4 minute read

EXNESS Vs Octafx (2025) | Which One is Better? Review, Fees, Spread

from Exness Guide

Confused between EXNESS vs OctaFX in 2025? Discover which broker offers better spreads, faster withdrawals, stronger regulation, and why EXNESS or OctaFX might fit your trading style best.

Introduction: Why Traders Compare EXNESS and OctaFX in 2025

Choosing the right broker is more than comparing spreads — it’s about trust, platform flexibility, withdrawals, and the freedom to trade how and what you want.In 2025, both EXNESS and OctaFX are big names among Forex and CFD traders. But each appeals to slightly different trading styles.

EXNESS: Ultra-tight spreads, instant withdrawals, multi-asset choice, and strong global regulation.

OctaFX: Simple MT4/MT5 and cTrader access, attractive bonuses, and higher leverage.

So, which one really suits your trading needs in 2025? Let’s see.

👉 Want to check why many traders prefer EXNESS? Open your EXNESS account now

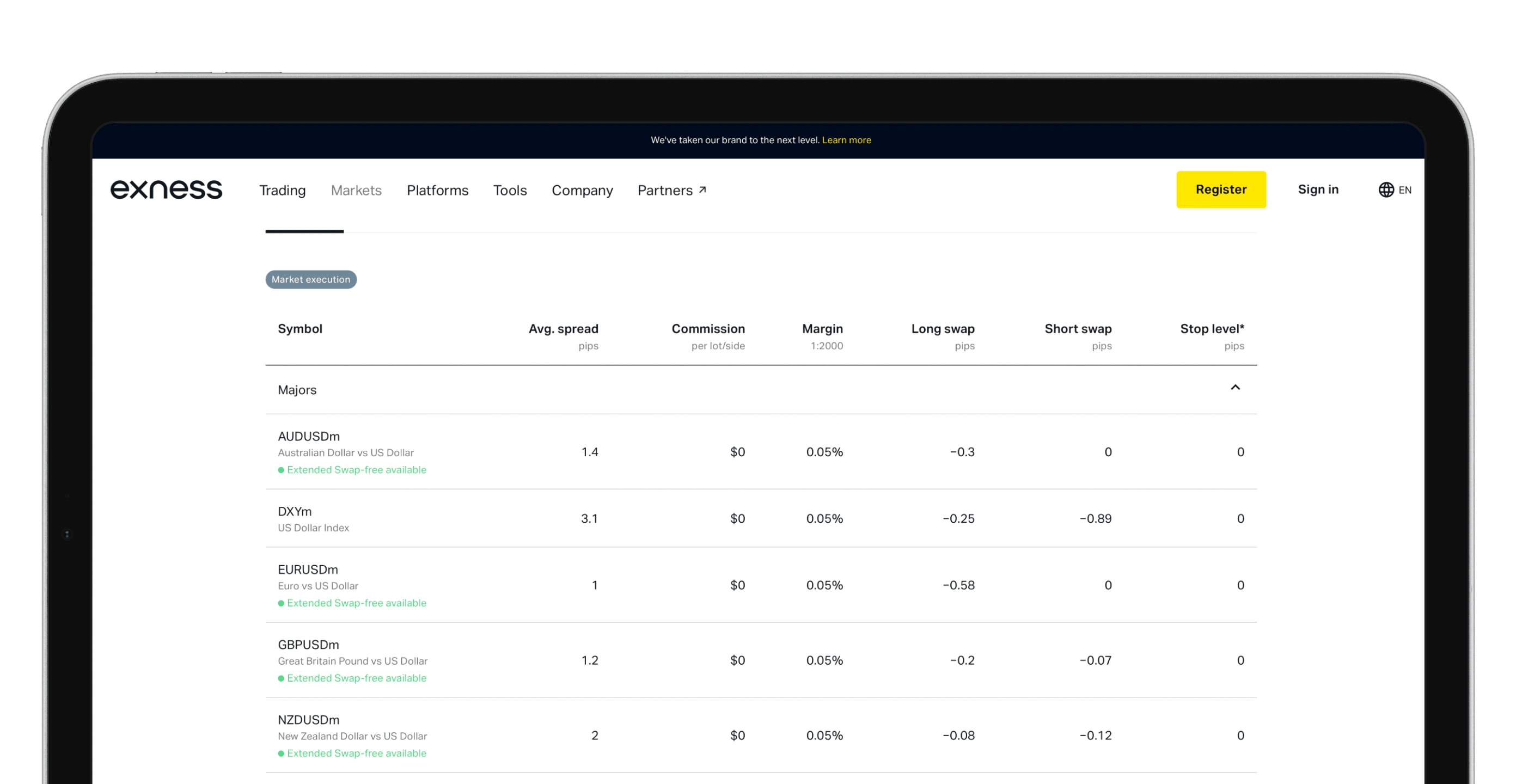

Trading Costs: Spreads & Fees

EXNESS trading stands out for cost-effective trading on its Raw and Zero accounts:

Spreads from 0.0 pips

Low commission (about $3.5 per lot)

Standard account: spreads ~0.3–1.0 pips, no extra commission

OctaFX keeps things simple with low spreads too:

Spreads usually start from around 0.6–1.1 pips

Typically offers commission-free trading (but spreads can be slightly wider)

No Raw or Zero account option with true 0.0 spreads

OctaFX: Open Account | Go to Website

Assets & Markets

EXNESS offers real multi-asset flexibility:

Forex

Metals & commodities

Indices

Stocks

Crypto CFDs (24/7)

In total: over 250+ instruments.

OctaFX mainly focuses on:

Forex

Metals

Indices

Some crypto CFDs

It covers popular assets but with fewer choices, especially for stocks and a limited crypto list.

Platforms & Trading Tools

Both brokers support the industry favorites: MT4 and MT5.

EXNESS also adds:

WebTerminal for browser trading

Fast mobile apps

Advanced account types for scalpers and EA users

OctaFX adds cTrader (for some regions), giving extra tools for advanced charting fans.

👉 Prefer MT4/MT5 with instant withdrawals? Start with EXNESS here

Leverage & Flexibility

EXNESS: Up to 1:2000 (Forex), depending on region and account

OctaFX: Up to 1:500

EXNESS offers higher leverage, which may appeal to experienced traders running smaller capital.

Withdrawals & Deposits

EXNESS shines with instant withdrawals, processed within seconds for e-wallets, cards, and crypto.

OctaFX offers fast withdrawals (often same day or within a few hours), but typically not instant.

👉 Prefer quick access to your profits? Open your EXNESS account now

Regulation & Trust

EXNESS: Regulated by FCA (UK), CySEC (Cyprus), FSCA (South Africa)

OctaFX: Regulated by CySEC and operates offshore in some regions

EXNESS’s FCA license and wider regulatory coverage give it an advantage in fund security and trust.

Why Traders Choose EXNESS

✅ Ultra-tight spreads & low commissions⚡ Instant withdrawals anytime, anywhere📈 Trade Forex, stocks, indices, crypto CFDs, commodities — over 250 assets📊 MT4 & MT5 support for scalping, EAs, and manual strategies🌍 Strong global regulation💰 Higher leverage up to 1:2000🌙 Crypto CFDs available 24/7

👉 Try EXNESS today: Open your EXNESS account here

Why Traders Like OctaFX

⭐ Simple account setup and bonus promotions📱 MT4, MT5, and cTrader options (in some regions)💰 Higher leverage than many brokers (up to 1:500)📊 Fast deposits and withdrawals (though usually not instant)

Final Verdict: EXNESS vs OctaFX — Which One is Better in 2025?

Choose EXNESS if you:

Want the lowest spreads and fast execution

Prefer stricter regulation (FCA, CySEC)

Need to trade multiple asset classes, including stocks and crypto

Value instant withdrawals

Use EAs or scalping strategies on MT4/MT5

Choose OctaFX if you:

Focus mainly on Forex & metals

Want a broker offering bonuses or cTrader platform

Don’t need stock CFDs or widest asset choice

For most traders who care about multi-asset choice, strong regulation, and instant payouts, EXNESS often leads overall.

👉 Ready to start? Open your EXNESS account now

FAQs – EXNESS vs OctaFX (2025)

Q1: Which broker offers lower spreads?EXNESS Raw & Zero accounts usually have tighter spreads.

Q2: Who has faster withdrawals?EXNESS — often instant; OctaFX is fast but not instant.

Q3: Which has higher leverage?EXNESS up to 1:2000; OctaFX up to 1:500.

Q4: Can I trade stocks?Yes, only on EXNESS.

Q5: Do both support MT4 & MT5?Yes.

Q6: Which is better for crypto CFDs?EXNESS offers more crypto CFDs and 24/7 trading.

Q7: Are both regulated?EXNESS is regulated by FCA, CySEC, FSCA; OctaFX is mainly CySEC.

Q8: Do they support automated trading?Yes, both support EAs.

Q9: Minimum deposit?EXNESS starts from ~$10; OctaFX usually from $25–$50.

Q10: Which is better for beginners?OctaFX has simple bonuses and fewer account choices; EXNESS offers more tools & regulation for long-term growth.

See more:

EXNESS Vs Oanda (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs Bybit (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs Quotex (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs JustMarkets (2025) | Which One is Better? Review, Fees, Spread