F ish F armer

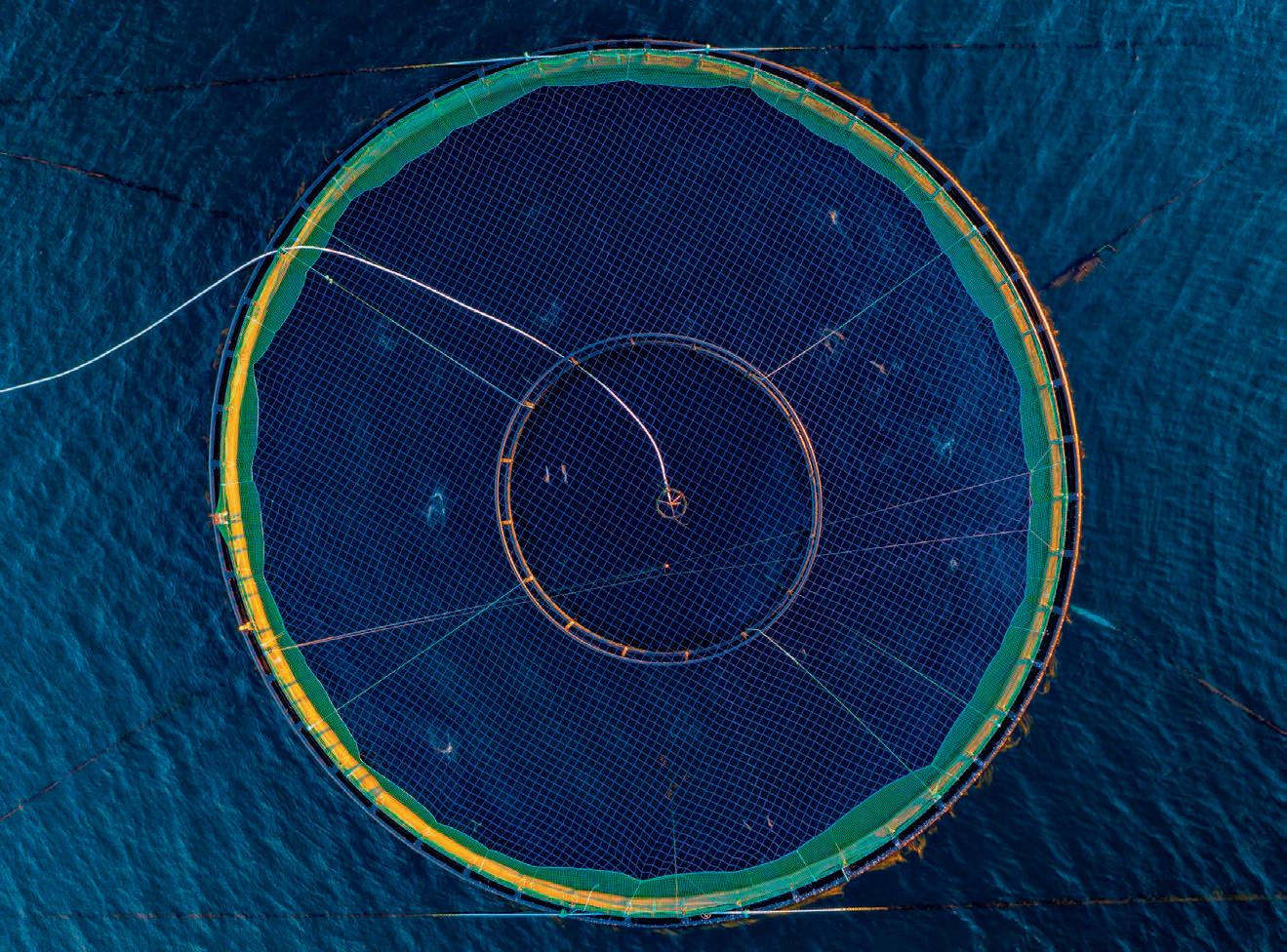

GO LARGE

Why farmers are opting for bigger pens

WOMEN IN AQUACULTURE

SEA POWER

Making boats and barges greener

Why farmers are opting for bigger pens

WOMEN IN AQUACULTURE

SEA POWER

Making boats and barges greener

Lessons from an island nation

Difficulty in securing deep water intake for the plant was also a factor.

Gigha Halibut operates on the island of Gigha, off the Kintyre peninsula. The plant has a volume in excess of 10,000m3 with a pumping capacity of 5,000 litres per second. It is powered by local renewable energy and has a seafood processing unit. The Gigha farm was built as a land-based site for rearing salmon in 1986 and has been a focus for onshore aquaculture for nearly 40 years.

The company said: “The directors of HFF have taken the decision to no longer stock the fish farm on Gigha with juvenile halibut. The remaining halibut stock will be harvested out between now and March next year.”

The producers of an award-winning halibut farm on the west coast of Scotland have said that the current stock will not be replenished once it has been harvested.

Gigha Halibut, which was founded 15 years ago, gathered a number of celebrity commendations and awards.

Despite this, the directors of Gigha’s parent company, Holt Fish Farms (HFF), say a number of factors have made the enterprise no longer viable. Chief among the problems have been rising energy costs for the landbased recirculating aquaculture systems (RAS) farm and biological challenges arising from climate change.

The statement added: “We hope this may not be the end of fish farming on the site and the directors are evaluating various alternative species and uses that may be more suited to the changing conditions around Gigha.”

The associated Otter Ferry Seafish marine hatchery on Loch Fyne will continue to produce halibut juveniles for customers elsewhere and will seek to identify potential sites suitable for halibut farming elsewhere in Scotland.

Alastair Barge, Managing Director at Otter Ferry, said: “It’s very sad indeed, with the effort that’s gone into it and the position the product commanded because of its quality and provenance.”

HFF is promoting the site as a unique “bluefield” opportunity for a fish farmer looking to rear another species on Gigha.

MOWI Scotland has acquired Dawnfresh Farming almost a year after Dawnfresh’s parent company was placed in administration.

Documents filed at Companies House on 9 February announced that Mowi Scotland now has “significant control”, meaning that Mowi now owns at least 75% of the target company’s share capital.

The documents also confirmed the appointment of Ben Hadfield, Chief Operating Officer, Farming, Mowi Scotland, Ireland and Faroes, as a director of Dawnfresh Farming as of 7 February; and also the appointment of Piotr Kamil Kapinos as a director. Kapinos is a director at Mowi subsidiaries Dorset Cleanerfish Limited and Anglesey Aquaculture Limited. Scott Nolan, Sales and Operations Director (UK, Ireland & Faroes) with Mowi has also been named as a director.

As of 7 February, the directorships of Raleigh

Salvesen, Darren Allan, John Christopher Young and Alastair

Salvesen were terminated. Charges believed to relate to mortgages on vessels have also been paid off since the beginning of February.

Dawnfresh Seafoods was placed in the hands of administrators FRP Advisory on 1 March 2022. FRP immediately sold Dawnfresh’s Arbroath processing facility to Lossie Seafoods Limited, part of the Associated Seafoods Limited (ASL) group, and in June it was announced that Thistle Seafoods had agreed a deal to acquire the former Dawnfresh plant at Uddingston, near Glasgow.

Dawnfresh Farming operates seven fish farms and hatcheries across Northern Ireland and Scotland. The company raises freshwater trout at Tervine and Braevallich on Loch Awe and Loch Earn, and loch trout (sea trout) at Loch Etive. Dawnfresh is the largest trout producer in the UK, and the largest supplier worldwide of Scottish loch trout.

Dawnfresh Farming’s last accounts, for the year to 27 March 2022, recorded a net profit of £2.24m and the administrators have always expressed confidence that they would find a buyer for the business. Given the difficulty in gaining consent for new or expanded fish farms in Scotland, it is believed that there was a great deal of interest among Dawnfresh’s competitors – but it appears that Mowi had the deepest pockets.

Bring confidence to your net cleaning job, with the most reliable pump on the market.

NLB’s high-pressure water jet pumps are proven reliable for offshore and onshore net cleaning. Engineered specifically for the aquaculture market, they withstand the harsh conditions of open seas, foul weather, and salt corrosion, all while delivering the same performance and durability NLB has been recognized for since 1971. Our units also offer a compatible interface with the industry’s leading head cleaning systems.

NLB will go the extra mile to make the switch easy for you. Contact us today to discuss your options!

LEADERS from the fields of aquaculture, technology and finance will be sharing their insights at the Blue Food Innovation Summit in London this May.

Taking place on 23–24 May at the Hilton London Tower Bridge, the summit brings together groundbreaking companies from around the globe to discuss forwardthinking approaches to aquatic

food production, including sustainable aquafeed, seaweed, fish health and welfare, and digital platforms for smallholder farmers.

Speakers include, to highlight just a few: Amy Novogratz, Managing Partner, Aqua-Spark; Jennifer Bushman, CMo, Kvarøy Arctic; ohad Maiman, founder and former CEo, The Kingfish Company; Melanie Siggs, Director of Strategic Engagements, Global Seafood Alliance; and Thor Talseth, Group CEo, Avramar. For details, see: www.bluefoodinnovation.com

TWo senior directors at trade body Salmon Scotland have left the organisation. Last month, Salmon Scotland said Hamish Macdonell, Strategic Engagement Director, and Lindsay Pollack, Aquaculture Sustainability Lead, were both leaving “to explore new opportunities” and thanked them for their contribution.

Macdonell joined Salmon Scotland in 2018. He was formerly Scottish Political Editor with The Times between 2016 and 2018, and also previously worked on The Scotsman as Political Editor. He was a regular columnist with Fish Farmer magazine.

Pollock had been with Salmon Scotland since 2021 and was previously Sustainability Manager with feed company Cargill.

Left: Hamish Macdonell with George Eustice, UK Secretary of State for Rural Affairs (centre) and Lindsay Pollock

BAKKAFROST Scotland has confirmed it is to continue sponsoring the Western Isles Island Games Association (WIIGA) as the squad prepares to travel to Guernsey for the 2023 NatWest International Island Games in July.

WIIGA is celebrating its 25th anniversary this year. Run with the support of volunteers from across the sporting community, it works in partnership with local sports clubs throughout the Western Isles and provides invaluable support to elite athletes to enable them to compete in the event against 23 other islands from across the world every two years.This year’s competition expects 3,000 participants and a further 2,000 island visitors to attend.

MARINE biologist Professor Elizabeth Cottier-Cook has been presented with an Outstanding Contribution award by Women in Scottish Aquaculture (WiSA) in recognition of her teaching in aquaculture and her research contribution to the global seaweed industry.

There were also awards for individuals at Mowi, Bakkafrost and Heriot-Watt University.

Professor Cottier-Cook of the Scottish Association for Marine Science (SAMS), a partner of the University of the Highlands and Islands (UHI), received her award in recognition of her teaching in aquaculture and her research contribution to the global seaweed industry.

She played a key role in establishing the Erasmus Mundus Joint Master’s Degree in Aquaculture, Environment and Society (ACES-STAR), which enables international students to learn at centres in Oban, Crete and Nantes.

Professor Cottier-Cook has also been principal investigator on the five-year Global Seaweed STAR programme, which has combined UK expertise in taxonomy, genetics and disease management with the knowledge and practical experience of seaweed farming in Africa and Asia.

Professor Cottier-Cook said: “It was such a surprise to be told I had won the Outstanding Contribution Award, and I am extremely honoured. It is important to celebrate the success of women in any STEM field.

“There is an increasing number of women working in aquaculture and it is interesting to note that in the eight years of our ACES Joint Master’s Degree, women have made up roughly two-thirds of our students."

Also in the awards, Ingrid Kelling, Chair of the Marine Alliance for Science and Technology for Scotland (MASTS) and Assistant Professor at Heriot-Watt University, was named Academic Champion of the Year.

Donald Waring, Learning and Development Manager at Mowi, was named Ally of the Year.

Charlotte Bolton, Freshwater Optimiser at Bakkafrost Scotland, was also named Rising Star of the Year, while Connie Pattillo, Western Isles Area Manager for Mowi, was the winner of the Role Model of the Year award.

The WiSA network – which was founded by the Sustainable Aquaculture Innovation Centre (SAIC) on International Women’s Day 2019 – represents all areas of the sector from producers and the supply chain to academia, and continues to champion the diverse range of career opportunities for women in aquaculture.

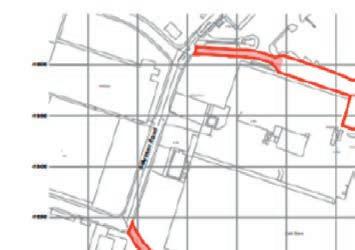

LOCH Long Salmon (LLS) is to appeal against the decision to turn down the company’s application to build Scotland’s first semi-closed fish farm.

The proposed farm at Beinn Reithe, near Arrochar, fell within the Loch Lomond and The Trossachs National Park, and the Park’s board rejected the company’s planning application in October last year.

Announcing the appeal, the company said: “Loch Long Salmon [is] disappointed that officers and the board of Loch Lomond and The Trossachs National Park opposed the plans and believe the decision was fundamentally flawed, and based on fear and a misunderstanding of the technology and its potential to transform the Scottish aquaculture sector.”

LLS is a joint venture between Simply

Blue Aquaculture,Trimara Services and Golden Acre Foods.

The project was supported by a crossparty group of councillors, MSPs and the local MP.

Campaigning group AFFtheClyde was one of those arguing against the proposal for the fish farm at Beinn Reithe.

Hilary Worton of AFFtheClyde, whose members are made up of residents from around Loch Long, said: “One would not expect planning departments, councillors or board members to be expert in the specific subject of any given planning application, but one would expect them to take heed of expert opinion in that particular field, which, on this occasion, The National Park has done. In so doing it found that while this new technology certainly goes a long way to tackling the sea lice problem, it presents other potential dangers.”

AFFtheClyde is sceptical of claims that the proposed semi-closed technology – which would protect the salmon from sea lice and predators with an impermeable membrane and pump water from lower depths – has been “tried and tested”.

► Powerful waterbased antifouling that offers excellent protection against fouling

► Safe for the fish and for the environment

► Protects against UV radiation

► Controlled leaking of the active ingredient

► Contains no microplastics

► Based on 35 years of experience

THE annual contribution made by the aquaculture sector in Scotland to the national economy soared over the past decade, according to the latest Scottish government statistics.

Scotland's Marine Economic Statistics 2020, which has just been published, shows that gross value added (GVA) by the aquaculture sector rose from £206m in 2011 to £362m in 2020, up by 76%.

Employment in the sector also increased by nearly a third over the same period.

Trade body Salmon Scotland said the research showed that farm-raised salmon “generates vital wealth for the country”.

Farming accounted for 9.4% of the Scottish marine economy in 2020, compared with 7.3% for sea fishing at £284m.

Overall, between 2011 and 2020, Scotland's fish farming sector contributed £3.3bn in GVA to the Scottish economy.

RESEARCHERS at Scotland’s Rural College (SRUC) have been awarded almost £39,000 to develop new seafood skills training courses in partnership with salmon producer Scottish Sea Farms. The project will develop and pilot three types of courses with seafood technicians, veterinary professionals and SRUC students. Technician training piloted with Scottish Sea Farms and continuing professional development (CPD) courses offered to vets will include topics such as higher-level data skills, fish health and gill health.

Undergraduate skills development will be offered to SRUC students –particularly those studying Rural Animal

Health and Animal Science – through work placement activities.

The money was awarded from the UK government’s £100m UK Seafood Fund, which aims to support the long-term future and sustainability of the fisheries and seafood sector. The aim of the project is to improve the skills and knowledge of technicians and veterinary professionals currently working in, or interested in diversifying into, the seafood sector. It will also highlight career opportunities available to students. It will maximise the use of SRUC’s virtual learning environment to ensure course materials are accessible to

workers in remote coastal communities and will improve links between aquaculture veterinary sector businesses in these areas.

Dr Mary Thomson,Vice-Principal, Skills and Lifelong Learning, at SRUC said: “This is a fantastic opportunity to support the sector with upskilling, which can improve business productivity.”

Ronnie Soutar, Head of Veterinary Services at Scottish Sea Farms, commented: “The health of our fish and the development of the people who care for them are central to everything we do at Scottish Sea Farms, and this new collaboration with SRUC will support both – namely, by providing current and emerging generations with opportunities to gain practical experience and, in turn, grow their skills and understanding.”

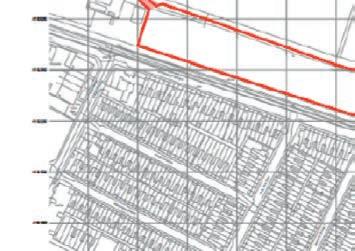

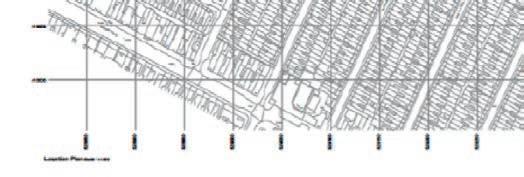

BAKKAFROST Scotland has said it intends to submit a planning application for a RAS facility at the Hunterston Port site in Ayrshire.

The recirculating aquaculture systems (RAS) plant would be the second in Scotland for the Faroes-owned salmon producer, which is already in the process of constructing a RAS site at Applecross on the west coast of Scotland.

Hunterston is one of Scotland’s largest deep water ports and formerly imported coal for power stations, but it is now a derelict brownfield site that has been earmarked for development as Hunterston Port and Resource Centre (PARC) by its owners, Peel Ports Group.

A Bakkafrost spokesperson said: “Bakkafrost Scotland can confirm it is in the early stages of a planning application process in relation to a proposed RAS facility and has lodged a planning application notice

(PAN) with North Ayrshire Council for the development at Hunterston PARC on the Clyde coast in Ayrshire.”

The company will be setting out its plans at public exhibitions on Wednesday 1 March at Fairlie Village Hall, near Largs, and on Thursday 30 March at West Kilbride Village Hall. Information will also be posted online.

The new RAS facility is expected to create around 35 specialist jobs and support the wider supply chain. Bakkafrost will use this and the Applecross facility to grow smolts for longer and to a larger size in freshwater before they are released into net pens at sea. Hunterston PARC has been granted special development status in the Scottish government’s National Development Plan, giving it priority as a site for investment in renewable energy, aquaculture, research and development, and the circular economy.

Anti-salmon farming campaigner Don Staniford has objected that the site will be

close to the Hunterston B nuclear power station, which was shut down in January last year and is currently in the process of being decommissioned. He described the combination of fish farming and nuclear energy as “a marriage made in hell”. Bakkafrost has stressed, however:

“RAS is a land-based biosecure closed system. Our system uses freshwater from local sustainable land-based water sources, is highly energy efficient and will convert all waste produced to a renewable product.”

THE combined fishing and fish farming group Lerøy Seafood has announced lower operating profits for the final quarter of 2022. However, revenues for the period were up from NOK 6,519m (£508m) in Q4 2021 to NOK 7,114m (£580m) this time.

Rising costs meant the operating profit, or EBIT, for Q4 2022 was NOK 800m (£65m) against NOK 902m (£73m) a year earlier.

Lerøy said that price inflation for almost all input factors over the past year had impacted on group costs.

Losses from associates and the joint venture, in which Norskott Havbruk/Scottish Sea Farms owns the majority stake, were NOK -113m (-£9.06m) in Q4 2022, compared with NOK -10m in Q4 2021 (-£08m).The quarterly report states: “It has been an extremely difficult quarter for Norskott Havbruk, with challenging biology."

The operation had an operating loss of NOK 122,312 (around £9,500) against NOK 10,709 (£870) in Q4 2021.

CEO Henning Beltestad said: “The seafood market in 2022 was very strong. At the same time, like other industries, we experienced pressure on costs.

“The other thing that has marked the year is the proposal for ground rent tax, where we are already seeing strong negative effects on investments along the coast of Norway in particular. This is very unfortunate for Norway as an aquaculture nation, and for the industry and everyone who works in it.”

The Lerøy report said a seasonal increase in harvest volume in Norway in the second half of 2022 meant lower prices for salmon and trout than in the first half. It went on: “This affected the group’s revenue for Q4, although the high harvest volume continued to generate good earnings for the Farming segment despite lower margins.

“As expected, lower whitefish quotas (cod, haddock and saithe) led to lower catch volumes and earnings compared with the same period in 2021.”

Mowi’s feed mill in Kyleakin on the Isle of Skye produces feed for salmon and trout at all lifecycle stages and for fresh and seawater environments.

R&D is central to everything we do at Mowi Feed and ongoing field trials inform our approach to optimising raw materials, growth rates and animal robustness.

We have a robust policy on sustainability and all ingredients used in fish feed are traceable. Mowi also holds certifications for feed production according to the GlobalGAP CFM, Label Rouge and organic (Naturland and Soil Association) standards and we are already working towards gaining accreditation to the forthcoming ASC Fish Feed Standard. Mowi is regularly audited by many of the major European retailers and comply with the quality standards prescribed by a wide diversity of retail outlets.

We offer bulk deliveries using our own vessels and we can deliver in bags by sea or road transport. To

expanded operations, and achieved significant growth in the final quarter and last year.”

He added: “We are entering 2023 in a strong financial position and as a proud contributor to the Icelandic economy and society.”

The fourth-quarter operational EBIT or profit was €9.3m (£8.3m) against €3.65m (£3.3m) in the same period in 2021.

The group’s operational EBIT or profit for 2022 amounted to €6.15m (£5.5m) compared with €7.3m (£6.5m) in 2021. In per-kilo terms, it more than trebled from €0.65 to €2.24 (£2) for the year.

The group’s harvest last year increased by 40% to 16,138 tonnes and from 4,272 tonnes to 6,008 tonnes during the final quarter.

ICELANDIC Salmon, the parent company of Arnarlax, has announced a big increase in its 2022 final-quarter operating income, which was up by almost €16m year on year to €51.7m (£46m).

For 2022 as a whole, income rose to

€157.6m (£140.4m) against €90.8m (£80.9m) in 2021, an increase of 74%.

Norwegian group SalMar owns both Icelandic Salmon and Arnarlax.

Björn Hembre, CEO of Icelandic Salmon and Arnarlax, said: “We are starting to reap the benefits of our

The report said the group had maintained cost control with regard to harvesting and reduced costs between the third and fourth quarters of 2022. Costs are expected to increase in this year, the company said, as a result of increased prices of raw materials.

NORWAY’S Måsøval Eiendom has entered into a strategic partnership with the family-owned Icelandic fishing company Ísfélag Vestmannaeyja to run Måsøval’s Iceland-based salmon operation, Ice Fish Farm. A separate holding company, Austur, has been created to manage the joint ownership.

Last November, Fish Farmer reported that Måsøval, the main shareholder in Ice Fish Farm, was seeking a suitable partner for the business.

Norway-based Måsøval Eiendom said in a market statement: “To facilitate the transaction and the partnership, Måsøval Eiendom has established Austur Holding AS (“Austur”) for the sole purpose of holding shares in Ice Fish Farm.

“Austur will at closing of the agreement i) own all 51,361,866 shares in Ice Fish Farm, formerly held by

Måsøval Eiendom, and ii) hold the shareholder loans provided by Måsøval Eiendom to Ice Fish Farm.”

Lars Måsøval, Chairman of Måsøval Eiendom, said: “Ísfélag Vestmannaeyja will broaden and strengthen the shareholder base of Ice Fish Farm and be a valuable stakeholder that we believe will contribute to our future success on the Icelandic east coast”.

Also last month, Ice Fish Farm reached a long-term agreement with four banks to secure a loan of €156.2m (£138m) to help take the business forward.

The new financing includes a €60m (£52.6m) term loan facility for the refinancing of certain existing indebtedness of the group, €20m (£17.5m) capex facility for financing of new equipment, upgrades to facilities, investments in barges, vessels and other assets, and up to €70m (£61.4m) as a revolving credit facility.

NORWEGIAN company Smart Salmon plans to build an 8,000-tonne land-based salmon farm in Brittany, France.

The Smart Salmon recirculating aquaculture system (RAS) facility will be near the small north-west town of Guingamp, although local media is reporting some opposition to the plan. Israeli firm AquaMaof will supply the technology.

The company said: “After many years of escalating work, it is a pleasure to inform that Smart Salmon recently has delivered the application for land-based salmon farming in Brittany, France.

“AquaMaof together with Alde Aqua [and] Cesia among others, have been of utmost importance in the application process.”

The application includes more than 1,000 pages in addition to detailed 3D models of all parts of the planned facility.

Smart Salmon is planning to produce the fish all the way from eggs to consumer-friendly packages of fresh fillet.

The company said: “Smart Salmon is excited regarding the plans for salmon production in France, but we recognise some resistance.

“We are respecting the opponents’ views, but we believe that most of the opposition is due to inaccurate information, even though Smart Salmon has had a strong focus on informing the public and all stakeholders.

“Our facility will produce some of the most environmentally friendly animal proteins in the world and this is backed by our ESG report released earlier this week.”

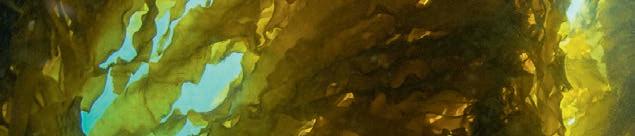

SALMON farmer Cermaq has teamed up with specialist producer Folla Alger AS on an innovative farm site that combines salmon and kelp farming.

The sea site is located in Steigen municipality, in the Nordland region of Norway. It is designed as a traditional salmon farming facility with 24 cages, but with special solutions for growing kelp in the middle cages and salmon in the outermost cages on each side. Folla Alger is collaborating with Cermaq on the salmon farming at the sea site, while research institute SINTEF Ocean is producing the first kelp delivery for stocking at sea.

Silje Forbord, Research Manager at SINTEF Ocean, said: “Combined operation can provide good area utilisation by producing several species within the same area. This area is already set aside for salmon, and by growing kelp on the same site in addition, we hope to be able to contribute to increasing value creation. This setup allows us to use the nutrients released by the salmon in a sensible way by producing kelp, which can in turn be used as a raw material in new feed.

“We know that we can get up to 50% better kelp growth by cultivating it together with farmed fish. Now we will also look at whether there are more advantages to combined operation, says Forbord.”

Folla Alger was set up as a company specifically to explore integrated kelp and salmon production. The company’s Chairman, Tarald Sivertsen, commented: “Fish farming and kelp farming are both industries for the future, and will be important contributors to the green shift.”

Some of the nutrients released from salmon net pens are water soluble, the project partners said. These nutrients will fertilise the kelp and lead to increased carbon sequestration as the kelp grows. With the help of photosynthesis, the kelp utilises the sunlight, grows and binds carbon from the sea. The project will look at how salmon and kelp farming can mutually benefit each other.

It will also explore how salmon might benefit from being reared in an environment where kelp is growing – essentially, integrated multitrophic aquaculture (IMTA) production.

Folla Alger has been granted research and development licences from the Directorate of Fisheries to carry out the project. SINTEF Ocean is responsible for the research, which will be carried out in close collaboration with Norwegian University of Science and Technology (NTNU) and Nord University.

Smart Salmon is also planning to build a large post-smolt, landbased farm in Smørhamn, in Bremanger, Norway, with the aim of supplying post-smolts to marine fish farms.

FRESH salmon prices hit a new record in week 9 of this year, with the price of salmon going up for a third week in succession, according to Statistics Norway.

Just when many people thought they might be due for a downward correction, they shot up by 6.2% to NOK 119.48 a kilo (£9.45).

Some buyers are describing the current market situation as being “quite crazy”. The industry’s main worry is that the high headline figures will provide more ammunition to those who want to impose higher taxes on the industry.

It is often forgotten that production costs, particularly in relation to feed, have also risen

sharply and now average more than NOK 50 a kilo (£3.96).

The prices being quoted by Statistics Norway is for quality fish of around 5–6kg, but there is also a sub-market of winter wound-damaged fish selling for considerably less.

The NOK 119.48 figure is 42% higher than the same week a year ago and almost 90% up on week 9 in 2021. In week 9, Norwegian salmon farmers exported 15,004 tonnes of fish, slightly up on week 8.

But overall export volumes appear to be on the way down, with overseas sales last month 41,000 tonnes lower than in February 2022.

GEIR Olav Melingen has been named as the next head of Benchmark Genetics. He is set to take up the post on 1 June when the current incumbent, Jan-Emil Johannessen, retires.

Benchmark Genetics is the genetics and breeding division of the Benchmark aquaculture biotechnology group. Melingen is currently Benchmark Genetics’ Commercial Director, Salmon, and he is a former CEO of Fishguard, part of the MSD group. He was also previously CEO of the Bergen Aquarium.

Meanwhile, Benedikt Hálfdanarson,has been appointed as General Manager of Benchmark Genetics Iceland HF, after his predecessor, Jonas Jonasson, stepped down. Hálfdanarson was previously General Manager at Vaki Aquaculture Systems.

THE Gadus group, one of Norway’s up-and-coming cod farming companies, has changed its name. It is now called Ode, which it says reflects a new chapter and new direction for the business.

CEO Ola Kvalheim said: “We have made the choice to reposition the entire company to focus on the international consumer market, while also showing that we are proud of what we have created so far and that we operate aquaculture.”

INTERNATIONAL pump and pumping solutions business

DESMI has named Morten Axel Petersen as its next Group CFO. An experienced executive, he joins from Danish wireless tech business RTX AS, where he was Group Chief Finance and Strategy Officer. Petersen’s predecessor as CFO at DESMI, Jan Thaarup, had been in post since 2001. He is leaving to pursue other interests, but retains a 25% share in the company.

NORDIC Halibut saw its losses mount during the final quarter of last year, but the company said its investment programme was on track and prices achieved so far had been good.

The Q4 operating loss increased from NOK 5.1m (£420,000) in Q4 2021 to NOK 13.3m (around £1.1m) this time. Operating income during the quarter was up slightly to NOK 32.3m (£2.6m).

Nordic Halibut is one of a new generation of Norwegian halibut and cod whitefish farmers , most of which are at an early growth stage so have yet to produce meaningful profits.

The company’s growth plan has production targets of 4.500 tonnes (HOG or heads on gutted) in 2026 and 9,000 tonnes (HOG) by 2030.

Nordic Halibut expects to put around a million juveniles to sea this year, enabling an eventual run rate of 4,500 tonnes of halibut (HOG).

The company said the buildup phase and other factors had led to increased expenses, but the volume ramp-up and planned growth towards 2026 and 2030 would have a significant impact on production costs and results.

The production ramp-up has been advancing according to plan with an all-time high figure of 700,800 fish put to sea during 2022 –equivalent to a harvest volume of 3,500 tonnes in 2025.

With promising biological performance throughout production, however, the company was still confident that the scale effect when target volumes are reached would be significant.

It added: “To reach this production target, Nordic Halibut will build a new land-based facility at Tingvoll, Norway, that will produce 1.25 million juveniles annually from 2027 – enabling production of 9,000 tonnes HOG halibut from 2030.

“The approval of the zoning plan during February 2023 and the overall project progression in 2022 and 2023 strengthens current timeline estimates for facility completion.”

The company exceeded its 2022 revenue target by 7%, ending at NOK 80m (£6.43m). Revenue in Q4 2022 ended at NOK 32m (£2.57m), up 4% year on year on lower harvest volumes and higher price achievement

Nordic Halibut saw improved average sales prices during Q4 2022 with the achieved price for fresh, whole halibut ending at 165 NOK/kg HOG (£13.26, an increase of 17% year on year).

The company has issued a guidance harvest volume of 1,200 tonnes for 2023, equivalent to 1,080 tonnes HOG.

NORWEGIAN cod farmer Norcod has reported 2022 fourth-quarter sales of NOK 51.48m (£4.1m), almost the same as for Q4 2021.

The operating loss before fair-value adjustment for the quarter totalled NOK 32.3m (£2.5m).The operating loss for 2022, again before fair-value adjustment, was NOK 123.1m (£9.8m)

Norcod said it had been able to initiate a second harvest and that it was receiving consistently good feedback regarding product quality.

It also reported a new generation of fry approaching the growth phase and good traction with existing customers.

The other good news, it reported, is that purchasing prices for feed stabilised during the period.The company expects that feed prices have peaked and a slow reduction is expected in the coming periods.

“Increasing prices of fuel and power continue to present challenges to Norcod and industry in general,” it added, however.

Norcod said the 2022 generation, stocked at the production site Forså and Jamnungen, was expected to provide an estimated harvest volume of 11,000 tonnes (whole fish equivalent) market ready in 2023/24.

In February, the Norwegian Directorate of Fisheries ordered Norcod to slaughter the contents of two out of five cages at one of its sites in Nordland after the discovery that some fish had reached sexual maturity early.

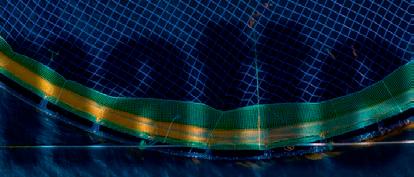

• Fish Cage Nets

– Nylon & HDPE

• Predator Solutions

• Net Service Plant

• Treatment Tarpaulins

• Lice Skirts

• Supplier of LiFT-UP

• Wrasse Hides

SALMAR has reached an agreement to sell the Norway Royal Salmon (NRS) sales operation to Dutch salmon and whitefish company Visscher Seafood.

The Norwegian salmon giant took over NRS as part of its acquisition of NTS group last year, of which NRS was a subsidiary. SalMar is now preparing to integrate its new businesses into the existing group operational structure.

It would appear that the NRS sales office, based in Trondheim, is now surplus to

Smarter, stronger, more economical drum filters

requirements.

Visscher Seafood has listed a number of goals over the next two years and these include a customer base on four continents with 50% of its turnover coming from overseas markets.

It also expects its brand portfolio to exceed €10m (£8.8m) annually and to be listed in retail chains in five countries, with two-thirds of its seafood MSC, ASC or organic certified by 2025.

Visscher Seafood also holds a stake in Scottish salmon farmer Organic Sea Harvest.

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

Contact us! Call

(0)40 42 95 30

aquaculture and specialises in functional feeding solutions that are suitable for northern conditions.The joint venture partners said the acquisition would complete Finnforel’s sustainable circular-economy fish-farming chain while enhancing aquaculture producers’ access to Alltech’s nutritional technologies.

Finnforel produces rainbow trout in land-based recirculating aquaculture systems (RAS) and its strategy is to control the entire production chain from eggs to harvest and processing. Acquisition of the Raisioaqua site is seen as the last link in that chain.

Pekka Viljakainen, Chairman of the board of Finnforel Oy, said: “I believe that Finnforel’s well-honed model, which works without antibiotics or environmental emissions, can support a significant part of this market.”

INTERNATIONAL feed producer Alltech has teamed up with Finnish fish farmer Finnforel to buy the Raisioaqua fish feed production facility from Finnish company Raisio. The acquiring parties, which also include Finnish company Heinio, paid €7m (£6.1m) in the form of a share deal.

Pekka Kuusniemi, CEO of Raisio, said: “Raisioaqua Ltd is the only Finnish fish feed manufacturer, and its production also plays a vital role in Finland’s fish farming and security of supply.Therefore, it is great that we found a good new home and buyer for the business – one whose business has a place for Raisioaqua’s fish feeds and who will continue to operate the factory in Raisio. Raisioaqua has performed well in the challenging market environment of 2022.”

Raisioaqua manufactures environmentally friendly feed for

He added: “At the heart of Finnforel’s strategy are so-called gigafactories specialised in sustainable aquaculture. In these aquaculture gigafactories, the entire production chain is in our own hands, from the parent fish and the eggs they produce to the consumer products.”

Ronald Faber, CEO of Alltech Coppens, Alltech’s aquafeed arm, said: “Finnforel and Alltech Coppens have been working together for several years on sustainable aquaculture practices. This joint acquisition reflects the ambition of both companies, our shared values and the strength of our partnership.”

Jussi Mekkonen, CEO of Finnforel Oy, said: “We have another new aquaculture facility that will be completed in spring 2023, after which we will be able to produce the eggs used in fish farming.Then, the entire fish-farming chain will be ready to be exported to the world.”

SALMAR’S results for the final quarter of 2022 reflect its new position as the world’s second largest Atlantic salmon farmer, after acquiring the NTS group.

Group-wide Q4 operating revenues totalled just over NOK 6.4bn (£525m) against NOK 4.67bn (£383m) 12 month earlier.

The operating EBIT or profit came to just over NOK 1bn (£82.5m) up from NOK 890m (£72m) for Q4 2021.

SalMar said the final quarter last year marked the end of an eventful year for the group, which saw SalMar winning a tough bidding war for NTS (and the NTS subsidiaries Norway Royal Salmon and SalmoNor) against Mowi, the world’s biggest salmon farmer.

However, SalMar’s results were affected by biological issues in central Norway and Scotland.

Norskott Havbruk (Scottish Sea Farms), which is owned jointly between SalMar and the Lerøy group, had a very weak result in the period because of its biological challenges. Even though the harvest at Scottish Sea Farms (SSF) increased from 4,900 tonnes in Q4 2021 to 7,300 tonnes this time, and operating revenue rose from NOK 344m (£28m) to NOK 693m (56m), the biological issues saw operating loss or EBIT increase from NOK 29m (£2.3m) to NOK 128m (£10.4m) between October and December last year.

SSF had a harvest volume of 7,300 tonnes of salmon in the quarter. By comparison, the company harvested 4,900 tonnes in the corresponding period last year.

Norskott Havbruk harvested 7,300 tonnes in the quarter compared with 4,900 tonnes in the fourth quarter of 2021.

Norskott Havbruk generated operating revenues of NOK 693m (£54.1m) in the fourth quarter 2022, compared with NOK 344m (£26.8m) in the fourth quarter last year.

The increase is due to more volume harvested. EBIT per kg gutted weight was a loss of NOK 17.46 (£1.36) in the period. This is up from a loss of NOK 5.84 (£0.45) per kg in the same period last year.

SalMar CEO Frode Arntsen said SalMar was considering strategic alternatives for ownership of its wellboat and aquaculture support business, Frøy ASA, with strong interest from several parties.

On the group performance, he said: “As a result of the acquisition of NTS, Norway Royal Salmon (NRS) and SalmoNor, which has given us more than 500 new colleagues and a strengthened operational structure along our entire value chain, SalMar has grown to become the world’s second largest salmon producer.

“We have thus created an even stronger platform for further growth in SalMar. We will continue to deliver healthy and sustainable salmon, and always strive for further improvements in our industry at sea and on land.”

THE impressive start to the new year for Norway’s seafood exports continued during February, the latest figures show, with values rising despite a fall in volume.

In value terms, seafood exports rose by 14% to NOK 12.8bn (just over £1bn) with salmon again the main driver. However, overall volumes were down by 17% to 207,000 tonnes and the rise in value has been attributed to foreign exchange factors.

Norwegian Seafood Council CEO Christian Chramer said: “We have to go back to 2006 to find a February with a lower export volume.”

He explained that a weaker Norwegian Krone was the main factor behind the increase in value.

The country’s salmon farmers exported 81,645 tonnes worth NOK 8.8bn (£704m).Thanks to continuing high prices, the value increased by NOK 1.2bn (£95m), but the volume was down by 8%.

The US, Poland and France were again the largest markets with the US showing a huge value increase of 77% or NOK 432m (£34.5m) and a volume increase of 41% to 6,604 tonnes.

Norwegian Seafood Council analyst Paul T. Aandahl said: “The good development in the US is the result of several factors. Demand growth in combination with a strong currency are the most important drivers.

“In addition, there has been a weak development over time in salmon production in other supplier nations.”

GRIEG Seafood ended 2022 with a record-breaking performance although biological issues took a chunk out of the final quarter’s profits.

The company reported operational profit or EBIT of NOK 1,739m (£142m) for last year against NOK 442m (£36m) in 2021.

The EBIT for the fourth quarter, however, fell from NOK 265m (£21m) in Q4 2021 to NOK 156m (£12.7m) for Q4 last year, on a 2,500 tonne lower harvest of 21,186 tonnes.

CEO Andreas Kvame said: “2022 was a record-breaking year for Grieg Seafood. In our 30-year-long history, we have never achieved a higher operational EBIT, seen a stronger market or harvested higher volumes in our existing farming regions... during the fourth quarter, we experienced challenging biological

conditions in our Norwegian regions, particularly in Finnmark.

“Mitigating measures have been taken and the underlying biology is improving. In BC, production was good during the quarter with stable survival. The Newfoundland region is developing according to plan.”

The company said it expected a harvest of 82,000 tonnes this year.

of giving anti-salmon farm campaigners news of the decision before informing the industry and those First Nation members who are likely to be affected.

Brian Kingzett, the Association’s Executive Director, said: “The Federal government continues to demonstrate a lack of care for rural coastal communities and continues to put the interests of activists above the people who grow Canada’s food. It is unacceptable that activist groups had advance notice, before licence holders and community leaders.

MOWI has signalled it is ready to take legal action if the Canadian government goes ahead with its threat not to renew salmon farming licences around the Discovery Islands in British Columbia.

Fisheries Minister Joyce Murray said last month that the licences held by larger companies in the region, also known as the Laich-kwil-tach and Klahoose First Nations territories, will not be renewed.

Canada’s Federal Court last year ordered that the decision by Murray’s predecessor, Bernadette Jordan, to rescind all finfish farming licences in the Discovery Islands region should be set aside and the question should be reconsidered. Murray has decided, following this process, to reaffirm the original order.

She said: “The state of wild Pacific salmon is dire and we must do what we can to ensure their survival.This was a difficult but necessary decision. By taking an enhanced precautionary approach in the Discovery Islands area, the government of Canada will help ensure the wellbeing of wild Pacific salmon for our children and grandchildren.”

A statement from the Canadian government said: “The Discovery Islands area is a key migratory route for wild Pacific Salmon, where narrow passages bring migrating juvenile salmon into close contact with salmon farms.

“Recent science indicates that there is uncertainty with respect to the risks

posed by Atlantic salmon aquaculture farms to wild Pacific salmon in the Discovery Islands area, as well as to the cumulative effect of any farm-related impacts on this iconic species.”

Farmers ‘disappointed’

Mowi Canada West issued a statement, saying it was very disappointed at the decision, describing it as a further blow to exports and BC’s coastal communities. The statement continued: “We had hoped today’s announcement by the government of Canada would correct the flawed previous decision and begin the path to recovery and certainty.

“We are very disappointed that Minister Murray has decided not to issue any salmon aquaculture licences in the Laichkwil-tach territory,” said Dr Diane Morrison, Managing Director at Mowi Canada West.

“Our company, along with the Wei Wai Kum and We Wai Kai First Nations, had provided the Minister a very reasonable path forward that would help Canada achieve its stated vision for sustainable aquaculture and advance its Blue Economy Strategy. She has regrettably chosen not to accept this opportunity.”

The statement concluded: “The company is now reviewing the decision and is considering its legal options.”

The British Columbia Salmon Farmers Association has accused the government

“The decision to not issue licences to salmon farms in the Discovery Islands area is devastating for all coastal communities who rely on the aquaculture sector... thanks to this wilfully uninformed decision announced earlier today, these communities will continue to experience negative socio-economic impacts [due to] an outcome that was based on politics rather than science.”

The Coalition of First Nations for Finfish Stewardship had previously set out a proposal for the possible reintroduction of some fish farms in Laich-kwil-tach waters, to be led and overseen by the Nations and their stewardship programmes.These sites would have operated in partnership with Mowi Canada West, Cermaq Canada and Grieg Seafood BC.

Dallas Smith, spokesperson for the Coalition, said: “Today’s decision unfortunately feels beyond procedural unfairness after many months of meetings with the Minister, her department and DFO staff.

“The Wei Wai Kum and We Wai Kai First Nations sent a thoughtful proposal to DFO in November to reissue some licences in their core territories.They put forward a cautionary approach to explore how and if finfish farming could be part of their Nations’ overall vision to manage their marine space.This decision to deny all licences in their territories has sent the Nations back to the drawing board. ”

However, Bob Chamberlin, spokesperson for the First Nations Wild Salmon Alliance, tweeted in a message to Joyce Murray: “I have spoken with many #FirstNation Chiefs across BC about your decision and they are all very happy and supportive for

SINGAPORE-based fish farmer the Barramundi Group has found a strategic partner for its Australian business, following a search it announced late last year.

Barramundi signed a share sale agreement with Wild Ocean Australia (WOA), in what it said marked “a significant and strategic milestone”.

WOA will take 75% of the equity of Barramundi’s Australian subsidiary, Marine Produce Australia (MPA), while Barramundi takes up 34% of WOA’s shares.

The deal also involves Barramundi’s CFO Helen Chow moving to MPA, while Jessie Lai takes her place as CFO at Barramundi Group.

WOA is expected to play “a strategic role” in driving the Australian business and operations, as well as co-leading the application for the 13 lease sites with the Australian State and Federal government and agencies. WOA already operates a fish processing business in Darwin, Australia, as well as the Darwin Fish Market retail outlet.

Barramundi Group CEO James Kwan said: “This is indeed a significant milestone, as Barramundi Group’s 34% stake in Wild Ocean allows the Company to retain an effective 50.5% economic interest in MPA. It allows us to have a meaningful participation in the value creation generated from our application of these 13 new lease sites.

“Apart from strengthening MPA’s position as Australia’s only oceangrown barramundi producer, we are also excited that Wild Ocean’s

offerings from [its] Darwin Fish Market business will be made available to our premium customer network in Asia.”

Meanwhile, Barramundi has reported preliminary financial results for 2022. The group recorded revenue of SGD $35.2m (£21.8m) last year compared with SGD $32.7m (£20.3m) for 2021.

The group remained in the red, with slightly reduced losses of SGD $19.7m (£12.2m) compared with SGD $24.9m (£15.5) in 2021.

WATER quality control, fish slaughter practices and welfare for shrimp broodstocks are among the issues addressed in proposed changes to the Aquaculture Stewardship Council’s Farm Standard.

The ASC is consulting on two aspects of the Farm Standard –Water Quality and Fish Health and Welfare – as well as a new module for the Freshwater Trout Standard covering pike and perch.

The consultation runs between 1 March and 30 April 2023, and details can be found on the ASC website at www.asc-aqua.org/ programme-improvements/aligned-standard

The key issue for the Water Quality Standard is eutrophication,

or the progressive and excessive enrichment of water with nutrients (such as nitrogen or phosphorous), which can lead to harmful algal blooms, reduction of dissolved oxygen and fish mortality.

The new Water Quality proposal, which will be included in the ASC Farm Standard, requires farms to monitor water quality to prevent eutrophication by identifying when a water body is starting to show signs of upward trophic status changes.

There are two main proposals for Fish Health and Welfare, which cover slaughter,and a tentative indicator to address shrimp eyestalk ablation.

The slaughter proposals set out more clearly the requirements for audit of slaughter practices, both on and off the farm being audited.

The proposal on eyestalk ablation attempts to deal with what is a widespread practice to induce rapid maturation and spawning through hormonal manipulation in female shrimp. It is a process that leads to suffering and stress, the ASC says.

The ASC says recent research, however, suggests that “ablationfree” production is possible in Pacific white shrimp (Litopenaeus vannamei). The current proposal thus only covers the Pacific white shrimp and no other species – e.g. black tiger shrimp(Penaeus monodon) – due to lack of research on the specific species.

A proposed indicator for Pacific white shrimp will require farms to source all nauplii (the crustacean’s first stage of larvae), larvae or post-larvae from “ablation-free” female broodstock within certain timelines.

The ASC pike-perch provisions are intended to function as a module to the ASC Freshwater Trout Standard. It will be applicable exclusively to recirculating aquaculture systems (RAS) and pond systems. The module will be structured based on seven principles covering compliance with laws and local regulations, conservation of habitat and biodiversity, minimising negative effects on water resources, risks of diseases transmission, responsible use of environmental resources, social responsibility, and requirements for fingerlings and egg suppliers.

The module will be launched in October 2023 and will be effective in 2024.

A fish farming startup has obtained permits to raise up to 35,000 tonnes of salmon off the coast of Namibia at a high-energy site.

Benguela Blue Aqua Farming has partnered with aquaculture technology business Innovasea, which will supply its submersible SeaStation pens for the project and provide consultancy services to help secure the permits.

The farm will be located 8km offshore from the town of Lüderitz. While water conditions at the site are ideal for raising salmon, Innovasea said, strong surface currents and wave heights often in excess of two metres require the use of submersible pens that can be submerged to avoid most of the wave energy.

The Benguela current, which sweeps up and along the coast of southern Africa from the Cape of Good Hope to Angola, carries cold, nutrient-rich water from the southern Atlantic Ocean, but also creates challenging conditions.

Johannes Aldrian, Co-Founder and Executive Director of Benguela Blue Aqua Farming, said: “We are proud to be the first company to bring sustainable aquafarming to Namibia. The area has excellent water conditions and enormous potential, and we’re optimistic that Namibia’s stable governance will encourage other companies to follow our lead to help create a thriving fish farming industry.”

IN what is being heralded as one of the world’s largest fish farm projects, aquaculture development company

Pure Salmon has signed a £420m deal to build a huge recirculating aquaculture system (RAS) facility in Saudi Arabia.

Agreement was reached between the Saudi government, which is putting up around 1.9 billion Saudi riyals or NOK 5.2bn. However, the projected output in tonnage terms has so far not been mentioned.

Pure Salmon is owned by Singapore-based equity fund 8F Asset Management Ltd and has already planned to develop a number of such projects of this type around the world, although nothing quite on the Saudi scale.

Pure Salmon claims to be one of the fastest-growing Atlantic salmon companies globally. It said: “We are on course to build and operate multiple 10,000-tonnes-per-annum [pa] and 20,000-tonnes-pa vertically integrated aquaculture production and processing facilities using land-based RAS technology.”

The company has set its target on producing 260,000 tonnes of annual Atlantic salmon by 2025, with 140,000 tonnes pa already mapped out.

Stephane Farouze, Chairman and founder of Pure Salmon, said on LinkedIn: “Pure Salmon’s vision and values are fully aligned with the Saudi government’s Vision 2030, which focuses on food security, the diversification of the economy and the development of disruptive sustainable industries within the Kingdom.

The Kingdom of Saudi Arabia KSA) plans to expand the local aquaculture industry to reach 600,000 tonnes per year by 2030 and said it was proud to contribute to the realisation of this vision with this latest project.

Pure Salmon Kaldnes said it would bring its cuttingedge RAS technology to the Kingdom of Saudi Arabia.

“This exciting project is not only poised to meet the needs of the local market but also has the potential to be a significant exporter, taking advantage of the Kingdom’s strategic location,” the ministry said in a post on LinkedIn.

It added: “This investment will create hundreds of direct and indirect skilled jobs and, through Pure Salmon Academy and in partnership with local educational institutions in the KSA, will groom and train next-generation aquaculture specialists.”

The farm is targeting the second quarter of 2024 to begin operations. Its first harvest is expected to be around 100 tonnes.

“We’re thrilled to be partnering with Benguela Blue Aqua Farming on this important project to bring open ocean aquaculture to southern Africa,” said Langley Gace, Innovasea’s Senior Vice-President of Business Development. “The company has a strong business vision and has worked closely with authorities in Namibia to develop a smart, realistic plan to safely raise healthy fish and create good-paying jobs for the local economy.”

Innovasea claims its SeaStation is “the world’s toughest fish pen” and has a proven track record of surviving hurricanes, typhoons and other significant storms unscathed over the last 28 years.

Benguela Blue Aqua is currently looking for additional investors to help fund the project in Namibia.

liquidity constraints. In an attempt to address its working capital requirements, the company has discussed carrying out a comprehensive financial restructuring with its secured lenders and a group of its largest bondholders.

The statement continued: “During this period, the company has also been granted certain waivers of payments of interest and instalments due under its super senior revolving credit facility and the loan facility to its subsidiary, Piscicultura Tierra Del Fuego SA.

“The discussions with the creditors are still continuing, but as the secured lenders have not been willing to extend such waivers, the company and Piscicultura are in default under the facilities agreements.

“The secured lenders have not yet declared any part of the facilities to be due for immediate payment, but they have reserved all rights to take action at any time without any further grace periods.”

THE large Chilean salmon company Nova Austral has admitted it is in debt default after grappling with various financial problems. So far, a plea for patience from bondholders has met with a cool response.

Although the company is based in Chile, its bonds are listed on the Oslo Stock Exchange. Nova Austral said in a Stock Exchange announcement that it was facing operational challenges and

It added: “The events of default under the company’s super senior revolving credit agreement have triggered a cross default under the bonds, and the company has informed Nordic Trustee AS in its capacity as bond trustee for the Bonds accordingly.”

Nova Austral said it would furnish further information to bondholders when it became available. The company is owned by Swedish private equity fund Altor and operates in southern Chile close to Chilean Antarctica, one of the world’s most remote salmon farming areas. Its fish is marketed on a global basis to retailers, hotels and restaurants.

TWO former executives from Nordic Aquafarms are behind a plan to build a land-based salmon farm on the site of an old paper mill in Maine.

Erik Heim and Marianne Naess left Nordic Aquafarms last year to set up their own company, Xcelerate Aqua. The proposed fish farm at Millinocket, a small town in Penobscot County, Maine, is their first tangible investment.

The farm project will be undertaken through Katahdin Salmon, a Portland-based company. Naess is CEO of Katahdin Salmon and Heim chairs the company. They will be working closely with Our Katahdin, a volunteer-driven, not-for-profit organisation that owns One North, the 1,400-acre, mixed-use industrial site in Millinocket, formerly known as the Great Northern Paper mill site.

Katahdin Salmon plans to develop a land-based recirculating aquaculture system (RAS) that will produce 5,000 metric tonnes of Atlantic salmon annually in the first operational phase, doubling to 10,000 metric tonnes in phase two of the buildout. The RAS facility will supply fresh Atlantic salmon to the north-eastern US. The project is expected to create 80 full-time local jobs at full production capacity.

The planned facility will utilise 100% renewable hydropower, which the developers say will make it the US’s greenest RAS aquaculture operation.

Maine Senators Susan Collins and Angus King said in a joint statement: “The arrival of Katahdin Salmon will be another exciting step toward the revitalisation of the former Great Northern Paper mill site.

“This state-of-the-art facility will raise Atlantic salmon in an environmentally sustainable way while creating dozens of new jobs. The real credit for this development goes to the people of the Katahdin region, who have worked tirelessly to strengthen the community and laid the foundation for future economic growth.”

Heather Johnson, Commissioner of the Maine Department of Economic and Community Development, commented: “This innovative project led by Katahdin Salmon will create good-paying jobs in the Katahdin region and we are pleased to see it move forward.

“The economic benefits of aquaculture extend beyond the coast. Land-based projects support our rural economies, harness the

potential of renewable energy, and support millions of dollars of economic value and thousands of jobs across the state.”

Mowi Scotland is to receive just over £2m from the UK Seafood Fund to buy equipment that will transform its salmon processing operations.

Executive of UHI Shetland, said: “We are thrilled to have been successful with our bid to the UK Seafood Fund, which was prepared in close collaboration with UHI West Highland and our partners in the seafood sector.

“This project will be run through our new Centre for Sustainable Seafood and will act as a catalyst to help provide a sustainable workforce for a sustainable seafood sector.”

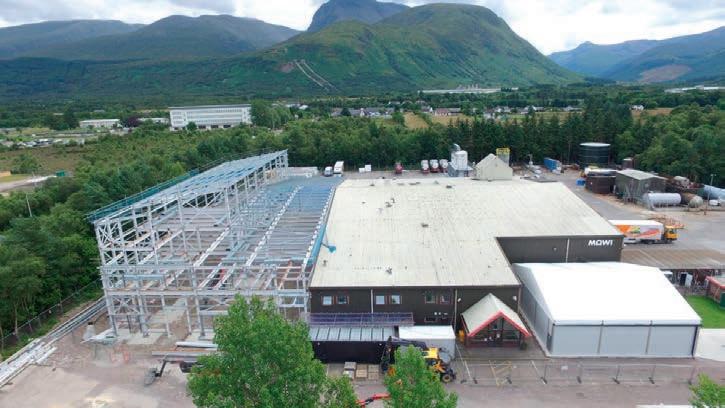

THE UK Seafood Fund’s £2m investment in Mowi is part of a wider project to expand and modernise the company’s fish processing facility at Blar Mhor. The project aims to increase throughput from 65,000 tonnes to at least 95,000 tonnes per year, reduce the number of single-use polystyrene boxes by 40% by 2026 and introduce automation.

The award to Mowi is part of a much larger multi-million pound tranche of funding for a number of seafood and fishing companies from the UK government’s £100m Seafood Fund.

Included in this is a £2.4m grant for Grimsby salmon processor JCS Fish Ltd to develop a state-of-the-art 2,000sq m processing factory with integrated smokehouse. Family-owned JCS Fish has won several awards for its salmon and trout products in recent years.

The JCS Fish project will:

• expand JCS Fish Limited’s salmon

and trout processing capability from its current 10 tonnes to 20 tonnes per day;

• create an estimated 32 direct jobs and 80 indirect jobs in a deprived region;

• make energy savings in the region of 30% despite it being a larger site, equating to a 30–40% reduction in greenhouse gas emissions; and

• reduce the UK’s reliance on imported salmon.

The University of the Highlands and Islands (UHI) Shetland has been awarded £186,000 to develop new courses supporting innovation and the future sustainability of seafood. These will be aimed at those working or entering the aquaculture sector.

Jane Lewis, Principal and Chief

IN a major deal for the UK seafood industry, the Sykes Group has bought the assets of Norfolk-based company Big Prawn for an undisclosed figure.

Founded almost 30 years ago, Big Prawn is a major user of both farmed and wild shellfish, and a key supplier to the UK retail and food trade. It has won many awards over the years.

The main business of Sykes Seafood is located in north-west England (Liverpool and Manchester).

Sykes was founded more than 160 years ago and it is now one of the UK’s leading suppliers of frozen fish of all types to the retail and food service sectors.

Alan Dale, Group Chief Executive at Sykes Seafood, said the Big Prawn Co was a business it had long admired, adding it had a

In another project, the Sustainable Aquaculture Innovation Centre (SAIC) has been awarded £250,000 from the UK Seafood Fund to develop a training programme to help finfish farmers tackle harmful algal blooms (HABs).

UK Fisheries Minister Mark Spencer said: “The UK government is funding opportunities from the quayside to the sales counter suitable for young people, as well as those changing careers.

“It is absolutely vital we invest in our workforce so these important industries prosper for generations to come.”

Meanwhile, a degree and higher-level skills offer for aspiring managers in the seafood industry will be developed by the National Centre for Food Manufacturing at the University of Lincoln.

strong management team, efficient production facilities and an innovative product strategy.

This would be supported by strong brands, and a sourcing strategy focused on quality and sustainable production.

The other main focus going forward would be on increased capacity, and building a strong relationship with its customer and supplier base.

Three years ago, Sykes bought Dutch shrimp firm Klaas Puul, so this latest acquisition will create a major force in shellfish in both the UK and Europe. The combined business will operate from six sites in Britain and mainland Europe.

Sykes also expanded seafood processing in Morocco in 2021 in order to cut down on shipping and transport time.

It is absolutely vital that we invest in our workforce ”Above: Blar Mhor new wing under construction. Right: Staff at Blar Mhor Mowi

ICELAND Seafood International Chief Executive Bjarni Ármannsson said 2022 had been a challenging year for the company, thanks to cost inflation and the impact of the war in the Ukraine.

ISI’s normalised profit before tax for 2022 was €12.4m (£10.9m), down €7.1m from 2021. Net loss for the ISI group in full year 2022 (under International Financial Reporting Standards) was €9.9m (£8.7m) compared with €8.8m (£7.8m) profit in 2021.

This was on sales of €420.8m (£372.4m), up 11% from 2021. Net margin for the group was €46.3m (£40.8m), up €1.0m from 2021 but down €1.6m on like-for-like basis.

ISI’s portfolio includes extensive salmon interests in Spain and Ireland, as well as its loss-making UK subsidiary, Grimsby-based Icelandic Seafood UK. ISI put up the latter up for sale last year, but later withdrew after two offers collapsed, opting to keep the Grimsby operation for now. However, the sale option may be revisited later this year.

The loss from Iceland Seafood UK (IS UK) in 2022 was €18.2m (£16m).

Ármannsson told shareholders: “The year was characterised by the war in Ukraine, which caused disruptions in supply chains and excessive increase in input costs – which we struggled to push on to our customers, and in any case, with a time lag [ie price increases lagged behind cost increases].

“As input prices continued to increase, we were constantly pushing through insufficient price increases once they came through the

system. This vicious cycle cost us dearly.

“But Iceland Seafood is in it for the long term. We pride ourselves on being close to the market and [the fact] that our customers can rely on our ability to deliver our products at the quality standards required.

“We are now seeing cost of input factors stabilise, and in some cases decline, so we are now operating in a more normal environment. We continue our sustainability efforts, to measure and reduce our carbon footprint, and create the necessary balance with the nature going forward.”

He added: “Iceland Seafood had a

particularly rough period in our UK operations and in November we decided to put our valueadded assets in Grimsby [up] for sale.

“It was, then, the results of our evaluation in the beginning of February this year to continue the operation.

“We still intend to participate in consolidation in the industry in the UK, which is badly needed. Despite this, most of our other operations managed well in turbulent waters, a sign of the solid and stable foundation they are built on.”

chain,” said Iain Shone, GSA’s Director of Market Development, Europe. “BSP and BAP certification will enable Associated [Seafoods] to build trust with retailers and their customers who have the highest demands in seafood.”

SCOTTISH seafood processor

Associated Seafoods has been recognised as an example of best practice by the Global Seafood Alliance (GSA).

Associated Seafoods has achieved certification under the GSA’s Best Seafood Practices (BSP) and Best Aquaculture Practices (BAP) schemes.

Associated Seafoods sources seafood from both wild-capture fisheries and aquaculture. It is

the first seafood producer in the UK to be certified to GSA’s newest programme, BSP, which provides assurances that wild seafood has been harvested and processed in a responsible manner. GSA’s BAP certification provides assurances for farmed seafood.

Associated Seafoods was established in 2010 through the merger of Lossie Seafoods, a specialist in smoked fish, and Moray Seafoods, a leading shellfish

producer. Its plant employs more than 300, the majority of whom live in and around the traditional fishing community of Buckie. Much of the processing is undertaken by hand by a highly skilled team of filleters, curers and smokers. Associated Seafoods’ customers include Loblaw and Marks & Spencer.

“Associated Seafoods has demonstrated a real commitment to advancing responsible practices throughout the seafood supply

BSP is the world’s only thirdparty certification programme capable of linking responsible fisheries to certified vessels and processing plants. Associated Seafoods encourages vessels they source from to engage with GSA’s Responsible Fishing Vessel Standard, which ensures high standards of crew welfare, enabling those within the seafood supply chain to demonstrate their commitment to responsibly sourced seafood.

Associated Seafoods specialises in Scottish smoked salmon, scampi from Scottish langoustines, farmed halibut and long-line tuna. Last year the group acquired the former Dawnfresh Arbroath processing business, which trades as RR Spink & Sons.

Last Christmas, 27 of the 44 houses on Harbour Street in Plockton were empty.

The village made famous by the Hamish Macbeth TV series was somewhat “quieter than usual”, the local newspaper noted at the turn of the year.

Plockton, on the shores of Loch Carron, has a high number of holiday and second homes – something the local community council has repeatedly highlighted.

It’s a situation replicated in towns and villages across the Highlands and Islands. But the housing crisis in rural Scotland is not just down to the region’s popularity with second homeowners.

There is also a problem with vacant properties. According to research by www.money.co.uk, using Scottish government data, the Western Isles has the highest proportion of empty homes in the UK, at 13.3%. That’s 2,000 empty homes from a total of just 15,000 dwellings.

Alasdair Allan MSP for Na h-Eileanan an Iar (formerly known as the Western Isles) said in January that the isles are in the grip of a “real housing crisis” as the result of a complex mix of issues.

The research found that, in terms of empty homes, Argyll and Bute is not far behind, at 10.4%, followed by Orkney and Shetland, at 9.1%.

In fact, Scottish towns and villages occupy the top of the list – and you have to look down as far as 16th place before an English location –Blackpool – appears.

Last year, the Scottish Empty Homes Partnership and Salmon Scotland made a joint call for vacant properties to be brought back

in to use to tackle the rural housing crisis in Shetland.

We urged Shetland Islands Council and other local authorities to explore more ways to bring homes back in to use.

But as Allan rightly identified, this problem doesn’t tell the whole story either.

That’s because house price rises in rural and coastal communities have soared above the Scottish average.

Registers of Scotland data analysed by Salmon Scotland shows that while prices across Scotland rose by 89% in 2022 compared with the 2004 baseline, the increase was as high as 168% in some remote areas.

The figures were above the national average in Argyll and Bute, the Highlands, Orkney, Shetland and the Western Isles.

So we have a toxic mix of unaffordable homes and empty homes, while those that are available are snapped up by investors.

Why does this matter?

The impact of a lack of affordable housing cannot be underestimated – it means not being able to live near where you work, and it separates families and contributes to the depopulation of our island communities. And it’s holding these communities back.

In many remote parts of Scotland, salmon farms are vital to the future of local businesses and communities.

That’s why we are so determined to improve housing availability so that we can provide sustainable growth in the areas where we farm.

Already, our member companies are doing their bit. They have invested in providing

”We have a toxic mix of unaffordable homes and empty homes

The housing shortage is stopping the Highlands and Islands from becoming a “northern powerhouse”.

By Tavish Scott

accommodation to colleagues so that they can stay in, or move to, the area to perform their roles and contribute to the local economy all year round. Currently, there are over 61 properties either owned or rented by our farming companies, which between them provide accommodation for more than 130 colleagues in Eday in Orkney, in Tarbert on Harris, across Sutherland and the Uists to Mull, Ullapool and Applecross.

Scottish Sea Farms has helped to provide housing for colleagues for over 15 years. The company currently has 21 properties to assist with living in rural and remote parts of Scotland.

Bakkafrost Scotland has provided accommodation for some of its staff for many years.

The company owns 15 properties from Harris to Mull, with several properties in the Strathcarron area, and it currently provides accommodation for 32 employees and their families.

As well as providing their own staff accommodation, including on Muck and Rum, Mowi has been part of a 10-year battle to secure more homes on Colonsay.

The ground has recently been cut on a £2.4m development to build 24 homes funded by Mowi, Scottish Government Land Fund, Highlands and Islands Enterprise and Argyll & Bute Council, along with the hard work of the community including progressive and dedicated landowners and spearheaded by Colonsay Community Development Company.

Loch Duart has invested in Sutherland

and the Western Isles for over 20 years, while Wester Ross Salmon provides accommodation for up to 19 colleagues.

And Cooke Aquaculture owns seven properties that have provided accommodation for families and colleagues across sea and freshwater sites in Orkney, Shetland, Argyll and Bute, and the mainland for many years.

Salmon worker Norman Peace knows only too well the housing problems affecting island life.

Peace moved to Stronsay from Orkney’s Mainland with Cooke Aquaculture Scotland helping provide a four-bedroom house when he was promoted to a new role.

“The lack of housing affects a lot of the islands,” he says.

“Young people leave to go to university or get a job elsewhere. With the younger ones moving, most of the islands in Orkney are ageing.”

Salmon farmers also use rentals, B&Bs and hotels, which contribute to the local economy all year round.

So our member companies are really doing their best to tackle the housing crisis.

But we have an idea that will really tackle this emergency for other local people.

We want £10m of the money paid by salmon farmers in government rents to be ringfenced for direct investment in rural housing.

At present, millions of pounds paid by salmon farming companies go to the Crown Estate Scotland – the property company that manages the coastal seabed on behalf of the Scottish government.

We believe the money should be invested directly in coastal communities.

Last year’s independent review of aquaculture regulation in Scotland by Professor Russel Griggs recommended a new single licensing payment for the sector, which he said should “address community benefit as well”.

There should be no more delays.

We know that working families understand the contribution of aquaculture to our coastal communities.

Let’s harness the transformational impact of our sector to tackle the housing crisis and unlock the potential for the Highlands and Islands to become a real northern powerhouse.

Tavish Scott is Chief Executive, Salmon Scotland.

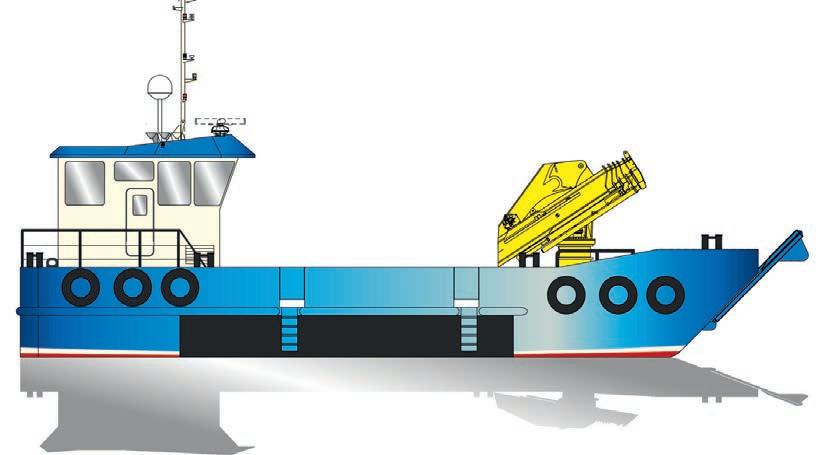

Since Century Marine Services Ltd has become increasingly interested in the UK aquaculture market, it has teamed up with Turkish Shipyard Med Marine as its exclusive broker to the UK aquaculture sector. Med Marine has delivered a vast number of vessels worldwide, from workboats and tugs to pilot boats and beyond for various types of operations. Its latest workboat design, the “MED-MPW” (pictured), is perfect for a variety of aquaculture tasks with a well-thought-out design for cost-effective operations. Standard designs go from 16m up to 32m. They are fully customisable to the client’s specification and are sold at a competitive price point.

www.centurymarineservices.com

An order has been placed for the world’s first combined fishing and aquaculture vessel. Norwegian shipbuilder Larsnes Mek has signed a contract to build the boat for Myre Kystdrift AS, a seafood business based in Vesterålen, Nordland. When completed in late 2024, it will operate as a dual seine net vessel and a farmed fish harvest boat, making it the first of its kind. The vessel will be the shipyard’s build no. 73 and will have the design designation SC-51. The design is adapted from a model used for white fish, and also includes a bleeder line for salmon and trout, for the aquaculture industry.

The all-new PRO-CAT 6000 is a unique twin-hull craft manufactured by Matrix Pontoons. It makes use of Matrix’s robust modular roto-moulded EPS foam-filled polyethylene pontoons.

This vessel has amazing stability and safe, unsinkable flotation with its 14 sectional pontoons making up the hulls. The large 12m² open deck features either Matrix’s waterproof, slip-resistant phenolic ply, or aluminium checker plate POA. For a small craft it boasts a large payload (recommended 2250kg CAT D Full RCD). The aluminium constructed top chassis, keel runners, protectors and surrounding SS rails make for a very low-maintenance craft. A full turnkey package (MAX60hp) and bespoke options are available.

www.matrixpontoons.co.uk

Icelandic fish farmer Háafell has signed a contract with Faroes-based JT electric to deliver a new-design feed barge to be situated in a remote and exposed area in northern Iceland.

The feeding barge is custom designed to maximise fuel efficiency. A hybrid power supply supports all onboard systems, with generators running only two to four hours per day, improving efficiency reducing carbon emissions and noise pollution. Designed for the harsh environment of northern Iceland, the barge can withstand a significant wave height of up to 5.5m. The hull has double sides, and is equipped with six feeding lines and a capacity of 480 tonnes for salmon, and five tonnes for lumpfish. All systems onboard are fully automated and remotely controlled from shore. Háafell is a subsidiary of seafood group Hradfrystihusid-Gunnvor hf.

Devon-based Coastal Workboats Limited (CWL) is to receive £6m in funding from the government-backed UK SHORE scheme, which was set up to help the maritime sector reduce its carbon footprint through greener technology. The fund is helping to back a £9m project to deliver a UK-first demonstration of a fully electric workboat and onshore charging station. Coastal Workboats’ purpose-built Electric-Landing Utility Vessel (E-LUV) will initially be demonstrated for four weeks in Shetland in a workboat capacity, running an inter-island route between West Burrafirth and Papa Stour.