10 minute read

Fluid Power Roundtable

FLUID POWER ROUNDTABLE 2021

Fluid power leaders discuss the latest tech, the impact of COVID and the state of the industry.

Given the lockdown’s impact, how has business been?

Campbell Tourgis, Vice Pres-

ident, Wainbee Limited: No one could have predicted the ups and downs in the industry. Our core markets – oil and gas, forestry, aerospace, mining and minerals and automotive – were all significantly impacted.

From an opportunity standpoint, chaos often creates opportunity and we do have a product line and people who are attuned to the life sciences and food and beverage marketplace. As a result, we saw some tremendous increases in portions of our business that were always solid but not outstanding. So while we saw a drastic drop-off in some sectors, we saw realizable gains in a few others. That helped us stay progressive during this year and provided some sense of balance on revenue for the year.

Like the last fundamental economic change, in 2008, events like the pandemic do force companies to look at what their market segments look like, what they are doing well in today, what’s at risk and what they need to start developing for the future.

Conrad Rieckhof, Business Development – Pneumatics,

Festo Canada: We’ve actually done very well. We were fortunate in that we have divisions in areas like life tech, food, electrical light assembly, packaging and even process, so we’re able to spread ourselves out quite a bit.

As a result, we can pick up the highs in one market during the lows in the others. In many of these industries, pneumatics is one of the default, go-to technologies for creating motion.

Going forward, while COVID has had a huge impact, we’ve seen a rise in medical and intra-logistics industries. For example, the need for testing, vaccine and related consumables has given that industry a new spike in a market that was already growing before the pandemic.

On the logistics side, automated warehouse systems were another growth area for us, pre-COVID, that saw its growth accelerated due to the pandemic.

Ted O’Donnell, Business Manager, Mobile Systems,

Bosch Rexroth Canada: While the business environment was challenging, we faired pretty well in 2020. During the lock-down, we were fortunate to be able to move to a work-from-home model. With social distancing, our shops remained working and we were better prepared to serve our customers when the restrictions were eased.

Looking forward, I ‘m optimistic. Customers are back to work in greater numbers now. The demand for their goods and services, according to what they tell us, is there. And with the vaccines easing people’s anxieties, there’s a general expectation of a return to normal later this year or in 2022. I think we all understand and agree that “normal” will be different but, from a business sense, things will be more familiar.

“Like any other company or individual, we accept that change in inevitable but we often think we can control it when it becomes personal. The reality is that change doesn’t wait for approval; it just happens.” – Campbell Tourgis, Wainbee Limited Are there positive ways in which the pandemic has changed your company or the industry?

Tourgis / Wainbee: From the company’s perspective, Wainbee is like any other company or individual; we accept that change in inevitable but we often think we can control it when it becomes personal. The reality is that change doesn’t wait for approval; it just happens.

It’s natural to resist change but, across the company, we experienced an overwhelming response to adopt what we needed to do to keep going. Online meetings, for example, have added a huge benefit, greatly enhancing efficiency and real-time in-house communication. That holds true for clients as well. Usually one sales call can accomplish everything that needs to happen versus the back-and-forth of the old way.

From an industry standpoint, we’ve also seen a rapid adoption that data points are integral to performance improvements. Our clients have discovered that analyzing their data, processes and operations helps them improve energy management and predictive maintenance to operate at the most efficient levels.

Rieckhof-Festo: Aside from the market growth, there have been some positives with the way that people work during the pandemic. The use of digital tools could be a time and cost saver as we return to normal – generally cutting down on travel and making more efficient use of time.

It has also led to better teamwork. Now that we’re really getting comfortable with this, the ability to bring in various experts from around the world when needed has shown us how efficient and productive virtual meeting can be. Initially, we might have all struggled, but now that we’re in the second year, it has become the accepted new work life moving forward.

O’Donnell-Bosch Rexroth:

Positives have definitely come from adapting to the pandemic restrictions, at least for our organization – some we may not be able to see completely just yet. It has forced companies like ours to become more efficient and find new ways to function. That will bring changes to how we work in the future, such as what space we need to occupy and how we communicate and interact with each other to conduct business.

The fact that we have been able to function in a work-fromhome environment outside of the office and without all of its equipment has changed the way we might work in the future. I still miss the ability to be face-toface with customers and people in the office. I don’t think that is going to go away completely, but it’s probably going to change.

“Previously, the weak link in this new generation of adaptable machines was the pneumatics. Now, with the latest fluid power technology, it’s possible to digitalized pneumatics and move them into the digital age of industry 4.0.” – Conrad Rieckhof, Festo Canada

“Positives have definitely come from adapting to the pandemic restrictions, at least for our organization – some we may not be able to see completely just yet.” – Ted O’Donnell, Bosch Rexroth Canada What are the biggest challenges facing the industry currently?

Tourgis-Wainbee: There are a lot of interesting industries that have opportunities in the chaos. For example, energy development with respect to electric vehicle enhancements, beyond just traditional hydraulics, as well as hydrogen charging and refueling. Those will certainly play a major role in the present and future. How companies will support and facilitate those are pretty interesting challenges to have.

From our perspective, governments and private industries will have to change the approach to attract market segments, specifically the pharmaceutical industries, to improve the supply chain and limit dependence on foreign countries. And that holds true for not just drugs but for all healthcare equipment, which we saw as a critical need at the beginning of the pandemic.

Rieckhof – Festo: Training is one area that has not yet fully adapted to the new normal. Training requires in-person components, such as hands-on activities, that haven’t been duplicated in a virtual environment. We’re also finding that a classroom creates a more comfortable environment for questions and interaction. If you’re learning a new topic and you’ve got 15 people on a virtual meeting, nobody wants to say anything. Every time I’m doing a training session, it’s typically pretty quiet.

Festo Didactic, the training division of Festo, is working hard at developing new interactive software tools to help improve the virtual training experience.

O’Donnell-Bosch Rexroth:

Education and recruiting new talent are probably the biggest challenges. For many years now, we’ve struggled with educational opportunities, specifically in the secondary education and colleges. That has limited our ability to bring in new people and created a skills gap.

By and large, we don’t have hydraulic education going on in the colleges. It has become part of a mechatronics or a millwright program and is typically a couple of weeks of education.

There are a few programs out there like BCIT in British Columbia and NAIT in Alberta, as well as Mohawk and Centennial in Ontario, but that’s not the way it used to be and it’s not primarily focused on fluid power.

I sit on the CFPA board and finding ways to bring that level of education back into our industry in Canada is a big topic for us.

Which technologies or trends are you currently excited about?

Tourgis-Wainbee: First and foremost is the integration of the electronic controls and displays with radio remotes and all the sensors to provide functionality to the hydraulics on off-road vehicles. The industry is forging ahead on this, not only in terms of energy efficiencies but also the operator and data collection efficiencies of these vehicles.

We also see a tremendous momentum in machine reliability, specifically fluid condition monitoring. With the introduction of new types of oils, we also have new contaminant challenges. So, topics such as varnish mitigation and removal of oil has generated excitement in the industry.

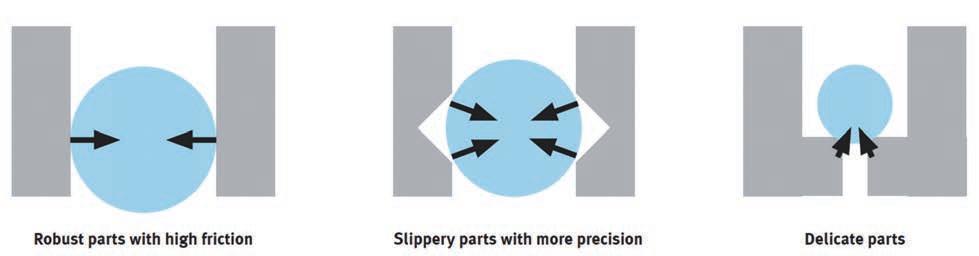

The third is the integration of

traditional fluid power with automation. Since we can’t have too many people within a squared circle anymore, we’re seeing an increasing adoption of cobots to help with operator interface and machine tending. With that adoption comes increased demand for complementary fluid power products such as end-of-arm tooling and pick-and-place units.

Rieckhof-Festo: We’re excited about the continued development of smart pneumatics. An example is the Festo Motion Terminal or VTEM. It’s one valve block but it can perform different pneumatic functions by using software apps to change the VTEM’s personality.

For example, instead of having a 4/2 valve, you can switch to a 4/3 or 3/2 using just the software. In addition to directional control, VTEM also allows for pressure, flow and speed controls to be changed using software but with one single set of hardware.

So, basically 50 traditional pneumatic components are replaced with the VTEM valve and software.

Machines are becoming increasingly flexible, where an operator can now make a product selection on an HMI and the machine will make the required changes automatically producing a different product variant.

For that to happen, pressure, force and actuator stroke length might have to change. So, with minimal human interaction, the VTEM software and hardware allow the machine to adapt automatically.

Previously, the weak link in this new generation of adaptable machines was the pneumatics. Now, with the latest fluid power technology, like VTEM, it’s possible to digitalized pneumatics and move them into the digital age of industry 4.0.

O’Donnell-Bosch Rex-

roth: The electrification of fluid power componentry, including connected hydraulics, the Internet of Things and artificial intelligence. All of these technologies are bringing new capabilities to the fluid power industry that previously weren’t available. For example, you can have a pump that doesn’t have a traditional mechanical control but has an intelligent electronic control. When mated with the appropriate motor and knowledge of the hydraulics involved, the pump can be optimized to ensure that a vehicles engine operates at its optimum operating point. In addition, better control of the hydrostatic transmission ensures the complete drivetrain operates at its highest efficiency.

It can do this while logging data from sensors in the system and passing that data to cloud based apps that monitor various aspects of both the components and the machine for functionality and performance.

These kinds of technologies will allow our industry to change in ways that will allow fluid power users to continue to innovate and develop new machines that solve the problems they are going to come across tomorrow. |DE

QUICK RELEASE COUPLINGS

Poppet Check Valves

With rubber poppet seal for improved sealing when disconnected.

Single Acting Sleeve

Manually retracted to connect, or disconnect.

Push/Pull Sleeve

Can be moved in either direction to connect, or disconnect.

Engineering excellence, customer focus and highest quality products continue to attract new clients from numerous industries. RYCO continues to provide quick release coupling solutions to meet customer demand. RYCO carries pneumatic, hydraulic and specialty couplings in a diversified offering of ball lock, poppet, flat face and screw to connect types.

For further information, contact our sales team: Call: +1 866 821 7926 | Email: Sales@RYCO.us

www.RYCO.com.au

ISO 9001:2015 | AS9100D ITAR Compliant - DDTC Registered DFARS Compliant

Engineering Development & Precision CNC Machining

CNC Swiss Turning • CNC Milling & Turning 4 & 5 Axis CNC Milling & Machining • Gear Cutting Bevel Gear Cutting • Rapid Tooth Cutting Only Capability

We are here to help, contact us today!