Spirits&Tobacco JULY 2019 · SPECIAL ISSUE

dav_dis19_com_ad_210x203mm_engl_250619.indd 1

26.06.19 09:53

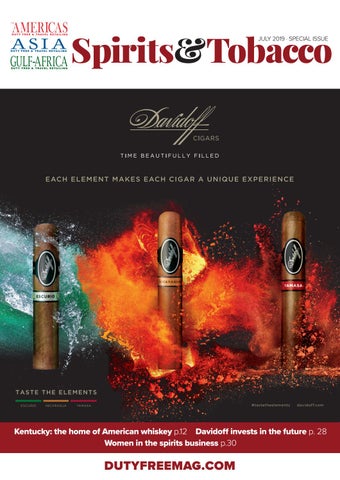

Kentucky: the home of American whiskey p.12 Davidoff invests in the future p. 28 Women in the spirits business p.30

DUTYFREEMAG.COM

Spirits&Tobacco JULY 2019 · SPECIAL ISSUE

dav_dis19_com_ad_210x203mm_engl_250619.indd 1

26.06.19 09:53

Kentucky: the home of American whiskey p.12 Davidoff invests in the future p. 28 Women in the spirits business p.30

DUTYFREEMAG.COM