Q3

DESPITE RECORD YEAR FOR NEW DEVELOPMENT, 2025 COULD SEE RETURN OF REAL RENT GROWTH

As of the end of Q3 2024, multifamily vacancy in the Sacramento region stood at 6.1%. This reflects a slight uptick from the 5.9% rate posted just three months ago. This increase in vacancy comes even though the market posted increased positive net absorption in Q3. Multifamily occupancy increased by 1,069 units in Q2, with occupancy growth increasing 17.5% to 1,257 units in Q3. Net absorption has not only remained in positive territory for seven consecutive quarter, but it has also increased for five consecutive quarters. The continued retreat of inflation closer to the Federal Reserve’s target rate of 2.0% has, in addition to prompting the central bank to cutting interest rates for the first time in four years in September, has also reduced some of the economic headwinds that had cooled tenant apartment demand and even sent it into sustained negative territory by 2022— something the Sacramento market had last experienced in 2011 when still recovering from the Great Financial Crisis (GFC).

The challenge for local landlords and developers has been one of timing. New multifamily development virtually disappeared in the immediate aftermath of the GFC. From 2001 through 2007, there were an average of 3,400 new multifamily units under construction at any given time in the Sacramento region (we should note that our survey only tracks major projects of 20 units or larger). From 2008 through 2015, that average fell well below 1,000 units. Local vacancy, which had spiked at 7.4% by Q4 2009, remained elevated until 2014, when it finally fell below the 5.0% mark. It was only by then that we saw developers tentatively return to market. By 2018, the local development pipeline was back at pre-GFC levels, but still lagging demand. This trend continued despite the arrival of the pandemic with the Sacramento market benefiting from an influx of Bay Area migration that saw local apartment vacancy fall to a record low of just 3.2% by Q2 2021. There were roughly 3,400 new housing units in the pipeline at that time but within two years, the amount of new multifamily product under construction in the region would double with deliveries accelerating even as demand by 2022 with inflation temporarily taking center stage.

The good news for existing landlords and developers alike, is not just that demand has been on an upswing. It is that the local development pipeline has been steadily emptying. There are now 25 major projects under construction throughout the Sacramento region, accounting for a total of 3,590 multifamily housing units. One year ago, there was nearly double (6,997

units) the amount of new housing development underway and since the recent uptick in vacancies, the number of new projects starting work has slowed to a trickle.

Assuming that all the projects we are currently tracking can maintain existing delivery schedules, there will be an additional 1,056 new housing units added to the Sacramento region’s multifamily inventory in Q4 2024. All told, the region will likely close this year having added more than 4,400 new units—the most the Sacramento market has recorded since 2000. Yet, if current demand levels hold or continue to increase, we should see local apartment vacancy fall back into the high 5.0% range within the next three months.

Heading into 2025, we have no doubt there will be some currently proposed projects that will move forward. But we anticipate continued moderation ahead. There are currently 15 projects underway that will add a total of 2,231 additional housing units over the course of 2025 assuming current delivery schedules are kept.

RENTAL RATE TRENDS

The current average asking rent of an apartment in the region is $1,772 per unit. This reflects a 1.9% increase over the $1,739 rate of a year ago, but keep in mind that these numbers are not inflation adjusted. Since Q3 2022, year-over-year gains have not topped 2.6%, even while inflation during much of that period was peaking. In other words, in real dollars rents have gone backwards locally in

the past two years. If there is any solace at all for landlords, it is that from 2025 through 2021, Sacramento rents were growing at a rate that far outpaced inflation—remaining at, or above, the 5.0% mark for four consecutive years. The markets where we are seeing the greatest levels of year-over-year rental rate growth; Elk Grove (+3.3%), and Roseville/Rocklin (+4.1%) are among the trade areas that have seen the least amount of new construction in the last few years. Meanwhile, there is only one submarket that has experienced a decline in year-over-year asking rents—Downtown, which has led all local trade areas in terms of new deliveries, saw this metric fall to -0.9% in Q3. As recently as last quarter, this metric was in the red in both the Folsom and West Sacramento submarkets—also focal points of new development, Yet the most recent data indicates rents are now up +1.0% annually in Folsom and +0.9% in West Sacramento despite the fact that both recorded rising vacancy rates over the past three months.

SUBMARKET REVIEW

Five of Sacramento’s 12 distinct multifamily submarkets reported higher vacancy rates in Q3, but only one posted significant negative net absorption (Davis, to the tune of -35 units). Demand trends were positive in all other submarkets, though deliveries surpassed occupancy growth in every trade area that saw increased vacancy.

In terms of overall vacancy, Downtown leads the way with 10.7%, down significantly from the 14.4% rate of a year ago, but still

elevated. Other Sacramento submarkets with vacancy still above the 5.0% rate include Arden Arcade (5.4%), Folsom (10.3%), Natomas/North Sacramento (6.4%), Rancho Cordova (7.3%), Roseville/Rocklin (5.2%), South Sacramento (5.4%) and West Sacramento (6.3%). With no new multifamily currently under construction in either the Arden Arcade or Roseville/Rocklin trade areas, both are on track (assuming current demand trends hold) to fall below the 5.0% threshold be the end of 2024. Meanwhile, the Carmichael/ Citrus Heights (4.8%), Davis (4.0%), El Dorado Hills (4.0%), and Elk Grove (2.9%) balance between supply and demand already favors landlords. Should the economy continue its recent performance heading into 2025, the stage is set for a return to rent growth that at least aligns with overall inflation next year with some select projects in key submarkets holding the potential for real rental rate growth heading deeper into the new year.

INVESTMENT OUTLOOK

Through the first three quarters of 2024, Costar tracked just 9,065 multifamily investment transactions nationally, accounting for total sales volume of $62.5 billion. Multifamily investment activity has been hobbled in recent years by challenging underlying fundamentals and high interest rates. By comparison, in 2019 Costar tracked 23,510 transactions accounting for $163.4 billion in total volume.

These same trends have impacted multifamily investment activity locally. Through the first nine months of 2024, 61 deals closed for a combined transactional volume of $362.9 million. This compares to 168 deals in 2019 and total deal volume exceeding $1.2 billion. Private investors (typically

in all cash deals) have driven 90% of local activity in the past year— institutional investors have virtually disappeared from the landscape since 2022. The rise in inflation and subsequent cycle of aggressive interest rate hikes from the Federal Reserve is clearly one factor for this, but just as great a challenge is the fact that the region’s outsized rental rate growth of 2016 through 2021 had meant there was little room for rental rate growth before the 2022 spike in inflation, temporary slowing of tenant demand and record setting wave of new development.

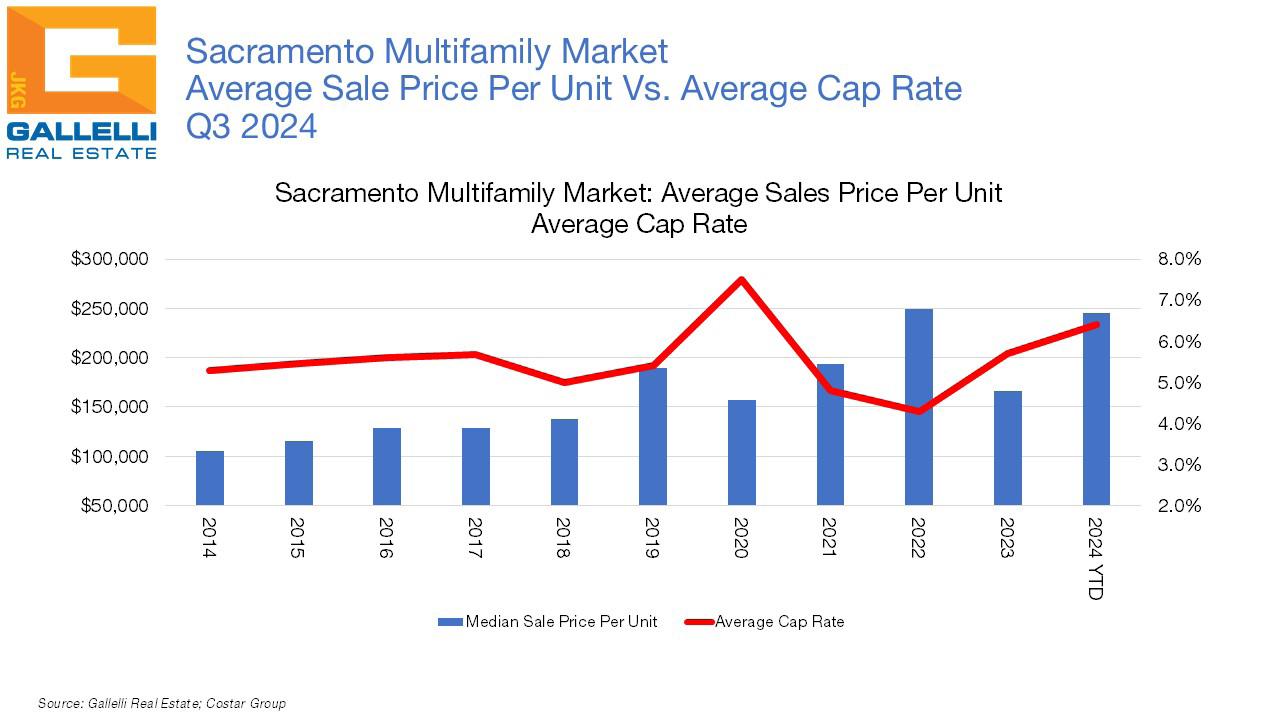

Cap rates have been climbing in recent years, with the average asking cap rate in the Sacramento region standing at 5.8%. The average cap rate on transacted deals has fallen as low as 4.7% in early 2022 but has been climbing since even as transactional volume has also slowed.

The Federal Reserve’s cutting of interest rates in September (and the high likelihood that further rate cuts are coming in 2025) is easily the most positive development for commercial real estate that has occurred this year. The Federal Funds Rate (FFR) was cut from 5.25% - 5.50% to 4.75% to 5.00% on September 19th. The Central bank has since signaled that they plan on at least one more rate cut before the end of the year that will likely take the FFR down to 4.50% to 4.75%.

We will, no doubt, begin to see buyers coming off the sidelines--especially as we get further into the rate cutting cycle. But we anticipate gradually increased multifamily investment opportunity heading into 2025, as opposed to any potential surge. Assuming economic conditions hold and the Fed rate cutting cycle can continue at this same pace, we will likely be looking at an FFR of 3.75% to 4.00% by Spring 2024—which is where we think the reduced price of lending will really start to make an impact.

In the meantime, we anticipate cash deals to still dominate deal activity in Q4 2024 and Q1 2025. Meanwhile, the market still needs to work through a significant gap that remains between ask and bid. We continue to see would-be buyers looking for opportunities with cap rates in the 6.0% range and above. Meanwhile, potential sellers are trying to keep rates in the 5.0% range. How this plays out in the next six months will depend heavily on the overall economy, as well as a continued improvement in leasing fundamentals and the ongoing trend of diminishing development continued. Should all these trends persist, especially if they pave the way for a return (albeit modest) to real rent growth by the second half of 2024 we see a potential end to the logjam.

SCHEDULED MULTIFAMILY DELIVERIES Q4 2024

25 Howe Avenue - Q4 2024

70 Units - Hope Cooperative Arden/Howe/Watt

The Richmond, Q4 2024

47 Units - UPPM

Downtown

Studio30, Q4 2024

30 Units - Urban Capital

Downtown

Wong Center, Q4 2024

150 Units - Sunseri

Downtown

Bear Hollow Estates, Q4 2024

149 Units - Hawthorn Group

Elk Grove

Northview Pointe, Q4 2024

66 Units - Excelerate

Natomas/North Sacramento

Sutter Green 2.0, Q4 2024

190 Units - Demmon Partners

Natomas/North Sacramento

Tran Villa Luxury, Q4 2024

32 Units - Thai Tran

South Sacramento

Kinect @Southport, Q4 2024

322 Units - Mark Pruner

West Sacramento

SCHEDULED MULTIFAMILY DELIVERIES 1H 2024

Greenhaus Apartments, Q1 2025

160 Units - Fulcrum

Davis

39th & Broadway, Q1 2025

43 Units - SHRA

Downtown

Anindell, Q1 2025

154 Units - Blue Mountain

Folsom

Stone Creek Village, Q1 2025

151 Units - Elliott Homes

Rancho Cordova

West Gateway Place II, Q2 2025

66 Units - Jamboree

West Sacramento

1600 Broadway, Q2 2025

68 Units - Core Commercial

Downtown

1901 Broadway, Q2 2025

140 Units - EAH Housing

Downtown

The A.J., Q2 2025

345 Units - McClellan Park

Downtown

326 5th Street, Q2 2025

30 Units - Jeff Berger

West Sacramento

SCHEDULED MULTIFAMILY DELIVERIES 2H 2024 AND BEYOND

Axis at Davis, Q3 2025

200 Units - Anton Development

Davis

Ascent Apartments, Q3 2025

120 Units - St. Anton

Natomas/North Sacramento

Medley Apartments, Q3 2025

160 Units - Blue Mountain

Natomas/North Sacramento

Anton Mosaic, Q3 2025

194 Units

South Sacramento

Natomas Fountains Apartments , Q1 2026

303 Units - Hines

Natomas /North Sacramento

GALLELLI BROKER TEAMS