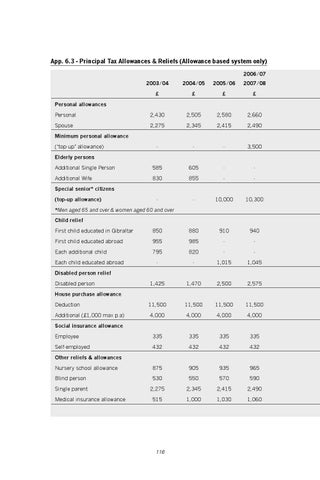

App. 6.3 - Principal Tax Allowances & Reliefs (Allowance based system only)

2006/07

2003/04

2007/08

£

2004/05 2005/06 £

£

£

Personal allowances Personal

2,430

2,505 2,580 2,660

Spouse

2,275

2,345 2,415 2,490

Minimum personal allowance (‘top-up’ allowance)

-

-

-

3,500

Additional Single Person

585

605

-

-

Additional Wife

830

855

-

-

Elderly persons

Special senior* citizens (top-up allowance)

-

- 10,000 10,300

*Men aged 65 and over & women aged 60 and over Child relief First child educated in Gibraltar

850

880

910

940

First child educated abroad

955

985

-

-

Each additional child

795

820

-

-

-

-

1,015

1,045

1,425

1,470

2,500

2,575

Each child educated abroad Disabled person relief Disabled person House purchase allowance Deduction Additional (£1,000 max p.a)

11,500 4,000

11,500 11,500 11,500 4,000

4,000

4,000

Social insurance allowance Employee

335

335 335 335

Self-employed

432

432 432 432

875

905

Other reliefs & allowances Nursery school allowance

935

965

Blind person

530

550

570

590

Single parent

2,275

2,345

2,415

2,490

515

1,000

1,030

1,060

Medical insurance allowance

116