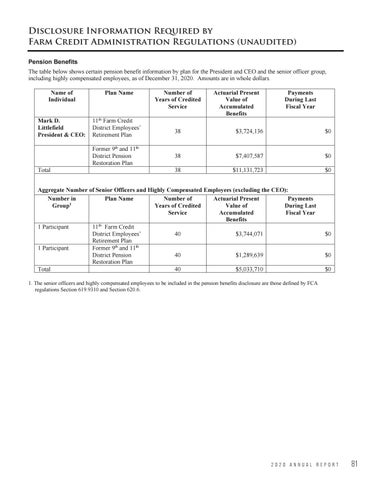

Disclosure Information Required by Farm Credit Administration Regulations (unaudited) Pension Benefits The table below shows certain pension benefit information by plan for the President and CEO and the senior officer group, including highly compensated employees, as of December 31, 2020. Amounts are in whole dollars. Name of Individual Mark D. Littlefield President & CEO:

Total

Plan Name

11th Farm Credit District Employees’ Retirement Plan Former 9th and 11th District Pension Restoration Plan

Number of Years of Credited Service

Actuarial Present Value of Accumulated Benefits

Payments During Last Fiscal Year

38

$3,724,136

$0

38

$7,407,587

$0

38

$11,131,723

$0

Aggregate Number of Senior Officers and Highly Compensated Employees (excluding the CEO): Number in Plan Name Number of Actuarial Present Payments Group1 Years of Credited Value of During Last Service Accumulated Fiscal Year Benefits 1 Participant 11th Farm Credit District Employees’ 40 $3,744,071 Retirement Plan 1 Participant Former 9th and 11th District Pension 40 $1,289,639 Restoration Plan Total 40 $5,033,710

$0 $0 $0

1. The senior officers and highly compensated employees to be included in the pension benefits disclosure are those defined by FCA regulations Section 619.9310 and Section 620.6.

2 02020 2 0 ANNUAL A N N U A LREPORT R E P O R| T81

81