEW

34 Summary of the Summit

6 GLOBAL TRAVEL RETAIL MAGAZINE MARCH 2024 Contents

Let the travel revolution begin.

We’re making the journey as rewarding as the destination; bringing together Dufry’s retail and Autogrill’s F&B expertise to revolutionize the travel experience worldwide.

Avolta in the

Americas

Highlighting Avolta’s strengths in the Americas, the company’s President and CEO LATAM Enrique Urioste offers an upbeat view of the future, adapting to local consumer trends and economic conditions

by HIBAH NOOR

In this exclusive interview with Global Travel Retail Magazine (GTR Magazine), Enrique Urioste, Avolta’s President and CEO LATAM, considers the company’s standing in the Americas, with a focus on expansion, innovation and sustainability, and the need to maintain a flexible, multi-channel approach. Highlighting regional markets, he underlines Brazil’s key role in Avolta’s growth in the LATAM region and the integration of retail and dining experiences. By leveraging the company’s expertise across both sectors, he believes Avolta will be able to create unique, memorable moments for its customers.

Global Travel Retail (GTR Magazine): How is Avolta’s business performing in the Americas overall? How is your border business in LATAM doing?

Enrique Urioste (Urioste): Avolta has experienced strong performance across the Americas as presented in our Q1 2024 investor call, with significant growth driven by increased interna-

8 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Feature Interview

Artistic renderings of Avolta's store that will be operational at the Fray Bentos international bridge at the border crossing between Uruguay and Argentina, also available to travelers coming or going to Chile and Paraguay

tional traffic, leisure travel demand and an incredibly strong execution that has allowed us to grow spend per head in every single country we operate in LATAM, with the exception of Argentina’s extraordinary 2023, driven by an FX factor. Our border business in LATAM, particularly in Brazil and Uruguay, is doing very well. We've seen notable success with the recent award of a duty free contract at the Fray Bentos international bridge between Uruguay and Argentina, and ongoing operations at the Uruguaiana store.

GTR Magazine: Avolta is continuously expanding its operations across different regions. Can you discuss

how the company’s multi-channel strategy is being implemented in these diverse markets to cater to varying consumer needs?

Urioste: Avolta's multi-channel strategy is centered on flexibility and responsiveness to local market demands, delivering on our FLEX model of flexible, local, entertainment and digital. In LATAM, this involves integrating duty free, duty paid and travel convenience, and exploring the expanded offering of F&B, all tailored to each location. For example, in Brazil, we are expanding our duty paid operations in airports like Recife and Maceió, while also enhancing digital engagement through innovative

technologies to cater to the evolving preferences of travelers.

LATAM is the region with the strongest delivery of digital engagement and services like duty free Locker and Reserve & Collect, with the possibility of processing the payment online in several countries as well as Home Delivery amongst others.

GTR Magazine: Can you share insights into some of the most successful innovations Avolta has rolled out/is rolling out this year in the Americas?

Urioste: Innovation is at the heart of Avolta's strategy. In the Americas, we've introduced AI-powered ‘try-on’ features

10 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024

Feature Interview

Enrique Urioste: “Innovation is at the heart of Avolta's strategy”

in our duty free stores and expanded our frictionless Hudson Nonstop stores powered by Amazon’s Just Walk Out technology. Additionally, we've enhanced our digital experiences with self-checkout, QR code payments, and mobile order and pay options, making the travel experience more convenient and engaging for our customers.

GTR Magazine: With a strong emphasis on sustainability, how is Avolta integrating eco-friendly practices into its operations, and what impact have these initiatives had on the company’s performance and consumer perception?

Urioste: Sustainability is integral to Avolta's operations. In LATAM, we are implementing eco-friendly practices such as reducing single-use plastics, promoting locally sourced products to boost local artisans in the communities around our airports and operations while delivering a strong sense of place, as well as incorporating sustainable materials in store designs. These initiatives have positively impacted consumer perception, as travelers increasingly value brands that prioritize environmental responsibility, thereby enhancing our overall performance and customer loyalty.

GTR Magazine: How is Avolta leveraging technology to enhance the customer experience across its travel retail and F&B operations? Are there specific technologies that have proved more impactful than others?

Urioste: Avolta leverages cutting-edge technology to enhance the customer experience across travel retail and F&B operations. In LATAM, we've seen significant impact from digital solutions such as mobile ordering systems and AI-driven personalization tools. These technologies streamline the shopping process, reduce wait times and provide tailored recommendations, leading

12 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024

Avolta’s Uruguaina store is highlighted as a strategic location

Feature Interview

to higher customer satisfaction and increased sales.

GTR Magazine: Avolta’s recent financial performance indicates strong growth potential in emerging markets. What are Avolta’s strategic plans in these markets, particularly with regard to consumer trends and economic factors influencing your operations?

Urioste: Avolta's strategic plans in emerging markets focus on understanding and adapting to local consumer trends and economic conditions. In LATAM, we are capitalizing on the strong demand for leisure travel and the growth of low-cost carriers by expanding our duty free and duty paid operations. We are exploring the integration of F&B into our offering and creating new and exciting styles of partnerships.

Additionally, we are enhancing our digital and loyalty programs to meet the evolving expectations of travelers, particularly the tech-savvy Gen Z demographic.

GTR Magazine: Avolta has recently extended its partnership with Aena at Recife and is opening new stores in Maceió and São Paulo Congonhas Airport. Can you discuss the strategic significance of these expansions within Avolta’s overall growth strategy in Brazil?

Urioste: Aena is a great global partner of ours, and we are working closely together to deliver on the exciting Spanish contracts we secured last year. The expansions in Recife, Maceió, and São Paulo Congonhas are crucial to Avolta’s growth strategy in Brazil. These

new stores enhance our presence in key travel hubs and allow us to better serve the increasing number of domestic and international travelers. Regarding border stores, we are continuously exploring opportunities to expand our footprint, leveraging strategic locations like the Uruguaiana store and the new contract at the Fray Bentos international bridge.

GTR Magazine: Avolta in 2023 reported a 32.5% growth in turnover compared to the pro forma figures for the combined Dufry/Autogrill in 2022. Brazil’s role is pivotal. How is Avolta capitalizing on Brazil’s a) domestic and b) rebounding international traffic to drive this impressive growth?

Urioste: Brazil's pivotal role in our growth is driven by a two-pronged approach: capitalizing on the robust

14 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024

Feature Interview

Offering a sense of place and locally sourced products are key to Avolta’s operation

domestic travel market and the rebound in international traffic. Domestically, we are expanding our duty paid stores in major airports, offering a diverse range of products and immersive shopping experiences. Internationally, we are enhancing our duty free operations, leveraging Brazil’s status as a key travel destination to attract and engage travelers from around the world.

GTR Magazine: Following the merger with Autogrill, Avolta has emphasized integrating retail and dining experiences. Have you begun this integration in Avolta’s operations in Brazil?

Urioste: Yes, we have begun working on integrating retail and dining experiences in Brazil, aligning with Avolta’s global strategy. As we speak, we are in the midst of negotiating a new large F&B

operation. By leveraging our expertise across both sectors, we will be able to create unique, memorable moments for our customers.

GTR Magazine: The Destination 2027 strategy involves a focus on flexible stores, local products, and digital innovations. How are these elements being specifically adapted to meet the needs of the Brazilian market?

Urioste: In Brazil, we are adapting the Destination 2027 strategy by incorporating flexible store designs that can quickly respond to changing consumer preferences. We prioritize local products that resonate with Brazilian culture and travelers' desires for authentic experiences. Additionally, we are enhancing digital innovations, such as mobile payments and personalized marketing,

to engage tech-savvy consumers and streamline their shopping journey.

GTR Magazine: Sustainability and local engagement are increasingly important in global business. How is Avolta integrating these aspects into its expansion and operational strategies in Brazil?

Urioste: Sustainability and local engagement are key pillars of our strategy in Brazil. We are incorporating ecofriendly practices in store operations, such as reducing waste and promoting recyclable materials. Local engagement is fostered through partnerships with local artisans and suppliers, offering products that reflect Brazil’s rich cultural heritage. These efforts not only support the local economy but also resonate with travelers who value responsible and sustainable practices.

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 15

Viva la Mexico: Local brands claim an eye-catching presence

A lasting

legacy

Under the new leadership of Carlos Loaiza-Keel, ASUTIL gears up for its conference in Bogotá, highlighting the association’s proactive strategies in successfully navigating travel retail complexities and fostering regional economic growth

by WENDY MORLEY

As the association prepares for the upcoming ASUTIL Conference, Carlos LoaizaKeel has now stepped into the role of Secretary General at ASUTIL, motivated by the profound impact and legacy of his predecessor, José Luis Donagaray. Reflecting on his inspiration, Loaiza-Keel says, “I was deeply inspired and immersed in this industry through my interactions with José Luis Donagaray. His passion and dedication served as a guiding light for me and compelled me to take on the role of

Secretary General of

ASUTIL.”

Taking the helm, Loaiza-Keel is determined to honor and build on the foundational principles established by Donagaray. “In accepting this position, I intend not only to honor José Luis’ legacy, but also to build upon it,” he states. Central to his strategy are the values of transparency, unwavering commitment, and forward-thinking, which he believes are crucial for the continuity and evolution of ASUTIL.

He also emphasizes his commitment to innovation and growth, aiming to

introduce fresh perspectives that will lead ASUTIL into a future marked by success and expansion. “Ultimately, my goal is also to bring fresh perspectives and initiatives to lead ASUTIL into a future of continued success and growth,” he says.

2024 priorities

Loaiza-Keel outlines several key priorities for ASUTIL for the second half of 2024, emphasizing the association’s active role beyond just advocating for increased spending allowances across Latin America (LATAM), although that is also part of its mandate. He comments, “In addition to organizing an excellent conference in Bogotá, which will become a third-generation

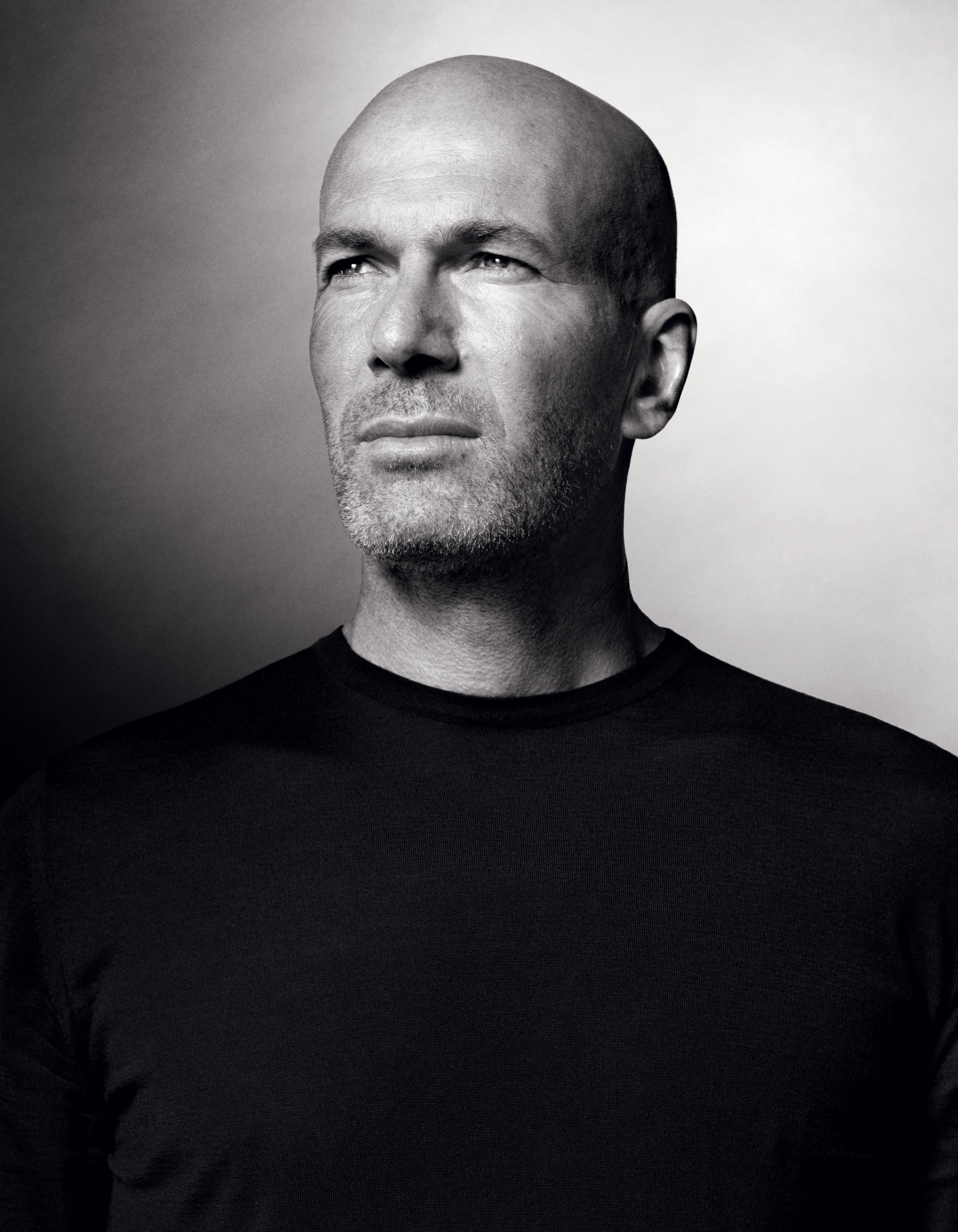

16 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Association News

Carlos Loaiza-Keel, Secretary General, ASUTIL

Once the highest building in Colombia, the landmark skyscraper Torre Colpatria is situated at the heart of downtown Bogotá PHOTO CREDIT: RICARDO BÁEZ

conference in the future, we are working directly with the Duty Free World Council (DFWC) on tasks related to the control of the illicit tobacco trade.”

He confirms ASUTIL’s commitment to collaborate with others in the industry in managing the complexities of regulatory changes and the battle against illicit trade, saying, “Of course, we have an interest and a vocation to work with other associations on this issue and we do so within the framework of the DFWC, which brings together all the industry associations worldwide.”

He stresses the importance of a dedicated and sensitive approach to regulatory issues, stating, “We believe that a sincere and genuine commitment to the issue is fundamental – sensitive to the general interest of the regulations, but also to the proper consideration of the industry, its high standards of compliance and its contribution to society.”

Loaiza-Keel also addresses the collaborative efforts involved in these initiatives, “We are in close cooperation with consultants, organizations and

authorities from various Latin American countries.” The association is involved in the improvement of certain aspects of the Free Shops regulations at the Brazilian and Uruguayan borders.

Significance of Bogotá

Loaiza-Keel highlights the significance of Bogotá’s economic and cultural transformation in its selection as the location for this year’s ASUTIL Conference. He states, “The choice of Bogotá as the venue for this year’s conference highlights the city’s remarkable development and growth, underscoring its importance beyond mere economic stability. While stability is undoubtedly important, Bogotá’s transformation into a vibrant economic center is a testament to progress.”

ASUTIL is building upon Bogotá’s vibrant fusion of rich cultural heritage with dynamic economic development. “We aim to showcase the city’s significant strides in fostering economic development and embracing innovation,” Loaiza-Keel says. “This evolu-

tion reflects broader trends within the industry and the region, making Bogotá an ideal setting for discussions on the future of travel retail.”

“Its transformation into a thriving business center, marked by impressive growth and a commitment to security, innovation, and sustainability, aligns perfectly with the conference theme of industry evolution,” he says. “In essence, Bogotá’s journey symbolizes more than stability; it represents resilience, adaptability, and growth. As such, it provides a compelling backdrop for exploring the evolving landscape of travel retail and shaping its future.”

Market evolution

Loaiza-Keel assesses the post-pandemic evolution of the travel retail market in LATAM, noting a robust expansion that will see PAX numbers exceeding those of 2019 by the end of the year. “According to information provided by m1ndset, PAX traffic at LATAM airports will reach 108% in 2024 compared to 2019 traffic, about 127 million PAX compared

18 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024

Association News

Over 10,000 feet above sea level, Mount Monserrate is one of the most popular attractions in Colombia

PHOTO CREDIT: RICARDO BÁEZ

to 118 million PAX in 2019 (and 121 in 2023),” he says, siting the key airports driving this growth, listing the top 10 LATAM airports in order: Cancun, Panama, Mexico, Sao Paulo, Bogota, Lima, Santiago, Punta Cana, Ezeiza, Dominican Republic and Costa Rica. Other channels are also seeing a boom, including cruise ships and border stores. While this trend is global and not unique to LATAM, it is certainly a positive development for the region. LoaizaKeel remarks that there is evidence of the return of the Chinese tourist, a different, younger tourist from the prepandemic era.

Duty free allowances

As an institution, ASUTIL has worked over the past few years to increase allowances to keep pace with prices and purchasing realities in the region, and Loaiza-Keel says, “We are proud to have achieved this Latin America wide. In most Latin American countries, duty free allowances are set between US$500 and US$2,000 for air transport and

between US$300 and US$500 for sea and land transport, although there is still considerable heterogeneity except within regional integration regimes such as MERCOSUR.”

This is not across the board with categories, however. According to LoaizaKeel, countries impose limits on the number of units in the case of alcoholic beverages or cigarettes. Updated information is available at the following link in a section AVOLTA has created specifically to inform travelers [AVOLTA Customs Allowances]: https://www. avoltaworld.com/en/travelers/ customs-allowances).”

Border store update

The state of border stores at the important junctions of Uruguay, Brazil, Argentina and Paraguay are in an interesting state, with Uruguay shining especially bright. “Argentina does not technically have border stores, but a free trade zone regime. Neither does Paraguay. Uruguay and Brazil do have border regimes. The Uruguayan regime,

which has been in place for more than 30 years, has returned to pre-pandemic levels and is growing steadily,” he says, noting that Brazil’s border shops are too new to compare with pre-pandemic, but he believes it is expanding steadily.

Loaiza-Keel acknowledges the challenges in Brazil due to regulatory complexities. “The rate of expansion has been slower than originally planned, but it is remarkable, especially in some cities such as Uruguaiana,” he says.

Inflation issues

Recently, inflation has been a global phenomenon, and LATAM is no stranger to inflation woes even at the best of times. Loaiza-Keel says, “This is an issue in almost every country, especially when you consider that revenues are in USD and costs are in local currency. This is very challenging.”

Despite these concerns, Loaiza-Keel remains optimistic. “The industry is very resilient and, particularly in LATAM, is more than used to this level of volatility, if not more,” he concludes.

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 19

Simón Bolívar Park is one of the largest urban parks in the world, with more than 1,000 acres of green spaces, bicycle paths, sports complexes and more

PHOTO CREDIT: RICARDO BÁEZ

Welcome to airport city

With the purpose to establish greater connectivity and accessibility, Lima Airport Partners and the new Jorge Chávez Airport in Lima, Peru, will introduce the “airport city” concept to South America; plus, the passenger terminal scheduled to open in December and LAP’s retail strategy

by LAURA SHIRK

Lima Airport Partners (LAP) is on a mission to create the first “airport city” in South America at Jorge Chávez International Airport (Lima Airport) in Peru. Centrally located on the western coast of South America, Lima serves as a strategic air connection point, supported by its proximity to the Port of Callao.

Considering the expansion, the new Jorge Chávez Airport will cover 940 hectares (three times larger than the current airport size) and deliver smart

infrastructure integrated with Lima that is key to the economic growth of Peru and the development of the capital city into a regional hub.

Already crossed off the to do list is the building of a new control tower and second landing strip, which started operations in April 2023.

“We are introducing the concept of an airport city, which does not exist in South America, but does exist in Europe, in airports like Paris, Frankfurt, Madrid, and Barcelona, among others. This is a broader real estate development

concept and plan that we start with, where we integrate various economic asset classes, complementing them with the surrounding area, with the Callao region, and with Metropolitan Lima,” explains Norbert Onkelbach, Chief Commercial Officer at Lima Airport Partners.

The project aims to integrate airport operations with multiple commercial areas, cargo and transport zones, business centers, hotels, offices, stores and other businesses linked to the economic activities in Callao. “We want Lima to become the regional headquarters for various companies in the aviation and non-aviation business, and to develop a special economic zone connecting sea and air cargo to take advantage of the proximity of the port and airport,” he

20 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Airports & Airlines

The new Jorge Chávez Airport in Lima, Peru, will introduce the “airport city” concept to South America; this will result in the integration of airport operations and smart infrastructure with the capital city

Norbert Onkelbach, Chief Commercial Officer, Lima Airport Partners

says. “Overall, the airport city concept is an umbrella concept to integrate the interest and development of our stakeholders within the airport’s ecosystem. We consider ourselves as airport platform managers in that regard.”

According to Onkelbach, LAP is expecting to secure new destinations and greater connectivity in Latin America, North America, and the Caribbean paired with stronger direct traffic to European hub airports.

Displaying more non-aeronautical activity, Onkelbach says airports are increasingly becoming engines of macro-growth and socio-economic development for the region and/or country. Lima Airport Partners recently conducted an economic impact study of the activity generated at Lima Airport and found that it is supported by 155 businesses including airlines, concessionaires, transportation companies,

security firms, cleaning services and a wide portfolio of other providers. In 2022, the airport community contributed US$1.4 billion to Peru’s GDP.

“Overall, we believe the airport city in Lima, Peru, will not only redefine the local airport industry, but also consolidate its role as a hub for sustainable job creation in the region,” comments Onkelbach.

Passenger terminal update and opening

The airport’s new single passenger terminal, which will have an initial capacity of 30 million passengers per year, is scheduled to open by December 18 of this year. After the opening, the airport will bring an additional 10 million passenger capacity by the end of 2025. With this, Lima Airport will have a capacity of 40 million passengers per year in a total space of 270,000 square meters.

As shared by LAP, the terminal’s modern design is inspired by the hummingbird of the Nazca culture. The five-level infrastructure will provide passenger services including check-in, arrivals, departures, lounges, food and beverage and a shopping complex with pedestrian access to the city. The five

levels will be accompanied by three boarding docks for national, international and swing flights.

Providing an update on its construction, Onkelbach reveals the terminal is more than 85% complete, in accordance with the commitments made with the Government of Peru. “This achievement translates into the completing of significant construction milestones such as the implementation of the first boarding bridges, installation of a stateof-the-art baggage system, construction of the internal vehicular access viaduct that will connect with the city, start of the asphalt paving of parking areas and access roads, as well as the installation of internal finishes, among other improvements that will offer passengers a state-of-the-art travel experience,” he says.

The terminal will feature expandable infrastructure to enable growth capacity after 2025, as well as promote sustainable transport and consist of automation systems, biometric records and LED lighting. It will be the first air terminal in South America to include a seismic isolation system, technology that isolates the movement of the structure in the case of an earthquake, and a remote

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 21

On track to open in December, the state-of-the-art passenger terminal will feature expandable infrastructure to enable growth capacity after 2025, as well as promote sustainable transport and consist of automation systems and biometric records

aircraft traffic management system.

“We have chosen the date of December 18 because it has less impact on air operations. The opening will take approximately six hours and has been scheduled during the early morning hours when there are fewer ongoing operations. This decision follows a study that LAP conducted on the processes and flows to determine the optimal opening date,” says Onkelbach.

Retail strategy and sense of place

When asked how the duty free channel factored into the planning and decisionmaking of the airport city, Onkelbach said LAP’s retail strategy is built on fundamental principles: customer focus and innovation, a deep connection with local culture and the execution of sustainable practices. “Through these principles, we reinforce our commitment to enhancing passenger experi-

ences and fostering a safe and sustainable environment. Customer focus and innovation are pivotal in engaging with customers and passengers, necessitating quick adaptation to meet their expectations and needs through digital and innovative approaches,” he shares.

As part of Lima Airport Partners’ vision to elevate the passenger experience and inspire enthusiasm for its offerings, the company has introduced innovative concepts including a central commercial plaza with a unique space for travelers to immerse themselves in Peruvian heritage while awaiting departure, international and domestic marketplaces that feature food halls celebrating local gastronomy and casual dining experiences created by globally renowned Peruvian chefs. Plus, LAP’s commercial partners are introducing flagship stores displaying luxury Peruvian apparel and jewelry crafted from

alpaca and vicuña. “Peruvian culture holds a central position in our strategy, weaving elements that evoke a bespoke and distinctive sense of place, leaving passengers with a memorable impression and deeper connection to Peru,” Onkelbach continues.

Lima Airport Partners has established partnerships with over 30 retail partners, collectively shaping a new landscape at Lima Airport. According to Onkelbach, among these partners are global travel retail leaders like Lagardère Travel Retail in the duty free and food and beverage categories and Morpho Travel Experience for specialty retail.

“Together, with the real estate activities outside the terminal, we consider the airport retail portfolio an integral part of our ecosystem and manage both in the same way: customer focused with a strong commercial partnership approach,” he concludes.

22 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024

Airports & Airlines

The new passenger terminal will provide passenger services including check-in, arrivals, departures, lounges, food and beverage and a shopping complex with pedestrian access to the city

Expansive horizons

As Motta Internacional eyes growth through strategic brand partnerships, airport expansions and joint efforts with other retailers to common purpose, Vice President Jose Ignacio Lasa highlights the promising trajectory of Attenza Duty Free across Latin America

by LAURA SHIRK

Through Attenza Duty Free, Motta offers a comprehensive product assortment including spirits and tobacco, leather goods, luxury accessories, perfumes and cosmetics, confectionery and electronics

Last year, GTR Magazine reported on Motta Internacional’s multiplying stores at Panama’s Tocumen Airport, and that growth has not stopped. Soon after the airport’s new terminal was inaugurated, the retailer, under the commercial name Attenza Duty Free, celebrated the opening of its flagship store, which covers 1,000 square meters, offers 200+ luxury brands and focuses on sensory engagement to enhance the shopper experience.

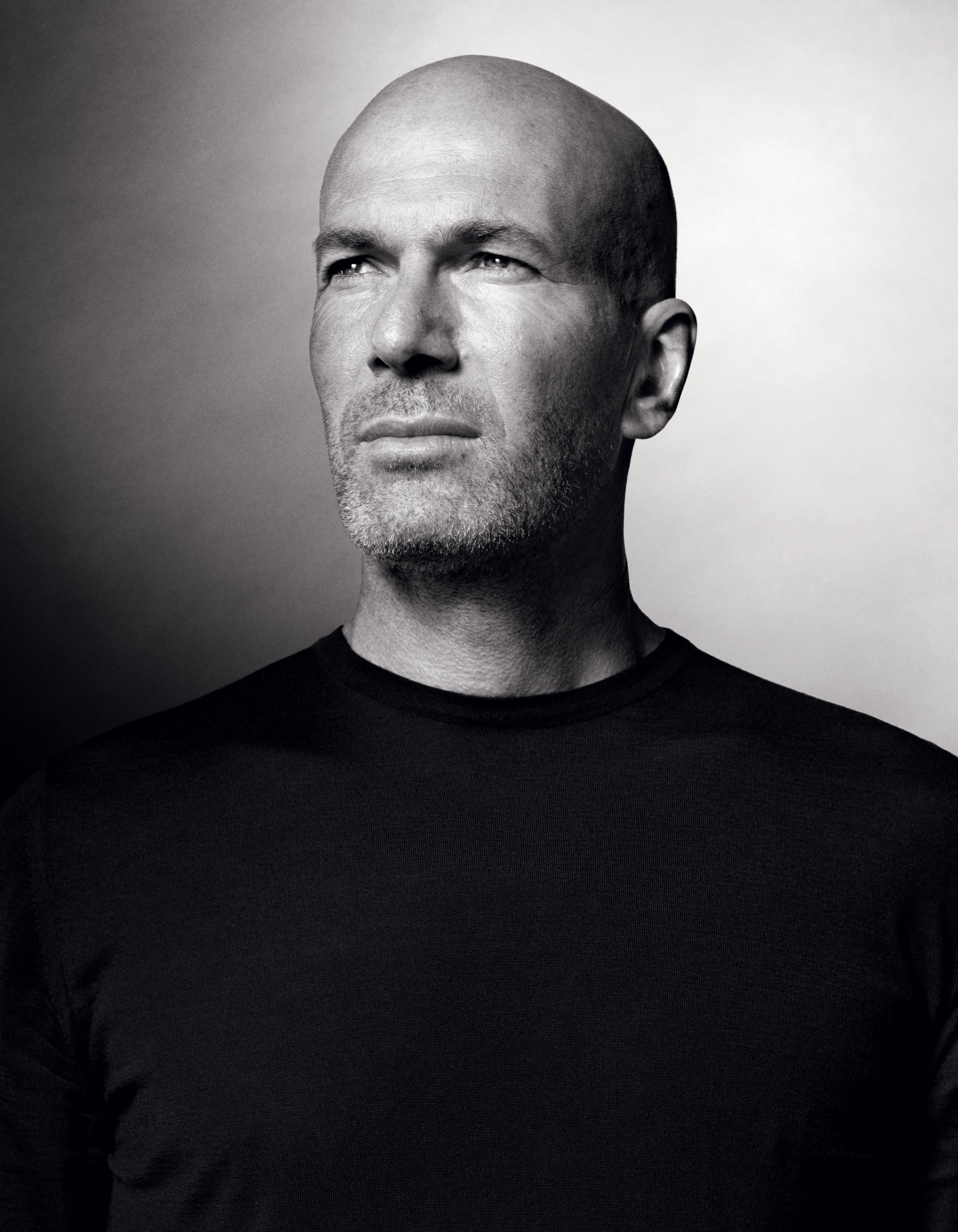

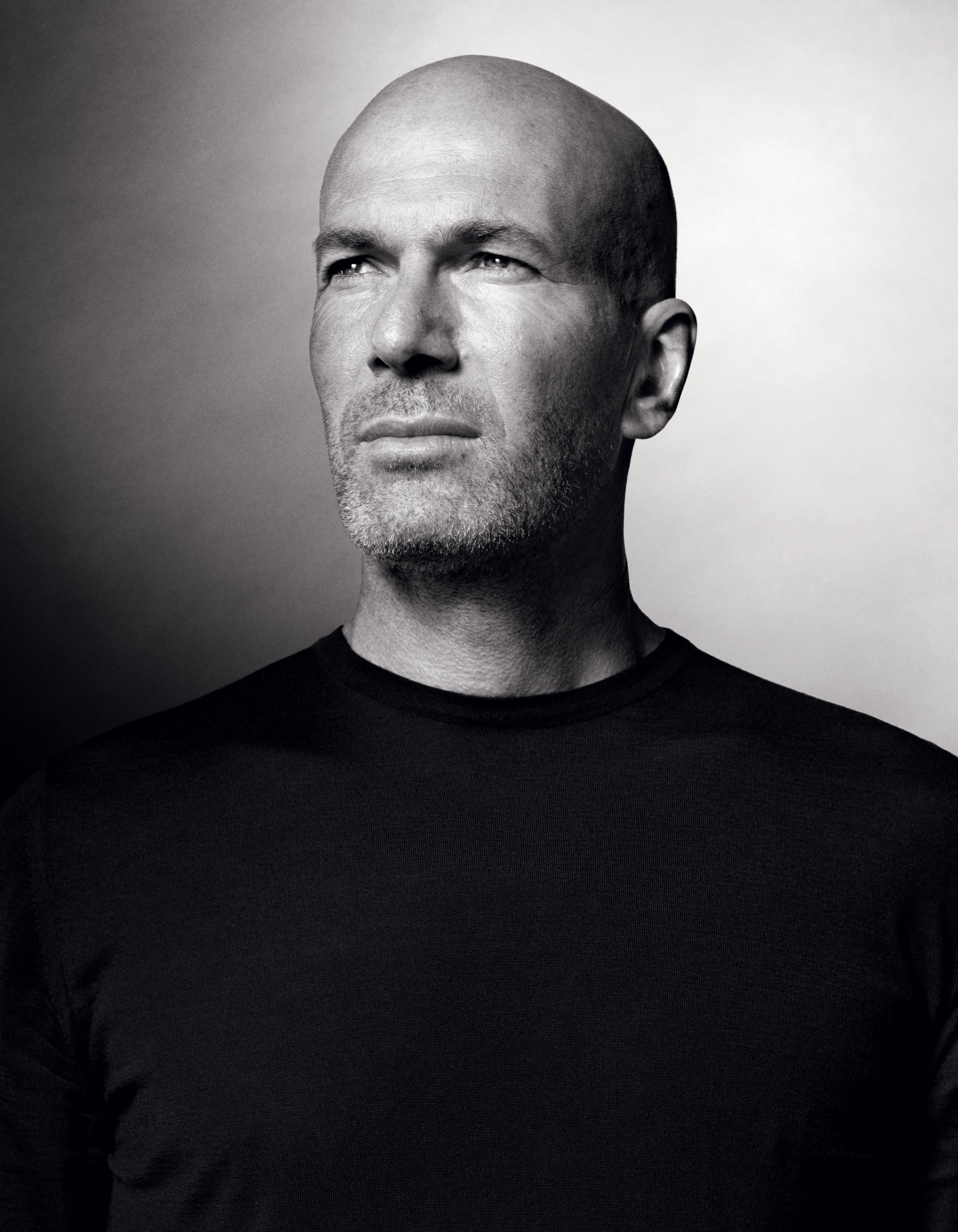

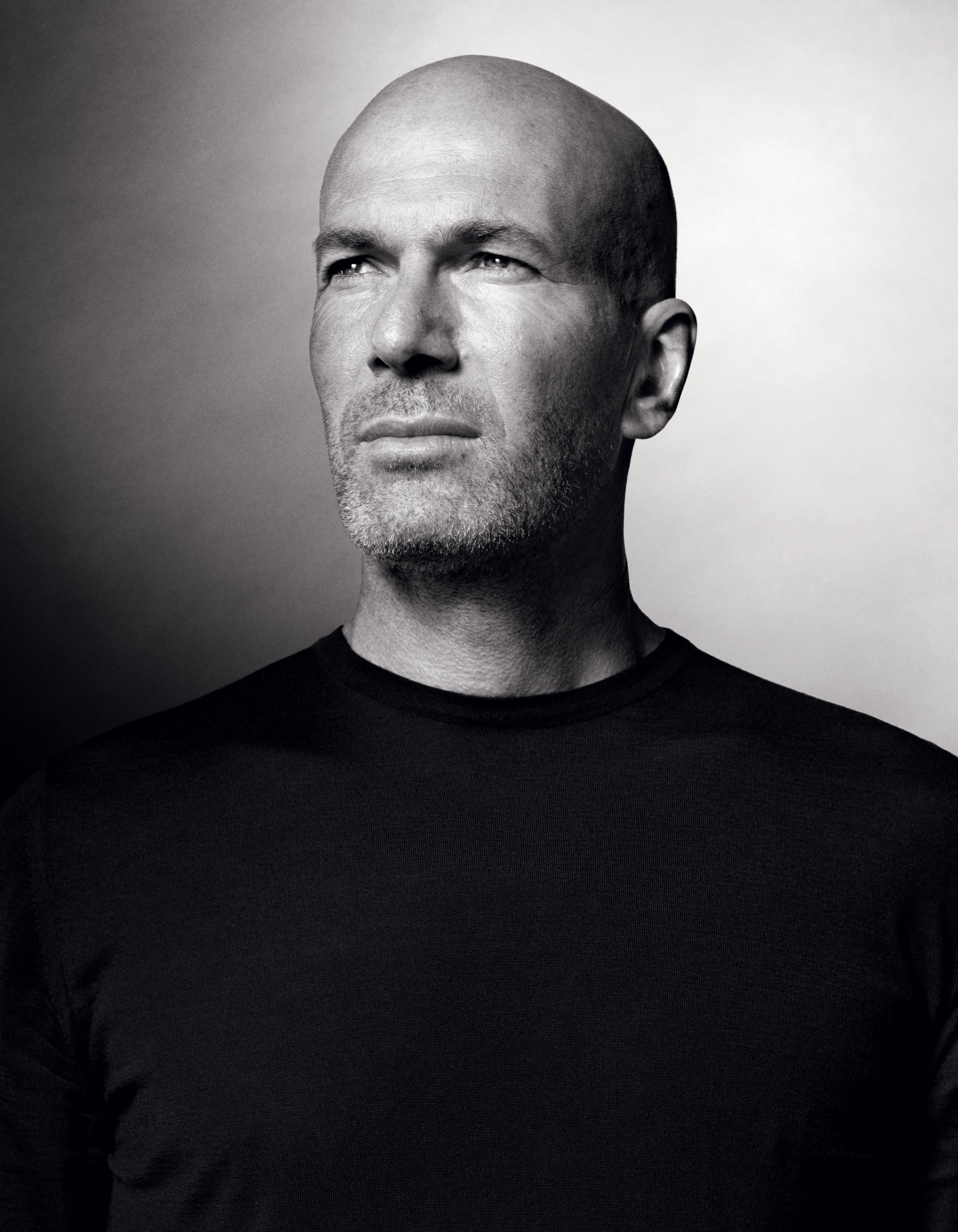

To further strengthen its presence in Terminal 2 at the airport, Attenza Duty Free will open new luxury boutiques in Q3 and Q4. The retail spaces will range between 80 square meters and 120 square meters, with brand partners including TUMI, TAG Heuer, Long-

champ, Montblanc and Tory Burch. Jose

Ignacio Lasa, Vice President Commercial at Motta Internacional, says the brands are all working together to create a visually appealing store specifically designed for the modern traveler. This will bring the total number of Attenza stores in T2 to 5.

Driving expansion

The retailer has also been focusing on driving key expansion at main airports across the region; for example it has been taking part in the bidding process for the exclusive operation of duty free shops at Santiago Airport in Chile. Although on hold at this time, the bid is expected to reactivate in the second half of this year.

Attenza Duty Free currently

boasts more than 53 operations at airports and border points across Latin America; Panama, Colombia and Ecuador remain its strongest markets. Through Attenza Duty Free, Motta offers a comprehensive product assortment including spirits and tobacco, leather goods, perfumes and cosmetics, confectionery and electronics.

Online sales and airline partnerships

Motta’s Attenza Duty Free has long prioritized developing its online presence and pre-ordering services with the goal to increase sales ahead of travel. With the support of direct promotions, introductory discounts and cross-promotion with partners, it is working to strengthen its site.

24 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Retailer News

According to Lasa, online sales contribute to approximately 2% of overall sales. “It is growing slowly, but we hope that the ability to review promotions and products from the comfort of one’s home or office before travel is an added benefit,” he says.

Although the retailer is always evaluating partnerships with passengerrelated businesses, at the moment it is keen to continue growing the alliances in place in connection to airline mileage programs. Programs like Copa Airlines’ ConnectMiles and LifeMiles by Avianca Airlines grant exclusive offers to Attenza Duty Free’s end consumers. “We believe there is good synergy with these programs that helps us work together to

bring great experiences and benefits to our common customers,” adds Lasa.

New boutiques, new brands

Lasa says Motta Internacional is in talks with commercial divisions of new brands with high growth potential, looking to further build its key longterm portfolio.

When asked about non-traditional duty free product lines in the mix, Lasa refers to the sports-team inspired apparel brand New Era. Designed for customizable sizing, the brand provides adjustable sports caps that guarantee comfort without compromising on style. He says the brand is steadily growing in Latin America.

A common goal

Beyond conversation around its portfolio and online presence, Motta Internacional is in close communication with airports and competing duty free retailers in a joint effort to reach potential duty free shoppers. Since market research can help to better understand consumer behavior and attract a new pool of customers, the company is uniting with other stakeholders in the channel such as airports, even competitors in the same airport to increase the overall effectiveness of duty free shopping as a marketing strategy.

“We believe the most important work still to be done effectively is communicating the benefits of duty free shopping. Although the next step is to create a market study, in the past the perception among potential clients is that duty free focuses on high-end products, hence high-ticket prices,” he explains. “This might be a deterrent for some clients. Our idea is to get to know the customer and then work together, as an industry, to invite them to visit our stores.”

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 25

Looking to further build its key longterm portfolio, the retailer is in talks with commercial divisions of new brands with high growth potential

Attenza Duty Free currently boasts more than 40 operations at airports and border points across Latin America

GAINING MOMENTUM

“Remarkable performance”: ARI experiences strong growth, significantly higher turnover in 2023

by HIBAH NOOR

Leading travel retailer ARI has released is 2023 Annual Results, with strong growth underpinned by higher passenger volumes and record passenger spends, post the lean COVID years.

ARI recorded a managed turnover of €1.24 billion (approximately US$1.34 billion), marking a 13.9% increase on 2022 performance.

Ray Hernan, ARI Chief Executive Officer, commented, "2023 was a very successful year for ARI, with significant growth across our global estate. The remarkable performance across all our locations, many of which achieved record-high sales, is a testament to our colleagues and teams in each location.

It is their continued dedication to improving the passenger journey and providing exceptional retail experiences for travelers that has led to such a resounding success.”

Compared to previous years, 2023 was a year of continued growth and recovery in all key markets for ARI. The year was exceptional as many business units achieved historically high turnover and levels of profitability.

ARI has a broad span of retail activities, with direct or indirect interests in 14 countries across North America, Europe, the Middle East, and minority shareholdings in Düsseldorf Airport in Germany, and Larnaca and Paphos airports in Cyprus, and are also respon-

sible for running the retail operations in Ireland’s Dublin and Cork airports.

“We remain focused on developing plans for future growth”, said Hernan. “Our performance in 2023 signals our intention to seek growth in key markets in the coming year, while also maximizing and delivering on our commitment in our current operations.”

Dublin and Cork airports in Ireland enjoyed record numbers of passengers, delivering strong growth for ARI across all categories, and with sustained development of airport exclusives and firstto-market offerings in liquor, beauty and confectionery.

ARI’s joint venture with ANA, at Portugal Duty Free exceeded expecta-

26 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Retailer News

Ray Hernan, Chief Executive Officer, ARI

Recovery in ARI’s retail operations in Canada gathered pace and performed in line with 2019 levels despite the lack of high-spending Chinese passengers

tions with the business trading ahead of plan in its first full year of operations for ARI. According to ARI, the focus for 2024 is now on the completion of an extensive capital refurbishment program to improve the retail experience in the stores.

ARI Middle East (ARIME), which comprises businesses in Bahrain, Cyprus, Lebanon, Oman, Saudi Arabia and UAE had a strong year despite challenges in the region in the last quarter.

The implementation of the state-ofthe-art new store at Zayed International Airport in Abu Dhabi was completed in November 2023 and saw the opening of a world-class store for ARI featuring beauty, jewelry, and sunglasses.

The company noted its business in Riyadh performed solidly, while Muscat had another year of very robust performance in 2023, with trading boosted by good liquor and tobacco allowances in arrivals. Bahrain Duty Free also showed a strong performance in 2023, with prevailing market conditions attributing to the solid performance across all sectors.

ARI’s retail operations at Larnaca and Paphos airports in Cyprus performed significantly ahead of 2019 levels with turnover exceeding €100 million for the first time. The business returned a healthy profit, benefiting from strong performance in the peak season period of the year. The business continues to benefit from the spend of UK passen-

gers following the re-introduction of duty free, post-Brexit.

Recovery in ARI’s retail operations in Canada gathered pace and performed in line with 2019 levels despite the lack of high-spending Chinese passengers. ARI North America celebrated its milestone 25th anniversary in 2023. The retail area at YUL MontréalTrudeau International Airport was rebranded as Montréal Duty Free during the year. A stand-alone duty paid store in partnership with Chanel was opened in September 2023 at Vancouver International Airport, and in Edmonton, a new contract won in 2023, opened in mid-January 2024.

ARI’s joint venture operation at Indira Gandhi International Airport Delhi, India, where ARI holds a 33.1% stake, had “another exceptional year” while the company’s operations at the two airports in Montenegro, Podgorica and Tivat, continued to trade profitably despite the lack of Russian and Ukrainian passengers.

“We began 2023 in a strong position, and with the launch of the revitalized ARI brand, and our new brand expression, ‘joy on your way’, our team were able to build on a solid foundation,” Hernan said. “We are delighted to be in a strong position for 2024, with ambitious growth plans and the anticipation of another successful year ahead. We will continue to enhance our current bespoke offerings and customer experience, nurture existing partnerships, and are excited by the prospect of exploring new territories.”

ARI said its strong financial performance is driven by the company’s strategic commitments, including a sustained focus on strengthening its leadership position in ESG and reinforcing its DE&I assurances. Together with ARI’s improved Customer Value Proposition, these programs reinforce the brand’s reputation as a pioneer in the industry.

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 27

ARI North America celebrated its milestone 25th anniversary in 2023

ARI’s focus for this year is on the completion of a capital refurbishment program to improve the retail experience

Taking control in cruise

AFeaturing information from Cruise Lines International Association, m1nd-set and key industry experts, Global Travel Retail Magazine reports on the potential of the cruise channel; with a look at the importance of sales staff, product assortment and data sharing

by LAURA SHIRK

Considering the unparalleled dwell time in cruise, the opportunity to deliver a retail experience on board is said to be even better than in the domestic market

s tracked by Cruise Lines International Association (CLIA), traveler interest in booking an expedition cruise is higher than ever as travelers seek more “immersive, bucket list travel experiences.” This trend is evident across all age groups, as the number of passengers sailing on expedition cruises has doubled from 2016 to 2022. This supports the finding that contrary to popular belief, younger generations are the future of the cruise industry (CLIA reports 88% of millennials who have booked a cruise say they plan to do so again). For this reason – and a host of others – cruises are increasingly becoming more experience-driven.

The association forecasts that global cruise capacity will grow at least 10%

from 2024 to 2028 reaching (745K cruisers) and states that every 1% increase in first-time cruise travelers is equivalent to four million new-to-cruise travelers. Key global trends to note about the often multi-generational travel option include that cruise lines are offering more flexible itineraries and immersive travel opportunities to attract first-time cruisers and meet the needs of repeat cruisers. The Caribbean remains the top destination for cruise travelers at 44%.

Speaking about cruise duty free shoppers in the Americas, Clara Susset, Chief Operating Officer at m1nd-set, shares 44% of cruise travelers visit duty free stores with a robust conversion rate of 66% and a purchase rate of 29%. This leads to an average spend of US$220 per buyer, which is significantly higher

compared to airport duty free. Regarding untapped potential, while both males and millennials fall below average footfall and conversion, they are the two consumer groups that spend the most when making a purchase.

Let’s talk about staff

With unparalleled dwell time, a unique “on vacation” mindset and the ability to visit shops multiple times throughout their trip, there is an opportunity among cruise shoppers to drive impulse purchases via experiences. This is especially the case in connection to the sales staff, since the importance of their role is significantly higher on board compared to at the airport.

According to a recent study by m1ndset, in the Americas, 82% of cruise duty

28 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Cruise Report

Harding+ has opened its “inside-outside” interactive retail concept on board the Queen Anne; a number of fragrance workshops are available within the beauty area

communication, but also create “the human effect.” Beyond sharing knowledge, personal excitement for brands or products among staff members often influences shoppers’ decision-making.

Product assortment and guest experience

free buyers are influenced by the sales staff versus 69% of airport duty free buyers. Also, interaction with the sales staff in cruise is associated with a 67% increase in average spend (US$144 vs. US$240). Perfumes and alcohol stand out as top categories purchased among cruise duty free buyers, who it is noted have higher expectations in regards to novelties and travel retail exclusives compared to airport duty free buyers.

Lisa Kauffman, Chief Sales & Marketing Officer at Starboard Cruise Services (Starboard) says, “One of the most wonderful things about the cruise experience is that we have staff on board in our shops from more than 60 countries – it’s an incredibly diverse group of people, with many languages spoken.”

Even considering Starboard’s favor-

able turnover rate, Kauffman recognizes the retailer has a constantly rotating team, which presents some training challenges. With an average of seven days to engage with travelers and share a brand’s story, she explains training is not a one and done. “Training involves constant reinforcement and is a mix of in-person and virtual. Also, all of our training is available on our global app, so that the team has access to it at any time.”

According to Emily Lively, Head of Cruise & Airlines at Diageo Global Travel, sales staff is often underutilized because the means of investment is difficult to quantify. As the number one tool at the supplier’s disposal, Lively says staff members not only offer a sustainable way to increase marketing and

When it comes to offering an assortment that addresses the wide range of nationalities on board or integrating the core cruise experience, it is essential that parties work together to make the most of the opportunity. Starboard works closely, and as far in advance as possible, with cruise line partners to learn about the cruiser demographic, in addition to referring to previous guests’ behaviors. This way it can be intentional with its brand partners in product selection.

Kauffman says this often plays out in the more luxury categories; the understanding of key items and the personalization of products per destination is valuable. She points out that a particular stone, scent or flavor on board that reflects the cruise destination or season allows the brands and retailers to collaborate on tailoring a brand’s story, resulting in a deeper connection among travelers.

“Cruise lines are also looking for experiences to offer their guests; they

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 29

The latest ship to launch from Cunard, Queen Anne features more than 30 exclusive brands across core retail categories

While both males and millennials fall below average footfall and conversion, they are the two consumer groups that spend the most when making a purchase

Cruise Lines International Association reports that every 1% increase in firsttime cruise travelers is equivalent to four million new-to-cruise travelers

want people to have a lot to do and a reason to visit the shops,” adds Kauffman. Developing ideas such as “Watches & Scotches” and “Scents & Sips” helps to promote cross-category purchasing and present brands and products in an unexpected way that feels entertaining.

“[It’s unquestionable the opportunity that we have to deliver an experience; it’s even better than what we look at from a domestic standpoint. Oftentimes, in domestic we can leverage experiences from festivals or other events where the store is the destination – and being able to tap into this is a great advantage,]” says Lively.

Because of the unique nature of the physicality of the shops on board, no shop is the same. In addition to figuring out how to best use the allotted space, collaboration is necessary to identify the pieces of the puzzle that support the success of the brand in cruise; the training, the storytelling and the ability to navigate logistical challenges.

Differentiating cruise duty free

On unlocking the potential of the cruise channel and travelers on board, Lively indicates that Diageo Global Travel is paving the way for players in the industry and working to establish its role as

leader. Lively says companies should go beyond customizing their product assortment and choose to customize how they activate on board in regards to their activations.

“[We are starting to take a new lens, where it’s no longer acceptable to have a one-size-fits-all solution. We have to have separate strategies; and part of that for us is creating a playbook for cruise and being able to feed that to our marketeers prior to them rolling out their year plan, so they know exactly what we need in terms of resources and support to make customized plans.

“And then, once you get to that level it’s not a one-size-fits-all solution for cruise. We know that every retail shop is different depending on the cruise line, the itinerary and who the passengers are on board. You have to go beyond just a cruise solution; you have to get to that level of data, create a segmented approach and develop different solutions for different cruise lines and retailers based on opportunity,]” she explains.

The collecting and sharing of data to gain a better understanding of those cruising continues to be a sticking point in the channel. Kauffman admits while the intentions are there, the systems of communication to carry out plans are not in place. She says sometimes the ideas are so big that they are hard to make a reality and that it’s important to start small and be flexible to test ideas in order to make them come to life.

30 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Cruise Report

Specialists in travel related marketing intelligence and consulting www.m1nd-set.com info@m1nd-set.com

THE FUTURE OF AVIATION

Providing an update on Latin America, Peter Cerdá, Regional Vice President for the Americas at IATA, discusses the dynamic aviation landscape of the region and air travel as a critical pillar of connectivity, economic growth and social progress

by LAURA SHIRK

The 80th International Air Transport Association (IATA) Annual General Meeting and World Air Transport Summit was held in early June in Dubai. According to IATA, around 1,500 delegates attended, including IATA member airlines, strategic partners and international and regional associations.

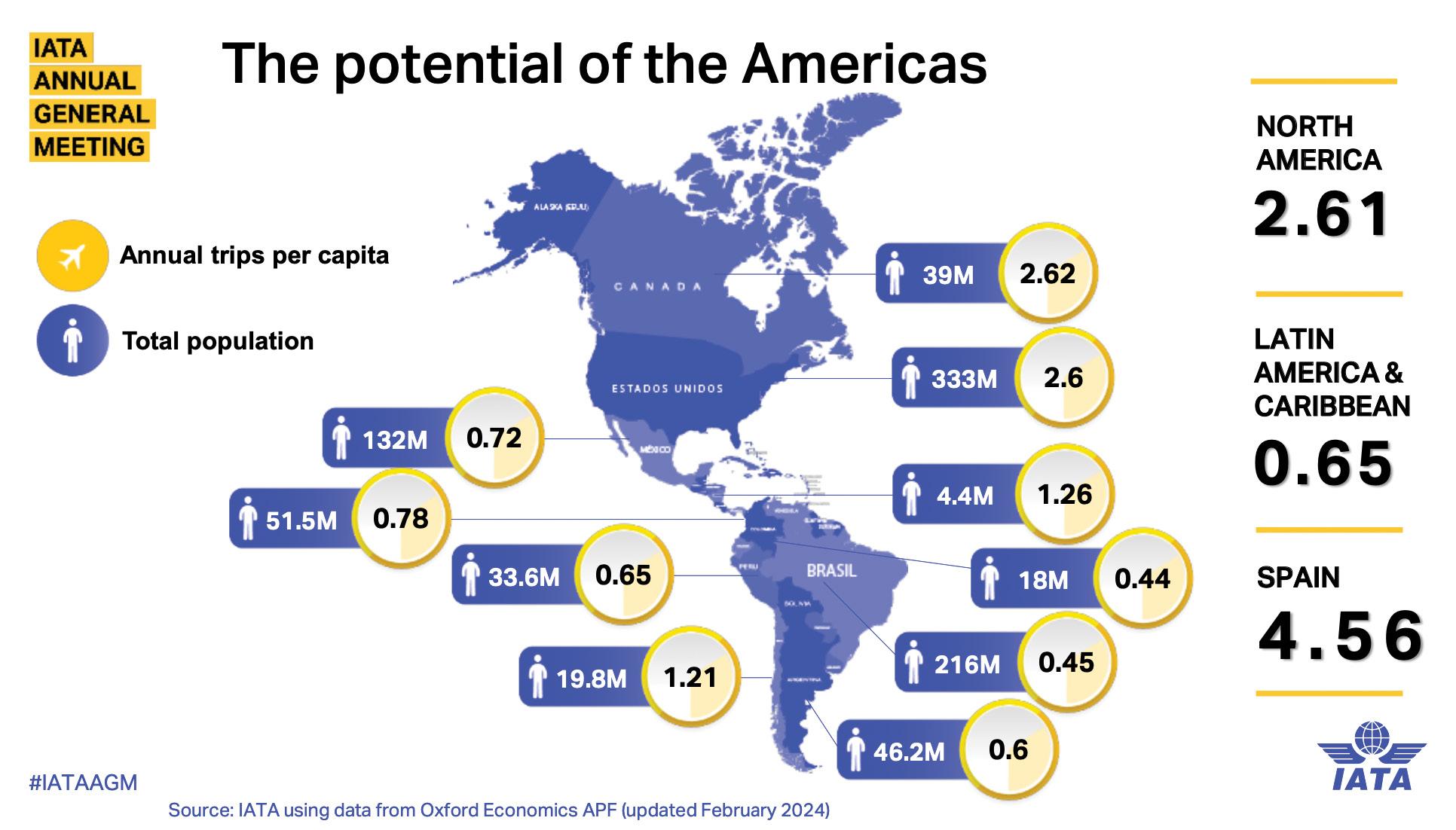

During the event’s media briefing, Peter Cerdá, Regional Vice President for the Americas at IATA, presented on the dynamic landscape of the Americas and aviation as a “critical pillar of connectivity, economic growth and social progress.” Cerdá opened by highlighting key figures like more than 90% of tourists in the Americas region arrive by air, and showing the importance of aviation as an access point for the continent.

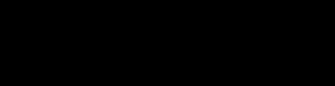

The Latin America market has potential for significant growth considering the average annual number of trips taken per citizen is 0.65 versus approximately 2.6 trips per year in the United States/Canada and 4.5 trips per year in Spain. However, based on the latest financial figures, Cerdá shared while airlines in North America are expected to profit substantially in 2024, airlines in Latin America are expected to continue to operate on “razor thin margins.”

“Despite efforts to streamline expenses and optimize routes, airlines are facing a challenging operating environment amidst fluctuating fuel prices, currency volatility, and stringent aviation regulations. The situation underscores the need for more infrastructure and supportive policy reforms to ensure the long-term viability of the aviation sector in the region and governments must recognize the sector as a trusted partner, integral to the region's prosperity, rather than a mere source of revenue.

“By fostering cost competitiveness and embracing collaborative partnerships, we can secure the industry's long-term success by focusing on the following key areas: reducing taxes, fees, and charges, enhancing regulatory frameworks, improving infrastructure for seamless travel, and prioritizing sustainability. By collaborating within

32 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Latin America Update

Peter Cerdá, Regional Vice President for the Americas, IATA

The average annual number of trips taken per citizen in Latin America is 0.65 versus approximately 2.6 trips per year in the United States/Canada and 4.5 trips per year in Spain

Cerdá calls for open dialogue between airlines, airports and respective government stakeholders to ensure airport infrastructure is fit for purpose. This would not only result in cost savings for airlines, but also play a role in the industry’s commitment to a more sustainable future

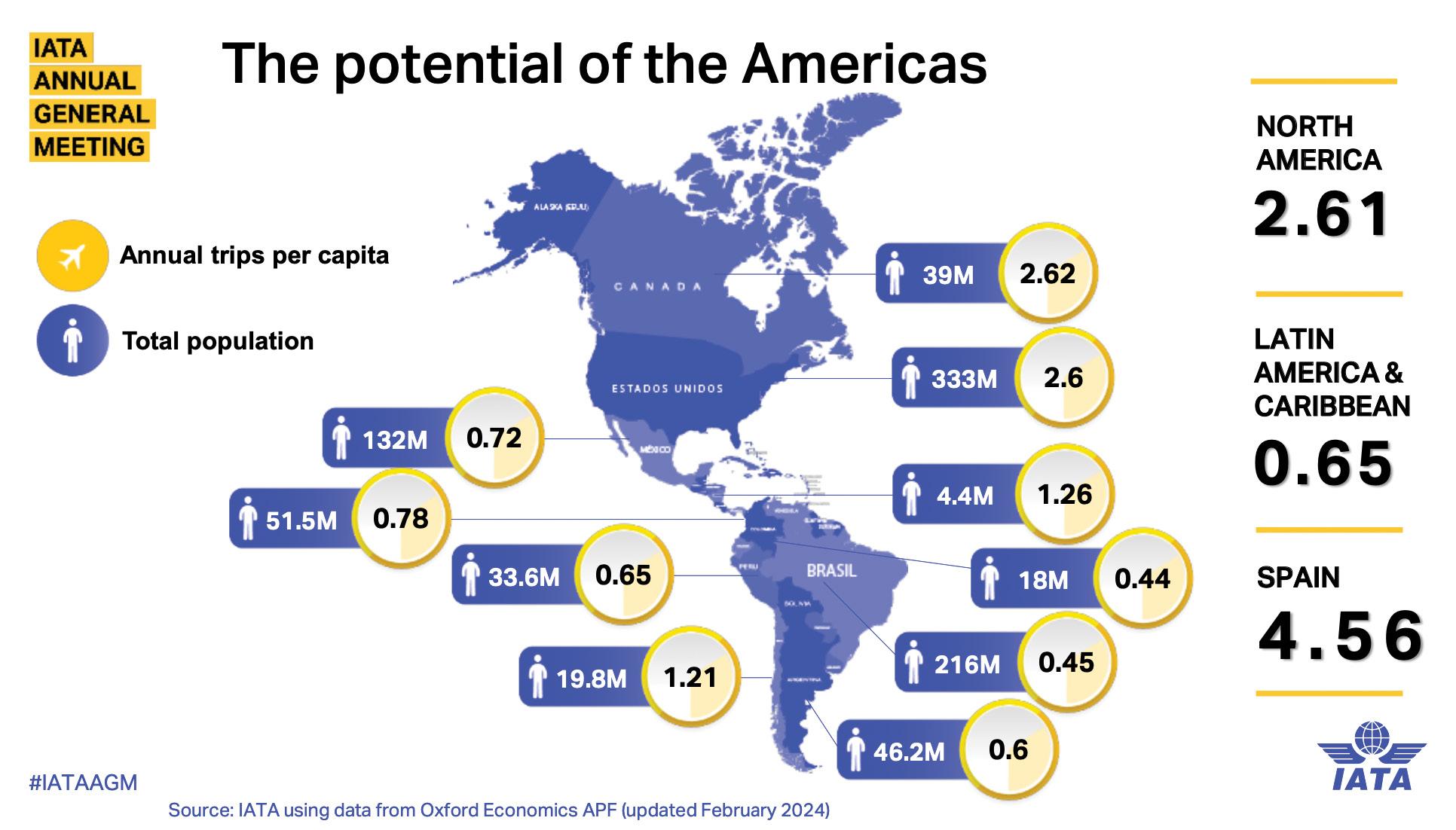

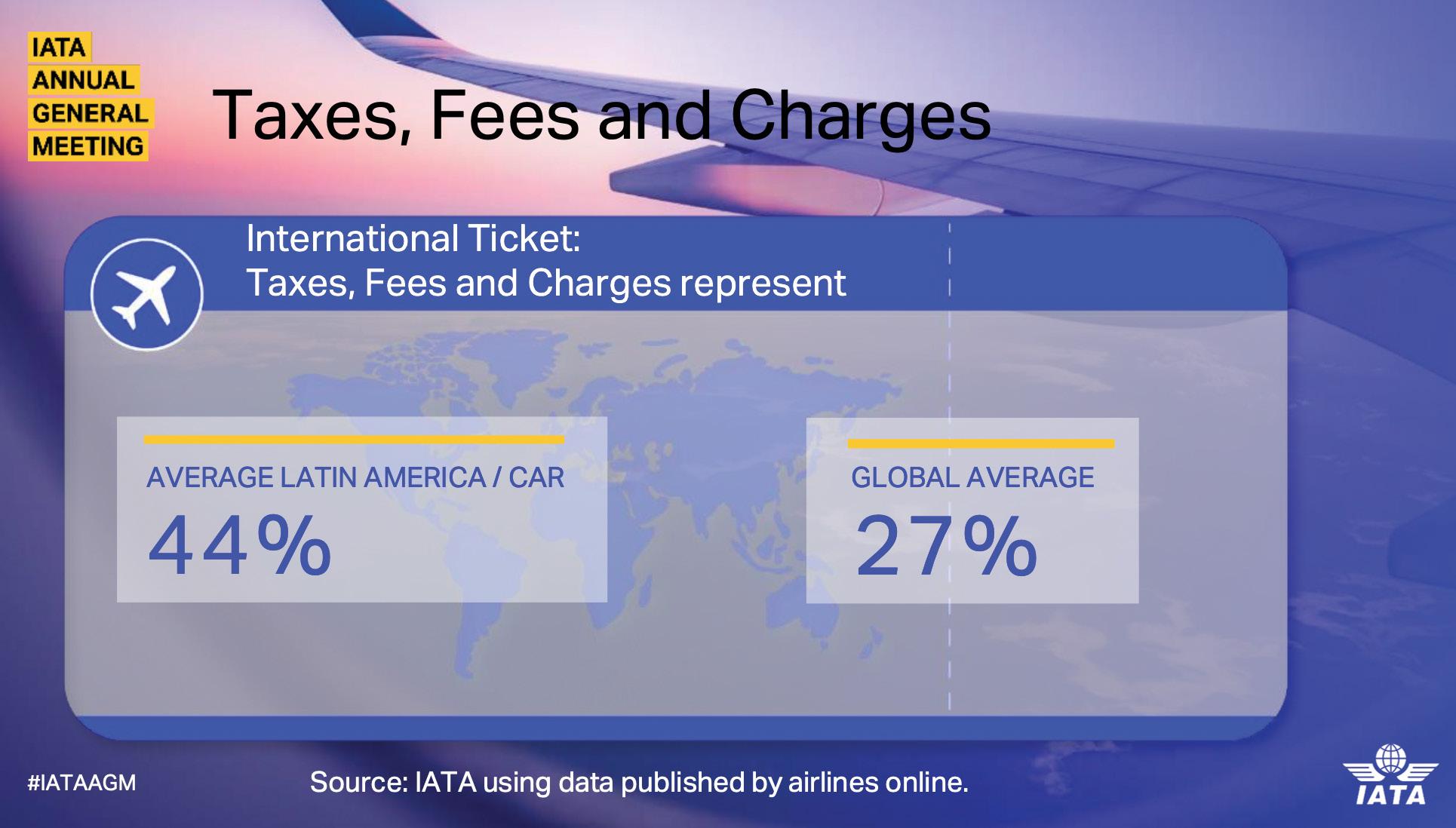

IATA reports the global average of taxes, fees and charges that represent the cost of an average international ticket is 27% compared to an average of 44% in Latin America and the Caribbean

these domains, we can unlock the full potential of aviation's connectivity, fostering growth and prosperity for all,” explained Cerdá.

Taxes, fees & charges and regulatory frameworks

It is often overlooked that taxes and fees can constitute up to half the cost of a flight. IATA reports the global average of taxes, fees and charges that represent the cost of an average international ticket is 27% compared to an average of 44% in Latin America and the Caribbean. This difference reflects the fact that the cost of fuel in Brazil represents almost 40% of Brazilian airlines’ expenses, surpassing the global average of 30%. IATA continues to advocate for the equitable treatment of aviation, in recognition of its vital role in the region’s connectivity.

He referenced, the passenger terminal at Lima Airport in Peru, which is

scheduled to open in December, will charge a new fee for in-transit passengers. Also, Colombia reintroduced a 19% value added tax (VAT) in 2023 compared to the 5% VAT applied during the pandemic. According to Cerdá, in combination with inflation, the high cost of fuel and the devaluation of the peso, this increase resulted in Colombia missing out on up to 7 million passengers last year.

Providing a sense of optimism for increasing the accessibility of air travel, Cerdá added, “There is a silver lining as some governments in the region, like Ecuador, are taking encouraging steps by reducing passenger taxes and easing burdens on fuel and fund repatriation.”

In line with regulatory frameworks, he explained, it is important to balance consumer rights with the unique aspects of air travel, ensuring fairness and sustainability for all stakeholders. Current

legislative initiatives like the proposal put forward in Peru that would allow passengers to choose their seat, fail to address shared accountability. “Airlines operate in a complex value chain where service disruptions can occur due to various interlinked factors,” said Cerdá.

Infrastructure and seamless travel

Since passengers have come to expect a seamless travel experience, the successful future of aviation “hinges on adequate and cost-efficient airport infrastructure to meet demand.” This is a current shortfall in many countries across the region. Cerdá calls for open dialogue between airlines, airports and respective government stakeholders to ensure airport infrastructure is fit for purpose. This would not only result in cost savings for airlines, but also play a role in the industry’s continued commitment to a more sustainable future.

On a positive note, in addition to high expectations for a comprehensive revamp of Argentina’s aeronautical code to open up the market and increase connectivity, Cerdá also recognized the excellent work of Operadora Aeroportuaria Internacional at Bogotá Airport in Colombia. Here, the industry and the government worked collectively to improve the immigration and security of departing passengers via the implementation of passport readers and the use of biometrics.

Connectivity and competition

Connectivity both on a regional and international basis has never been higher; and the market is seeing greater competition among airlines. IATA says, low-cost carriers are responding to the uptick in demand and forecasts North America will see a growth of 6.3% (yearover-year) in 2024, while Latin America is expected to grow by 7.4% (yearover-year).

“These figures reflect the industry’s significant contribution to socio-economic development, and the continued commitment to uniting people and fostering business opportunities through air travel,” Cerdá concluded.

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 33

Conducted by IAADFS

and

“The

the

–

panelists [L-R]:

Summary of the Summit

and

34 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Summit Overview

Chairman René Riedi, the workshop session

Americas

Change

Promise” featured

following

Nuno Amaral, Chief Operations

Business Development Officer, ARI; Greg Ford, General Manager – TR Americas, Pernod Ricard; Felipe Grant, General Manager, Puig Travel Retail Americas; and Markus Suter, Marketing Manager GTR – The Americas, Lindt

Global Travel Retail Magazine

Deputy Editor Laura Shirk and TFWA

President Erik Juul-Mortensen at the WITR+ opening event

Airport Restaurant & Retail Association Executive Director Andrew Weddig and IAADFS President & CEO Michael Payne at the welcoming cocktail

Global Travel Retail Magazine’s coverage of this year’s Summit of the Americas; IAADFS welcomed more than 1,200 delegates to West Palm Beach, Florida, in April and announced its move to Miami in 2025

by LAURA SHIRK

Global Travel Retail Magazine (GTR Magazine) traveled to West Palm Beach, Florida, in April to attend Summit of the Americas 2024. Organized by IAADFS, the exhibition and conference was held April 14 – 17 at the Palm Beach County Convention Center. As shared by IAADFS President & CEO Michael Payne at the closing press conference, the association welcomed 81 exhibitors (versus 74 in 2023) and more than 1,200 registered delegates, a slight uptick from last year.

The exhibition hall spanned around 26,000 square feet; and as in previous years, alcohol and spirits companies led

the exhibitor mix. Select beauty, jewelry and confectionery brands were also present. For the second year, the trade show floor consisted of a networking area to allow non-exhibitors in on the action.

Speaking about the purposefully limited number of workshop sessions scheduled this time around, over 120 people attended day two’s “Sailing into Success: Cruise Retail” session. The association is considering both extending and further segmenting the workshop schedule next year.

According to Steven Antolick, Executive Director at IAADFS, feedback suggested that delegates were impressed by

the quality of buyers in attendance and the convenience that the Summit of the Americas app offered.

Providing the pros of the Miami decision, Payne said as a hub airport, the location will provide easier access for travelers, a vibrant food and entertainment scene and minimal cost for those based in the city. While there is a risk that Miami-based companies will choose to host people in-office, he added this is the case whatever the location. “We don’t know yet how it will play out, but we will adapt. We expect good support from the Miamibased companies,” he added.

Conference highlights

The session “The Americas – Change and Promise,” kicked off day one, following a welcoming from IAADFS Chairman René Riedi. The Chairman introduced the new members of the IAADFS Board: Lisa Bauer, President &

www.gtrmag.com GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 35

Italy’s Illva Saronno has entered the gin category with the purchase of Piedmont-based Engine Gin

Frontier Duty Free Association

Executive Director Barbara Barrett; Chris Foster, Manager of Operations at Queenston-Lewiston Duty Free; and Blue Water Bridge Duty Free

President Tania Lee represented Canadian business in the channel

Moderated by Chris Madden, Special Projects Editor at DFNI [on the left], the workshop session “Sailing into Success: Cruise Retail” included a panel discussion featuring [L-R] Estelle Baumann, Managing Director, Denizen; Emily Lively, Head of Cruise & Airlines, Diageo Global Travel; Lisa Kauffman Chief Sales & Marketing Officer, Starboard Cruise Services; and a presentation by m1nd-set COO Clara Susset [on the right]

CEO, Starboard Cruise Services; Greg Ford, General Manager – TR Americas, Pernod Ricard; Felipe Grant, General Manager, Puig Travel Retail Americas; Julia Seve, Managing Director, L’Oréal Travel Retail Americas; and Markus Suter, Marketing Manager GTR – The Americas, Lindt.

During the session, which was conducted by Riedi, Nuno Amaral, Chief Operations and Business Development Officer at ARI, joined Ford, Grant and Suter in a panel discussion covering a range of topics including digital connectivity, technology and brand and retailer partnership. Although premiumization continues to top the list of industry trends, Amaral explained that added value proposition is also growing, potentially leading to polarization.

36 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024

Snapshots from the exhibition floor:

Summit Overview

King Edward Hotel,

November 18-21, 2024 FDFA CONVENTION CELEBRATING 40 YEARS OF GROWING TOGETHER! 2024

Toronto, Ontario

Beyond e-commerce and digital services, duty free is relying more on technology to collect data, profile passengers and drive engagement, which leads to the question of scalability. To learn about personalized consumer habits and achieve a level of insight that allows for targeted offers, Ford pointed out the importance of convenience to the shopping dynamic and programs to increase brand loyalty. “We need to work harder to attract the attention of Gen Z and re-iterate the brand message to convert shoppers. Ultimately, this could happen once travelers start thinking about booking a trip,” he said. The potential to partner with the cruise industry on onboard sampling and offerings is exponential and he believes this should translate to the airport environment.

Day two’s cruise retail session, took place shortly after Seatrade Cruise Global’s new initiative “The Retail Day” in Miami. Moderated by Chris Madden, Special Projects Editor at DFNI, the workshop consisted of a presentation by m1nd-set COO Clara Susset, in addition to a panel discussion featuring Lisa Kauffman, Chief Sales & Marketing Officer, Starboard Cruise Services; Emily Lively, Head of Cruise & Airlines, Diageo Global Travel; and Estelle Baumann, Managing Director, Denizen.

38 GLOBAL TRAVEL RETAIL MAGAZINE JUNE 2024 Summit Overview

LAURA SHIRK Deputy Editor laura@gtrmag.com

LAURA SHIRK Deputy Editor laura@gtrmag.com