7 minute read

Does JustMarkets Have Negative Balance Protection

from JustMarkets Review

by ForexMakets

Does JustMarkets Have Negative Balance Protection

Forex trading has opened the gateway for millions of retail investors to access global financial markets with ease. However, with the opportunity comes risks, and one of the most critical concerns for any trader is: negative balance protection. This feature has become a decisive factor when choosing a broker — especially when market volatility can wipe out an account in seconds.

💥💥💥 Trader with JustMarkets: 👉 Open An Account or 👉 Go to broker

But the big question remains: Does JustMarkets have negative balance protection? This article provides a deep-dive analysis, written specifically for serious traders, beginners and professionals alike. Whether you're just starting out or looking to change your broker, this content will equip you with insights, facts, and marketing clarity — all centered around JustMarkets and the core issue of account protection.

Introduction: Why Negative Balance Protection Matters

For many traders, losing capital is an accepted risk. However, losing more than your deposit — going into debt with your broker — is a nightmare. This is where negative balance protection (NBP) steps in as a safeguard. It ensures that a trader cannot lose more money than they deposit. In other words, if the market moves sharply against your position, your losses are limited to your account balance.

Without NBP, sudden price gaps or volatility spikes can cause traders to owe money to their brokers ❌. This risk is even greater during events like:

High-impact economic news releases

Unexpected geopolitical events

Flash crashes

Overnight position gaps

A broker that offers NBP is automatically more attractive to risk-conscious traders.

Understanding the Basics of Negative Balance Protection

Negative balance protection is a feature provided by brokers to cap a trader’s risk exposure. With this system in place, if your account goes into a negative balance due to extreme volatility or slippage, the broker will reset your balance to zero instead of demanding repayment.

It is especially important for traders who:

Use high leverage

Trade during volatile market hours

Have limited capital

Are new to trading and still learning risk management

Some regulators (such as ESMA in the EU) mandate that brokers offer negative balance protection for retail clients. Even in regions where it is not a legal requirement, ethical brokers voluntarily provide this feature ✅.

How Market Volatility Impacts Retail Traders

Volatility is both a friend and foe in trading. It creates profit opportunities but also increases risk. During extreme market movements, the price can skip your stop-loss levels, causing massive losses.

For example:

A sudden 200-pip drop in a currency pair

A flash crash on major indices

Black swan events like COVID-19 announcements or war declarations

In such cases, retail traders without NBP can see their accounts swing into negative, leaving them in debt ❌. This not only leads to financial stress but also legal complications.

Does JustMarkets Have Negative Balance Protection?

✅ Yes, JustMarkets offers negative balance protection for all retail clients.

This is one of the key features that makes JustMarkets attractive to both beginners and professional traders. With this protection in place, traders can explore opportunities without the fear of going into debt, even during unexpected market swings.

Here's how JustMarkets handles it:

If your account goes negative, it is automatically adjusted to zero

There is no obligation to repay negative balances

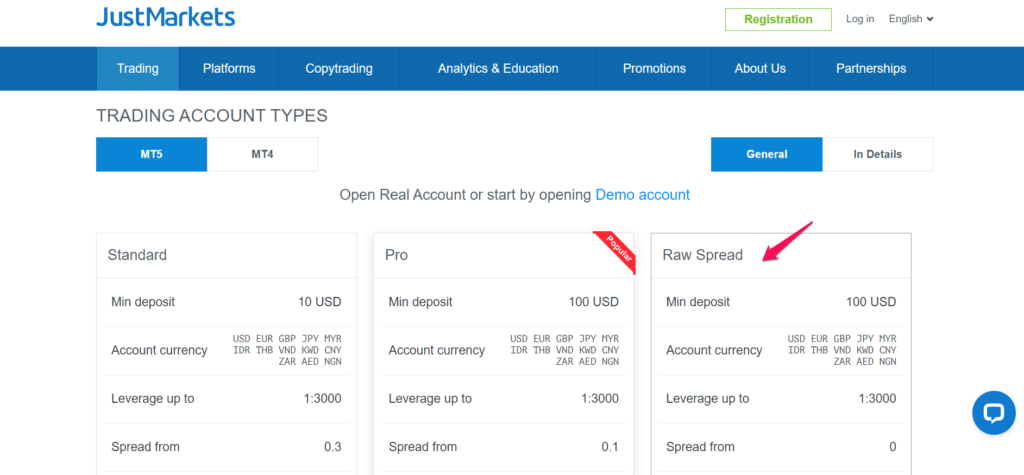

Protection applies across all account types: Standard, Pro, Raw Spread, and Cent accounts

This ensures peace of mind and allows traders to focus on strategy, not on risk of bankruptcy.

How JustMarkets Compares with Other Brokers (Listed, Not in Table Format)

Compared to other brokers:

JustMarkets offers NBP by default ✅

Some brokers offer NBP only in regulated jurisdictions ❌

Others require traders to apply for it manually ❌

Certain brokers still leave traders exposed to debt recovery actions ❌

When it comes to transparency, consistency, and client protection, JustMarkets outperforms many global brands.

💥💥💥 Trader with JustMarkets: 👉 Open An Account or 👉 Go to broker

Scenarios Where Negative Balance Protection Saves Traders

To understand the real-life importance of NBP, let’s look at sample situations where this feature is critical:

News Trading Gone Wrong: A trader uses high leverage to trade Non-Farm Payroll (NFP). A surprise result causes a 300-pip reversal. Without NBP, they owe the broker $1,500. With JustMarkets, loss is capped at deposit.

Weekend Gap Risk: A position held over the weekend opens on Monday with a 250-pip gap. Stop-loss skipped. Without NBP, account is negative. With JustMarkets, balance reset to $0.

Slippage during Crisis: A war breaks out, market crashes. Many brokers leave clients in debt. JustMarkets protects its traders ✅.

Leverage, Margin Call, and the Risk of Negative Balances

High leverage amplifies both profits and losses. For instance, a 1:1000 leverage can turn small market movements into massive gains — or devastating losses.

JustMarkets allows flexible leverage, but also employs:

Margin calls to warn traders of low equity

Stop-out levels to automatically close losing positions

Negative balance protection to eliminate the worst-case scenario

This three-layered system ensures capital preservation, especially for new traders still refining their skills.

JustMarkets Risk Management Tools for Clients

JustMarkets doesn't stop at NBP. It provides a complete suite of risk management tools, including:

Negative balance protection ✅

Adjustable leverage

Real-time margin monitoring

Stop-loss and take-profit functions

Trading calculators and risk simulators

Educational resources on risk strategies

Together, these tools help clients not only survive but thrive in volatile markets.

The Real Benefits of Trading with JustMarkets ✅

When you trade with JustMarkets, you gain access to:

✅ Negative balance protection for all accounts

✅ Tight spreads starting from 0.0 pips

✅ Ultra-fast execution

✅ 24/7 multilingual support

✅ Multiple deposit & withdrawal methods

✅ Advanced trading platforms like MetaTrader 4 & 5

Whether you're trading currencies, commodities, or indices — JustMarkets gives you the confidence and tools needed to succeed.

Ready to trade safely and profitably? Now is the perfect time to open your JustMarkets account.

Marketing Advantage: Why JustMarkets Is Growing Rapidly

JustMarkets is not just another broker. It's a brand built on trust, innovation, and trader-first policies. With features like negative balance protection, low spreads, and powerful platforms, it's easy to see why more traders are switching daily.

The brand also attracts affiliates, educators, and influencers, creating a strong global presence. Their campaigns often highlight:

Zero negative balances ✅

Zero limitations on trading strategies

Zero manipulation of prices

If you're looking for a broker that stands with you, JustMarkets is your go-to partner.

How to Open an Account with JustMarkets

Opening an account is simple and fast:

Register with your email and basic info

Verify your identity (KYC process)

Choose your account type

Deposit funds securely

Start trading with full protection ✅

Take the first step towards safe and profitable trading today! 💥 Open JustMarkets account now

Frequently Asked Questions (FAQ)

1. Does JustMarkets really offer negative balance protection?✅ Yes, it applies to all retail clients automatically.

2. What happens if my balance goes negative at JustMarkets?Your account is reset to zero. No debt. No stress.

3. Do I need to apply for NBP separately?No. It’s enabled by default for all accounts.

4. Is NBP available on demo accounts too?Demo accounts simulate trading and don't incur real losses, so NBP isn’t applicable.

5. Does NBP protect against all market conditions?Yes. Even during extreme volatility, your balance won’t go below zero.

6. What leverage is best with NBP at JustMarkets?You can use high leverage, but always apply proper risk management.

7. Are there fees for using NBP?No, it’s a free protective feature.

8. Is JustMarkets regulated?Yes, it operates under international regulatory standards.

9. Can I change account types and still keep NBP?Yes. NBP applies across all account types.

10. How do I start trading with JustMarkets?Register, verify, deposit, and start trading securely with NBP ✅. 👉 Join JustMarkets Now

Stop worrying about going into debt. Focus on trading smarter. Open your account with JustMarkets today and enjoy real trader protection.

💥 Read more: