Keurig

Keurig

CEO & Executive Editor

CEO & Executive Editor

Cesar Pereira

Cesar Pereira

Functional botanical ingredients such as flowers, berries and plant roots continue to blossom in the food and drink sector, the latest Insight By Gama Compass can reveal. As we explore on pages 14 and 15, this all links in to ongoing demand for wild, ancient and functional ingredients, pared back formulations and premium concepts, as well as complex and adventurous flavour combinations.

The trend for functional food and drink boasting hero botanical ingredients is also exemplified by this month's Innovation Insight, which looks at a new electrolyte drink from the UK touting the health benefits of “whole watermelon”. Turn to page 29 for the full story.

Elsewhere, we look forward to no less than five different events, as the tradeshow season well and truly hots up in the second quarter, and speak to Rio Food Industries Factory and Bauer about the innovation trends shaping the food and drink landscape in Saudi Arabia and Italy, respectively.

Enjoy our latest issue edition.

Peter House, Oxford Street, Manchester, M1 5AN United Kingdom

Company Number: GB 8773764

phone: +44 1618188700 info@gamaconsumer.com @GamaConsumer

www.gamaconsumer.com

Cesar

Pereira

CEO, Gama

SWITZERLAND:

Nestle, the Swiss consumer goods giant, has announced plans to spin-off its water and premium beverages business from 1st January 2025.

“As part of the action plan to drive operational performance and unlock potential, Nestlé’s water and premium beverages activities will become a global standalone business under the leadership of Muriel Lienau, Head of Nestle Waters Europe, as of January 1, 2025”, the company said in a statement.

“This will include exploring partnership opportunities to enable Nestlé’s iconic brands and growth platforms to achieve their full potential”, the company added.

Nestle’s bottled water brands include Acqua Panna, Nestle Pure Life, Perrier and S.Pellegrino.

Commenting on the company’s new “Accelerating Nestle” strategy, Nestle CEO Laurent Freixe said: “Our action plan will also improve the way we operate, making us more efficient, responsive and agile. This will allow us to deliver value for all our stakeholders. I am confident that we can deliver superior, sustainable and profitable growth and gain market share, while transforming Nestlé for long-term success.”

As a result of the strategy Nestle said it expected an improvement in organic sales growth compared to 2024.

By: Innovation Editor – Europe Source / Image source: Nestle

NETHERLANDS: FRIESLANDCAMPINA TO MERGE WITH MILCOBEL

DutchdairymultinationalFrieslandCampina and Belgian dairy cooperative Milcobel have announced their intention to merge with the aim of creating a leading dairy cooperative and company spanning the Beneluxregion.

2023 figures (excluding Milcobel’s Ysco business, which is in the process of being divested) suggest the combined organisation would achieve €14 billion ($14.56 billion) in pro forma revenue, operate across 30 countries, employ nearly 22,000 staff, and process 10 billion kilograms of milk from 11,000 farms.

Commenting on the proposal, FrieslandCampina chair of the board Sybren Attema said: “The combination of FrieslandCampina and Milcobel is bigger than the sum of its parts. It creates a future-oriented, combined dairy cooperative that is resilient and capable of capitalising on opportunities in the dynamicglobaldairymarket”.

Milcobel chair of the board Betty Eeckhaut added: “Through our regional complementarity wewillbecomethecooperative dairy partner of choice for current and new members, with a solid milk supply for a successful future. […] For customers, this merger means more innovation, an expanded product portfolio and further professionalisationofourservices”.

The companies have signed a framework agreement with a detailed merger proposal expected by mid-2025 for FrieslandCampina members and Milcobel shareholders to review. The mergerisalsosubjecttoapproval fromantitrustauthorities.

By: InnovationEditor–Europe

Source: FrieslandCampina/ Milcobel

Image source: FrieslandCampina/Milcobel(montage)

Nestle, the Swiss consumer goods giant, has announced an investment of $150 million to expand its frozen food facility in Gaffney,SouthCarolina.

The investment will be used to install a new production line for single-serve frozen meals and upgrade automation and digitaltechnology.

Operating since 1980, the Gaffney plant produces frozen food for brands such as Stouffer’s and Lean Cuisine and is one of 112 facilities owned by thecompanyintheUS.

Commenting on the move, Nestle’s Gaffney plant factory manager Nicole Caldwell said:

“This investment further solidifies our dedication to the Gaffney community, where Nestle has been an integral part for nearly 45 years. It also reflects our continued commitment to enhance our US manufacturing footprint and inhousecapabilities”.

“These enhancements will enable us to meet the consumer demand for the beloved brands in our frozen meals portfolio”, sheadded.

By: InnovationEditor–North America

Source: FoodBusinessNews

Image source: Nestle

US confectionery firm Hershey has announced the expansion of its portfolio with the acquisition of Sour Strips, a brand of soursweetsfoundedin2019.

Sour Strips is claimed to make sweets with intense flavours and creative branding, and is marketed withthetagline “sour candythatdoesn’tsuck”.

Commenting on the deal, Hershey president of US confection Mike Del Pozzo said: “The acquisition of Sour Strips expands Hershey’s offerings within our growing sweets portfolio with a product that is beloved by consumers. We’re energized to welcome Maxx and the Sour Strips team to Hershey as we relentlessly accelerate our growthinsweets”.

Sour Strips founder Maxx Chewning added: “Our partnership with The Hershey Company represents a significant step in our mission to innovate and set new standards within the Confection category. Hershey’s exceptional track record making iconic brands worldwide aligns perfectly with our vision forSourStrips”.

By: InnovationEditor–North America

Source: Hershey/SourStrips

Image source: Hershey/Sour Strips(montage)

Unilever, the multinational consumer goods giant, has announced plans to sell its Knorr pasta sauce brands Tomato al Gusto and Speciale al Gusto in Germany to Italian food firm Casalasco for an undisclosed sum.

Casalasco is described as one of the main global operators in the production and processing of industrial tomatoes, managing the Pomi, Pomito, and De Rica brands and with a supply chain that includes 800 agricultural companies, five factories, and70packaginglines.

Commenting on the move, Casalasco CEO Costantino Vaia said: “With this transaction, our Group intends to consolidate its presence in Germany, one of the leading European food markets, and to give a distinctItalian identitytobrandsdistributed globally. The acquisition of the ‘Tomato al Gusto’ line is part of the internationalization process we have undertaken in recent years and willl strengthenCasalasco’spositionat the European level in the strategicpreservedtomatosegment”.

Casalasco receives exclusive rights to use the Knorr brand within the product range for 12 months, but Unilever retains complete ownership of the brand throughout the transitionalperiod.

Keurig Dr Pepper (KDP), the soft drinks and coffee firm, has announced that it has entered into an agreement to acquire Ghost Lifestyle and Ghost Beverages (collectively “Ghost”) for $990 million.

Founded in 2016, Ghost is a brand of sports nutrition products, energy drinks, dietary supplements, and apparel, anchored by its flagship energy drink brand Ghost Energy.

Commenting on the move, KDP chief executive officer Tim Cofer said: “GHOST is a differentiated brand with significant growth potential, and we are excited to partner with its founders to take the business to the next level. This acquisition strengthens our position in the attractive energy drink category, accelerating our portfolio evolution toward consumerpreferred, growth-accretive spaces through a disciplined deal structure”.

GHOST CEO and co-founder Dan Lourenco added: “As we thought about our company’s next chapter, KDP’s track record of cultivating disruptive brands, similar challenger mindset, and shared vision for the energy category and beyond made it the right home for our brand and team. We are excited to pair KDP’s insights and capabilities with our products and people and know that together we will continue to scale and build GHOSTtowardsourvisionofa100yearbrand”.

The transaction is subject to customary closing conditions, with the initial step expected to close in late 2024 or early 2025. KDP will initially acquire a 60% stake in GHOST, with the remaining 40% set to be acquired in 2028.

By: Innovation Editor – North America

Source: Keurig Dr Pepper

Image source: Keurig Dr Pepper / Ghost (montage)

The transfer of the product range is set to take effect on 1st March2025.

By: Innovation Editor – Europe

Source: Corriere Ortofrutticolo

Image source: Unilever UK: THE NUTRIMENT COMPANY ACQUIRES THE DOG’S BUTCHER

The Nutriment Company (TNC), a Swedish natural pet

food firm, has announced the acquisition of The Dog’s Butcher, a UK-based raw dog food brand, marking its first acquisition of 2025.

Headquartered in Stockholm and owned by Nordic private equity firm Axcel, TNC supplies pet food, including raw diets, snacks, and supplements, through retail, online platforms and pet shops throughout Europe. Its brands includes AniForte, Barfgold, Carnibest, Dibo, Energique, Leo & Wolf, Natural Instinct, Nova, Nutriment, Oscar, Rauh! and Totally Natural PetProducts.

Commenting on the deal, TNC CEO Anders Kristiansen said: “We are extremely happy to welcome The Dog’s Butcher team to The Nutriment Company. Their unwavering dedication to quality and innova-

tion aligns perfectly with our values, and we look forward to expanding their reach in the UK market”.

The Dog’s Butcher founders Joanne and Daniel McMahon said: “We were delighted when we met with the team from TNC. Their commitment to raw feeding and the quality of ingredients mirrored our own. Knowing they are deeply invested inthepetindustry made this aneasy decisionfor us”.

This acquisition follows TNC’s purchase of Petman Germany, Pet Treats Wholesale, Natural Instinct UK and Totally Natural PetProductsScotlandin2024.

By: InnovationEditor–Europe

Source: AnimalFeedMEA

Image source: TheNutriment Co/TheDog'sButcher (montage)

Nestle, the leading FMCG multinational, has announced it is increasingitsportfoliointheUS with the launch of a “liquid espressoconcentrate” line.

Promising consumers “the ultimate hack for customizing café-style iced espresso beverages at home”, the company claims its 100% Arabica espresso concentrate can be prepared without

brewing or equipment, simply by pouring over ice and blending with water or milk.

The new launch comes as a “rich and strong” Black variety and a “sweet and smooth” SweetVanillavariety.

“Though Gen Z and millennial consumers’ tastes are everevolving,havingcold,convenient, customizable, and café-quality coffee remains in demand”, said Felipe Acosta, Nescafe Senior BrandMarketingManager.

“Following our successful NESCAFÉ Gold Espresso and Ice Roast launches, delivering on these needs is a top priority and NESCAFÉ Espresso Concentrate does exactly that. The brand’s first-ever liquid espresso empowers consumer creativity and allows adventurous, modern coffee lovers to create caféstyle beverages in an instant – without any extra machinery and from the comfort of their home”.

By: InnovationEditor–North America

Source / image source: Nestle

Arnott’s, the Australian biscuit and cracker firm, has announced the acquisition of New Zealand food brands Mother Earth, Flemings, and VP Brands from Prolife Foods to expand its snacking portfolio. Mother Earth is described as a brand of muesli bars and baked slices with a growing presence in Australia. Flemings and VP offer bars, nuts and snack mixes in the New Zealand market. Source: Inside FMCG

Lakeview Farms, a leading manufacturer of dips, desserts, and specialty products, has announced the acquisition of the Noosa yo-

BioSteel, a Canadian sports drink and nutrition firm, has announced the opening of its first dedicated manufacturing facility, located in Windsor, Ontario.

Founded in 2009 and acquired by Coachwood Group in 2023, BioSteel offers sports drinks, hydration mixes and protein powders for both consumers andprofessionalathletes.

According to sources, the manufacturing facility will manufacture powders and stick packs locally, with a capacity of 100 million stick packs per year and 10,000 powder containers daily.

ghurt brand from Campbell Soup. Noosa is a manufacturer of premium-positioned, “Aussiestyle” cheesecake bites and yoghurt ice cream that are claimed to be known for their rich, creamy texture and unique flavours. The acquisition includes a facility in Colorado. Source: Lakeview Farms (via PR Newswire)

Kepak, the Irish supplier of foodservice solutions and ready-for-market convenience foods. has announced the acquisition of Summit Foods, a UK-based specialist in frozen and chilled foods. Kepak is a leading meat producer with 15 plants across Ireland and the UK, serving brands including Rustlers, Big Al’s, Celtic Beef, McIntosh Donald, Watergrass Hill, Black Angus, and Hereford Beef. Source: Kepak

For the time being, ready-todrink products will continue to be produced by Flow Beverage inAurora,Ontario.

Commenting on the move, BioSteel CEO Dan Crosby said: “Having the ability to produce our own products and meet NSF standards is a complete game-changer for BioSteel. It allows us to elevate our innovation and product quality while ensuring we remain the go-to brand for professional athletes and anyone seeking the best in hydration and nutrition. Establishing this facility in Windsor is about more than creating jobs it’s about securing our position as a leader in sports hydrationandnutrition”.

By: InnovationEditor–North America

Source: BioSteel/Coachwood Group/Am800Radio Image source: BioSteel

Safety Shot, a wellness and dietary supplement company, has announced that it has entered into an agreement to acquire Yerbae Brands, a plant-based energydrinkfirm.

Founded in 2017, Yerbae Brands offers plant-based energy drinks based on yerba mate that are claimed to be zero calorie, zero sugar, non-GMO, vegan, kosher, keto-friendly, paleo-approved, gluten-free,anddiabetic-friendly.

Commenting on the deal, Safety Shot chairman John Gulyas

said: “We believe that this acquisition could be a significant revenue catalyst for Safety Shot on top of an expected revenue growth rate of 50% expected in Q4, versus Q3. We believe Yerbaé’s impressive growth and established presence in the plant-based beverage market, generating approximately $12 million in revenue in fiscal year 2023, could be instrumental in drivingourpotentialgrowth”.

Yerbae Brands chief executive officer Todd Gibson added: “We are thrilled to join forces with Safety Shot and leverage their expertise and resources to potentially accelerate our growth. We believe that the Transaction will provide us with access to new distribution channels, expanded marketing capabilities, and valuable synergies that will looktobenefitbothbrands”.

The transaction is expected to close in the second quarter of 2025,subjecttocustomaryclosingconditions.

By: InnovationEditor–North America

Source: SafetyShot(via GlobeNewswire)

Image source: SafetyShot/ YerbaeBrands(montage)

Ziyad Brothers, a provider of Middle Eastern and Mediterranean products and a portfolio company of Peak Rock Capital, has acquired Indo-European Foods (IEF), a US-based ethnic food business, from equity fund

Corridor Capital for an undisclosed sum.

Founded in 1966, IEF is described as a leading importer and distributor of specialty ethnicfoods,offeringadiverseportfolio of products, including Zergut spreads, Mediterranean grains, Eastern European cheeses, and private-label items, distributedacross45states.

In a statement, the companies said the move is intended to combine two businesses with complementary brand portfolios and geographical coverage, as well as to supportIEF’s accelerated growth in strategic markets across the South and MidwestoftheUS.

Headquartered in Chicago and with additional facilities in New Jersey and California, Ziyad Brothers has a diverse portfolio ofover800SKUs.

By: InnovationEditor–North America

Source: BrownGibbonsLang& Company(viaSpecialtyFood)

Image source: ZiyadBrothers/ Indo-EuropeanFoods (montage)

Mayfair, a UK investment company, has acquired Irish bakery brands Pat the Baker and Irish Pride, according to a report in JustFood.

The agreement was said to have been concluded through Ceres, Mayfair's holding company for its baked business, for an

What are the key success factors in creating a healthoriented drinks brand?

Success in building a leading health-oriented drinks brand relies on a well-balanced combination of quality, innovation and smart marketing strategies. First and foremost, the product must be based on natural ingredients with genuine health benefits, supported by full transparency in communicating these details to consumers. Additionally, continuous innovation in flavour development, enhancing health benefits, and adapting to consumer preferences is a key pillar for achieving differentiation.

" Sustainability has shifted from being optional to essential "

Building a strong brand identity with a clear message that reflects the brand’s philosophy also plays a vital role in gaining customer trust and turning them into loyal advocates. Lastly, investing in effective distribution channels and targeted digital marketing is crucial for reaching the right audience and firmly establishing the brandinthehealthdrinksmarket.

What major trends do you expect to shape food and drinks in the GCC in 2025?

Gama

The food and beverage sector in the GCC is undergoing a significant transformation driven by changing consumer habits and increased health awareness. One of the key trends expected to shape the industry in 2025 is the rapid growth of natural, health-focused products, as consumers increasingly seek beverages rich in nutritional benefits and free from added sugars and preservatives. Sustainability has shifted from being optional to essential, with a rising focus on eco-friendly packaging solutions and more responsible production practices.

Additionally, there’s growing demand for functional beverages that support digestive health and immunity, creating new opportunities for growth in this segment. Lastly, technology will play an important role in shaping the industry, with advanced analytics and artificial intelligence enabling brands to customize products and meet consumer needs with greater precision.

What advice would you give other brands seeking to gain a foothold in a competitive market?

In a highly competitive market, success is not a matter of chance but the result of a clear strategy and flawless execution. First, brands must deliver genuine added value to consumers, whether through product quality or innovative solutions that address health-conscious needs.

Second, building trust with customers is essential, achieved through transparency in ingredients, effective communication, and consistent engagement with the audience. Third, brands must remain flexible and ready to adapt to market shifts, whether by introducing new products or enhancing customer experience. Lastly, investing in technology and targeted digital marketing can be a game-changer in strengthening market presence and driving sustainable growth.

undisclosed fee. The two brands were previously owned by a company known as Azeda Unlimited.

PattheBakerandIrishPridewill join the Ceres portfolio alongside other major Irish bakery brands such as Promise Gluten Free and Gallaghers Bakehouse, as well as the US brands Rudi’s BakeryandThreeBakers.

TheacquisitionofPatthe Baker and Irish Pride will reportedly help Ceres overcome manufacturing constraints and meet growing customer demand, in particular for the “fast growing” Gallaghers Bakehouse artisanal bakerybrand.

By: InnovationEditor–Europe

Source: JustFood

Image source: Mayfair/Azeda Unlimited(montage)

Woolworths, the Australian supermarket chain, has filed for clearance with New Zealand’s Commerce Commission to acquire Beak & Johnston subsidiaries Beak & Johnston NZ Pty Ltd(BJNZ),B&JCityKitchenPty Ltd(BJCK)andAlors.

Beak & Johnston is a manufacturer of chilled and frozen ready meals, soups and meat which are sold under brands such as Pitango, Ready Chef and Beak & Sons. BJCK and Alors do not operateinNewZealand,withBJCK

supplying products to BJNZ. BJCK manufactures chilled mealsandpiesinAustralia.

In a filing, the retailer said: “There is no horizontal overlap between the parties’ activities in New Zealand. Woolworths’ New Zealand subsidiaries do not undertake any relevant manufacturing operations in New Zealand, while BJNZ does not operate a retail grocery offering in New Zealand. Furthermore, while Woolworths New Zealand Limited (“WWNZ”) operates a wholesaling business unit (New Zealand Grocery Wholesalers (“NZGW”)), that business unit is simply a wholesaler of products sourced from other third-party manufacturers/suppliers”.

The acquisitions follow the opening of a10,000 sq mpastry and ready meals production facility by Beak & Johnston at Arndell Park in Western Sydney,Australia.

By: InnovationEditor–Asia Pacific

Source: InsideFMCG/New Zealand government Image source: Woolworths/ BeakandJohnston

Wellful, a supplements and weight-management business and a Kainos Capital portfolio company, has announced the acquisition of supplements firm Ancient Nutrition from equity funds VMG Partners and HillhouseInvestment.

Founded in 2016, Ancient Nutrition has a product portfolio that includes protein and gut health supplements, vitamins & multivitamins, herbs, mushrooms, and greens. It isdescribed as the fastest-growingvitamin,mineral,and supplement (VMS) category brand and the largest collagen brandwithinthenaturalchannel.

Commenting on the deal, Wellful CEO Brandon Adcock said: “The Ancient Nutrition team has done a phenomenal job of building a scaled brand with considerable future growth potential.AncientNutritionfundamentally stands for something within the industry and delivers real results to its customers. We’re very excited to further strengthen the brand and to expand the product portfolio that customers have come to knowandtrust”.

Ancient Nutrition co-founder Jordan Rubin added: “I am proud of how far Ancient Nutrition has come in our mission to Save the World with Super Foods and look forward to seeing our innovative products become a staple in every North American household and beyond. I’ve appreciated the partnership with VMG and Hillhouse Investment in helping us build one of the leading brands in the naturalproductsindustry”.

By: InnovationEditor–North America

Source: Wellful(viaBusinessWire)/AncientNutrition Image source: Wellful

TreeHouse Foods, a leading manufactureranddistributorof private-label foods and beverages, has announced it has completed its acquisition of HarrisTeafor$205million.

The acquisition includes Harris Tea’s manufacturing facilities in Moorestown, New Jersey, and Marietta, Georgia, along with approximately300employees.

Commenting on the deal, TreeHouse Foods chairman, CEO and president Steve Oakland said: “The acquisition of Harris Tea is a good use of our balance sheet strength, bringing a fast-growing, marginaccretive business into TreeHouse Foods, and giving us an immediate leadership position in private label tea. Harris Tea’s capabilities in tea sourcing, blending and packing, as well as its scale, industry expertise, and customer relationships, fit our strategy well”.

The acquisition, financed through cash on hand, is expected to enhance revenue and profitability in 2025, the companyadded.

By: InnovationEditor–North America

Source / image source: TreeHouseFoods

Flowers Foods, a US producer and marketer of packed bakery food, has announced the acquisition of Simple Mills, a bakery and snacks firm, for $795 millionincash.

Founded in 2012, Simple Mills is a provider of health-oriented crackers, biscuits, cakes, snacks bars and baking mixes with operations in Chicago (IL) and Mill Valley (CA). After the transaction, Simple Mills will remain an independent subsidiary of Flowers Foods, led by founder andCEOKatlinSmith.

Commenting on the deal, Flowers Foods chairman and CEO Ryals McMullian said: “With leading market positions and abundant white space forfuture growth, Simple Mills perfectly fits our strategy of adding compelling brands in better-for-you segmentsthatcomplementand diversify our existing portfolio. Equally important, the brand’s mission aligns with Flowers’ values centered on honesty and integrity, respect and inclusion, andsustainability”.

Katlin Smith, founder and CEO of Simple Mills, added: “This transaction marks the beginning of a new phase of growth for Simple Mills and we are thrilled to join the Flowers family. With Flowers’ resources, we will be well positioned to broaden distribution, accelerate innovation, and amplify brand awareness, while advancing our mission”.

By: InnovationEditor–North America

Source: FlowersFoods

Image source: FlowersFoods./ Simple Mills

entered into an agreement to acquire Billson’s, an Australiabased brand of flavoured alcoholbeverages(FABs).

The Billson’s product range includes “local market leaders” Vodka with Tangle, Vodka with Grape Burst and Vodka with Portello, the company said in a statement.

“We are excited to add Billson’s to our portfolio of Australian brands”, commented Matthias Blume, Coca-Cola vice president of marketing, ASEAN and South Pacific. “This acquisition allows us to expand in the dynamic and growing alcoholic ready-todrink category in Australia and aligns with our vision to provide a beverage for every occasion, always keeping the consumer at the centre of everything we do”.

Coca-Cola added it that had no current plans to expand Billson’sbeyondAustralia.

By: InnovationEditor–Asia Pacific

Source: Coca-Cola

Image source: Coca-Cola/ Billsons

USA: HAIN CELESTIAL OPENS NEW INNOVATION CENTRE

Coca-Cola, the soft drinks multinational,hasannouncedithas

US natural and organic products company Hain Celestial has announced the opening of an Innovation Experience Center (IEC) in Hoboken, New Jersey in a bid to further develop its food, drinks and personal carebrands.

The new centre, which features a 2,200 sq m working kitchen intended as “a hub for handson creativity and sensory exploration”, is designed to advance product innovation, conduct ingredient testing, ensure quality and enhance packaging sustainability.

One zone of the IEC is dedicated to the technical team’s

product development work, while a second will offer a sensory experience to Hain Celestial’scustomersandpartners.

Commenting on the move, Hain Celestial president & CEO Wendy Davidson said: “Our investment in the Innovation Experience Center is an important next step in our journey to reimagine our future in better-for-you. Earlier this year we redesigned our innovation process to strengthen our pipeline across our leading brands and categories. This center further enables us to transform bold ideas into distinctive products and underscores our dedication to leading in our categories, challenging the status quo and delivering exceptional value to our customers”.

By: InnovationEditor–North America

Source / image source: Hain Celestial

Functional botanical ingredients such as flowers, berries and plant roots continue to blossom in the food and drink sector, the latest Insight By Gama Compass can reveal. This trend for botanicals ties into ongoing demand for wild, ancient and functional ingredients, pared back formulations and premium concepts, as well as complex and adventurous flavour combinations.

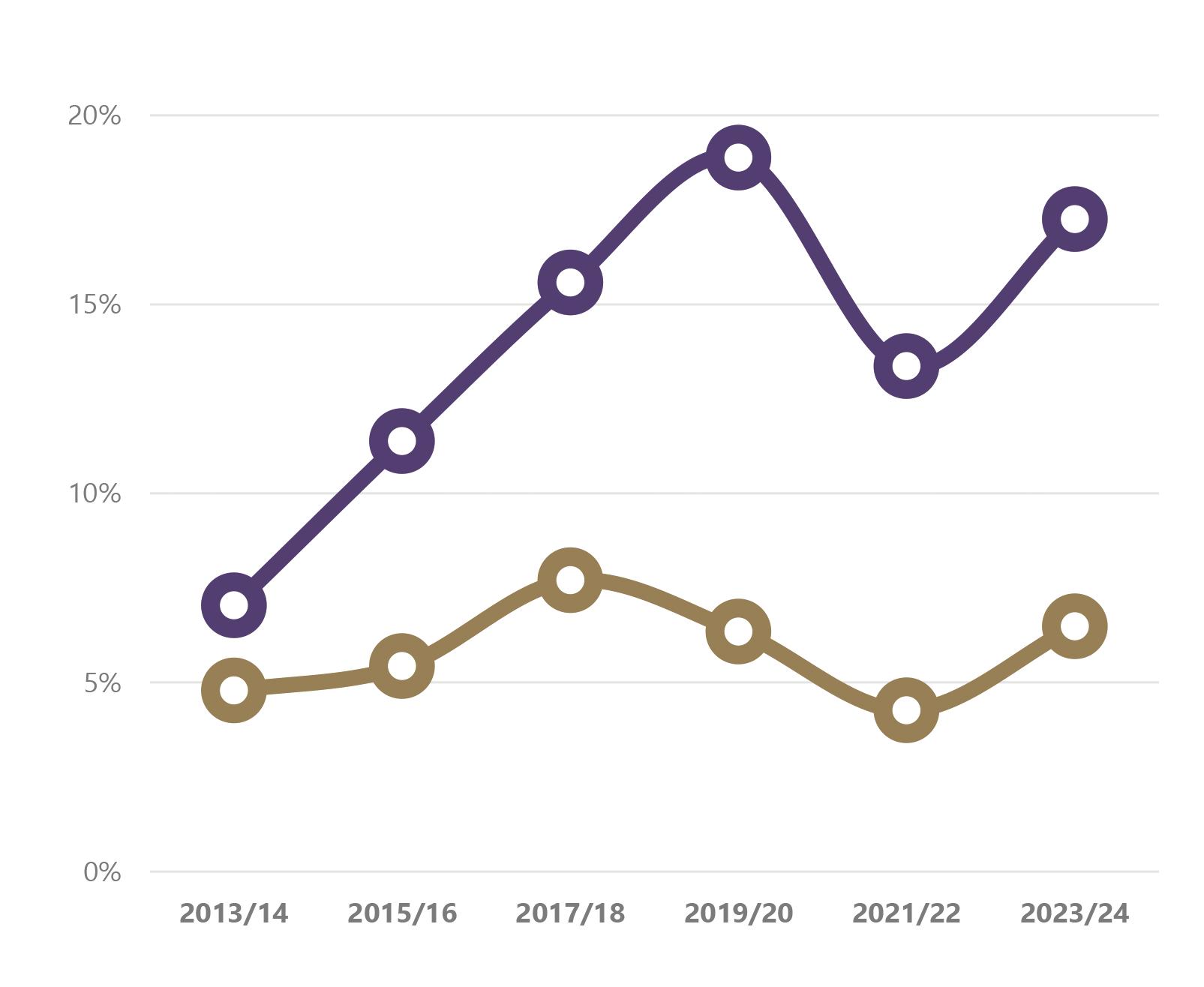

Use of botanical ingredients in food and non-alcoholic drinks has been increasing over the past ten years, with 8.9% of new products reported on Gama Compass featuring botanicals in 2023/24, compared to just 5.2% in 2013/14. Botanicals saw an especially precipitous rise between 2013/14 and 2017/2018 – coinciding with burgeoning interest in plant-based

and vegan formulations in general – and have not diminished in popularity since, demonstrating a degree of longevity not always enjoyed by other ingredients that rapidly rise to prominence in food and drink.

Compared to food, growth of the use of botanicals in non-alcoholic drinks has been especially marked, with an

" Botanicals align strongly to the trend for more 'natural' and stripped-backed formulations, alongside the concept of 'infused' flavours "

almost 250% increase between 2013/14 and 2023/2024. Aside from tea, where botanicals have an inevitably strong showing, functional drinks and carbonated soft drinks are the leadingcategoriesforbotanicalingredientsacrossfoodanddrinkNPD asa whole, underlining the important role plant-based ingredients have played in the premiumisation trend in soft drinksinrecentyears.

In terms of overall popularity (excepting herbs, which were excluded from this analysis due to their ubiquity), two botanicals stand out, namely ginger and turmeric: respectively, these two ingredients featured on 3.2% and 2.5% of food and drink launches across the 2013-2024 period. Both ginger and turmeric emphasise the correlation between the botanicals boom and the plant-based trend

more widely, with over 18% of the launches containing either one of the ingredients marketed as vegan, versus over 17% for launches containing botanical ingredients as a whole, and fewer than 12% of all food and drink launches.

Other botanicals towards the top of the popularity ranking broadly fall into the category of berries and flowers: in the case of the former, guarana and acerola are particularly popular. But where guarana is especially associated with energy drinks (as an alternative to other active ingredients such as caffeine and taurine), acerola fulfils a fundamentally different function, often headlining launches (especially fruit drinks) that are touted as high in vitamin C, as well as those that are free from added sugarorlow in calories.

When it comes to florals, meanwhile, hibiscus can claim the accolade of being the go-to botanical ingredient, followed some way down the ranking by jasmine, rose, elderflower and lavender. And while elderflower is a long-establishedbotanical flavouring, especially in categories such as fruit drinks and cordials – and hibiscus a

cornerstone ingredient of many herbal teas – more overtly ‘fragrant’ flavours such as rose and lavender are relative newcomers, benefitting from the willingness among consumerstoexplore morecomplexand adventurous flavour combinations. Lavender in particular (as well as other botanicals such as chamomile and ashwagandha) has also emerged as a fan favourite as the self-care trend has come to prominence, in line with its long-standing reputation for relaxation, stress-relief and similar therapeuticproperties.

Beyond functionality and flavour, botanicals align strongly to the trend for more 'natural' and strippedbacked formulations, alongside the concept of 'infused' flavours that has emerged over recent years – with 'infused botanicals' perhaps viewed as more real and natural than traditional flavourings, given their theoretical relianceontheuseofwhole, fresh and minimally-processed ingredients. This is also borne out statistically, with 21% of products boasting “infused” flavours marketed as “natural” and 19% as “organic”, mirroring claim patterns seen for specific botanicals such as acerola, lavender, and rose. Products marketed as “infusions”, as well as those boasting botanical ingredients, are also significantly more likely to make claims such as “no artificial colours”, “no artificial flavours” and “no additives”, and alsosomewhatmore likelytobe marketed as “real” or “authentic”. This ties into the wider trend for premiumisation in soft drinks, especially among brands seeking to market themselves as a worthy “adult” or upscale alternative to alcoholic drinks: indeed while launches containing botanicals are 13% more likely to make one or more health claims versus launches as a whole, they are 22% more likely to make a quality claim, emphasising

While premiumisation, functionality, and natural formulations remain key innovation drivers, the success of botanical ingredients has remained undimmed: indeed in some categories, such as functional drinks and flavoured water, botanicals may even become the 'new normal'. In this scenario, the requirement for brands – in what is likely to be an increasingly crowded category – will be to continue to find avenues for differentiation, either through the identification of lesser-known botanicals (the recent launch in the UK of a functional shot touting the Amazon camu camu berry as its flagship ingredient being a case in point), uprated health benefits or distinctive branding and marketing.

Source: Gama Compass Image source: Al Shifa / Jane / Amai

Boasting “30 editions of F&B legacy”, Gulfood’s latest outing was a further opportunity for food and drinks industry professionals from the United Arab Emirates (UAE) and beyond to explore the latest trends and innovations impacting supermarket shelves across the Middle East region.

Spread across 24 halls amid the ample showgrounds of the Dubai World Trade Centre, Gulfood 2025 saw 5,500 exhibitors from across the world (including for the first time Zambia, Mauritius and Madagascar) set up shop to showcase hundreds of thousands of new products across a diverse range of categories including beverages, dairy, meat & poultry, pulses grains & cereals, fats & oils, and world foods. Over two fifths of companies were first-time exhibitors, demonstrating the continued allure of the Middle East market to international suppliers.

Away from the show floor, famous chefs were also on hand to exhibit their skills and reveal imaginative new culinary trends, while the

Gulfood Innovation Awards once again shone a spotlight on the trailblazers driving impactful change in food and drink, as well as celebrating groundbreaking products demonstrating creativity, ingenuity and impact in their category. New for 2025, meanwhile, was Food500, a global CEO summit engaging the foremost visionary world leaders in thought -provokingdiscussions.

The success of Gulfood 2025 –and apparent record demand from the global F&B community – has compelled organisers to think bigger for 2026. From next year, the show will span not one but two venues, as Gulfood seeks to “double its impact” and “further advance its pivotal role in creating value and impact for the global food sector”. As well as its current home at the Dubai World Trade Centre, Gulfood 2026 will establish a presence at the new Dubai Exhibition Centre (DEC) at Expo City, which also hosted Expo 2020 Dubai and COP28. The expansion creates space for new

" The success of Gulfood has compelled organisers to think bigger for 2026 "

sectors that include Digital Innovation, Startups, Logistics, Fresh & Perishables, Health, Wellness & Functional Foods, Next-Gen Food and Beverages, Hospitality, HoReCa and Foodservice Innovation, as well as features such as Gulfood Green, Gulfood Startups, GulfHost and Gulfood Logistics.

The expanded 31st edition of Gulfood will take place from 26th to 30th January 2026.

Image source: Gulfood

Adani Enterprises Limited (AEL), aholdingcompanyoftheAdani conglomerate, has announced that it has entered into an agreement to sell its 44% stake in Adani Wilmar, an Indian FMCG joint venture, to Wilmar subsidiary Lence through Adani Commodities LLP, a whollyownedsubsidiaryofAEL.

Adani Wilmar, co-founded by AEL and Wilmar International in 1999, is India’s largest edible oils and food company. It operates 24 factories, achieves 100% urban coverage and serves 30,600 rural towns, as well as exporting to 30 countries. Its flagship Fortune brand has a significant presence in oils, rice, flour, and other staple food categories.

As part of the deal, AEL will divesta13%stakeinAdaniWilmar toachievecompliancewithminimum public shareholding requirements. Wilmar will acquire a31%stake,raisingitsholdingto 75%. Following the transactions, Adani Wilmar will also undergo arebrandingprocess.

The transaction is subject to regulatoryreviewandapproval.

By: InnovationEditor–Asia

Pacific

Source: AdaniEnterprises Limited/Wilmar

Image source: AdaniWilmar

Finland-based food company Paulig has announced that it is acquiring Asian foods brand Conimex from consumer goods giant Unilever to strengthen its presence inthe Netherlands.

Founded in 1932, Conimex is said to have a 100-strong product range that includes meal makers, prawn crackers, soups, sauces and seasonings, and 87% brand awareness domestically.

Commenting on the move, Paulig CEO Rolf Ladau said: “We aim to shape a popular food culture, and with the acquisition of Conimex we want to make it easier for even more consumers to enjoy cooking Asian food at home. This acquisition establishes our position in the Asian category in the Netherlands”.

“It also allows us to combine portfolio and concept development, leveraging Paulig’s strong R&D and production capabilities to grow our World Foods portfolio in Europe”, he added.

Paulig said it intended to boost Conimex’s growth by capitalising on the manufacturing expertise of Panesar Foods, which itacquiredthisautumn.

The acquisition is subject to approval by the Dutch competition authority. Financial terms of the transaction were not disclosed.

By: InnovationEditor–Europe

Source: Paulig

Image source: Paulig/Unilever (montage)

Unilever, the multinational consumer goods giant, has announced that it has received a binding offer from Dutch food company Zwanenberg Food Group to acquire the soup and meat brands Unox and Zwan foranundisclosedsum.

Launched in 1928 and 1937 respectively, the Zwan and Unox brands have been part of Unilever’s portfolio for nearly a century.

In a statement, the company saiditplanstosharpenitsfoods portfolio,prioritisingfewer,larger brands in cooking aids, mini meals,andcondiments.

“The meat and soup products of Unox and Zwan require a distinct supply chain, sourcing model and set of technological and R&D capabilities, making them less scalable within the broader Unilever Foods portfolio”, Unilever said in a statement

News of the deal comes just a day after Paulig announced a deal to acquire Conimex, another of Unilever’s long-standing brandsintheNetherlands.

Commentingonthemove,Unilever Foods president Heiko Schipper said: “Unox is a beloved and iconic brand in the Netherlands and the decision

to part with it has not been easy. […] Zwan is a cherished brand in Belgium, associated with comfort and nostalgia and with quick and easy meals, making the brand a beloved partofeverydayBelgiumlife”.

Zwanenberg Food Group CEO Sjoerd van der Laan said: “The Unox and Zwan brands are a wonderful addition to our range. We are a broad food company with strong brands. After the acquisition of the Unilever factory in Oss in 2018, the acquisition of the Unox and Zwan brands is a great addition that fits in perfectly with our ambitions”.

Thetransactionisexpectedtobe completed within 2025, subject to closing conditions, regulatory approvals,andconsultations.

By: InnovationEditor–Europe Source / image source: Unilever

Surya Foods, the leading UK world foods importer and supplier, has announced the acquisition of a majority stake in KarmaBites,ahealthsnackbrand.

Karma Bites makes popped lotus seedsnacks in Himalayan Pink Salt, Peri-Peri, Wasabi, Caramel, and Coconut & Vanilla flavours, white the range described as vegan, glutenfree, non-GMO, and free of refined sugars.

Commentingonthedeal,Surya Foods group chief executive officer Harry Dulai said: “We are pleased to have acquired a major stake in Karma Bites, which is a stylish contemporary brand with lots of mainstream potential. It aligns well with our plans to grow our snacking portfolio with several new launches in 2025. We continue to invest in the Harwich site to support our expansion plans and are committed to creating ‘better for you’ snacks, that have an improvednutritionalprofile”.

Karma Bites founder Ashwin Ahuja said: “When I launched Karma Bites I was so excited to share them with the world and spread goodness! Working alongside Surya Foods, my aspiration is to take Karma Bites on the next big step of its journey – to scale up production, distribution, enter multiple markets and expand the range”.

By: InnovationEditor–Europe

Source: AsianTrader Image source: SuryaFoods

Monoprix, the French retailer owned by the Casino Group, has announced a partnership with convenience retailer TMT to enter the Egyptian market in 2025.

“Monoprix will utilise its expertise in assortment management, store design, and customer experience, while TMT will take responsibility for operations management and adapting to market specifics”, the company said in a statement.

Monoprix will offer a variety of fresh food, local delicacies, and a broad range of nonfood products such as fashion, beauty, homewares and leisure items.

Commentingonthe move,Monoprix managing director Alfred Hawawini said: “We are pleased togiveEgyptianstheopportunity to discover our brand. Through this partnership, we wanted to bring our vision of convenience retailing to the table, with an offer that meets both the expectations of Egyptian city dwellers and the quality standards for whichwearerenowned”.

TMT founder Mahmoud Monir Soliman added: “Driven by a passion for quality and a dedication to customer satisfaction, TMT is committed to delivering excellence in every aspect of its business. It was therefore a natural choice for us to partner with Monoprix, France’s leading convenienceretailer”.

By: InnovationEditor–Middle East&Africa

Source / image source: Monoprix

Nestle, the Swiss consumer goods giant, has announced the sale of its New Zealand based Egmont Honey brand to Huatai International, a Beijingbased private equity fund, after twoyearsofownership.

Founded in 2008, Egmont Honey specialises in manuka honey and sustainable beekeeping practices, exporting its productstomorethan20countries.

The move is described as being part of a wider strategy to streamline Nestle’s portfolio, as wellaligningwithEgmontHoney’sexpansiongoalsinChina.

“Egmont Honey, which we acquired with our acquisition of The Better Health Company in 2022,isthefastest-growingmanuka honey company globally and has had impressive growth over the past two years”, the companysaidinastatement.

Egmont Honey is expected to generate approximately A$54 million($34.56million) inrevenue fortheyearendingnextMarch.

By: Innovation Editor – Europe

Source: InsideFMCG

Image source: Egmont Honey / Nestle

Paine Schwartz Partners, a private equity firm, has announced the acquisition of Promix, a nutrition and supplementsbusiness.

Founded in 2014, Promix is known for producing a range of ‘clean’ nutritional products, including supplements, vitamins, meal replacements, and snacks, with a claim of ‘nothing artificial’. The company’s product range, including prebiotics, protein powders, bars, electrolytes, collagen, and creatine, is sold via the direct to consumer channel, as well e-commerce and small wholesalers.

Commenting on the move, Paine Schwartz Partners CEO Kevin Schwartz said: “This strategic acquisition of Promix is directly aligned with our long-

JM Smucker, the diversified US food business has expanded production capacity for the Uncrustables brand with the opening of a new 900,000 sq ft manufacturing facility in McCalla (AL). Uncrustables is the company’s brand of sealed crustless sandwiches, available with fillings such as Strawberry, Grape, Chocolate Hazelnut,RaspberryandHoney. Source: JM Smucker

US food manufacturer Mart Frozen Foods has announced it has inaugurated a $65 million high-tech food manufacturing facility in Rupert (ID). The new 100,000 sq ft facility, located

term thesis of identifying companies that provide access to healthier, more nutritious, and saferfood”.

“We appreciate Promix’s strong brand loyalty and its track record of growth acceleration, which we believe can lead to growth within existing categories and into adjacent consumers and products lines”, he added.

Promix CEO and founder Albert Matheny said: “As a leading investor in high quality brands, Paine Schwartz brings significant expertise and resources –particularly in the consumer and wellness space – that will help us grow our business, including launching new innovative products, improving our operational capabilities, and expanding into new markets andchannels”.

Financial terms of the transactionwerenotdisclosed.

By: InnovationEditor–North America

Source / image source: Paine SchwartzPartners

adjacent to the company’sheadquarters will produce and package fully baked Idaho potatoes, marketed under the OH!Tatoes brand. Source: Mart Frozen Foods (via PRWeb)

Haleon, a consumer healthcare firm, has announced an investment of £130 million ($169 million) to build an innovation centre in Weybridge, UK. The new facility intends to support Haleon’s oral health portfolio, including brands like Sensodyne, Polident/Poligrip, Aquafresh and Corsodyl. It will reportedly feature digitally enabled research laboratories and a dedicated consumer behaviour research facility.

Source: Haleon

Hindustan Coca-Cola Beverages (HCCB), the Indian CocaCola subsidiary, has announced it has inaugurated a factory in Siddipet, in India’s Telangana state.

The factory, spanning 49 acres, has a planned investment of 2,091 crore INR ($251 million), with 1,409 crore INR ($170 million) utilised in the initial phase. It is HCCB’s second manufacturing facility in Telangana, complementing the existing factory in Ameenpur, Sangareddydistrict.

Commenting on the news, HCCBL CEO Juan Pablo Rodriguez said: “This is a significant step in HCCB’s growth journey and a reaffirmation of our com-

mitment to Telangana. This state-of-the-art factory combines advanced manufacturing technology with sustainable practices, positioning it as a benchmarkinourindustry”.

The facility operates seven advanced production lines and is expected to create over 400 jobs.

By: InnovationEditor–Asia Pacific

Source / image source: HCCB

Lactalis,theFrenchdairygiant,has announced plans to invest $55 million at a plant in Tulare (CA) to increasefetacheeseproduction.

This investment will be used to build a 38,000 sq ft production line,creating20full-timejobs.

Organic cocoa and guarana specialist Koawach has announced the launch of an energy drink which is claimed to be the world’s first caffeinated soft drink made with cocoa fruit juice. Koawach said it had collaborated with Koa, a Swiss-Ghanaian startup that specialises in upcycling cocoa fruit pulp, to create the beverage. Source: FoodBev

SuperYou, a protein food and supplements brand, has announced the launch of what it claims is India’s first protein wafer bar. The

Commenting on the investment, Lactalis USA chief executive officer Esteve Torrens said: “We are expanding to increase our cheese production capacity at our facility. This investment into new jobs and expanding operations supports our local communities and demonstrates Lactalis’ long-term view forbusinesssuccessintheUS”.

“This expansion helps us meet the growing demand for Président feta cheese in the United States, which is good news for our retail customers and consumers who continue to choose Président Feta for cooking at home and creating new occasionstoenjoyfeta”, headded.

The facility is expected to be operational by 2027, with partial operation of the line startinginMay2025.

By: InnovationEditor–North America

Source / image source: Lactalis

product reportedly employs fermented yeast protein technology to offer a nutritious snack that contains 10g of protein and 3g of fibre per bar. Flavours available include chocolate, chocopeanut butter, strawberry creme and cheese.

Source: Indian Retailer

Meiji, the Japanese food and pharmaceutical firm, has announced the launch of Well Cacao Spicy Crisp, sweet spiced biscuits made with the company’s “cacao granules” ingredient Meiji cacao granules are described as a form of cocoanibsmadefrom cacaobeansfermentedto reduce astringency, using a unique process that preserves nutrients like polyphenols and lipids.

Source: Meiji

US food giant General Mills has announced that it has reached an agreement to acquire the Tiki Pets and Cloud Star food brands, part of investment firm’s NXMH’s Whitebridge Pet Brandsbusiness,for$1.45billion.

As part of the transaction, General Mills will take over two manufacturing facilities in Joplin (MO), while NXMH will retain the Whitebridge Pet Brands businessandbrandsinEurope.

Commenting on the deal, General Mills group president, Pet, International, and North America foodservice Jon Nudi said:

“Acquiring the Tiki Pets and Cloud Star portfolio strengthens our commitment in the Pet space. These brands complement our Blue Buffalo portfolio and will help us incrementally growinCatfeedingandTreats”.

“We’re excited to welcome the North American Whitebridge team to General Mills and to provide pet parents with an expanding portfolio of brands to feed and treat their pets like family”, headded.

The transaction is expected to close in the third quarter of fiscal 2025, subject to regulatory reviewandapproval.

By: InnovationEditor – North

America

Source: GeneralMills

Image source: GeneralMills / WhitebridgePetBrands

BRANDS TO SELL BABY WELLBEING BUSINESS

South African consumer goods firmTigerBrandshasannounced the sale of its Baby Wellbeing business in a deal valued at 605 million ZAR ($33.4 million), accordingtoaReutersreport.

The Baby Wellbeing business comprises baby toiletries under the Elizabeth Anne’s brand name and medicinal products including antacid Muthi Wenyoni, Telament colic drops, and skincreamAntipeol.

The buyer, which is said to be one of the South African’s leading manufactures of home and personal care products, will also acquire inventory and the rights to manufacture and sell multivitamins under the ViDaylinbrandunderlicence.

The deal excludes the baby food business marketed under thePuritybabyfoodbrand.

“This transaction marks another milestone in the simplification of our portfolio and will enable us to intensify our focus on the Baby Nutrition business, a core area where we believe we have a clear competitive advantage”, said Tiger Brands CEO Tjaart Kruger.

By: InnovationEditor–Middle East&Africa

Source: Reuters Image source: TigerBrands

UK: CCEP TO INVEST

£42.3 MILLION IN

Coca-Cola Europacific Partners (CCEP), the UK-based CocaCola bottler, has announced an

investment of £42.3 million ($53.1 million) in its facility in Wakefield,UK.

The investment is for a new automated storage retrieval system (ASRS) that will more than double current warehouse capacity to over 58,000 pallets, and reduce annual vehicle journeys by 18,500.

In total, the facility has received £103 million ($129 million) in investment since 2019 to enhance efficiencies and allow it to operate more sustainably. This includes a new state-of-the -art canning line, capable of producing 2,000 cans per minute, which began operations inJuly.

“Wakefield offers a range of modern manufacturing jobs and sits at the heart of many of our latest manufacturing technologies”, commented Stephen Moorhouse, vice-president and general manager, Coca-Cola EuropacificPartners(GB).

By: InnovationEditor–Europe

Source / image source: CocaColaEuropacificPartners

JBS, the global meat company, has announced plans to invest $2.5 billion in Nigeria over the nextfive yearstobuiltonepork, two beef and three poultry meatpackingfacilities.

The company said the project would focus on promoting sustainable agricultural practices , similar to similar initiatives in otherregions

Commenting on the move, JBS Global CEO Gilberto Tomazoni said: “Our experience in regions where we operate worldwide shows that developing a sustainable food production chain creates a virtuous cycle of socio -economic progress, particularlyforvulnerablepopulations”.

“Our goal is to collaborate with the Nigerian Government to support the implementation of the National Food Security Plan, sharing our expertise in developing sustainable agro-industrial supply chains and best practices to enhance the country’s efficiency, productivity and production capacity”, he added.

By: InnovationEditor–Middle East&Africa

Source: FoodBev

Image source: JBS

PepsiCo, the global snacks and drinks giant, has announced the company has invested 746 million ZAR ($41 million) to add a new state-ofthe-art potato crisp production line to its factory in Johannesburg, South Africa.

The new line is intended to ease the burden on PepsiCo’s existing four potato crisp lines across in South Africa, all of which are said to be operating athighcapacity.

The Isando plant in Johannesburg is described as being centrally located near key potato farms, and the new line will improve transport efficiency by reducing over 2,300 crosscountryshipmentsannually.

Commenting on the move, PepsiCo South Africa CEO Riaan Heyl said: “Expanding our potato chip production capacity is an important move to meet the growing demand for South Africa’s much-loved snacks. Alongside creating new jobs, this new line shows our commitment to innovation and efficiency, as we continue to deliver high-quality products to people”.

This expansion will create 100 newjobs.

By: InnovationEditor–Middle East&Africa

Source / image source: PepsiCo

Heineken, the leader global brewer, has agree a joint venture with consultancy firms Sirocco and Mercantile International to manufacture beer in the United Arab Emirates, accordingtoaFoodBevreport.

Located in Dubai, the brewery will reportedly be the largest in the Middle East region and will produce beer for brands such as Heineken, Kingfisher, Amstel and Birra Moretti. Up to 190 workers will be employed at the site.

“This investment marks a new phase in Sirocco’s journey of

overtwentyyears,duringwhich it has become the leading beer supplier in the UAE, catering to the flourishing tourism and hospitality sectors”, Sirocco said in a statement. “It will also support Dubai’s vision to become a top three global city to live, work and invest in by 2033 as partofitsD33strategy”.

By: InnovationEditor–Middle East&Africa

Source: FoodBev

Image source: Heineken

Unilever, the leading FMCG firm, has announced it has completed a £40 million ($51 million), five-year investment at its food factory in Burton, UK, as it seeks to consolidate manufacturing of its condiments range.

In a statement, the company said the aim of the investment was to drive growth in its UK food business and develop supply chain efficiency. The investment includes a second factory built next to its existing one, expanding the manufacturing footprint from 15,000 to 31,000 sq m and enabling production for goods under the Hellmann’s, Marmite, Bovril and Colman’s brands. Total production capacity will now reportedly double to nearly 9 million jars and bottles of condiments monthly.

Unilever UK & Ireland Food Lead Andre Burger said: “The

Sensei, a global leader in autonomous retail technology, has announced the introduction of s largest autonomous supermarket”, in partnership with Portugal’s leading grocery retailer Sonae MC.

The 1,200 sq m Continente Bom Dia store in Leiria is described as integrating computer vision, shelf sensors and real-time inventory tracking, in “a new customer experience with democratic entry, which simplified real-time basket checkout, discrepancy detection and streamlining the grocery experience for customers”.

Unlike other autonomous stores, consumers do not need an app, card or registration to access the store.

“This new store represents a significant milestone in the innovation and modernization of the retail sector", said Luís Moutinho, CEO of MC (Sonae Group).

Source: Sensei (via PR Newswire) / Retail Technology Innovation Hub Image source: Sensei / Sonae MC (montage)

Instacart, the US grocery technology company, and Coles, the Australian supermarket retailer, have announced a partnership to bring Caper Carts ‘smart trolleys’ to the Asia Pacific region for the first time, expanding their presence beyond North America.

Caper Carts, which will launch in Australia in early 2025, are described as being equipped with artificial intelligence (AI) systems, cameras, and a built-in scale which work together to automatically recognize items as they are added to the trolley, so as to replicate the online shopping experience as closely as possible.

In a press release, Instacart also claimed Caper Carts allow customers to manage their budget in real-time and check out easily.

Source: Instacart

Image source: Coles / Instacart (montage)

Ocado, the specialist online UK grocery company, is to invest heavily in its private label range in 2025, with the launch of hundreds of new items, according to a report in Grocery Gazette.

The retailer, which said the new product range would particularly focus on seasonal items, said 89% of customers it surveyed agreed it was important that the supermarkets they buy from sell a wide range of value items. The company has already added over 100 new product to its own brand range in 2024, such that by the end of the year it will be nearly 750 items strong.

Sales of Ocado’s private label products have reportedly risen 12%, with such products now accounting for more than 10% of total items sold, and dairy produce, meat, fish and canned goods proving especially popular sellers.

Source : Grocery Gazette

Image source: Ocado

March 2025 welcomed a freshfaced entrant to the UK tradeshow scene, with food-to-go showcase Lunch! North marking itsinauguraloutingintheheartof Manchester’sbustlingcitycentre.

Cramming over 400 stands – and over 12,000 visitors – into the main hallof theManchesterCentral exhibition venue, Lunch! North (and its existing sister show Northern Restaurant & Bar) proved a worthy showcase for the North of England’s thriving cafe, food-to-go and restaurant sector, as the Lunch! brand expanded its horizons beyonditstraditionalLondonbase.

hosted discussions with some of the cafe and restaurant sector’s biggestnames.

Out on the show floor, a diverse range of exhibitors had set up stall, with major players such as Kellanova and Britvic (the latter promoting the Lipton brand’s recent foray into kombucha) rubbingshoulderswith aspirantstart-upsandSMEs.

Among the products on display, canned mineral waters particularly caught the eye, with a number of exhibitors touting product lines notable primarily for their

simple branding and sustainability-oriented messaging. Indeed a focus on environmental benefits was a primary feature of many stands, with many referencing benefits such as packaging recyclability, traceable ingredients, sustainable agriculture, renewable energy and low water footprint. One brand of water in particular boasted use of aluminium bottles that were reportedly refillable, reusable and recyclable.

Highlights of the co-located shows included thoughtprovoking presentations from industry leaders in the Keynote Theatre, culinary expertise from expert cooks in Chef Live, panels on leadership, brewing innovations and mixology at the Pub & Bar Theatre, and Kuits NRB Top Fifty, recognising the most influential operators in Northern hospitality. Specific to Lunch! North was the Food-To-Go Leaders Panel, which

Elsewhere, health benefits remain the centrepiece for many brands, with protein-rich formulations and mood enhancement among the major themes. Highlights included a new line of breakfast cereal with tiger nuts as a hero ingredient, as well as a range of gummies and hot drinks made from functional mushrooms such as reishi, lion’s mane and chaga, and fruit and vegetable shots “boosted with baobab”.

Lunch!North,co-locatedwithNorthern Restaurant & Bar, will return to ManchesterCentralinMarch2026.

Image source: Gama

investment in our Burton site and new factory reaffirms the siteasakeyfoodhubforBritish produce, making delicious condimentsthatarehelpingtocreate meals in homes up and downthecountryeveryday”.

“By bringing all our condiment production under one roof and focusing on advancing digital capabilities, we’ve really optimised our supply chain and manufacturing whilst significantly increasing the site’s capacity”, he added. “The investment has already delivered recordbreakinggrowthforthesite and will be key in supporting the continued growth of our food business and market leadingbrandshereintheUK”.

By: InnovationEditor–Europe

Source / image source: Unilever

French based dairy major Lactalis has announced plans to invest R$250 million ($41.7 million) to expand operations in Brazil’sMinasGeraisstate.

The company’s presence in Minas Gerais includes factories in Antonio Carlos, Pouso Alto, Sabara, Guanhaes, Para de Minas, Sete Lagoas, and Uberlandia, as well as logistics centres in Contagem and its administrative headquarters in BeloHorizonte.

Commentingonthemove,Lactalis Brazil CEO Roosevelt Junior added: “Minas is a state of utmost importance for our present, but also for our future

where, working together with the government, producers and the entire supply chain, we will continue to grow and invest to generate more business for the company, but also more value forourentiredairychain”.

Lactalis has invested R$736 million ($125 million) in Minas Geraissince2020.

By: InnovationEditor–Latin America

Source: SuperVarejo/Valor

International

Image source: Lactalis

Toms, the Danish confectionery group, has announced a ninefigure investment plan to consolidate chocolate production in Nowa Sol, Poland, and licorice and sugar confectionery in Helseholmen,Denmark.

As part of the reorganisation, Toms said it was also planning to phase out its operations in Ballerup, Denmark, within the nextthreetofouryears.

Founded in 1924, Toms Group presently manufactures around 30,000 tonnes of goods annually at its factories in Denmark, GermanyandPoland.

Commenting on the move, Toms Group CEO Annette Zeipel said: “This is an investment in the future of building a stronger Toms Group. With an improved profitability follows the ability to invest further in our beloved brands, product innovation, our international growth and footprint, and in

our commitmenttosustainability and talentdevelopment”.

“The transformation is a significant strategic move to support our vision for a profitable and competitive Toms Gruppen. It willbringus closer to theindustry’s profitability benchmark, simplify processes, and enable us to strengthen our strategic procurementsheadded.

The exact amount of the investmentwasnotdisclosed.

By: InnovationEditor–Europe

Source / image source: Toms Group

Supreme plc, the diversified consumer goods supplier, has announced the acquisition of the Typhoo tea brand from administration in a £10.2 million ($12.95million)deal.

Founded in 1903, Typhoo was the UK’s first pre-packaged tea brand but succumbed to administration in November as a result of falling sales and rising debts.

As part of the acquisition, Supreme plc will acquire brands including QT, Lift, Herbalists, Heath & Heather, London Fruit & Herb Company, Glengettie, Melrose’s, Ridgeways and Red MountainCoffee.

Commenting on the deal, Supreme CEO Sandy Chadha said:

“The acquisition of Typhoo Tea Ltd marks a significant step in our broader diversification strategy and brings one of the most iconic UK consumer brands into the Supreme family. I believe Typhoo will thrive under our ownership, further benefitting from Supreme’s significant market reach and successful track record in creating brand loyalty, making us an idealfitforthisbusiness”.

“We are very excited about these latest additions to our portfolio, which mean we can serve our existing customers even better and get acquainted with many new ones”, he added.

In a statement, the company said it intended to turn Typhoo’s fortunes around by using its efficient supply network tolowercosts.

By: Innovation Editor – Europe

Source: Supremeplc/ESM

Image source: Supremeplc

Leading alcoholic drinks company Constellation Brands has announced it has agreed to sell its Svedka vodka brand to peer Sazerac, with the deal expected to be completed in the next fewmonths.

Commenting on the move, Constellation Brands said its aim was to prioritise growing

market sectors, with a focus on premiumwine and craftspirits.

“The actions we have taken over the past several years to reshape our wine and spirits portfolio support our efforts to accelerate the performance of that business”, said Bill Newlands, president and chief executive officer, Constellation Brands. “This transaction is anotherstepforwardinseekingto ensure that our wine and spirits portfolio is optimized to succeed and to meet our growth objectives”.

Sazerac CEO Jake Wenz added: “The team at Constellation has built the SVEDKA brand over the years to be known for its high-quality vodka-making traditions, premium liquid standards, and flavor innovation. We are honored for this opportunity and excited to add SVEDKA to our global spirits portfolio featuring their award-winning vodkas,seltzers,andgins”.

By: InnovationEditor–North America

Source / image source: ConstellationBrands

Electrolit, the Mexican sports drink firm, has announced plans to build a new $400 million manufacturing facility in theUSstateofTexas.

The new 600,000 sq ft plant will be the company’s first USbased production facility and is expected to open by 2026. It is being constructed in re-

sponse to “surging” demand driven by its partnership with Keurig Dr Pepper for sales and distribution and a rapidly growing retail network

The Waco facility will create over 200 jobs and will also have the capability to combine non-virgin and recycled packaging materials.

“We’re excited to announce our new U.S. manufacturing facility, marking a major milestone in our growth and commitment to quality”, an Electrolit spokesperson said. “As we move forward, we remain dedicated to providing the best hydration solutions in the market and are confident that the years ahead will bring even greater innovationsandimprovements”.

By: InnovationEditor–North America

Source: FoodBev/Waco Chamber

Image source: Electrolit

FMCG giant PepsiCo has reached an agreement to acquire the remaining 50% of Sabra and Obela and take full ownershipofbothcompanies.

PepsiCo said the move would allow it to accelerate innovation in fresh dips and spreads to meet growing consumer demand.

Created between 2008 and 2012, Sabra and Obela are 50/50

In this month’s Innovation Insight, our attention turns to the sports drinks category and a new electrolyte drink from the UK that boasts the functional benefits of “wholewatermelon” –Raw HydrateElectrolyteDrink.

Promising “a surge of pure vitality”, Raw Hydrate Electrolyte Drink from The Turmeric Co is a novel functional drink that “prioritises simple, natural hydration with high watermelon content”. Boasting 3,600mg of electrolytes, the drink stands out from the crowd with its use of “essence of whole watermelon” –which, depending on the variety, makes up between 76% and 94% of the ingredients – and unpasteurised formulation, supporting the brand’s central positioning of being “honest”, “pure”, “raw”, “free from artificial nasties” and “as nature intended”.

With its focus on a single hero ingredient, Raw Hydrate Electrolyte Drink positions itself among a swathe of recently-introduced drinks (especially fruit juices) that market themselves as more real and natural alternatives to traditional sports drinks, often associated with especially artificial flavour and formulations. One of the pioneers in the “natural sports drinks” category was arguably coconut water, a debt acknowledged by What A Melon Watermelon Water, another “watermelon sports drink” and precursor to Raw Hydrate that was promoted as “the all natural, mouth-watering taste of summer that's packed full of rehydrating electrolytes”. Elsewhere in the emerging segment of functional watermelon drinks, World Waters from the US has launched WTRMLN WTR, a coldpressed drink made from watermelon flesh and rind, strawberries and filtered water

Elsewhere, Katharos of India markets a “world’s first” cheese alternative block made from watermelon seeds, a product that is claimed to be “lighter on the digestive system” thanconventionaldairycheese.

" Raw Hydrate Electrolyte Drink positions itself among a swathe of new drinks that market themselves as real and natural alternatives to traditional sports drinks "

Away from sports drinks, watermelon is also staking a claiming in another somewhat unlikely category – that of dairy alternatives, although here it is the seeds, rather than its pulp or rind, that are finding a new purpose. MILKish Watermelon SeedMilk from Forca Foods in the US, for instance, is a new milk alternative that “combines the superfood properties of watermelon seeds with other natural, plant-based ingredients, creating a deliciously creamy, sugar-free, milk-y goodness”, and which claims to have a water footprint 99% lower than almond milk.

The emergence of watermelon fruit as a natural and refreshing alternative to artificial sports drinks, and watermelon seeds as an in-vogue option in the dairy alternatives space, is a reminder that consumers remain attracted by brands and products that make a virtue of a single, natural hero ingredient – especially when that ingredient is already positively associated with health, flavour or other benefits. The connotations of watermelon as a ‘clean’, healthy, refreshing and natural ingredient lends the fruit to further innovation in functional and plant-based categories, especially where its role up to now has been largely peripheral.

Image source: The Turmeric Co

What are the main trends that are expected to influence the food industry in Italy in 2025 and beyond?

Modern consumers are focused on the quality of ingredients and healthy eating, but above all they have less time to spend in the kitchen due to their increasingly hectic lives, and so they are looking for quick and practical solutions without compromising on quality. We can therefore see how everything revolves around three key points: sustainability, convenience and innovation.

Gama spoke to Giovanna

Flor, Chief Executive Officer, Bauer

convenience, ease of use and quality. It is a natural, creamy puree of Italian vegetables available in two flavours (meat and vegetable) that gives that extra touch to recipes in record time. What's more, it combats waste because you can dose exactly the amount of product you want to add to your dish. The tube then keeps in the refrigerator and has a shelf life of more than three weeks.

ciples of tradition and good Italian food.

" The key is to stay true to the principles of tradition and good Italian food "

" Everything revolves around sustainability, convenience and innovation "

How is Bauer innovating to capitalise on these trends?

Bauer's constant commitment to research and development has led to the creation of a perfect solution for those who want to cook in a quick and healthy way: Dadocrema, the stock cube that can be dosed with a simple squeeze. A solution that is extremely close to what the modern consumer is looking for:

everything it takes to win over a large segment of the public, even among those who are not very familiar with cooking, such as young people.

What are the specific considerations for ‘heritage’ brands like Bauer when it comes to brand loyalty and engaging new generations of consumers?

The key point is not to lose our roots, but to stay true to the prin-

This is what consumers appreciate about historic brands like ours: not losing our identity is an appreciated and recognised quality. Obviously, to remain competitive we cannot fail to adapt to modern times, which is why we turn our attention to the new generations with new smarter’ products that do not, however, sacrifice quality. It is a way of ‘being close’ to this new target group and simplifying their daily life in the kitchen, offering them the artisanal goodness that has always distinguished us, combining tradition and innovation.

joint ventures between PepsiCo and Strauss Group to manufacture, distribute and sell refrigerated dips and spreads. Obela is based in Geneva operating in Australia, New Zealand and Mexico, while Sabra is based in New York operating in the USA andCanada.

Steven Williams, chief executive officer of PepsiCo Foods North America, commented:

“Nutritious, simple foods like refrigerated dips and spreads represent a space we have long desired to expand in the U.S.and Canada”.

“We are grateful to the Strauss Group for our long and successful partnership and look forward to this next chapter for the Sabra and Obela brands, as well as the PepsiCo food portfolio”.

The transactions are expected to close by the end of 2024. Financial details were not disclosed.

By: InnovationEditor–North America

Source : PepsiCo Image source: PepsiCo/ StraussGroup(montage)

Samworth Brothers, a leading UK supplier of chilled and ambient foods, is seeking a buyer for its Soreen cakes business, according to reports in Grocery GazetteandTheGrocer.

Founded in the 1930s, Soreen is especially known for its flagship malt loaf, marketed as a low fat option with 43% less sugar than the average. More recently, the Soreen portfolio has expanded to include banana and toffee loaves, as well as cake bars marketed under the Lunchbox Loaves and Lift

Bar brands.

The company is said to be working with financial adviser Spayne Lindsay to divest the brand, which could reportedly be worth as much as £75 million ($95 million). According to sources, the Soreen business generated £41 million ($52 million) in 2023, up 13% on the previousyear.

By: InnovationEditor–Europe

Source: GroceryGazette/The Grocer/SamworthBrothers

Image source: Samworth Brothers

Agro Tech Foods (ATFL), a confectionery and snacks firm backed by private equity firm Samara Capital, has announced it has entered into an agreement to acquire Del Monte Foods in a 1,300 crore INR ($156 million) share swap deal with Bharti Enterprises and Del MontePacific.

selves in food and drink product discovery”, the latest edition of International Food Event, IFE onceagainprovedtobea vibrant showcase of the biggest and brightest food and drink innovationsfromtheUKandbeyond.

With ExCel in London’s Docklands playing host, IFE brought together 1,500 exhibitors from all around the world, representing countries as diverse as Greece, Italy, Vietnam, Türkiye, South Korea, Kenya, Poland and India.

The event also saw the return of the New Products Tasting Theatre, a stage for innovative food & drink brands to demo and pitch live, as well as Startup Market, showcasing new-to-market companies and inspiring entrepreneurs. Other prominent features were the Future Food Stage, where renowned thought leaders gave an insight into the food and drinks trends of tomorrow, and the Trends & Innovation Platform, offering a window into the consumer behaviours and attitudes influencing buying choices in the current environment. Meanwhile the Exporters Hub offered expert guidance for companies seeking to expand internationally, while the Certification Clinic offered bespoke advice and updates on new rules & regulations, and the World Food Innovation Awards again celebrated innovation and excellence across every category of the globalfoodindustry.

Other co-located events, held as part of Food & Drink Hospitality Week, included IFE Manufacturing, The PUB Show, HRC and InternationalSalonCulinaire.

A tour of the showgrounds revealed that major trends such as plant-based and additive-free remain a focal point of innovation, highlighting ongoing consumer interest in natural formulations. Alternative grains were much in evidence, including pasta ranges made with ingredients such as milletandalmondflourasheadline ingredients.Elsewhere,snackmakers maintained a resolute focus on adventurous flavourblends, including dried fruit combined with barbecue and beetroot, and popcorn withwasabiandseaweed.

Thenext edition ofIFE is scheduled for three days in 2026, starting on 30thMarch.

Image source: Gama

Following the acquisition, Del Monte Foods will become a wholly owned subsidiary of Agro Tech. Bharti Enterprises will hold a 21% stake, with Agro Tech securing an exclusive licence for the Del Monte brand inIndia.

As part of the transaction, ATFL will acquire access to Del Monte Foods’ manufacturing and R&D facilities in Hosur, Tamil Nadu,andLudhiana,Punjab.

Commenting on the move, Bharti Enterprises joint managing director Harjeet Kohli said: “The plan is to aggregate the food business of Agro Tech, which has Sundrop edible oil and Act II popcorn, with that of Del Monte, which offers branded processed food and beverages. While both businesses can combine and

grow organically, there is nothing preventing the company from acquiring brands in adjacent spaces”.