8 minute read

ASI's 2022 Economic Briefing

RAISING BUSINESS POTENTIAL AT THE ASI'S 2022 ECONOMIC BRIEFING

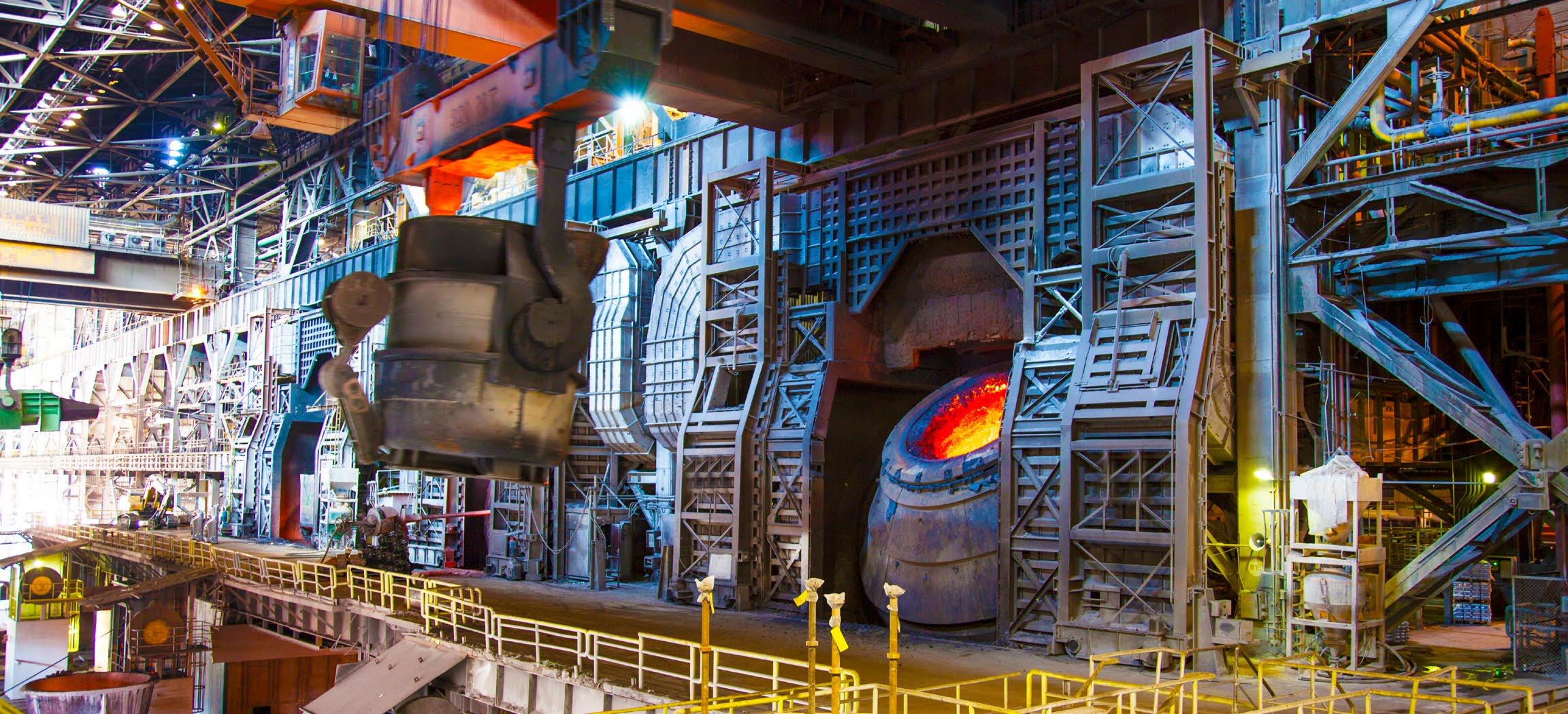

MEMBERS OF THE AUSTRALIAN STEEL INSTITUTE (ASI) RECENTLY GATHERED FOR THE POPULAR ECONOMIC BRIEFING SERIES. THE ONLINE EVENT COVERED THE SECTOR’S ECONOMIC OUTLOOK AS THE NATION ENTERS ITS POST-PANDEMIC RECOVERY. THE EVENT WAS DELIVERED WITH THE SUPPORT OF ASI’S CORPORATE PARTNERS, AUSTRALIANSUPER AND BANJO LOANS, AND ALSO SUSTAINING MEMBER, INFRABUILD. THE ANNUAL EVENT SEEKS TO HELP ASI MEMBERS ENHANCE THEIR DECISION-MAKING SKILLS AND REMAIN COMPETITIVE IN THE GLOBAL STEEL SECTOR.

Advertisement

Delegates heard from a variety of speakers with knowledge from within, and outside the sector. The topics were wide ranging, including the challenges and opportunities during the COVID-19 health emergency; the ongoing crisis in Ukraine; and the economic outlook for small-medium sized enterprises (SMEs) in Australia for 2022.

According to Mark Tierney (Global Economist with AustralianSuper), Australia will leverage its investment opportunities and expertise with a renewed ambition towards construction projects.

“This type of recovery that we’re going through at the moment, is going to be very different from anything that we’ve been through before,” Tierney said.

The Australian steel industry is the backbone of the nation’s economy and is vitally important for building the next generation of critical infrastructure.

However, the sector came to a grinding halt during the pandemic, which led to a large backlog of projects and a disrupted pipeline.

“Part of the problem is that there’s been a big dispersion between goods and services consumption. Goods consumption has roared, whereas services consumption has remained soft as a result of lockdowns,” Tierney said.

Analysts predict that when China eases several COVID-related policies, it will have a vital impact on global supply chains and steel demand.

“We do have these divergences between economies and these imbalances, which have developed, and are causing inflationary problems around the world, with the crucial exception of Asia,” Tierney said.

China is responsible for over half of the world’s steel production. In 2019, China’s share of global steel jumped from 50.9 to 53.3 per cent—a global trend that has remained steady.

Tierney gave an in-depth analysis of how the Australian economy has pivoted and recovered from the height of the COVID-19 crisis. In comparison to other countries, Tierney said that policymakers have managed to steer the economy through an “exceptionally difficult period”.

“But that’s not to say that there aren’t problems developing,” Tierney explained.

He noted the three areas that will challenge the Australian steel and production sector in the next 12 months: 1. Energy transitions 2. China 3. Construction backlogs

Tierney said the transition to clean and renewable energy is the most urgent challenge. He added that AustralianSuper is carefully considering a suite of innovation projects to overcome these obstacles.

The International Monetary Fund recently concluded that metals are a “potentially important input” for ongoing assessments and models of climate change.

“There is no historical precedent for this. We could try to look at when oil took over from coal. There is nothing that we can compare it to.”

“Over the remainder of this decade, it is absolutely essential that China’s use of coal plummets,” Tierney explained.

Coal is embedded in China’s key industries, which requires a transition, rather than a complete phase-out.

“Inevitably, without the backup of infrastructure, we can understand why China’s steel production fell in the second half of last year… rarely do we see declines of that magnitude,” Tierney said.

GETTING EVERYONE ON BOARD THE RENEWABLES TRAIN

Presenters at the ASI’s Economic Briefing shed some light on China’s economic downturn, which was plagued by ongoing pandemic lockdowns and a COVID-zero strategy. However, Tierney believes the nation will use this economic slump to pivot towards more sustainable energy projects for the future. “We are absolutely confident that the Chinese authorities are going to stimulate the economy aggressively through fiscal and monetary policy,” he added.

The recent assessment report by the Intergovernmental Panel on Climate Change (IPCC) recent assessment report concluded that average global greenhouse gas emissions reached their highest levels in human history between 2010 and 2019. However, analysts understand the rate of growth has slowed since the onslaught of COVID-19.

Hoesung Lee is the Chair of the IPCC, who said “we are at a crossroads”, and called on nations to make critical decisions to secure a liveable future.

“Having the right policies, infrastructure and technology in place to enable changes to our lifestyles and behaviour can result in a 40 to 70 per cent reduction in greenhouse gas emissions by 2050,” said Co-Chair Priyadarshi Shukla.

However, the global energy transition to renewable sources requires a global commitment.

China has recently announced several policies to support its transition to cleaner energy. For example, the nation of 1.4 billion people will delay steel curbs and peak carbon emissions for the steel industry by five years. It has also set out green policies for steel scrap collection and electric arc furnaces. Interestingly, China also plans to significantly increase its domestic production of iron ore. Mei Leong (Head of Market Analytics, InfraBuild) addressed the ASI Economic Briefing about the impacts of COVID-19 and supply chain shortages—from commodities to consumer goods. Leong drew on the recent rainfall in the Brazilian iron ore hub of Minas Gerais, which led to a severe mining disruption for a range of international operators, including in China. Brazil is China's second-largest source of iron ore after Australia.

“Iron ore prices have been very volatile. The prices are much higher than history shows,” Leong said.

Severe weather events across Brazil and Australia have historically led to lower shipments and availability of resources across the sector. Likewise, winter weather in Canada and Russia has also shifted operations in the first few months of each year.

The ongoing global supply chain crisis has drastically shifted the price and availability of raw materials like iron ore, scrap, hard coking coal and steel. International transport costs are also expected to remain at an elevated level. Container freight rates are around 79 per cent higher than this time last year, and analysts believe that will firmly hold.

In addition, Leong said the unfolding war in Ukraine has also disrupted steel raw materials and steel trade flows. “Russia is a big coal exporter. In terms of where they supply to, it’s certainly northeast Asia: Japan; South Korea; Taiwan and China, who make up about 54 per cent of their exports,” Leong said.

Prices skyrocketed when Russian forces entered Ukraine on 24 February 2022. Although, Leong said they appear to have stabilised to some degree. Leong concluded her keynote address with a check on how the residential construction market is performing. She said new housing development is being constrained by the increased costs of materials, labour shortages, and rising interest rates. However, she conceded there are positive indicators—like low mortgage rates and investor demand—that will continue to drive the domestic housing market.

BRINGING IT ALL TOGETHER

Brendan Widdowson from Banjo Loans joined the ASI Economic Briefing to share his expertise on driving sustainable growth at a company-level.

Banjo Loans unlocks finances to help businesses achieve their goals. Widdowson leads the company’s sales department, which has seen a 30 per cent increase in revenue targets among SMEs in the last 12 months.

Some of the actions undertaken by these companies include: • Investing in modern technology • Purchasing new assets • Increasing staff • Increasing marketing spend • Expanding existing and additional premises • Entering a new market

Widdowson also spoke about the barriers to growth in some SMEs. Specifically, he divulged the data around Banjo Loans’ latest SME Compass Report, which focuses on the current challenges for business growth in Australia. He encouraged SMEs to drop their existing ways of thinking and understand how to navigate the current economic environment of a tight labour market; restricted supply; and rising inflation.

He reported that economic, or market conditions are the key challenge for business growth (33 per cent). Meanwhile, recruitment (28 per cent) and consumer confidence (22 per cent) were also crucial concerns for survey respondents.

“There’s some uncertainty around inflation… and obviously the situation in Ukraine are causing some economic challenges,” he said.

Recent data from Banjo Loans demonstrates that over half (55 per cent) of businesses are concerned that inflation will remain a barrier towards growth within the coming year. However, Widdowson said businesses have plans to mitigate these risks, including price increases (42 per cent), and reducing supply costs (37 per cent).

Despite the ongoing economic challenges for Australian businesses, Widdowson is hopeful for the future. “There is really high optimism for the year ahead, 83 per cent of businesses are confident about the future of their business,” he explained.

As the sector recovers from the pandemic, analysts are encouraging increased resilience. Widdowson believes nearly two-thirds (63 per cent) of businesses are seeking to leverage funding to drive growth in the next 12 months.“There are a range of different means that businesses are using to raise that capital,” he said.

Some of these measures include bank loans; founder investment; family and friends; or a capital raise. Meanwhile, the most important finance selection factors include: • Interest rates • Ease of application • Length of loan • Spend of obtaining funds • Customer experience or support • Existing relationships with lenders • Reputation of the lender • Security

The 2022 ASI Economic Briefing concluded with an interactive Q&A session. The three speakers shared their thoughts about Australia’s economic forecast, which featured optimism and hope as the sector bounces back from the perils of COVID-19.

The Australian Steel Institute encourages its members to take part in future professional development and networking events. For more information about ASI membership, please visit: steel.org.au/become-a-member