4 minute read

EXNESS Global Review Safe or Scam broker? By Exness Trading Tips

If you're evaluating EXNESS Global as your trading partner in 2025, this comprehensive review is for you. We dive into every critical aspect—regulation, account options, platform tools, funding methods, security, support, and user trust—to help you determine whether EXNESS is a safe broker or a scam.

👉 Visit the Official EXNESS Website👉 Securely Sign Up Here

⬇️⬇️⬇️

Regulation & Legitimacy: Is EXNESS Global Trustworthy?

EXNESS Global operates under multiple reputable financial authorities, including:

FCA (United Kingdom)

CySEC (European Union)

FSCA (South Africa)

FSA (Seychelles)

CMA (Kenya)

These regulatory frameworks enforce standards like client fund segregation, negative balance protection, and regular compliance audits—key indicators of a legitimate broker. No credible scams or regulatory breaches have been linked to EXNESS, strengthening its reputation as a safe and reliable broker.

Account Types & Trading Conditions

EXNESS offers flexible account options tailored to all trader levels:

Standard / Cent Accounts: Commission-free, spreads from ~0.3 pips—great for beginners.

Pro Account: Low spreads (~0.1 pips), no commissions.

Raw Spread: Ultra-tight spreads from 0.0 pips with a fixed commission.

Zero Account: 0.0 pip spreads on majors, with variable commission tiers.

Islamic (swap-free) options available on most account types.

With leverage up to 1:2000 and access to 200+ instruments (forex, CFDs, crypto, stocks, and metals), EXNESS delivers competitive conditions for all trading styles.

See more: Exness forex broker review

Platforms & Tools: Empowering Traders

EXNESS provides access to several robust platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for desktop, mobile, and web—supporting EAs, advanced charting, and custom indicators.

Web Terminal (based on MT5): No download needed, fast, and reliable.

EXNESS Go App: Full mobile trading platform with account management, analytics, and alerts.

All platforms include tools like pip/margin calculators, economic calendar, watchlists, and live market news to empower informed decision-making.

👉 Visit the Official EXNESS Website👉 Sign Up Securely

Fund Safety & Deposit Methods

EXNESS protects your money and offers smooth payment options:

Segregated accounts ensure client funds are kept separate from company assets.

Negative balance protection ensures traders can't lose more than their deposit.

Over 98% of withdrawals are auto-processed, including weekends.

Supports global and local payments, including M-Pesa in Kenya, cards, e-wallets, and crypto—often instant and fee-free.

These measures underscore EXNESS’s commitment to fund security and flexible access.

Security Measures & Account Protection

EXNESS takes security seriously:

SSL encryption protects all data transfers.

Two-factor authentication (2FA) and biometric login options enhance safety.

PCI DSS compliance and 3D Secure for card payments.

Fast verification methods like one-time-passwords for transactions.

These protections make EXNESS far from a scam—its infrastructure meets top industry standards.

User Feedback: Is EXNESS Reliable?

Thousands of traders from forums like Reddit report smooth experiences—same-day withdrawals, low spreads, and intuitive interfaces. A few users mention rare technical issues or support delays, but these are exceptions, not indicative of widespread problems.

⬇️⬇️⬇️

How to Create Exness Real Account

Pros & Cons at a Glance

Pros

Strong regulation across multiple jurisdictions

Low fees, flexible leverage, and account diversity

Fast, easy deposits and instant withdrawals

Multiple trading platforms and powerful tools

Top-tier security and 24/7 support

Cons

Not regulated in certain local jurisdictions

High leverage can be risky for inexperienced users

MT4 mobile requires separate download—EXNESS Go is MT5 only

Occasional isolated technical glitches reported

FAQs: Your Top Questions Answered

Is EXNESS Global a scam?No—it’s a well-regulated, trusted broker with global oversight.

Is my money safe with EXNESS?Yes—funds are segregated, secured, and protected against negative balance.

Which account type is best for beginners?Standard or Cent Accounts—no commission and low entry cost.

Can I trade on mobile?Yes—with the EXNESS Go app, including full account and trade functionality.

How fast are deposits/withdrawals?Most are instant; occasionally up to 24h for certain bank transfers.

Does EXNESS offer Islamic accounts?Yes—swap-free accounts are available.

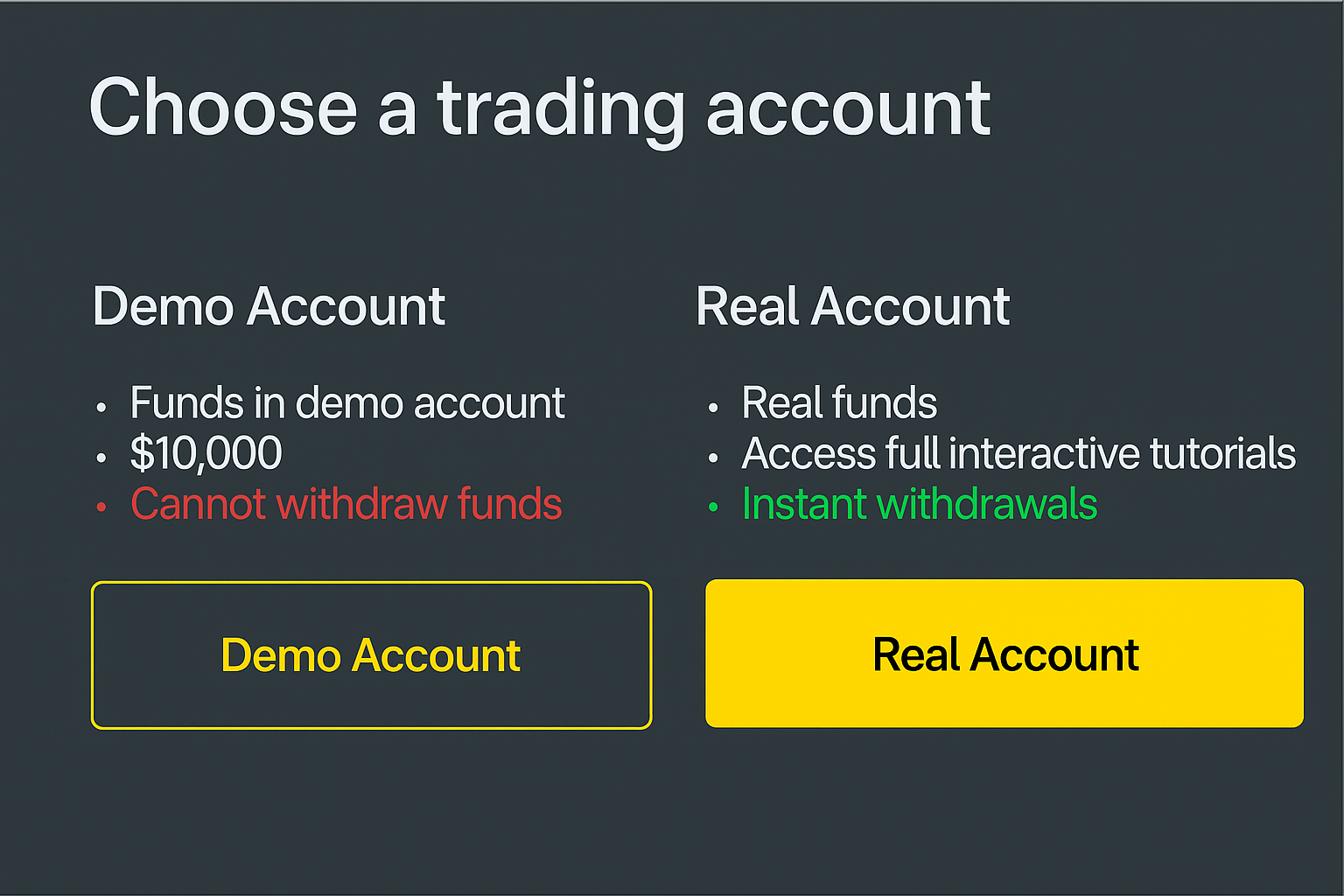

Is demo trading available?Absolutely—demo accounts are free and virtual.

What’s the max leverage?Up to 1:2000, with unlimited in some regions.

Are there deposit or withdrawal fees?No—EXNESS covers internal fees, although third-party charges may apply.

How effective is customer support?Live chat is responsive; email replies within a few hours; multi-language support available.

Final Verdict

EXNESS Global is a bona fide, safe, and professional trading broker—not a scam. With robust regulation, comprehensive platforms, strong security, and efficient payment options, it stands out as a reliable choice in 2025.

👉 Start your EXNESS journey today

Read more:

مراجعة وسيط EXNESS 2025: المزايا والعيوب للمتداولين في تونس 🇹🇳

EXNESS Broker İncelemesi 2025: Avantajlar ve Dezavantajlar

EXNESS Broker Syn 2025: Üstünlikleri we Kemçilikleri

EXNESS Broker Review 2025: Pros and Cons for Uganda