report

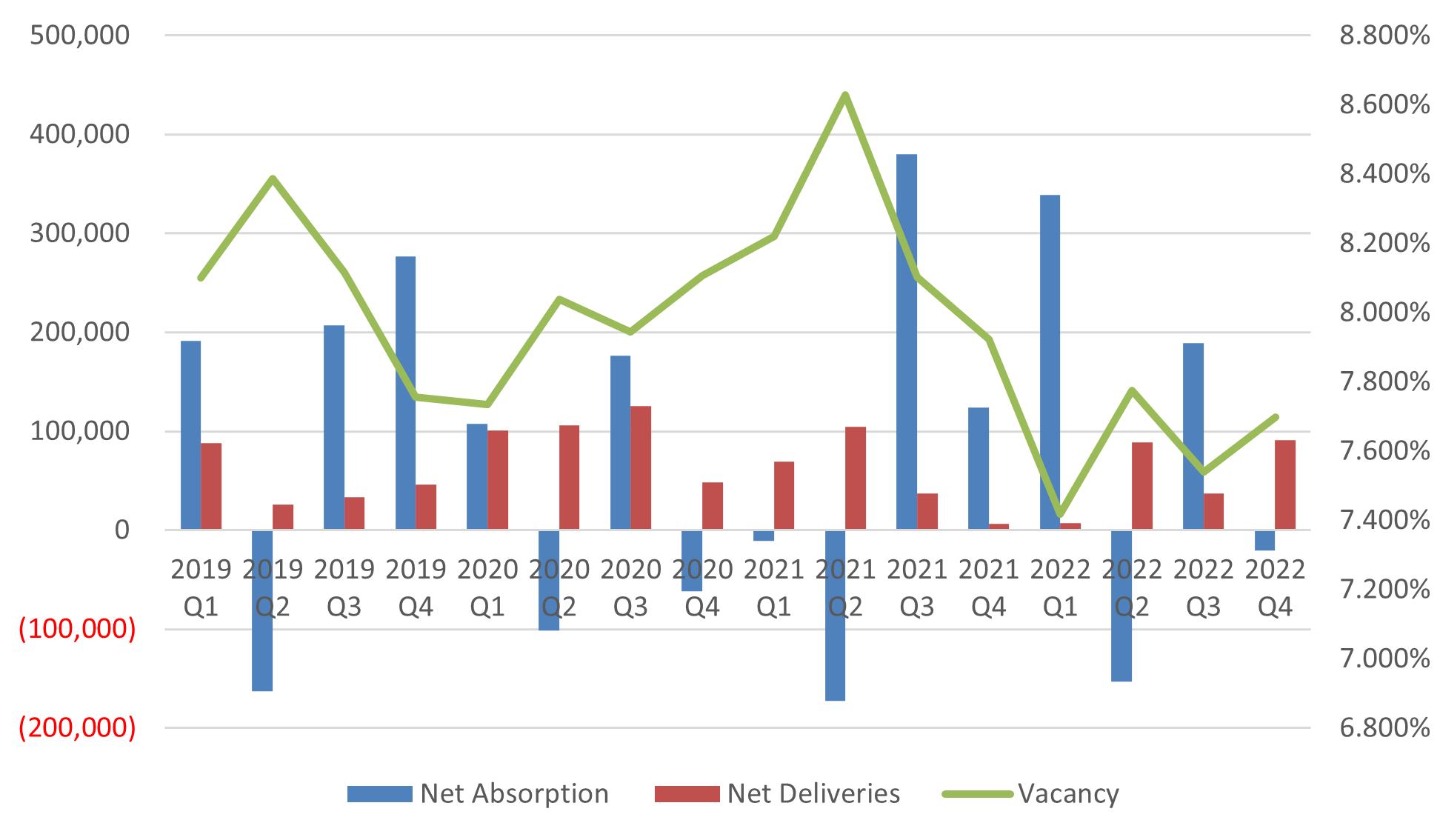

2022 was another strong year for retail commercial real estate in the Sacramento region with an overall vacancy rate at 7.7% to close out the 4th quarter. With continued robust demand and nominal new construction, we have experienced positive net absorption and a relatively tight retail market. Despite Federal Reserve rate hikes, consumer spending in the region was still strong with retailers overall performing well in 2022.

As we head into 2023, there are certainly concerns for the greater economy and the potential for a recession, but once again the Sacramento region appears to be poised to weather the potential storm. With a positive cost of living to quality of life ratio, the region is likely to continue to attract employers and thus continued increasing population and housing growth to foster retail commercial real estate.

The Sacramento retail sector closed the year with steady fundamentals going into the start of 2023. While the overall vacancy rate only rose from 7.6% to 7.7% from Q3 to Q4, activity has remained positive for well located and anchored shopping centers. Examples include new leases signed in Elk Grove for a 55,000 SF Safeway joining the Laguna Reserve Shopping Center and a City Sports occupying a 35,000 SF space at The Ridge. Top performing submarkets include Elk Grove with an impressive 2.8% vacancy, Natomas at 4.8% and Folsom at a 6.0% vacancy. Overall, leasing remained strong in 2022, but the market has started to show signs of a softening in comparison to a white hot 2021.

Some recent notable challenges for tenants include delayed openings due to slow permitting with cumbersome approval procedures through city and county municipalities. Because of this, many tenants faced rent commencement dates prior to store openings. Supply chain hurdles have also played a role in these delays while tenants wait for equipment and fixtures for shops or restaurants. However, the supply side seems to be making progress as the year comes to a wrap.

Rent growth slowed a bit in 2022, however, overall asking and achieved rents are still near record levels with the region totaling an Average Asking Rent of $19.22/square foot.

There has been significant slowing of bankruptcy among retailers in the last 12 months. One significant concern among investors and landlords is that Bed Bath & Beyond is likely facing an eminent bankruptcy filing in 2023. The future of their subsidiary company, Buy Buy Baby remains unclear. It seems the stabilization of the market is a reflection of brick and mortar companies weaving online sales into their business models.

Q4 started to show a slight disconnect between buyers and sellers in terms of current market conditions. With interest rates quickly climbing sellers were holding onto expectations dating back to earlier in the year. While buyers approached deals with their pricing assumptions in the future. This disconnect caused trading to slow, while also accounting for overall uncertainty in the economy.

Some Q4 sales included:

• Sunridge Plaza - $34.85M

• Combined Sale: Rock Creek Plaza & Park Place I - $84M

• Single Tenant Sprouts, Folsom - $11.3M

• Broadstone Plaza 1 - $62.75M

Submarket

Arden/Watt/Howe

7,155,512 1,008,614 6,792 1,015,406 14.2% 34,820 32,443 57,552 $15.84

Auburn/Lincoln/Loomis 3,120,024 134,872 8,278 143,150 4.6% (4,795) 13,406 - $17.16

Carmichael/Citrus Heights/ Fair Oaks/Orangevale 7,792,633 796,256 4,705 800,961 10.3% (61,292) (25,266) - $15.36

Davis/Woodland 3,308,349 145,905 - 145,905 4.4% 45,664 6,257 12,440 $17.16

Downtown/Midtown/ East Sacramento 1,590,856 116,925 20,050 136,975 8.6% 6,225 (1,890) - $29.40

El Dorado 2,549,941 119,414 - 119,414 4.7% 30,599 (12,956) 6,360 $20.16

Elk Grove 4,719,207 83,547 - 83,547 1.8% (4,726) 20,226 18,175 $26.52 Folsom 4,448,884 219,699 - 219,699 4.9% 9,972 (22,091) 8,000 $20.04

Highway 50 3,490,288 451,606 - 451,606 12.9% 72,658 (37,518) 88,225 $16.08

Natomas 3,067,315 116,243 - 116,243 3.8% (4,384) 34,861 3,966 $21.00 Rio Linda/ North Highlands 2,870,849 171,988 - 171,988 6.0% 7,265 6,342 - $15.48

Roseville/Rocklin 11,607,731 582,928 51,595 634,523 5.5% 100,522 72,439 - $20.40

South Sacramento 8,499,376 785,197 134,635 919,832 10.8% (253,465) 37,410 100,675 $11.76 West Sacramento 1,807,741 124,501 - 124,501 6.9% 300 - 900 $18.00 Totals 66,028,706 4,857,695 226,055 5,083,750 7.7% (20,637) 123,663 296,293 $18.88

Gallelli Real Estate is a private firm that specializes in commercial real estate services and property management. We believe that as a boutique firm whose understanding of the business runs as deep as our core values, our advantage is large. We take pride in our unique approach to offer more individual solutions that address the ever changing needs of our clients and the industry. After all, our success is measured by the success of our clients and the strength and longevity of our relationships.

For the latest news from Gallelli Real Estate, visit GallelliRE.com, or follow us on LinkedIn.

Gary Gallelli President 916 784 2700 gary@GallelliRE.com

Gallelli Real Estate

3005 Douglas Blvd #200 Roseville, CA 95661 P 916 784 2700