1 minute read

LICs: New challenges emerge compared to pre-HIPC era

Compared to the pre-HIPC era: Debt stocks are not as high.

Public Debt-to-GDP Ratio in Country Subgroups (Median, percent of GDP)

Advertisement

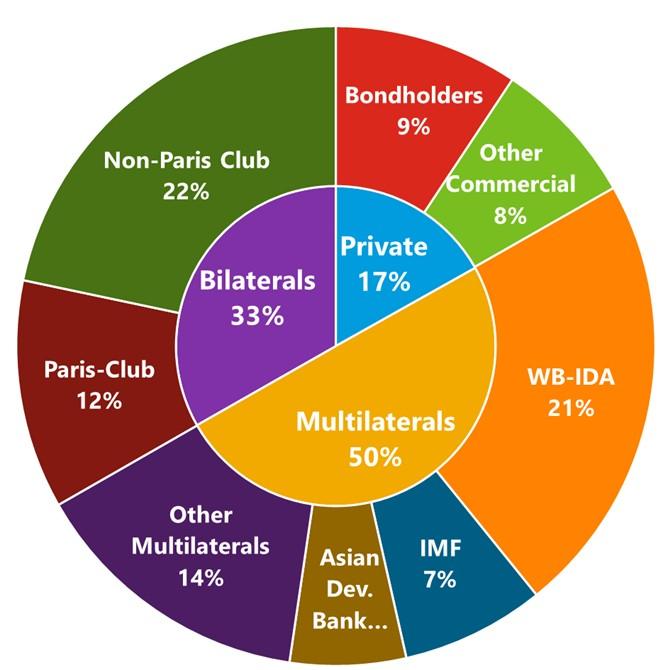

evolving creditor landscape with increasing lending from non-Paris Club and private creditors poses new coordination challenges.

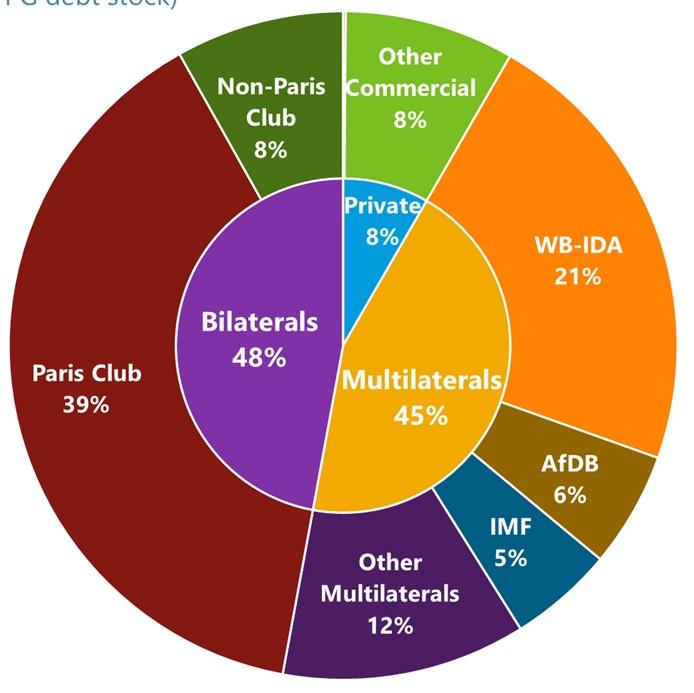

End-1996: Distribution of PRGT Creditors (in percent of total PPG debt stock)

End-2020: Distribution of PRGT Creditors (in percent of total PPG debt stock)

Sources: IMF Global Debt Database, IMF WEO and staff calculations

Arrears accumulation also appears to be minimal.

Outstanding Arrears (in Percent of Exports, median)

Pre-HIPC HIPC

Principal arrears, official Principal arrears, private Interest arrears, official Interest arrears, private

Source: WB IDS and staff calculations

Sources: World Bank IDS and staff calculations

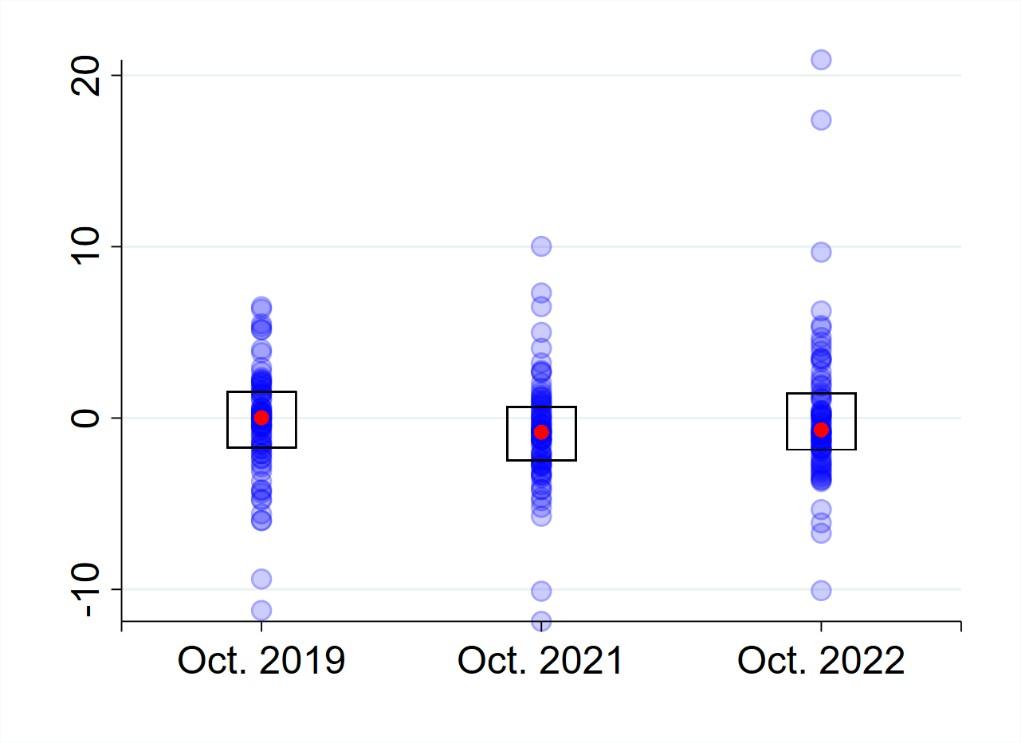

Debt Vulnerabilities in EMs: debt and interest payments are projected to be at pre-pandemic levels for 2023, but primary balances worsen Projections for year 2023 (in percent of GDP)

Interest Payments of Countries Displayed: 79.

Note: Charts exclude Venezuela, Lebanon and Ukraine. Red diamond indicates median value. “Boxes” indicate interquartile range.