8 minute read

CFD trading vs options: Which is better?

CFD trading (Contracts for Difference) and options trading are two popular financial instruments that allow traders to profit from price movements in various markets. While both offer unique opportunities, their mechanics, benefits, and risks differ significantly. This article dives into a detailed comparison to help you decide which is better suited for your trading style and goals.

What is CFD Trading?

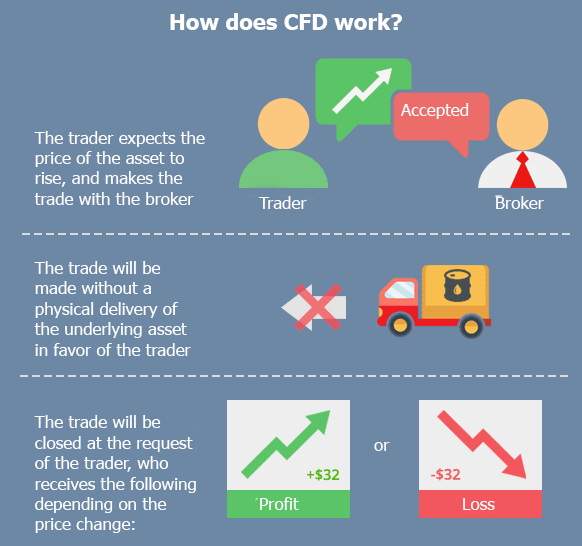

CFD trading allows investors to speculate on the price movements of assets without owning the underlying asset. CFDs cover a wide range of markets, including forex, stocks, commodities, indices, and cryptocurrencies.

Key Benefits of CFD Trading:

High Leverage: CFDs offer leverage, enabling traders to magnify potential profits while increasing risk.

Two-Way Trading: Profit opportunities exist whether markets are rising or falling, through long (buy) or short (sell) positions.

No Expiry Dates: CFDs do not have fixed expiration dates, offering flexibility in holding positions.

Market Variety: Traders gain access to thousands of instruments across multiple asset classes.

Drawbacks of CFD Trading:

Leverage Risks: While leverage amplifies profits, it also increases the potential for significant losses.

Overnight Fees: Holding CFD positions overnight incurs swap fees, adding to trading costs.

Regulatory Restrictions: In some jurisdictions, CFDs are heavily regulated or require higher initial capital.

What is Options Trading?

Options trading involves contracts that give the trader the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before the contract expires. There are two main types of options:

Call Options: The right to buy.

Put Options: The right to sell.

Key Benefits of Options Trading:

Limited Risk: When purchasing options, the maximum loss is capped at the premium paid for the contract.

Diverse Strategies: Options offer a range of strategies, from hedging risks to complex speculative trades.

High Potential Returns: Options can deliver significant returns with a small initial investment if market movements align with your strategy.

Hedging Capabilities: Options are effective tools for managing portfolio risks during volatile market conditions.

Drawbacks of Options Trading:

Complexity: Options trading involves understanding strike prices, premiums, expiration dates, and implied volatility.

Time Decay: The value of options decreases as they approach expiration, making timing crucial.

High Costs: Advanced strategies often require higher transaction fees and premiums.

Key Differences Between CFDs and Options

FeatureCFDsOptionsOwnershipNo ownership of the underlying assetNo ownership of the underlying assetLeverageHigh leverage availableLeverage depends on margin accountsExpirationNo expiration datesFixed expiration datesFlexibilityFlexible positionsRequires precise timingRisk ManagementLimited to stop-loss ordersLimited risk for buyers (premium)

Which is Better: CFDs or Options?

The better choice depends on your trading goals, experience level, and risk tolerance:

Choose CFDs if:

You prefer simpler and more flexible trading.

You want to take advantage of high leverage and access multiple markets.

You value the ability to hold positions without worrying about expiration dates.

Choose Options if:

You want to limit risk to the premium paid for the contract.

You aim to implement sophisticated strategies for hedging or speculation.

You are comfortable managing expiration timelines and understanding option pricing dynamics.

Conclusion

Both CFDs and options offer unique opportunities for traders. CFDs are ideal for those seeking straightforward access to a wide range of markets with leverage and flexibility. Options, on the other hand, cater to traders looking for defined risk and advanced strategies. Carefully consider your trading objectives and experience level before choosing the instrument that best aligns with your needs.

Meta Description:Compare CFD trading vs. options to determine which suits your style. Explore the benefits, risks, and strategies for each to make an informed choice in your trading journey!

You said:

Tôi không muốn so sánh ở dạng bảng, so sánh chi tiết bằng text

ChatGPT said:

ChatGPT

CFD Trading vs. Options: Which is Better for You?

CFD trading (Contracts for Difference) and options trading are two widely-used financial instruments, each with distinct characteristics, advantages, and risks. Both allow traders to speculate on price movements without owning the underlying asset, but the mechanics and strategic use of each instrument differ significantly. Below is a detailed comparison to help you determine which trading method suits your style and goals better.

Understanding CFD Trading

CFD trading involves contracts between a trader and a broker, where the trader profits from the price difference of an asset between the opening and closing of the trade. This form of trading spans various markets, including forex, commodities, indices, and stocks.

Advantages of CFD Trading

Simplicity and FlexibilityCFD trading is relatively straightforward. Traders can open positions to speculate on price increases (buy) or decreases (sell), offering opportunities in both bullish and bearish markets.

Leverage OpportunitiesCFDs allow traders to use leverage, enabling them to control larger positions with a smaller initial investment. This feature amplifies potential profits but also increases risk.

No Expiry DatesUnlike options, CFD contracts do not have a fixed expiration date, making them more flexible for traders who prefer longer-term positions.

Broad Market AccessCFDs provide access to thousands of instruments across multiple asset classes, making them highly versatile for traders looking to diversify.

Risks and Drawbacks of CFD Trading

High Risk with LeverageWhile leverage magnifies potential profits, it also significantly increases the likelihood of large losses. This makes risk management crucial.

Overnight CostsHolding positions overnight incurs swap fees, adding to overall trading costs.

Regulatory ChallengesIn some regions, CFDs are highly regulated, and restrictions may limit trading options.

Understanding Options Trading

Options trading involves contracts that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before the contract expires. Options come in two types: call options (right to buy) and put options (right to sell).

Advantages of Options Trading

Risk ControlWhen buying options, the maximum risk is limited to the premium paid for the contract. This makes options an attractive choice for traders seeking capped risk exposure.

Versatility in StrategiesOptions provide a range of strategic opportunities, from speculative trades to hedging against potential losses in other investments.

High Profit PotentialThe ability to control large positions with a small initial investment can yield significant returns if the market moves in the trader’s favor.

Hedging CapabilitiesOptions are often used as a hedging tool to protect portfolios during volatile market conditions.

Risks and Drawbacks of Options Trading

ComplexityOptions trading requires an understanding of concepts like strike prices, premiums, expiration dates, and volatility. This complexity may deter beginners.

Time SensitivityOptions lose value as they approach expiration, meaning traders must time their positions accurately to avoid losses.

Costly for Advanced StrategiesComplex strategies involving multiple contracts often incur higher transaction fees and premiums.

Comparing CFDs and Options in Detail

CFD trading is generally more accessible to beginners because of its straightforward structure and ease of execution. It allows traders to profit from price movements in either direction without worrying about expiration dates. This makes CFDs a better choice for those who value simplicity and flexibility in their trading.

On the other hand, options trading offers unmatched versatility with its wide range of strategies. However, it requires a deeper understanding of financial markets and is more suitable for experienced traders. Options also provide better control over risk since the maximum loss is limited to the premium paid, making them appealing for traders with specific risk-management needs.

When it comes to leverage, both CFDs and options offer opportunities to amplify returns. However, CFD leverage tends to be higher, making it more suitable for aggressive traders willing to take on additional risk. Options, by contrast, are often favored by those who prefer a more conservative approach to managing leverage.

A key difference lies in time sensitivity. CFDs have no expiration dates, allowing traders to hold positions for as long as desired (subject to overnight fees). Options, conversely, are bound by expiration dates, which can create pressure for traders to execute within a specific time frame.

Which is Better for You?

CFD trading may be better suited if:

You prefer a simpler trading approach with fewer moving parts.

You are interested in short- or medium-term trading without worrying about expiration.

You want access to diverse markets like forex, commodities, and indices.

You are comfortable managing higher leverage and associated risks.

Options trading may be better suited if:

You want a defined risk profile with limited losses (premium paid).

You are looking to implement advanced strategies, such as hedging or multi-leg trades.

You have experience with timing the market and understanding option pricing mechanisms.

You are focused on maximizing returns with minimal upfront capital.

Conclusion

CFDs and options each have unique advantages and disadvantages. CFDs offer simplicity, flexibility, and access to multiple markets, making them an excellent choice for traders seeking straightforward opportunities. Options, on the other hand, excel in risk management and strategic versatility but require a higher level of expertise.

Ultimately, the choice between CFDs and options depends on your trading goals, experience level, and risk tolerance. Understanding these instruments thoroughly will empower you to make an informed decision and succeed in your trading journey.

See more: