4 minute read

CFD trading vs stocks: Which is better?

CFD trading and stock investing are two popular methods for participating in financial markets. While both allow you to profit from price movements, they differ in structure, advantages, and risks. Whether you're a beginner or an experienced trader, understanding these differences can help you decide which suits your financial goals.

Understanding CFD Trading

CFD trading is a derivative product that allows you to speculate on the price movements of various financial instruments, including stocks, indices, forex, and commodities, without owning the underlying asset.

Advantages of CFD Trading

Leverage OpportunitiesCFDs let you control large positions with a small initial investment, amplifying potential profits.

Ability to Short-SellCFDs enable traders to profit from falling markets by short-selling, offering flexibility in various market conditions.

Wide Market AccessTrade across multiple asset classes and markets using a single platform.

No Ownership RequiredSince CFDs don’t involve owning the underlying asset, there are no additional fees like stamp duty (in some regions).

Global Trading HoursCFDs allow trading outside regular stock market hours, providing more opportunities to act on global news and events.

Disadvantages of CFD Trading

High Risk from LeverageWhile leverage increases profit potential, it also magnifies losses, making risk management critical.

Overnight and Spread CostsHolding CFD positions overnight incurs financing charges, and spreads can erode profits in frequent trading.

Less Ownership BenefitsSince CFDs do not provide ownership, you miss out on dividends and shareholder privileges.

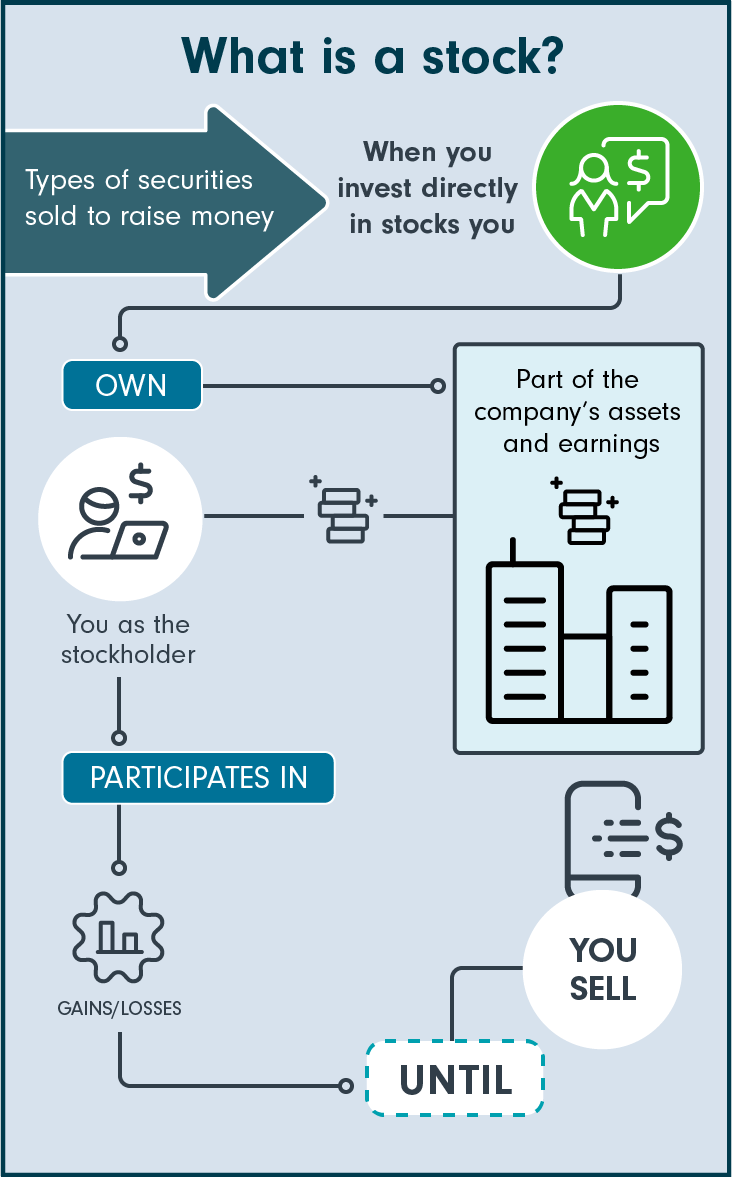

Understanding Stock Investing

When you invest in stocks, you purchase ownership in a company. Stocks are long-term investment vehicles and come with benefits like dividends and voting rights.

Advantages of Stock Investing

Ownership and DividendsStockholders benefit from company profits through dividends and potential stock price appreciation.

Lower Risk in Long-Term InvestingStocks can provide stable, long-term returns, especially in established companies with a track record of growth.

No Overnight Financing FeesUnlike CFDs, holding stocks doesn’t incur daily financing costs.

TransparencyStock markets are heavily regulated, ensuring fair pricing and transparent transactions.

Wealth Building Over TimeHistorically, stock markets have provided consistent returns over the long term, making them ideal for retirement and wealth-building strategies.

Disadvantages of Stock Investing

Limited Profit from Falling MarketsProfit opportunities are generally limited to rising markets unless you engage in short-selling through other financial instruments.

Higher Initial CapitalBuying stocks outright often requires significant upfront capital, especially for high-value shares.

Market Hours LimitationsStocks can typically only be traded during exchange hours, limiting access to some price movements.

Lack of LeverageUnlike CFDs, stock investing does not allow you to amplify your returns using leverage.

Key Differences Between CFD Trading and Stocks

Ownership

CFD Trading: No ownership; you're speculating on price movements.

Stocks: Provides ownership of the company and potential dividends.

Leverage

CFD Trading: High leverage, allowing you to control larger positions with less capital.

Stocks: No leverage in traditional investing; full capital is required.

Trading Flexibility

CFD Trading: Short-sell easily and trade across multiple markets.

Stocks: Typically focused on long-term growth and rising markets.

Costs

CFD Trading: Includes spreads, commissions, and overnight financing fees.

Stocks: May include brokerage fees but no daily financing costs.

Risk Level

CFD Trading: High risk due to leverage and market volatility.

Stocks: Lower risk when held for the long term, with potential for steady growth.

CFD Trading vs. Stocks: Which Is Better for You?

Choose CFD Trading if you:

Want to trade with smaller initial capital.

Are comfortable managing high leverage and risk.

Prefer to profit from both rising and falling markets.

Seek flexibility and access to multiple markets.

Choose Stock Investing if you:

Aim to build long-term wealth with lower risk.

Want to own a part of the company and earn dividends.

Have sufficient capital to invest in valuable shares.

Prefer a regulated, transparent market environment.

Conclusion

CFD trading and stock investing cater to different financial goals and risk appetites. CFDs are ideal for active traders seeking flexibility, leverage, and short-term opportunities in volatile markets. Conversely, stocks are better suited for investors aiming for long-term growth and stability, with the added benefit of ownership and dividends.

Your choice depends on your trading style, experience level, and financial objectives. Whether you opt for the speculative nature of CFDs or the long-term security of stocks, understanding these instruments will help you make informed decisions.

See more: