2 minute read

Fluid Power News

WAJAX 2020 FINANCIAL RESULTS REVEAL IMPACT OF PANDEMIC

Reflecting the Canadian industrial equipment market, Wajax Corporation’s year-end results revealed that the industrial products and services company’s 2020 revenue decreased 8.4%, or $130.4 million. In total, Wajax’s revenue fell to $1.4 billion, versus $1.5 billion in 2019, with net earnings dropping to $31.7 million compared to $39.5 million in 2019.

“While the challenges of 2020 were clear, the Wajax team seized on opportunities to improve in areas important to our long-term success,” said Wajax President and CEO, Mark Foote, commenting on the company’s results.

“As the pandemic unfolded, we were in constant contact with our customers to ensure we were there when they needed us,” Foote added. “We developed new ways of working with our team, using technology to increase communication, and the team did excellent work to protect the financial health of the corporation.”

According to the 163-yearold Mississauga-based firm, the decrease was due to lower sales in all regions, and nearly all product categories, except for higher engineered repair services sales in western and central Canada and higher mining equipment sales in western and eastern Canada.

Looking forward, the company says it expects revenue from its $99.1 million acquisition of Tundra in January 2021 to contribute significantly toward revenue growth in 2021.

At the same time, the company said it expects modest organic growth in the present year, considering that heavy equipment markets won’t likely fully recover to 2019 levels in 2021.

“Recognizing that the challenges we faced in 2020 have persisted into 2021, the corporation nonetheless enters 2021 with confidence expecting that it is positioned to succeed over the longer term,” Foote said. “In 2021, Wajax remains focused on the same priorities that guided it in 2020: protecting the health, safety and well-being of its team, providing excellent customer service, protecting the corporation’s financial health and driving its long-term growth strategy.”

www.wajax.com www.tundrasolutions.ca

163

Years since the founding of the Mississauga-based industrial products firm, Wajax Corporation.

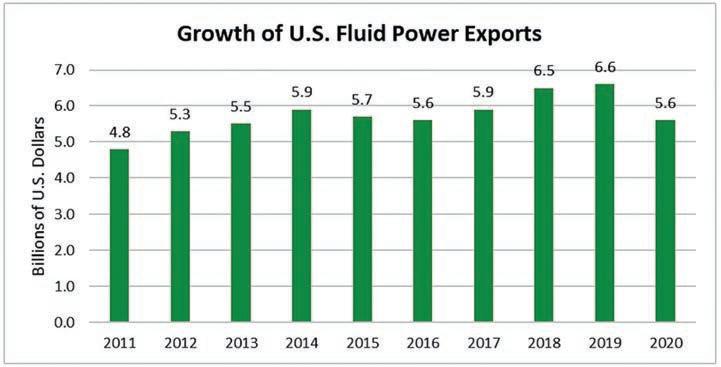

U.S. fluid power exports deviated from an otherwise consistent growth trend, declining 14.3% in 2020 compared to 2019.

U.S. FLUID POWER PRODUCT EXPORTS DECLINE $1 BILLION IN 2020

According to the National Fluid Power association, hydraulic and pneumatic exports took a heavy hit in 2020. In total, U.S. exports declined by 14.3% compared to 2019, reaching 5.6 billion dollars in 2020. That’s a drop of nearly one billion dollars compared to 2019. In addition to a recessionary economy brought on by the pandemic, an uncertain foreign trade environment due to unstable trade policies, unpredictable sanctions and wavering tariffs contributed to the 2020 decline.

According to association, the U.S. fluid power industry’s top five trading partners, including Mexico, Canada, China, Germany and the U.K., represent over half of the U.S. industry’s exports at 55%, while the top ten trading partners represent 72%. The remaining 28% exports is divided among 180 other countries.

Despite the grim numbers for 2020, more recent soundings show the beginnings of a comeback for the industry. In January 2021, the NFPA said shipments of mobile hydraulic, industrial hydraulic and pneumatic equipment had increased 5.4% when compared to December 2020.

www.nfpa.com

Photo credit: NFPA