24 minute read

PIAGET

POSSESSION NOVELTIES TIMEPIECE AND JEWELRY COLLECTION

BY: SARA O’BOYLE

Advertisement

Since its beginnings in 1874, Piaget was founded on the principles of “métiers d’or and craftsmanship,” or the space where heritage and technique meet passion and creativity, seemingly effortlessly. Behind the curtain, however, are expert craftsman who devote their time to individually create the timeless pieces we have seen on generations of the largest celebrities at the most exclusive events including the Grammy Awards, The Oscars, International Film Festivals, charity galas and the list goes on

Natural Mother-of-Pearl dial with Row of Diamonds Available in 29mm & 34mm

Possession Watch with 2 Rows of Diamonds on the External Turning Ring

Available in 29mm

Possession Pink Gold Pendant with Paved, Sliding Center Motiff Possession Pink Gold Earrings with Diamonds

There are three ways to wear this unique piece – as studs, drop earring set, or one stud and one drop earring. Dress it up according to your style and event.

Piaget Polo Watch

The best of both worlds is found in Piaget’s aesthetics – pieces are simple and classic, with a hint of playfulness and versatility. These factors are highlighted especially in the Possession collection, featured here. Pinks, blues, and teals light up the fine jewelry, yet the timeless staple of Piaget remains ever so elegantly.

To view the full Possession

collection online, visit www.piaget.com/ww-en/ jewelry/possession.

Price is available upon request of each item.

PAINTING THE NEW PICTURE OF FAMILY OFFICE TRAVEL

Are Family Offices Ready for Travel?

As many have experienced, COVID-19 has put a screeching halt to international travel, impacting preplanned holidays and grounding many people hoping to conduct business face-to-face.

Those who were traveling for business or pleasure last spring had to cancel their trips, ultimately leaving travel options between owned properties or opting for more “rustic” alternatives such as camping or “glamping.” The numbers spoke for themselves, as RV rentals saw a massive upswing this summer. The popular booking site, RVshare, reported a 1000% booking surge since the pandemic began.

However, for those who are tired of glamping and stay-cations, the bounce back in luxury travel has already begun.

The Parisian market research agency, Ipsos, has predicted that the affluent will be the first to begin traveling again, despite continuing restrictions and safety precautions. Those with the financial means to do so can navigate complicated travel restrictions and required quarantines while pinpointing travelfriendly destinations that offer socially distanced options suitable for the entire family. More surprisingly, the options available for the wealthy have grown and evolved as the pandemic has continued. Travel has been an integral part of their lives, and so, this elite population has been reported to be far more likely to participate in required testing and quarantine measures to make their desire to travel a reality.

One option that has emerged recently is the idea of a “travel pod,” that is, putting together a group of healthy travelers or family members and renting out an entire villa or small hotel. Upon arrival, a whole family or travel pod can effortlessly adhere to required quarantine measures at their exclusive property. There are highly luxurious options with vetted and socially distanced staff, meal preparation preferences, and butlers dedicated to keeping the pod safe and healthy.

Operators are also seeing an uptick in requests for logistics options for exclusive use, whether it is an entire private locomotive, luxury jet, or large bus suitable for a family’s travel pod. Those with the means to do so are making great efforts to seek out travel options that are more private, secluded, and offer more space to socially distance and avoid the general public.

Maine has emerged as a popular travel destination for those who want to stay domestic but wish to still getaway. The coastal state has maintained its COVID-19 case counts below the 6,000 mark, making it a promising destination for an extended break away from major cities.

While the “Keep Maine Healthy” initiative has implemented a strict 14-day quarantine protocol, some providers are offering luxury villas that would make those 14 days extremely comfortable, with high-speed internet for remote work and spacious and luxurious quarters fit for royalty. Iceland is another option, as private luxury tours allow families to explore the country’s vast sceneries and stunning hilltops comfortably. This country has one of the lowest case-counts in the entire European Union and has eagerly been awaiting a bounce back for its tourism sector.

Further, this country’s luxury travel options are extensive and can include off-road convoys and satellite internet capabilities while enjoying the northern lights and simultaneously keeping families safe. Iceland has implemented a two-test COVID-19 procedure for all travelers, with a quarantine period that could last just five days.

Since the European Union opened its borders to a shortlist of countries, airlines have offered COVID-19 medical insurance to incentivize travelers despite the ongoing pandemic. While traditional travel insurance plays an important role for many, it might not be enough for the high-asset traveler that is planning a getaway with the entire family. “During today’s health crisis, we’ve noted quite an uptick in travelers’ stress and confusion,” said Peter Martin, Global CEO of FocusPoint International. “We work to bring science and stability into play and provide travelers with the highest probability of being safe during this pandemic.”

Martin and his team have worked tirelessly during this pandemic to repatriate and return travelers home with CAP™. This travel assistance plan offers response and concierge services for a long list of travel mishaps often overlooked by travel insurance.

CAP™ is a unique travel product that goes far beyond the offerings of traditional travel insurance, speaking directly to the travel needs of the affluent with concierge services and incountry response that can mean the difference between making lasting memories or experiencing a total disaster.

“Wherever someone is in the world, we provide 24/7 access to live medical and security assistance, including emergency response,” Martin added.

“While traditional travel insurance policies may offer coverage for mishaps like lost baggage or canceled flights, they often do not include the costs of specialized travel assistance services used to help you escape danger or evacuate back home if something goes wrong during your trip.”

Martin references the tremendous costs of air ambulance services and how FocusPoint and CAP™ can save travelers hundreds of thousands of dollars if they require such services.

As Martin continues to work alongside the many affluent travelers eager to return to normalcy, he urges those with the means to do so, to plan for anything, and travel fearlessly™ with CAP™.

https://www.focuspointintl.com/

Why Investing Why Investing Pre-IPO Matters Pre-IPO Matters

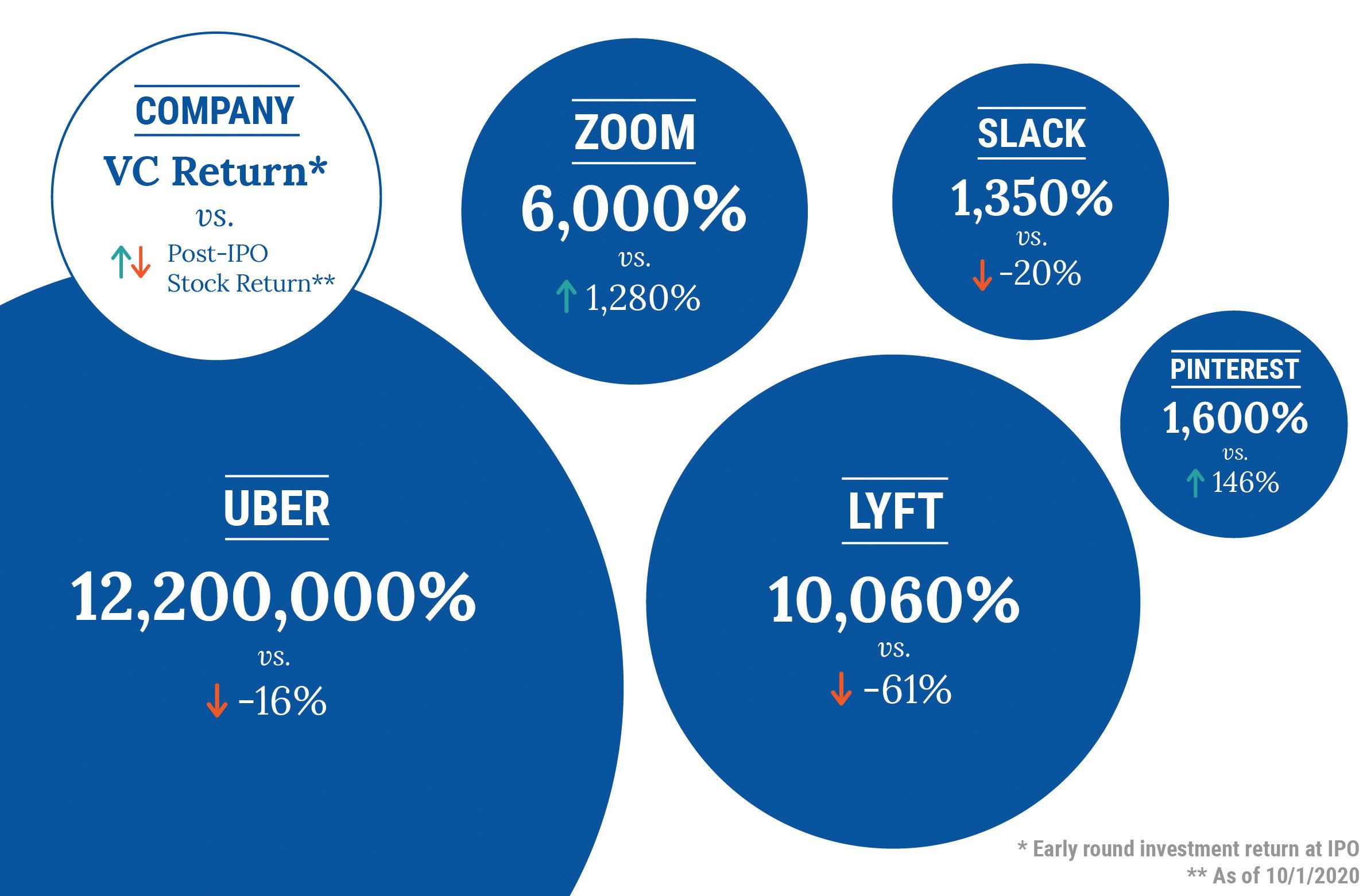

FACT: Companies are staying private longer — or not going public at all. Between 1993 and 2000, the average number of yearly IPOs was 451. From 2000 to 2016, it dropped significantly to only 108.1 As more companies are remaining private longer, the best time to get into high-growth deals is not typically occurring at the IPO stage. It’s happening much earlier, in private fundraising rounds. This is the opportunity that venture capital presents accredited individuals and family offices. Venture capital is the practice of investing in innovative, private companies that are believed to have long-term equity appreciation potential. Many of the most game-changing companies of the last 25 years were venture-backed: Amazon, Uber, Google, Facebook, Twitter, Spotify, etc. These businesses — disruptive category creators — took years to grow from small offices in their founders’ garages to some of the world’s most highly valued companies. Famously, a seed investment in Amazon (1996-97) would have delivered a return of ~70,000x, as of this writing. A $50k investment would now be worth $3.5 billion.

For a case study, let’s take a look at Uber’s valuation over time. In 2010, the company priced its seed offering at $0.36 per share. In 2011, it offered Series A shares at $3.70 — a ~10x increase in value in just one year. In each subsequent round, the value of Uber increased, culminating in its 2019 IPO where shares were priced at $45.00 — an increase of ~125x from its seed round share price. That is an outstanding increase — though it happened over a decade, not overnight, with ‘patient capital.’

Venture capital is frequently called a high-risk, high-reward asset class. While this type of investing is not for everyone, it’s an

Comparing a venture return to post-IPO gains in some famous companies, venture returns are more attractive. The bottom line is that if you wait for an IPO to invest in a great new venture, your greatest chances to clean up are likely past.

attractive fit for some investors, especially those who are seeking portfolio diversification. Most family offices see alternative investments or “alts” as an important part of their portfolios, commonly in the form of real estate and angel investing.

Venture capital, while an important asset class, has typically been accessible to only the largest family offices—those managing $500M or more. That’s changing, with a few innovative firms like Alumni Ventures Group making VC investing available to

smaller family offices and accredited individual investors, as well as wealthier investors who want to go slow into venture.

Here are four key considerations for determining if venture is the right asset class for your family office. Risk tolerance. Mark Suster of Upfront Ventures has described performance expectations for his venture fund investments as “1/3, 1/3, 1/3”: one third will fail, one third will return the initial investment, and the remaining third will produce the majority of the fund’s return. Alumni Ventures Group sees a likely successful batting average as even lower, but the general idea holds true. Some companies in your venture portfolio will go to zero, some will return your investment, and a few big winners will be responsible for the vast majority of your gains. Over many time periods, the VC asset class outperforms the S&P.2 But there are winners and losers and modest performers.

Time. Venture capital is illiquid. Typically VC means committing capital to a long-term investment strategy, as much as 10 years. Over that time, as some investments in your portfolio experience growth, you will see that growth reflected in the value of your portfolio as “paper gains.” However, a liquidity event— IPO, merger/acquisition, direct listing, etc.—is required for your capital and gains to be returned.

Access and capacity. Do you or your family office have access to high-quality, private startup investments (not just angel deals) AND the capacity to do enough deals to ensure you have sufficient chances for the winners to emerge? If so, then it might make sense to “self-serve.” If not, investing in a venture capital fund with a large, diversified portfolio may be the right approach. Other important factors. Do you want to contribute and have a front-row seat to innovative technologies that will build the future? Do you want to support visionary founders who are solving some of our toughest technical, market, and societal problems? Is it important to you or your family to invest in social impact causes? Do you want to support the entrepreneurship ecosystem at your alma mater? Through targeted venture funds, such as those offered by Alumni Ventures Group, you can achieve these goals while seeking market returns.

The overwhelming shift of startups staying private longer means that many of the greatest opportunities for value creation have moved out of the public markets into the early-stage private markets. Adding VC to your investment strategy can give you the chance to get into high-growth companies in their early stages, ride with them as they potentially build world-changing businesses, and perhaps realize outsized returns over a longer time horizon.

To learn more about how Alumni Ventures Group creates diversified venture portfolios to help family offices and accredited investors achieve their financial goals, please reach out to

Familyoffice@AVGFunds.com.

1. https://openviewpartners.com/blog/why-are-we-seeing-fewer-venturecapital-backed-ipos/#.X9p3jOlKhhGnoth

Member Spotlight:

Sound Affects Sound Affects

Sound Affects is a new cancer-fighting movement that capitalizes on influencers of our popular culture to help raise funds and awareness for promising cancerfighting innovations. Sound Affects is a 501(c)3 charitable organization dedicated to supporting entrepreneurial biotech initiatives where promising concepts have been advanced to treat cancer, but where lack of critical funding hampers efforts to move potential solutions forward. Our model uses a crowdfunding platform that enables biotech innovators to access a nondilutive raise through charitable donations of crowdfunding supporters, empowering the interested public to directly and transparently support cancer solutions they find personally and intellectually appealing. With its innovative approach and platform, Sound Affects is transforming how we think and finance promising entrepreneurial approaches that bring an array of partners together to fight cancer for the benefit of all.

Sound Affects Model Helps Innovators While Increasing Odds of Success for the Public

A major challenge facing any crowdfunding platform is that of “cultivating the crowd that cares.” This is particularly challenging for Sound Affects because the public is largely unfamiliar with the role of biotech in advancing cancer cures to market. Sound Affects intends to improve public understanding by using outreach mechanisms highlighting the necessity and potential of biotech innovation for winning the war on cancer. Sharing messages across popular culture platforms, makes this a common concern, versus one for scientists or pharma alone.

Sound Affects utilizes music as its principal medium to reach audiences that seek better outcomes for those suffering from cancer. Cross culturally, music has always been an effective expression of cultural norms, values and desires. Therefore, those who create music have great potential to positively influence beliefs and cultural change. Sound Affects strategically partners with emerging musical artists to help us shift the conversation around the war on cancer, giving people the opportunity to actively participate in the innovation process, rather than rely on others for the arrival of “cures.”

For more information, contact Mona S. Jhaveri: mona@soundaffects.org, Phone: 202-251-2672

Cannabis and the Impact of Cannabis and the Impact of

The cannabis industry was one of the most dynamic and fastest growing sectors of the U.S. economy in 2019, with revenues growing from $9.1 billion in 2018 to $12.4 billion and this momentum has continued into 2020. As the pandemic spread across the world, analysts predicted devastating economic impacts to a swath of industries. While this uncertainty continues to hang over the global economy, the legal cannabis market in the U.S. is expected to eclipse $17.0B in 2020 and more than double by 2024.

Emerald Park Capital, a leader in cannabis financing, expects the industry’s growth trend to continue as state and local governments will be increasingly committed to providing cannabis to their constituents and desperate to realize the resulting tax revenues. As evidence, the firm notes that most states have deemed cannabis businesses as “essential,” sales have continued to grow through the pandemic, social distancing guidelines have helped accelerate the issuance of e-commerce regulations, cannabis companies are less susceptible to supply chain risk, and while lawmakers are intensifying their search for additional sources of tax revenues public acceptance continues to grow, as demonstrated by five additional states (Arizona, Mississippi, Montana, New Jersey, South Dakota) passing new cannabis legislation on November 3rd, 2020.

COVID-19’s initial impact on the cannabis market was incredibly positive with sales surging in March as some consumers were “pantry loading” ahead of sheltering mandates. Sales were a bit choppy in the second quarter, but the growth curve has been trending upward in the second half of the year. This rapid growth can largely be attributed to the appeal of cannabis across almost all demographics, not only for recreational use, but also as it relates to remedies for chronic pain, stress management and sleeping disorders. Overall, the cannabis sector has been resilient in the near term and has been making systemic changes to become stronger over the long term.

Meanwhile, as the cannabis sector has grown, access to capital in the market has been challenging. Given the regulatory framework, businesses need to build a vertical supply chain in each state. The original investment thesis in the sector revolved around hoarding licenses and building capacity. Consequently, this approach required continued access to cheap capital. However, liquidity from the public equity markets has been spotty, and traditional institutional lenders are largely precluded from participating. To survive and thrive, companies have quickly realized that they need to have fully funded business plans and/or clear paths to positive cash flow.

Private Client Services at BDO

With personal wealth, comes fi nancial complexities. With BDO Private Client Services, comes unique opportunities. Not only do we help affl uent individuals and families manage day-to-day fi nancial activity, we advise on long-term needs such as estate income, gift taxation, and retirement and life insurance planning. BDO also offers investment opportunities with some of the world’s most successful private equity fi rms. It’s all part of the exceptional range of private client services available from one of the world’s largest and most respected accounting and advisory organizations.

Jeffrey B. Kane

National Managing Partner, Private Client Services 616 389 8619 / jkane@bdo.com

Scott Hendon

National Private Equity Industry Group Leader 214 665 0750 / shendon@bdo.com

Accountants and Advisors

© 2019 BDO USA, LLP. All rights reserved.

www.bdo.com/FON

This strategic shift from breadth to profitability began in late2019, but COVID-19 accelerated rationalization. As the sector continues to bifurcate, healthier companies will fine tune operations, become more capital efficient and focus on cash flow over expansion at any cost. Consolidation will likely accelerate as well. Companies in each state will vie for top five status. To do so, they will need to pick off strategic assets from distressed competitors to bolster their intra-state operations. Overall, these factors present a reasonable arbitrage opportunity in the near term and an attractive, long term value creation opportunity for investors.

“Most domestic institutions are precluded from participating in the cannabis sector, so the majority of capital in the sector comes from Family Offices and High Net Worth investors. But many of the FOs and HNWs have stayed on the sidelines to date. The ones that entered the sector from 2017-2019 may still be reeling from losses in early cannabis investments that soured in the second half of 2019. New regulations such as the SAFE Banking Act could allow traditional institutional investors to participate in cannabis over the next year. Initially, these new entrants would likely dip their toes in the market before providing meaningful competition for established cannabis funds. Even if these traditional institutions start competing and drive down return profiles, cannabis debt funds should be able to lower their cost of capital in lockstep through back leverage on their portfolios,” said Emerald Park Capital’s Managing Partner, Joel Magerman. Several cannabis funds have emerged over the past few years, but the pool is highly fragmented and performance has been varied. Funds that invested in ancillary businesses have seen nice growth but will have difficulty getting liquidity as the public markets have not been accepting of their businesses and many logical strategic buyers cannot enter the space yet. Funds that were early investors in plant touching businesses may be underwater or dealing with certain distressed assets. Regardless, very few funds have the scale to lead rounds for the more attractive borrowers or equity investments.

It is also important to note that many capital raises across the sector are with friends and family. This “insider” dynamic creates unique risks when investing unless outsiders can secure sufficient minority consent rights and other protections. Over the next year, HNWs and FOs will need to decide if they want to source their own deals, which has been a trend in non-cannabis private equity, or if they want to rely on or partner with institutional investors dedicated to the sector.

“The cannabis sector in North America will have a total addressable market approaching $100B within the next ten years. Over that time, we expect these businesses to generate average EBITDA margins around 20% and command a standard CPG EBITDA multiple of 15x or greater. This translates to $300B of potential market value in the sector. Today, all of the cannabis companies that service the U.S. and Canada are valued at less than $50B thereby creating the potential for massive value creation. Obviously, certain factors need to change to unlock this value including increased recreational approvals, shrinking of the illicit market, greater access to capital, breaking down liquidity barriers, tax reform and continued consumer adoption.

Given the total addressable market, broad demographic appeal and illiquidity, we believe it is a prudent time for investors to allocate capital to the cannabis sector, with a focus on debt to achieve the best risk adjusted returns,” Magerman said.

How alternative asset managers and family offices can use IQ-EQ Cosmos to counter

COVID-19 challenges

The COVID-19 outbreak is changing the way that businesses around the world are operating. How can alternative asset managers and family offices leverage the right technological platforms to weather the crisis?

Before the outbreak, we were seeing LPs and GPs increasingly inclined to use technology to keep abreast of the changes in the regulatory landscape, simplify processes and create efficiencies. The rationale for using technology is even greater in a postCOVID context where people are working from home, from split sites or on split shifts to help control the virus.

Challenges in a post-COVID context

Industry commentators have begun to advise organisations to think past the immediate repercussions and implications of the COVID-19 crisis into how technology can be leveraged to accelerate programs and push priorities that can help position the business to succeed when the downturn ends.

A McKinsey report notes that technology leaders are now starting to think beyond the first wave of crisis management and recommends that organisations invest in capabilities for the ‘new normal’ in the form of more remote work, more online interaction and more automation. It also emphasises expanding the use of technology that supports effective collaboration. Meanwhile, a report by PwC recommends that wealth management and asset management firms should re-evaluate their enterprise risk management framework to address the new and enhanced risks that COVID-19 is creating, and suggests that in a situation of extended volatility with uncertainity in the decision-making process, such organisations might need to consider how to reduce costs through new efficiencies in a costoriented environment.

In terms of introducing new process efficiencies, alternative asset managers and family offices could be well served by implementing data visualisation tools such as interactive dashboards that help both the buyer and the seller by providing a single, unified view of data and facilitating personalised simulations with the possibility of setting up automated alerts for capital calls, redemptions, and stock and cash distributions.

The launch of IQ-EQ Cosmos, an innovative visualisation tool that allows investors access to real time data across multiple asset classes, comes as a timely solution for family offices and asset managers looking for an efficient technological platform to meet their reporting needs.

IQ-EQ’s cutting edge reporting tool offers up-to-the-minute data partnered with genuine expertise. Key benefits include: • Single point of truth, accessible anywhere and at any time

• Fully customisable end-to-end solution

• Side-by-side assessment of different asset classes, portfolios, funds and investments

• An online platform that is both user-friendly and secure

• Environmental, social and governance (ESG) reporting capabilities

• ‘Plug and play’ with no need to buy, implement and dedicate resources to expensive software.

IQ-EQ’s service offering is unique in the market as a multi-asset solution supported by a dedicated client onboarding team with fund industry experience and knowledge, as well as expert inhouse technical and technological support teams. Family offices and alternative asset managers would be well served to explore the power and potential of this unique offering that seeks to propel their organisations into an exciting new era of investment intelligence. Preparing for the ‘next normal’

As family offices and alternative asset managers settle into the new normal of a life involving COVID-19, it is important to use the coming months to plan for the ‘next normal’ – a future in a post-coronavirus future where enhanced analytics capabilities and new lenses on risk, with an overarching ESG-focus, will be critical to success.

The only thing currently clear is that, however long it takes, the COVID-19 crisis will eventually end. Whether or not organisations shall endure the crisis depends on how well prepared they are to transition into the digital economy, with a strong operational infrastructure and the right technological tools put into place well before the crisis blows over.

About IQ-EQ

IQ-EQ is a leading investor services group that brings together a rare combination of global technical expertise and deep understanding of client needs. We have the ‘know how’ and the ‘know you’ to provide a comprehensive range of compliance, administration, asset and advisory services to fund managers, multinational companies, family offices and private clients operating worldwide.

IQ-EQ employs 3000+ people in 23 jurisdictions across four continents and has assets under administration (AUA) exceeding US$500 billion.

Bas Horsten

Sales & Business Development Director, Caribbean and Latin America, IQ-EQ

E: bas.horsten@iqeq.com T: +599 9 461 12 99 (ext 715) M: +599 9 566 1914

FON Webinars

FON Webinars

FON Magazine

Reader Services

Office Address:

307 Evernia Street 3rd Floor West Palm Beach, FL 33401

Phone & Fax: 561-906-1181

Subscriptions:

A subscription to FON Magazine includes 4 quarterly issues a year. Email subscription questions, change of address, reprint requests, and back issue requests to info@fonmagazine.com

Reader Feedback:

Send letters and story ideas to charlotte@fonmagazine.com

Advertising:

For a copy of our media kit and to discuss advertising rates, contact andrew@fonmagazine.com

The information in this issue of FON Magazine is for information purposes only. FON Magazine Inc. assumes no liability or responsibility for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained about each individual, company, product or organization has been provided by such individual, company, product or organization without verification by us.

The opinion expressed in each article is the opinion of its author and does not necessarily reflect the opinion of FON Magazine or Family Office Networks. Therefore, FON Magazine and Family Office Networks carry no responsibility for the opinion expressed thereon.

Any form of reproduction of any content on this website without the written permission of the publisher is strictly prohibited.

© 2020 FON Magazine. All rights reserved.

Connect with FAMILY OFFICE NETWORKS

A unique collection of different Family Offices located throughout the world

We link the financial industry and financial professionals to single family and multi-family office locations. Our unique business concept has been around for centuries, allowing us to perfect wealth management and financial management for extremely wealthy individuals around the globe. The main objective is to maintain and protect families that have large fortunes, trusts and successful family owned businesses. In addition, we offer our members effective and efficient ways to manage family fortunes through specific financial investments and charitable donations, while ensuring confidentiality, risk management consolidation and transparency.

WWW.FAMILYOFFICENETWORKS.COM

307 EVERNIA ST, 3RD FLOOR WEST PALM BEACH, FL 33401 P: 1-561-463-4300