6 minute read

Is JustMarkets a Market Maker? An In-Depth Review for Forex Traders

from JustMarkets Review

by ForexMakets

Is JustMarkets a Markets Maker

In the dynamic world of forex trading, choosing the right broker is crucial. ✅ One of the key considerations is understanding whether a broker operates as a Market Maker or follows a different model. This distinction can significantly impact your trading experience, including aspects like spreads, execution speed, and potential conflicts of interest.

📌 Navigate the world of forex with confidence—start with our expert content on the Forex Markets!

💥💥💥 Trader with JustMarkets: 👉 Open An Account or 👉 Go to broker

In this comprehensive review, we delve into JustMarkets, exploring its operational model, trading conditions, and how it compares to other brokers like AvaTrade. Our goal is to provide traders with clear, actionable insights to make informed decisions.

Understanding Market Makers

A Market Maker is a financial institution or individual that actively quotes both buy and sell prices in a financial instrument, aiming to make a profit on the bid-ask spread. They provide liquidity to the markets, ensuring that traders can execute orders promptly.

However, this model can sometimes lead to conflicts of interest, as the broker may take the opposite side of a client's trade. ❌ This raises concerns for traders who prioritize transparency and fair execution.

📌 Discover the key features, account types, and trading conditions in our comprehensive JustMarkets Review!

Is JustMarkets a Market Maker?

JustMarkets operates using a hybrid model, offering both Market Maker (Dealing Desk) and Non-Dealing Desk (NDD) execution methods. This depends on the account type and trading conditions.

✅ Transparency: JustMarkets provides clear information about its execution policies, allowing traders to choose what best fits their strategy.

This approach is particularly beneficial for traders who:

Prefer tighter spreads and are comfortable with paying commissions.

Want the option to avoid potential conflict-of-interest scenarios.

Value fast execution and minimal slippage.

JustMarkets Review: Trading Conditions and Features

Account Types

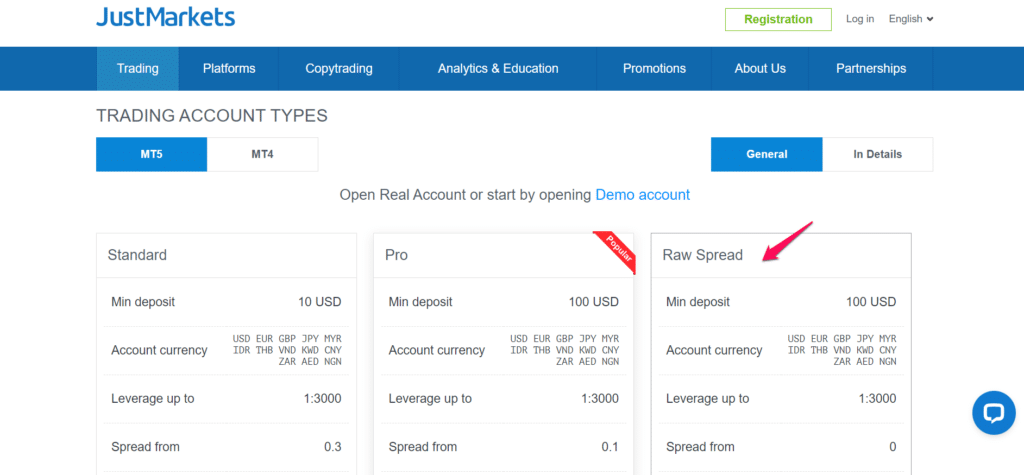

JustMarkets offers multiple account options:

Standard Account – Ideal for beginners. No commission. Spreads from 0.3 pips.

Pro Account – Designed for seasoned traders. No commission. Spreads from 0.1 pips.

Raw Spread Account – Best for scalpers and professionals. Spreads from 0.0 pips + fixed commission per lot.

These options ensure flexibility based on trader experience, style, and capital availability.

Trading Instruments

You can trade over 90 financial instruments including:

Forex Pairs – Majors, minors, and exotic pairs.

Commodities – Gold, silver, oil.

Indices – S&P 500, Dow Jones, FTSE, and more.

Stocks – Global companies.

Cryptocurrencies – Bitcoin, Ethereum, Litecoin, and others.

This wide range allows diversification, which is critical for risk management.

Platforms

JustMarkets supports:

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

A proprietary mobile trading app

These platforms offer:

Advanced charting tools

Algorithmic trading

Fast execution

Spreads and Leverage

Spreads: From 0.0 pips on Raw Spread Accounts

Leverage: Up to 1:3000, based on account and region

✅ High leverage can amplify gains — but also risk. Use with proper risk management.

👌 Trade with JustMarkets? Click Here!

Deposits & Withdrawals

Multiple payment methods supported

Instant deposits in many regions

Withdrawals processed within 1–2 business days

❌ No internal fees — but payment providers may charge their own

AvaTrade vs JustMarkets: Which Broker is Better?

Let’s break it down without a table:

1. Regulation & Trust

Both brokers are regulated by well-known authorities.

AvaTrade has broader global regulation coverage, while JustMarkets focuses on operational efficiency and low-cost access.

2. Leverage

JustMarkets offers up to 1:3000, which is much higher than AvaTrade’s conservative 1:400 limit.

3. Account Flexibility

JustMarkets provides more tailored options for different levels of traders.

AvaTrade has simpler structures but lacks the same degree of customization.

4. Execution

Both support NDD and STP options.

JustMarkets’ Raw Spread account is highly competitive for scalpers.

5. Marketing and Tools

AvaTrade offers great educational tools.

JustMarkets focuses more on low trading costs and fast execution, which appeals to active traders.

✅ For aggressive traders or those starting small, JustMarkets offers more freedom and potential.

However, if you’re a long-term investor or someone who prefers a highly structured environment, AvaTrade may be a safer pick.

Marketing Insight: Why Open an Account with JustMarkets?

If you're still deciding, consider these benefits:

✅ Low entry barriers – Start with just $10

✅ Leverage up to 1:3000

✅ Tight spreads and commission-free options

✅ Access to MT4, MT5, and mobile trading

✅ Fast and reliable order execution

✅ Multiple instruments for diversified trading

✅ Multilingual customer support available 24/7

JustMarkets is built for flexibility and affordability — two things that matter most to modern traders. Whether you're into scalping, day trading, or swing trades, JustMarkets is designed to support your growth.

✅ Don't wait – explore the full power of trading with JustMarkets now.

💥💥💥 If you do not have a JusstMarkets account, please: 👉 Open An Account or 👉 Go to broker

FAQs: JustMarkets Review and Market Maker Questions

1. Is JustMarkets a Market Maker or STP broker?JustMarkets offers both Market Maker and NDD models, depending on the account type.

2. Can I use JustMarkets for crypto trading?Yes. It offers popular cryptocurrencies like BTC, ETH, and more.

3. What is the minimum deposit at JustMarkets?You can start trading with as little as $10 on certain accounts.

4. Is JustMarkets suitable for scalping?✅ Yes. With tight spreads and fast execution, it's ideal for scalpers.

5. How does JustMarkets compare to AvaTrade?While AvaTrade is more regulation-focused, JustMarkets offers better leverage and account flexibility.

6. What trading platforms does JustMarkets offer?It provides MetaTrader 4, MetaTrader 5, and a proprietary mobile platform.

7. Are there educational resources available?Yes. JustMarkets provides webinars, articles, and market analysis for all experience levels.

8. Does JustMarkets charge deposit or withdrawal fees?❌ No internal fees. Third-party fees may apply.

9. Is there a JustMarkets demo account?Yes. It’s perfect for beginners to practice risk-free.

10. Is JustMarkets a good broker for beginners?✅ Absolutely. The low deposit requirements and simple platform make it beginner-friendly.

Final Thoughts

Is JustMarkets a Market Maker? Technically yes — but that’s only part of the story. With its hybrid execution model, JustMarkets gives traders the flexibility to choose the path that fits their strategy best.

From ultra-tight spreads to high leverage and low deposit requirements, JustMarkets is built for traders who want freedom, speed, and performance. But while it offers exceptional features, AvaTrade still stands strong for those seeking a more traditional, highly-regulated environment.

✅ If you're a trader who values low costs, high speed, and global access — JustMarkets is the broker for you.

💥 Read more:

JustMarkets Review 2025: safe, legit, Is a good forex broker?

Exness vs JUSTMARKETS Review Compare broker

JustMarkets Vs XM 2025: Compared - which is better broker?