CONFECTI ONERY & FINE FOODS JUNE 2019 · SPECIAL ISSUE

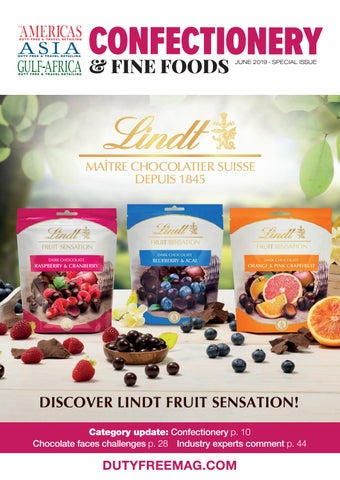

MAÎTRE CHOCOLATIER SUISSE DEPUIS 1845

DISCOVER LINDT FRUIT SENSATION! Category update: Confectionery p. 10 Chocolate faces challenges p. 28 Industry experts comment p. 44

DUTYFREEMAG.COM

CONFECTI ONERY & FINE FOODS JUNE 2019 · SPECIAL ISSUE

MAÎTRE CHOCOLATIER SUISSE DEPUIS 1845

DISCOVER LINDT FRUIT SENSATION! Category update: Confectionery p. 10 Chocolate faces challenges p. 28 Industry experts comment p. 44

DUTYFREEMAG.COM