14 minute read

EXNESS vs XM comparison 2025: Which is better? Review

When it comes to online trading, choosing the right broker can significantly impact your trading experience and profitability. In this comprehensive EXNESS vs XM comparison, we will explore various aspects of both brokers, helping you determine which option suits your trading needs better. Whether you're a novice trader or an experienced professional, understanding the nuances of these platforms is essential for making informed decisions.

EXNESS vs XM: An In-Depth Comparison

In the world of forex and CFD trading, two names frequently come up: EXNESS and XM. Both brokers offer a variety of services aimed at different levels of traders.

EXNESS comparison, has carved out a reputation for its low spreads and significant leverage options, catering primarily to forex traders. Meanwhile, XM prides itself on providing extensive educational resources and robust customer support, appealing to beginners and seasoned traders alike.

Start Exness Trade : Open Exness Account and Start Trade

This section will delve into the fundamental differences and similarities between the two, allowing readers to grasp the essence of each broker before proceeding to more specific comparisons.

Overview of EXNESS

Established in 2008, EXNESS has grown rapidly to become a key player in the forex market. The broker offers a plethora of trading instruments, including currencies, commodities, cryptocurrencies, and indices.

One of EXNESS's standout features is its commitment to transparency and reliability, showcasing its strong performance in terms of execution speeds and withdrawal processes.

Traders often appreciate the user-friendly interface of EXNESS's trading platform, which allows them to navigate easily through various features.

Overview of XM

Founded in 2009, XM boasts a global presence with clients from over 196 countries. The broker offers access to a wide range of trading instruments and emphasizes customer education through numerous webinars and seminars.

XM also has a solid reputation for its competitive spreads and no re-quotes policy, which many traders find attractive.

Additionally, XM’s demo account feature allows potential traders to practice their strategies without the pressure of losing real money, making it particularly appealing for new entrants to the trading world.

Key Differences

While both brokers provide access to similar financial instruments, their approach to trading, client support, and educational resources sets them apart.

For example, EXNESS focuses more on advanced trading tools and strategies, while XM emphasizes a hands-on approach to educating traders, ensuring they can make informed choices. This difference highlights how varied trading environments can be, influencing traders' successes based on their preferences and skill levels.

Which is Better: EXNESS or XM?

Determining which broker is better ultimately depends on individual trading goals, experience level, and personal preferences. However, this section aims to outline critical factors that may influence your decision.

Target Audience

Understanding the target audience of each broker plays a vital role in deciding which is suitable for you.

EXNESS typically appeals to forex traders who prioritize speed and efficiency in executing trades. With its high leverage options, it attracts experienced traders looking to maximize profit potential.

Start Exness Trade : Open Exness Account and Start Trade

On the other hand, XM caters to a broader audience, including those seeking educational resources and personalized support. Beginners often feel more comfortable with XM due to its focus on providing robust training tools and resources.

Trading Goals and Strategy

Your trading goals also influence which broker might be better suited to you. If your primary objective is long-term asset accumulation through diversified portfolios, XM's vast educational materials could help enhance your skills.

In contrast, if you aim for short-term gains through forex trading, EXNESS's minimal spreads and rapid execution times may align more closely with your strategic objectives.

Making Your Decision

Ultimately, deciding between EXNESS and XM comes down to evaluating your own trading style and preferences.

Are you a seasoned trader who thrives on quick execution and high leverage? Or are you an aspiring trader looking for comprehensive educational resources to guide your journey? By answering these questions, you can lean towards the broker that meets your specific needs.

Trading Features: EXNESS vs XM

Trading features are critical components that can either enhance your trading experience or deter your progress. In this section, we'll explore how EXNESS and XM stack up against one another in terms of various trading functionalities.

Types of Accounts

Both EXNESS and XM offer a range of account types designed to cater to different trading styles and preferences.

EXNESS provides several account types, including Standard and Pro accounts, allowing traders to choose based on their experience level and trading needs. Each account type has its unique benefits, such as varying spreads and leverage options.

Meanwhile, XM offers Micro, Standard, and Ultra-Low accounts, with each type providing different advantages, including lower minimum deposits for beginner traders. The variety in account types gives users the flexibility to select the best fit based on their trading goals.

Leverage and Margin Requirements

Leverage plays a significant role in trading, allowing traders to control larger positions with smaller amounts of capital.

EXNESS stands out by offering leverage of up to 1:2000, which can be advantageous for experienced traders aiming for higher risk-reward scenarios. However, it's crucial to remember that higher leverage also comes with increased risks.

XM provides leverage of up to 1:888, which still offers considerable opportunities for maximizing returns while maintaining a balance between risk and reward. Traders should carefully assess their risk tolerance when choosing between the two brokers.

Execution Speed and Order Types

Execution speed is another important aspect of trading features.

EXNESS claims to have some of the fastest execution times in the industry, with an average trade execution speed measured in milliseconds. This speed is vital for traders who rely on accurate entry and exit points to maximize profits.

XM also offers efficient execution but does not emphasize speed as heavily as EXNESS. Instead, XM touts its no re-quotes policy, ensuring fairer trading conditions for its clients.

Both brokers provide various order types, such as market orders, limit orders, and stop-loss orders, enabling traders to implement diverse strategies effectively.

Account Types Compared: EXNESS and XM

Choosing the right account type is crucial for a successful trading experience, as it can influence your overall costs, available leverage, and trading environment. This section breaks down the account types offered by both brokers and analyzes their respective advantages and disadvantages.

EXNESS Account Types

EXNESS account types designed to cater to different trader needs:

Standard Account: Ideal for beginner traders, this account type offers low spreads and allows for flexible trading conditions.

Pro Account: Designed for more experienced traders, the Pro account features tighter spreads, making it more suitable for high-frequency trading. Additionally, EXNESS has specialized accounts for Islamic traders, ensuring compliance with Sharia law.

The diversity in account types helps traders select the most appropriate option according to their trading strategy and experience level.

XM Account Types

XM's account offerings also include multiple types to accommodate different traders:

Micro Account: Aimed at beginner traders, this account requires a low minimum deposit and offers micro lot trading, making it easy for new traders to start small.

Standard Account: Suitable for retail traders, this account type provides the ability to trade standard lots with competitive spreads.

Ultra-Low Account: This account type is specifically designed for traders seeking the tightest spreads possible.

Each account type at XM comes with a demo version, allowing traders to practice before committing real funds. This feature is invaluable for new traders looking to gain confidence in their strategies.

Comparing the Benefits

When evaluating the account types provided by both EXNESS and XM, traders must weigh the pros and cons based on their unique trading profiles.

If you prefer tighter spreads and advanced trading features, EXNESS might be the better choice. Conversely, if you value the opportunity to learn and grow through demo accounts, XM could be more appealing.

Fees and Spreads: EXNESS vs XM Review

Understanding the fee structures and spreads associated with trading is vital for maximizing profitability. This section delves into the charges imposed by both brokers and how they compare.

Spread Analysis

Spreads refer to the difference between the bid and ask prices, acting as a cost for executing trades.

EXNESS offers variable spreads that can be as low as 0.1 pips on major currency pairs, particularly appealing to day traders and scalpers looking to minimize costs. However, spreads can widen during periods of high volatility.

XM offers competitive spreads as well, typically starting from 0.6 pips for its Standard and Micro accounts. For those utilizing the Ultra-Low account, spreads can be even tighter, enhancing profitability for frequent traders.

Commissions and Fees

While spreads are a primary expense for traders, commissions can also play a significant role.

EXNESS does not charge commissions on its Standard accounts, whereas its Pro accounts include a commission structure linked to traded volumes.

Start Exness Trade : Open Exness Account and Start Trade

XM operates similarly but ensures that all of its accounts maintain competitive pricing. It's essential to analyze how commissions impact your trading strategy, especially if you're planning to execute numerous trades daily.

Additional Costs to Consider

Beyond spreads and commissions, traders should consider other potential fees, such as withdrawal fees, inactivity fees, or overnight financing fees.

EXNESS has relatively low withdrawal fees, depending on the method chosen, which can be beneficial for active traders. XM does not impose any fees on deposits or withdrawals, which adds to its attractiveness, especially for beginners just starting their trading journey.

Customer Support Analysis: EXNESS vs XM

Reliable customer support can significantly impact a trader's experience, especially when navigating challenges or seeking assistance. In this section, we will evaluate the customer service offerings from EXNESS and XM.

Availability and Channels of Support

Both EXNESS and XM understand the importance of accessible customer support.

EXNESS offers multilingual support through live chat, email, and phone calls, ensuring traders can communicate effectively regardless of their language. Their support team is available 24/5, accommodating traders across different time zones.

XM, too, provides round-the-clock support via live chat, email, and phone. They take pride in their customer service, ensuring that clients receive prompt assistance whenever needed.

Quality of Support

While availability is crucial, the quality of support matters equally.

EXNESS has received mixed reviews regarding response times; however, clients often highlight the professionalism and expertise of their support agents once connected.

Conversely, XM tends to receive positive feedback about their customer service, with traders appreciating the promptness and helpfulness of the support staff. The additional educational resources provided by XM further illustrate their commitment to supporting their clients' growth.

User Feedback and Experiences

To truly understand the effectiveness of customer support, it's essential to examine user experiences.

Many traders have reported satisfactory experiences with both brokers, although XM appears to have a slight edge in terms of overall satisfaction. This distinction may play a crucial role for traders who value ongoing support throughout their trading journeys.

Trading Platforms Overview: EXNESS and XM

The trading platform you use directly influences your trading experience, affecting everything from execution speed to charting capabilities. This section evaluates the platforms offered by EXNESS and XM.

EXNESS Trading Platform

EXNESS primarily utilizes the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both well-regarded in the trading community.

MT4 is particularly popular among forex traders due to its user-friendly interface and extensive analytical tools. It supports automated trading algorithms, allowing for greater flexibility.

MT5, on the other hand, enhances the MT4 experience with added features, such as more timeframes and advanced order types. Additionally, MT5 offers a wider selection of financial instruments, making it a versatile choice for traders looking beyond just forex.

XM Trading Platform

Similar to EXNESS, XM also offers MT4 and MT5, providing users with familiar interfaces and robust functionality.

XM enhances the MT4 and MT5 experience by providing custom indicators, templates, and expert advisors (EAs). The ease of use combined with the powerful tools available makes XM’s platform appealing to both new and experienced traders.

Mobile Trading Options

In today's fast-paced trading environment, mobile trading apps have become increasingly important.

EXNESS's mobile app allows traders to access their accounts, monitor the markets, and execute trades seamlessly. The app aligns with the desktop version, ensuring continuity of experience across devices.

XM likewise offers a mobile trading app compatible with both iOS and Android devices, enabling traders to stay connected to the markets anytime, anywhere.

The availability of mobile trading solutions from both brokers highlights their commitment to meeting modern traders' demands.

Regulation and Security: Comparing EXNESS and XM

When selecting a broker, regulatory compliance and security measures are paramount considerations. This section examines how EXNESS and XM rank in these critical areas.

Regulatory Bodies

Both EXNESS and XM are regulated by reputable financial authorities, adding layers of trust and reliability to their operations.

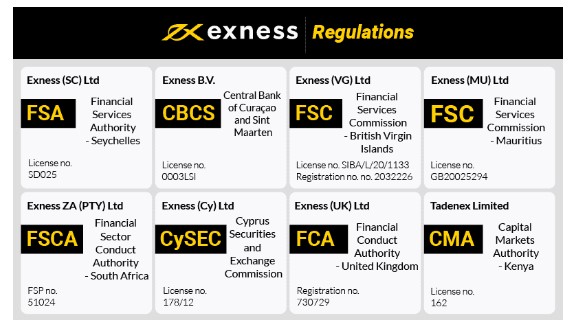

EXNESS is regulated by the Financial Services Authority (FSA) of Seychelles and the Cyprus Securities and Exchange Commission (CySEC), which ensures that they adhere to international standards.

XM is regulated by entities such as the Australian Securities and Investments Commission (ASIC) and the CySEC, providing traders with peace of mind knowing that they are trading with a compliant broker.

Security Measures

Security is essential in protecting traders’ funds and personal data.

EXNESS employs cutting-edge technology, including SSL encryption and segregated accounts for client funds, ensuring that traders’ information is safeguarded against unauthorized access.

Similarly, XM prioritizes the security of its clients by using advanced encryption protocols and storing client funds in top-tier banks. The broker conducts regular audits and adheres to strict security measures to maintain the safety of its trading environment.

Trustworthiness and Reputation

Both brokers have built strong reputations within the trading community, with many satisfied customers attesting to their reliability.

However, traders should conduct their research and read user reviews to gauge the overall sentiment surrounding each broker. While both EXNESS and XM generally receive positive feedback, personal experiences can vary, making it essential to choose the broker that aligns best with your values and expectations.

User Experience: EXNESS vs XM Reviews

User experience encompasses various factors, including platform usability, educational resources, and overall trader satisfaction. In this section, we analyze how EXNESS and XM perform in these areas.

Platform Usability

A user-friendly platform is crucial for maintaining engagement and facilitating smooth trading operations.

EXNESS's interface is intuitive, allowing traders to navigate effortlessly through charts, tools, and account management features. Most users report favorable experiences when using the platform, contributing to a positive overall impression.

XM also excels in platform usability, with an easily navigable interface that enhances the trading experience. The incorporation of educational tools and resources further complements the user experience, making XM an appealing choice for traders of all backgrounds.

Educational Resources and Tools

Education is a cornerstone of successful trading.

EXNESS offers various guides, tutorials, and webinars that cover topics ranging from basic trading principles to advanced techniques. These resources empower traders to enhance their knowledge and refine their skills.

XM takes educational support a step further, providing a rich library of resources, including videos, articles, and live webinars. The broker also hosts regular seminars in different locations, allowing traders to engage with experts and learn in a dynamic setting.

Overall Trader Satisfaction

Customer reviews indicate that both brokers generally enjoy high levels of trader satisfaction.

EXNESS users appreciate the speed of execution and low spreads, while XM clients highlight the quality of educational resources and customer support.

Reading first-hand experiences from other traders can provide valuable insights into what to expect when dealing with these brokers and can help shape your decision-making process.

Final Verdict: Which is Better, EXNESS or XM?

After examining various aspects of both brokers, it's essential to summarize the key findings for a final verdict on the EXNESS vs XM comparison.

Pros and Cons of EXNESS

Pros:

Low spreads and high leverage options

Fast execution speeds

User-friendly trading platform

Cons:

Mixed reviews regarding customer support

Limited educational resources compared to XM

Pros and Cons of XM

Pros:

Extensive educational resources for traders

Responsive customer support

Competitive spreads across multiple account types

Cons:

Slightly lower leverage options than EXNESS

May not cater to experienced traders seeking advanced trading tools

Conclusion on the Better Choice

Ultimately, determining which broker is better hinges on your specific trading goals, style, and preferences. If you are an experienced trader seeking speedy executions and high leverage, EXNESS may suit you better.

Conversely, if you are a beginner or someone looking to deepen your trading knowledge, XM's educational resources and supportive environment may prove more beneficial.

Conclusion

In the ever-evolving landscape of online trading, choosing the right broker is crucial for success. As demonstrated in this detailed EXNESS vs XM comparison, both brokers offer unique advantages tailored to different types of traders.

By considering factors such as account types, trading features, fees, customer support, and educational resources, you can identify which platform aligns best with your trading aspirations. Take the time to assess your needs and preferences, and you’ll embark on your trading journey with a broker that supports your growth and success.

See more:

EXNESS vs fxtm Which is better Broker? Review

EXNESS vs justmarkets Which is better Broker? Review