Are You Prepared for Year-End Payroll Adjustments? by Stacy Smith

E

ach year, the Internal Revenue Service (IRS) and the Social Security Administration announce the changes to limits, benefits and taxes for the upcoming year. It’s important to be aware of these changes and share them with your accounting, human resources and payroll staff.

Changes to Social Security Benefits

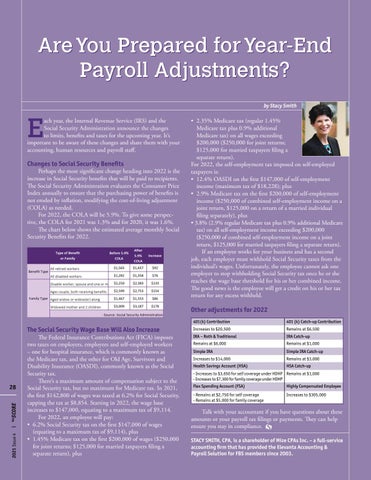

Perhaps the most significant change heading into 2022 is the increase in Social Security benefits that will be paid to recipients. The Social Security Administration evaluates the Consumer Price Index annually to ensure that the purchasing power of benefits is not eroded by inflation, modifying the cost-of-living adjustment (COLA) as needed. For 2022, the COLA will be 5.9%. To give some perspective, the COLA for 2021 was 1.3% and for 2020, it was 1.6%. The chart below shows the estimated average monthly Social Security Benefits for 2022.

• 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages exceeding $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return). For 2022, the self-employment tax imposed on self-employed taxpayers is: • 12.4% OASDI on the first $147,000 of self-employment income (maximum tax of $18,228); plus • 2.9% Medicare tax on the first $200,000 of self-employment income ($250,000 of combined self-employment income on a joint return, $125,000 on a return of a married individual filing separately), plus • 3.8% (2.9% regular Medicare tax plus 0.9% additional Medicare tax) on all self-employment income exceeding $200,000 ($250,000 of combined self-employment income on a joint return, $125,000 for married taxpayers filing a separate return). If an employee works for your business and has a second job, each employer must withhold Social Security taxes from the individual’s wages. Unfortunately, the employee cannot ask one employer to stop withholding Social Security tax once he or she reaches the wage base threshold for his or her combined income. The good news is the employee will get a credit on his or her tax return for any excess withheld.

Other adjustments for 2022 The Social Security Wage Base Will Also Increase

2021 Issue 4 |

THE

SCORE

28

The Federal Insurance Contributions Act (FICA) imposes two taxes on employers, employees and self-employed workers – one for hospital insurance, which is commonly known as the Medicare tax, and the other for Old Age, Survivors and Disability Insurance (OASDI), commonly known as the Social Security tax. There’s a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. In 2021, the first $142,800 of wages was taxed at 6.2% for Social Security, capping the tax at $8,854. Starting in 2022, the wage base increases to $147,000, equating to a maximum tax of $9,114. For 2022, an employee will pay: • 6.2% Social Security tax on the first $147,000 of wages (equating to a maximum tax of $9,114), plus • 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus

401(k) Contribution

401 (k) Catch-up Contribution

Increases to $20,500

Remains at $6,500

IRA – Roth & Traditional

IRA Catch-up

Remains at $6,000

Remains at $1,000

Simple IRA

Simple IRA Catch-up

Increases to $14,000

Remains at $3,000

Health Savings Account (HSA)

HSA Catch-up

- Increases to $3,650 for self coverage under HDHP Remains at $1,000 - Increases to $7,300 for family coverage under HDHP Flex Spending Account (FSA)

Highly Compensated Employee

- Remains at $2,750 for self coverage - Remains at $5,000 for family coverage

Increases to $305,000

Talk with your accountant if you have questions about these amounts or your payroll tax filings or payments. They can help ensure you stay in compliance. STACY SMITH, CPA, is a shareholder of Mize CPAs Inc. – a full-service accounting firm that has provided the Elevanta Accounting & Payroll Solution for FBS members since 2003.